The car market is in an odd place right now. Automakers are doing their best to hold the line on tariff-related price increases, but this will not last forever. A few brands are offering tempting zero percent finance offers on select models. However, buyers should be aware that cheap loans are only part of the total cost equation, and saving in one area may end up costing more in another.

In a previous post, I stressed the importance of doing the math ahead of time by working backwards from the monthly payment to a total budget. Loan interest is a factor in how much a car can cost you over time, as the APR can add thousands of dollars in additional cost depending on the rate and the term. So when buyers see a zero percent APR offer, that might be a deciding factor between one brand versus another.

CarFax has a current list of the zero-percent offers across all automakers for August. What you will notice is that the bulk of the offers apply to electric vehicles, while the zero percent offers on gas/hybrid models are, for the most part, targeted towards less popular/desirable models like the Ford Escape, Nissan Rogue, Dodge Hornet, and so on. There are certainly some exceptions with the Ford F-150 and Mustang, along with popular Korean-made crossovers like the Sportage, Sorento, Palisade, and Tucson, but by and large, you see 0 percent offers on poorer-selling vehicles.

Even though loan cost is one variable in the total cost equation, another important one is depreciation. While it is recommended to hold onto a car for as long as possible to get maximum financial value, the reality is that a lot of buyers frequently trade in their cars for something newer every three to four years, and within this time frame, depreciation curves matter.

Low Interest Now vs High Resale Later

Let’s examine two hypothetical purchases. The first would be a Ford Escape SEL with a total purchase price of about $40,000, and a Toyota RAV4 Limited, also with a total purchase price of about $40,000 (for simplicity). The Ford customer took advantage of the zero percent for 48 months offer; the RAV4 customer got 4.99 percent for 48 months based on the current advertised special from Toyota. The Ford customer will pay zero interest, whereas the Toyota customer is looking at a total interest cost of almost $4,200 over the course of four years.

Three years go by, and both customers decide they need to upgrade to larger cars due to a growing family; they both put about 30,000 – 36,000 miles on their vehicles throughout that time. To compare the relative depreciation between two cars, we can look at the retail prices of three-year-old examples within that mileage range.

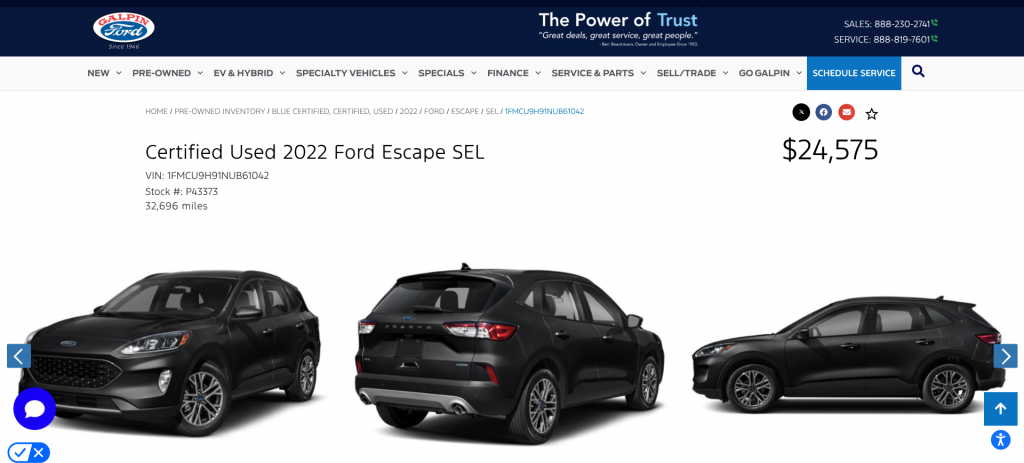

Here is a Ford Certified 2022 Escape SEL with 32,696 miles for a current used price of $24,575:

The original MSRP, according to Ford’s window sticker, is $40,430. This Escape lost almost $16,000 in value after three years.

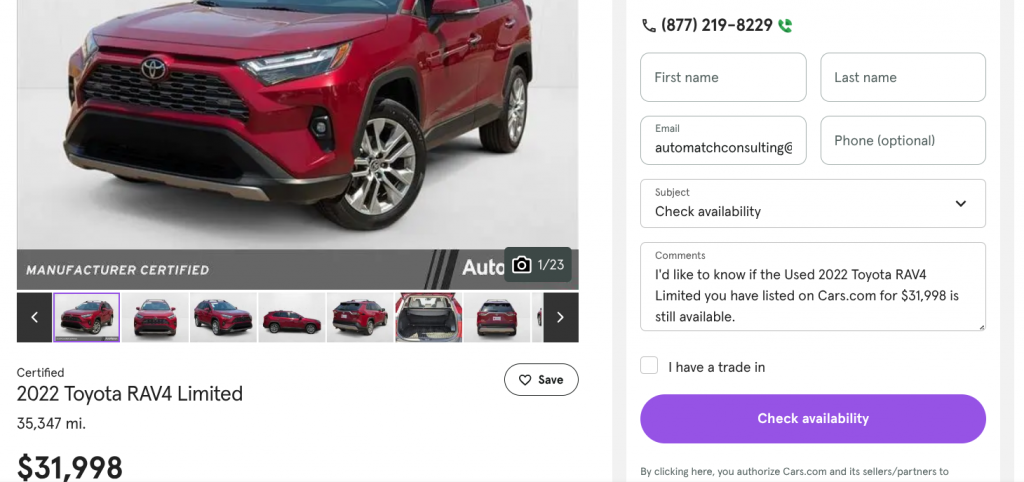

For the Toyota scenario, here is a Toyota Certified RAV4 Limited with a little over 35,000 miles with a current asking price of $31,998. The ad doesn’t provide an original window sticker, but according to Toyota’s configurator, a front-wheel-drive RAV4 Limited with a moderate level of equipment has a sticker price of $40,120. This car lost just over $8,000 in value in three years.:

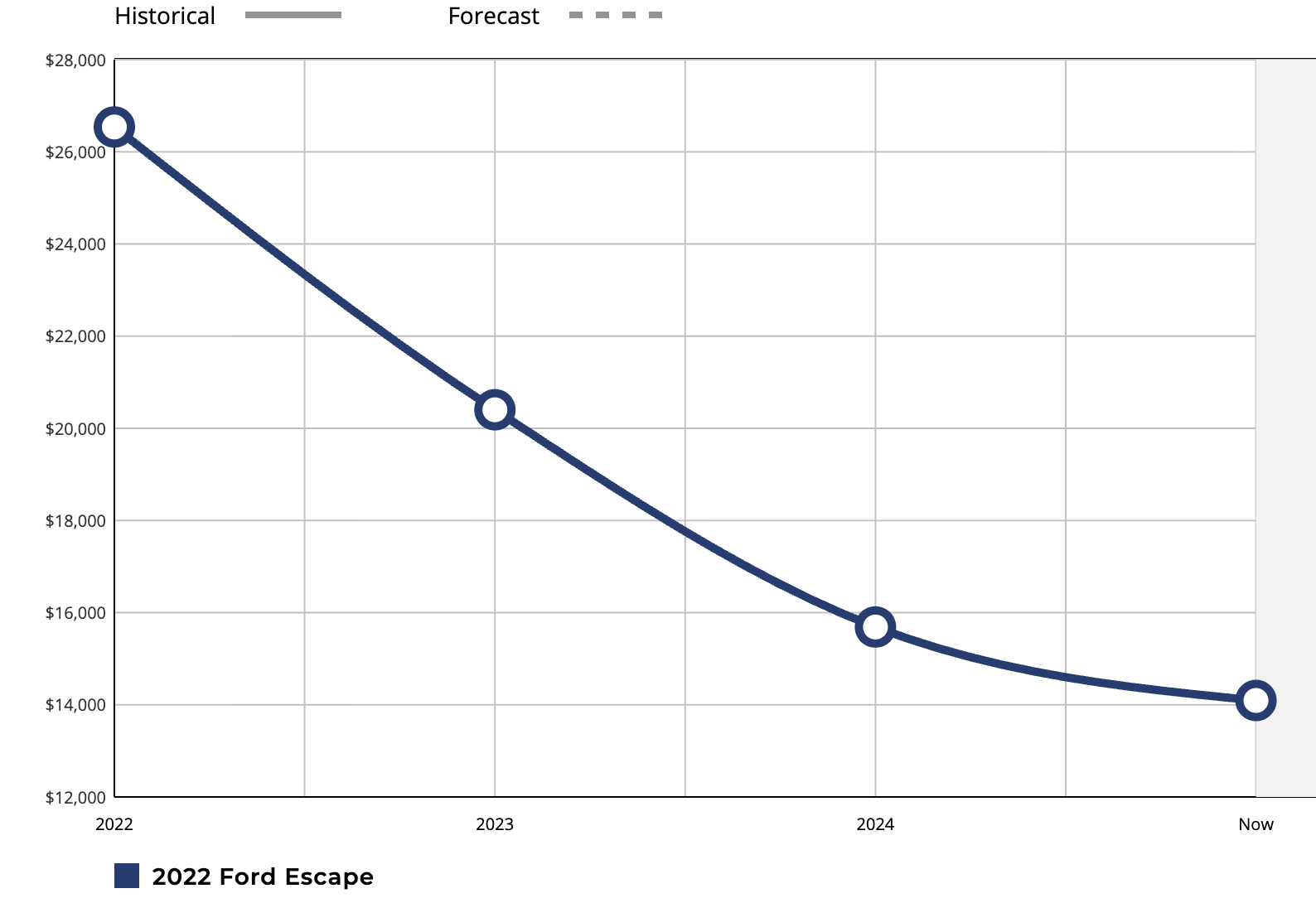

[Ed Note: If you’re curious about whether a Rav4 really does depreciate at almost half the rate as an Escape, here’s a look at some data from KBB showing that the 2022 Ford Escape has depreciated roughly 46 percent over the past three years:

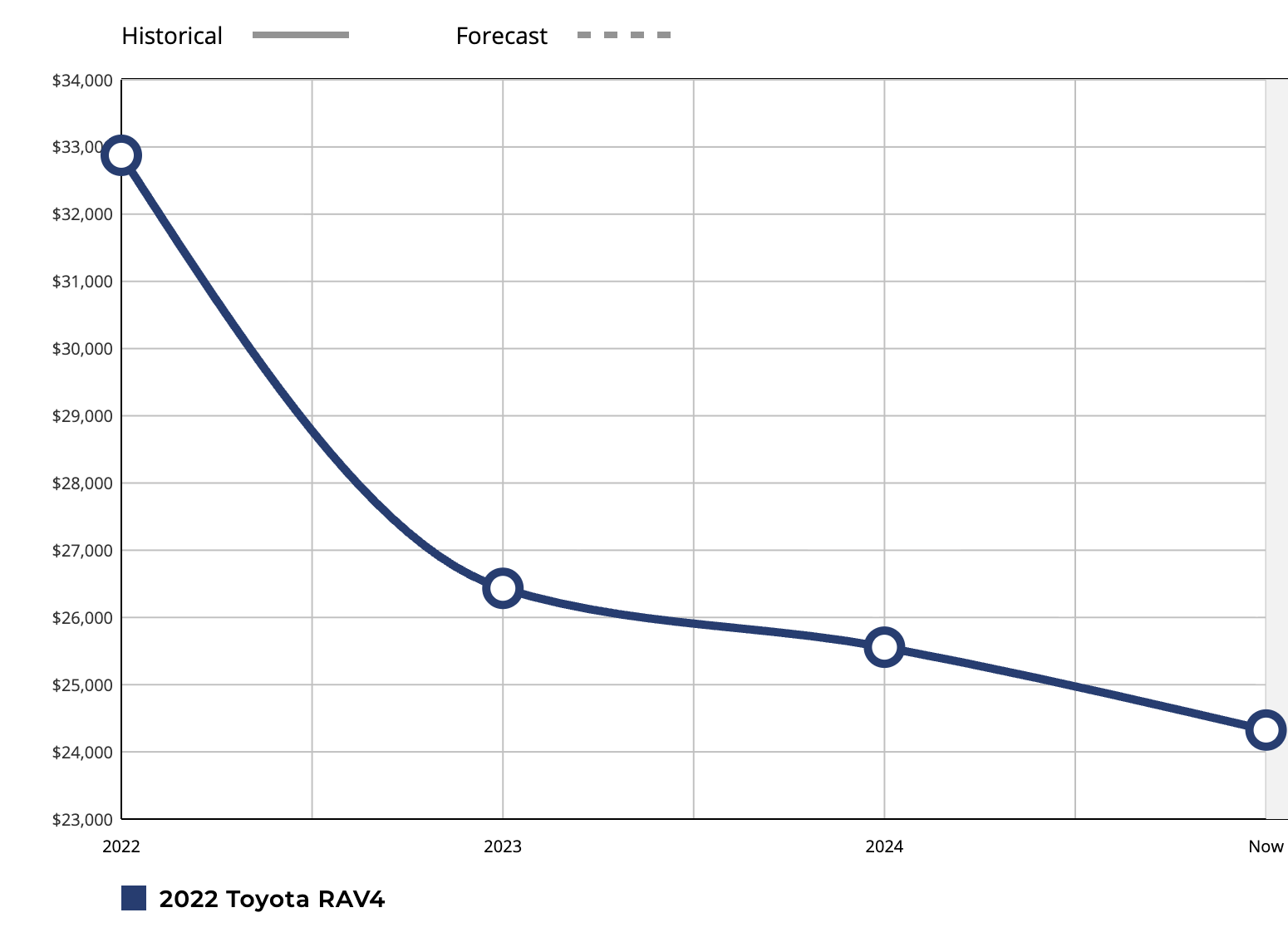

The 2022 Toyota RAV4 has depreciated only 26 percent over the past three years, per KBB:

So, 26% vs 46% is a huge delta, not unlike what we saw in the two examples that Tom picked out. The plots above, it’s worth noting, show resale value, which is based on Kelley Blue Book Private Party Value. It is an “estimation for what a private party seller could reasonably expect to receive from a private party buyer or dealership for their vehicle based on the information (e.g., condition and mileage) provided by the seller.” I’m not entirely sure what the Y axis represents, but I’m assuming that’s some sort of average resale value. Another thing worth mentioning is that cars with higher resale values often cost more, so you’d have to take out a smaller loan — so that’s worth at least considering, though the point here is simply: Depreciation matters, possibly as much or more than APR. -DT]

It’s also important to note that since the Toyota buyer didn’t carry the loan to the full term, but rather traded that car in after three years, based on the loan amortization table, that buyer only paid $3,915 in interest. The RAV4 buyer will have potential depreciation and a loan cost of $11,915. On the other hand, the Escape buyer is looking at a potential total depreciation cost of $16,000, but no loan cost. In this scenario, the RAV4 would cost that customer $4,000 less over that three-year ownership term, even though they had a higher interest rate.

Of course, if you aren’t the type to trade your car out every few years and keep them for a while, these three-year depreciation curves don’t matter as much. What does matter is maintenance costs. So the question becomes: Is the Toyota going to cost $4200 less over a long-term ownership course because it either lasts longer or has lower maintenance costs versus the Ford? That can be a tough question to answer, but there is a lot of data to suggest that the RAV4 is likely the safer and therefore “cheaper” bet for someone who plans on keeping their car for ten years or more.

Low Interest On New vs Lower Price On Used

Let’s look at another scenario, going back to the Carfax list. Many new EVs offer some sort of zero percent financing offer, but is it smarter to get a new EV with no interest or a used one with a higher rate?

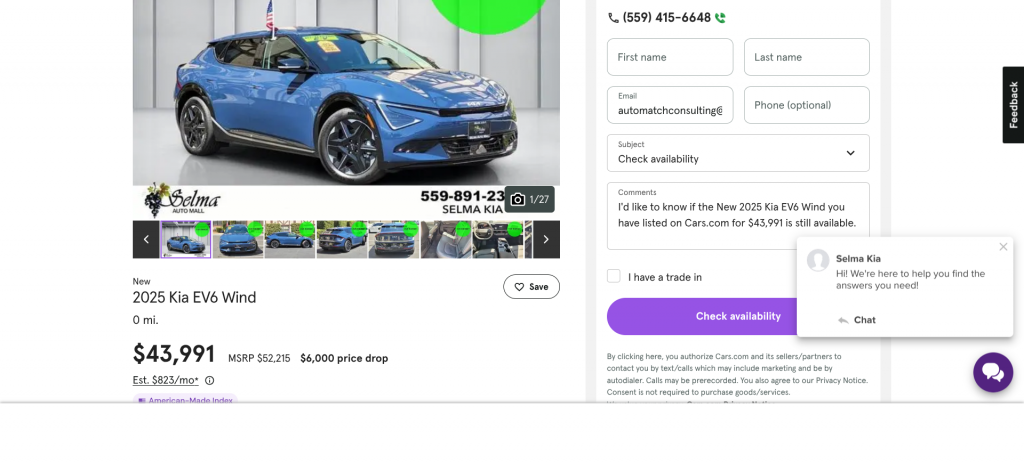

Here is a brand new 2025 Kia EV6 Wind RWD with an MSRP of $52,215 and an advertised sale price of $43,991.

We will assume that this discount can be combined with Kia’s zero percent for 60 months offer on 2025 EV6s.

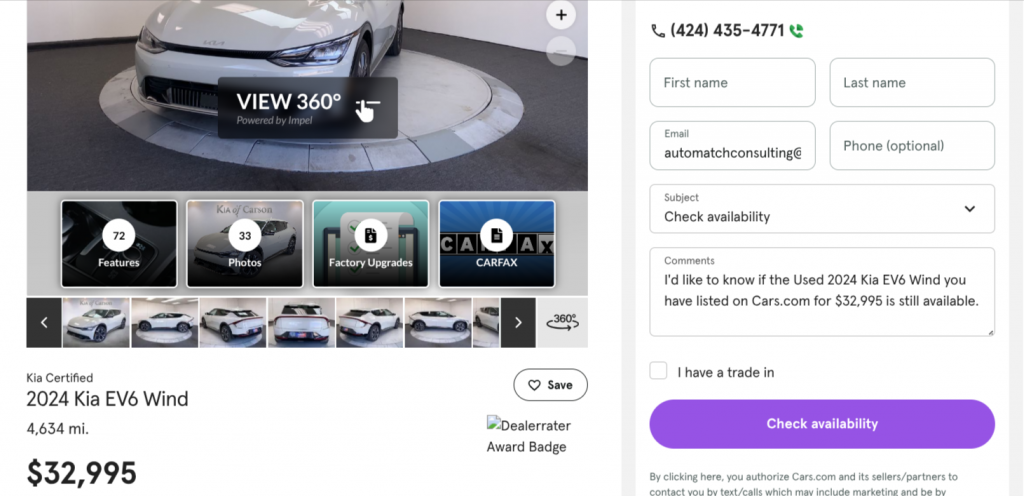

Here is a Kia Certified 2024 EV6 Wind RWD with 4634 miles and a current asking price of $32,995. The original MSRP on this pre-owned model was $50,860. Instead of buying the new car at 0 percent, suppose a buyer purchased this used one at a market rate of seven percent APR for 60 months.

They would be spending $6,205 on interest and a total loan cost of $39,200; that is still almost $4800 cheaper than the brand-new car. And this comparison was for a super-low-mile 2024 compared to a new 2025. By choosing a less expensive ’22 or ’23 MY car with 20,000 or 30,000 miles, the savings delta would be even wider.

This isn’t to say that buyers shouldn’t take advantage of zero-interest programs. If you conclude that a specific model is the best fit for your needs and budget, and that model happens to have an interest-free option, absolutely go for it if you want a new car. But I would caution buyers against exclusively shopping for models with zero-percent programs, because when you look at the bigger picture, short-term savings on the loan may result in higher long-term costs.

Top photo: Ford

…is this where I ask you to find me an already-depreciated beater Lancer? I’m not taking my nice, rustless Texas one out in the winter and I need a winter beater.

When I got my new 2023 Hyundai Santa Cruz in December 2022, I was ready to pay cash. Hyundai offered 36 months at 0% interest, which was an immediate no-brainer. I got that (and a $1039 per month payment). I also put the money I was going to pay in an high-interest account and earned around 4%, so I actually saved a few dollars and was able to pay out of cash flow.

Due to some odd job circumstances and coincidentally around $1000 a month in benefits I now pay for, I decided to pay the Hyundai off early and preserve my monthly cash flow income form the job. Otherwise I would have happily taken the loan to term.

It’s probably worth noting that I plan to keep it at least ten years, definitely through the 10/100 bumper to bumper warranty I purchased, so I won’t need to worry about major repairs. Now I have a warranted car, no payment, and 7 more years of the same. Just routine maintenance.

We keep cars for over a decade. My current car I bought new in 2012. I do not give a damn about resale as my cars are worthless when I finally get rid of them. I also live where we get tons of snow and they use tons of salt on the potholed roads and there is a 130 degree temp swing between summer and winter so 3 year old cars can be rusty and beat to shit.

I got my 2016 Smart Fortwo through one of those neat 0 percent programs because I was a “loyal” MBFS customer. My car spent most of the loan depreciating faster than I paid it off. That’s despite my treating the car like a garage queen and only rarely driving it.

But it still worked out in my favor in the end because I’m keeping the car for life, so I don’t care about depreciation. Amusingly, now that Smarts are popular again, the car is worth a bit more. Still not selling. 🙂

I think this thought is relevant to the sharpest of car buyers, but almost ALL of the people buying these cars don’t have the credit to achieve these rates, so point is mute. Also most Toyota customers keep their cars longer than 3 years, and the Fords break before then. Lease the Ford, buy the Toyota.

moot

Another note that wasn’t mentioned:

The “Big Beautiful Bill” is making interest on American-made vehicles tax deductible.

So, if you get a better price, but at higher interest rate, you may actually have a lower effective cost because the interest is deductible.

I wouldn’t even be surprised if dealers figure out how to game the system by giving you an even better price on the car, but charging an especially high interest rate that they get kickbacks on that results in a win for both the buyer AND the dealership (and at the expense of lower tax revenue).