The car market is in an odd place right now. Automakers are doing their best to hold the line on tariff-related price increases, but this will not last forever. A few brands are offering tempting zero percent finance offers on select models. However, buyers should be aware that cheap loans are only part of the total cost equation, and saving in one area may end up costing more in another.

In a previous post, I stressed the importance of doing the math ahead of time by working backwards from the monthly payment to a total budget. Loan interest is a factor in how much a car can cost you over time, as the APR can add thousands of dollars in additional cost depending on the rate and the term. So when buyers see a zero percent APR offer, that might be a deciding factor between one brand versus another.

CarFax has a current list of the zero-percent offers across all automakers for August. What you will notice is that the bulk of the offers apply to electric vehicles, while the zero percent offers on gas/hybrid models are, for the most part, targeted towards less popular/desirable models like the Ford Escape, Nissan Rogue, Dodge Hornet, and so on. There are certainly some exceptions with the Ford F-150 and Mustang, along with popular Korean-made crossovers like the Sportage, Sorento, Palisade, and Tucson, but by and large, you see 0 percent offers on poorer-selling vehicles.

Even though loan cost is one variable in the total cost equation, another important one is depreciation. While it is recommended to hold onto a car for as long as possible to get maximum financial value, the reality is that a lot of buyers frequently trade in their cars for something newer every three to four years, and within this time frame, depreciation curves matter.

Low Interest Now vs High Resale Later

Let’s examine two hypothetical purchases. The first would be a Ford Escape SEL with a total purchase price of about $40,000, and a Toyota RAV4 Limited, also with a total purchase price of about $40,000 (for simplicity). The Ford customer took advantage of the zero percent for 48 months offer; the RAV4 customer got 4.99 percent for 48 months based on the current advertised special from Toyota. The Ford customer will pay zero interest, whereas the Toyota customer is looking at a total interest cost of almost $4,200 over the course of four years.

Three years go by, and both customers decide they need to upgrade to larger cars due to a growing family; they both put about 30,000 – 36,000 miles on their vehicles throughout that time. To compare the relative depreciation between two cars, we can look at the retail prices of three-year-old examples within that mileage range.

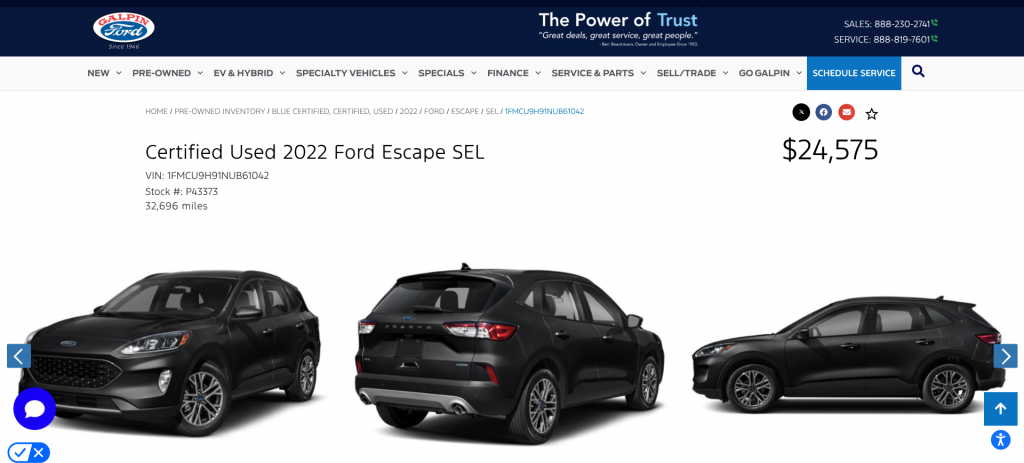

Here is a Ford Certified 2022 Escape SEL with 32,696 miles for a current used price of $24,575:

The original MSRP, according to Ford’s window sticker, is $40,430. This Escape lost almost $16,000 in value after three years.

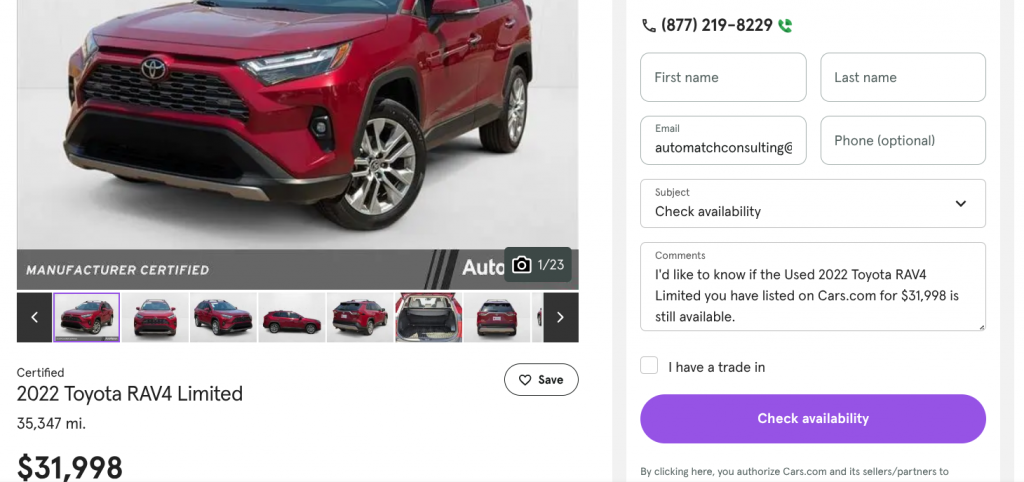

For the Toyota scenario, here is a Toyota Certified RAV4 Limited with a little over 35,000 miles with a current asking price of $31,998. The ad doesn’t provide an original window sticker, but according to Toyota’s configurator, a front-wheel-drive RAV4 Limited with a moderate level of equipment has a sticker price of $40,120. This car lost just over $8,000 in value in three years.:

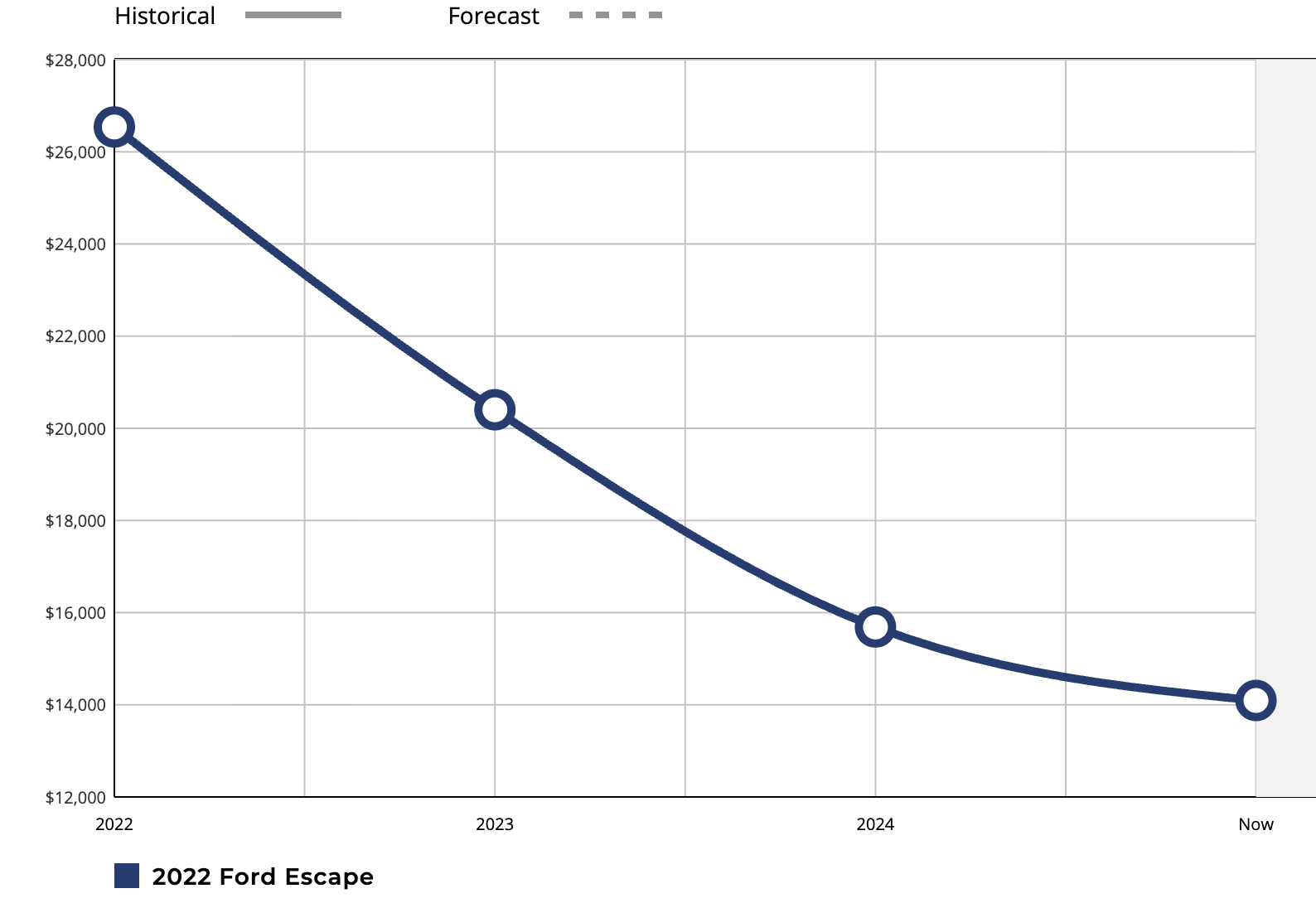

[Ed Note: If you’re curious about whether a Rav4 really does depreciate at almost half the rate as an Escape, here’s a look at some data from KBB showing that the 2022 Ford Escape has depreciated roughly 46 percent over the past three years:

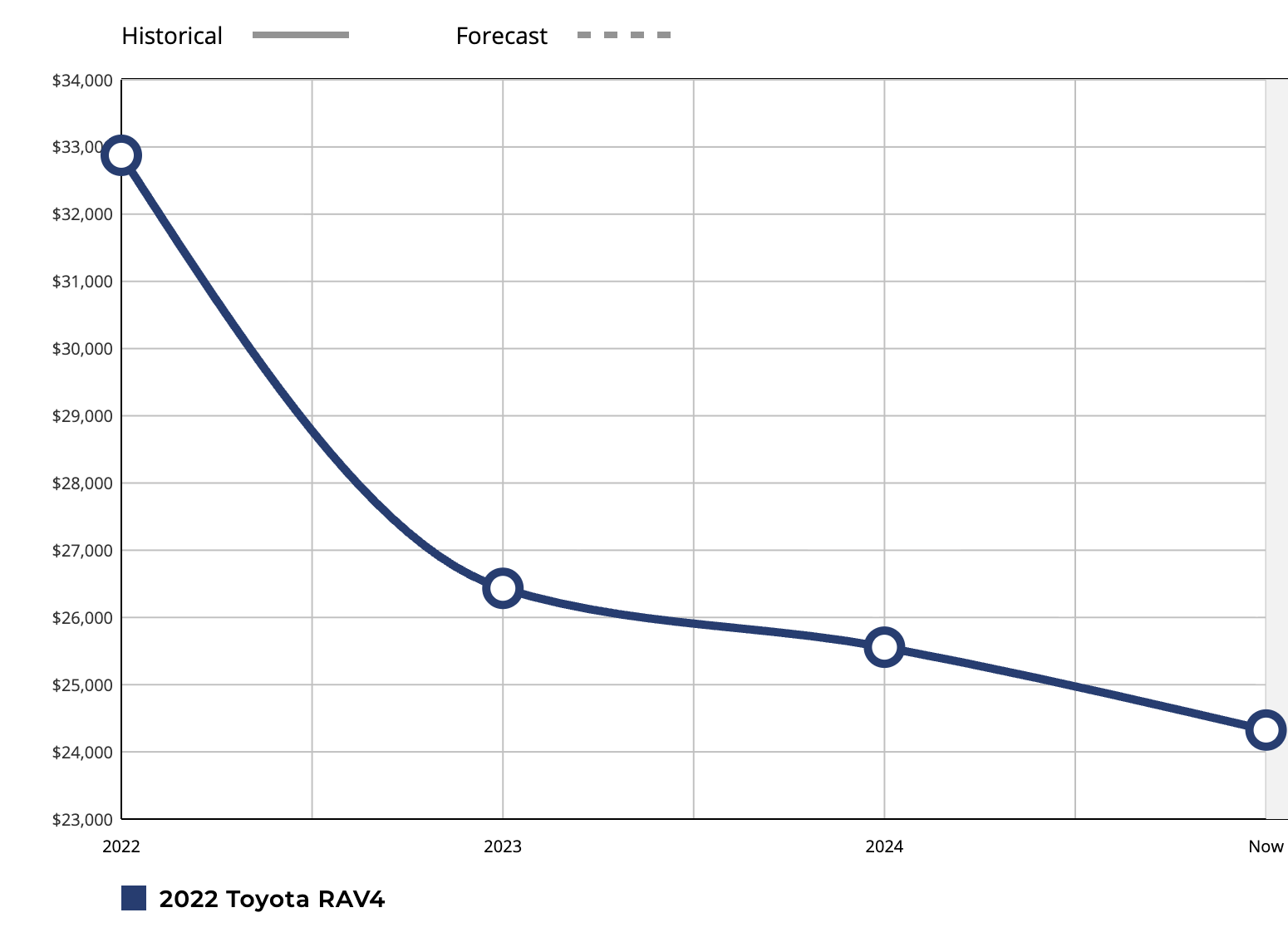

The 2022 Toyota RAV4 has depreciated only 26 percent over the past three years, per KBB:

So, 26% vs 46% is a huge delta, not unlike what we saw in the two examples that Tom picked out. The plots above, it’s worth noting, show resale value, which is based on Kelley Blue Book Private Party Value. It is an “estimation for what a private party seller could reasonably expect to receive from a private party buyer or dealership for their vehicle based on the information (e.g., condition and mileage) provided by the seller.” I’m not entirely sure what the Y axis represents, but I’m assuming that’s some sort of average resale value. Another thing worth mentioning is that cars with higher resale values often cost more, so you’d have to take out a smaller loan — so that’s worth at least considering, though the point here is simply: Depreciation matters, possibly as much or more than APR. -DT]

It’s also important to note that since the Toyota buyer didn’t carry the loan to the full term, but rather traded that car in after three years, based on the loan amortization table, that buyer only paid $3,915 in interest. The RAV4 buyer will have potential depreciation and a loan cost of $11,915. On the other hand, the Escape buyer is looking at a potential total depreciation cost of $16,000, but no loan cost. In this scenario, the RAV4 would cost that customer $4,000 less over that three-year ownership term, even though they had a higher interest rate.

Of course, if you aren’t the type to trade your car out every few years and keep them for a while, these three-year depreciation curves don’t matter as much. What does matter is maintenance costs. So the question becomes: Is the Toyota going to cost $4200 less over a long-term ownership course because it either lasts longer or has lower maintenance costs versus the Ford? That can be a tough question to answer, but there is a lot of data to suggest that the RAV4 is likely the safer and therefore “cheaper” bet for someone who plans on keeping their car for ten years or more.

Low Interest On New vs Lower Price On Used

Let’s look at another scenario, going back to the Carfax list. Many new EVs offer some sort of zero percent financing offer, but is it smarter to get a new EV with no interest or a used one with a higher rate?

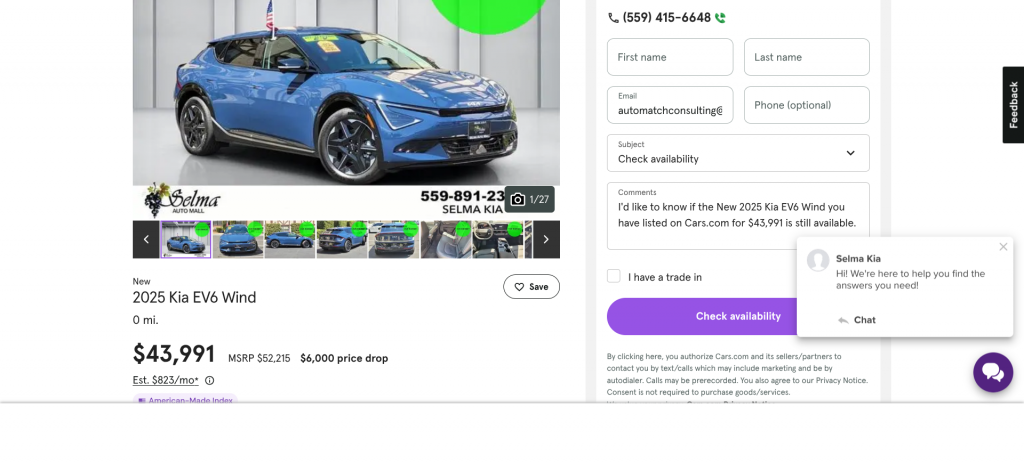

Here is a brand new 2025 Kia EV6 Wind RWD with an MSRP of $52,215 and an advertised sale price of $43,991.

We will assume that this discount can be combined with Kia’s zero percent for 60 months offer on 2025 EV6s.

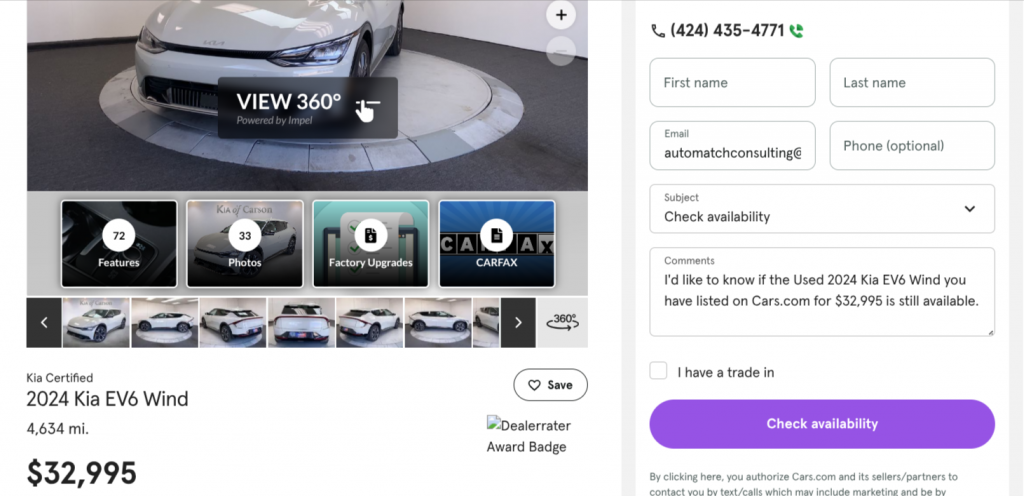

Here is a Kia Certified 2024 EV6 Wind RWD with 4634 miles and a current asking price of $32,995. The original MSRP on this pre-owned model was $50,860. Instead of buying the new car at 0 percent, suppose a buyer purchased this used one at a market rate of seven percent APR for 60 months.

They would be spending $6,205 on interest and a total loan cost of $39,200; that is still almost $4800 cheaper than the brand-new car. And this comparison was for a super-low-mile 2024 compared to a new 2025. By choosing a less expensive ’22 or ’23 MY car with 20,000 or 30,000 miles, the savings delta would be even wider.

This isn’t to say that buyers shouldn’t take advantage of zero-interest programs. If you conclude that a specific model is the best fit for your needs and budget, and that model happens to have an interest-free option, absolutely go for it if you want a new car. But I would caution buyers against exclusively shopping for models with zero-percent programs, because when you look at the bigger picture, short-term savings on the loan may result in higher long-term costs.

Top photo: Ford

If you’re trading cars every three years, you’re not really all that worried about maximizing every automotive penny you can.

Yeah I mean, if you do the math one way on acquisition and another way on resale, you can do whatever with it.

But yeah, this isn’t apples to apples. I think the short story on this is factor in total cost of ownership and depreciation into the net present value yadda yadda yadda

Eh, by the time I’m done with a car it’s rarely worth more than about $3000 anyway. That’s not to say that the article doesn’t have valuable insight for people who don’t keep their cars as long as my family does. If you only plan to keep your car five years or less considerations like this absolutely matter.

No they don’t. Those poeple should be leasing.

This just totally makes no sense because you didn’t do two toyotas together. OF COURSE THE FORD DEPRECIATES FASTER. I’d love to see a Toyota vs Toyota break down of the same car and see if your point stands.

I see a lot of Mazda mentioned here, and I’d just add we also just got a Mazda CX-90. Wife wanted an AWD 7-seater, preferably a PHEV. We went to the Mazda dealer expecting to pay cash for a CPO mid-spec CX-90, but they offered $15k off MSRP for a lease on a brand new fully-loaded one for $400/month. Looking at the residual, assuming we buy out the car at the end, that comes in a few grand cheaper than buying the lower-trim CPO one with cash.

I should note though that we have the cash reserves to buy the car outright at the end of the lease, so we wouldn’t be subject to a used car loan, which usually have higher interest rates and would tip the total cost back in favor of the CPO car.

I’ve never leased before, and we’ve generally avoided it since we keep our cars for a long time, but after talking with some friends and family who are familiar with leases, they said it was a great deal.

My parents signed on the dotted line for a 2025 CX-50 on Black Friday 2024 because Mazda was offering 0% financing for 36 months. They also took ~10% off MSRP which was nice as Hyundai was also offering 0% APR on the Tucson hybrid at the time but that meant you forwent any cash on the hood.

The difference in out the door costs for both meant that the hybrid Tucson would never save them enough money at the pump to offset its higher price in the time they keep their cars for (about 4 years).

Yeah, unpopular vehicles now will be unpopular in the resale market.

Do note that since new car prices are gonna get jacked, used cars will also retain some value as people look elsewhere and demand rises. Temporary and Indefinite, cuz TACO Tuesday.

Also, 0% vs 18%, new cars will depreciate independent of the APR. Negotiate the lowest price possible — APR will be higher, but you’ll have a Credit Union loan in your back pocket. Or just pay it off.

Or, buy what you can afford with cash, which might not be a new car.

I have a personal counterpoint to both of these scenarios.

In 2018 we bought my wife a new Mazda CX-5. We were wanting to buy used but in our shopping we realized a used 1-2 year old car with 10-20k miles was only $1-2k less than buying brand new. We then found that they were offering 0% 60 months on the new ones, which made the total cost of buying new LOWER than buying used.

Fast forward and we just sold the car in February with 70k miles for about 38% lower than we paid for it. Which seems like very lower depreciation over 7 years.

Another thing to keep in mind for new vs lightly used is also warranty length available. Especially on something likely to have more repair costs like a Kia/Ford rather than a Toyota, or an EV (less proven and tested tech) than an ICE with a proven powertrain.

Those who qualify for 0% typically do and should put a fair amount down to compensate for depreciation and stave off an upside down loan.

Just how much depends on the factors mentioned above.

Inflation is going to shoot up, making 0% APR seriously attractive.

I’d say one can either put down a fair amount, or see how much GAP insurance will cost.

GAP gets more and more attractive when real interest rates run at -5% or better.

*IF* the underwriting company actually PAYS your GAP claim. I had an experience with a GAP underwriter who simply played the, “e-mail it over/fax it over/mail it over – oh yeah, we never got it it, send it again” game with me for like 8 months. It was outrageous. If I paid myself slave wages for the hours spent on hold, getting transferred, leaving voicemails I could have paid the claim myself in cash. I eventually gave up and they never paid.

Seriously, if a company plays that game and is dumb enough to give you a fax number then spam them with faxes until they say “uncle”. If they have a physical machine on the other end you can run them out of paper and cost them money. Even with electronic receipt and a server you can potentially fill their disk and hose them that way. For extra annoyance points create a cover sheet that is black with minimal white lettering to cost them extra toner.

When that happens you contact your state insurance commissioner

Putting any money down on a 0% loan is stupid. You want to compensate for depreciation? Put the money you were going to put down in a safe investment that you can cash out of if you need to. Why give it to the finance company???

Why would I take money that can earn 4%* pretty much risk free and use it to pay down a 0% loan? That makes absolutely no sense.

If for some reason the car is totaled or you need to sell it and are upside down just take the money plus interest out of the bank.

*Vanguard’s money market is currently has a 4.22% yield and a 30 day Treasury is paying 4.45%. Even a regular bank account is paying 3.5% today.

I’m about to buy a Pacifica Hybrid (again), and the new vs. used debate is exactly what we’re wrestling with right now. Dealers are putting $10k on the hood + $7500 federal tax credit if we take delivery by 9/30. There are vanishingly few low mileage used PacHy’s in our area, so we’d likely have to pay for shipping for a quality used one. It’s probably going to come down to what’s available used in early/mid September.

Lease a new one.

This isn’t a 0% vs. cost battle; there should always be in the calculation of true cost of financing on any given vehicle.

This article is actually a Brand vs Brand battle.

If you are concerned on resale of a vehicle after 4-8 years, then look at that specifically. Resale isn’t related to financing, it’s down to the brand/model reputation: e.g. Toyota, and Honda generally do better than Stellantis, GM, Nissan.

It isn’t exactly a slim jim to wagyu comparison, but we all know depreciation is very different between Ford and Toyota.

I feel really lucky with my Mazda3. Bought it for $18,5k in February 2019 with 7500 miles on the clock. Now in 2025 with 75000 miles, similar mileage cars are going for around $15k on Autotrader. So only $3500 depreciation in 6.5 years. Not that it really matters because I have no desire to sell it anytime soon, but it’s still fun to see.

Pretty much same, bought my Mazda3 new in December 2018 for a bit over 20k, has about 95k miles on it now. 60+ miles a day commuting will get to that 100k mark pretty soon, but I’d gladly keep it to 200k and beyond if it keeps on chugging, it’s been a great car.

My plan is to keep it to 200k and if I can hold it long enough, have my 4 year old learn manual on it. I think it’s possible. Totally agree about it being a great car.

2017 – 2019 was just about the golden age for buying a new or lightly used car. Low interest rates, tons of available off-lease vehicles available, reasonable MSRPs, etc. A car similar to my wife’s current Forester that was 24k with 0% financing in 2018 is now 33k with 6% financing today. That’s pretty wild.

That’s really depressing. A lot of cars I’ve wanted to buy have stayed the same price after all of these years. It sucks when you’re on the bad side of it.

It totally sucks, and for a country that’s completely dependent on cars for basic transportation, obviously a bad result.

And with tariff effects finally coming down the pike, it’s going to get worse.

I’ve been driving EVs for 12 years now.

My advice: Never finance a new EV. If you want a new EV, lease only!

If you want to finance an EV then buy low mileage used example.

EVs are essentially like consumer electronics, where you always buy the newest one for the better tech. Thus, older models depreciate a substantial amount.

Yep. We’ve had EVs for over 7 years. I probably should have leased my 2022 Mach-E, so I’d probably be turning it in about now when there are EV fire sales before the Sept 30 tax credit cutoff, but I financed it. At least it was back in the days of 2% rates, and I switched jobs for one that pays for my car as like a company car kind of thing, so other than insurance, that car has been free the past 2 years. Mach-E depreciation is extreme, but I’m not really bearing the cost, plus we love the car and plan to keep it for at least another 5 years.

We paid about $30k total for our 2018 Leaf with zero percent financing and the $7500 tax credit. We paid off the loan in 2022 when we got the Mach-E (so we’d only have one car payment). We just sold the Leaf with 65k miles for $9k, but I feel like we got our money’s worth out of that car overall. Had we sold it at 3 years though, that depreciation would have been brutal.

I think EV depreciation up until now is not necessarily a good indicator of depreciation in the future.

There are a couple unique reasons why EV depreciation has looked worse up to now, but those scenarios may not be replicated in the future.

-New models that have been somewhat revolutionary in the market resulting in temporary, inflated initial cost due to hype and lack of competition. For a while, the Model 3 was really the only affordable, primary-vehicle-replacement EV, for instance. Then there was the Model Y. Then you’ve got the first full-size truck (and first electric version of the country’s best selling vehicle), the Lightning.

These all originally sold, new, for years, at prices substantially more than the same vehicles sell for, now. In 2017, a new Model 3 LR RWD was $42,500 after tax credit. Now the new (and actually better) version is $35,000 after tax credit.

Overall in the car market, most cars don’t see that happen to that degree. A new Camry doesn’t come out, sell for $30k for a couple years, then drop by 20%.

-The Federal EV tax credit went from $0 in 2022 for the majority of EV sales in the US to $7500, crushing the price of used vehicles because new ones were suddenly much cheaper. This *could* happen again in, say, 2030 if a new president/congress adds the credit back, but that’s a relatively unique situation.

So, if you bought an EV in 2020 (soon after Model Y came out), and then you tried to sell it in 2024, you would take a bath, but two unique scenarios made depreciation way worse than it would be if you bought a Model Y today.

Also, the incremental improvements in EVs are much smaller with each new model or refresh, now, so “obsolete” models aren’t much worse compared to, say, 2018. If you had paid $40k for a Leaf in 2014 and then wanted to sell it after the Model 3 came out that had 5x higher max charge rate, 300 miles of range vs 80, etc., of course the Leaf is worth its weight in scrap. It’s not even on the same planet as far as capability. But the 2025 Model 3 vs the 2021 Model 3? Better, but now it’s 10% better, not 60% better or whatever.

Exactly my point.

I bought a new 2012 Chevy Volt in March of 2012 with an MSRP just under 45k. There was a $7500 tax rebate available then but you didn’t get that money until you filed your taxes. Of course, you still financed the entire amount. In my case, we have to pay taxes every year so this just reduced what we pay. Sigh.

In July of 2012 GM announced that the 2013 model of the Volt would be reduced in price by $5000. Ouch!

I’m not sure how, but I managed to break even when I sold my Volt to CarMax in the summer of 2014 when I leased a Cadillac ELR.

I absolutely STOLE that ELR. MSRP for 82k. I put down 2k in GM credit card money. $0 out of pocket. 2 years 24k miles for $460 per month. I wanted to keep the car but GM buyback was like 52k and they were selling used for 32k at the time. Sigh.

As a person who bought a new Suzuki SX4 in 2011, this is very, very real. Now, that totally worked out for me as I kept it for 9 years, but boy oh boy did that loan not look so hot when Suzuki announced their departure from the US. In theory, an Impreza would have probably been the more prudent decision, given both the anticipated depreciation, and of course, the reality.

At the very least, if you’re going for the weird, or the down on their luck brand, it needs to be understood what you’re potentially missing out on. To those buying Mitsubishis, Nissans, and Stellantis products… beware.

Why buy a NEW car if you are going to SELL it in 3 years, knowing it will lose 30, 40, 50% ?

Just keep using it for 7,8,10 years and then sell. So pick a car which is good for 10 years.

I get the whole thing about buying new, I’ve only ever bought used and will continue to do so, but buying a car now for the needs you think you’ll have 7 years from now is just not good practice. If right now you need a small commuter, but you may decide to have kids 2 years from now, that doesn’t mean you need to take on the purchase and fuel costs of a kid-carrier right now. Same with buying a truck because you’d like to get a house, trailer or boat, or ponying up for AWD because you might move somewhere colder within the next decade. More doors, space and seats don’t only cost money to buy, they also take fuel to carry around.

If by “good for 10 years” you meant that it’ll mechanically last that long, disregard the paragraph above, because you’re absolutely right.

I realize that the article you’re commenting on is about saving money. But the answer is… because they want to. Because they like having a new car. I love getting a new car. I’ve had mine less than 2 years and I’ve already made a spreadsheet for picking the next one. I’m sure not every purchase you make is based on strict economic rationality.

Also, Ricardo is right. Lives and needs change.

Same here. I love having new cars every 2-3 years. I lease them. I can afford it so why not?

Me? I’d rather retire early.

Same here. I starting thing about things differently at 25 and the question was “Do I want a new car or do I want to retire 3 years earlier”. I didn’t have to think about that long.

There are plenty of cheap, fun cars out there that don’t require another mortgage payment per month.

Very true.

Personally I like to buy a 2-4 year old car off lease and then drive it for 10 years. That has been the sweet spot of cost to reliability for me.

I’m with you. I find myself ready to consider at a new car at about the 2 year mark, often based on a change in hobbies or discovering that my vehicle just doesn’t do something as well as I’d like. It takes some time to find the right car, so I am usually actively shopping around year 4 and buying at about year 5 or 6. I’ve considered just leasing permanently, but the timing gets too locked in and I do too much research to end up in a vehicle I’m happy with at every lease return (“Oh, the lease ends in 6 months and there is a car I think I would like coming out in 9 months. Not worth short term rentals. Guess I’ll lease something that’s okay.”).

Also, I am absolutely a spreadsheet planner, too.

I’ve been shopping for my next car since the moment I drove my current car off the lot. For better or worse it’s just how my neurodivergent brain works. I’ve had my Kona N for over 3 years now and barring something unforeseen happening I’ll have it at least another 2, and we’re going to pay it off in the next couple of months just so we can have a year or two without any car payments.

But my next car? I have lots of ideas and I actively do research constantly. The same goes for my wife’s next car, which will be necessary sooner than mine will be. I’m obsessed with cars! I like buying them. I live well beneath my means and buy cars that are well beneath my means so I can enjoy them without much guilt.

Will I lose some money each time? Sure, but to me it’s worth it to have a little extra joy whenever I have to drive somewhere…and it’s not like I buy at the top of my budget and wind up with 4 figure car payments on an M3 or Macan or something. My current car payment is roughly 10% of my individual monthly post tax income and less than 4% of our monthly post tax income.

Who cares? Life is short. It’s okay to live a little.

If you can afford it, then sure, do it. Still I’d think that the $1000 or more a month would be better spent on a better house then. Or an apartment you rent out. Because cars just depreciate.

15 years from now you’d have money to buy a supercar without a loan.

Tom, this is too real… I fell for the exact same trap once on what became my biggest automotive regret. Wish I had this article back then.

I’ll never miss an article by Tom (he was the only reason I kept hanging out at the old site as long as I did), but the top shot pic is what grabbed me – I’ve always wondered why Ford insisted on giving the final gen Escape that out-of-proportion grill emblem. It’s weirdly big for the vehicle, which makes me wonder what Ford model it’s actually from.

With a big emblem and a fake grill sticker I think* some folks might be fooled into thinking a Model Y is an Escape.

*Hope

Excellent points. Mazda was offering 0% for 60 months for a while on CX-5s. Anybody who needed a vehicle that it met the needs of, would have been well advised to jump on that. Ours has been flawless for 22 years and counting. We don’t buy vehicles often though. That’s the “new” car in our fleet.

Did you mean 12 years? I think you meant 12 years…

I actually meant 11 years. Whoa, that was quite a fat-finger there!

My next newest vehicle is 19 years old, followed by 24 years old, and 51 years old.

The points are valid, but for me I like to purchase my (daily) cars below my means, with good warranties, drive them like I stole them so if something breaks…it happens during the warranty, and go for as long as I can after that.

But don’t get aftermarket warranties…if you buy an extended one, get it through the OEM. I’ve had enough experience with that on both sides of the service counter.

I had Ford pay for a hilarious amount of shit through the OEM extended warranty on a 2003 Explorer, Subaru replaced my engine for free, and I got Hyundai to give me a $9,000 check to not lemon law the car without other implications (still has it’s warranty and everything).

The Hyundai issue was very minor (chassis would creak sometimes)…but I read enough of the state laws to say I could lemon law it if I wanted to… so Hyundai corp (who were actually great to work with) gave me the $9k check to not do that.

Can we talk about the present value of money? Our 0% interest payment on the Ionic hybrid (2019 in 2020) of 346 bucks isn’t 346 bucks 72 or 84 month later. Apples to apples take the loan out for 5 or 6 years and then let’s discuss residual value. Remember also the downstroke is in present value $$’s which affects the entire cost scenario. But yes your analysis is why it can be less expensive to lease a BMW than a Kia. Residual value. And while I’m on my lease soapbox this shite about 189 per month but 4000 down???yeah. Sure idiots can’t divide 4000 by 24 or 36 and add that to the cost? Plus wait just one sec. I’m paying you an upfront amount to rent your depreciating asset. F that

Yup. And leases have GAP included to cover the leasing company. There’s no reason to put money down on a lease- if the car gets totaled you’re not getting it back.

Great article, Tom. Good to see you touch on the subject that is often ignored by the Kia fans.

I love my specific Hyundai but what Tom’s saying is very important to remember. Korean cars depreciate horrifically. I tell people that ask me for input when car shopping all the time-don’t buy one unless you have a downpayment and are okay with losing some money over time. The initial savings over a Honda or Toyota are more or less wiped out when it comes time to sell.

If you really like the car (clearly I like mine since it’s in my profile) and are okay with that and the dice roll then go right ahead. But you’re not actually saving money owning a Korean car long term. In fact my biggest complaint with mine other than the horrid dealerships is the depreciation. My car was $36,000 in 2022. Right now according to CarFax and KBB with only 20,000 miles and a spotless record/all of its preventative maintenance I’d get $20,000ish on it in a trade in.

That’s ghastly, and if I’d been more aware of it when buying I probably would’ve pivoted back to a GR Corolla like I’d originally planned. But whatever, I enjoy the car and had a big enough downpayment that I’ve never been close to being underwater.

Another consideration is that surprises happen. Suppose your car is stolen or totaled a year after purchase. You’re going to be reimbursed by your insurance based on the current value of the car, not based on what you owe. Things can change–you get a job with a company car, get a divorce, whatever. There’s an advantage in owing less.

Hello GAP insurance

… Which only adds to the cost of the “cheaper” car.

We had that happen with a 2 year old Mazda5. After only 9 months it was totaled. We got out of it with enough cash in hand to lease a CX-5, which we drove for 8 years and sold. Our current rides were cheap, and we paid cash. My truck may get bad mileage, but no payments and low insurance pays for a lot of gas, not that I drive it that much

I sold an F350 to a company recently. Most times, taking 0% on a more costly vehicle yields lower payments (which is the only metric most of my customers care about). However, in this guy’s case, he gave up $8500 in rebates. Even with interest, the payments were very close to the 0% payment and he would’ve started the loan with a much lower balance. I guess he didn’t care since it was a company vehicle and would get depreciated, but still…

That’s interesting, is “choose either 0% or a rebate” pretty common? I can maybe see how the math would work out for the customer there, since if the payment is the same, more depreciation is better.

It’s very common with Ford.

It’s pretty common for brands that regularly advertise some kind of cash back offers. There might be some cash back that everyone gets, but for what you can stack on top of that, it’s a choice of a promotional rate (even if it’s not 0%) OR additional cash back*, but not both. Honda/Toyota don’t advertise cash back so much, but domestic brands often do, as do Nissan and Hyundai/Kia.

*Sometimes the extra cash back is still tied to financing with the manufacturer’s financing arm, just at standard rates. Dealers may play that game about financing, but the OEMs certainly do too.

Regarding your customers only caring about monthly payments, my personal experience with every new car salesman I’ve dealt with is that THEY only want to talk about monthly payments. It’s like the total cost is some heavily guarded secret.

The last time I sat down with a salesman, I was looking at trading in my van for a newer one. The guy gave me a trade in value, then proceeded to present the monthly payment.

At no point did he even tell me the price of the new vehicle, and he really wanted me to agree to the purchase right then and there. I told him I’ll think about it. He even called me the next day to see if I would agree to the monthly payment. I still have no idea what the thing he wanted to sell me actually costs.

The scary thing is that the payment seemed attractive and I actually considered it for a second.

Car sales certainly would prefer to obscure the real numbers into a nice tidy monthly payment so they can wring all the profit out.

But plenty of customers are happy to go along. It makes it easier for them to wrap their head around I guess.

I saw a post on Reddit the other day where someone was asking about the wisdom of trading in for the latest model of the car they have. To do so they’d have to pay $5k out of pocket (or rolling into a new loan) to cover the underwater status of a lease. A lease! Just hold on to it until the manufacturer runs a lease pull up. But the justification was that the payment would be about the same! So good deal right?!

And it is a great sales tool when when a payment went over the target – it was “only $50 a month”. You have an extra $50 don’t you?

That sounds like a crappy salesperson (or, more likely, a crappy manager telling them what to say.) I mostly sell commercial vehicles, and the first thing I’m asked after we find the right vehicle is “how much?”

So I tell them. It’s not rocket science. Also, I’m not a fan of bullshit, either giving or receiving.

As someone in car sales, I always present all of the numbers and its shocking to me how many focus on monthly payments. I’ve had people say no to $503 a month but yes to $498 a month. I think most people just think in monthly budgets

Yeah, pretty much every time you get the option of the 0% interest or the rebate, the rebate is better (at least as far as I’ve seen). But they know 0% sounds really appealing and people will take it. And giving people a choice makes them feel like they’ve gotten the best deal.

And people routinely overestimate the amount of interest they’ll pay, because back of the napkin math forgets a lot of things. $50k loan with 5% interest each year for 6 years would cost $15k with the principal remaining steady, but a quick trip to a loan calculator gives me about $6600 when accounting for the decreasing balance.

Welcome to autopian, Tom. You did me a solid on a Porsche in Covid era. Good to see you here.

Welcome, indeed! Happy to see you here, I’ve always liked your posts and insight.