Every few months, a new headline emerges showing that the average car note monthly payment keeps creeping upward. In what most analysts consider an uncertain economy, new cars are becoming less and less affordable for the average buyer. Let’s talk about why monthly payments should, but also shouldn’t, be the focus when you are shopping for your next ride.

Now, if you are in the “I only pay cash for my cars” camp, that’s a fine place to be. However, if you aren’t buying old and/or whacky stuff from Craigslist or Marketplace for cheap, and prefer newer, with modern features and a warranty, most people simply lack the thousands of dollars in liquid assets to spend $15,000 or more for a vehicle. Therefore, these buyers will need to finance a car loan and will have a monthly payment.

Naturally, there is no shortage of online commentary, especially from “finance gurus” who will say things like:

Are too many Americans buying cars they can’t afford to keep up appearances? Sure. Does that mean that financing a car is one of the worst financial decisions you can make? Not if you use your brain first and an old-school device called a calculator.

There is an old piece of car buying advice that says “never focus on monthly payments,” and this has some validity, because far too often a buyer goes to a dealership with a payment target only for the dealer to structure the loan and the deal in such a way where the monthly note is where they want to be, but the overall deal is a bad one.

For example, if someone has a monthly payment target of $400 and is shopping for a Honda Civic with an MSRP of $25,745. On the surface, it seems that $400/mo should get you a pretty reasonable car. After some back and forth dealer tells the customer, “Good news, I was able to get you a payment of $401.27 on your new Civic.” The buyer isn’t going to balk over $1.27 per month over budget and signs on the dotted line. Except, in order to achieve that payment, the dealer had the customer finance this car at an eight-percent interest rate for a whopping 84 months! This person will pay almost $8,000 in interest and have a total cost of $33,706 over the course of the loan.

This is why the “finance experts” say to look at total cost first, which is not bad advice. Except that most people conceptualize their spending based on a monthly budget, and in doing so, they are looking at how affordable a car is through the lens of monthly payments. This is fine, as long as you do so before you go shopping for a car.

Here is how you focus on monthly payments by working backwards and then determining the total cost. The first step is to take an honest look at your finances, money coming in and money going out via rent/mortgage, utilities, food, et cetera. You will then determine if you have a chunk of money you can allocate for your car payment.

The next step is to know your credit score; there are ways to do this by checking all three reporting bureaus. Keep in mind that the score you see may not be exactly the same as the figure the banks see. Why this is the case is a mystery for the ages and one of the many confusing aspects of the credit system. However, you should have an idea of where your FICO is. Generally speaking, if your score is above 720, you are in good shape and you will usually qualify for competitive rates.

Step three is to fire up a loan calculator that allows you to input the payments, loan term, and interest rate. In regard to the APR, that is going to take some estimation; if you happen to have a Tier 1 score (720+ FICO) you can safely use the “average” rates for new or used cars. If your score is below that, you will have to estimate the rate up accordingly. I recommend estimating on the higher side of APR for these calculations.

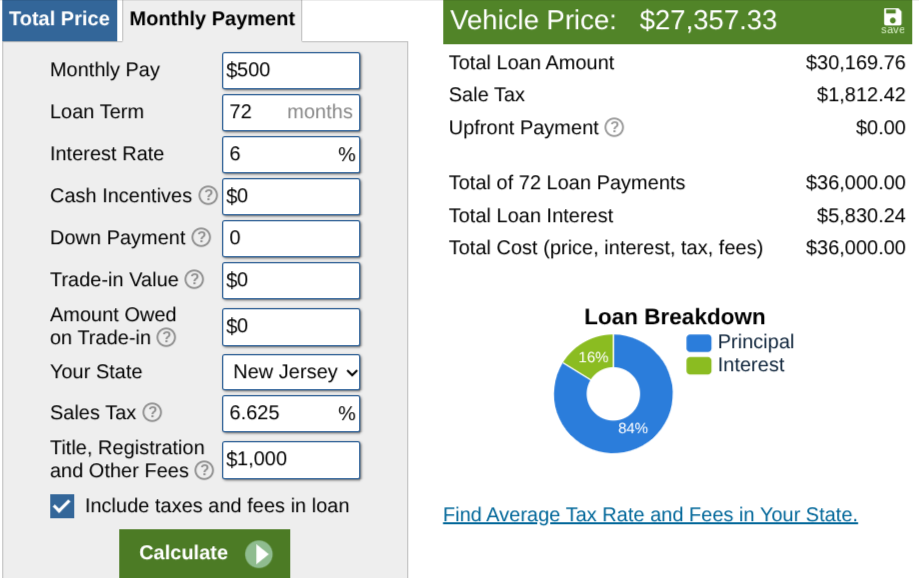

For some example calculations, let’s try to figure out what our budget for a car would be with a target payment amount $500/mo, assuming we have a Tier 1 FICO score. You need to set the loan term; sixty months or five years tends to be the sweet spot for having a reasonable loan term, but also allowing for a healthy budget. Shorter terms are fine if you like paying loans off sooner than later, but they will limit your budget if you want to stay under $500 a month. My recommendation is to go no longer than 72 months. You will also have to factor in your local sales tax, dealer fees, and registration. Fortunately, there are calculators that have those options as well.

This is how I would go about setting a car budget: by starting with the monthly payments and then working towards the total cost. I would do this before I even start considering what cars to buy. I have my hypothetical target of $500 per month, I am going to set my loan term at 60 months with an estimated interest rate of six percent. I’ll set my NJ sales tax at 6.625 and put a rough estimate for dealer, DMV, and doc fees at $1000 (again, I like to err on the higher side). I also need to make sure I check the box to include all tax and fees in the loan.

Plugging this into Calculator.net’s auto loan calculator results in a spending budget of $23,318 before tax, DMV, and fees. Pushing the loan term out to 72 months gives me $27,357 before additional charges. Now that I have an idea of what I can actually afford, I can start my research to see what cars fall within that budget range. Of course, if I were using a down payment, I could adjust my budget accordingly by whatever amount of cash I am comfortable spending. Bringing money to the table is always a wise decision, as it establishes some equity in the car and can prevent you from being underwater on your loan.

If this all seems like a bit of work, it is, but doing this is one of the most surefire ways to avoid buying more car than is appropriate for your finances. While there are plenty of dealers who won’t hesitate to rip buyers off, being armed with a clear and honest understanding of your budget and loan terms is one of your best defenses against a bad deal.

I’m very late to the party here, but welcome Tom!!! Thanks for your help in the past and I could’nt be happier to see you contributing to the Autopian!

Welcome to The Autopian Tom! Do you (or any other reader) know if there is a Canadian version of this calculator?

Have a quick conversation with your insurance broker, unless you have a perfect driving record, are married and over 25 (still not a bad idea, though) before pulling the trigger. Two or three hundred per month for insurance could sink your well-planned budget.

Insurance for a brand-new car is not cheap, even when you have all the factors that should be on your side.

I just wanted to say it’s good to see your work here at The Autopian, Tom.

We’d be delighted if you came and said hello at Opposite-lock.com

It is unfortunate that you had to provide this information because it is obvious to some of us, but the reality is that many (or most) people are financially stupid. So thank you for helping some folks here.

However I suspect the people who need your help most aren’t largely the ones reading your article.

Yay!!!! Tom is on the Autopian!!!!!!!!

Great advice! I play with those online calculators too often, haha!

The car payment is only one piece of the puzzle, and without the others, it won’t show the true picture. If you don’t look at the true picture, you are unlikely to ever be a person who can buy your car with cash.

Car buyers need to look at the overall cost of ownership, including fuel, maintenance, insurance, and depreciation. All of those things could swing the real numbers more than a percentage point or two on your loan rate.

Getting a Corolla with a 10-year maintenance cost of $4200 vs a Jeep Compass at $11,000 is a $56/mo difference. That is about the same as a $20,000 48mo loan going from 5% to 10% interest.

Over 5 years, a RAV4 retains about 70% of its value while a Ford Escape retains only 50%. So if you spent $34k on a RAV4, it would be worth about $24k five years later while the Escape would be worth $17k. That is $7k difference over 5 years, or $116mo. That is enough to cover all your fuel costs for the average driver of those vehicles.

So just the upkeep and depreciation have the potential to create a gap of over $160mo on cars that are filling the exact same niche in the market. That gap gets much wider if somebody thinks they can take their $400mo payment and pick up an off-lease BMW over a new Camry.

If you have the resources to afford a decent car payment, I have found that looking at certified pre-owned can offer good value since it avoids the initial depreciation hit while eliminating the risk of a major repair event. Hold the car for the length of the warranty (and if it is in good shape, maybe a bit longer) and then trade it in for another certified pre-owned.

This provides a very reliable monthly transportation cost. If you select a model with low depreciation, say a RAV4 that goes from $30k to $25k over your four years of ownership, you are only really out $5k over 60 months, or $83mo plus the loan interest. If you have paid the car off over those four years and now trade in the $25k car for another $30k car, you will only need $8-10k for the transaction. Maybe that is something you can swing with cash. If not, it is a relatively small loan.

Eventually, if you can cover the transaction with cash, you need to at most spend $10k every four years, which is about $200mo to always be driving an almost new car with a full warranty. That is about the same monthly cost as a person with good credit pays on a $12,000 6-year used-car loan, which would get you a 13-year-old RAV4 with over 100k on the clock and the extra maintenance cost that would include.

For whatever it’s worth, my 18-year-old RAV4 didn’t have any extra maintenance costs beyond ordinary consumables like belts, fluids, spark plugs, brake pads, tires, and wiper blades until last year, when I replaced the struts. It never even burned out any bulbs! And it now needs an alternator, at 190,000 miles. But really, nearly any other aging car would support your point.

That only matters if you plan on selling it as soon as the loan is paid off. Which… why would you?

Even a CPO car is still a used car. While it might cost less, it means that you’ve got fewer (if any) maintenance or repair-free years left.

If you want to drive a car until it “dies,” then you don’t need to care about depreciation. But that is a very, very rare case. Very few people buy a car and then drive it until it’s no longer functional and only has scrap value. You could do the same exercise over 10 or 12 years rather than five. Something like the Escape or Jeep Compass will be worth basically nothing if they are even still on the road, while the RAV4 is likely to still have meaningful value. The initial 5-year depreciation figures represent that reality clearly.

The number of “repair-free years left” is largely immaterial if you take everything into account and simply budget a monthly expense for transportation and minimize it. The only way to have a predictable expense is to eliminate the possibility of a significant repair, especially nowadays, as repair costs increase more quickly than car prices. The person who can’t budget $200-$300 per month on a car payment is unlikely to have $3-6k for a new engine or transmission, especially if they are driving a car with 180k on the clock that isn’t worth repairing. That puts them into a position of having nothing of value to trade or sell.

Owning a car during the last years/miles of its life is full of expensive risks. Lots of people have no other choice, but for people who do, it is something worth avoiding. It is the back-end version of avoiding the big depreciation hit at the start. The best value is in the middle.

There is a point where trying to save money costs you more in the long run. Getting to a point where you can always be driving a car that is less than 6 years old, with a warranty for $200-300mo is hard to beat. Low cost, low risk, low stress.

In 1985, the average car payment was $250 on a 12% loan for a $10,000 car termed at 36 to 48 months.

In 2025, the average car payment is $750 a month on an 7% loan for a $50,000 termed at 84 months.

So car payments have to cover 5x as much car, but payments only 3x, but term 2x. Jesus Christ.

People used to buy shitbox little Asian cars like, wait for it… Honda Civics, Ford Taurus and all order of Nissan products that were cheap, etc. Now every Karen that is blitzed out of her mind on prescription medicine on her way to a wine tasting has to drive a Tahoe, Wagoneer, Armada, etc and even the “efficient” cars they drive are like X5 and XC90s. So they’re burning the candle at both ends: the payment and keeping the car on the road from fuel to maintenance.

I regularly see mortgages in amounts like $4000-6000 per month from people who have regular ass cookie cutter houses. People who rent have it even worse these days paying something like 45% of income on paying to live in someone else’s house.

Everything is ridiculously expensive and becoming more so all the time and at a faster clip than the rise of incomes and social mobility.

Maybe we should just stop electing people who blatantly redistribute income from everyone else to the wealthy class. People identify with Peter Pan, but for some reason they love to vote for Captain Hook much, much more.

Problem is that people are happy to throw their money at the wealthy class to keep up with the Jones’s. I got ahead by living with roommates until I could afford a house payment (~15% of my net income) and a large cash down payment. I have never bought or leased a new car, and probably never will. The most expensive thing with wheels I’ve ever bought was a new flatbed trailer, for $3600.

Most people I know that are broke, choose to live the way you describe. They need a new car every 4 years, refuse to live with roommates despite being single, and need a 1200sqft apartment even though they’re almost never home. Yet they wonder why they’re still broke. Everyone wants to look wealthy, but most won’t suffer living like you’re broke long enough to stop being broke.

Believe it or not, if people just leased new cars that were cheaper (especially EVs), the entire economy and social mobility would improve. It’s the LOANS people get that really do bad for everyone.

Can you justify this beyond just making the statement?

Leasing a vehicle is just a long term rental with very specific terms. If you’re saying subsidies tilt the balance in the leasee’s favor, sure, but I need some numbers that back it up. You do avoid the direct depreciation hit compared to buying a new car, but you end up with zero equity at the end of the lease and paid someone else for all of the depreciation plus some during the term of the lease.

A lease is nothing more than betting the car will depreciate more than the cost of your lease compared to buying and eating the depreciation directly but keeping the equity.

Leasing only makes sense for 2 categories of buyer in my opinion. 1. People who absolutely have to have a new car every 2-3 years, and 2. People who drive so little they need a car occasionally but otherwise can’t be bothered by dealing with a vehicle.

Both groups are predicated on having plenty of excess income to afford it, and trend towards retirees and upper class urbanites.

How much can I afford to pay for a car?

Well, I assume that it will get stolen, catch fire, someone I loan it to will forget where they parked it (that happened!), or maybe I will turn it into an art project.

Assume the value will go to zero in a year.

Pay cash!

Insure for liability and injury generously.

If I still have it in a year consider it to be a free car until I give it away.

If I need a truck sometimes, buy a beater truck to do truck stuff. Vehicles that do everything aren’t as cost-effective or fun as vehicles specific to the task.

That’s for cars used for transportation, and to have a daily driver, so that the collector cars I don’t drive often can be insured. Except I’m getting rid of those mostly. Moving soon – looking for a house to buy for cash

$3000 cash seems like plenty. If half the cars turn out to be duds, that’s fine. I will say that I know billionaires who drive shittier cars than I do, and I’m a mere thousandaire.

Oh, and never lock the car. People don’t mess with cars that aren’t locked. Except in San Francisco where they don’t even check.

I think Tom is addressing a different demographic than I am a member of, So I’ll just sit back and observe.

This might be a US vs UK thing, but I only know a few people who’ve bought a brand new car on credit, and none of those people are good with money. (One of them is rich and doesn’t need to worry).

Literally everyone else I know will only look at second hand cars, paid up-front.

I’m in the US of A, but buying new cars on credit seems to be the norm. Well also a lot of of people lease, which is just like buying in that you have to pay for the car and are responsible for any loss that may occur, but the only difference is you don’t get a car when you finish paying.

And people think I’m some sort of weirdo.

People DO mess with cars that are not locked. Tweakers spend the entire night walking around pulling on door handles. When a car is open, they rifle through it an take whatever they feel like. I know one person who left her car unlocked, and they stole the registration card and a few stupid things, and left other, more valuable items behind. Another person left a commercial van unlocked overnight, and the next day found the ignition switch ruined with part of a key jammed inside.

If you want to get rid of a box of garbage, wrap it in gift paper and leave it in an unlocked car overnight. It will be gone in the morning, but your battery may be gone, as well.

Buying a good car for not a lot of cash is a very wise idea. Lower your expectations just a little, and you will be much more satisfied with life. Invest a “monthly payment” in some solid, dividend-paying stocks, and in a few years you will be in a much better position than you are now. Let someone else buy a brand new Depreciationmobile, and pay interest on it.

Welcome Tom

Great to see you here, Tom!

I would also say to shop finance rates. If you are in the market for a new car look at the finance incentives in your area that the manufacturer is offering.

If there aren’t good finance deals that you qualify for, try to get prequalified for an auto loan with one of the major lenders.

When there aren’t good manufacturer finance rates, the dealers just shop the big banks and mark up the finance rate as a commission, so you’ll always do better if there isn’t some kind of manufacturer incentive by prequalifying before you go to buy.

People don’t all need salesmen to talk them into higher payments, they do it to themselves too. I started getting up on a soap box, but realized nobody comes to a car site for a 30 minute personal finance lecture. I will just say that even at higher incomes a conservative approach to budgeting/saving pays huge dividends and I absolutely see it with my friends. The earlier they start the further ahead they are. One friend in particular is slightly stressed right now trying to stick to an aggressive budget. He started a little later than I did, so he has to be more aggressive, but once he gets ahead of things he’ll feel a financial freedom that too few experience.

The disparity between different groups of friends can be downright astonishing. College buddy I lived with for 5 years? He bought a new Vette before turning 30 and had already paid off 100k in student loans. He’s less than 2 years away from paying off that $360k house.

It wasn’t great having roommates after college, and I’ve never bought a new car, but from this point on I’m basically set. My college buddy played the game much better than I did, but both of us are better off than most.

TOM! Good to see your work!

Came here to also remark. Glad to see Tom’s byline!!

How did I miss that you started writing here? Man, they really just did recreate the best parts of the old lighting site and added on some extra goodies, didn’t they?

It’s good to see Tom move over here. I always enjoy his content, and of course like to support other members of the worldwide Tommunity