Every few months, a new headline emerges showing that the average car note monthly payment keeps creeping upward. In what most analysts consider an uncertain economy, new cars are becoming less and less affordable for the average buyer. Let’s talk about why monthly payments should, but also shouldn’t, be the focus when you are shopping for your next ride.

Now, if you are in the “I only pay cash for my cars” camp, that’s a fine place to be. However, if you aren’t buying old and/or whacky stuff from Craigslist or Marketplace for cheap, and prefer newer, with modern features and a warranty, most people simply lack the thousands of dollars in liquid assets to spend $15,000 or more for a vehicle. Therefore, these buyers will need to finance a car loan and will have a monthly payment.

Naturally, there is no shortage of online commentary, especially from “finance gurus” who will say things like:

Are too many Americans buying cars they can’t afford to keep up appearances? Sure. Does that mean that financing a car is one of the worst financial decisions you can make? Not if you use your brain first and an old-school device called a calculator.

There is an old piece of car buying advice that says “never focus on monthly payments,” and this has some validity, because far too often a buyer goes to a dealership with a payment target only for the dealer to structure the loan and the deal in such a way where the monthly note is where they want to be, but the overall deal is a bad one.

For example, if someone has a monthly payment target of $400 and is shopping for a Honda Civic with an MSRP of $25,745. On the surface, it seems that $400/mo should get you a pretty reasonable car. After some back and forth dealer tells the customer, “Good news, I was able to get you a payment of $401.27 on your new Civic.” The buyer isn’t going to balk over $1.27 per month over budget and signs on the dotted line. Except, in order to achieve that payment, the dealer had the customer finance this car at an eight-percent interest rate for a whopping 84 months! This person will pay almost $8,000 in interest and have a total cost of $33,706 over the course of the loan.

This is why the “finance experts” say to look at total cost first, which is not bad advice. Except that most people conceptualize their spending based on a monthly budget, and in doing so, they are looking at how affordable a car is through the lens of monthly payments. This is fine, as long as you do so before you go shopping for a car.

Here is how you focus on monthly payments by working backwards and then determining the total cost. The first step is to take an honest look at your finances, money coming in and money going out via rent/mortgage, utilities, food, et cetera. You will then determine if you have a chunk of money you can allocate for your car payment.

The next step is to know your credit score; there are ways to do this by checking all three reporting bureaus. Keep in mind that the score you see may not be exactly the same as the figure the banks see. Why this is the case is a mystery for the ages and one of the many confusing aspects of the credit system. However, you should have an idea of where your FICO is. Generally speaking, if your score is above 720, you are in good shape and you will usually qualify for competitive rates.

Step three is to fire up a loan calculator that allows you to input the payments, loan term, and interest rate. In regard to the APR, that is going to take some estimation; if you happen to have a Tier 1 score (720+ FICO) you can safely use the “average” rates for new or used cars. If your score is below that, you will have to estimate the rate up accordingly. I recommend estimating on the higher side of APR for these calculations.

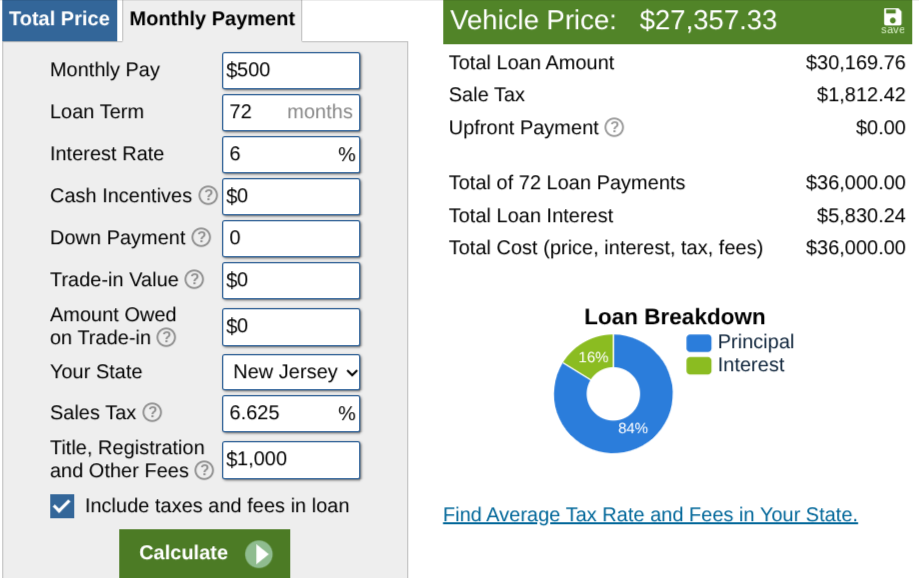

For some example calculations, let’s try to figure out what our budget for a car would be with a target payment amount $500/mo, assuming we have a Tier 1 FICO score. You need to set the loan term; sixty months or five years tends to be the sweet spot for having a reasonable loan term, but also allowing for a healthy budget. Shorter terms are fine if you like paying loans off sooner than later, but they will limit your budget if you want to stay under $500 a month. My recommendation is to go no longer than 72 months. You will also have to factor in your local sales tax, dealer fees, and registration. Fortunately, there are calculators that have those options as well.

This is how I would go about setting a car budget: by starting with the monthly payments and then working towards the total cost. I would do this before I even start considering what cars to buy. I have my hypothetical target of $500 per month, I am going to set my loan term at 60 months with an estimated interest rate of six percent. I’ll set my NJ sales tax at 6.625 and put a rough estimate for dealer, DMV, and doc fees at $1000 (again, I like to err on the higher side). I also need to make sure I check the box to include all tax and fees in the loan.

Plugging this into Calculator.net’s auto loan calculator results in a spending budget of $23,318 before tax, DMV, and fees. Pushing the loan term out to 72 months gives me $27,357 before additional charges. Now that I have an idea of what I can actually afford, I can start my research to see what cars fall within that budget range. Of course, if I were using a down payment, I could adjust my budget accordingly by whatever amount of cash I am comfortable spending. Bringing money to the table is always a wise decision, as it establishes some equity in the car and can prevent you from being underwater on your loan.

If this all seems like a bit of work, it is, but doing this is one of the most surefire ways to avoid buying more car than is appropriate for your finances. While there are plenty of dealers who won’t hesitate to rip buyers off, being armed with a clear and honest understanding of your budget and loan terms is one of your best defenses against a bad deal.

I went to a dealership once that of course didn’t have the prices marked on the windows. I asked the salesman the price of the car. He literally wouldn’t tell me. He kept repeating “What do want your monthly payment to be?” I told him I want to buy the car outright. He said “That’s not how we do things here.” This is when I left. Befor you think this might have been some sort of shady buy here pay here place it wasn’t. It was a used dealership but it was part of a chain that sold primarily new cars. He literally wouldn’t tell me the price of the car.

Madness. Madness!

Hey remember that brief moment in the sun when this behavior would have been illegal under the FTC CARS rule?

Pepperidge Farms remembers.

Used car dealers that are part of a chain with a fancy name on the building are still used car dealers, just with a fancy name on the building.

Exactly this. Almost certainly separate legal entities too.

Happened to me on a new car, there was a monroney, but next to it was the dealer added crap like, ADM, pinstriping, ceramic coating exterior and (new to me) interior, wheel locks, door edge guards and some other crap, and under total price was “ask us”. So what’s the total? How much you want to pay a month? I’m going to buy iy outright, we don’t do tat here. I told the salesman I don’t want all that stuff. Too late its already installed you can order one but it’ll take 6+ months to get it but the dealer ADM will still be there. It was on a Ford Maverick they were still a little hard to find but every lot had a few. He said we don’t do cash deals, I said see you, I don’t think this is even legal but I’m not wasting another minute at your dealership. I did buy one that week under MSRP.

Being the ass that I am, and having the time to troll I went back parkd on the side of the building asked for the same sales person, ok lets take it for a test drive again wouldn’t give me the price even after I told him $650 and I think my trade in is worth about $11-12K eyes lit up goes and gets the keys, took it on an extended drive, parked as close as I could to mine, as we talked walking away said I think I like black better got in mine as he said I think that’s a customers car as I shut the door & drove away.

Again being a troll I filed with the BBB and made reviews on google and anywhere else I could. Don’t know if it did anything but made me feel better haha

honestly, they don’t like cash deals because that removes the financing kickback on the back end. I think you still pay the dealer prep fees to take it out of transport mode and install the antennas and hub caps on a maverick, they also supposedly check fluids and tire pressures, but I can tell you that rarely the mechanic doing that only checks them if the warning lights are on.

“Yeah, but you see that TruCoat gets put on at the factory!”

Do love to see it. Are they enjoying being poached yet?

I think they’re more scrambled at this point.

Over, easy. With no Herbs.

Definitely hard boiled.

It’s amazing how impulsive people can be when facing what’s commonly their second biggest purchase. (Or I guess the biggest, as outright owning a house becomes out of reach for the average American).

“Ooooh, shiny!” is buried in a deeper level of our brains than “Is this a sound financial decision?”. It’s not an easy impulse to overcome.

Yep. Thinking, fast and slow. (Kahneman)

“Shiny” is built into our DNA, and that of all mammals. We’re instinctively drawn to sparkles on the water.

Us and crows.

Those little fuckers are smart.

Also marriage.

I think this may be why learning to do a really nice job buffing out old paint may have been one of the best financial moves I’ve ever made, at least in regards to vehicles.

Reminds me of talking to a friend who worked for a multinational CPG company. In some markets people can’t afford to buy a bottle of shampoo. Instead, they purchase single-use satchels for a few coins. The rub is that to purchase enough satchels to fill up a bottle of shampoo it costs many, many times more than to buy the bottle outright. It’s expensive to be poor.

See the “Last Week Tonight” episode where John Oliver talks about dollar stores. The unit price of dollar store items is often much greater than the same brand in a grocery store due to smaller packaging sizes.

They are definitely more expensive but do I drive the extra 25 minutes to save $1.75?That’s why every neighborhood has one,rich or poor.

I pass a DG about 1 mile before my work. If I need one item I either forgot or couldn’t find, I’m hitting that small store vs wandering around a Kroger to find it.

I promise you rich neighborhoods are not rife with Dollar Generals.

I promise you,they are beginning to build in locations with some larger than average incomes.

In the Philippines, those single use sachets go straight into the river and then out to the ocean, which will have more plastic than fish in it by 2050.

https://www.breakfreefromplastic.org/the-story-of-sachets/

Terry Pratchett’s Sam Vimes theory of socioeconomic unfairness:

“The reason that the rich were so rich, Vimes reasoned, was because they managed to spend less money. Take boots, for example. … A really good pair of leather boots cost fifty dollars. But an affordable pair of boots, which were sort of OK for a season or two and then leaked like hell when the cardboard gave out, cost about ten dollars. … But the thing was that good boots lasted for years and years. A man who could afford fifty dollars had a pair of boots that’d still be keeping his feet dry in ten years’ time, while a poor man who could only afford cheap boots would have spent a hundred dollars on boots in the same time and would still have wet feet.

This was the Captain Samuel Vimes ‘Boots’ theory of socio-economic unfairness.”

Also my first thought. It’s always cheaper to be have money. Better paying positions also tend to be more accomodating of cheaper and less reliable cars than ‘be on time or lose your minimum wage job’.

It can apply to used cars too, if you’re particularly unlucky you could end up buying several cars between $5-$10k that all have major failures in less time than a $10-$20k new car would last.

Better paying jobs trend more specialized/dangerous and have smaller talent pools. You’re near immediately replaceable for min wage – unspecialized jobs. It’s all about your worth to the company and replaceability.

As for vehicles it all comes down to your research and diligence.

The more simple the purchasing rules, the better because the same people who don’t understand interest rates are the same people who will zone-out if you try to make this too complicated.

NEVER haggle over the monthly loan amount. The amount is the amount. ALWAYS haggle over the final out-the-door price. And remember that EVERYTHING is negotiable, including all the stupid shit dealers like to tack on at the end which too many people don’t even question.

Purchase price of the car should not be more than 25% of your yearly income. Sound insane? Maybe, but just because you can pay the amount, that doesn’t mean you can ACTUALLY afford that car. Grown the fuck up and realize your ass is broke.

We talking gross income or net income? Because if it’s net income I’m not sure exactly who could buy even a Toyota Corolla based on that rule. Hell if that rule was followed by all based on gross income I don’t think we’d have an automobile industry anymore.

It is also relative to geographic location with regard to salary. Say 100K before taxes is the midwest standard where 4 bedroom housing is still an option for under 200K for the house, that is drastically different than someone making 200K in San Diego having to pay 500K for 2 bedroom houses, assuming you can even find one of those.

Yeah, there are an awful lot of factors at play when it comes to properly affording a car purchase. Massive housing and property tax disparities, childcare, student loans, etc. Someone buying a car whose purchase price is 40% of their annual gross income might not be a big deal if they don’t have childcare costs, student loans, and they have relatively inexpensive housing.

I don’t think there’s any single family homes for 500k in San Diego proper these days, unless it needs a bunch of work

Generally the number is 20%-30% of gross income. The higher your income, the closer you can get to 30%.

As you said very few follow it, which is one of the reasons so many are functionally broke despite making decent money.

I’ve a few times here have supported the concept of broke-ish people (with decent credit) going the cheaper end new car route that would violate this rule. So I feel like this rule should have a modifier like “a base Corolla can be purchased new as long as the payment can be made and the buyer DOES NOT replace it within 10 years”.

Back in 2018, my wife bought a base Forester for 24k with 0% financing (remember when?). Now, based on that rule above, this car purchase price would have represented 50%+ of her annual gross income (ignoring my presence). This would seem irresponsible, but she had it paid off in 3.5 years, and still owns the car today with less than 50k miles on it. Instead of going through multiple beaters like some Ramsey-ite would have demanded, she owns a vehicle that she knows absolutely everything about how it’s been maintained, that’s been reliable and assuming it doesn’t explode, could last us for many many more years.

I get the sentiment of not buying what you cannot afford. And nobody making 45k a year should be buying a brand new 3-row SUV. But for the rational and level-headed type that wants the low risk that comes with a new car (warranty) and reliability, I don’t think there’s anything wrong with boosting that percentage higher if the purchase is for something modest.

The problem with violating the gross income ‘rule’ is you’re one financial hardship away from the entire house of cards collapsing. You can make it work if you have solid safety nets (family/religion/work/etc), but it’s where a ton of people get into trouble and end up in a spiral all the way to bankruptcy.

Not to mention warranty issues are increasingly common, so you might end up with a new car under warranty that’s stuck at a dealer being fixed for 2 months while you’re still making payments.

Your proposal only really works for retirees, who have slightly liquid assets in the form of investments or assets they can cash out if absolutely necessary. My Dad did this with a new Crosstrek during COVID at 0.9%. He could pay it off at any time if he needed to, but the loan is cheaper than pulling money out of investments.

I would argue that an powertrain replacement on a used car is far more of a financial burden than a planned car payment each month. Which is simply the dice roll of a used car. Our personal experience is that we’ve been screwed pretty hard by used car failures, where the new cars have been predictable. This isn’t a shocking result.

Obviously everyone’s situation is different. Though even with warranty work (which we’ve usually been given a loaner for?) I would imagine the odds of a new car being off the road for work is far, far lower than a used car.

Naturally, if you have decent options in the world of used cars, like an old relative getting rid of a low mileage Camry, or some other trustworthy person getting rid of something with limited flaws, by all means this is the best way to go. But in the absence of decent used options (the used market is absolutely fucking terrible right now) sometimes a modest new car is the way to go.

I am not condoning the nonsense behavior of people buying cars that are completely beyond their needs that they cannot afford though.

I guess that’s where we’ll have to agree to disagree.

There’s a ton of older and rationally priced used cars that are stupidly reliable for half of Nissan Versa money. Pick a late model, 100k mile, Honda or Toyota for $12k. Obviously YMMV as always, and you have to absolutely do your homework, but they’re available right around the 10k mark.

I’m curious which used cars have burned you so badly. I know a bunch of late model cars have significant problems but always like to learn new ones.

From recent memory you’ve got Nissan CVT problems, FWD Fords like to leak coolant from the water pump into the oil pan, Hyundai engine issues, GM PCV, turbo, and transmission problems, and the list goes on.

Most recent example being a Hyundai Elantra Touring that I know is a great car new (my parents owned one for 200k that didn’t have any of the issues I had) but the one I bought the previous owned hid a lot of issues on, that were not caught when I brought it in for an independent inspection. It was a bad situation, but it also highlighted the value of knowing the entire history of a car. Also, while I don’t trust new car dealers much, my history with used car dealers and private sellers tells me that somehow these people can be even less trustworthy.

Seeing the list of rough problems so many manufacturers have, makes me even more gun-shy about recommending used cars to people, knowing that those failures often happen around the time the second or third owner come in.

As for the used Corolla concept, the resales of these things are absolutely bananas. Seems like on average a 10 year old Corolla with 100k on it goes for 13k? Which is a car that probably sold for 20k brand new? I think my hangup here is that if you don’t make much money and aren’t liquid, you’re still probably not buying a 13k car with cash. And this 13k car is going to more than likely need expensive maintenance pretty quickly, tires, brakes, etc. at the very minimum. I don’t really think anyone should be financing a 10 year old car if they can help it. Seems like a new Corolla for 23k that’s literally 10 years newer is a better value.

I’ll add, my mindset on this has change A TON lately with how shitty the used market has been. When an off lease vehicle was retailing for just over half the price of a new one, buying new was a horrible value and only made sense if you just had to own a new car for the luxury of it. Now it seems like instead of taking huge depreciation hits up front, cars are depreciating in a linear way that makes buying used not the deal it once was.

Long response, but I suppose I don’t see the harm in buying a new Corolla, when the old one has little chance of exceeding it’s reputation.

I’ll quickly add: if someone is in the market for cheap reliable transportation, I would probably recommend they at least TRY to find something used that meets their needs before immediately going for cheap/new. But I’m never going to shake my head at someone financing a new Corolla.

I think the core of our differences is in my experience, 10 year old cars are significantly better than new cars in general. Yes they obviously have way more miles, but parts complexity is much lower along with repair costs and insurance (which is a significant cost we’ve ignored this far in the conversation). With due diligence researching older cars, the problem areas and diagnostics are easily available online. Same goes for highly problematic vehicles which your Hyundai Elantra seems to be (2012-2017).

My current daily is a 2008 Toyota Avalon with 253k miles, 40k of that I’ve put on it. Yes it’s a 17 year old car, but they’re known for very few rust problems, near bulletproof engines (after you fix one problematic oil line), and most were grandma/grandpa cars where they saw little abuse. With a rather basic scanner you can diagnose most issues, and parts are widely available for reasonable cost. It has such a good reputation they [Autopian] recently wrote an article about them [3rd gen Avalons].

That’s why I said a 100k mile Honda or Toyota above, even 10 years old they hold their value very well due to their durability.

That Avalon is a real winner, and 00’s Toyotas in general are rock solid.

I would imagine that anyone reading on this site can do what you did for the most part and identify a super reliable model, find the limited number of sore points and monitor them. Someone like say, my sister, is not one of those people. I tried to find her something in the world of “old Toyota” and failed to find something she could afford with cash that wasn’t swiss cheese (upstate NY). She ended up in a dealer loaner Impreza which has been working out well for her. It’s a payment, but it’s modest, and she’ll pay it off before the warranty is up. She hopes to run the thing (slowly) into the ground.

To each their own, and going old Toyota is definitely a smart move. For the record, I don’t totally disagree with you, but I just think there’s a little more nuance to the new vs used conversation than I think some people around here are willing to admit.

Fair point, although I place the blame on the individual person. I don’t believe some people are incapable of learning exactly what you describe, I think they choose not to.

Reminds me of the old joke: ‘[Vehicle] Owners Manuals used to tell you how to gap spark plugs, now they say don’t drink the coolant’.

People would rather pay extra and gamble than research one of the largest purchases in their life. This is especially true if it requires going backwards in ‘category’ of vehicle, such as downsizing from a large SUV to a mid size sedan (even if the sedan is an overall better vehicle). The emotional decision making is encouraged by dealers, as it’s the easiest way for them to pad their profit margin.

People make loads of stupid financial decisions. Just look at how crowded the casinos are, and new ones are popping up all the time. That is just a way to slowly flush your money down the toilet.

Being lazy (not researching what to buy and how to buy it) and paying interest on it results in a transfer of your money to those who are wealthier than you.

Super-low interest rates are not easy to find any more. You need to have good income and a stellar credit rating.

(Work on your credit rating before going car shopping, people!)

I hear this X% of yearly income rate fairly often and don’t understand it. If I saved up for years and am paying cash, what’s wrong with buying a car that’s 80% of my gross income?

You could probably make an argument for financing that much, but if you don’t have other expenses it could make sense.

Spending 80% of your gross income on a depreciating asset would never make financial sense.

One tactic the wealthy use heavily is financing to offset the depreciation. You’re basically betting that your income and inflation will rise faster than the loan costs you. It works out to offsetting negative interest with positive. Pay 7% on a loan, but your other asset (income, investments, pokemon collection) will increase 7% or more.

If you just paid cash at day 1, you’re tying up money in a depreciating asset that could be making you more money than the loan would cost. Example would be a Pre-COVID 0.9% 60mo loan, but goverment bonds are paying 5% per year.

To be clear, it is a general rule and honestly almost no one follows it, but it should give some people a cold dose of reality if they think they can ACTUALLY afford a $50k on a $40k salary.

But to your specific point, the problem is that your income is finite. If you are saving up or taking out a loan, the end result is that you are taking money away from other things that, as an adult, you should be funding.

Saving up for retirement, house costs, kids costs, and all that other shit none of us want to think about. If you are living with your parents and somehow don’t have rent or a mortgage, then GREAT, but using the money you could be saving on a down payment for your own place is silly if you instead spend it on a depreciating asset like a car. And I say that as someone who loves cars, but goddamn are they great at wasting money.

Shortest way I’ve ever explained it: “Just because a bank will loan you the money, doesn’t mean you can actually afford it.”

Just because you can, doesn’t mean you should.

But people live that YOLO fantasy life and then bitch and moan about always being broke. It is especially infuriating when it is people that you know who are making decent income. But those people will be living paycheck-to-paycheck no matter how much they make.

I’ve got a big spreadsheet called “Budget”. In that spreadsheet is an item for car payment. Right now it’s $0 and it’s been that way for ~4 years. Every once in a while I’ll delve into the spreadsheet and start messing around with it to see how adding a car payment affects things and what’d I’d have to sacrifice to afford larger and larger car payments.

how much do you have in there for repairs? And does it change if you have a car under warranty? Also does the repair potential increase with miles and your ability/desire to wrench yourself?

I currently budget $35 per month for repairs, which is probably artificially low since I haven’t looked at past spending recently to determine if this is accurate. I got that number several years ago by looking at my average spending for the previous 12 months (basically looking for RockAuto on credit card statements) and then increasing it by a bit and dividing by 12. I probably should put $75+ per month given I’m now approaching 120k miles and the repairs I can think of recently.

I don’t understand the second part of your request. I assume it has to do with how much I’m willing to spend on repairs vs a new car payment; which yes, there is a point at which I’ll say it’s too expensive to maintain that I’d rather just get a new car. I’m a ways off from that point, and it’s more likely I’ll just get a new car in the near future that better fits my lifestyle, but I’ve got a baby on the way so I’m waiting to get settled in there to see how my life changes before committing to a new car.

Basically you pay for repairs or a payment with a warranty. there is a sweet spot in there in the past at least where repair cost likelihood was lower than the the delta or even the cost of a newer car payment, but used car prices being abnormally high has kind of put a lot of that comparison shopping out of whack. the other question is do you save back budgeted money each month or not? if not, then that is where a no annual fee credit card can be handy. use it for repairs and repairs alone and then budget the amount to pay back if needed.

I don’t move the unspent repair funds into their own specific savings account or anything like that. They simply sit unallocated, which means my checking account where my paycheck gets sent, should be growing faster than intended since less is being pulled out than budgeted. There’s other things in the budget like this (for example, if I “underspend” my grocery budget, or the budgeted amount for home repairs), so I occasionally go an manually move money from my checking account to a savings account (or elsewhere) to correct for that.

The budget ain’t perfect, but it works for me. About once a year (generally when I do taxes) I tend to comb over the budget with more scrutiny, update items, reallocate line items, talk it all over the with wife, and make sure we are both happy with it. Luckily we aren’t living paycheck to paycheck, and have ample savings, so this system is a bit flexible if we overspend by a tad here and there.

That being said, I’m in the middle of a kitchen renovation (that we planned and budgeted for) so my wife has been a bit nervous that our savings account is been “going backwards” for the first time in a long time. But this is exactly what we saved for.

and my beef is this lease crap that says 179$ for 24 months, just bring 4K to close. New flash 1. Present value of money, your 4K is worth more now than it will be amortizing it over the 24 months. 2 WTF. 4000/24=167/ so that 179 is actually $346 plus whatever you lost on the PV of that 4K today. Finally regarding loan term: if they are giving you 0% extend it to infinity if possible. Again our 2019 Hyundai Ionic bought in 2020 with 0 down (see present Value of Money above) 84 months 0% interest. Im going to get the Ionic 5 as soon as they give it to me at 0 down and 0% for 6 years or more, hell I would even buy on those terms and not lease a vehicle whose value will plunge like a concrete block in a pond at those terms.

Finally, the insurance loophole we have is a car 20 years old or more, Collector car. Thou shalt not drive in Wisconsin in January, but full collision buyout at an appraised value for 25/month on the Del Sol, yes more of that please.

Clearly you are in the wrong class. This is Intro to Personal Finance for Freshmen. You want to go down the hall

So the whole lease math thing is another article I need to write

I can’t wait!

Dunning Kruger told me that I already know everything I need.

But Mr. Barnum says that I might be the one.

Yes, please.

And hurry up before my lease is up. 😉

it would be interesting to see a deep dive into those electric Fiat Leases in Colorado. the ones that were in effect 0 dollars a month.

I generally agree with your thoughts on 0% going for a longer loan, but this does open you up to being underwater on the loan for a long time if you put little down. If you were to lose your job (hope that doesn’t happen) 3 years into that loan you still probably owe more than its worth. But if you did a 5 year loan, at 3 years you would most likely be able to break even or get bit back. Again, this is dependent on you putting little money down, and its a worst case scenario. Problem is, this current economic climate means we are all looking at possible job cuts, ugh…..

Also, insurance! people love to forget about that monthly payment that comes along with buying a new car and adding it into their calculations. In states like Michigan, insurance costs are insane and can rival the monthly payment of the car itself.

And yes, the lease deals with huge money down drives me crazy, people don’t know how math works.

Leases can be ok for electric cars… might be better to use it for a couple of years and then trade out for newer technology.

They also works out well for people like us who like to purchase used CPO cars that are two or three year old lease returns. Let someone else take the hit in depreciation and get a little more factory warranty on your lightly used car.

Most people choose not to learn it, because math makes them feel bad for not being able to afford the thing they want. Also, math is boring and nerdy.

Stretching a low or 0% rate out to the longest possible term, and taking advantage of 0% down can both be great options for some buyers, but sadly most people aren’t smart enough to use them to their advantage.

Too often I hear people brag about how smart they are for financing something because they can earn a better rate on their money through savings/investing but at the end of the day they didn’t have the money to spend/invest anyway. I also work in the general realm of finance and once had a co-worker explain why leasing was the cheapest way to own a car since it was less than a car payment.

Not to mention your $4k is pretty much gone if that vehicle gets totaled during the lease. Leases include gap insurance. Keep your 4k, use it to help make the payments every month and let the finance company take the hit if something happens to the car.

The trick is to have much of this ready at the right time. buying in January right after Christmas with winter weather affecting other things, is often a great time to get a new car from the previous MY, for deep discounts. Buying stuff when the rest of the herd is browsing is often pretty bad. Also going into a dealer with a pre-approved number for X number of dollars from your personal bank or Credit Union is a very very good idea as you can leverage terms or just use your own bank. Just be willing to with hold specific details when “giving” the stealership a chance to get that kick back on the back end via financing.

I feel like this window is shockingly very very short. Mostly due to tax returns often coming in as early as mid February (if you don’t owe and file ASAP like I do). That second to third week in January is probably the sweet spot.

Personally, I have gotten the best deals at end of a sales quarter. I’ve actually had a dealer drive a car to my house in the evening so I could sign on the 31st. I wonder if the week after Christmas would be a good time, who is out car shopping then?

In certain situations where a dealer is coming up sort on volume for the quarter after an unsuccessful Christmas season? I could see that. Not sure what sorts of annual targets dealers may have as well.

I’m no expert like Tom and would like his input on this too, but I don’t think that’s as true as it used to be with tax refunds getting processed much more quickly than they used to.

Tom, we’ve missed you. Hope the family’s well. Would absolutely read an article updating your van situations! I hope the tech available has gotten both better and cheaper since last you discussed it.

Thanks man, family is good…kids are growing up fast. We still have the 2019 Honda Odyssey with conversion. I have not seen any major updates to that realm yet. Curious how EV platforms will play a role in making accessible vehicles more affordable.

It will be a challenge figuring out how to fit things like a deployable or lifting ramp on to an EV that uses most of the floor as a battery pack. I’m confident companies that do these conversions will find a solution, and I’d love to see how they pull it off.

This sounds like a job for universal design. What else would a deployable ramp to a boxy car be useful for and how do we sell it as a factory feature?

Welcome Tom. I for one have been waiting for you. 🙂

(You might remember me as Thad)

Tom, welcome! Good to see your contributions here.

In before someone thumps their chest and says you cant afford it if you can’t pay it cash.

One thing I do take into account now is, I’m fine with financing my day to day cars, but fun 2nd/3rd cars should be cash.

Second this. fun cars should be seen as a discretionary budget line. on par with a pair of shoes (from an ‘impacting my fixed costs’ standpoint)

Unless interest rates are very high or you have so much money that it doesn’t matter, it’s not particularly savvy to buy a car outright. You can be making 8-12% conservatively with your money invested while paying a 3-5% loan or you could buy your car outright but not have any invested money making a return.

Instead of buying your $35k car outright, you put 10% down and have $31,500 to invest. At the end of your 5 year loan, that investment return was about $14,500…a substantial amount to put towards your next enthusiast car.

Traditionally 8-12% isn’t considered a “conservative” annual return… Most of the information available seems to say you should assume ~4-6% (if you’re really being conservative).

Also, are 3-5% car loans still a thing? I’ve never had them since most of the vehicles I purchase are 5+ years old when I acquire them, but when I was interested in the GR corolla a few years ago the rates I saw made me want to pay cash ( >6.5% with perfect credit and a ~20-30% down payment).

The return rate for something like SPY has been 89.28% over the last 5 years, so 17%+. But i do agree – stock returns can and are volatile even with the steadiest hands on the tiller.

My current car loan is 3.9% and there are good rates out there right now. There’s also terrible rates out there in the 7%+ range if you go for a long term or have not great credit.

The most desirable cars will rarely have very good dealer financing just because they don’t need to sweeten the deal on something that’s already desirable.

You can be making 4.25% conservatively with your money invested (Vanguard money market). 12-month CDs are in the same range. That’s before taxes. So more like 3.5% after tax.

Now, I think the liquidity of money in the bank is worth something.

Glad I’m not the only one that read that and thought the numbers were a bit off.

I fully concur on the liquidity of money.

SPY or many S&P tracking ETFs return about 90% over the last 5 years. 8% is conservative compared to my actual returns which have been about 18% per year.

The stock market has averaged 10% long-term. So for every five years at 18%, one might expect to find five years at 2%. Will they be the next five? The S&P 500 certainly looks overvalued. But when will the bear market hit?

I’m old enough to remember the “Lost Decade” of 2000-2010, although my 401k was pretty little back then.

Paying off a loan is more like buying a CD – the % “return” is guaranteed, but your money is also locked up. There’s a reason the current CD rates are what they are.

Not paying off your loan and investing the proceeds in the S&P is higher risk than paying off the loan. Of course, with more risk comes the potential for greater profit.

Obviously the appetite for risk and return is variable but even 10% return is far superior to buying a car outright and paying interest instead of making a return. A CD is completely not worth it since the return rate is nearly identical to the interest rate.

What investment gets you $14,500 over 5 years with 31,500?

I just ran a Vanguard calculator and 30K got about 1200/year estimated return.

Ignoring compounding and just doing the back of envelope math, 31500*1.08=34020, 34020*1.08=36741.6, 36741.6*1.08=39680.93, 39680.93*1.08=42855.40, 42855.40*1.08=46283.83.

What’s getting 8%?

SPY (or any of the various other S&P ETFs) has returned 90% over the last 5 years or 18% per year.

This makes sense on a $35k purchase, or even a $25k one. But by the time you get down to an $8k used car, it’s a better investment because it takes you to work, where you earn more money.

Yes, this article isn’t about buying very cheap cars though. $8k might only be one year or a bit more on payments for a new car anyway.

What should I buy – from this crew will be epic. Jason some old french car, Mercedes a JDM import, David a rusty Jeep, SWG a salvage yard special, The Bishop something acutally reasonable.

Adrian has a Rodius he thinks would be PERFECT for you.

Or someone. Anyone, really, as long as it’s not him.

zzzzz buy a Camry zzzz

Where is the fun in that??? Two time Camry owner.

This is the exact same way I budget for a car purchase, with the exact same calculator actually. Determine what you can afford (or stomach) to pay for a car, and back calculate your target purchase price. The focus on getting the best price you can within that budget. It’s pretty simple, but a step that most people seem to forget to do when shopping for a car.

There’s an even better one built in to excel as a template. In addition to doing these calculations it’ll also let you tweak what you pay month by month to show the impact of overpaying on month 3 for example or skipping a payment. It’s less dramatic on something like a 3 year car loan where you’re not actually paying a significant portion just towards interest, but on a 30 year mortgage it can turn an extra thousand paid early into 2 thousand saved by the end

Well would you look at that. There’s a bunch of specific templates including “payoff student loans, or invest?”. Handy.

I found an excel template online which did all the calcs from the article but also let me estimate trade in values for my car with slots for KBB, Carvana, etc. which it would average into the calcs. I had to do some modifications to it because we were trading in 2 cars for one and making a moderate down payment but it was really great having a confirmation that the listing prices I was looking at would actually fit within our budget.

The only thing we forgot is that trading in two cars for a single car worth 2x as much is that insurance goes up not down but because we were conservative with our purchase that was really just annoying not a crisis.

Pro-tip on loan length: Pay attention to interest rate differences (or lack thereof) between different loan terms. I once took out a 7 year loan because the 7 year rate was the same as 5, but I made payments like it was a 5 year loan. The end cost is the same as if I had just taken a shorter 5 year loan, but if something happens and you find yourself financially distressed you have the flexibility to make the lower 7 year payment for a few months until things get better.

Good point. The last vehicle I financed, the rate was roughly the same for 3 years as it was for 4. So I took out a 4 year loan, but set up payments to pay it off in a little over 3 years. If something sucky happens, I’ll at least have the flexibility to reduce my payments a little bit.

To add to that suggestion, I also recommend doing this, and during the first 6 months spend as much as you can afford on paying extra on the loan. By paying an extra 1 or 2 months up front, you generally shorten the length of the loan by 2-4 months if you have a fixed payment loan, or a significantly cheaper monthly payment if the recalculate the amount owed to match the loan term.

The last one I financed was for 3 years because, even though the rate was the same for 5, I can’t trust myself to voluntarily make the larger payments every month, even though I easily could have.

That’s fair. It’s also important to know your own personal financial habits and adjust accordingly.

Ha, I made sure to set the auto-debit higher IMMEDIATELY after I had login information for the loan.

This is a reasonable strategy, but make sure to watch out for prepayment penalties. I am not sure how common these are with car loans, but it came up with my last purchase. For the loans I looked at, prepayment penalties varied based on how early the loan was paid off. The penalties were minimal if you paid the loan off a few months early, but the fees were hundreds (maybe thousands?) if you paid the loan off quickly. In my case, I was selling my old car via private sale and intended to use the proceeds to pay off roughly half the loan balance when it sold, so I intended to pay the loan off several years early.

I don’t finance cars often so I didn’t consider these penalties when I bought my car. Fortunately, the dealer finance department was cool and found me a loan without penalties (but with a slightly higher rate) when they found out I intended to pay the car off quickly.

Good point. I don’t believe my state even allows prepayment penalties on car loans, but if yours does you will want to know that ahead of time.

And once you’ve figured all that out and have agreed to a price on the car, firmly and repeatedly say no in the financing office when they try to sell you the prepaid maintenance, extended warranty, undercoating, gap insurance, etc. Those add ons can raise your $25k loan to $30k or more. And if you really want something, such as gap insurance, you don’t need to get it from the dealership at time of purchase. Almost all those additions are sold by third parties, where they pay a commission to the dealership for selling them, so you can comparison shop after you have the car.

You certainly don’t need to finance any of these extras!

Where is the insurance bill in this article? Maybe I can afford $1000/month on a car, but if the insurance is $300 a month, that means I can spend $700/month on the loan payment.

If I’m concerned about the insurance impact, I usually got to my insurance company (website or agent) and get a quote for the new car. Usually I’m trading something in, so I’ll compare that quote to the one I’m dropping. You’re right, this could impact the payment you can afford, but my experience has been that the difference is usually negligible.

So much this, I have backed out in the past due to insurance rates.

It probably doesn’t matter too much if you’re replacing a RAV4 with a CRV.

But if you’re replacing a Park Avenue with a WRX well, you might want to check out the rates before making that switch.

When I sold my 06 jeep commander for a new 12 JKU my insurance cost dropped by 1/2.

The insurance aspect is a good point, but since there are so many variables to insurance premiums and I didn’t want to make the piece longer than it already was, I figured I would stick to the major beats. But buyers should absolutely look at their coverage costs before selecting a car.

The funny joke is that I went from a ’13 Hyundai worth $5k into a ’17 Mazda worth $20k and my insurance went *down*. Stupid Hyundai “tax”.

When I sold my 06 jeep commander for a new 12 JKU my insurance cost dropped by 1/2.

Early in my career I had a girlfriend who at twenty years old got suckered by a dealer into buying a brand spanking new Buick Reatta with a low down payment. She totally failed to consider the insurance would cost just as much as the monthly payment. Man it was tough.

Some people have no resistance to the salesperson’s tactics. A guy I know has an ex who was about to buy a flashy, new, showroom-floor Camaro which at the time would have cost 25K on the sticker, and $40,000 total after the down payment and five years of loan payments (which was a hell of a lot of money at the time). She kept nagging him to give her the money for the down payment… and not too much longer became his ex.

Absolutely a consideration. I checked rates on the Progressive app using VINs from the dealer websites on my top two contenders and saved the quotes. Not only did I know going in what I would be paying but it made transferring the insurance that much quicker while at the dealer.

And the costs can and will vary wildly depending on a whole bunch of factors. What might cost me $150 as a middle aged married male insurance agent with no tickets or accidents might have cost me $1,500 as teen with a suspended license for multiple speeding tickets.

Sometimes I wonder just where the hell insurance companies get their numbers. Here’s one for ya, from about a year ago. My friend had full coverage on a 2012 Beetle. No accidents or tickets on her record. She was paying $250/month through State Farm. I have a 2014 Sportwagen, also insured through State Farm with full coverage. However, I have one ticket and two accidents on my record. I pay $98/month. Maybe there was something in her policy that wasn’t in mine, but that’s still a huge price difference for two people the same age, with similar cars by the same manufacturer, worth about the same.

There are so many factors involved that it appears like some type of opportunistic guesswork, but in reality there are highly paid and usually very bright actuaries putting this shit together. But yeah, it can feel pretty opaque.

Exactly what I did when I purchased about 6 months ago. I shopped around for the best rate (wound up to be with my credit union) and used a loan calculator to figure out what I could comfortably afford based on where I wanted to be on my monthly payment. I wound up buying from a dealer 2 hours away as well (dealers in my area charge pretty exorbitant “fuck you fees”; read the fine print on those dealer listings!), which gave me a few thousand extra dollars to play with. Buying a car from a dealer sucks but going in with a plan (and sticking with it!) will pay off.

Tom, good to have your insight here.

Another reason they focus on the monthly payment is to distract you from the true cost of options and dealer services like maintenance contracts. $20 a month more doesn’t sound bad on its own, but depending on the length of your loan you may have just added over $1,000 to the cost of the car. I always focus on the total price for that reason. I ask myself that if I hypothetically bought the option in cash would I really think a panoramic glass roof and a navigation system is worth $3,000? Hell no, I don’t use navigation more than a couple times a month and my delightful Midwestern weather means that half the time my panoramic roof will only show me an overcast sky.

This is the correct way. I’ve spent many hours researching and punching numbers into loan calculators. So far, nothing is lining up where I want it, so I keep watching the market and bandaiding the car I have.

Problem is, eventually that decision is gonna be made for me. With a young child and no public transportation options, my spouse and I both need reliable transportation.

You’ll find something that works for you. If nothing else, there are reasons why the Toyota Corolla is basically a meme answer for when someone just wants “a car”.

Unfortunately, anything less than an SUV doesn’t really work for us. My wife has a sedan, I drive the “utility” vehicle that can do all the other stuff. Living rural means that if I can’t haul it myself, then I’ll be paying exorbitant delivery fees, even though it’s only 20 minutes away.

I feel this. And swapping 1 of those for 2 dedicated, cheaper vehicles adds to the stress of maintaining, insuring and space needs. With a family to raise, no less!

Corolla Cross, then!

My spouse borrowed my 2016 sorento for a camping excursion. After packing it, she declared it “too small” as she couldn’t fit everything in it along with her 6′ tall self, our daughter, and our 120lb rottie.

I don’t think a corolla cross is gonna cut it.

I’m in a similar situation, in that I’ve researched our next family car replacement for hours and hours. I pretty much know what I want and would love to go get one, but it’s just not financially reasonable right now. Fortunately, my current car has been trouble free for a couple years after a spat of expensive repairs that initially kicked off my search (knock on wood).

Eventually the decision might be made for me, but at least I have a lot of background knowledge and won’t feel as much pressure if I have to get a replacement in a short timeframe.

Good article. This is a rational way of determining your budget without getting stuck in an extreme such as only buying junk or only paying cash.

Some people are braggadociously proud of buying junk and paying cash, like it is the only moral yardstick on earth.

Junk is fine, if you can wrench and if it’s not your only method of transportation (see your comment below), but most of us don’t live in that world.

I laugh at that screenshot with George Kamel because he isn’t even comparing apples and oranges, he’s comparing apples and a shrimp cocktail. A car loan has a set term and hopefully you’ve set this to a reasonable one. You’re making set payments to principal every month according to an amortization schedule. His hypothetical $30,000 of credit card debt is going to have a minimum payment that stretches paying off that debt way, way past a typical car loan with a minimum payment barely over what covers the interest – at an interest rate way higher than typical car loans.

Not to mention that a car generally fills a need, whereas a lot of the crap we put on a credit card is highly “discretionary” such as dining out or vacations.

Kamel is a new-gen Dave Ramsey demonize debt so much so that any “reasonable” advice goes out the window.

It is a total shame we do not have good public transportation in this country. There are so many people that have to spend a lot to have reliable transportation for their families so everyone can get to work reliably and not everyone has the space, tools and time to fix up a cheap crap can by themselves. I really hope that people would be compassionate and empathetic before they cast disparagements.

Agree…unless you live in a major city, public transit really stinks

Yeah also might be okay for certain parts of the burbs but for people like my who have a 40+ mile commute public transit does not work well haha

Even in major cities, how many public transit systems don’t suck other than NYC and Chicago, DC and SF?

Philadelphia, Boston

Should have remembered Boston, but surprised by Philadelphia. Can’t tell the stop density or coverage on typical maps, but it does look a lot more impressive than I would have expected.

That’s assuming that the Republican majority in the state Senate doesn’t strangle SEPTA this week; if it does then many public transit services will be eliminated.

The bastards are nuking the United States, in slow motion.

The massive irony is that I work for public transportation, but live outside of their operating area. Thus, I need to drive to work.

Public transportation works best in densely packed cities where access points are perhaps a five minute walk on either end. So many American cities are far too sprawled out to make public transit effective the way it is in Europe.

For instance, my closest public transit access is a half-mile trek for the bus and a mile trek for light rail on fairly steep elevations. My most common usage mode for the public transit is when I get my Jag worked on because the mechanic is close to the light rail line. I drop off the car and take the light rail home, then take light rail back to pick the car up. But it still involves nearly a mile and a half of walking on each leg, something I’m certainly not going to do on an every day basis.

I solved my commute problems a different way – I’ve worked from home since 1999.

Tom’s here! Man I missed these articles.