Affordability will continue to be the biggest issue for the auto market going forward, and until it’s addressed, I don’t think new car sales can grow considerably. New data shows the problem is maybe, slightly, sort of improving.

Now that the fourth quarter is over, and analysts have put down their yuletide drinks and crunched some numbers, I can take a look at how the year ended in this Morning Dump.

Affordability? It’s going in the wrong direction. Sales? Even with all the mishegas of this last year, the market was up 2% last year according to early estimates, which isn’t terrible.

One brand that didn’t grow was Audi, and the brand is now in the middle of a turnaround. It’ll have to do that turnaround without a lot of its core team.

Renault is launching a new model, and I’m amused by the name.

Let’s dump!

What’s Left To Give?

A new car purchase is a complicated transaction, and the MSRP is merely one number. While Trimflation and other factors have raised overall car prices, basically every variable in a transaction has gone against consumers. Why?

When you raise the price of a car, both the selling dealer and the buyer have to find new ways to make that vehicle a practical and affordable monthly expense.

One way to do this is to offer a lower interest rate, but interest rates are probably up compared to the last time many buyers were in the market. So borrowing money is more expensive.

This can be countered with a larger down payment, but everything is getting pricier, so people don’t necessarily have more money. What’s left? You can always make the payments longer. Or you can just make the payments bigger, which usually means a lower interest rate.

Alternatively, things can just go wrong in every single vector.

I wrote a similar article last year, and people seemed surprised that a total of 18.9% of new car transactions in Q4 2024 resulted in a $1,000+ monthly car payment. According to data from Edmunds, it’s only gotten worse.

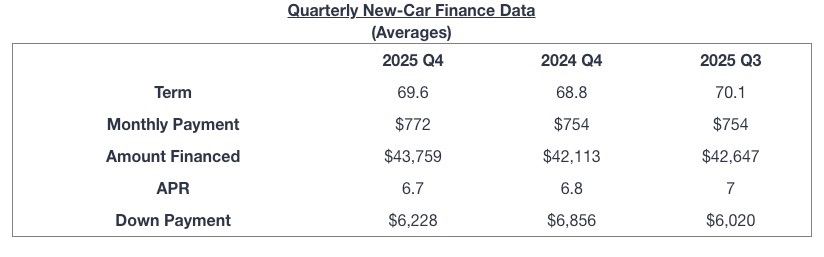

In Q4 of last year, a whopping 20.3% of new car buyers opted for a $1,000+ car payment. The amount financed rose to $43,759 from $42,113 a year earlier. As you can see in the chart above, the term increased y-o-y, and the down payment dropped.

“Auto financing trends in the fourth quarter underscored just how challenging 2025 was for car shoppers,” said Ivan Drury, Edmunds’ director of insights. “Faced with persistently high vehicle prices and borrowing costs, many consumers were forced to adapt by financing larger amounts, stretching loan terms and, increasingly, taking on four-figure monthly payments. The record-setting figures we’re seeing reflect the financial strain many buyers faced throughout the year.”

Looking ahead, Drury weighs in on how these dynamics could shape the auto market in 2026.

“Entering 2026, many of the affordability pressures that defined 2025 are still in place, including elevated new-vehicle prices and ongoing economic uncertainty,” said Drury. “That said, there are early signs of rebalancing ahead. New-vehicle prices remain high but are beginning to stabilize, lower interest rates could offer some relief for both new- and used-vehicle shoppers, and an increase in off-lease returns is expected to provide more affordable alternatives in the used market.”

If there’s some good news, it’s that interest rates are coming down and terms are at least better than Q3 of 2025. Basically, these numbers have to improve as there are only so many buyers who can reasonably swing a $1,000+ car payment.

It’s an interesting challenge to think about how to quantify how many people could actually afford a $1,000+ car payment. One way, and it’s not great, is to look at the per capita Real Disposable Personal Income (RDPI) number from the Federal Reserve Bank of St. Louis, which is about $52,000, therefore putting a car purchase at like 23% of that total number.

This is skewed, though, because of the K-Shaped economy, as that “per capita” isn’t equally shared. Most people expect a flat car market in 2026, and it’s largely because there are not enough affordable good cars that can be affordably financed for the bottom half of that K.

There are regulatory constraints (EV investment, tariffs) and larger economic ones (rates) at play here, of course, but the availability of good quality, lower-trim models of vehicles in bodystyles people want remains a persistent issue.

Car Sales Were Still Probably Up 2% In 2025

It’s impossible to know how well the market would have done in a world without tariffs and everything else, but it might not have ultimately been that different.

Overall, the early numbers show that the market hit about 16 million sales, which is an increase of about 2% from 2025. Even though everything has gotten a little more expensive, that’s not entirely a tariff cause yet, according to J.D. Power in this Reuters article:

While some automakers bumped up prices of models made outside of the U.S., tariffs did not substantially affect vehicle prices, J.D. Power found. The average new-vehicle retail transaction price in December had been expected to reach $47,104, up $715 or 1.5% from December 2024, the firm said.

There’s going to be a hearing this month on new car affordability in the Senate, but who actually shows up is a bigger question, as all the main automotive CEOs in America were asked to come testify… except Elon Musk. The double standard there is so obvious, as CEO Jim Farley has made clear, that right now that the Big 3 CEOs haven’t committed.

Does Anyone Work At Audi Anymore?

Last year, Germany’s Manager Magazin ran an article about Audi CEO Gernot Döllner, and the theme was basically that Döllner’s management system wasn’t exactly winning friends in Ingolstadt.

This week’s follow-up story? A bunch of senior members of the company are leaving, including development lead Roger Styss, who was offered a promotion but decided to depart instead. Christian Schneider, head of chassis development, is also rumored to be leaving, joining a bunch of other people in product development.

That seems bad, although I don’t really know enough about the internal workings of Audi to judge. The article does include this incredible kicker:

When a former top Audi executive heard about the exodus, he pointed to a developer in the management circle whom he considers particularly strong: “As long as Ulrich Herfeld is there, I’ll remain calm. He’s a real asset.” What this man, a staunch defender of Döllner, didn’t know was that Herfeld (54) will no longer be responsible for the software platform and the central integration of the entire vehicle. Insiders report that he will be in charge of homologation, the type approval process from regulatory authorities, which is considered a rather bureaucratic obligation. The Audi CEO has just sidelined Herfeld.

Yeesh.

Get Excited About The Renault Filante

The wild and avant-garde Renault Filante concept from a few years ago was incredible. Is Renault going to build it? Nope, instead it’s going to build a big SUV thing in Korea with the same name.

Per the company:

“Korea has exceptional strength in the D and E segments. This is why Korea is so important to Renault. Filante is the second new-generation model in the Renault International Game Plan 2027 to be designed in Korea. It illustrates our vision of a distinctive and daring crossover, a bold expression of Renault’s global move upmarket. It perfectly embodies the brand’s French roots.” Nicolas Paris, CEO Renault Korea

Renault Filante will be built at Busan (RK), South Korea, initially launched in its domestic market and then exported to other regions.

If it has at least 15% of the bonkers of the concept, I’ll be pleased. Renault has been doing good work lately, but I’m a little skeptical that this will be anything other than a fancy SUV.

What I’m Listening To While Writing TMD

Only 50,000 views have been recorded on this video from British musician Richard Hawley, so I don’t feel so bad about having missed it. Or him. The song is called “The Ocean” and it has a relaxed vibe I’m taking into 2026.

The Big Question

What’s the biggest gap you’ve seen between a concept car and the actual production vehicle we got?

Top image: News 12 Long Island/Jeep

Speaking here of the Canadian market…

What gets me clenched is the price of relatively fresh used cars compared to new. Take a year or to off the warranty and add 20k kms on — for example — a Toyota Grand Highlander hybrid, and the price only drops by $3-4k. So much for “it depreciates 30 percent when you drive it off the lot.” All of a sudden, paying close to 60K new looks like a good idea.

We *might* be in the market for a car in the next couple of years. If we go Sienna again, the price will have gone up $20k compared to when we bought our 2013 new. That’s more than I have ever paid for a car and my last two were family sedans still under factory warranty.

It’s gotten bonkers. And with tariffs et al, it’ll only get more bonkers. Possibly megabonkers.

I remember reading an article over a decade ago about how certain Toyotas make more sense to buy new than slightly used.

I recently bought a new truck and found this to be the case as well. I was originally thinking I’d go a few years old with 30-40K miles, but when factoring the better trade deals and incentives on new, it wasn’t much more at all to just buy a new one.

And to think, when I bought in 2019 could have had a new Accord Sport 1.5T with a manual for $25,600, when similar used ones go for between $19-21k with no warranty and all those kilometers on them.

Of course, had I known the pandemic would hit, I wouldn’t have bought at all.

May have dodged a bullet on that one. Head gaskets!

Yep. I have friends who had to replace their Sienna due to their head gasket issues, and they went with…

…a CRV with the 1.5t. Eep.

What year Sienna, are we talking the 3.5 or the hybrid?

I think theirs was a 2011 or 12. The 3.5 V6 is starting to show these problems alot, I gather. It’s seepage that doesn’t seem to get into the cylinders. Ours has it, but I put Bars Leaks in there and we don’t seem to be losing coolant.

Head gaskets on the 3.5 Sienna is an engine out job. Book is 23.5 hours, IIRC.

Hmm. Have that engine in my GS, I’ll have to watch for that as it ages. At least both cylinder banks are more accessible.

This was the case with our 4Runner 9 years ago. You could negotiate $2500 off a new one (but not the TRD Pro) and have the same take home price as a 3-yo used one with 36,000 miles. No brainer. And there wasn’t a moment in the loan when I couldn’t have sold it for thousands more than owed.

Same is true in the US, and has been for a while. Gently used vehicles are not the deals they were 15 or 20 years ago.

Especially not Toyotas.

Sadly this is the US a lot of times as well. this year was the first time in a while that I saw just off lease 3/4 ton trucks actually for sale for more than $5K off the original sticker price. A year old, but new version was cheaper in January last year than many of the comparable used versions with 20-30k miles. Weird, but I kind of think it was those people that bought for too much during the pandemic that were just stuck and trying to get out of the hulks that were now failing due to Pandemic Era IDGAF manufacturing attitudes.

At the end of 2024 I bought a new car, compared used to new at the time and was a no brainer to buy new for about 5k more and 80 to 100k miles less. Full warranty, low interest finance, no mysteries as how a used one was maintained and driven.

I bought a new ~$40k vehicle back in April. I was going to put $15k down and finance the rest at 4.9% for 36 months, which would have been ~$750/month payment. I could have done a longer loan term to make the payments around $500/month, but then the interest rate would have increased to 5.9%.

The morning I went to the dealer to sign paperwork, they told me that they no longer accept personal checks greater than $2k (due to issues with too many checks bouncing). I didn’t have time to set up a cashier check or money transfer, so I put the $2k down, which ended up giving me a monthly payment around $1,100.

I immediately paid the other $13k of my down payment via ACH transfer after setting up the financing online. Which means my monthly payment is still $1,100, but my loan will now be paid off in 2 years instead of 3.

I’m not saying any of what I did was a good financial decision, just offering an anecdotal example of one of those 20% that have a $1,000+ monthly car payment. My point is that having a stupidly high monthly payment isn’t as big of a problem as having a stupidly long loan term.

It does seem to be getting harder and harder to give a dealership money on the spot. No personal checks, because fraud. Oh you want to use a credit card? We pass on the fee for that (but if you were paying the same amount in our service department, no fee).

Right? I didn’t expect it to be so hard to give them my money. If I had chosen to go the wire transfer route, it would have been another separate fee.

Maybe my situation is more unique than I realize, but if others are being forced into making a lower down payment at the dealer and then following up with an big lump sum payment on the loan, then that could certainly skew the statistics a bit.

A couple years back I bought my Miata in cash from a dealer. It was out of state, but not too far, so I flew there to pick it up and drive it back. Got a cashiers check for the amount discussed (no taxes because out of state cash deal and I was going to register it myself) and I got there to “oh we forgot to add the doc fee.” Ended up paying for it on my debit card because they wanted me to pay the fee to use credit. So dumb.

The last time I was in a Ford service department the dealer tried to pass on a credit card fee. I vowed that that would be the last new Ford I buy. I sold the Ford to carmax and have moved on to other brands.

You will also save 12 months of interest.

Yes, I’m fortunate enough to be able to swing the $1100 payment for 2 years instead of $750 for 3 years in order to save a little on interest in the long run. Wasn’t my original intention but that’s how it worked out…

I did something similar on my current car, and noticed that when I paid the lump sum it moved my next due date out about a year (essentially applying the lump sum over the upcoming payments). It sounds like it doesn’t matter for you, but if you ever needed to delay a payment or only pay the $750 you could probably do so without any late penalties since you’re probably considered ahead on payments.

Cross reference this article with Mercedes ( the person ) article about the shit her wife took over the car she drives, and we begin to understand why so many commit financial-cide when choosing a vehicle.

We’re continually shamed by advertising to buy a large SUV, and to show off the brand’s badging.

Now, go back and pull yourself up by your bootstraps and show everyone how successful you are with your financial choices.

The crap dumped on Mercedes’s wife angered and disappointed me. Ugh.

Hope we learn what her wife chose or if she just kept the Scion iQ.

I believe KIA has raided many talented people from Audi and BMW. Perhaps those who have made the move have been telling their friends left behind that the grass is much greener, both financially and job satisfaction-ally, elsewhere.

“What’s the biggest gap you’ve seen between a concept car and the actual production vehicle we got?”

The General Motors Firebird I, II, and III concept cars of 1953, ’56, and ’59 compared to the first production (Pontiac) Firebird in 1967.

I think part of the expensive car issue is lifestyle bloat, don’t forget that. I got caught up in it as I switched jobs/got promotions/made more money in my 20’s but I am dialing it back now, but still never got even close to a 4 digit payment. At this point, I’d rather just buy out my current lease when its over because I can’t imagine spending the $10-15K more on MSRP and starting over would really gain. My car has enough options, space, and comfort. The only thing its missing is vented seats and some more power, but I’m not the backroad demon I used to be and I can just buy $700 ceramic tint instead.

All that to say, I know so many people who when it comes to upgrading think they ‘need’ a million things or the biggest car they can get, when in reality they don’t. They then get caught in a huge loan and get so used to paying so much that when they’re already paying $800 a month, they get a raise and think, what’s $900 a month? Sometimes the car that hits *most* of your desires is simply just better, especially if its $10000 less.

People do work at Audi but they have to divide their time between there and Sephora.

The average vehicle purchase price is $50K. The best selling vehicle is a Ford F150, which is mid-$50K+. The second best seller is a similar thing from Chevy. They guzzle fuel. They result in large monthly payments.

Reasonably priced midsize sedans have been dying because consumers want crossovers and pickups. And they continue to go into debt to buy them when a base Camry, Accord, Civic, Malibu is still available and loaded with features for $28-33K.

This looks more like shitty money management and/or overconfidence in one’s current (but not future guaranteed) income on the part of consumers rather than a big conspiracy by the automakers to me. Doubly so when housing, healthcare, and childcare costs have been rising for years now. This is not new, so if you’re financially stressed about it, why are we shopping for a new F150?

Keeping up with the Joneses is expensive? Who would have thought? Most of the stressed about money people I’ve known make way more than average, but have really high spending habits and expectations. Add in poor decisions of rolling in negative equity over multiple vehicles, and the $1000 monthly payment might be on something that would only be $400 to lease.

My friends with cheap beater old vehicles tend to be happier with better quality of life.

Wealthier neighbourhoods near me have a very large proportion of Toyotas in the driveway. And a very large number are clearly not turning over a new lease every 2-3 years.

You’d blend quite well with a base 5yo RAV4.

If you’re purchasing a new $50,000 vehicle you’re also going to have it fully insured. That costs isn’t going any lower either. On top of that, if you’re unfortunate to live in the wrong state, and you’ve a vehicle that’s even partially electrified, you may get dinged an extra fee on your annual registration.

That $1000+ a month, is probably closer to $1300 or so if you roll up the all the cost just for parking a new car with your name on the title.

A gently used car with some factory warranty remaining still remains the better choice for many buyers. Buying brand new is more of an emotional choice, not a logical one.

Honestly, for the buyer whose most important factor is having a new, warrantied vehicle, leasing is potentially better than buying new. If you’re trading in every few years to keep that bumper-to-bumper and have the latest tech or best crash testing, a lease might make financial sense. Especially one that includes all the maintenance, so all you have to worry about is fuel and insurance.

But, yeah, gently used is nice, especially if it has maintenance records.

I just went from a 2013 4Runner with 200k miles to a 2026 Ram 1500. I checked with my insurance agent during the research phase and found that my premium would only go up $60 per term for the Ram. I was pleasantly surprised at that.

Insurance rate calculations are baffling to me. When I was looking to get rid of my Niro, I ran numbers on a number of vehicles, including some I had no interest in. A brand new EV6 was cheaper to insure than the Niro (both were fully-loaded). A new RAV4 Prime with all the options checked cost the same to insure as the Niro. A Tesla Model 3/Y or an EQS would more than double my insurance. A BMW i3 would increase it, but fell somewhere in the middle. An Outback was an increase, but not a large one. A Blazer EV was around the same increase.

I know they have a lot of numbers to crunch, but it’s wild to me just how different the numbers can be for some comparisons and how close they are for others.

Well, having watched the hell someone has to go through to get a tesla repaired after an accident …. can’t get parts… have a drive an hour and a half away to bring it to an “approved” shop… etc. I can see why the insurance is a hell of a lot more on those. It was a minor fender bender and the repairs were $12k.

That’s fair. I do understand the sky-high rates for Tesla and I only checked the rates to see how much higher they were (there are many reasons I was not actually considering one, even though a used one can be pretty cheap). But the EV6/Niro comparison was the big surprise for me. The EV6 is more expensive, faster, and has pretty much no additional safety features, but it is cheaper to insure (maybe it does better in crash testing or their data shows the drivers just have fewer accidents, but the local dealer irked me enough that the EV6 fell off my list of possibilities before I bothered to research why it might be cheaper to insure).

In certain jurisdictions, also “personal property tax.” I kept my old car for so long partially as a way of stickin’ it to the (tax) man.

I have a very smart and capable friend with a big mortgage and a big note on a high-spec (non Raptor) Bronco, both justified by income level and good feedback at work.

His position was just culled with a lot of other tech people. He’s now actively shitting his pants about the lack of response to any job applications.

I feel totally justified in thinking that no matter what the income level, cars are just too expensive.

I work in, and employ people in the tech sector, particularly R&D. My inbox is stuffed with unsolicited resumes. It’s scary out there, and going to get worse before it gets better.

Buddy in question is a red-teamer and manager. Had director in his title, though other former colleagues are hitting me up too. Scary scary times.

I’ve been out of professional level work for two years as of next week.

Cripes.

A friend of mine in HR was just telling me that they’re getting 100+ resumes a day, and are using AI to weed through them, and are looking for any tiny reason to reject, because there are so many applicants.

I believe this. After recently hitting a decade with my current company I decided it was time to start looking. I try to apply to 1 or 2 a week. The only replies I get are instant AITS denials. The rest send nothing. That’s a lot of resume tailoring for no response.

Yuuup. At the end of the day, they are tools. Why spend so much on a tool when the cheapest tool available would probably work. It’s not like buying a hand tool and a power tool. They’re both extremely capable power tools that do their jobs just as well as each other, just one has a softer handle.

$1,000 is roughly the monthly note of a $325,000 house with 20% down and a COVID-era mortgage rate.

wow. and sucks to be first time home buyers that can not afford a $65K downpayment.

We bought at age 26 because we scored a 5% down loan. I think it would have been another 15 years if we needed to put 20% down because we were literally just making ends meet until around that point. Common story.

A lot of people screamed for 20% down to make a resurgence, but IMO that’s bad for the entire market as prices skyrocket, it becomes a carrot you’ll chase but rarely achieve (and also probably while deferring retirement investments with much higher returns than housing). A high credit score in a solid housing market shouldn’t need much down at all.

IIRC the minimum 20% down was required to avoid PMI ( private mortgage insurance, which only protects the loan shark, not the customer). It’s an additional fee that get tacked onto the mortgage payment.

I still don’t understand why everyone is so afraid of PMI. It only added $80 to my mortgage and it was removed after 2.5 years when my equity passed 20%. I just had to pay for an appraisal.

You must have put down close to 20% then. The first 2.5 years of payments on a mortage are almost entirely interest so you wouldn’t have paid down much principal.

Also, 2.5 years x $80/month is $2400, plus $500+ (I don’t know what they go for these days, but when I dropped PMI a number of years ago I think it was around $500) for a new appraisal is a non-trivial amount of money. If you can avoid it that is far preferrable.

I put down 3%. I remodeled 2 bathrooms and my home appreciated enough in those 2.5 years to make my outstanding balance less than 80% of the homes value.

I’ve been in my house for almost 6 years now and my home’s value has increased about 170%.

That’s very fortunate, but nobody should be budgeting their home purchase on the idea that their house will appreciate that much that quickly. See also: 2008.

We bought with very little down 25 years ago and we had a adjustable rate that was far below 2% for the longest time until we locked it at a very low rate. The sad part is that I could not afford my house now on my new higher income as house prices in my area have shot up so high.

Literally everyone I know that bought a home prior to 2020 says that, that there’s no way they could afford that house now. It’s absolutely insane how much the cost of housing has skyrocketed since 2020.

And it would likely cost you more to “downsize.

It was the same deal for us. We bought almost a year ago and had to do a much lower down payment than I would’ve wanted, but our rent was beginning to skyrocket and I was tired of basically just throwing all of that money down a hole once per month.

Throwing money at an appreciating asset should keep you warm at night.

It does. Sucks to see how much of our payment is going to interest at this early stage, but it’s still better than just lining a landlord’s pockets every month.

Have you looked at the amortization table to see which month has you crossing to paying more principle than interest? Nice psychological line to cross.

I also bought at age 26 in 2020. I did something that’s probably controversial and bet on the market and my planned home improvements placing just 3% down. I refi’d a year later to 2.68% APR and my house appraised high enough after 2 years of ownership, and some remodeling work, that the PMI was removed.

It would have taken me several more years to save up 20%, and the housing market would have priced me out of what I bought.

That was smart. I’ll never own a home now because I was saving the 20%, and then 2020 happened.

I could have bought a home for under 200K in 2019, that same home was 350+ 2 years later.

To be fair, it’s not like any of us saw this Covidflation coming in home prices. It felt like a temporary blip, but never really went away.

I live in a traditionally low-cost area, and even people today who shop for home here are like “Where are all these deals I was hearing about?” — especially if you want to live in more desirable areas and/or better schools.

Like others have said, I don’t think we could afford to move now!

Sucks to be the “leg” part of the K-shaped economy rather than the “upward pointing arm.” The price of admission for so many things is eye-watering.

$1,000 is also cost of $hitty non-ACA private health insurance with crazy high deductibles/out of pockets. The ACA approved version is $2k+, without subsidies!

Why? Is this just corporate greed? Obviously, automakers are not benevolent organizations operating in my interest. But surely there’s money to be made selling less expensive automobiles; all the big players already do so in other markets (i.e. Honda Jazz).

I keep hearing (here in the autopian comment sections) that our incomes are keeping up and cars are cheaper than ever when adjusted for inflation.

That is because both are true in a society-wide sense.

In a country of 330 million, averages and medians cannot capture everyone precisely, obviously. But snarky comments aside, more Americans than before can afford new cars, more people’s incomes are higher adjusted for inflation than they were in 2019 or 2015 or 1990 or 1970, and fear of offending those for whom that is not the case should not prevent us from stating facts.

Ok

Read this . . . https://www.economist.com/leaders/2025/12/30/the-truth-about-affordability?giftId=OWViYWNlYzctYTdkOC00OGQxLTkyNzgtOTk0ODZlMGQxNzgy&utm_campaign=gifted_article

An article about affordability locked behind a paywall.

*chefs kiss*

It should be a “gifted article.” You can’t read it?

Nope.

It’s not lmao

I think it’s important to remember that the rich are driving the economy more than ever before. So much so that statistics on paper are so far removed from reality for most people that they’re irrelevant.

If you’re already rich, things are going great for you. Taxes are low, and stuff is cheap no matter how much it costs because that’s just how filthy rich you are. You’re probably richer than ever.

Meanwhile, the middle class is getting hammered by tariffs increasing the cost of goods, and everything not affected by tariffs is going up because of greed. Our wages are not keeping up with inflation and unchecked greed across most industries and economic sectors. It’s more expensive than ever to insure ourselves, feed ourselves, house ourselves, and keep ourselves employed at jobs that don’t pay enough. And don’t forget, our employers will fire as many of us as possible once AI matures.

One person can say, “$50,000 for a car is more than I make in a year and I can’t afford that on top of everything else I’m milked for each month.” And another can say, “Cars come with so many features for the price now, isn’t this great,” at the exact same time.

The only difference between the two is the number of zeroes in their net worth.

This is the right take. Even if new vehicle SAAR were to stay flat or decline a bit in the US, the OEMs will sell the vehicles with greater margins to the people who can (or believe they can) afford them.

Username checks out.

“Username checks out.”

https://m.youtube.com/watch?v=MCTm4gczqP8

“Free access to this article has expired”

I don’t know if it’s the biggest, but I’m still bitter about the Chevy Volt.

It remains unclear to me why the site’s persistent take on this kind of stat is:

“No one can afford cars!”

rather than:

“Many thousands of people every quarter feel confident enough in their earning power to take on a $1000+ payment”.

No one near the poverty line who is forced by circumstances into getting a new (to them) car is among the 4 digit payment club, about that I feel extremely confident. The people buying these vehicles are not being coerced, they are not victims, they are not in financial jeopardy. They are simply buying something they feel they can afford.

If car payment terms weren’t getting longer and down payments weren’t dropping I’d agree, as most things get more expensive over time. However, all the other data shows that many consumers really, really would rather not be doing this:

There’s a mix of reasons here, but my positive spin on this is that I think this creates an opportunity for some automaker to swoop in and pick up some of these consumers who are, it seems, sitting on the fence.

I have my skepticism about this too, because cheaper vehicles are out there and aren’t being bought in the numbers you’d expect if the car buyer really was struggling.

A Camry vs an F150 is a big financial difference. The fact that so many are willing to pay so much extra for capability and image that everyone here says they don’t actually need tells me affordability is not priority one for actual buyers.

Wasn’t there a morning dump a while back that showed based on days supply data that cheap cars were sold before they arrived at dealers while expensive ones are rotting on the lot?

Someone is signing up for those $1000 payments.

I’m sure they are, buta waiting list for cheap cars and a pileup for expensive ones still shows that planners failed.

Perhaps we should all be getting used to these numbers. $1000 today is less than $800 in 2019.

Planners may not have failed. It may be that the accountants won, and “proved” there’s more money to be made on the more expensive trims/models.

Probably a pedantic take here, but one to consider nonetheless.

$800 in 2019 was still ridiculous.

I think people for whom those payments are a stretch are just becoming more risk tolerant. “Am I going to stay above water until that term is done? Maybe not, but let’s enjoy it for now! I can always sell it later or file bankruptcy.”

Bankruptcies fell sharply during covid due to a number of cash infusions, but they have started rising again since bottoming out in 2022. Short memories.

Dave Ramsey will never run out of ‘callers’ to his show (insert laughing emoji).

I do think that there is a customer who needs a new car now and ends up spending too much because they get one that is on the lot. And there’s certainly a customer who gets convinced to buy one on the lot instead of waiting for the one that would be better for them. Perhaps more availability of the cheaper cars would help.

But I also think monthly payment is a terrible way to approach car buying. That’s how people end up in 72-month loans paying too much interest–the dealer asks how much they can afford, massages the numbers, and gets them to pay a lot more over the course of the loan than they should have been willing to pay. I’d like more data on the breakdown of payments by term length and as percentage of household income, because that would be more informative.

This is it. People are not acting consistent with any general notion that affordability is actually issue #1. I judge people and their intentions based on how they act, not what they say, and things seem to make sense more often then not with that approach.

The lower down and longer terms are the ones that concern me. Average car age isn’t a huge issue to me, since vehicles last longer without major rebuilds than they did in the past. And I do think higher payments aren’t necessarily an issue, but might be. I’d much rather have solid data on car payments as percentage of income. I know housing as a percentage of income is higher, on average, than the ideal, and transportation may be in a similar spot. The last data I could find was in 2022, and it showed the average household spent about 15% of their income on transportation. It’s really rough for the lowest quarter of earners, but they aren’t the ones with $1000 payments.

I think the market just hasn’t hit the tipping point yet.

Eventually, there will be more people in the market that can only afford a used vehicle, I just hope that’s not when we have 20 year car loans and $2000 a month payments.

There are 22 million people whose healthcare premiums just skyrocketed. Not all of those were in any position to buy a new car anyway, but all of them were spending money on things that they will now need to stop spending money on or choose cheaper options in order to stay insured. Think restaurants, clothing, vehicle and home maintenance/upgrades, travel etc. The economy will see a result from this. The “savings” the government thinks they see from not helping with or solving the issue will be directly transferred as a cost and loss of income not to that individial healthcare premium payer but further on to the person or business that is now going to see less of that person’s dollars since the money now has a higher priority than any other voluntary purchase. This will also directly translate into lower taxes due on lower business income, thus less income to the government and less spending by businesses due to potentially lower sales volume.

You’ll also see a number of people that will be forced to seriously determine their actual “needs” in terms of the number of vehicles in their driveway. Some work from homers will downsize by a vehicle, some others will get rid of the “extra” car, some will no longer need the mulch-runner that sits for 360 days of the year.

I was just answering a Reddit post about high car payments. The poster was trying to decide what deal to take and really just needed someone to tell them that it’s okay to pay a large monthly (if they could afford it) if it offers the best deal.

Longer terms are a much bigger problem than larger payments. That indicates people are less able to afford the car and need to spread the financial hit over a longer period of smaller payments.

I have a stupidly high car payment at the moment, but that’s also a function of getting 0.9% financing for 36 months.. I couldn’t imagine a payment approaching anywhere near this and being in it for 60+ months.

Yeah, that’s essentially what I explained to this person. If you can afford the payment and get the lower interest rate on the 36 month loan, absolutely go for the shorter term and get it paid off sooner. I paid my last loan in under a year because interest rates dropped and I was no longer earning more interest keeping the money than it cost to borrow it. It did mean that I averaged more than $1000/month for that year (mostly in a couple big payments at the end), but it’s paid off and done.

I could afford a new car if that was a priority, but I rarely buy a new car unless there is a specific reason. Like with my truck, the new truck was a better value during Covid, because the delta between a 2 year old truck and a new one was like $1500 for me. It was a no brainer to buy new in that case. And I’ll keep it for at least 8-10 years. I do have a payment of almost $1000 on that truck, but I only did a 5 year loan and it’s only not paid off at this point because it’s at 1.74%.

Otherwise I try to buy stuff that is 2-3 years old and coming off a lease if I can. I research the heck of out things to find the stuff with minimal problems. And I love highly depreciated PHEV’s and EV’s that have lots of battery warranty/electric powertrain warranty left. But I need people to buy and lease new cars so that I can go buy the used ones.

I was having a conversation with my in-laws last night (or more like, I was being told by my in laws) about how “cheap their Can-Am Spyders were compared to getting a new Harley Trike” It was “only” like $30,000 each (they have 2) vs. like $50,000. I was sitting there biting my tongue about having purchased 2 used, but very nice Miatae for like 2/3 of the cost of one of their Can-Ams. And those are real cars that I can drive in all weather conditions and have arguably more fun in. And this was right after I paid for dinner.

Can someone get european auto execs to either go fully casual or agree to wear ties with collared shirts again when they do the ubiquitous smile-handshake photo?

I’m sure they’re wearing whatever the marketing team told them to wear.

Careful or they’ll break out the sandals and socks.

I have this feeling that things will have to become historically economically bad for people to stop buying crap they can’t / shouldn’t afford.

Automakers are built to generate revenue, and will continue to do so as long as their customers accept what they’re offering. Trimflation exists because people are willing to pay. And instead of saying “No” and looking at a used car lot, people are asking about 10 year car loans to get that $1000 a month payment down to something more reasonable.

If y’all want more affordable cars, you’re going to have to start buying ONLY affordable cars.

Unfortunately, many buyers buy the most vehicle that the credit people will let them finance. Long term planning doesn’t enter the discussion.

I remember when $1,000 was my theoretical upper limit on what I’d pay for a mortgage (before insurance and taxes). I’m still just barely above that, but that’s mostly due to buying our current home in 2011 at 3.5%. Today a comparable home would be at least twice that payment.

I don’t like shopping “payments” but I also don’t like pretending they’re a useful metric. The actual cost of vehicles is the real concern, everything else (payments) is much more dependent on credit score, income, term, choice of lenders, etc.

I’m one of the few that pushes people for longer terms, provided the interest rate doesn’t jump to astronomical levels. A half-decent car will last you at least the financing term, as long as you don’t get bored and make the mistake of trading excessively. If you’re going to play that game, you need the deep pockets to support it.

The last point being that you’re transferring more risk to the bank, which is one of the small ways that average people can take advantage of a system that is largely aligned against them.

Longer terms aren’t the answer. That’ll just make the problem worse. Once everybody really fully only considers the monthly payment (as they do with mortgages now), that effectively will open it up for automakers to completely eliminate the affordable end of the market.

Frankly, I’d enforce shorter terms. If your credit score is within N range, you can only obtain a 4-year loan. That will effectively force buyers off new car lots and onto used car lots.

(But there’s less than 0 chance of that ever happening)

It’s an arms race, very analogous to cheap student loans and skyrocketing tuition; or basically everything about healthcare (“shopping around for the best price?” LOL).

Trimflation is definitely a big piece of it — the manufacturers allege that we all want higher trims and fancier amenities, but anecdotally I know far more people who want LESS on their car.

But the market “correction” that’s also occurring is that resale values are pretty strong, so I always like to take that into account. Yes, it’s still a hard pill to swallow, especially if buying new. A few months ago I chose a nicer 4yo car over a mainstream brand new one, and the economics of value retention were a big part of that. The lower up-front costs also helps…

There’s an easy way to stop trimflation: don’t buy.

Or do as you did: buy used.

Automakers are all entirely focused on revenue. Just look at how quickly they aligned to the current administration. They will squeeze buyers until there’s nothing left to squeeze, then lobby for “better” borrowing capabilities to help squeeze more.

You won’t be enforcing shorter terms when your re-election is financed by the banks or your annual bonus is determined by how many people you get to buy a new car from your lot. Keep America Rolling! (downhill)

Bought my house in 2011 around the same % I think. 30 year loan and payment around $1200 or so. I’ve told people I will likely only leave this house “feet-first” barring a fire/disaster.

If I’m going to pay $1K+ it better have a fancy Italian nameplate.

I’m in the process of being pulled out of our house we bought in 2012 feet first. It’s not great but at least we won’t have gang violence around us anymore.

When I bought my house, almost 30 years ago, the mortgage payment was about $1,300, and that was way too damn high.

A grand a month for a car is lunacy.

In 1993 I bought a brand-new house for $80,000 and the payment was like $750 a month including taxes and insurance.

1 in 5 Americans having a four figure car payment is absolutely insane.

Does that mean 1 in 5 Americans is absolutely insane?

Why so low?

Approximately 40% of them certainly warrant further assessment

(Insert obligatory most-recent election joke here.)

Too easy!

It’s going to mean there will be a lot of used vehicles for sale in a year or two.Wait until they have their wages garnished for student loans they thought that had just magically disappeared. I wonder if the housing market will also see an adjustment?

1 in 5 people who bought a new car have a 4 figure car payment.

Good point, at least some of us are still sane.

That’s closer, but not completely accurate either. Playing the Ferris Bueller reference here, my daughter’s husband’s sister’s fiance is the finance guy at a used car dealership. He says it’s not uncommon to have $1,000 payments on used cars these days, and he doesn’t work for a high end dealership. They do sell a few higher end units here and there (Audi, Caddy, etc) but they do sell a lot of big pickups. And even used, they ain’t cheap.

Obligatory Spaceballs reference.

I didn’t say there weren’t used car buyers with 4 figure payments, just that the source data for this article was new car financing. My gut says that the percentage of used car buyers with that big of a payment is likely lower, much lower, than the percentage of new car buyers with that big of a payment. Then of course there are those that don’t have any car payment.

Fair point, and I agree with your gut. Seems completely reasonable to me, too.

I recently took on a FIVE-figure car payment.

Thankfully I chose the 1-month term.

As the post says, not 1-in-5 Americans, 1-in-5 new car transactions in Q4.

Fair enough, if I was good at numbers I’d be much wealthier than I am. It’s still a bleak statistic though…

1 in 5 Americans *with a new car loan* have a 4-figure payment. I think that’s a wildly different number than 20% of Americans as a whole having a 4-figure loan.

I made a whoopsie and have already owned it

To follow up with an Office Space reference, it’s probably just a case of the Mondays.

Are there enough used cars to satiate the “people should only buy used” calls.

There are plenty of used cars, but they are being sold close enough in MSRP to the identical new car unless they are a giant pile of junk. For someone who wants a new car, if they are financing anyway, ESPECIALLY if they are someone who targets a payment and not a price, they will just say, what’s 3-5k more over 72-84 months?

And if they’re financing, APR will be lower on the new car

The Ford Interceptor to Ford Taurus

Big awesome looking brick of a RWD performance sedan with the 5.0 V8 and a 6-speed manual to a toned down FWD/AWD SUV based sedan with turbo 4’s and V6’s and automatics.

Also the Foose Hemisfear to Plymouth Prowler

My monthly on my FRS was $275. It was pretty hard to wrap my head around a nearly $500 payment for a new Corolla-Cross for my wife (particularly because a bigger percentage of it would be interest on a depreciating asset) and we ended up leasing an EV to take advantage of incentive. But $500 was scary, even with our otherwise manageable expenses.

I really can’t imagine how people can afford the $700-800/month needed for buy a family hauler on top of the cost of actually feeding and clothing kids. But I also don’t understand how people can afford a lot of things that seemed so normal 6 years ago….

We are probably in the top 5% of earners in the US and it was really tough for us to accept the monthly payment on my husband’s new truck. He’d never bought a new car before this but after a few years of terrible (and very expensive) bad luck, we decided to go new. $15K down just to get the payment under $800/month on a truck with cloth seats.

I don’t understand how anyone living near the median is affording this.

Well I remember when they touted the Amphicar, but then we ended up with a Veyron in a shallow lake in Texas. Or was it a Lambo?

Then you have that lady in Vegas, but technically the Equinox missed the pool.

Is it though? Considering current Audi, a management shakeup is hardly a bad thing in my eyes. Maybe they could poach a few people from Genesis and get some actual leadership in there.

No kidding, their current lineup is incredibly meh in my eyes, the Q7 is ancient for it’s segment, the Q5 is meh, their sedans are losing enthusiast appeal while looking more generic, and their product roadmap seems nonexistent. Someone needs to step up and steer the ship soon. Slapping their name on a mediocre Sauber F1 team will not magically boost sales 20% like they seem to think.