Between rising healthcare costs, tariff-related price increases on various goods, and a housing market that drains most of the paycheck, we are reaching an affordability crisis in America.

The car market isn’t offering any relief with average transaction prices for new cars approaching $50,000. The solution for some buyers is to stretch a loan as long as possible, upwards to 100 months, to get payments in line with their budget. Here is why that can be a risky move.

There is still a lot of economic uncertainty, and for folks shopping for a new or used car, some tough decisions may have to be made regarding what they can actually afford. Many buyers will fall into the monthly payment trap and stretch a loan out for as long as possible so that their car note is reasonable. Some people may be tempted by a 100-month car loan, but they may not fully understand the math as to why an over-eight-year loan is financially dangerous, or what their alternatives should be.

Cheap Payments Now With Big Costs Later

Let’s examine a hypothetical purchase of what most would consider a “reasonable” and high-quality car, the 2026 Honda CR-V Hybrid, with the goal of getting a payment under $500 per month. The base price of a Sport trim with AWD is $38,580. Perhaps with some good negotiation, you can wiggle that price down to an even $35,000.

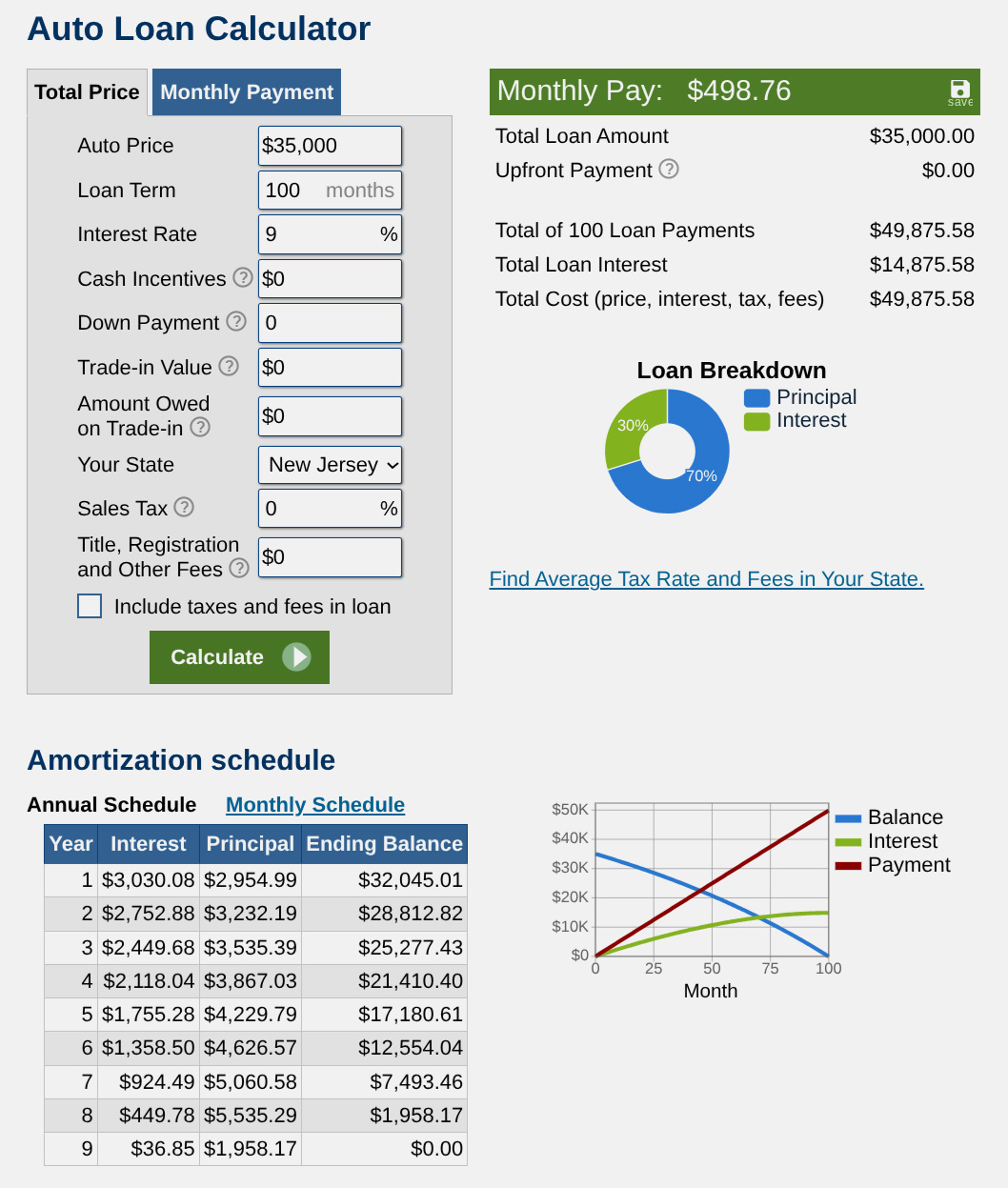

Currently, Honda is running an APR special of 4.99% for 60 months. With no down payment, that works out to about $660 per month. That is pretty steep, now suppose we stretch that loan to 72 months. Naturally, the interest rate will be higher. Assuming a 7.0% APR for the six-year loan, the payments are $596 per month, a bit better but still not quite affordable. The dealer manages to find a bank willing to underwrite a 100-month loan at 9% APR with payments of $498.76 per month.

You got your very reasonable car under budget, but at what cost? Here is the breakdown:

At the conclusion of the loan, you will have paid almost $15,000 in interest on a $35,000 purchase, and about $8,200 of that interest will be paid in the first three years. If we compare that to the 60-month loan at 4.99% APR, that’s only about $4,600 in interest.

Not only does the 100-month loan cost over three times the interest compared to the five-year loan, it also puts the buyer in a potentially underwater situation if they decide to trade that CR-V after a few years. In fairness, a Honda should hold value pretty well, compared to some other brands, but the likelihood of having any equity if you decide to get rid of it after the first few years is low. There is also the chance that the person would have to roll over negative equity into the next loan.

What Could You Do Instead?

If you are trying to achieve a specific monthly payment, there are two solutions. The obvious solution, though not one that most buyers want to admit to, is to simply get a cheaper car. There is no shame in concluding that a brand-new ride is not the best move for your finances. In fact, a less expensive used car is often the smartest play.

If you were targeting a payment of $500 per month on a 60-month loan, assuming a 7.0% APR, your total spending limit comes to about $25,000 with tax and fees. Even though a new CR-V Hybrid is not in the cards, that doesn’t mean you can’t get a quality car. But you may need to be flexible when it comes to models, color, and equipment.

For example, here is a quick selection of 2020+ hybrid crossovers within 200 miles of the LA metro with under 50,000 miles. Granted, none of these are CR-Vs, but almost all of them will give you a practical car that will have respectable gas mileage for much less than a new Honda:

Alternatively, Leasing Can Get You The Same Car For A Similar Price

If a buyer insists on getting a brand new car, but needs to stay within that $500 per month threshold and doesn’t want to roll the dice on a 100-month loan, a potential solution is to lease. Honda’s current offer on a CR-V Sport Hybrid lease is $299 per month with $4,899 due at signing before tax and fees for a 10,000-mile/36-month program.

If we were to restructure that into a zero-down lease, it works out to around $436 per month before tax and fees. And most folks would likely fall under the $500 per month target even after those additional charges are added in.

The classic argument against leasing is that you don’t have any equity in a vehicle, as you are essentially “renting” it from the finance company, and you are always stuck in the cycle of payments. In that respect, if you look at a lease compared to a 100-month loan, we have already established that having equity after a few years is not likely. Also, instead of paying on a car where your loan far outlasts the warranty, you could have cycled through three leases in the same time with payments well under your target and maintain full warranty coverage. Most “finance experts” will say that leases aren’t a smart money move, but they are far less risky than taking out a loan for 100 months.

One of the common bits of car-buying advice is to never tell the salesperson how much you want your payment to be. Now with 100-month car loans available, this is just one more tool for unscrupulous dealers to convince buyers that some cars are more “affordable” than they really are.

Your best defense against a bad deal is to understand how the math works ahead of time and not get roped into paying way more interest than you should while being trapped in a car loan for over eight years.

Top graphic images: Honda; DepositPhotos.com

I am a regular reader and contriburtor on the personalfinance subreddit. There is a fairly predictable flow of people who either want to “Get out” of their underwater car loan, or their underwater vehicle has been totaled and they don’t have gap insurance. Those problems are only going to increase if people buy 100 months loans. That’s crazy. Many people never learned about the dark side of car loans and they’re easily pulled into these traps.

Well, a loan is simply a rental of money. (Same as a mortgage that way.) So, you are either renting a car or renting the money via interest.

And paying it in full leaves one losing the opportunities to invest that money (or keeping a rainy-day fund), though it would be difficult to match a return to the interest rate on the car.

So, the first question should be: do I NEED a new car?

If so, do I NEED THIS car?

Etc.

I borrowed money from my mom at 0% interest for a used car, paid her back when she asked for a payment. That’s the best deal (IMO — she did not break my kneecaps once!).

Also, leasing is a good deal IF the math works out. I mean, suppose that CRV payment were $100 instead of $299 or $436? There is likely an indifference amount wherein one would choose either own or lease indifferently, so sayeth the math.

People who don’t do the math will learn the hard way about math.

Long loans make sense only with cheap financing. Like 1% or 0%. And planning on keeping the car for a long time.

Don’t tell me what to do dad. /s

But cereally the prices I paid for any of the used cars I have owned I just find it hard to want to get a new car. All my recent (non-classic car) purchases so daily drivers are always within 5 or so years old and the price you can get a car in that range vs new is pretty ridiculous especially if you get a CPO.

Instructions unclear, are you telling me I should be buying Jeep Grand Royale with Cheese with 96month financing?

No, 100 month financing! Read the article! 🙂

As always, great advice Tom.

This is before you factor in the depreciation hit, biggest in the first couple of years, on that new car.

OMG! Haven’t had a car payment since 1987.

Recommending a used Jeep with a hybrid powertrain should not be in the same article saying 100 month term is a poor financial choice.

TBF – Stellantis is most famous for their 96month financing.

Why stop with just one bad life choice?

The Jeep would be a poor financial decision. That ’24 Hornet right below it is the smart move.

This makes me wish for the heady days of zero-percent financing…

Until my last two or three cars, I bought cheap but interesting vehicles, and often sold them for more than I paid. My friends would give me a hard time about getting, something newer, but I would say “one year of your payments buys me this car and a lot of gas.”

I know the Joneses. Nice folks. But I don’t feel the need to keep up with them.

“I know the Joneses. Nice folks. But I don’t feel the need to keep up with them.”

Nice, I am using this and I will absolutely give you credit!

An 8 year 4 month auto loan. So much can happen in that amount of time. You could fall ill. You could lose your job. You might move somewhere that you don’t even need a car.

But, some people have no concept of anything beyond the short term so there will be plenty of people who fall for this.

A vivid, plain language description of the situation and its real world dangers, understandable by anyone willing to take the time…which was exactly what I expected. Tom’s pieces were the last reason I stuck it out at the old site for as long as I did.

Finance companies grinning at someone paying twice the MSRP to finance a vehicle for 100 months, only for it to be worth half that MSRP by the time the loan is paid off.

With Tom’s arrival, the circle is complete. The Autopian global domination is now assured.

Ok. Now do this for trucks so haters can see that we are paying way more than cars

Sorry, your username requires you to phrase that in the form of an angry rant.

We will also accept a tirade.

Add “shaking a fist” for maximum effect.

I don’t think my brain could even comprehend “100-month loan” in the title. I saw $100 / month instead. 100 months is just too insane to be a real option…

I DO WHAT I WANT!!!

Also, hey Tom! Glad you’re here!

until they run out of people willing to sign on the line for crazy loans for expensive vehicles we’ll never see any downward price pressure.

convincing people that they don’t ‘deserve’ a new car won’t work. consumers would rather be poor than look poor.

BHPH lots show they will not run out of people. You will never fix stupid. I worked in a shop and my colleague would always say “Never underestimate the power of an idiot.”

Hell yes! Love seeing Tom at the Autopian!