I’ve probably mentioned this before, but I got a ride from BYD Chairman Wang Chuanfu in one of his plug-in hybrids back in 2008, just a few months before legendary investor Warren Buffett bought a large stake in the company. I thought BYD was a fascinating company and its founder a visionary, but it would have been unethical for me to invest in a company I also covered.

That’s the excuse I’m using, at least. The other one is that I didn’t have the millions of dollars Buffett had at the time to invest. I’ve been watching Buffett’s company sell his shares for the last few years, and his timing has been near perfect. Why? I often cover the challenges of the Chinese market here in The Morning Dump, and now we have a word for what’s happening: Involution.

Whereas Buffett’s Berkshire Hathaway made at least $8 billion on its investment, Porsche’s parent company just had to take a $6 billion write-down on its EV shift, which hasn’t exactly panned out. Now the company is getting back into ICE and hybrids.

If that doesn’t work, BMW continues to try to make hydrogen happen.

Buffett Shifts Money To Investments That ‘I’ll Feel Better About’

It’s hard to express how little attention the press gave to Chinese automaker BYD back in 2008. This was the year that a bunch of brands from China flooded the Detroit Auto Show, but most were relegated to the basement.

There was just a vague hint that something could be happening in the housing market in the United States, but everyone was pretending like nothing was wrong. Instead, drinks were flowing from the major automakers, and they pretty much treated the Chinese brands with their little electric vehicles as a joke. The prevailing belief at the time was that China was the place where companies like GM and VW made huge profits, and not an actual threat.

What struck me from my test drive with BYD’s chairman downstairs was that his company was already building what everyone upstairs was only pretending to build. Chuanfu’s pitch, via his translator, was that the Chevy Volt being paraded around in the main hall was just a concept, but he had a real working car with a relatively cheap-to-produce LFP battery.

He was right, even if no one else realized it at the time. One person who did see the potential upside with BYD [Ed Note: There’s a famous video of Elon Musk scoffing at BYD’s car in 2011. The car was pretty unimpressive compared to a Tesla. -DT] was Berkshire Hathaway’s Charlie Munger, who led the firm to put about $230 million into the company.

There’s great audio from the 2009 Berkshire Hathaway annual meeting wherein someone asks why the usually conservative investment firm would make such a silly investment, which seemed more like something a VC fund might do. Here’s Munger’s response:

“From a standing start at zero and with very little capital, [Chaunfu] rapidly was able to create the best-selling single model in China, and that’s against competition that was Chinese Joint Ventures with all the major automakers of the world… this is not some unproven, highly speculative activity. What this is is a damn miracle.”

It’s hard to say to the dollar exactly how much the company made because I don’t have specific dates for every sale, but the company’s Hong Kong-listed stock went up around 4,000% over the period it was owned, and the value of the company’s holdings was listed at a peak of $9 billion. It’s safe to assume the company made at least $8 billion on the original investment.

Berkshire Hathaway did start selling its shares a few years ago, and Buffett explained why to CNBC:

Buffett says it is an “extraordinary company” being run by an “extraordinary person,” but “I think that we’ll find things to do with the money that I’ll feel better about.”

What does he mean? While the Chinese market has expanded and BYD has seen its share price rise, recently things have been going in the opposite direction. If the trends hold, it’ll make Buffett’s purchase and sale seem incredibly well-timed.

The issue is “Involution,” which is the name given to the Chinese EV market essentially eating itself alive. Let’s talk about what this looks like.

Chinese Automakers Are In Trouble As ‘Involution’ Sets In

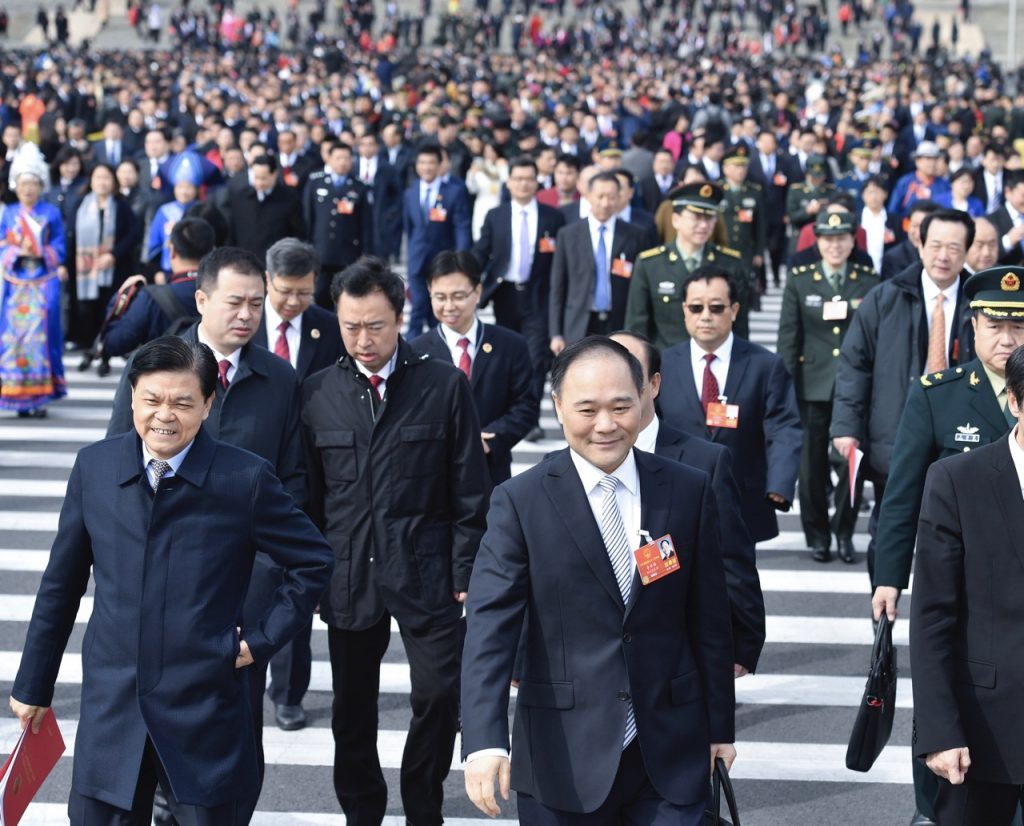

It’s no secret that China made a massive effort to become the world’s leader in both electric cars and the technology that underpins these vehicles. The way China’s politics work, most of the society is capable of moving in one direction towards a goal.

While this has worked from a product standpoint, China has a massive overcapacity problem, as the domestic market simply cannot buy all the cars Chinese automakers are building. At the same time, global exports aren’t happening fast enough, and these same automakers are finding obstacles to reaching new markets.

This has led to what many are calling “involution.” There’s a big Reuters piece that gets into all of this that is worth reading:

The problem of excess capacity leading to overly ambitious sales goals isn’t unique to China. In the early 2000s, General Motors, Ford and Chrysler had too many factories cranking out too many cars, and eventually closed more than a dozen U.S. plants.

But pressure to hit sales targets and gain market share is greater in China, industry analysts and former executives say. Lately, industry players have been using the term “involution” to describe competition that becomes self-destructive and incentivizes irregular practices.

Vehicle manufacturers in China are driven to keep selling and producing, even at deep losses, because this ensures cash flow, which is crucial to survival, said Liang Linhe, the chairman of Sany Heavy Truck, one of China’s largest truck makers.

“It’s like riding a bicycle: As long as you keep pedaling, you might feel exhausted, but the bike stays upright,” he told Reuters.

As the story details, almost no one is making money in this market. Dealers, automakers, insurance companies, and suppliers are all maxed out building cars. It’s fine for consumers, who can regularly get brand new cars for less than a quarter of the original price, but it’s not sustainable.

As a shrewd investor, Buffett seems to have started divesting right before the price war and overcapacity problems started really hitting the market.

VW Takes $6 Billion Hit On Porsche EV Transition

I have seen a few electric Porsche Macans on the road, and I think they look nice. The Taycan, though range-limited, is incredible to drive and absolutely one of my favorite electric cars. Are electric Porsches the future? Probably. That future, however, is way way further away than anyone at Porsche predicted, so the company’s rapid shift towards electrification now looks like an overreach.

The great news this weekend is that we’re getting a gas-powered Porsche 718 Boxster/Cayman to go along with the new EV version. There will also be a few other plug-in hybrids and ICE models joining the team.

According to Volkswagen, via Reuters, that un-transition will cost the company something like $6 billion:

The move comes after Porsche, which is 75.4 percent-owned by VW Group, said it would change its product strategy to reflect a slower-than-expected electric vehicle market.

“We are seeing massive changes within the automotive environment,” Oliver Blume, CEO of both Porsche and VW Group, told analysts and journalists on Sept. 19, citing a clear drop in demand for exclusive EVs.

“We have made key strategic decisions,” he said. “Now it’s time to put them into action. It’s going to be a tough and long road, and it will demand our full focus and strong effort.”

That, plus tariffs, is keeping profit forecasts for the company severely diminished.

Oh, Look, Another Hydrogen BMW

Technically, I guess this is the first look at the new BMW X5, which will have a bunch of powertrains, including battery electric, plug-in hybrid, regular ICE, diesel, and a hydrogen fuel cell. This is the iX5 Hydrogen, which, as the name suggests, is a fuel cell vehicle.

It looks good, I guess. Here’s what the company says about it:

“By launching the new BMW X5 with a choice of five drive system variants, we are once again demonstrating our leading position as a technology pioneer,” says Joachim Post, Member of the Board of Management of BMW AG, Development at an BMW event in New York. “Hydrogen has an essential part to play in global decarbonisation, which is why we are committed to driving the technology forward.”

I don’t get it, to be honest. Scaling hydrogen for consumers hasn’t worked yet, and that’s with Toyota trying very hard.

What I’m Listening To While Writing TMD

My friend Dan has this theory that you can tell if someone is an android if they clap too early in the break in the chorus for “Private Eyes” by Hall & Oates. Try it!

The Big Question

If you had $230 million to spend on automaker stock, what are you buying?

Top photo: DepositPhotos.com

Saab

I’ll add my $230M to that pot.

So will I.

Awesome 710,000,000 should be enough seed capital.

me too!

I work with some Swedes that are still mad at Americans about Saab hah

I guess getting in at the ground floor for best chance of returns would mean either Slate or Scout (in the US at least).

Pretty risky though.

Wouldn’t those investments just be investing into Amazon or VW? 230 mil into Amazon sounds like a safe bet. VW has just been downhill for a little while now.

I don’t think Amazon itself is investing in Slate – sounds like it’s just something Jeff Bezos thew money at. And I personally think Slate is DoA. Too little for too much.

Ah okay yeah if it isn’t an Amazon owned company I think it will be tough for them to stick around especially with no tax credit around anymore. I want them to succeed they look like cool trucks but if they start at 27k with next to nothing people may say they want that but you are paying that for not radio, power windows etc there are now EVs popping up in that range that will have many more options at base spec yeah sure they are not trucks but still.

Depends on the expectation. They will be offering a niche that isn’t well served in the market now. Small, single-cab trucks are a thing that is desired but are not going to sell in any volume that will attract a large/legacy manufacturer but there is money to be made if you are ok with smaller gains and lower volume. If it becomes any sort of success, they can expand to higher volume models later.

I don’t think you’re wrong but there is a way for them to succeed if they manage those expectations.

It’s just such a small niche, though, and if you really need a truck of that relative size for grounds maintenance or whatever, kei trucks are readily available and much more usable.

I see a lot of comments disparaging the regular-cab trucks as not useful enough or comments that no one wants them because they can’t load the family in them. And those are certainly valid arguments.

But I do think there is a market for a cheap(er) vehicle that is used for weekend trips to Home Depot that don’t need to load a full crew or family. And there are many more couples choosing to not have kids (of which I am one so that could cloud my judgement here). Also, single/regular cab trucks just look better, proportionally speaking.

The fact that it is electric with limited range also serves this use case but that could also support your argument against it too.

Kei trucks could serve this but who knows if you’ll be able to register it.

I honestly don’t know if it will work but I definitely see a use for a truck like these.

It’s a fleet vehicle for Amazon deliveries. No more, no less.

The market for selling *new* regular cab-trucks to private citizens is a minuscule niche within a niche, and there is no way Slate didn’t spend the 5 minutes of market research required to figure that out.

A private citizen has to be quite privileged to spend new car money on an entire vehicle just for Home Depot runs. I can understand owning an old truck for that sort of thing, but thats more of a $3000 purchase, not the sort of thing anyone spends $30,000 on. No new vehicle will ever compete for that market.

but subject to being made illegal / unregisterable at the whim of a politician looking to ‘make roads safe again!’ or some such crap.

(otherwise I would have replaced my truck with one by now, they do exactly what I need a truck to do)

Mattress Motors seems like a pretty safe bet these days.

I would invest that money in my brand new start-up company Birdman’s totally real motors and not laundering money to make me set for life LLC. You ask what kind of car are we building? Ummmmm a mini nuclear reactor powered brown stick shift boxy wagon.

So, the Faraday Firebirdman? Sounds awesome!

Not androids. Middle aged white men.

I feel seen.

Perhaps I’m just a cranky bastard today, but investing money in almost all car companies right now – especially BEV-only firms – is akin to lighting it on fire.

I’m not the captain, and I’m not going down with the ship.

$230million…

Hmm. I’m one of those crazy idiots that only cares about money enough to feed myself and my family and keep myself and my family warm and dry.

So, if I magically had that much to spend, I would do it in a way that made me the most happy, as are most of my choices in life. What would make me the most happy?

Probably an electric karting company, and all the kart tracks around the country, as many as I could with the money available.

I would then actually price it (aka each ride on a kart) such that they made enough money to cover costs, and then a little more to allow moderate growth, whatever that means, but hopefully lower than the ~$20-30 per ride we pay now.

My time would be spent driving around the country to the different tracks, showing off the innovations made by the engineers at karting HQ. I would position myself like an Elon, guiding overall decisions while allowing the engineers to go crazy and do what they want.

To add more detail to my vision, I have had this ongoing concept for kart racing.

I”m skinny, and it’s like a cheat code. My 50-75 heavier friends often can’t keep up. So, my concept is that each kart, before going on track, gets brought up to a nominal weight, for instance… 500lbs (example only).

As the karts enter the track, they go onto a scale setup, and water is filled into a reservoir in each corner, helping get the CG and overall weight to within a few pounds of one another. This, in theory, or my mind, would take the weight and kart out of the equation, and make it more about driver skill.

When you exit the track, the reservoirs are automatically emptied, and the process starts all over again next race.

Ooo – Can I use it to fund a Rebelle Rally team or two. I could hang out with the teams at the pit stops, it looks like so much fun (and challenge for the teams).

Hydrogen? That is just plain nuts. That is a tried and failed solution.

The perfect response, and I 100% agree.

I’m glad someone is trying something. the “all eggs in one basket” solution is what got us where we are now with traditional ICE.

If hydrogen production can be made efficient, it has great potential in “return to base” setups like transit and city-bound commercial/delivery vehicles.

For consumers though, I don’t see a path in the next 15 years.

Yeah. “return-to-base” energy intensive vehicles like planes and ships. That would be the only use case for hydrogen.

Buses and trucks are also energy intensive. Our EV buses are currently averaging ~2.6kWh/km. We’re lucky if they get 300km from a 565kWh pack under ideal scenarios.

That’s city driving, where EVs do best.

The use case for hydrogen is any time you energy storage needs start scaling into the metric tons. Thanks to the square-cube law, the more energy you need to store at any given time, the better hydrogen becomes because liquid hydrogen has just about the highest possible energy density of any currently known fuel. So for large aircraft, commercial freighters, trains, perhaps even semi-trucks, there is a compelling case to be made.

Consumer vehicles? The jury is still out. But probably wise to hedge bets rather than assume one way or another.

https://abc7.com/post/zemu-first-hydrogen-powered-passenger-train-us-now-service-san-bernardino/17815089/

The downside is that you have to go to San Bernardino (I’m sitting in Rialto right now, so I can make that joke).

I lived in San Bernardino for a year and my car got stolen the day I moved in! You can transfer to the Metrolink and take that into LA, or as far as Pomona and then take the subway all the way to Long Beach.

Buffet probably sees exponential growth elsewhere where Hathaway can make more bank thank BYD, now that they’re established. Maybe he’s cashing in on Taco Tuesdays.

I could have sworn that there was some punk/new wave song from the ’80s that actually had the word ‘involution’ in the lyrics, and I was looking forward to sharing it, but I couldn’t find it. That means it doesn’t exist and I’m mis-remembering, or I’m too tired/lazy to search thoroughly. Or both, since two things can often be true at the same time.

Honestly, I don’t know enough about car companies’ financials and next-decade prospects to invest a million confidently, let alone $230 million. Mazda makes great products in almost every niche it inhabits, but I have no idea if investing in them would be safer or riskier than putting money in a much bigger company. So, I guess Toyota? On the theory that they’ll almost certainly still be in business decades into the future?

Speaking of Toyota, I’ve been seeing some videos on Youtube and the non-GR Yaris hatch available in other parts of the world (but not America) seems like a really nice small car. It’s a bit spaceshippy looking like the Corolla hatch, but I don’t mind it. Plus, it comes in a lovely medium metallic green color called Forest Green I think that is really, really nice. Also, I think buying a regular Corolla hatch with a manual when the current generation first came out (2020 I think, which is the E210/12th gen I also think) when the cars were in the low $20s would have been the best thing I could’ve possibly done at the time. They even make a proper small wagon of this very competent car for other markets… that’d be my first choice of course in some alternate universe.

But then, I don’t have Warren Buffet’s financial foresight.

So what you’re saying is that the Chinese are not some unstoppable force that has somehow figured out how to produce cars at prices that far undercut all competition and may in fact actually be an unsustainable house of cards?

I mean, they DID figure it out. But the Tribbles are multiplying and overrunning the ship.

Tribbles can be troubling, creating a tribulation by trial. Say that five times in a row really fast.

They did figure out how to produce cars at prices that far undercut all competition. The competition all went crying to their mommies and now their mommies all put up trade barriers to block Chinese cars. If it was an open level playing field, it would be a very different headline.

Well to that point, if had been a open and level playing field, then China probably would not have so massively able to steal tech to the level they did to catch up this fast (by forcing Joint ventures, essentially trade walls), which would have had the traditional OEMs doing what they do best and crushing the majority of newcomers. The Chinese car market would still have been built up, but it would have taken many more years from where it is now, and probably would have scaled a little slower and less likely to be so self destructive. But yes, if you look at right now and had all the other countries drop all Chinese car protections then they would be taking over. They still probably will, albeit slightly slower.

It’s almost like they used capitalism to defeat capitalism

Lol, nope. China is not magic, they are still subject to the same laws of physics as everyone else.

In an open and level playing field, China would have to follow the same laws and treaties regarding environmental regulations, labor laws, and state subsidies- and shockingly the cost advantage would disappear.

You can even see this in Chinese vehicles sold in Europe. Yes, some of the high end BYDs for example are competitive with Mercedes and Audi in terms of quality and features…. and price tag.

You understand there is a 30% tariff on Chinese EVs in Europe, right? It’s far from a level playing field.

You understand there is a massive state subsidy on Chinese EVs sold… everywhere, right? Its far from a level playing field.

That’s standard Chinese business SOP – seriously undercut your rivals (domestic and international), in order to build market share and maintain cashflow, even if you are selling at a loss.

In the case of Chinese auto-manufacturing, generous state subsidies based on “vehicle sales” keep the lights on.

It has been the standard SOP here in the US for the last 20 years. Tesla lost money for the first ~10 years. And they only started making money after that from the government mandated emissions credits. Rivian and Lucid continues to lose money on every EV their build. Ford too. GM only started making money on their EVs last year. Amazon lost money for the first dozen years of its existence, while it was decimating mom-and-pop brick-and-mortar stores all over the US. Even now it’s not clear that their retail operation is profitable. Their big money maker is the cloud service. Uber- have they ever turned a profit? They’ve totally wrecked the traditional cab industry in the mean time. Netflix only stating turning a profit on their streaming platform in 2023 (I could almost swear that their shows and catalog took a nose dive right after). So losing money while ‘disrupting’ the market is totally SOP here in the US.

Oh yeah- the US and EU all have subsidies for EV purchases and all governments have heavily subsidized battery R&D and manufacturing.

i clapped on time. (in time too) –

it’s just one datum, but that theory failed to detect me.

carry on.

You’re walking through the desert and see a turtle on it’s back. What do you do?

Same thing as a tortoise.

Tickle it’s belly shell?

Don’t know of many turtles that live in the desert. Now, if you’re talking tortoises, plenty of species of those in desert regions.

What model replicant are you?

All tortoises are turtles, actually. Tortoises are just a specific subset of turtles.

that’s some heavy shit, Holden.

“Buffett Shifts Money To Investments That ‘I’ll Feel Better About’”

And I believe the reason he’s not feeling good about the Chinese BEV makers anymore is because competition has greatly intensified and because of that, it’s become far less profitable. And the market is at a point now where there will be a big shakeout where some makers will go under

“If you had $230 million to spend on automaker stock, what are you buying?”

Right now? Rivian.

And what makes you think Rivian would turn a profit any time soon?

Investments from Amazon and VW do make them interesting at least.

I agree it has found some saviors for now. But in terms of technology, I am not seeing anything indispensible from Rivian. Lucid is a clear leader in terms of efficiency. So Lucid’s got something. Too bad in terms of finance, Lucid is deeper in the hole.

Rivian makes a really good product, so they’ve got that going for them. Now the trick is scaling. We’ll see how it goes, but I do like the vote of confidence from some other large companies. Not sure I’d put my whole $230 mil in Rivian, but I’d carve off a slice.

With the Saudi wealth fund I’m thinking they have the best long term prospects. But Robin helped out on ‘The Long Way Up’ so they get the money

but Amazon is also starting to buy the GM big electric vans, which may hurt Rivian. And VW also has Scout, which is poised to sell extremely similar electric (and EREV) trucks. If Scout gets off the ground I don’t see why VW would put any more money into Rivian. My guess is Rivian is trying whatever they can with these investments to build the real next gen products at scale before the rug gets pulled out from under them/they are consumed by another OEM (like VW).

I believe the Rivian/VW tie up is all about software, so that may well continue when Scout becomes a real thing. Amazon operates at such a scale that they absolutely have to work with multiple suppliers for their vehicles. I’m not arguing that Rivian is a homerun, but I do think they are interesting and have a real shot if they can stick around long enough.

I hope they do too! It took me a long time to get comfortable with the R1’s front styling, but I like it now and the other tech bits are very cool. That R3 is something I am waiting for personally. And yes you are right, VW is working mostly with SW, maybe the Scout overlap is not a big issue.

Once the R2 Rivians go on sale, I believe they’ll have enough scale/revenue to be able to have a bottom line profit. There is also the possibility of VAG eventually buying them just for their software alone.

As for VW’s Scout brand… At the moment the upcoming Scout brand is only supposed to use Rivian’s software architecture. But given how Scout vehicles is still nowhere near production, I wouldn’t be surprised if VAG taps Rivian for other stuff.

Plus their vans, as of earlier this year, can now be sold to anyone.

Gimme the chaebol, perhaps with some in Toyota to be safe. Hyundai/Kia are well positioned no matter where the industry goes. They have competitive EVs, a slew of hybrids, and upcoming EREVs to go along with a nice selection of ICE vehicles.

They also have a strong USA manufacturing presence which will be critical.

If you had $230 million to spend on automaker stock, what are you buying?

Elio. They’re gonna make it. I just know it. They’ve got to, Paul was so sincere when he told me they were the future.

I don’t see how a car company can be more sincere than this one. You can look around and there’s not a sign of hypocrisy. Nothing but sincerity as far as the eye can see.

Did you like the Segway too?

Matt, um, your friend Dan…does he meet a lot of androids?

He’s just wondering if “friends” are electric.

Toyota. Always Toyota.

I’ve had enough Hall & Oates for a lifetime.

Luckily, I have the capacity for several lifetimes’ worth.

H&O is still one of the best live shows I have ever seen, and I’ve seen my share.

In maybe 2019 I had an opportunity to go to one of their concerts, but the footage of their recent concerts sounded like the songs were being played at half speed. Which, good on them for continuing, but I wasn’t as interested.

The best live show I’ve seen was Rammstein, but that’s a slightly different genre and vibe.

Just a history reminder. How many car companies were there in the US, beginning in the early part of the 20th century? A few thousand. BYD might be just part of the Chinese automotive shake up that’s coming. This is why Warren Buffett got out at this point.

There you go. All those car companies, and we’re basically down to handful a 100 years later. The Chinese auto industry is going through the same shake-out. Way too many companies, too much production. Some will go extinct, and others will survive. Buffett knows this. He won’t re-invest until the survivors float to the top.

BYD once promised to launch a network of service centres across France and other EU countries.

Still waiting, while passing a Citroën garage, a Peugeot garage, a VW garage, a Renault garage and the independent garage where mechanics do not have to wear uniforms…

And somehow I do not think it is because BYD cars never go wrong. They have to pass the roadworthy test after 4 years from new just like everyone else.

Seems they rather spend millions on silly TV advertising than actual garages you can go to to get the car fixed.

Great Zot! I’m surrounded by androids!

Who’s Zot?

Didn’t think anyone would ask – extremely obscure Apple II software reference. Wizard’s Castle.

Hyundai’s P/E is below 5, their lineup appears relatively diverse and future-proof, they pay a dividend, and their stock has mostly been stuck since about 2011.

You could do worse I think.

I’d spend it on the IPO of DrunkenWrenchMotors. Then do a rug pull and disappear someplace tropical.

These right here is the American dream

I’m just a Canadian living the American dream.

the “North American Dream”?

Nah, these days especially I like to keep the distinction between countries.

I don’t blame you. Unrelated, do you know the process to get Canadian Citizenship?

Git gud.

Check out the “Canada Resists” substack – lots of options

Ooo will you be offering some sort of crypto that others could buy as well?

I’m not Presidential enough for that racket.

Heck, just skip the whole IPO part and proceed immediately to tropical locale.

Rules said I needed to buy stock in a company. I’m assuming we’re being given an NYSE gift card.

Rules? When you have that kinda dough, there are no rules! 🙂

And your business plan should involve reviving the Bricklin.

I’m going to spin this a bit, from “what would I do to make the most profit” to “What company could 230M get me enough influence in to develop what I want?” My initial thought was “hey maybe that would be enough to convince Mazda to finally build the RX-Vision” but at about 5% of Mazda’s market cap, I don’t think 230 Million would do it.

What 230M would do however, is buy Caterham in it’s entirety, several times over, which I would use to boost the business and attempt to scale distribution and options in the US, even with the possibility of US based manufacturing as a way to drive down cost. The philosophy of Caterham seems to be one that enthusiasts are craving, but the cost of a Super 7 in the US is astronomical for what you get, but making the kits much more available at a price comparable to base Miata’s, instead of base Caymans, would move a lot more units.

Similar thought here.

Though I’d have picked Honda, and convinced them to build a modern versions of the RC51, and NT650/RC31.

And then offer a touring package for the RC51 with matching hard bags that can fit a laptop, and helmet for commuting daily.

Those who learn nothing from history are doomed to repeat it.

Yugoslavian, “reliable“?