Mark Twain once said that a lie can travel halfway around the world while the truth is still pulling on its boots. That was back when social media was what you heard in a tavern. It’s only gotten worse since, and recently, there’s been a freakout over the 15-year car loan. This doesn’t seem to be real, but it’s also not far from reality, which makes the response interesting.

The Morning Dump is wading into affordability, because that seems to be the most pressing issue for the automotive industry. This, and the potential for a 50-year home loan, has created the rumor of a car loan that could stretch to 180 months.

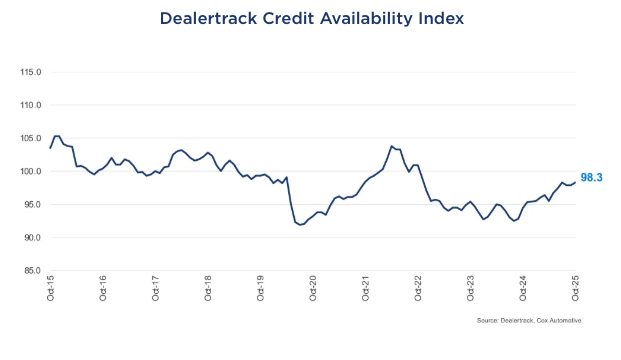

Taking a look at the overall credit market for cars, things are loosening up a little, and car loans themselves are already getting much longer. This isn’t to say all is well in the world of auto financing, as a deep dive into the failure of Tricolor shows how much fraud there potentially is in the system.

As the First Brands (they make all sorts of car parts) bankruptcy demonstrates, getting $10,000 for a car loan might be hard, but getting $100,000,000 for your company on the back of allegedly double-counted invoices is easier than you might guess.

The 15-Year Car Loan Isn’t Real

I woke up this morning and saw that the Autopian Discord (open to everyone) was excited about something. That something had been deleted, but I was able to infer and confirm that it was a rumor about the White House proposing a 15-year car loan. Specifically, there was an image going around in the White House Comms-style saying one was coming, and that Secretaries Lutnick and Duffy were working on it.

This sounded wrong for many reasons, and the post was deleted from Discord after everyone realized it was probably just some social media nonsense. I won’t link to the original because that merely reinforces the problem, but it went viral on both X and BlueSky. There’s a good fact check over on Yahoo! News, and it points out that there’s no version of the fake release on any White House-related accounts.

What tipped me off that it was probably fake was the mention of Secretary of Transportation Sean Duffy. As the old saying goes, the most dangerous place in the world is between Secretary Duffy and a camera, and he hasn’t been out there promoting this.

I think what really made this believable was that President Trump is attempting to address the housing crisis by promoting the 50-year mortgage. The idea there is to potentially lower monthly payments by stretching out the loans. Realtor.com points out one of the reasons why this might not be ideal for homebuyers, and the logic is similar to why it’s not great for people trying to finance a car:

Assuming for the sake of argument that mortgage rates were equal across both products, a 50-year mortgage would lower mortgage payments by about $250 per month on a $400,000 home, assuming 10% down and a 6.25% mortgage rate.

Total interest payments over the life of the 50-year loan would amount to $816,396, compared to $438,156 on the 30-year loan, a difference of $378,240. That amounts to 86% more interest over the life of the loan.

“Buyers do benefit from spreading out the high cost of a home purchase over a longer period, but lenders certainly benefit, too, by having a longer period to charge higher interest rates,” says Berner.

A key difference here is that the main cause of housing costs is a shortage of supply, which this doesn’t address. There’s a way to look at it where the most obvious outcome is that the addition of more buyers without more supply means higher prices. Cars don’t quite have this issue. While there’s some shortage of affordable models, carmakers can more easily turn up production of cars than homebuilders can turn up the supply of affordable housing.

However, homes tend to appreciate in value, whereas cars do exactly the opposite. The bit about interest rates is essentially the same as homes, and that’s worse because cars depreciate so quickly. Doing the math: if someone bought the average car (about $50,000) with the average down payment (about $7,500) at a better-than-average interest rate (7.00%), that person would only have a monthly payment of $382. However, that person would pay $26,261 in interest, making the total payment for the car $76,261 over 15 years. Additionally, the buyer would likely be underwater on the loan for a long period of time.

For all these reasons, a 15-year car loan probably isn’t going to be a White House priority, although there are times when it seems impossible to know these days.

The 15-Year Car Loan Isn’t As Crazy As It Sounds

Car loans are getting longer, with or without White House intervention, and buyers are increasingly underwater. The 84-month loan isn’t that unusual, and, with a slowdown in car buying, lenders are doing more to give access to buyers with lower credit scores.

According to Cox Automotive, the approval rate for auto loans in October hit 72.6%, which is down from September but up from last October. The one area of the market that expanded was subprime lending, with way longer terms being offered to buyers. The latest analysis shows that the share of loans over 72 months is 27.5%, up 300 basis points from last October.

Buyers tend to think in terms of car payments and not the overall market picture, but with rates dropping, these borrowers are not getting the best deal, as Cox points out:

The improvement was driven primarily by lenders’ increased willingness to extend credit to subprime borrowers through longer terms and lower down payments, even as overall approval rates declined. However, this expanded access came with higher yield spreads, meaning consumers paid more for financing compared to prevailing market rates.

Once again, money isn’t everything, but not having it is, especially for subprime borrowers. The longer the loan term, the higher the interest that a lender is going to provide, meaning that as rates go down, borrowers are paying even more for their money.

Tricolor Disaster Shows The Difficulties Facing Subprime Borrowers

The saga of subprime used car retailer Tricolor has revealed a lot about the underwriting practices of large institutional lenders like JPMorgan Chase, but it’s also shown how hard it is to be a subprime borrower.

There’s a great piece from Bloomberg that gets into the chain of events that led to the collapse of Tricolor, which allegedly borrowed money by using the same loans as collateral with multiple lenders. The company’s history is interesting to say the least, but what really got me is how much harder the company was on its borrowers than its lenders seem to have been on Tricolor:

Customers described aggressive sales tactics, confusion over loan documents and long delays in receiving car titles. Some said Tricolor called repeatedly when payments were late, often numerous times a day and deep into the night. Many vehicles were worn out, poorly maintained and had high mileage, according to car buyers and former employees.

Raquel Ramirez says her used GMC Yukon SUV has done nothing but give her trouble since she bought it in 2023 — it constantly jerks when she drives even after repeated repairs — and yet Tricolor staff would hound her when she fell behind on the $35,000 loan she took out. “If I missed a day of a payment, they would call until 10 at night asking for the payment,” Ramirez says.

The lack of scrutiny for massive companies isn’t just an issue with Tricolor. It’s also a key issue in the failure of First Brands.

First Brands Group’s New CEO Admits Company Faked Invoices To Get Loans

First Brands Group, the parent company of brands like Fram and Trico, declared bankruptcy in September after it was discovered that the company had massive debts it wasn’t likely to be able to pay. It was later revealed that the company’s founder, Patrick James, allegedly funneled hundreds of millions of dollars to his own personal accounts.

The company’s new interim CEO, Charles Moore, told the judge handling the bankruptcy that he discovered massive fraud at the company as soon as he arrived.

First Brands lawyers showed a 2022 message from one member of the company’s finance department to another, in which an employee suggests they may have to make “dummy invoices” to secure additional financing. In a subsequent message, a top member of the finance department doesn’t express any concerns about falsifying invoices, Moore testified. That surprised Moore, he said.

“I would think that if the notion of creating a dummy invoice was new or not happening, there would be some reaction to that,” Moore said on the witness stand.

Did you catch that? The new CEO was surprised to find out that the company’s finance department was not surprised to be asked to allegedly commit fraud in order to borrow money.

What I’m Listening To While Writing TMD

Brian kindly took over TMD yesterday, meaning that I missed the opportunity to mark the 50th anniversary of the wreck of the SS Edmund Fitzgerald by playing the eponymous song from Gordon Lightfoot. Today, I fix that.

The Big Question

What car would you take a 180-month loan to buy?

Top photo: Stellantis

not many vehicles are worth much of anything in 15 years. you will start the loan upside down maybe get close to catch up in equity at the 6 year mark … and then slowly be more and more upside down again. we don’t need longer loans we need more “reasonable” automobiles. Every car is a ‘luxury’ vehicle now. we need more commodity type cars.

None, save 500 a month and accrue interest then after 5 years buy a car in cash, make the banks pay you money, not the other way around

And how are you getting around for those 5 years?

With the car most car buyers already have.

Keep your existing car an extra 5 years after you pay it off

Toyota Hilux.

Is this still so true though? Last time I looked there were far more sellers than buyers of homes now. My neighborhood is littered with homes for sale, and my previous hood, which had 1 house for sale 2 years ago now has dozens. Granted it will vary across the country but overall there is a glut of homes for sale and not nearly as many buyers.

There’s plenty of supply when buyers are offering 10 million dollars for an outhouse. The supply gap referenced here is affordable supply. It takes time for the market to cool prices since houses are appraised based on recent comparable sales. Once they sit on the market for a couple months the discounting begins and comps readjust valuation once sales volume picks back up.

How much is a pound of gold worth, assuming you have no way to look up market rate?

To piggy back off of this; the rental vacancy rate in my area continues to go up, but rent isn’t coming down.

And the change in interest rates from historical lows means many people aren’t moving out and thus providing more supply because even a lateral move in housing will dramatically increase their payment.

Color me floored when I looked up KBB for my 2020 van. It’s valued at the same price that I bought it brand-new in 2021, right before the market really started going nuts. That’s all to say that I took a 6-year loan because they offered the same rate as a 5-year. Even though I’m due to pay it off early, I can’t imagine stretching out payments for three times as long.

Air. Cooled. Nine. Eleven.

Plenty of excellent cars available for a lot less than the oft quoted “average” (a worthless metric) of $50,000.

Everyone should pay cash for a car. Can’t afford to pay cash for a new car? Perfect: buy a used car for cash. Take care of it, maintain it and stop acting like you somehow deserve a brand new pickup truck.

This might be a US vs UK thing, or perhaps it’s just who I know, but I only know a few people who’ve bought a brand new car on finance, and all of them are people who make terrible financial decisions.

(Except for one person who’s rich and can afford it).

Literally everyone else I know just buys second-hand cars. No loans.

Another totally moronic comment here.

Get back in your basement before I call your mother.

Easier credit makes the underlying good more expensive, not less. A 50 year mortgage will screw new buyers, leaving payments the same (but now 20 years longer), and increase the value of my investment properties. Which is the point of it.

Nailed it.

See college tuition over the past 30+ years as a concrete example of this phenomenon.

Bingo. It’s a bandaid for a bullet wound. In short order prices will readjust to vacuum up the additional cash available, because buyers are stuck in a monthly payment mindset when it comes to borrowing.

Can we also deport racist and uninformed folks?

Cause we find them to be turd like?

Sure we allowed self deportation but I thought you were legal.

180 month loan? Maybe a motorhome if I have a plot of land to park it on and rent it out as a dwelling.

Otherwise, I actually could see doing that if I got the wild hair to purchase a high condition #2 near-concours car. Something along the lines of a mid ’50’s to late ’60’s Cadillac in at that condition is a car I’d seriously consider on a 180 month loan if I could get the same rate as the current one on my home – 2.5%. If the car appreciates during that time, cool, otherwise it’s not something I’d likely ever get rid of and maybe I could do the wedding-rental thing or something and turn it into a tax-dodge.

And of course, I could always pay it off early.

Who will build the new houses and apartments?

(And pick our fruit and veggies, cut and package our meat, clean our houses and offices, wash our dishes, etc, etc.)

There is already a labor shortage in the USA. My employer has struggled to hire with the only requirements are to show up on time and pass a drug screen (not including pot). That is for decent paying assembly line jobs not paid by the pound picking in the blazing sun.

There absolutely is a labor shortage – at least there was until last year. We had to give up on staffing a second shift because we simply could not get the workers.

US prime age work force participation is at near record levels (83.7% vs an all time record high of 84.6% in 1999)

No, people that are in the US without proper work permits are not criminals – the vast majority are just hard working people looking to make a buck and support their families. The very fact that they risk so much to better themselves makes them desirable additions to our society.

The real solution is to fix our legal immigration system to provide the number of immigrants that we need to fill our job requirements

Being in the country without documentation is a civil offense not a criminal offense. Similar to a traffic ticket.

I work for an automaker. Those jobs were UAW assembly jobs. You now – the guys that just boosted their average hourly pay to $70 an hour. Still couldn’t get people to show up on time long enough to get through the probation period.

Although more than half of that is benefits which is a sore spot for the new guys that don’t care about things like platinum plated healthcare with basically no deductibles or copays. Also every part of the job is seniority based so new guys start on an off shift – and get the hardest job, and the last pick of vacation.

Jesus christ…. you really hit every talking point there didn’t you? You managed to conjure every outdated 1980s trope into one comment. I would have thought it was satire, but it lacked any comedy or self awareness of an old man yelling at the clouds.

He just playing “the asshole card here.”

As usual.

Talking points courtesy of the Trump Whitehouse I see

No that is a liberal trope for promoting slavery like Biden 360,000 children admitted no idea where they went

More uninformed bullshit here, not surprised at all.

This is a bad, stupid, entitled, terrible take.

“No one wants to work” is a huge flashing sign for “we’re too cheap to pay people decent wages because we like having the money more for ourselves.”

I bust my fucking ass as a mechanic 50 hours a week. I put 35″ tires on gigantic stupid wheels on a gigantic stupid truck. I put new shocks, struts, and brakes on it. I did 15 other cars that week – not to the same magnitude, but I did not stop working even to eat. You know my paycheck for that week? For my lazy ass not “wanting to work” and feeling entitled to a 10,000 square foot house (or a 900 sq ft shack that’s falling apart and still I can’t afford, but don’t let that get in the way of your grievance politics)?

$283.49.

Kindly go fuck yourself with this “no one wants to work” bullshit. Come do my job for what is effectively $8.50 an hour. The first time you blow out your back but still have three more wheels to pick up, the first time the cords of a bare tire stab you with 100 pinpricks already bleeding, the first time you do all these things and look at your sub-$300 paycheck at the end of that week and go home to your small, rotten house that the bank is trying to take back from you because that paycheck doesn’t even cover your meager mortgage, you can talk to me about who’s not willing to work an honest day’s work for an honest day’s pay.

You’re an ouroborous of shat out, made up misinformation.

America is far too greedy for a 50 year home loan to actually work. If can be done – Sweden does 60 year loans and apparently it’s common for the bank to just forgive the rest of your loan if you lived there for several decades and made on time payments.

This has no chance of working when our politicians are easily purchased and their primary focus is keeping corporations and billionaires happy.

There’s a chance of seriously screwing with the long run economy as well, since such a large amount of wealth would be tied up in extremely long term loans. They would have to be adjustable rate as well, or interest rates would have to be fixed so loans maintain a higher rate than the fed.

It was mentioned as being a fixed rate loan.

There has never been a car made that I would take out a 15yr loan on, there’s a profound difference between being able to pay for something and being able to afford it.

What car would you take a 180-month loan to buy?

Gotta be something fairly reliable, that is already near the bottom of its depreciation curve where miles wont wreck the value, but also trying to stay under or near my current payments would be around a $75k loan.

Looks like I’m getting the nicest J200 Toyota Land Cruiser Heritage Edition I can find in budget. It will lose some value, but after I add another 150k miles to it, in 15 years it will still have a decent bit value left

If you have something for 15 years, why does it need to have value left? I have had my truck for 15 years, and its value is that it is my truck. I think people get so caught up in looking at things as investments and containing $X value that they don’t just have the things the like.

If you wanted a Landcruiser so much that you would pay for it for 15 years, why would you want to sell it then? And if you don’t want to sell it, does it really have any value in the market?

Knowing my car history, I’m not keeping it longer than a few years anyway. I don’t buy cars to keep forever, I buy cars I like in that moment, then move on when I feel it is the time. So far, the longest I have owned a daily driver was 4 years and it was my wife’s CX9. When I thought about the value, I just would not want to be under water in a couple of years. This is all hypothetical regardless, I wouldn’t go longer than 72 months on a loan, and even then, I don’t like that length.

Yeah, I’m the opposite. I keep every car until its scrap. I have ever only sold one car still complete and running, and 18 years later I will still tell my wife I wish I hadn’t.

Fairly reliable? I want a 15 year warranty if I have a 15 year loan.

So you might be able to buy one house, and then you’ll be stuck there for the rest of your life because you’ll never build any equity. Even a lateral move in terms of price costs you a fortune in closing costs and moving expenses, and if you have no equity it would be financially ruinous to move.

Of course, we can always play the 2007 game of “housing line always go up”, but we know how that ends.

3%. It’s 3%. Quoting percentages in basis points is the stupidest thing the financial industry ever did. And that’s saying something.

One basis point is equal to 1/100th of 1%, or 0.01%. In decimal form, one basis point appears as 0.0001 (0.01/100).

The finance industry quotes in basis points because each once represents hundreds of millions or billions of dollars, and it’s very useful to have a shorthand to discuss the fine-scale movements that affect their day to day work. Whole percentage point movements are reserved for long timescales or serious shit.

Actually on a 30 year home loan you pay more for interest than the home.

I mean before any 15 year loans are actually issued, interest rates are going to fall below the rate of inflation because of monopolization of the fed. Now that interest paid on new car loans is tax deductible it would be interesting to see the math between an 8 year and 15 year if the interest rates were lower and closer together. Still a terrible financial decision unless you can invest the money at a higher rate of return.

I would guess the people who take out a 15 year loan to lower the payments are not also going to be investing equal money in the market to offset the interest on the loan.

Yuck, Cox Automotive. Makers of the absolute shit show that is Dealertrack.

Always screwing up, always taking a century to fix problems. Don’t know if I’d trust what they say, definitely can’t trust their programs.

They own Manheim, Clutch Technologies, Dealer-Auction Ltd, AutoTrader, Kelley Blue Book, vAuto, Dealer.com, Dealertrack, NextGear Capital, Xtime, Vinsolutions, Dickinson Fleet Services, FleetNet America. Cox Media is a massive conglomerate. It’s hard to avoid them in the automotive industry unfortunately. I too am burdened with Dealertrack DMS and Xtime at work.

Sidenote: autotrader.ca is not owned by Cox… it’s owned by Trader Corporation

https://en.wikipedia.org/wiki/Trader_Corporation

I don’t really have a strong opinion on a 15 year car loan, its a bad financial move but won’t completely ruin you if you take one out.

But a 50 year home mortgage? That’s longer than most people’s working adult life. People who take these out probably expect to die before that and then it becomes someone else’s problem.

I can imagine a bunch of people getting a 50 year loan. Isn’t the average house only owned for like 7 years? They would just cause massive inflation with people buying a big house on a 50 year loan and NEEDING it to increase over the 5-7 years they live there enough to cover the rest of the mortgage when they sell. So It would incentivize people to drive up the cost of housing all round. But of course, it would make the banks profits soar in the short term. That what we get for policy fixes in the US, always the short term fit to get to the next quarter or next election, or next news cycle.

Yes they can sell in 7 years when they move, people might even make a profit. But its the same old problem where if housing appreciates, their next house is that much more expensive. Making it easier to afford this type of mortgage just means that more people get trap in this cycle. 7 years in their example of 6.25% interest means paying less than 3% of the loan off. People need to build equity in their homes, not keep moving and chase bigger houses.

Lots of people take out 30 year mortgages and many sell before 10 years – and you don’t build much equity there, either.

The 15 year loan is just a HELOC. I have seen this in the boating industry where dealers talk about 15 year loans. The truth is that the buyer is taking a HELOC to buy it.

Not only is the 50-year mortgage horrifying for a homebuyer, I’m pretty sure there are lots of people that think it’s a perfectly acceptable solution to a housing crisis. And nearly all of those people will never have such a mortgage in their life, if they have a mortgage at all.

Will people remember this when they vote? Probably not. They’ll likely remember that their payment went down though.

Other note: I will never do a 15 year loan in a car. I had one 84 month loan, but that was because the interest rate was significantly lower than the 60 month rate. I paid the car off in 48, mostly by pretending that I had the 60 month payment each month.

15 year loan on a vehicle? Probably one of those gonzo overlanding trucks. A range extended EV. With enough solar and battery it’ll be perfect for extended trips. And it will likely last through the loan period.