Every year, analysts from Bank of America put together the “Car Wars” report that looks at where the market is expected to go over the next few years. It’s a big deal and uses the idea of how often carmakers are updating or launching models to determine who the winners and losers are likely to be. This year, it looks like almost everyone is a loser. “We have never seen this kind of change before,” said BofA’s chief analyst John Murphy on a call with reporters yesterday.

Why? The combination of tariffs and what he calls the “EV head-fake” has basically tossed all product plans into a state of profound confusion. I’m going to start today’s Morning Dump by summarizing the findings of the report, and then I’ll apply them to the news of the day. I’ll start in Germany, with mega-supplier ZF. The company makes some of the world’s best transmissions. It’s also on the verge of collapse. How did that happen?

For all of the hype around Chinese EVs, the market there is a mess. How could that affect our market? I’ll get into that, too. I’ll also follow up on the Rare Earth conversation from yesterday, as China’s export limits are already hitting a car, and not one you’d expect.

‘This Is A Really, Really, Really Big Deal’

Between 2006 and 2025, the industry launched approximately 41 new vehicles a year (including new models and new generations of existing products). Recently, that number has gone up, with approximately 44 new cars being launched every year between 2022 and 2025. This number is connected to the “replacement rate” of models in a carmaker’s lineup, which looks at what percentage of an OEM’s sales volume is replaced with a new model/generation.

The BofA “Car Wars” report is focused on these stats for a pretty straightforward reason:

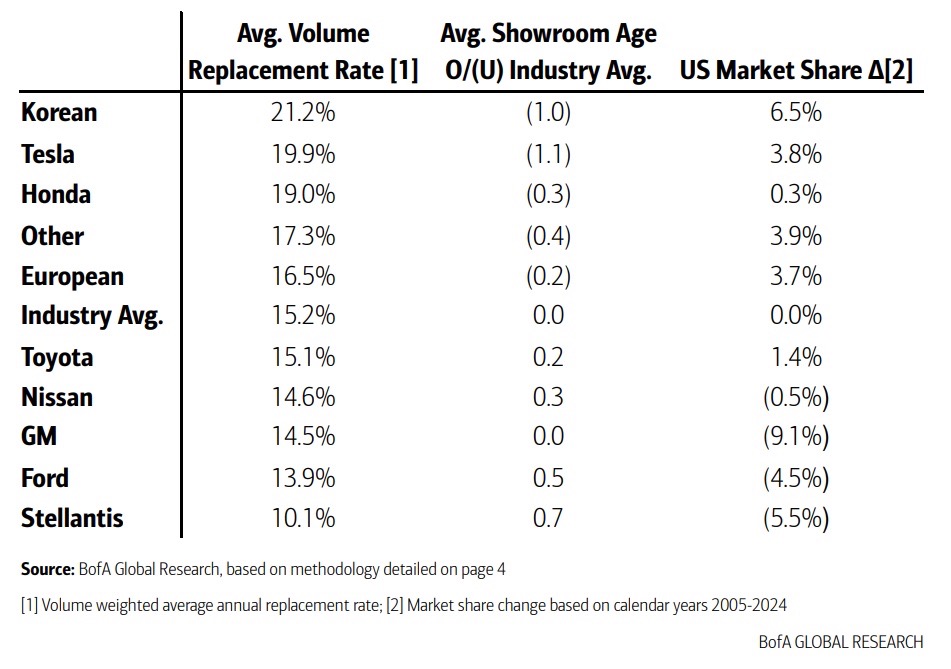

“We believe replacement rate drives showroom age, which drives market share, which in turn drives profits, and ultimately stock prices,” the bank’s analysts wrote in their report, which I have a copy of but cannot fully share. I’ll grab the parts I think are key, starting with this chart:

There seems to be a connection between the average volume replacement rate, the age of the cars in the showroom, and the change in market share. GM is a little bit of an outlier here, but this number is likely skewed by the big increase in overlapping electric model launches over the last two years, which hasn’t yielded a huge sales increase.

As a regular reader of TMD, you’re probably aware that the hype around electrification and the rising costs associated with environmental regulations created a strong push from automakers to build electric cars. That didn’t quite work out for automakers, as expensive EV crossovers haven’t exactly found as many customers as necessary to justify all the investments.

With the election of President Trump, things have gotten even harder to predict:

The unprecedented EV head-fake has wreaked havoc on product plans. This has been driven by consumer disinterest and regulation/ incentive changes. In addition, the recent tariff war is also complicating the equation. This has driven a pothole in product launches in Model Years 2026 & 2027, with only a slight recovery in Model Years 2028 & 2029. The next four+ years will be the most uncertain and volatile time in product strategy ever. Therefore, we think that automakers must lean heavily into their core ICE product portfolios to generate the capital to fund the uncertain future.

The immediate future doesn’t look great. With plans being tossed asunder, the number of launches estimated in 2026 drops to just 29:

“We have never seen this kind of change before,” said BofA analyst Murphy on the call. Next year’s predicted drop in new product launches is the result of cancellations and the “lowest we’ve had in decades.” That should eventually turn around in 2028 and 2029 as automakers implement adjusted plans, but that’s assuming tariffs don’t screw with too many plans.

“This is a really, really, really big deal,” he said to underline the point.

How does this impact car buyers?

People like new models and more choices, and that extreme competition usually offers a chance for lower-priced cars. OEMs have had more price discipline since the pandemic (see Trimflation), and that’s maybe going to continue into the future, which could mean less choice and worse deals:

Although industry-wide pricing has historically been challenged, an unprecedented period of pricing power manifested for the automotive value chain from 2020+, driven by a significant imbalance of strong demand versus tight supply as well as relative discipline through the industry. This was evidenced by average transaction prices climbing to historic highs, and average incentives dropping to historic lows. This was the key reason for robust financial results among automakers and dealers. So far pricing has remained remarkably resilient, but it remains to be seen whether this discipline can hold over the long run as volumes return. We remain hopeful, but somewhat skeptical.

If the dam breaks on pricing, it would be better for consumers, but worse for car companies. There’s more in here, specifically the likelihood that the CUV market has become overstuffed and we’re likely to see fewer CUV launches and, maybe, more affordable small cars. That would be nice. Hybrids, too, are on the rise.

What Is Happening At ZF?

Whenever I’m in a super high-powered car with an automatic transmission, like the BMW M5 Touring Comp above, I look to check and see what the transmission is. If it’s excellent at handling the torque and shifts predictably, I assume it’s a variant of the ZF 8HP eight-speed transmission. This gearbox has been used in everything from the Aston Martin Rapide to the Hellcat Dodge Durango.

ZF is, in my experience, the builder of the best automatic transmissions in the world. It’s also in trouble. Why? There are many reasons, but a lot of it has to do with the same “EV head fake” that’s disrupting automakers. ZF assumed a huge need for EV components and made that investment. It’s not working, and it has many wondering if the supplier, which makes a bunch of other components, might just get out of the transmission game altogether or spin off the Division E powertrain unit.

The company’s new CEO and current board member, Mathias Miedreich, talked to reporters, including one from Manager Magazin, and basically said anything was possible:

“We’re preparing for all eventualities,” he told manager magazin. “It would be negligent not to do so.”

“A rampdown would be the worst thing that could happen to us, because we would not only destroy value but also lose market share very quickly,” says the board member. “But you never know exactly how the situation will develop and which ripcord you might need to pull if the economic situation demands it.”

His goal, however, is different. “My ideal scenario is that Division E delivers cash and profits for ZF in the long term. And I firmly believe we can achieve this. There are various paths and options to achieve this, with or without partners.”

Good luck with that.

Chinese Automakers Got Called To The Principal’s Office

I mentioned last week that Chinese automakers have been chirping at one another over the ongoing price war and activities like trying to sell new cars as zero-mileage used cars. The logic of selling cars so cheaply and losing money seems a strange one to people raised in a Western-style capitalist system. China has its own form of a capitalist market, but one where profits are not particularly important.

Instead, Chinese companies want market share. They want to own as much of a sector as they possibly can, eventually squeezing out the competition if they can manage it. The photovoltaic/solar cell was invented in the United States, but now the entire world is basically beholden to Chinese companies because they figured out a way to make them much, much cheaper and at a scale no one else can compete with right now.

Chinese automakers are trying to do the same and finding it a lot harder, given how expensive cars are and because Chinese authorities essentially subsidized the creation of too many car companies. All this is finally coming to a head with government officials finally encouraging automakers to self-regulate.

“The meeting was hosted by the Ministry of Industry and Information Technology, the market regulator and the top economic planning agency, said the people, who asked not to be identified discussing private information. The gathering was attended by senior executives from more than a dozen manufacturers that also included Zhejiang Geely Holding Group Co. and Xiaomi Corp., the people said.

Officials told EV makers to “self-regulate,” and that they shouldn’t sell cars below cost or offer unreasonable price cuts. They also addressed issues such as “zero-mileage” cars and mounting bills owed to suppliers that are squeezing cash flow along the supply chain and acting as quasi-debt financing for automakers, the people said.

Almost every company is trying to compete on price, but BYD is clearly the worst of the bunch here. The bit about squeezing suppliers and using them as quasi-debt financing is fascinating. I’ve heard some talk of this before, and it’s basically when companies delay payments to suppliers in order to either avoid a cash crunch while rapidly building plants and expanding. This is essentially a zero-interest loan. You won’t be surprised to hear that BYD, again, is a main culprit here.

An analyst from BofA also noted this is a concern here in the United States, and that Western regulators should keep China’s carmakers far away from here during that country’s price war, and to wait for “rationalization of that market to occur before you open the doors.” That seems sound.

Rare Earth Restrictions Claim Its First Victim, And It’s The Last Car You’d Guess

When I talked about the concern over Chinese restrictions on Rare Earth materials yesterday, I wanted to impress upon everyone that this isn’t just about fancy electric cars. All sorts of vehicles need these parts. Proof of my claims came a lot faster than I expected, as overnight, Japanese automaker Suzuki had to cut production of the extraordinarily not fancy Swift over issues related to Rare Earth exports from China, as Nikkei Asia reports:

Rare-earth metals, crucial for motors in electric and hybrid vehicles, are largely produced in China, which accounts for 70% of global output. In April, the Chinese government imposed export controls on seven types of rare-earth metals in retaliation for U.S. tariffs on Chinese goods.

Suzuki has suspended production of its Swift models, except for the sport model, from May 26 to June 6. The company did not say why. Parts procurement has been delayed because China has been slow to issue export licenses.

Some Swift models have simplified hybrid systems designed to limit fuel consumption. If Suzuki halted production only of models with hybrid systems, that would reduce the efficiency of the production line. The company thus seems to have halted production of other models as well.

Expect more, not less, of this going forward.

What I’m Listening To While Writing TMD

Annie Lennox and Dave Stewart are almost too cool as Eurythmics. I thought of a bunch of different songs from the band for today’s musical choice, but I gotta start with the classic “Sweet Dreams.”

The Big Question

I’ve asked this question in various ways before, but looking at all the above, who do you think is best positioned to win the next three years of Cars Wars?

Top Photo: Game Of Thrones (HBO)/Toyota

“because they figured out a way to make them much, much cheaper and at a scale no one else can compete with right now”

Slave labor and zero environmental regulation or care is a helluva competitive advantage

“With the election of President Trump, things have gotten even harder to predict.”

Understatement of the year. Watching the value of my IRA bounce up and down more than a Duncan Yo-Yo has been trying my patience. But I really sympathize with product planners in the automotive industry. It’s probably been much harder for them.

To me, it seems like China’s near monopoly of rare earth minerals and decent magnets trumps Trump’s tariffs saber-rattling. China can cripple nearly every automotive manufacturer, if they want to.

Tread carefully, Donald. If you’re actually capable of that.

I would love to have a Swift. A Swift and a Jimny is like a dream 2 car garage if you ask me. Add a Miata and it’s perfect. (Or maybe a Cappuccino to keep it all one make, haha, but I’m sure I can’t fit in one!)