The predictions for next year’s car market are starting to come in, and it is looking extremely meh. Car sales are expected to drop, which isn’t a huge surprise. Will cars get less expensive at the same time? Probably not. Will the cost of car ownership drop? Definitely not.

I talk a lot about new car affordability in The Morning Dump, and new data shows that the lack of cheap cars isn’t likely to improve next year. There’s more to it, though, because once the car is purchased, the overall costs of ownership have gone up, which is leading to a rise in delinquency.

Another frequent topic is the delay in tariff-related price increases, as automakers are slow to raise prices directly. Instead, as the head of Nissan’s dealer group points out in an interview, a reduction in incentive spending ends up having basically the same impact.

Do you want a fun prediction for 2026? Let’s end on an up note.

New And Used Car Sales Predicted To Drop In 2026

Cox Automotive puts out one of the best reports on where the car market is going. Last year, the prediction was for a slightly up market if tariffs didn’t spoil the party; this year, pretty much all signs point downwards.

Even the one green arrow going up (Manheim Used Vehicle Value Index) isn’t necessarily in favor of consumers, unless you plan to trade in a new car. Leasing volume is also an interesting and nuanced metric, given that a lot of leasing was driven by electric cars getting the IRA tax credit. Without that credit, leasing is likely to take a hit.

The big one, though, is that new car sales are expected to drop to 15.8 million, which is something like the new normal. What’s going on? Cox points out a lot of the same issues that are frequently mentioned here, including the bifurcated market (or K-shape economy) and various policies. Inflation is also a big open question:

Inflation appears to be peaking, and rate cuts this fall and into 2026 will help affordability. Yet uncertainty looms with Federal Reserve Chair Jerome Powell’s succession and questions about Fed independence. Lower rates will provide some relief, but long-term rates remain sticky, delaying housing recovery and limiting auto sales. Uncertainty has been a key theme lately, and in 2026, our team is expecting more uncertainty when it comes to inflation and Fed’s decision path. As the Fed works to balance its dual mandate, there is no simple way forward.

And then, once you buy the car, it gets worse.

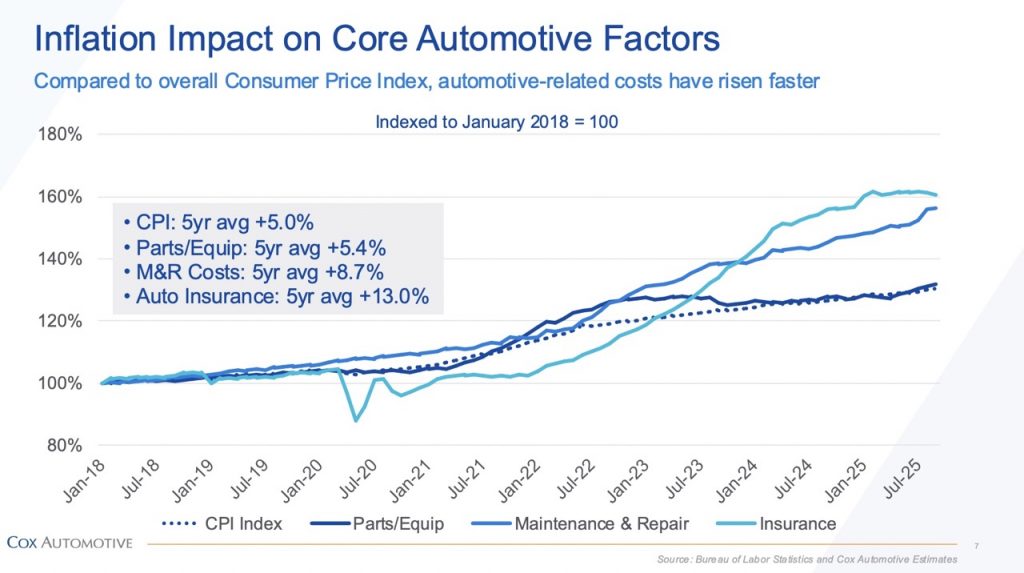

Insurance And Repair Costs Make Car Ownership More Expensive

There’s a graph that’ll make you feel kinda terrible. If you compare the Consumer Price Index (one of the main ways that inflation is measured) to the various car ownership costs, you’ll see how fast car-related costs are outpacing the overall market. It sucks.

Parts and equipment are close to the average, although I suspect tariffs will create an even bigger impact going into next year. Maintenance & Repair? Yikes! The shortage of good labor and the complexity of new cars are playing into this.

The biggest increase has been in insurance, as explained in this NPR story:

Cars are more expensive; parts and repairs are more expensive; medical bills following auto accidents are more expensive. Modern cars are packed with pricey electronics, pushing up the cost of fixing even minor fender benders, while empty streets during the pandemic encouraged speeding and led to more severe (and more expensive) crashes.

All those things cost insurers money.

Men repair the brakes on a truck in the parking lot of an auto parts store in Middletown, Ohio, in 2024. Prices of car parts, car repairs and car insurance are expected to rise if tariffs remain in place.

Patty Kuderer is the insurance commissioner for the state of Washington; when insurance companies want to raise premiums, they need to ask her office for approval. “The claims paid really drive the cost of the premiums,” she says.

It’s possible that insurance costs are finally topping out? Perhaps, but in the meantime, consumers are getting stuck. There’s an interview in the latest episode of the Odd Lots podcast with Rikard Bandebo, the chief economist at VantageScore. He talks about the rise in auto delinquencies, and he says something interesting:

“One of the things that has caught many consumers guard is, okay, they’re in the dealership, they’re being shown some numbers… and they think ‘we can make it work’… what they often forget about is that insurance has gone up substantially, as have just the cost of ownership, repair costs have gone up significantally, and when all those things hit them they realize they just can’t make that work. And that’s not good.”

This is quite bad. If you get behind on your home payments, it takes a long time for you to actually get kicked out of where you live. Auto lenders will come take your car if you fall behind for a long enough period of time, which might stop you from going to work, or at least make going to work harder.

For all the talk of making new cars more affordable, policymakers should probably keep an eye on keeping car ownership affordable.

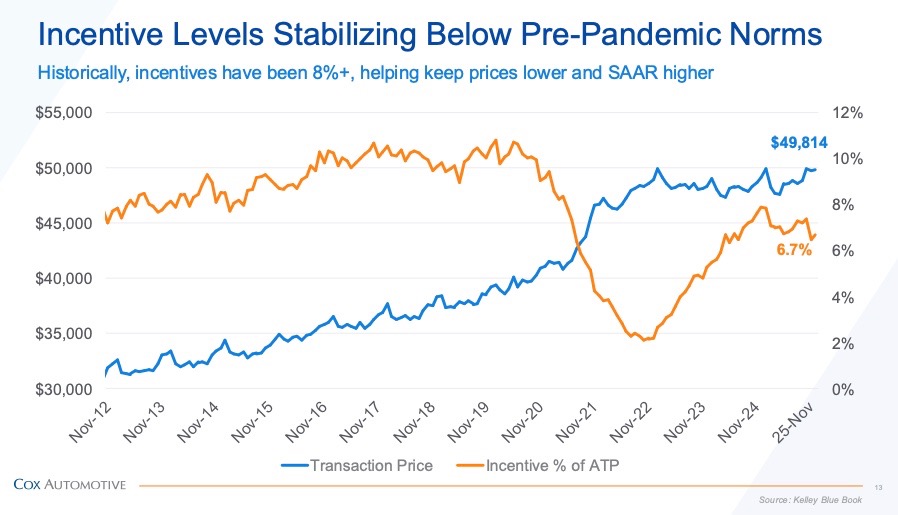

How Tariffs Are Keeping Cars More Expensive

One of the more interesting stories of 2025 is that automakers didn’t immediately pass on the costs of tariffs to consumers in the same way that they seemed to during the pandemic, although there are some similarities. Carmakers cut incentive spending once it became clear there would be fewer cars to sell, and now carmakers are doing the same to offset tariff costs.

There’s an interview in Automotive News with Mike Rezi, chairman of the Nissan National Dealer Advisory Board, and he says a lot of interesting things, but this jumped out at me:

U.S. tariffs damaged profitability on key models such as the Mexico-made Sentra and Kicks. Nissan has not passed the tariff cost to the consumer, but it has reduced incentives and marketing support.

Throughput and profitability remain a key concern going into the new year. High interest rates and inflation hurt customers in their pockets and made them more budget-conscious.

Dealers need to average about 70 units per rooftop per month. We are currently selling about 40 new vehicles a month.

Dealer gross profit per vehicle has eroded. There is barely any profitability on new-car units.

If you can’t make the MSRP of the car higher, you can still make the cost elevated by just lowering incentive spend.

Hey, Look, Caterham

If there’s one automaker that is uniquely suited to do well in this new environment, it might be Caterham. I know that sounds crazy, but hear me out. The automaker builds its cars in the UK, a country that arguably got the best trade deal with the United States so far. A K-Shaped economy? Sevens are definitely 3rd or 4th cars for wealthy people, but there are plenty of wealthy customers. What is the DOT making smaller, lighter, cheaper cars easier to sell going to entail from a regulatory standpoint? Unclear, but there’s a nonzero chance it makes life better for Caterham.

To that end, the company is making a bigger push, announcing a new dealership at a unique location in Miami:

Fuelled by generations of passionate automotive experience and located within the iconic Wynwood Arts District of Miami, Walt Grace Vintage is a unique gallery which showcases and sells the finest investment grade automobiles, watches and guitars.

Marking Caterham’s continued expansion across the United States, the new dealership will offer the range of Caterham’s lightweight sports cars, and customers on the East Coast will be able to configure, purchase and take delivery of Sevens directly through the Miami gallery.

Given that everything is getting heavier and more complicated, there has to be some room for Caterham, right? Also, one of their press people suggested I might be able to borrow one, so the company needs to stick around long enough for that to happen.

What I’m Listening To While Writing TMD

I have not seen Lucinda Williams live, and I must fix this (I was a day away from doing it this week, oh well). Here she is performing “Drunken Angel” at Farm Aid in 2004.

The Big Question

Are you going anywhere for the holidays? How are you getting there? If not, any projects coming up?

Top graphic images: Bureau of Labor Statistics; Cox Automotive Estimates; State Farm; Progressive; Geico

With a totally paid off Honda Accord 71K miles on the clock, I won’t have to deal with vehicle prices for a while. It’s a 2017 and I’m thinking about dropping collision and comprehensive off my insurance. It has depreciated to about $13K and the ~$2,000 I am spending for full coverage doesn’t seem worth it. I really like the car, but I guess I need to look at the breakdown of how much is the liability part of my policy is vs the rest. And maybe start shopping around. I have State Farm for my car, my scooter and my home and umbrella policy.

I’m hanging around Tacoma until Sunday and then heading down to Northern California to help my brother deal with our rapidly declining mom. Probably be down there for weeks. Maybe months.

Not a great, happy way to start 2026, but he’s not capable of taking care of her finances and someone has to, and that’s me.

Paid my GTI off in 2023, and I fully intend to drive it until it disintegrates around me. I dropped comprehensive and collision last year, I can’t take the ridiculous insurance I pay with a clean record.

I almost bought a GTI instead of the Honda, but VWAG so screwed me on my ’01 Jetta TDI, that I just could not. The GTI was a fun car to test drive. And one of my best friends has an Audi S4 that is an absolute riot to drive.

People keep denting/rubbing on my car for some reason, but now that it’s 8 years old, I kinda don’t care. Back in the late 70s, people left notes. I would get an estimate and use the money they sent for beer money. Now, nobody leaves notes and I have plenty of money for beer.

And if you try to use insurance to fix those things, your rates go up in kind. People suck bumping cars and not saying anything, and insurance companies suck too.

All the best to your mom. Hope she rests peacefully while under your and your brother’s care.

Thank you for your kind thoughts.

This nonsense needs to stop being parroted. US retail automotive dealers are still making a cubic shitload of money even when the apparent profit (spread between MSRP and sales price) is small. There are manufacturer to dealer incentive programs in play, holdback, “processing and documentation fees,” back-end money for financing (this can be thousands of dollars of profit), and a wide range of high margin/low value add-on products that consumers are coerced into purchasing.

Also, consider that the sale of a new vehicle even at a low margin ignites years of annuity business in the form of parts, service, and body shop sales. Hell, the new car sitting on the lot has already generated somewhere between 2-5 warranty hours (depending on the model and brand) for the service department in make-ready reimbursements from the manufacturer!

Note that dealers rarely, rarely go out of business, as they are essentially a license to print money. When dealers say “we’re not making any money on this” what they really mean is that they aren’t paying the salesperson much of a commission on this particular sale.

Hey, Jason: assign someone to do a story about the true nature of a “skinny deal” on a new car, outlining all of the revenue streams in play. I suspect that it will become one of your most-viewed stores ever.

Two things: I’ve only been to Wynwood once (last year), and I don’t think I went past that storefront, but somehow I instantly clocked it as Wynwood. Good job, brain.

The other thing is that Matt is right, he needs to fix that. Lucinda is great live. Only saw her once, at a free outdoor show. Great energy, hot band.

I’m on my way back from my holiday trip as I write this. Detroit to Kansas City area and back for 3 days with the folks. We drove to put a quick 1800 miles on a lease that we return next week. It’s still 5500 miles under the limit! I’m in the passenger seat, trying to get some more learner miles done by my last kid to not have his license yet. Why do these kids not want their licenses these days! I have fun cars for them to drive and everything!

My kids are 17 & 21, with exactly 2 lessons between them. The 17-yo actually had a great session, but has said no at least 20 times to a second one. Kids these days!

My 21 and 23 yo love driving now, but it was a tough road. The 21yo has a Miata now and wants to learn stick next. The 18 yo is the toughest. He’s up to about 25 hours after 3 years, but is still a horrible driver and went a year between lessons at one point.

Holy crap, that’s a bleak thing to read. The whole point of having a non-partisan, non-political adult as Fed chair is for stability and doing the right thing over what’s politcally expedient. This whole situation is terrifying and makes me want to toss my 401(k) dollars over to a country run by freaking adults.

Or by raising destination and other fees attached to the MSRP. I wish more studies would look at overall transaction price because destination fees be wildin’ out lately.

I SHOULD HAVE BEEN flying to Mom’s house right now, but NO. My Lyft driver was confused by his nav directions and asked ME for guidance. Buddy, I moved here in September and go to the airport a) mostly in Lyfts and b) mostly half-asleep. I don’t know jack about movement in that direction. The dude even hung up at an intersection, asking ME which direction to go when the nav was pointing ahead and he had a green arrow. Dude, just GO. I don’t care if it’s the direction you know or the back way Waze is pointing towards, just GO.

Anyway, I’m in an airport until at least 1-something p.m.

Ugh.

I WANTED to pick up another, non-carry-on-able part of a present (covertly, without being discovered) and eat cajun food since I’m flying into Shreveport, and I was set to fly into Shreveport around mid-day. NOPE! I got rebooked for the last flight into town and will not get to eat delicious cajun food for lunch. >:(

At least the snow at BDL is pretty to watch, I guess. My OG Puffalump Christmas Mouse stole my 12% Russian imperial stout, because of course he did.

THE LANCER DEMANDS ETERNAL ADMIRATION AND A SACRIFICE WORTHY OF ITS MIGHT. IT MUST CONTINUE.

I think of myself as a reasonably hardcore driver. I daily drove an S1 Elise Sport 160 for 9 years, I was fine in my 2CV for years, I crossed the country in my stripped out and caged MX5 with its welded diff. And I ride motorcycles.

But I just don’t get Sevens. I don’t like being in them and I don’t want to drive one, not even on track. I got out after being driven half a mile in one and walked back. I don’t know why. Too small? No impact protection at all? They have to be safer than a motorcycle, but I just don’t want to be in one.

Heading up to my mum’s in Maine, it’ll be the first longish drive for my 21 mazda3 since I bought it in august. Looking forward to it actually, I’m sure it’ll be more comfortable than when I made the drive in my 03 tacoma.

I pay roughly $330/month total in insurance on my 3 cars (96 tacoma not mentioned above). Considering it’s full coverage on the mazda and the 03 taco I’ve never been too bothered by the price. Would love to see it not go up though. I’ll keep my fingers crossed the rate setters forget about me.

Maybe insurance would be a bit cheaper if the average driver would put their cell phone down while driving. I can’t go more than 1/4 mile in my city without seeing someone using their phone while driving.

Insurance rates going up has more to do with insurance companies buying your telematics from third party data brokers, which in their mind justifies demerits like, accelerating to get on the highway (too fast, that’s another $100 per month) etc.

Going to visit aunt on Christmas eve day, about 60 miles round trip. Going to visit my sister on Christmas day, about 20 miles round trip. The Focus ST will be my ride.

One of the many benefits of minivan ownership is low, low insurance costs. Outside of it being a thirsty thing, it’s a pretty cheap vehicle to keep on the road.

We host Christmas dinner, and have my in-laws and brother-in-law staying with us for the week. It’s a lot, but it’ll be fun. Especially since we have young kids that are pretty much at peak Christmas age. I’m excited. All projects have been postponed for 2026 me.

And lots of room for hauling and activities. I know they aren’t cool, but I’d rather have a minivan than an SUV.

I was pleasantly surprised how cheap it was to insure my Odyssey when I bought it.

I don’t remember what the breakdown is, but as a couple who own a Chrysler and a Forester, we seem to be paying less for insurance on two cars than what a lot of people are paying on one.

Our area is also devoid of youth so, that might be part of it. Seriously, I’m married with two kids and I’m 12 years below the median age.

Damn. What Florida retirement village do you live in?

Upstate NY, lol.

Staying put for the holidays. Not hosting. Not going to any parties. Doing the home version of “Closed for the holidays. See you in the new year.”

Man, all this winning sure is tiring, isn’t it?

When the people in the downward facing part of the “K” realize that there are a LOT more of them than there are people in the upward facing part of the “K”, things could get interesting. I’m kinda hoping for something like the ending of the movie Weapons.

Feudalism 2.0 . . . serfs will soon become nostalgic for the guillotine.

The downward part of the K is populated by folks who are still lapping up the promise of trickle down economics, which has never worked in the 50 years or so it has promised dividends to the great unwashed. But they’ll punch you in the nose for asserting they are ignorant of reality, and point to their unbiased news sources as proof that it works.

Meanwhile Corporate salaries feel the positive effect, but we just get trillions in national debt every year for our trouble. Huzzah for our corporate overlords, who meanwhile are leeching every bit of margin they can out of every product they sell because corporations are ONLY beholden to shareholders – the law says that.

/rant

Mutual fund owning me understands all of that. But not-a-billionaire me still wants to see a workers’ uprising.

I drove my 96 Mustang to Mexico from SE Michigan to visit family. Talking about repair prices, before this trip, I had a shop replace some intake gaskets and the water pump. Labor and parts were $1K. I brought a bunch of parts with me for a full tune up and all fluids replaced, rear brakes, ball joints, plus new speakers, subwoofer, and stereo. I also took the car to a body shop to fix a big dent on the fender and they are doing a full detail on the paint (ceramic coating included).

Mechanic: $150 for labor. Parts were on sale in Rockauto

Audio installation: $150 (including wiring). $400 for parts

Body shop: $450 (My insurance sent me a check for $1200 for the repair).

All this in Michigan will be probably at least $3K, insane.

Love the reminder about getting fleeced by insurance, so true. Having a fully paid car still doesn’t yield the saving I was hoping for – strong insurance bill (I just get penalized for living in the city despite a spotless record) and some insane repairs that really should not have happened on a 52k mile car bought new.

Yea, I need a $5,000 car without full insurance.

ShIATA: shitbox is always the answer.

It’s insanity. Despite a spotless record and well below-avg driving (7k per year, thanks WFH!), it just doesn’t matter. My premiums skyrocket every year (Thanks NJ!). I can’t imagine what premiums look like for even one minor accident.

“Spotless” records don’t mean squat to insurance companies. They have your telematics. Have you ever accelerated to merge into highway traffic? That’ll cost you. Ever had to emergency brake because of some other driver? That’ll cost you. Etc.

They don’t have mine. My phone is not tied to their tracking and I had my car’s 3G module removed by the dealer as part of a battery draining recall. So it’s “if we don’t know, we’ll assume the worst”. I have been driving in the US for 25 years and in all that time I had a single $1500 claim in a chain event on the interstate. So at this point I paid in premiums way more than totaling a medium priced car. If you factor in interest or using that money on the stock market, they win even bigger.