The predictions for next year’s car market are starting to come in, and it is looking extremely meh. Car sales are expected to drop, which isn’t a huge surprise. Will cars get less expensive at the same time? Probably not. Will the cost of car ownership drop? Definitely not.

I talk a lot about new car affordability in The Morning Dump, and new data shows that the lack of cheap cars isn’t likely to improve next year. There’s more to it, though, because once the car is purchased, the overall costs of ownership have gone up, which is leading to a rise in delinquency.

Another frequent topic is the delay in tariff-related price increases, as automakers are slow to raise prices directly. Instead, as the head of Nissan’s dealer group points out in an interview, a reduction in incentive spending ends up having basically the same impact.

Do you want a fun prediction for 2026? Let’s end on an up note.

New And Used Car Sales Predicted To Drop In 2026

Cox Automotive puts out one of the best reports on where the car market is going. Last year, the prediction was for a slightly up market if tariffs didn’t spoil the party; this year, pretty much all signs point downwards.

Even the one green arrow going up (Manheim Used Vehicle Value Index) isn’t necessarily in favor of consumers, unless you plan to trade in a new car. Leasing volume is also an interesting and nuanced metric, given that a lot of leasing was driven by electric cars getting the IRA tax credit. Without that credit, leasing is likely to take a hit.

The big one, though, is that new car sales are expected to drop to 15.8 million, which is something like the new normal. What’s going on? Cox points out a lot of the same issues that are frequently mentioned here, including the bifurcated market (or K-shape economy) and various policies. Inflation is also a big open question:

Inflation appears to be peaking, and rate cuts this fall and into 2026 will help affordability. Yet uncertainty looms with Federal Reserve Chair Jerome Powell’s succession and questions about Fed independence. Lower rates will provide some relief, but long-term rates remain sticky, delaying housing recovery and limiting auto sales. Uncertainty has been a key theme lately, and in 2026, our team is expecting more uncertainty when it comes to inflation and Fed’s decision path. As the Fed works to balance its dual mandate, there is no simple way forward.

And then, once you buy the car, it gets worse.

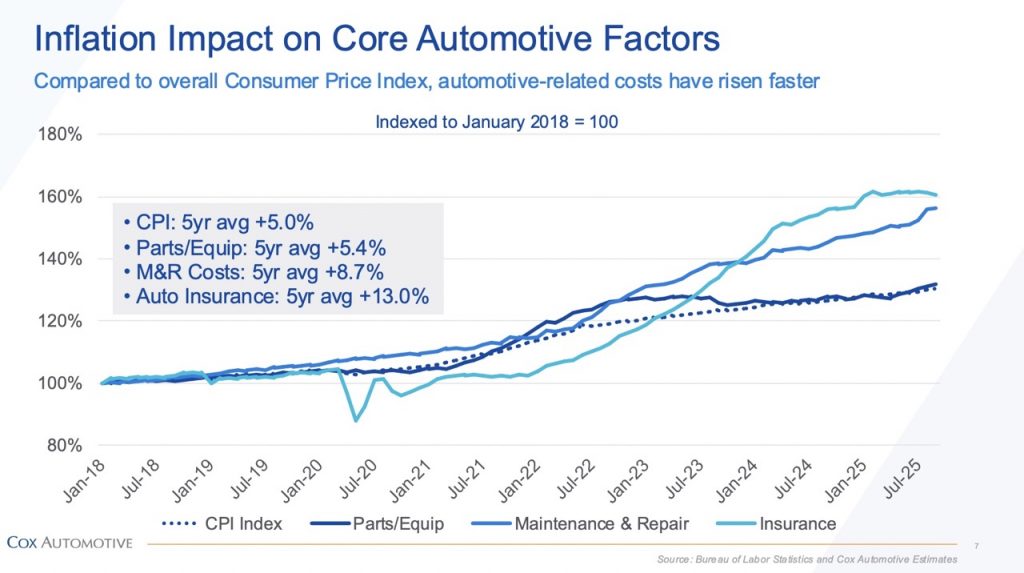

Insurance And Repair Costs Make Car Ownership More Expensive

There’s a graph that’ll make you feel kinda terrible. If you compare the Consumer Price Index (one of the main ways that inflation is measured) to the various car ownership costs, you’ll see how fast car-related costs are outpacing the overall market. It sucks.

Parts and equipment are close to the average, although I suspect tariffs will create an even bigger impact going into next year. Maintenance & Repair? Yikes! The shortage of good labor and the complexity of new cars are playing into this.

The biggest increase has been in insurance, as explained in this NPR story:

Cars are more expensive; parts and repairs are more expensive; medical bills following auto accidents are more expensive. Modern cars are packed with pricey electronics, pushing up the cost of fixing even minor fender benders, while empty streets during the pandemic encouraged speeding and led to more severe (and more expensive) crashes.

All those things cost insurers money.

Men repair the brakes on a truck in the parking lot of an auto parts store in Middletown, Ohio, in 2024. Prices of car parts, car repairs and car insurance are expected to rise if tariffs remain in place.

Patty Kuderer is the insurance commissioner for the state of Washington; when insurance companies want to raise premiums, they need to ask her office for approval. “The claims paid really drive the cost of the premiums,” she says.

It’s possible that insurance costs are finally topping out? Perhaps, but in the meantime, consumers are getting stuck. There’s an interview in the latest episode of the Odd Lots podcast with Rikard Bandebo, the chief economist at VantageScore. He talks about the rise in auto delinquencies, and he says something interesting:

“One of the things that has caught many consumers guard is, okay, they’re in the dealership, they’re being shown some numbers… and they think ‘we can make it work’… what they often forget about is that insurance has gone up substantially, as have just the cost of ownership, repair costs have gone up significantally, and when all those things hit them they realize they just can’t make that work. And that’s not good.”

This is quite bad. If you get behind on your home payments, it takes a long time for you to actually get kicked out of where you live. Auto lenders will come take your car if you fall behind for a long enough period of time, which might stop you from going to work, or at least make going to work harder.

For all the talk of making new cars more affordable, policymakers should probably keep an eye on keeping car ownership affordable.

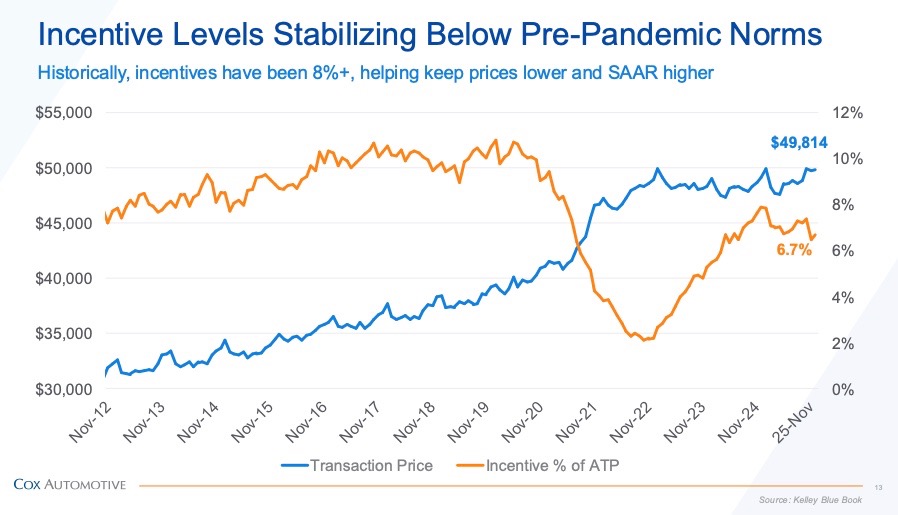

How Tariffs Are Keeping Cars More Expensive

One of the more interesting stories of 2025 is that automakers didn’t immediately pass on the costs of tariffs to consumers in the same way that they seemed to during the pandemic, although there are some similarities. Carmakers cut incentive spending once it became clear there would be fewer cars to sell, and now carmakers are doing the same to offset tariff costs.

There’s an interview in Automotive News with Mike Rezi, chairman of the Nissan National Dealer Advisory Board, and he says a lot of interesting things, but this jumped out at me:

U.S. tariffs damaged profitability on key models such as the Mexico-made Sentra and Kicks. Nissan has not passed the tariff cost to the consumer, but it has reduced incentives and marketing support.

Throughput and profitability remain a key concern going into the new year. High interest rates and inflation hurt customers in their pockets and made them more budget-conscious.

Dealers need to average about 70 units per rooftop per month. We are currently selling about 40 new vehicles a month.

Dealer gross profit per vehicle has eroded. There is barely any profitability on new-car units.

If you can’t make the MSRP of the car higher, you can still make the cost elevated by just lowering incentive spend.

Hey, Look, Caterham

If there’s one automaker that is uniquely suited to do well in this new environment, it might be Caterham. I know that sounds crazy, but hear me out. The automaker builds its cars in the UK, a country that arguably got the best trade deal with the United States so far. A K-Shaped economy? Sevens are definitely 3rd or 4th cars for wealthy people, but there are plenty of wealthy customers. What is the DOT making smaller, lighter, cheaper cars easier to sell going to entail from a regulatory standpoint? Unclear, but there’s a nonzero chance it makes life better for Caterham.

To that end, the company is making a bigger push, announcing a new dealership at a unique location in Miami:

Fuelled by generations of passionate automotive experience and located within the iconic Wynwood Arts District of Miami, Walt Grace Vintage is a unique gallery which showcases and sells the finest investment grade automobiles, watches and guitars.

Marking Caterham’s continued expansion across the United States, the new dealership will offer the range of Caterham’s lightweight sports cars, and customers on the East Coast will be able to configure, purchase and take delivery of Sevens directly through the Miami gallery.

Given that everything is getting heavier and more complicated, there has to be some room for Caterham, right? Also, one of their press people suggested I might be able to borrow one, so the company needs to stick around long enough for that to happen.

What I’m Listening To While Writing TMD

I have not seen Lucinda Williams live, and I must fix this (I was a day away from doing it this week, oh well). Here she is performing “Drunken Angel” at Farm Aid in 2004.

The Big Question

Are you going anywhere for the holidays? How are you getting there? If not, any projects coming up?

Top graphic images: Bureau of Labor Statistics; Cox Automotive Estimates; State Farm; Progressive; Geico

Car expense is something you have a great deal of control over. Nobody NEEDS to buy a brand-new car, ever. There are unlimited used options out there of every type and at every price point from free to millions of dollars. You can learn to turn a wrench to keep costs down. I did while living in a downtown apartment back in the day. You can choose to not drive like an idiot and thus have cheaper insurance. You can choose to live in places that result in cheaper insurance. You can choose to buy cheaper/more efficient/simpler and easier to fix vehicles. You can choose to structure your life to drive less.

Taken to the extreme, you can structure your life such that you can choose not to have a car at all. When my elderly mother needed a replacement car a few years ago, we seriously considered her simply not getting another car at all. She could get by just fine with me, friends, and Uber, and it would have been cheaper than even the cheap new Soul I bought her. But she decided that the freedom was worth the money, and I was OK with subsidizing that.

My Christmas travel is the same as my Thanksgiving travel. About five miles to my friend’s place for the Maine ex-pat holiday gathering Christmas edition. I will be making baked rigatoni with San Marzano Bolognese from scratch. I’ll be driving my BMW convertible with the top down, as it’s going to be 79F and bright sun here in God’s Waiting Room on Christmas Day.

Tariffs are making car repairs truly needlessly expensive. I had to run to advance auto for a single idler pully for my project 08 Elantra, because I missed one part on my big rock auto order. That single Idler pully, not the whole tensioner, just a single pulley, for a 2008 Elantra was 53 dollars. Fifty Three American Freedom Dollars. Same price for comparable ones from all the other parts stores around. Yes there was the convenience tax, but still, parts prices are getting insane.

Not to be that guy, but I see two mistakes today, only one of which is technically yours Matt (btw, thanks again for digesting the economic data for us).

1) In your copy/paste of the NPR excerpt, you got the (unincluded) photo caption text also, about ‘men repairing brakes…’ Good thing those guys were working on a truck though, had it been a Hyundai Ionic 5, they’ve have needed a laptop and maintenance software subscription just to install new pads.

2) Presumably part of the actual quote and not an editorial error, but Rikard Bandebo (how is that not the name of a Star Wars character? …like a second-tier bounty hunter who gets the jobs that Boba Fett declines) probably said or meant to say that higher ownership expenses are catching consumers off guard, rather than catching their ‘guard’ which almost means nothing.

I kind of want a new(ish) car for a change, given that my current fleet average will be 30 years old in a couple weeks. Something with automatic emergency braking front and back, and a 360 degree camera would be nice (and modern crumple zones) but not a soulless appliance besmeared with pointless tech. I can even afford it, but the lack of actual need and a smidgeon of common sense keeps the money in the bank instead.

You just need a decent scan tool for those pads. Similar situation with modern Hondas too. I got a cheapo Autel Bluetooth one to do the pads on my Civic The Drive is wrong: Anyone can replace brake pads on the Ioniq 5 N | Articles | Grassroots Motorsports

I bookmarked that just in case I get one. Thanks Sack!

My fleet of four will be an average sprightly 27 in ’26.

I kind of remember what it was like to be 27. 🙂

No trips planned for the holidays.

If I do go somewhere , Miata with the top down.

Going to be over 40 here in SW Michigan.

Insurance is a big factor in my car purchases.

I have a fairly high risk tolerance so no full coverage on the NB Miata.

Basic coverage is about $170 every 6 months.

The 2020 F350 insurance seems crazy to me, but it is not as bad as the numbers many of you are posting.

It is still scary to think that I could spend 10K on a car and have a deer or turkey take it out on the way home.

Ach! Where do you live? Not a major metro area, right? I’ve got no collision on my NA Miata, and barely drive it a couple thousand miles a year, but it still costs about twice what you’re paying to insure with a major carrier (Progressive).

Still, it’s nice to have an old Miata to drive when the big daily (not a F350 for me, but a nice old 240 wagon with the clear coat baked off) seems like overkill. 🙂

I live in SW Michigan, in a rural area. The Gilmore car museum is close by.

Still only 10-15 minutes away from a strip of highway with at least 5 auto part stores, home depot, walmart , meijer.

I have been driving the Miata F350 combination for almost 30 years.

I figure that I have saved enough $$$ on insurance to buy one used Miata.

Are we great yet?

Yeah so much winning going on that’s totally the reason we’re all exhausted. The economic winning…

“We are the hottest country in the history of the world”

And a shit ton of other bullshit lies and accusations as always…

Put forth by the only guy to visit Epstein’s Island not to score with a 14 year old…

Because he blew Bubba…

I can’t take anymore of this “winning” bullshit.

We’re Grate.

Motorcycles are the answer.

Not until something is done about all the idiots on the road they aren’t. I prefer to be IN the safety cage, not BE the safety cage.

Not traveling for holidays is a very easy way to seriously level up your life. I see relatives at other times. I will enjoy the entirety of the holidays at home with my family (wife, dogs, mother in law) and leave travel misery to the rest.

So wise. 🙂

I think people are insane for doing it. My mom is just as happy to see me on her birthday as on some higher-stress hullabaloo that is a holiday

They’re really cater(ham)ing to the enthusiasts. So many great driving roads around Miami.

Going anywhere? No. My family is all close. Only need to drive 25 miles away. Projects? Nope, can’t afford them. I think I’ll sell my car and buy a scooter.

I just got my auto insurance bill for 2026. $1900 for the year for a 9 year old CUV that might be worth $14k. Feels like a lot. Time to do some shopping.

2160$ a year for a 16 year old Jeep that might be worth 3500$ if I was lucky.

We got 2 new cars last year and I got a bill for $3264/year. Shopped around and got that down to $850 for the same coverage.

Who the heck is the silhouette on the right side of the topshot?

My eyes say Geico Gecko?

E.T. muppet could also work, but he ain’t got anything to do with autos. So I’m going with your answer.

So pulling on this thread some more, is that Progressive Flo in the middle and the Mayhem guy from I forget which company on the left?

Mayhem is from Allstate

Good catch! I dunno what that is, but maybe some iteration of Marvin the Paroid Android since HGGttG came up today in another story?

Also, I think I’ve mentioned both of these before, but I LIKE the little Space Invadery icons we get if we’ve yet to upload a picture, and also, I’ve had a TV crush on Flo from Progressive for years. 🙂

The chick from the dog park is better looking. /s

Is that the short one? If so, I agree, but the sauciness of the Flo character is more appealing than the depressiveness of the short one. Both fictional of course. On another website, this would be a Gal Gadot vs Lynda Carter discussion.

Yeah it’s the short one.

I dig her too of course, but I’m so suggestible. At least once a week, after reading a particularly fetching Shitbox Showdown, I’m actually googling plane tickets, aftermarket support, etc…

Oh I think you’re right. Flo and Gekco I can see. The other one, who knows…Mayhem from Allstate, Jake from State Farm, Doug from Liberty Mutual. It’s not JK Simmons from Farmers because the shape has hair…

The one on the left looks vaguely menacing in the way it is gesturing, which is why I went with the Mayhem guy. Doesn’t have the gravity of JK Simmons either!

My first thought would be ET. Although he’s keeping a low profile because of ICE.

Exports of used vehicles have increased 10 fold. Value exceeds $8 Billion annual.

Removing lower cost vehicles from market raises costs overall with greatest impact on lower income consumers.

Going to see the kids. Driving all the way.

It’s my opinion that the next recession will be fueled by risky automotive debt.

Not the AI bubble?

The AI bubble is what is going to drive the price of electricity up to the point that heating my home with wood looks attractive again.

Funny you should mention that… I bought a Jotul 602 (an older one, in a nice green enamel) just for that purpose: in case of a zombie apocolypse or economic meltdown or whatever. Now if I could only get around to splitting that big pile of wood in the carport (I let my neighbor use of what was left of my woodpile last winter).

If you don’t have a hernia (don’t ask) then splitting your wood is actually a pretty relaxing day. Don’t get crazy, just settle into a rhythm.

And go ahead and use up last year’s woodpile yourself. It’ll burn eventually.

I’ve had three, but none at the moment thankfully. Tons of wood left, but none of it split, and it’s gotta be pretty small to fit in the stove, so…

…it’s on my to-do list, like fixing up the Volvo, etc…

Nonsense. The is no comparing automotive debt and what happened in 2008 with mortgages. Auto debt is nearly always priced appropriately for the risk. And unlike houses, cars are *easy* to repossess and resell. Completely and utterly different markets, and the auto debt market is much smaller anyway. 1.66T vs $13T. Student loan debt is actually bigger at $1.8T. Of course, usually the only way to get out of paying that is dying. And not even then sometimes.

I’m going to folks, top and windows down as always. 100 miles round trip.

Looking like a high just above freezing. So it’ll likely be 20-25 minutes before the rear tires have any heat in them, driving like a sane person. However, it seems to be slotting in between two days of icy precipitation, so I luck out there. I had a contingency rental lined up just in case, but I like being able to cancel it and not use it.

I do holiday celebrations on the day before, and my folks I do it earlier in the day, so I’ll be going against normal work traffic in both directions.

Oh, and eating everything. I trimmed down back to low 140s, but as I eat all the turkeys (they’re cheap, I buy them) and all the baked goods, it’s returning to 150. That’s OK, as after the eating is done by mid-Jan, I’ll trim down to 140 by spring.

In the meantime, here is my recipe for “Cookies of the Peanut” (serves 36):

* 8 Tbsp unsalted butter.

* 1 cup (256g) crunchy peanut butter.

* 1 cup (192g) granulated white sugar.

* 1 cup (192g) dark brown sugar[1].

* 2.5 cup (300g) all-purpose flour.

* 1.5 cups (200g) honey roasted peanuts.

* 2 large eggs.

* 1/2 tsp. salt.

* 1.5 tsp. baking soda.

* 1 tsp. baking powder.

I recommend chilling the dough in the fridge for at least 2 hours. It just makes it easier to take it out as a big hunk out of the bowl, and divide it up with a pastry/dough slicer to ensure you’ll get 36. Roll them into balls to place on sheet pans.

These take 11 minutes at 375°F (190°C) on a thin, cheap baking sheet lined with parchment paper. After removing from the oven, flatten and finalize shape with a spatula. Let them rest on pan for 3 minutes before transferring to cooling racks.

I include weights for those with food scales. If you have a food scale, you can always get things exact, and not worry about “packed” versus less packed, etc.

I have several new pie recipes to do still. I do now have a “Cinnamon Almond Cranberry Caramel Oatmeal Crunch” cookie, a new recipe, but I’m still refining it. Yet the peanut butter recipe is such a favorite at car shows, I’ve had many pregnant women genuinely threaten me for the recipe for these (and other treats I make).

—

[1] If you don’t have dark brown sugar, you can add 1 Tbsp (21g) molasses to light brown sugar, or 2 Tbsp (42g) molasses to granulated white sugar.

I’ll just get on my soapbox a bit here and say that this is why people should learn how to do basic repairs and maintenance on their own vehicles. I know that time is money but I just did an oil and driveline (diffs/transfer case) fluid change on my vehicle. Total cost was under $200 in materials and 3 hours of time. That service would have cost at least $1k at a dealership. There’s nothing overly complicated about swapping fluids and anyone should be able to do it (unless there are physical limitations). With YouTube there’s no reason why someone can’t do these basic tasks.

In regards to insurance, everyone should seek quotes from other carriers every year. Carriers underprice policies to get you in the door and then slowly increase the rate every renewal until you’re paying over the market value.

What are you driving that takes $1k for someone to change your diff fluids?

I mean, my jaw dropped the floor when I had a local shop change the fluids in our Subaru’s diffs, transmission, and engine – but it was a few hundred less than that. With the majority actually being the oil cost (local shop is pretty transparent with materials costs – I’ve got a good local shop where I can even drop off parts for them to install)

Where can matter a lot.

Mainstream dealer labor around me (Boston area) is $200/hr. Mainstream luxury dealer is $250/hr. Add $50/hr for somewhere like SFBA, especially if you don’t shop around.

Even my specialist independent is now $180/hr.

But, HCOL area. It’s going to be cheaper in, say, central Pennsylvania, or a bit outside Lincoln, Nebraska. Labor rates are very different depending on where.

Then you have the difference of dealer charging “book”, whereas the independent charges actual wall clock time. For example, spark plugs for me is 3.5 hours book labor. Independent? 1.5 hours, which checks out as that’s about what it takes me to do them since I won’t take the rear wheels off.

Yep the local jeep dealerships around here are all $200/hr

Local Ram ,Ford , Dodge ( same dealership)is 140 hour here in N Wisconsin while paying their lead Mechanic 45 an hour.

Actually have guys that can diagnose and repair without shooting the parts cannon.

GMC Chevy (combined dealership)is 145 an hour.Same as above as far as quality.

Toyota Honda ( combined dealership)is 150 but they are not reliable and shoot a double barreled parts cannon at everything that comes through the door.

Indyshops are around 120 to 130 but most have bad attitudes.

Of Course the cost of living is comparatively inexpensive also as well.

Gotta take the good with the bad .

Happy holidays fellow Autopians and please keep buying memberships to help support the great writers and support people who give us this great site.

Do they take payment in spotted cow beer?

I’d be really interested to see some in-depth analysis of whatever factors are driving dealerships labor cost up forever. Dealer technician time now costs more than my firm bills Sr Engineer time for.

Probably the fact that for mainstream manufacturers it’s where they claw back margin on the cheaper stuff, and where they generally make money in general. Service makes money.

Moreover, for high volume “lower cost” models, all the money to make is in finance and add-ons. They then get more from service.

The manufacturers aren’t making any money on dealer service, though. Barely even any on parts. There was once a thing called “competition” that would cause the price of a service to be set based on the balance of supply and demand. If some suppliers of the service couldn’t make money at the current price level, they’d exit the market and the price level would rise until a balance was achieved. If profits were fat, more providers would jump in until prices fell.

This is where I could start griping about how I’ve never seen it because a retired actor sacrificed antitrust policy on the altar of corporate profits a few years before I was born, but I don’t even know that that’s it. Even really GOOD mechanics don’t make that much money. OEMs are so unprofitable that they regularly require state intervention. Dealers… Sometimes. The whole thing feels broken like child care (which somehow costs about 50% of the after-tax median salary per child, and yet the people providing the service live in poverty) or health insurance (providers of which actually operate on razor thin margins). I suspect that a deep dive would find rent-seekers borrowed deep into the system at every step.

That is not true.

A mainstream dealer’s service department nowadays is easily 40-45% of their gross profit. About 25% is new car sales, and 25% is used car sales. In huge economic downturns, the service department is what genuinely keeps some dealerships afloat.

EDIT: “Car sales”, both new and used, do include things like finance, “accessory” sales including warranties, etc.

I didn’t say the dealers weren’t making any money on service, I said the manufacturers aren’t. I just don’t see how they (the dealers) can be jacking up their rates to subsidize unprofitable sales operations when they have to compete with service-only operations

It’s because of, “stickiness.”

It’s the same reason why even if deals are far better elsewhere, why people will still go to a (mainstream, not premium) supermarket that’s 20, 30 or 40% more money than another one.

There are people who have a hard habit of going to a dealer for service. They’ve always done it. Ergo, they will continue to do it unless something pushes them not to, and that something isn’t price. It’s a larger factor that entirely forces them to revisit their finances.

… and the reason is simple. Most mainstream car dealers will give you a fairly consistent experience. Independents can be amazing, but you do have to research them. Moreover, in less populous parts of the country (especially as things get more rural), the dealer will appear better than the competition simply as a function of how much better they visually appear. That presentation of a nice, shiny dealership… works!

Nothing exotic, a 4Runner. Material cost at a dealer is estimated at $300 (they mark it up) and labor is about $150-200/hr. I don’t know what book time is but figure 2-3 hours for the oil, both diffs, and t-case and you’re there once taxes and disposal fees are factored.

I was about to reply, “a 4Runner could cost that”, till I scrolled and saw your reply.

I don’t think they even factor labor time into it, they just put a cost to the service, with the thinking that most customers are not going to know how easy it actually is. Especially when Toyota calls for rather expensive fluids, and they likely just pump 85/90 out of a bulk tank.

I was quoted $1000+ just to change the transmission fluid in my E350 Mercedes by the dealer. A regular oil change from them is $150+ *with a coupon*. Labor rate is $270/hr… Even the indie shop here is $170/hr.

Needless to say, unless there is no alternative at all my car will never darken their doorstep (I am going to have to pay their extortion for a key at some point). I bought a pump, the fill adapter (it’s a fill up the drain hole setup), and the OBD-II reader needed to read the fluid temp while filling it for a couple hundred bucks, a hundred or so of fluid and a $25 filter kit, and changed it myself. And I am all set for the next time, and lots of other repairs to the car. Same with oil changes – bought a fluid extractor, which makes it the easiest oil change you will ever do. Don’t even need to get under the car. $35 a year for the annualish oil change.

Reminds me, I need to change the cabin filter. I shudder to think what they would charge for that job. $250+? My BMW dealer charges $150 to do those in my cars – it’s an $18 filter and on the BMW it takes five minutes if you are slow. Mercedes not as easy, took me 20 minutes the first time.

Ultimately what got me into wrenching in the first place was realizing I had champagne tastes in cars on a bottled water budget. I could buy some boring shitbox and pay to maintain it, or I could buy elderly nice cars and learn to fix them myself. So I did that. now I buy much newer nice cars and still maintain them myself.

If you own your home, a good homeowners’ insurance company may be able to give you a significant discount if you go through them for your car insurance. Shop around, because you want an insurance company that’s good to deal with for both home and car claims if they ever arise. But if you can bundle both with a satisfactory insurance company, you’ll definitely come out ahead. Unfortunately, this kind of savings may be out of reach for too many folks who find home prices and/or mortgage rates unaffordable. (See my comment on the K-shaped economy…)

Doing your own routine maintenance and light repairs is definitely a money-saver. My daughter got a quote on having a shop do routine brake pads and rotors on her car. Then she priced the parts alone — so I did the brakes for her and cut the cost virtually in half. Oil changes in the driveway instead of the shop are kind of a no-brainer for cost savings. The caveat, of course, is that when a car is under warranty, it’s generally best to have it done at the dealership’s shop so that service records are kept seamlessly updated which makes a difference in getting some warranty repairs done later. If your car is used or out-of-warranty, wrenching yourself can save a lot of green.

I cringe thinking how much it would have cost to track down the electrical issue on my wife’s 2014 Dodge van. Likely multiple diagnostic fees, plus the parts cannon which probably would have involved the very expensive TIPM fusebox/central electrical bus unit. Instead, I fixed it in a few go-rounds of replacing poorly-fitting battery clamps, replacing an aging original battery, taking the TIPM apart and cleaning up a couple of corroding bus lines, and cleaning the battery grounds. No expensive major parts needed to be replaced. Technically, the cost of one $200 or so diagnostic fee could be figured in because I bought a spiffy new OBDII/scan tool that can read/clear Stellantis proprietary codes and read the real-time CAN bus electrical data, which was helpful to prove that the battery was getting iffy and contributing to the problem. In the end though, it’s still a lot of money saved because electrical troubleshooting in cars tends to be awful in terms of labor hours, and worse if they start throwing parts at it.

“I know that time is money”

Very very few people’s time is actually worth that kind of money, especially if they add buying the materials and dropping off the waste as part of their normal shopping.

Yes, shop insurance every year.

Anyone who brags about loyalty discounts because they’ve been with their company for many years, is getting ripped off.

I’ve been circling between the same 3-4 insurance companies for the last 10 years.

Rates are still going up right at about 13% as listed, but this year Progressive wanted to add 40% to my rates! No thanks!

So I’m back with Safeco for the next year.

It is faster to change my own oil than it is to drop it off at the and go pick it up, ditto for swapping winter and summer wheels and tires. I have only paid shops a few diagnostic fees and the cost of inspections over the last 10 years. I will also add that YouTube is great, but I have also bought a shop manual for every car or motorcycle I have ever owned. I enjoy having a written reference material that I don’t mind getting oily.

I’ve had the same cars with the same insurance price for a long time. Both are so old and have so many miles that a clumsy squirrel with cold total either with an acorn.

I’m not going anywhere for Christmas. It’s going to be a bit depressing. Just my wife, my daughter and I with about 20 dogs. My wife boards dogs for friends and forgets who she says yes to, so every evening, we have someone call us up and say “what time should I bring over Boozer and Brisket?” and we have to scramble to figure out where to put them all.

Honestly, that sounds amazing. Last Xmas, my GF and I fostered a dog that week, so we were able to get out of family Xmas obligations. It was my best Xmas since I was a kid, haha.

This is the way.

Just got word from my mom that my sister’s entire family is sick, so fingers crossed Xmas eve gets cancelled/postponed. I couldn’t justify getting out of it again this year.

Oh dear Glob, I agree. The most I ever had over for the holidays was five (including my one) dogs, back when I used to do that regularly. I put them all in the back of my Volvo XC90 and drove them around Los Angles, which is always nice and empty for holidays. They loved it and nobody peed or pooped in the car… not even me! It was great. 🙂

I grew up with Christmas being both the most stressful and most wonderful time of the year. My dad was the manager of a big group and my mom was Suzie Homemaker on steroids. The parties we had as a kid were:

It feels weird to have a tiny 3′ Christmas Tree (up high to avoid dog tails), plans for my daughter to come over from her BFs on Christmas Eve and have some Oyster Stew and get a gift (that is all electronic transfer) and then have just 3 of us (and 18 dogs) at the house. It doesn’t feel like Christmas.

But I’m realizing (sort of) that it’s ok. I remember a lot of good times at Christmas as a kid. But if I think about it, I can also remember times of my mom laying in bed all day because her back seized up or getting super angry due to stress. I’m starting to realize that I am not my mom and I’m not even sure that Mom would have been so crazy for Christmas if she didn’t feel pressured to be Suzie Homemaker by her background and culture.

Cool tidbit about Caterham!

I will build a Seven at some point in my life.

Me too. I’ve largely given up on returning to riding a motorcycle due so overwhelmingly bad/inattentive drivers around me. A Caterham would be perfect to scratch the itch for offbeat, no-frills fun motoring though.

I like that entry-level one with the stamped steelies and little engine. It’s suh-weet and I wouldn’t need more.

“Insurance And Repair Costs Make Car Ownership More Expensive”

Always get an insurance quote before buying a given make/model of car. You might get surprised like I was when I was quoted CAD$4000-$4500/year for used Tesla Model S selling for CAD$18K.

By comparison, the Ford C-Max I bought costs a bit under CAD$1500/year for insurance.

The Toyota Prius is similarly cheap to insure.

“How Tariffs Are Keeping Cars More Expensive”

And Crooked Trump and his gang of deplorables are 100% to blame. Word needs to get out that the Trump Republicans are bad at business and bad for business. And their fiscal policies are anything but conservative.

They are fiscally reckless.

I did this when I bought my Ram. Only about 10 bucks a month more expensive than my 13-year-old 4Runner was for the exact same coverage.

The daughter is on the road from Ithaca NY, wife will be driving up from A2, they will converge on Swamp Castle and we will have a delightful time around the home fires. No new rides or projects until existing fleet is pared down.

Thanks for featuring Lucinda Williams. Everyone should have a well worn copy of Carwheels on A Gravel Road. Hoping you will honor The late, great Joe Ely.

I keep hearing and reading that new cars are cheaper than ever to buy when adjusted for inflation and that our incomes are rising so cars are cheaper to buy with our increase in income.

What I know and feel when looking at repair bills, insurance, and new car prices is that car ownership is not getting any easier.

That’s the K-shaped economy right there. Above a certain income+net worth level, things are getting better. Below it, things are not improving, and may be getting worse. The cutoff is at a higher level then the what the public thinks, or is being sold.

I really don’t want to live in a re-creation of the Gilded Age’s gulf of a wealth divide, but here we are.

Yeah, it’s a complicated analysis, for sure. On one hand, cars ARE cheaper adjusted for inflation, but as soon as more efficient manufacturing takes over (along with Moore’s Law for the electronic bits), we just take everything and crank it up to eleven because the market will bear it. Or at least it used to.

I still think a modern, safer take on a 1980s car probably COULD be built for $20k and reverse this whole trend, but it would feel like a Poverty-spec econobox in comparison. I’m not blaming consumers for why cars and homes are so expensive, but at the same time, we are very demanding now. We tend to be collectively shallow and sensitive about what we drive, where we live, you name it.

It’s fascinating to watch 80s and 90s movies to see all these really wealth people in massive houses… with laminate countertops. I have no beef with them, but it’s an example of what I mean.

“It’s fascinating to watch 80s and 90s movies to see all these really wealth people in massive houses… with laminate countertops. I have no beef with them, but it’s an example of what I mean.”

When I was shopping for a house build some years ago I was surprised how cheap granite and quartz countertops could get. There was a shockingly wide spread of cost; the cheapest was quite affordable whole the most expensive well past the giggle test. And to my eye there was no real correlation between cost and “fancy”. They were different, but not better or worse.

Same with cabinets. High quality cabinets made from water resistant materials weren’t that much more than disposable crap that falls apart when it gets wet.

Same with flooring; water resistant laminate costs about the same as crap that swells, huge ranges in tile with little benefit to spending more, triexta and nylon carpet prices overlapping with polyester, etc.

External facing? Real rocks cost a bit more than fake, painted concrete rocks but the labor was cheaper so overall it was a wash, however real rocks are harder to chip and when they do they don’t show bare concrete. Those painted concrete fake rocks chip and scuff to look like crap in a few years.

I think if people put more effort into sourcing they could build far better houses for the same costs but its a lot easier and faster to just buy crap from Home Depot.

Exactly right on the material price gap shrinking — I was more referring to people’s baseline expectations being so high, they lose perspective.

Or to put it the way an older coworker once told me (early 2000s): People in their 20s today want to start out in a way that it took us 30 years to achieve.

That’s not so much true anymore, but it was definitely an element in how much people’s expectations went up really quickly. And also the proliferation of HGTV showing the world everything they don’t have.

Progress is generally a good thing, but it has its pitfalls.

“People in their 20s today want to start out in a way that it took us 30 years to achieve”

Counterpoint: 30 years ago housing was much more affordable than today. 60 years ago even more so. Today a 30 yo starter house with 30 years of neglect still commands a price that would have bought a better new home 30 years ago. I doubt many 20 somethings just starting out would turn up their nose at something, ANYTHING even resembling affordable.

Perhaps you are thinking of trust fund nepobabies whose parents gift them one of the many houses they bought decades ago and put into a LLC to ensure the tax basis will live forever. They are the ones most likely to complain that the kitchen needs to loom like the ones they see on TV.

That may even be true, but so many other things, namely housing and medical, are much more expensive than they were even a decade ago.

By the time you pay for everything else, you have much less left for vehicle expenses.

Lowered projections on vehicle sales is not a good sign for job security / pay for anyone in the industry.

A week and a half ago, I was hit by a red-light runner in my 7500-mile 2024 Forte GT. Driver’s rear quarter bashed in, rear suspension broken, side curtain airbags deployed. Despite it being a fundamentally brand-new car, this was a total loss. Fortunately my only injury was a bruise where the side-curtain airbag broke my sunglasses against, umm, my face.

A week later, I’m in a CPO 2024 Integra A-Spec with 9300 miles in Performance Red Pearl (for visibility, you know). My insurance has gone down by $400 per year (apparently the “Kia Tax” is real), my payments have gone down slightly due to better interest rates, and I’m really enjoying my fancy Civic.

Just going over to Mom’s for Christmas. Project for the weekend is to do a paint correction and ceramic coat on Teggy.

Glad you came out of the accident okay and it is not surprising that your vehicle was a total loss. The cost and complexity of repair is driving up insurance rates and making total losses more common.

We went through this last year with an in insured driver in a vehicle with a salvage title broadsiding my wife. She was okay but the Odyssey was a total loss due to the whole passenger side being damaged with b pillar and c pillar damage. Wound up in a new Odyssey that my wife is quite happy with.

Glad you’re OK. Sounds like you failed up with a sweeter car and lower insurance.

Kia? Acura?

Where’s the Miata? Did you not dial “M”?

Kias and Acuras come and go. The Miata is forever, and I’m very glad I didn’t take her to work that day.

Perhaps next time the stars will align on a 6MT Soul red 6.

“Rate cuts will help with affordability” is a confusing statement. Yes, I get how monetary policy works and all that, but this statement just struck me as a way to potentially say this:

Yes, everything is a more expensive but at least you can finance it more cheaply.

If anything, rates might soften the blow of big-ticket items a little more (plus corporate borrowing, which is a big one), assuming the rate cuts don’t stoke inflation back up — but the Man on the Street perspective looks a lot like doomspending to thumb your nose at reality, not to reflect reality. Mass layoffs, inflation, and every morning I wake up to even more insanity from the adult daycare we still call The White House.

I feel like the long financing periods feeds a cycle of people to make even worse financial decisions – I’m sure continue to encourage more people into being underwater on trade-ins.

Right — cheap money leads to price increases in general (just look at how the recent proliferation of student loans created a vicious cycle with tuition; it’s chicken & egg but they’re highly intertwined, on top of “any service where you can’t shop around or negotiate” like education or medical care).

As masochistic as it sounds, I was really starting to get used to the slight austerity of higher rates, and at least it encouraged us to save money because it was actually earning something. I put off my car purchase for an extra 4-5 years and paid cash, in part, because of the waiting.

That vicious cycle is grossly exacerbated by employers drowning in supply of overeducated candidates demanding degrees for jobs that do not need a degree.

For the holidays, we are going to my moms house, then my inlaws house, then my sisters house, then back to my moms house, then my dads house. Meanwhile, this is our first christmas in our new house and we wont be here at all!

At least we are riding in style, in our bright orange Vibe. unless the weathers bad, then its the 4xe wrangler. Which the incentives did sell us on, even with the current multitude of recalls (Which the battery one has another fix for!).

I was hoping to gift myself a new/used car for the end of the year, but it looks like Ill have to make due with a new/used motorcycle instead.

Please, and I’m being sincere, be careful traveling anywhere in your 4xe.

If nothing else, a burning 4XE would help keep a group of people warm.