Cars are a necessity for many, as public transit is insufficient or inconvenient to get to work across most of the country. Cars are also expensive, which means financing is required by most to purchase even a used vehicle. A long pause in student loan repayments and delinquency reporting led to a period of elevated credit scores that fundamentally shifted the way car loans operated. That pause is over, and now certain carbuyers and lenders are in a tough spot.

The interconnectedness of the world can create moments of bliss, as when anyone with an Internet connection gets to enjoy the schadenfreude of watching a tech CEO enjoy a Coldplay concert a little too much. Or it can create moments of conflict, like in the EU, where its own tariff concerns are leading one Chinese manufacturer to walk back its plans.

This runs somewhat counter to what Ferrari Chairman John Agnelli wants, which is an affordable small electric car plan for Europe. None of that is GM’s concern, as GM got out of Europe years ago, but the brand invested heavily in Mexico and is now paying the price for that.

In One Night, 30% Of Young Borrowers Saw A 100-Point Credit Decline

If you’ll give me a second here, I’m going to moralize about the act of moralization. Politics, at its best, organizes society to improve everyone’s lives in spite of special interests. At its worst, it does basically the opposite and prioritizes outcomes for the few at the expense of the many. Historically, in the United States, it’s a constant conflict between the two.

Someone is always getting money and, often, someone is having that money taken away. There’s no true equivalent to Effective Altruism in governance, whereby the action taken is only determined by the most effective outcome and not feelings. Effective Altruism was always kind of silly, and feelings are important because that’s what motivates us to take action in the first place.

Student loan foregiveness/forbearance is one of these issues that always raises issues of fairness, morality, and efficiency. Everyone seems to agree that it’s good to give those who serve in the military a free or discounted education, but that’s basically where those agreements end. Should loans be forgiven for people who went to a college, only to see that college lose its accreditation? What if the college was a scam? What if the person took out loans to become a social worker and makes very little money? What if that person took loans to go into finance and now makes a ton of money?

I am not going to answer these questions for you, though I will point out that I’m uniquely impacted by college loan forgiveness because I paid off the last of my college loans in 2020. This means that I forked over the full value of my loans and got none of the advantages anyone got during the pandemic. Does this bother me? Absolutely not. On a personal level, I think paying for people to go to college (or a trade school/community college) is something we should do as a society.

Also, it’s probably good for the economy if we do it. Unlike handing out checks to people, which is inflationary, the slow drip of forgiving college loans is probably not, according to a report from the Roosevelt Institute. Even better, a paper from the National Bureau of Economic Research shows that there are a ton of positive impacts:

Putting all the findings together, it seems that the debt relief results in a multiplier slightly above one, because a debt relief shock of $7,400 translates into $4,600 lower indebtedness, a $3,000 increase in income and a $1,000 decline in delinquency amount.

That income comes, primarily, from job holders having the ability to switch to a better-paying career or position.

Back in 2020, as the pandemic was in full swing, holders of federal student loans were given a break. Here’s how the New York Fed describes the program and the impact of taking away delinquency reporting:

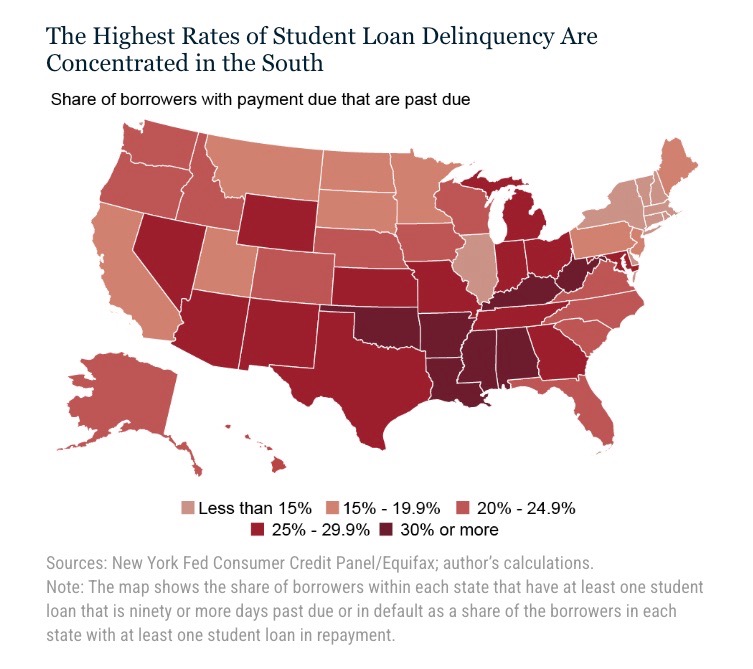

Payments on federal student loans were paused for forty-three months, beginning at the start of the pandemic in 2020 and lasting through September 2023. During this time, the delinquency rate on student loans fell to less than 1 percent. After the resumption of payments, a one-year on-ramp was instituted which prevented negative remarks of missed payments from being reported to credit bureaus. That on-ramp expired in October 2024 and delinquencies began appearing on credit reports during the first quarter of 2025.

This hits all forms of borrowing, whether for a home or a car, but it hits auto loans in a big way as many borrowers finance a car and not a home. Cox Automotive talked to Shams Blanc from credit rating agency FICO, who provides some interesting data points:

When federal forbearance officially ended in October 2024 and delinquency reporting resumed, the scoreboard caught up with reality. Approximately two million auto-loan borrowers had a student-loan delinquency added to their credit file in Q1 2025. One in five of these consumers saw their score drop by 100 points or more overnight. Among 18-29-year-olds, nearly 30% experienced that same 100-point decline.

Scores didn’t make these consumers riskier – they revealed risk that had been hidden for several years. The result: a sharp rise in the subprime mix of the current loan portfolio. The share of auto borrowers with scores below 620 climbed nearly a full percentage point in one quarter, reversing much of the credit ‘lift’ observed during the payment pause – a period that temporarily boosted average scores by sidelining many riskier borrowers.”

Does this mean we should freak out? Not really. Looking at the pure numbers, auto loan delinquency rates actually among subprime buyers improved during the period, but this is somewhat of a “mirage” because of the huge shift of buyers into the subprime category who weren’t there before (and probably should have been).

There’s no unscrambling that egg, and severe delinquencies are up over the last three years. However, loans have been in forbearance during much of that time, so the bigger issue is likely the huge increase in the cost of cars. It’s all connected, however, and there is a risk that this will topple people who are still upside down on their daily drivers.

The slight upside here is that lenders will have a clearer picture of the creditworthiness of buyers. The major downside is that this will likely further diminish affordability, especially in the used car space where these buyers tend to transact. Here’s how Cox Automotive puts it:

For consumers with student loans and dropping credit tiers, it means affordability is declining. A tier decline in credit score can result in a higher interest rate on auto loans by almost 300 basis points for a 1-tier drop and more than 600 basis points for a 2-tier drop. That is a significant shift.

[…]

We do not expect credit availability to improve in the near term, which will likely mean that rates will remain high and about where they have been, at least for the next six months. Tight credit and high rates will keep demand limited.

Coming into the year, I was hopeful that we’d see a continued return to affordability. The combination of the tariffs, credit availability, and other factors makes that a more remote possibility.

BYD Is Slow-Rolling Its Hungarian Factory Plans

The European Union is an interesting case of how the best-laid plans gang aft agley, as Robert Burns once wrote. The EU has been concerned about Chinese automakers dumping cheap EVs on Europe and risking local manufacturing, so it passed a number of tariffs on Chinese-built cars. The initial response from the Chinese government was to encourage Chinese automakers to build in EU countries that voted against the tariffs (really, in favor of China).

This shouldn’t have been an issue for the BYD plant planned for Hungary, as Hungarian Prime Minister Viktor Orbán has long been perceived as friendly to both Russia and China. Welp, so much for that. Reuters is reporting that China wants to punish all of the EU, even friendly countries, by shifting more production to Turkey:

China’s BYD will delay mass production at its new electric vehicle factory in Hungary until 2026 and will run the plant at below capacity for at least the first two years, two sources familiar with the matter said.

At the same time, China’s No. 1 automaker will start making cars earlier than expected at a new plant in Turkey where labour costs are lower, and will vastly exceed its announced production plans, one of the sources said.

Shifting production away from Hungary in favour of Turkey would be a setback for the European Union, which has been hoping that its tariffs on EVs made in China would bring in Chinese investments and well-paid manufacturing jobs.

Turkey is interesting because, while not in the EU (it’s had an application for EU membership held up indefinitely by concerns over governance and human rights issues), the two have a strong trade agreement that generally allows cars built in Turkey to be sold without tariffs in the EU.

Will this cause a change in the arrangement? Either way, it’s a big loss for Hungary and the EU.

Ferrari Chairman Wants Europe To Support A Tiny Electric Car

John Elkann is an interesting cat. The grandson of the great Italian industrialist Gianni Agnelli, he was tapped from an early age to eventually be a large part of the company. This was supposed to be later in life, but the unfortunate early passing of Giovanni Agnelli and the death of his uncle Umberto Agnelli meant that John had to take over his grandpa’s parent company, Exor, at a young age.

He was smart enough to see the potential in Fiat CEO Sergio Marchionne, and the two of them turned the automaker around. All of this, as you all know, eventually led to Elkann’s company sitting over both Fiat and Chrysler, as well as Opel and Ferrari. This is why I can do the funny subhead above.

Manager Magazin was on hand for a McKinsey-run summit called the “Stuttgart Dialogue” (my least favorite John le Carré book), and caught this interesting idea from Elkann:

In perfect English, the Italian delivers a fiery speech to entrepreneurs, multi-supervisory board members, and CEOs on this July evening at the Stuttgart Art Museum. China, he analyzes, will produce more cars by 2025 than Europe and the USA combined. In Europe, however, politicians’ focus on electromobility has entire industry segments on their conscience. In 2019, before the coronavirus pandemic, there were 49 small car models on the market for under €15,000. And today? “One model left. One.”

His message is clear: whoever loses the base gives up.

His proposed solution: “Smart electric cars, also enabled by more liberal regulation.” He envisions lightweight subcompacts, no more than 3.4 meters long, fuel-efficient, and, above all, supported by tax incentives. Unrealistic? “We’ve done it before,” he recalls the 1970s and the Fiat Panda and the Opel Corsa. “This isn’t a nostalgic dream.”

That’s an interesting thought, and, wouldn’t you know, Stellantis happens to have a perfect option in the form of the European-produced Leapmotor mini EV. Elkann may have had that in mind, but I’d also bet all the money in my pocket versus all the money in his pocket (he has more) that he’s also hoping to get EU support for a new tax class/regulatory class that allows him to produce a bunch of super low cost Fiats, Opels, et cetera from other Stellantis-owned companies as well.

GM Lost $1.1 Billion From Tariffs In The Second Quarter

While Stellantis posted a loss so far this year, General Motors is still profitable. How profitable? The company made about $1.9 billion of net income, which is down a bunch from the $2.9 billion it made in Q2 last year.

The difference? According to GM, it sure looks like the tariffs hit hard, representing a $1.1 billion net impact, due probably in no small part to the fact that General Motors makes a lot of vehicles in Mexico. It’s rectifying that, but not fast enough to be able to fully offset the tariffs.

Is there something for GM to look forward to? From CEO Mary Barra’s investor letter, there was this:

We will continue to drive improved overall profitability and focus on EV profitability improvement to generate ongoing strong free cash flow. In addition, we will continue to drive American innovation in batteries, autonomous technology and software.

I believe everything we’re doing strategically and proactively, along with closer alignment of emissions rules with consumer demand, will further differentiate us from our competitors, increase our resilience, and help us emerge from this transition period even stronger and more profitable than before.

The bolded bit (by me) is a funny way of saying that the end of CAFE penalties will help GM because GM builds a lot of trucks.

What I’m Listening To While Writing TMD

My wife was humming Paula Abdul this morning, and it wasn’t “Opposites Attract,” but I loved this video. Both because Paula Abdul was very cute, and also, the choreography with an animated rapping cat is incredible.

The Big Question

What should a small EV for Europe look like? How big? How much range?

Top photo: NY Fed, Nissan

Forgiveness should apply to the interest, not the principal. The interest is already tax deductible, and this is because Congress already knows it’s wrong. Well, wrong is wrong, forgive the interest.

Principal, on the other hand, should have to be repaid. You took a loan, you had mandatory counseling for it in which you stated you will pay it back, no ifs ands or buts, so pay it back.

I honestly don’t see why student loan forgiveness was ever a thing.

I wish we lived in a better timeline.

I’m not a fan of student loan subsidies and guarantees, they just make college more expensive and create a gross, inefficient “how much does it cost, how much can you borrow” culture in higher education.

But anyone mad about student loan forgiveness should be a lot more mad about the Paycheck Protection Program loan forgiveness scam that cost taxpayers at least $800 billion to give welfare to corrupt wealthy con artists. Beyond the direct theft from taxpayers it has massively distorted the economy putting every asset class in a bubble.

Sorry you borrow money expect to pay it back. Don’t expect people who didn’t have the luxury of going to college or couldn’t get loans for tech school to bail you out. And whining about I knew I owed $100,000 in student loans for a French Poetry degree that had no chance to get a job and my parents allowed me to move back into the house so I live for free I should be able to buy a car and expect everyone else to pay my bills

You can’t expect a child to know the consequences of drinking hydrochloric acid. They haven’t had enough experience in the world or enough guidance from adults to understand it’s dangerous.

You can’t expect a teenager to know the consequences of predatory loans. They haven’t had enough experience in the world and don’t understand the depth of guidance from adults to understand it’s dangerous.

Most people don’t even comprehend finances enough to stay on top of them until they’re in their thirties, because functionally to them it’s just “money come in, money go out” for everything. Throughout their teenage years and throughout their twenties they literally have not lived long enough to understand the flow of time itself, and how long twenty more years actually is.

And that’s not even getting into how the NCAA and other organizations have made colleges more into corporations than institutions. And we all know the only purpose of a corporation’s existence is assurance of capital accrual.

This points to the need for basic financial education in K-12 education.

Ah, but you see if the system did that people would understand that they’re being screwed. Education’s purpose in the U.S. is no longer about empowering people. It’s returned back to being a tool to prepare future workers for a life of low labour. Those who finished their education before 2015 may be the last people this wasn’t true for.

“You can’t expect a child to know the consequences of drinking hydrochloric acid”

I’d say this definitely applies to…

1978fiatspyderfan

All comments are total gibberish nonsense

Ah yes, it’s definitely the student’s fault for tuition to have gone up 2000% vs the standard rate of inflation and for major employers to require a bachelor’s degree to simply take phone calls.

Let’s not talk about the elephant in the room that financially preventing people from obtaining higher education is how the wealthy stay wealthy. You want your kids or grandkids to be doctors? Sorry, You can’t afford it!

This is how societies collapse, the devaluing of education. You should be more upset that these educational institutions that are generally funded with your own tax dollars still have the gall to charge anyone more than a few dollars in tuition.

Tell that to all the businesses that got a bailout because they couldn’t pay their debts. Tell that to the “President” that has declared bankruptcy 6 times because he never paid his debts. It’s amazing how a certain group of people get so mad at students for loan forgiveness while not batting an eye when billionaires and mega corps do it all. the. time.