Cars are a necessity for many, as public transit is insufficient or inconvenient to get to work across most of the country. Cars are also expensive, which means financing is required by most to purchase even a used vehicle. A long pause in student loan repayments and delinquency reporting led to a period of elevated credit scores that fundamentally shifted the way car loans operated. That pause is over, and now certain carbuyers and lenders are in a tough spot.

The interconnectedness of the world can create moments of bliss, as when anyone with an Internet connection gets to enjoy the schadenfreude of watching a tech CEO enjoy a Coldplay concert a little too much. Or it can create moments of conflict, like in the EU, where its own tariff concerns are leading one Chinese manufacturer to walk back its plans.

This runs somewhat counter to what Ferrari Chairman John Agnelli wants, which is an affordable small electric car plan for Europe. None of that is GM’s concern, as GM got out of Europe years ago, but the brand invested heavily in Mexico and is now paying the price for that.

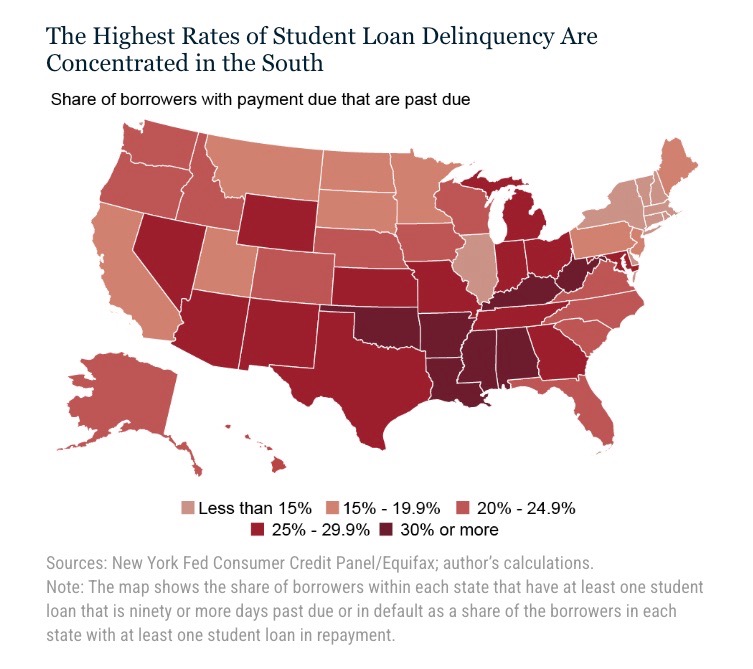

In One Night, 30% Of Young Borrowers Saw A 100-Point Credit Decline

If you’ll give me a second here, I’m going to moralize about the act of moralization. Politics, at its best, organizes society to improve everyone’s lives in spite of special interests. At its worst, it does basically the opposite and prioritizes outcomes for the few at the expense of the many. Historically, in the United States, it’s a constant conflict between the two.

Someone is always getting money and, often, someone is having that money taken away. There’s no true equivalent to Effective Altruism in governance, whereby the action taken is only determined by the most effective outcome and not feelings. Effective Altruism was always kind of silly, and feelings are important because that’s what motivates us to take action in the first place.

Student loan foregiveness/forbearance is one of these issues that always raises issues of fairness, morality, and efficiency. Everyone seems to agree that it’s good to give those who serve in the military a free or discounted education, but that’s basically where those agreements end. Should loans be forgiven for people who went to a college, only to see that college lose its accreditation? What if the college was a scam? What if the person took out loans to become a social worker and makes very little money? What if that person took loans to go into finance and now makes a ton of money?

I am not going to answer these questions for you, though I will point out that I’m uniquely impacted by college loan forgiveness because I paid off the last of my college loans in 2020. This means that I forked over the full value of my loans and got none of the advantages anyone got during the pandemic. Does this bother me? Absolutely not. On a personal level, I think paying for people to go to college (or a trade school/community college) is something we should do as a society.

Also, it’s probably good for the economy if we do it. Unlike handing out checks to people, which is inflationary, the slow drip of forgiving college loans is probably not, according to a report from the Roosevelt Institute. Even better, a paper from the National Bureau of Economic Research shows that there are a ton of positive impacts:

Putting all the findings together, it seems that the debt relief results in a multiplier slightly above one, because a debt relief shock of $7,400 translates into $4,600 lower indebtedness, a $3,000 increase in income and a $1,000 decline in delinquency amount.

That income comes, primarily, from job holders having the ability to switch to a better-paying career or position.

Back in 2020, as the pandemic was in full swing, holders of federal student loans were given a break. Here’s how the New York Fed describes the program and the impact of taking away delinquency reporting:

Payments on federal student loans were paused for forty-three months, beginning at the start of the pandemic in 2020 and lasting through September 2023. During this time, the delinquency rate on student loans fell to less than 1 percent. After the resumption of payments, a one-year on-ramp was instituted which prevented negative remarks of missed payments from being reported to credit bureaus. That on-ramp expired in October 2024 and delinquencies began appearing on credit reports during the first quarter of 2025.

This hits all forms of borrowing, whether for a home or a car, but it hits auto loans in a big way as many borrowers finance a car and not a home. Cox Automotive talked to Shams Blanc from credit rating agency FICO, who provides some interesting data points:

When federal forbearance officially ended in October 2024 and delinquency reporting resumed, the scoreboard caught up with reality. Approximately two million auto-loan borrowers had a student-loan delinquency added to their credit file in Q1 2025. One in five of these consumers saw their score drop by 100 points or more overnight. Among 18-29-year-olds, nearly 30% experienced that same 100-point decline.

Scores didn’t make these consumers riskier – they revealed risk that had been hidden for several years. The result: a sharp rise in the subprime mix of the current loan portfolio. The share of auto borrowers with scores below 620 climbed nearly a full percentage point in one quarter, reversing much of the credit ‘lift’ observed during the payment pause – a period that temporarily boosted average scores by sidelining many riskier borrowers.”

Does this mean we should freak out? Not really. Looking at the pure numbers, auto loan delinquency rates actually among subprime buyers improved during the period, but this is somewhat of a “mirage” because of the huge shift of buyers into the subprime category who weren’t there before (and probably should have been).

There’s no unscrambling that egg, and severe delinquencies are up over the last three years. However, loans have been in forbearance during much of that time, so the bigger issue is likely the huge increase in the cost of cars. It’s all connected, however, and there is a risk that this will topple people who are still upside down on their daily drivers.

The slight upside here is that lenders will have a clearer picture of the creditworthiness of buyers. The major downside is that this will likely further diminish affordability, especially in the used car space where these buyers tend to transact. Here’s how Cox Automotive puts it:

For consumers with student loans and dropping credit tiers, it means affordability is declining. A tier decline in credit score can result in a higher interest rate on auto loans by almost 300 basis points for a 1-tier drop and more than 600 basis points for a 2-tier drop. That is a significant shift.

[…]

We do not expect credit availability to improve in the near term, which will likely mean that rates will remain high and about where they have been, at least for the next six months. Tight credit and high rates will keep demand limited.

Coming into the year, I was hopeful that we’d see a continued return to affordability. The combination of the tariffs, credit availability, and other factors makes that a more remote possibility.

BYD Is Slow-Rolling Its Hungarian Factory Plans

The European Union is an interesting case of how the best-laid plans gang aft agley, as Robert Burns once wrote. The EU has been concerned about Chinese automakers dumping cheap EVs on Europe and risking local manufacturing, so it passed a number of tariffs on Chinese-built cars. The initial response from the Chinese government was to encourage Chinese automakers to build in EU countries that voted against the tariffs (really, in favor of China).

This shouldn’t have been an issue for the BYD plant planned for Hungary, as Hungarian Prime Minister Viktor Orbán has long been perceived as friendly to both Russia and China. Welp, so much for that. Reuters is reporting that China wants to punish all of the EU, even friendly countries, by shifting more production to Turkey:

China’s BYD will delay mass production at its new electric vehicle factory in Hungary until 2026 and will run the plant at below capacity for at least the first two years, two sources familiar with the matter said.

At the same time, China’s No. 1 automaker will start making cars earlier than expected at a new plant in Turkey where labour costs are lower, and will vastly exceed its announced production plans, one of the sources said.

Shifting production away from Hungary in favour of Turkey would be a setback for the European Union, which has been hoping that its tariffs on EVs made in China would bring in Chinese investments and well-paid manufacturing jobs.

Turkey is interesting because, while not in the EU (it’s had an application for EU membership held up indefinitely by concerns over governance and human rights issues), the two have a strong trade agreement that generally allows cars built in Turkey to be sold without tariffs in the EU.

Will this cause a change in the arrangement? Either way, it’s a big loss for Hungary and the EU.

Ferrari Chairman Wants Europe To Support A Tiny Electric Car

John Elkann is an interesting cat. The grandson of the great Italian industrialist Gianni Agnelli, he was tapped from an early age to eventually be a large part of the company. This was supposed to be later in life, but the unfortunate early passing of Giovanni Agnelli and the death of his uncle Umberto Agnelli meant that John had to take over his grandpa’s parent company, Exor, at a young age.

He was smart enough to see the potential in Fiat CEO Sergio Marchionne, and the two of them turned the automaker around. All of this, as you all know, eventually led to Elkann’s company sitting over both Fiat and Chrysler, as well as Opel and Ferrari. This is why I can do the funny subhead above.

Manager Magazin was on hand for a McKinsey-run summit called the “Stuttgart Dialogue” (my least favorite John le Carré book), and caught this interesting idea from Elkann:

In perfect English, the Italian delivers a fiery speech to entrepreneurs, multi-supervisory board members, and CEOs on this July evening at the Stuttgart Art Museum. China, he analyzes, will produce more cars by 2025 than Europe and the USA combined. In Europe, however, politicians’ focus on electromobility has entire industry segments on their conscience. In 2019, before the coronavirus pandemic, there were 49 small car models on the market for under €15,000. And today? “One model left. One.”

His message is clear: whoever loses the base gives up.

His proposed solution: “Smart electric cars, also enabled by more liberal regulation.” He envisions lightweight subcompacts, no more than 3.4 meters long, fuel-efficient, and, above all, supported by tax incentives. Unrealistic? “We’ve done it before,” he recalls the 1970s and the Fiat Panda and the Opel Corsa. “This isn’t a nostalgic dream.”

That’s an interesting thought, and, wouldn’t you know, Stellantis happens to have a perfect option in the form of the European-produced Leapmotor mini EV. Elkann may have had that in mind, but I’d also bet all the money in my pocket versus all the money in his pocket (he has more) that he’s also hoping to get EU support for a new tax class/regulatory class that allows him to produce a bunch of super low cost Fiats, Opels, et cetera from other Stellantis-owned companies as well.

GM Lost $1.1 Billion From Tariffs In The Second Quarter

While Stellantis posted a loss so far this year, General Motors is still profitable. How profitable? The company made about $1.9 billion of net income, which is down a bunch from the $2.9 billion it made in Q2 last year.

The difference? According to GM, it sure looks like the tariffs hit hard, representing a $1.1 billion net impact, due probably in no small part to the fact that General Motors makes a lot of vehicles in Mexico. It’s rectifying that, but not fast enough to be able to fully offset the tariffs.

Is there something for GM to look forward to? From CEO Mary Barra’s investor letter, there was this:

We will continue to drive improved overall profitability and focus on EV profitability improvement to generate ongoing strong free cash flow. In addition, we will continue to drive American innovation in batteries, autonomous technology and software.

I believe everything we’re doing strategically and proactively, along with closer alignment of emissions rules with consumer demand, will further differentiate us from our competitors, increase our resilience, and help us emerge from this transition period even stronger and more profitable than before.

The bolded bit (by me) is a funny way of saying that the end of CAFE penalties will help GM because GM builds a lot of trucks.

What I’m Listening To While Writing TMD

My wife was humming Paula Abdul this morning, and it wasn’t “Opposites Attract,” but I loved this video. Both because Paula Abdul was very cute, and also, the choreography with an animated rapping cat is incredible.

The Big Question

What should a small EV for Europe look like? How big? How much range?

Top photo: NY Fed, Nissan

“What should a small EV for Europe look like?”

It already exists and it looks like this:

https://en.wikipedia.org/wiki/Citro%C3%ABn_Ami_(electric_vehicle)

And for a small car that is highway capable, there is this:

https://en.wikipedia.org/wiki/Fiat_500e

As I understand it, Elkann was main the force behind pushing Mergio Sarchionne to merge FCA with some other automaker… creating the mess that is Stellantis.

So Elkann/Exor can go suck an egg.

The small cars he wants already exist. He’s just trying to scam government into paying for vehicle development costs.

Fuck him and his self-serving ideas. And fuck him for Dodge/Chrysler being starved of funds/product in favour of Fiat/Alfa/Maserati.

Kei cars for Europe 😀

Europe should just use the kei car formula. The engine displacement limit is moot since hybrid/electric shit is out now, and the 63 hp limit isn’t a real Japanese law, just a gentleman’s agreement which only Japanese companies are bound by anyway.

Europe already makes one kei car: the Caterham 7, with a Suzuki engine under the kei displacement limit, though it has 80 hp (which Japan said should remain unchanged since that’s how it’s sold in the UK)

When President Biden tried to do student loan forgiveness (and for a piddling $10K each), I was in favor even though I had long since paid off my substantial student loans. Why? Because all through the post 2008 period when interest rates were generally *insanely* low, Federal Student Loan borrowers were still getting screwed with rates double and more that of mortgage interest rates. Because, you see, CONGRESS sets Federal student loan interest rates. I am lucky enough to be old enough and went to school long enough ago that my rates were dirt cheap, but people like my housemate who got them just after I did literally had student loan rates 3X as high. And this for a loan that literally the only way you can get out of paying them back (typically) is by *dying*. And not even then if you have a cosigner. This should be the cheapest money you can ever borrow. The Feds *owe* these people a rebate, IMHO.

But for sure the insane cost of higher ed today is a problem too. I spend much of my working life in universities, and it is absolutely insane how different the environments are today than when I started college going on 40 years ago. Every dorm room I lived in for both undergrad and grad school was basically a concrete prison cell with no bars on the doors and windows, and with food best described as “slop”. I see how the kids live today and my jaw drops. But all those amenities come at a HUGE cost. On the academic side, the most tech I had in a classroom was an overhead projector, but a lot of classrooms today look like the bridge of the Starship Enterprise, and everything related to your education goes through a massively expensive back-end computer system (support of which pays a good chunk of my salary, so thanks…). My project next week is a routine IT hardware refresh for a small community college in North Carolina. It’s a roughly half-million dollar project for just the hardware and my time. And then hundreds of thousands in software licensing costs JUST for the infrastructure to RUN all that stuff. And they will have to do it all over again in five years.

Not only should we encourage higher ed through lower rates, if anything, but high rates tend to equate to lender risk and, since the debt is not dischargeable in bankruptcy (I get it—everyone would just take that hit), then there is very little risk. It’s all part of the wide system of control and the slow whittling away of real world freedoms through forced dependency.

A federal student loan should be the cheapest money you can borrow. But it very much isn’t today, and that is just wrong, and a big reason why big student loans are such a burden for people.

Yes, I think it should all be 0%, maybe reverting to a bit more if the borrower doesn’t finish as an incentive to do so, but still nothing near the onerous rates it is today for everyone. Like everything, it seems backwards to common sense in the US, but it all makes sense when for the people is recognized as Orwellian double speak for: for the oligarchs.

I figure .5% above the Federal Funds Rate should be enough to cover the costs of the program, given the volumes involved.

For sure the little people matter less and less in the US of A. And yet we literally get what we vote for (or don’t bother to vote for, as the case may be). Kind of amazing, really.

I always vote. I don’t usually get what I want*, but that’s all I can do

*Except one time when I ended up wishing I had voted against legalizing marijuana, but as is always the case, my vote the other way wouldn’t have changed the outcome other than not cursing myself every time I’m behind obviously high drivers and smelling skunk everywhere I go.

It is literally all any of us can really do – even if there is that one guy on here who fancies himself some sort of political radical tilting at windmills. But so many people don’t. I really admire the Australian method of “vote, or pay a fine”. And they make it really, really easy to vote. Which of course would hurt one party here in the US far more than the other…

And almost by definition in closely divided 21st Century USA, half of us are always going to be at least somewhat disappointed. But that’s democracy for ya.

I didn’t vote in the first election I was eligible for because I hated both candidates. I still usually have to vote for the candidate I hate less, but I made a rule for myself that I can’t complain unless I vote and I love to complain. I also vote in local elections and I feel like that makes more of a difference. Being in an uppity blue town in a blue state, voting is really easy. I even went to a town hall meeting where I got the town to take over responsibility for the pond adjacent to our property that neighbors somehow felt we were responsible for when the beavers build dams that partially flood their yards. A permit to whack a beaver is $1500 each and even messing with their dams technically requires a permit. (And these suckers are serious engineers—they use Y-shaped sticks as buttress to hold lateral members that they kind of interlock. First time I went out there, I thought 5 minutes with a pickaxe. A couple hours later, I dragged myself up the driveway after making a hole they patched overnight. I even put a cheater in a small dam with a T on the intake side as the internet said they can’t figure out how to plug it. Drive past the next morning and the T end is raised out of the water like an exhibitionist Nessie. Put a 30 lbs rock on top of it with fiberglass stakes and bailing wire to hold it on top. Next morning—Nessie again. Looked for the rock assuming they just pulled it off the top, but it was nowhere within a 6′ radius. Anyway, the town uses a backhoe.)

Historically, in elections I have often found myself voting for the lesser evil. I *seriously* held my nose and voted for G. W. Bush twice because I thought he was the slightly better (really least worst) option, even though I thought he was a bit of an idiot (in hindsight, I wish I had voted for Gore). I campaigned for his father in college – my first college roommate was the President of the state chapter of the young Republicans. I still greatly respect Bush the Elder. Though since 2016 the Republican party has become so evil that I can’t even contemplate voting for them. I didn’t love Hillary Clinton – but Donald F’ing Trump??? The few Repblicans that I have any respect for have been run out of town on a rail, and none of them are in my state anyway. If it wouldn’t cost me a small fortune in taxes, I would change my residency back to Maine JUST so I can vote against Susan Collins, and I voted for her for *decades*. My views have not changed much, but politics in the US sure have.

Beavers are amazing creatures. Imagine if humans had that much innate understanding of engineering? Stop building houses in their territory, problem solved! 🙂

Mostly agree. I didn’t vote for anyone for the first GW election and I almost flipped a coin on the 2nd one to land on Kerry. I did like his father. I’m registered independent, but am a Democrat voter by default as, even though I don’t like them, the other ones are completely stupid, insane, and outright evil.

When this development was built, there were no beavers. I personally don’t have an issue with them and I like the ponds they made from a small canal and the wildlife that brings, but the human neighbors were a nuisance. (The coyotes and assorted snake neighbors we have are better than people even when they’re not a creepy dolt who took ayahuasca once and proclaimed himself a shaman before becoming part of/founding a cult like the guy at the end of the driveway.)

Sounds like you have FAR more interesting neighbors than I have. I just have a paranoid retired Miami cop and a couple who like to have a domestic disturbance inside their house every now and again. But I left plenty of jungle around my new house as insulation.

Of course, this being God’s Waiting Room, FL, of the 10 houses on my street, five occupants have died in the years I have lived here. GWR – they are always dying to get out.

Yeah, the shaman is interesting, if weird in a bad way. He’s somewhat notorious (hits on every married woman he runs into while he’s on his 3rd marriage and his wife lives with her ex husband half the week), so he’s good for conversation around town and a lot of people have a story about him. He’s it, though. I find the animals more interesting. Did you know turtles kiss (or something like it)? I came upon two snapping turtles doing that one day while the female was laying eggs. I had to look it up to confirm.

Huh, that’s interesting about the turtles. We have TONS of gopher tortoises here in my neighborhood, and they are pretty friendly critters because people feed them. And we have a giant egret that comes around every year who will come right into your house looking for a handout if you leave a door open. Has startled me in my garage a couple times.

Meet George:

https://photos.app.goo.gl/DFTrwsyyu7pThyjW8

That’s awesome! We have the smaller ones and great blue herons, but they want nothing to do with people. Love the noises they make.

College costs have been increasing at about twice the rate of inflation for decades. The net result is the value proposition is no longer there – sure, you end up with a degree that supposedly gives you higher earning potential for the rest of your life, but you’re starting out in a financial hole you may never did yourself out of.

I had a coworker that was marrying a gal with $200,000 in loans for a music degree. Her career path (if she stayed in her field) was basically limited to high school music teacher – not something known for high pay (or stability, as the arts are the first thing to go when budgets get tight). Between them, they were essentially going to have to pay off the equivalent of a mortgage before being able to actually buy a house.

Years ago you could work through school and graduate debt free. Those days are gone, and trade schools are getting more popular while traditional four year institutions are seeing declining enrollments.

It’s just part of the long term dummifying of America. Long term, society will suffer from it, but that’s a discussion for a different arena.

The value proposition is going to vary wildly depending on the choices you make (and I very much think it is wrong that we make 18yo’s make those choices). Very obviously, $200K for a music degree is idiotic unless you can get it for free or nearly so via scholarships or rich parents. But you don’t need to spend that much for a degree, and you can get a degree in something far more generally useful. Not having a degree at all slams a LOT of doors shut. You won’t get past the first post for most white collar jobs without one, as it’s a very easy way for HR to do an initial culling of applicants.

And as I have long told my high school dropout kid brother, I spent all that money and all those years in school so I don’t have to work outside in the hot sun all day. And because of all that physical work, he’s in rougher shape at 47 than I am at 56. “The trades” is a rough way to make a living.

It depends on the trade, but yes – almost none of them are “cushy office jobs”.

That said, I’ve got one kid (turning 30 this year) that went to a four year and majored in non-profit administration. The other (five years younger) went to a two year tech school for architecture design and building construction.

The younger one already owns a house.

I consider both of them to be successful at their chosen endeavors, but as you said, it’s all about choices.

You make your choices and take your chances, but the statistics still clearly show that on average you are better off with a degree. Your kid who already owns a house may be doing better NOW, but will he be in another 25-30 years? Fresh out of college I didn’t have two nickels to rub together for a decade – certainly in that time frame anybody in the trades would have been FAR better off than I was. But that guy doing framing or running wires would still be doing about the same today as back then, absent being one of the damned few who end up as an owner of the business (one in 20? one in 50?). I make well into six figures today at a relatively cushy job. And I still wonder sometimes – if I had gone to a better, more prestigious, but much more expensive law school would I have stayed with a career in law and ended up much better off than I am today?

You make your choices and take your chances, and I agree college isn’t for everyone. But neither are the trades, and I would argue far fewer people are suited for that work than for getting a general 4yr degree of some type. And many, many, many small businesses fail because the owner doesn’t have the education to understand how to run a business, including the one that my grandfather spent a small fortune setting my kid brother up in. And that was with me trying very hard to steer the dumbass in the right direction with it. But he “knew what he was doing”.

I’m lucky to be an Architect, which gets me out in the field enough that I am not entirely deskbound. Some physical effort is a good thing, hard labor not so much. It also reminds me of why getting student loans made sense for me ($20K left to go).

As an IT consultant working in datacenters sometimes, sort of the same. Nothing like a straight week of racking and cabling to make you think you did some honest work. But unlike the guys on my team who do nothing BUT that, NO THANK YOU as a full-time job at my age. I just help out on the really big jobs. But I travel all the time to work with clients onsite, which gets me out and about even if I am largely sitting at a different desk or conference table while onsite. At least I get to do OJ runs across airports regularly (grumble, grumble). And I suppose THAT reference dates me…

I have zero regrets about the $60K or so I borrowed (real money in the late ’80s/early ’90s), even though I never really worked in either field I have degrees in – accounting and law. Both teach you very fundamental skills and how the world works. But also glad I chose the schools I did – it could very easily have been $150K. I was especially mercenary about law school. That was the era when the ABA was trying very hard to make up for years of keeping non-white folk out of the profession, and many schools offered minority scholarships. I applied to the seven schools in the country with the highest scholarship awards, and ended up going to the school who made me the best offer. And it was pretty damned good. In-state tuition (pretty cheap at the time in IL, and much cheaper than in-state at U. Maine Law, which I would not have gotten into anyway) plus a $300/mo cash stipend. The essay I wrote about how I was disadvantaged as a minority was a creative work of art.

State schools often provide as good or a better education, as long as you are willing to deal with subpar back-office workings and seek out the strong/tough teachers. For me it was SUNY and then City College (NYC) – as a white male in an architecture program especially tailored towards minorities I was forced to work extra hard, but not being already disadvantaged, that only served to provide me with a better education.

I figure you get out of any school what you put into it. What gets me about the “fancy” schools is how often you pay all that money to take the classes, and so many of them are actually taught by TA’s, with the actual famous professor only putting in an appearance occasionally, as he is too busy doing research to actually teach. I got a very good education at all the state schools I attended.

My undergraduate education was “interesting”, in that I managed to attend three different U. Maine schools in my college career (for the locals – Farmington, Machias, and USM, graduated from Machias). The much larger and nominally more prestigious one, USM, I went to for a year had classes that were nowhere near as rigorous as the tiny campus I graduated from. You can’t sleep in class when there are only 10 students, but you sure can in a lecture hall with 200+…

“Affordability” is a tricky term. But easy credit makes the prices of everything from college to cars higher, not lower.

If government guaranteed/subsidized student loans went away and private student loans were properly dischargeable in bankruptcy, just like stupid private equity investments, then there would be no college loans and the cost of college would collapse and people would be able to start paying cash for it.

If less people can finance cars then they will get cheaper.

I don’t know how you think the cost of college would drop in that scenario. It’s not as if colleges (outside of the for profit scammers) are sitting on huge piles of money at the end of the year. The only way to make college cheaper is more government investment from states for state schools, or fewer college students and fewer colleges. The loan isn’t driving the cost of college, the divestment by states and the inflation in general and the inflation of services have driven the cost of college. If you want cheaper college for students, then that means lower standard of living and higher investment from taxes. This is a problem less of loans and more of baby boomers pulling the ladder up but insisting their kids go to college to be hired for any job.

The non-profit colleges often fleece people a lot harder than the for-profit ones, but they get to call it an endowment.

College is incredibly inefficient with a massive amount of unneeded staff, many administrative, buildings, and facilities that students are forced to pay for because when they ask the cost they are told “how much will the government loan you.”

Honestly, a lot of the for-profit colleges could serve a good need if they could only charge people the money they have on hand instead of rely on loans. $500 a semester would be reasonable for a Phoenix “degree.”

And the non-profit and state schools could be a lot more remote and online, like they proved during COVID, which would massively drop costs.

So interest rate increased by 60%? To like interest rate of nice 69%?

Or WTH is “basis point”? Was it not a tenth of percent (0.1%)?

.01

THanks!

Is just in this instance or every time I read about “basis points of interest” instead of number of percent?

A basis point is always 0.01 percentage points.

Interest rates sort of live in the realm of tiny decimal places, so “small” changes like from say 3.1 to 3.2 don’t seem like much to the general public. But to the people who understand the game, that increase is significant.

They speak of it in terms of a 10 basis point increase instead of a 0.1% increase.

The “weightier” number better encapsulates the significance of the rate change.

I genuinely feel sorry for generation Z. Compared to the last decade, private college tuition is $10k-$15k more per year, average cost of cars are $15k more, with far less selection on smaller affordable models (no more Ford Fiestas, Chevy Sonic, Kia Rio, etc), while average college graduate jobs are only paying $5k-10k more.

This is on top of higher costs through inflation, a higher unemployment rate that the general population (about 50% more, around 6% versus 4% for general population), increased competition with AI for entry level positions (e.g. data entry), and a higher interest rate environment (which further compounds housing issue, leads to more revolving credit, shadow credit)

Yeah, those kids have it tough.

Starter homes aren’t really a thing anymore either, what with private equity hoovering up the market for rentals and shitty zoning laws that make it hard to build smaller and less expensive houses.

Zoning laws etcetera for sure (also tax profiles and other elements that all favor larger, single-family homes), but also the fact that the profit margin is higher the larger the house. They make more money building a McMansion that takes six months to sell than a starter home which would be snapped up immediately. This is where you need government action, but that would assume a government which is a) competent and b) has our best interest in mind.

When everyone has a college degree, it’s the same as if no one does for wages. In theory, those with degrees should have significantly more training and be more productive, but income vs productivity charts show this hasn’t increased wages by a meaningful margin vs the cost of the degree (in generality).

If I could give a high school senior today advice, be a machinist, electrician, or plumber if you want to make serious income. By the time you’re 22 you’ll make more than I do in a year (10 year big 3 mechanical engineer).

Unlike handing out checks to people, which is inflationary, the slow drip of forgiving college loans is

What about the inflation of college tuition?

according to a report from the Roosevelt Institute.

There is no mention of “probably not” inflationary effects in that link. There IS however mention of action that could exacerbate the already inflated housing market even more:

Canceling student loan debt could help with economic opportunities by making other wealth-creating investments, such as homeownership, more feasible. Student debt has led to a 20 percent decline in homeownership among young adults. Cancellation could help reverse this trend.

Increasing the supply of buyers without increasing the supply of available housing is a inflation 101.

Even better, a paper from the National Bureau of Economic Research shows that there are a ton of positive impacts:

Sure for the borrowers. I’m sure we’d all see a ton of positive impacts in our personal lives if we could borrow a bunch of money and have someone else pay it back too.

So we should build more housing too.

From your own linked reports loan forgiveness would decrease delinquency across all borrowing accounts allowing lenders to re-lend to other borrowers, increase entrepreneurship and new business creation, decrease the unemployment rate, and increase the US GDP by up to $108B over the next 10 years.

All of these things are mildly inflationary just like increasing potential home buyers but I would gladly trade these productive inflation factors for what we are currently doing.

“So we should build more housing too.”

Yes, we should. But in places where people actually want to live that’s easier said than done.

“From your own linked reports loan forgiveness would decrease delinquency across all borrowing accounts allowing lenders to re-lend to other borrowers, increase entrepreneurship and new business creation, decrease the unemployment rate, and increase the US GDP by up to $108B over the next 10 years.”

It also creates a huge moral hazard in which lenders have no risk giving multi billion dollar loans to unemployed underwater basket weavers because Uncle Sam will cover their losses.

Why would Uncle Sam do that?

Because someone told Uncle Sam those wholly underwater basket weavers will be snapped up to be high earning employees or start taxpaying companies making baskets underwater.

And that’s likely just the appetizer for the shit buffet to come. In the second quarter they still would have had plenty of pre-tariff stock to sell. Third quarter will be worse.

I think they’re predicting $4.5 to $5 billion for the year. So yeah, much worse.

Good thing those foreigners are paying it. Uh, wait as sec…

The great thing about Europe is the public transportation. They have it, and can exploit it. Meaning, if you need to travel further than half of your battery can take you, it’s easy. In addition, they have great charging infrastructure already.

So, I think the Toecutter solution is probably the best solution (as long as it looks good, has he commented yet?)

Small car, smallish battery, aerodynamic. It’s already in their blood to drive something like this.

Re: GM. They also mentioned in the NYT article that they are basically immediately starting to double down an V8’s at the Tonawanda plant, at behest of their EV plants. In 10 years, when we are discussing this time, these vehicles are going to known as Trump turds. Why, cause they will be shit to the environment at a time when the world will have long forgotten that turd and gone back to wanting to breathe clean air. I feel there is only a small cadre of our US population (outside of work vehicles) that actually wants all those V8’s back as daily drivers.

In UK taking a train is faster than traveling by car because of roads and low speed limits.

From Liverpool to Bristol it was about 4 hour train ride vs 3 hour car ride

How can you continue that which doesn’t exist?

During the chips shortage automakers had the perfect opportunity to prioritize the production of base model vehicles (which have less features that rely on chips) in order to keep the production lines going and to give the people much more affordable new transportation options, while long term they could have their engineers and designers come up with chip-less retrofits for existing designs to further minimize the chips they need (like hand crank windows).

Instead they prioritized the production of the highest profit margin trims that relied the most on chips, so much so they even omitted certain features specific to the trims and said they’d add them back for “free” later which ended up being over $1000 for the “free” part.

Base trims are fairly often a complete bait and switch. Automakers offer a base trim with the features you want, but if you try to find one on dealer lots they’re nonexistent, if you try to order one best case you’re waiting 4 times as long to get it, and that’s if the dealership that places the order doesn’t sell it out from under you as soon as they get it, maybe you’ll be lucky enough that they just hold it for ransom and if you pay the ransom they’ll sell it to you.

For example: 80% of orders for the Ford Maverick were for XLs with the Hybrid Drivetrain, which made up 20% of production. The “standard” hybrid drivetrain never made up more than half of production ever, even though it made up 80% of orders. Call me old fashioned but if you have 2 drivetrain options, and one is standard, the standard one should make up more than half of production, not 20%. After several years of production XL Hybrids didn’t crack 50% of production, the order holders who waited years either got a different car, finally caved to the pressure to just buy a higher trim and or 2.0L Turbo Maverick, or just left the car market entirely.

Agree completely. The idea of any auto maker being motivated to sell “affordable” anything is sooo misplaced. No corporation wants to sell anything “affordable” if they can possibly avoid it. They have every motivation to maximize the margin on every dollar they spend, and the quickest means to that end is to sell products to people with money to spend (or borrow). The entire structure of corporations is designed to separate as much money from consumers as possible while spending as little as possible in the process.

They, chips in vehicles, are not organized as such. Sure, lying Ford and GM told customers they would install optional seat heaters that customers paid for later in their Lariat Denali Limited Platinum cosplay mobiles. But they didn’t even have enough chips for any engine computers. They literally installed PCMs/ECMs at the end of assembly line to drive them to parking lot and then removed them to move another crappy truck off of the assembly line.

Even base vehicles didn’t have enough chips to start the engines

If chip allocation was focused on the necessary things like PCMs/ECMs the limited chip supply would have went further. But no, every car needs electric windows, seats, sunroofs, tailgates, etc. they absolutely cannot be made with mechanical mechanisms that have no need for electricity, let alone chips, to work.

It was not a chip shortage either. Truck makers cancelled their chip orders first and then cried about delays after re-ordering them and called it a shortage

College tuition is too expensive but if someone chooses to take school loans that’s on them.I pay enough taxes already and have been to working overtime for the past 4 years to pay for both my kids tuition.Education should be free but it should be free for EVERYONE.If you choose a low income field expect to earn low wages.Paying for college tuition shouldn’t be looked at as punishment because people with college degrees still earn more money that people without a college education.If a janitor earned as much as a brain surgeon then that would be punishment.I agree with tuition costs being out of control but so is the cost of everything else.

Fully agreed. At the end of the day, student loan forgiveness is a massive handout to the wealthy, or soon-to-be wealthy. Yes, you absolutely can dig up sob stories to the contrary, but the statistics paint a rather different picture: college graduates, on aggregate will make roughly $1 million more in lifetime income than their high-school diploma counterparts. At every level of the economy pay is higher for degree holders than those without, and virtually all of the top sectors are closed to those without degrees, barring exceptional talents.

There is a much better solution to this mess: make student loan debt dischargeable in bankruptcy proceedings. That would force student loan lenders to actually start doing the same sort of due diligence literally every other lender already has to do. Right now the default risk on student loans is dramatically lower than any other type of loan, and it has dramatically skewed the price of college.

You’re missing the point. The entire justification behind student loan forgiveness is that you are investing in the population. Think about it: if that person with a degree is making $1m more on average over their lifetime than someone else without a degree, that person is also paying income tax on that extra $1m. If you figure that a third of that is paid to income tax, then it would’ve been well worth the fed investing $80k or whatever to pay off that person’s student loans.

Don’t make them think too hard.

But..but..what if a rich person I made up in my head sent their kid to college to get an Art History degree? The potential of that person I just made up somehow receiving a handout surely justifies saddling every other college student with a mountain of debt.

But the loans were already taken out, and the recipients already have the higher paying jobs.

If the federal government said “We want to invest in our citizens by subsidizing the cost of a 4 year degree for all students starting next fall, allowing more people to attend college”, that would make sense for the reasons you laid out.

But one-time forgiveness doesn’t help the next generation afford college, it doesn’t invest in anyone who hasn’t already received the entire benefit of their degree, and it does disproportionately help those with higher incomes, which is the opposite of progressive.

This should be implemented in tandem with loan forgiveness.

What is the payoff to the government for doing the forgiveness then? Again, those people already have a degree, presumably already have a job, etc.

This is the part of the argument that seems inseparable from “I have student loans and want them paid off” by proponents.

I completely agree that investment in the next generation and lowering the cost of a degree are worthy policy goals. I strongly question the value of paying off existing loans in tandem with the first goal, or possibly even as counterproductive to it as it invites backlash.

The point is that it’s a deferred method of paying for someone’s education up front. This theoretical policy of investing in education didn’t exist when myself and thousands of others took out their loans, so this is a way of leveling the playing field.

Those of us who have their degrees may have jobs, but that debt is still a monumental hindrance. In many cases, it’s keeping people from buying homes, cars, and other essentials and non-essentials.

That to me is a much different argument than:

“that person is also paying income tax on that extra $1m. If you figure that a third of that is paid to income tax, then it would’ve been well worth the fed investing $80k or whatever to pay off that person’s student loans.”

There are two arguments to be made here. I am completely agreeing with you that we should be paying for people’s college degrees from the very start. That’s what I am saying there.

I also believe that we should be forgiving existing loans, as those are a hindrance to the people who have them.

I’m with you on only the first one.

My mortgage payment, much like a student loan, is both a hinderance to the carefree life I’d prefer to live, and also a method where I can invest in my own financial future by borrowing money. I agreed to the terms of the loan with open eyes and a clear understanding of its tradeoffs.

Asking other taxpayers, especially those who on average are less affluent than a typical college grad, to subsidize a decision that I made that provides great financial benefits to me, is not something I can countenance morally.

but it’s not asking other taxpayers to subsidixe it. It’s debt owned by the government and if they write it off it will affect other taxpayers not one bit. taxes are there to take money out of the economy, not pay for the government to do things, as evidenced by the most recent spending bill.

Ultimately less revenue for the government means higher taxes, either now or in the future.

Somehow the same people who got really upset about student loan forgiveness are all about decreasing government revenues in every other way.

That is not a position I agree with either.

Student loans and mortgages are different beasts. No one was giving me a mortgage when I was a broke 19 year old with no job or prospects. They were more than happy to give that 19 year old a massive student loan, however. So eyes wide open, maybe, but the wisdom behind those eyes varies significantly. I appreciate the efforts of the last administration to work the forgiveness angle, but if we’re not having the conversation simultaneously about reforming the broken system then what are we even doing?

I agree with you insofar as reforming the system makes sense (see my posts above) but I do not agree with the idea of one-time forgiveness for current borrowers, especially given stats on who holds the majority of student debt.

I get that, but lots of us find ourselves working in industries like education that are useful and fulfilling, but not very lucrative. A bachelor’s degree in education cost the same as one in engineering at my university, so the burden hits different depending on what you study and then do with it.

George W Bush created the Public Service Loan Forgiveness program:

https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service/public-service-loan-forgiveness-application?os=v&ref=app

Yep, which was good but the program was totally broken until just a couple of years ago. Prior to that the application and verification process was ridiculous and hardly anyone could manage to qualify. Thankfully it’s much better now, hopefully the Dept. of Ed. doesn’t break it on their way out the door.

If you do not know a college student, then you cannot understand the pressure to take the loans and then more loans. The barrage of offers for “do you need more money (for school) are endless. You would have to have had some unusual upbringing to fend them off as a dumb college kid (and by definition college kids don’t know much about- that is why they are in college). The system really has become highly rigged against the college kids.

It was rigged 40 years ago when I was about to go to school. I could have cheerfully borrowed $30K+ per year to go to a private college. But thankfully, even 18yo me didn’t see the value in that vs. state schools at $10K/yr. I still ended up with a relative mountain of debt for the time after a combined eight years of undergrad and grad school, but it it could have been sooooo much worse if I had made different choices.

But on the other hand, I never whined about that mountain of debt either – I got to work and paid it off early. And lived my first few years out of school basically destitute, and on a tight budget for a decade or more after that. So I have SOME sympathy, but not a ton of it, for the plight of the participation trophy generations who seem to want it all, right damned now.

Honestly, I think that improvements and investments to lower tuition permanently need to be done first. Once that is complete (and I think it would be popular), then most would agree that we need to help those stuck in student loan hell.

Your math and logic (aka reality) are absolutely correct. I am in the same boat as Matt, I paid mine off in ~2019 or something. I had no issue with the debt foregiveness other than one thing, it was a one time deal. I would have rather they set up some sort of longer term thing. What that is, not sure. But the one time giveaway, I think, is perhaps the more painful thing to witness.

I was in favor of the forgiveness for the simple reason that for more than a decade, student loan borrowers were getting absolutely SCREWED on interest rates. When mortgage and car loan rates are <3%, there is no reason at all that non-dischargeable student loan debt should be double and more that. Congress set those rates. The rate on a student loan should be no higher than needed to cover the minimal servicing costs of the loan.

But then again, we live in the land of for-profit healthcare, so good luck with that.

Why do people not refinance (genuine question)?

The day I finished grad school, I was in a terrible position: $70K in student loans and both credit cards maxed out. My first job earned me $43K (in NYC, in 2017!!!), and I was still able to refinance and drop my interest rate by about 2 percent. That allowed me to stay afloat for the first year or two out of school.

Sure, I was unable to take advantage of any of the other Federal loan advantages, but as they mostly seem to consist of kicking the can down the road or digging the hole deeper at no immediate cost, I considered that an advantage. I was 100% certain that forgiveness would not happen.

You need to be able to qualify to refinance with a private lender to be able to do that, and many (probably most today) people can’t. And even 2% less is still kind of a screwing. For comparison, my refinance interest rate was 2.65% back in the early 2000s, after the paying on time for X years discount that was offered. Still a Federally-backed loan, so not dischargeable, but via a private entity. I paid it off in about 20 years, but at that interest rate I wasn’t in that much of a hurry.

If you are REALLY in debt, the straight Fed loans sometimes do have advantages, like the income-based repayment where the balance goes away after 25 years. Friend of mine got out of a couple of hundred thousand that way – he never earned enough to where the payment even covered the interest, so the principal just ballooned over time. Biden actually did manage to get that program fixed, it evidently was horribly broken for many years, and people were not getting loans forgiven that should have been.

That’s why I gave my example, because my credit was not impressive at the time (no real credit history, my score was low 600s) and they still got me down to 4.38% in late 2019. But I guess a lot of people are way below 600.

My brother opted for income-based and 25-year forgiveness, but he tells me he will be on the hook for like $50-60K in additional income tax the year balance goes away (unconfirmed). I think he would have been better off refinancing and paying it off, especially if the government does another rug pull.

No, I am not missing the point- I am fully aware it’s an “investment in the population.” But many things are an investment in the population, and many of them are either outright bad investments or money better spent elsewhere.

That $1 million figure may be an average value, but it is not at all evenly distributed. Many college degree holders will never use their degrees for any economically useful purpose, but still have large loan debts. These are bad investments for the government to be paying off. Many college degree holders will use their degrees for economically valuable purposes and be capable of paying off the loans themselves without difficulty. This may be a more financially sound investment, but coming from the same crowd chanting “tax the rich” it’s kind of funny to hear.

Finally, you are left with the people who either already paid off their loans, or chose less expensive colleges (or no college at all) and are thus getting no benefit whatsoever from this program. And yet they have economic contributions too- why are you not investing in them?

Citation needed. And at the end of the day, to any employer, someone with an Art History degree is still going to be a better option than someone with no degree at all. I’ve been on the hiring side many times, and we don’t care what someone’s degree is in unless it’s a highly specialized role. Someone with an Art History degree and a decent resume is much more appealing than someone with a Business degree who hasn’t done anything else.

The entire article you’re commenting under is talking about how this loan debt is prohibiting people from making large essential purchases.

They benefit from living in a society with a better-educated, working populace.

Two seconds of searching- stop being helpless.

Depends entirely on the role. If I’m hiring a mining safety officer, I probably do not give a single fuck that they can explain the various movements of Renaissance sculpting, and considerably more fucks about what they know about carbon monoxide poisoning, emergency evacuation procedures, and seismic stability analysis.

What? A better resume is a better resume? You don’t say… The only differences is when I hire I don’t care about degrees at all if the role doesn’t require one.

That’s an argument against predatory student loan practices (with which I agree entirely!), not an argument for forgiveness. You do not create net value by extending further credit to someone already stretched by existing credit, we had a large crisis some years back brought on by exactly this practice.

They pay more taxes to subsidize their own competition in the work force while incentivizing inefficiency and administrative overhead. Some benefit.

VERY much agree with this. It really matters not what your degree is in other than in very specialized fields, but the fact that you have one shows that you managed to accomplish something, and hopefully “learned how to learn” along the way.

I have degrees in accounting and law, and the only use I put either of them to was a couple year stint as a seasonal paid tax preparer as a second job right out of school. But I don’t regret a single penny of the small fortune I spent to get them.

What is an economically valuable purpose? If we only gave degrees for “economically valuable” jobs then there goes the entire humanities and everyone goes into engineering and finance. I don’t want to live in a world where everyone with a college degree is in business or engineering.

Nonsense- there is plenty of economic value in arts and the humanities. Always has been. People like beauty, whatever it’s form, and there is plenty of value in creative endevours.

Unfortunately, modern liberal arts curricula seem to be rather more adept at producing critics rather than creatives, which where a substantial portion of the value is lost.

Damn right – we need a well rounded society.

Student loan forgiveness isn’t going to raise your taxes one red cent. That’s not how the government uses money. It will essentially be free economic stimulus.

EV for Europe? What about a .75 scale Slate?

Oh man now that would be small. I like the way you think! I think even the full scale Slate will do well over there if/when it makes it across the pond.

I think Europe getting interested might be the only path to success for Slate without the EV credits.

Yeah we’ll see, even with the higher price, I think I am still in for it, and there really isn’t another EV in the price bracket, and I have zero interest in a maverick or similar, so we’ll see. But yeah Europe would be a huge help for them and I hope they planned for that from the get go and that it will be certified for sales there.

I am looking at preowned long range model 3s in the 20k range. 70k-ish miles. The Musk connection is a major bummer, but that is a LOT of car for that amount of money. I think it would be hard to consider a new Slate for more.

Yeah, I know they are very different, and I am likely the only one cross shopping them, but I have zero interest in a Tesla, no desire to own a Bolt, or a Leaf, or any of those. I want an EV, but it has to be both cheap, and unique in some way, so I have been looking primarily at the Mini E and the 500e, this fits in with them being more expensive than they probably should be, having less range than most would be willing to accept, but also being quirky and fun.

In that vein, the Slate new is supposedly going to be around the same price, and the Slate is both more fun with the infinite customization, and more practical. So it is the frontrunner to me, but I also have no need of another car anytime soon so we’ll see if I follow through. I might be one of those douche nozzles who buys the car and immediately drives it to carmax because they offer more than MSRP for it.

Personally, I would rather have a Slate Station Wagon than a Model 3 of any kind – but that’s just me. I want a car with personality and as few features as possible, beyond power windows and locks.

I sometimes drive a friend’s Model 3 and I swear it makes me a terrible driver. Part of it being that no one can see me inside of it, which obviously applies to nearly all new vehicles.

That’s MC ScatCat to you sir

It turns out, if you mess with people’s ability to borrow, they will stop borrowing. In an economy that needs borrowing to survive, kind of a foolish own goal.

Fun fact – it isn’t just the citizens that need to borrow, it’s also the government. And those that lend money to governments are looking at the US and starting to think “eh, maybe not”.

There’s your foolish own goal.

An education system that requires predatory lending to function is fundamentally broken.

People often refer to “the trades” as though they are distinct from social work, nursing, or other vital social services. There is a lot more support for subsidising those traditional trades than there is for the less traditional careers. The difference is that “the trades” provide labor to the wealthy, while people who study social work or public health benefit people with fewer resources.

But this is to be expected when half of the country openly hates the concept of learning. Largely because any education quickly shows them how wrong they are.

I assume there is some insanely simple and outrageously bigoted sick fantasy logic behind right’s attitude which goes something like: Brown people do the labor, which doesn’t require social education, while white people celebrate their superiority. Browns take loans, while whites get preferential grants and scholarships from their local church.

And those brown people who support the right? Pure suckers. The majority of their party, in reality thinks, they are less than, but are delighted to have their helpful idiot support.

I could go on and on, but promised David I would refrain from such.

The majority of my close family have been teachers for most of their careers and have a couple of thoughts on the subject.

Conservatives claim that education has an anti-conservative bias, and they are right because knowledge has an anti-conservative bias.

Excellent post! Thank you.

Fascinating take on concepts I’ve had feelings about but hadn’t fully formed yet. Cheers.

As a European who moved here in the 1990s, I can only second everything you say. From the day I got here, I have acknowledged that I am a) coasting on a European education b) benefitting from systemic racism in getting a green card by simply requesting one, and not being in any way hindered by having an unpronouncable name. The response from White Americans is nearly always super defensive, I have even repeatedly been called a racist for mentioning that I derive huge benefits simply for being white.

This has changed over the last few years, as many people no longer get defensive about racism but consider it just and right.

The pause in loan payments during the pandemic allowed my wife and I to finally save enough for a down payment on our first house which we purchased in ’21. Then, I was able to complete the Public Service Loan Forgiveness process in December ’24 a mere weeks before the Cheeto took back over and blew it all up! That stuff was life changing for me. Thanks Grandpa Joe!

The pause also helped us save enough for a down payment on our house. After closing on the house, that monthly savings from the federal forbearance just went into paying down the predatory private loans my wife took out in order to afford college.

Public Service Loan Forgiveness – isn’t that still relatively intact? I had thought it was the income based repayment plans that were blown up, like SAVE. PSLF is still around because it is harder to blow up due to it being a program specifically created by Congress vs something created by a Department like the income based repayment plans.

PSLF is still intact, exactly because of what you said; it’s written into law by congress. Not that something like that hasn’t prevent Trump from trying to get rid of it though (cough, cough, department of education, cough, cough). My last statement is why I would be sympathetic to someone feeling a great sense of relief they were able to successfully complete their PSLF before Trump took office.

I believe it is still around, although I know things like certifying your employment etc. has gotten tricky in some cases. Thankfully I don’t have to pay attention to the news on that as much as I used to since I miraculously reached the finish line. It’s life changing. Prior to that I would make payments every month and not see much change in my balance, I would have been paying those loans for the rest of my life. Fixing PSLF was a huge win by the last administration even if most of their other forgiveness efforts ultimately fell flat.

You are the living embodiment of why student loan forgiveness is beneficial to society. “Life changing”, and I’m guessing for the better.

But for some reason we live in a world where people are okay with suffering as long as “the others” are suffering more.

“Historically, in the United States, it’s a constant conflict between the two.”

Look. I understand the Autopian wants to keep calm and carry on, but sane washing is a disservice. There is nothing Normal about T2, and any glossing over that is effectively complicit.

“One day, two con-men visit the emperor’s capital. Posing as weavers, they offer to supply him with magnificent clothes that are invisible to those who are either incompetent or stupid.”

https://en.wikipedia.org/wiki/The_Emperor's_New_Clothes

I’m not sure how germane it is to the current discussion, but it should be clear that my personal view is that the “doing things for the good of all” side of American history is getting its ass-kicked.

Well, yes. Happily, we don’t elect officials in America to do good for all, we elect them to do good for Americans, and by that measure sanity is being restored.

Rising tides lift all boats, not just in your harbor.

The saying is not actually true- rising tides in one place require falling tides in another, so unless you have put all of your boats in your harbor, they are not all being lifted.

You can see this for your own eyes driving through former factory towns in the rust belt.

I was speaking more macroscopically, versus micro. I live in a city that was once the brass capital of the world, not so much anymore. So, I can understand your point. But, your point was “America” first over the world, not Waterbury, CT within the US.

Our wealth drives economies around the world. Becoming an “America first” country will have hurt us collectively as humans more than the benefit of helping only Americans, IMHO.

I personally vote for who will help the most people, not just me.

Melting glaciers lift all boats, and seaside housing.

Better get rid of NOAA funding, lest the public start believing in science.

See, we’re not even arguing about the nature of things, just the degree. You say “America first” will be a collective harm, and I would disagree- the very same mechanisms that allow American wealth to drive foreign economies dictate that increasing that wealth will increase foreign wealth as well.

Becoming an “America First” country will hurt us.

What has made us a wealthy country is our involvement and influence with other countries around the world. But no one wants to do business with a petty, self absorbed, bullying, US. Much less one where masked goons attack immigrants.

Its incredible that instead of embracing the growing and resource heavy countries in South America and Africa, we are effectively forcing them into China’s trade embrace.

I suspect the views of staff and 99% readership alines with that. The way you phrased it, made it seem like it is a part of historical normal change in the US. It is not hyperbole to recognize that we are in uncharted territory for the country, and we should all try to restore reason.

We all do better when we all do better.

But a shadowy cabal of unelected officials running the country in the name of democracy somehow was normal? Lol, lmao even.

I think your myth is very appropriate, just perhaps not in the way you intended. When even the NYT is having to admit that perhaps the emperor was naked the whole time, oopsie.

You mean the Supreme Court?

They may be a cabal, but they are rather exposed to be shadowy. Also ostensibly accountable to elected officials via congressional impeachment. Court clerks would be more appropriate.

They aren’t “sanewashing” anything (and this term is way overused and misused these days). If you read between the lines just a bit it’s not too hard to see that most if not all of the staff and leadership here probably agree with you and share most of your values and feelings on T2. They’ve made many objective criticisms of the new policies that directly impact the auto market. Blistering takedowns of the Trump Administration are not the primary focus of this auto blog, and that’s okay. If you want political rants masquerading as auto journalism, Jalopnik is over there. I don’t know about you, but I get more than my fill of dedicated political news in other areas. I don’t need it here and frankly it’s refreshing to go without it.

I absolutely abhor that it is inescapable that our government is in chaos, almost as much as, the regret if ” I didn’t speak out when they came for”. It’s only when the topic is brought up, and especially when done in a manner that trivializes that I can’t be silent.

I had converted all my loans to private ones with Earnest to get my interest rates way down prior to the pandemic, so no relief for me, but I’m glad others got it. I paid mine off completely in 2022 when I was shopping for a new house and realized paying those off resulted in a better position to accept a higher monthly payment than putting the same amount of money into the down payment on the new house.

When I hear about people who have been paying student loans for 20+ years and barely made a dent the system feels very broken. Yes I know most probably opted for an interest only option, but the cost of education has gotten so high and salaries haven’t kept up to justify it.

I saw on the NY Times the other day how a lot of states changes their main source of income or employment from other areas to healthcare after covid. Insurance premiums are higher, the amount of money you have to pay for a small issue after the insurance “pays” a big portion of it… add student loans, inflation, etc, its getting very expensive to live in this country.

I think the Renault 5 looks pretty good so think like that, but may not be small enough for some Europeans.

As for the student loan thing, I’m old enough to have seen tuitions and health costs go from a manageable expense for middle income families to omg this will cripple an individual financially, potentially leading to bankruptcy. The system is definitely broken, not sure how to fix it but doesn’t seem to be getting better.

We punish those who want a higher education to become a greater contributor to America’s GDP by earning more, spending more, and contributing more tax revenue.

We take away health care to make the workforce less healthy and less productive to the GDP.

Yeah, America is the envy of the world.

We are winning BIGLY! You stupid people don’t even understand a thing. /s

We’re the only developed country I’m aware of that actively punishes you for trying to become a more productive citizen. My only guess as to why is because they ultimately just want a country of cheap labor so they can do Industrial Revolution 2.0.

Right? Benefits society, which also increases taxes paid to government.

It’s like, because of my college degree, I was able to get a decent-paying job, which means income taxes for the feds, a house, which means more taxes for the feds, cars, etc. etc. etc.

But how about fuck you?

but you forget the part where if you make even more money and move it around the right way, you pay nearly zero taxes, and that group doesnt want any more poors joining in on that party, so they must pay for school! /s

Has there been a study on the dollar cost-benefit ratio of this?

If the cynics are to be believed, the elements of the “real economy” don’t matter that much anymore, not as long as we’re all just feeding AI through ChatGPT, Linkedin, Facebook, Twitter, and the rest. In the book I’m reading now, that’s the general premise — the old guard is irrelevant, now it’s all about harvesting AI to enrich the technocrats or oligarchs or hegemons (gotta catch em all!). The 99% no longer really matter, we’re just keeping up appearances.

More practically speaking, our overall tax rate needs to go up, not down. Free college if you qualify, free tech education for those who don’t. Healthcare, at least the basic level, fully covered.

Think for just one second about how this would actually benefit the hardline conservatives once they get past the “socialism” label — it removes a lot of the barriers to having children and thus also tends to reduce the need for immigration. I could wrap this policy up and pitch it to either side pretty easily. But I don’t think they’re interested.

Sadly, they are not. Thinkers, they ain’t

Definitely not suspicious at all that a technology that was introduced to the public writ large like 2 years ago has been declared a completely indispensable part of life and is the thing we should structure our entire global economy around.

I finished reading “Nexus” by Harari a few weeks ago, and am now finishing reading “The Handover” by Runciman. I need a new book — what are you reading?

I read about 1-2 books a year, this one is Technofeudalism by Yanis Varoufakis. His “baseline economic position” is socialism and he’s very skeptical of capitalism (more so than most people, especially Americans) but his insight into the new battle over Cloud Capital and the US vs China Cold War are very good. Basically that China has a huge advantage of the CCP essentially vertically integrating the country, subsidizing winners, etc. And that was largely in response to the US forcing everyone to use the dollar for so long, that China is responding by skipping all the traditional methods and going straight into the free version — collecting and leveraging data

Thanks. I’ll pick that up as it sounds like a great complement to the two I mentioned that are about AI related to countries, corporations, and global societies and life in general.

I think the 99% still matter but only in our existence, not in our happiness. They’ve built a whole system pushes wealth and power up to the top and so long as the gap between the 99% and the 100% remains large, and growing, they will continue to keep control.

Exactly, we’re not obsolete, but we work harder for lower wages (almost everyone around the world). We also have headcount numbers on our side, but we’re not going to physically revolt. We’re going to keep downloading free game apps to find joy 🙂

Leave aside any questions of fairness of forgiveness, pauses, etc. What was the possible justification for this? So people could get loans under misleading pretenses in 2023-24? It’s not as if skipping payments was never going to come back to haunt these buyers, as we are seeing now; in fact it could easily be argued that relaxing the lending standards in this way hurt those borrowers by allowing them to qualify for a loan they shouldn’t have.

When has enabling/encouraging consumers to rack up huge amounts of debt ever come back to haunt us? s/

“Have I got a great home mortgage deal for you my friend.”…/s

Also, I assume the federal govt took on more debt to pay the interest on those loans during the two year hiatus. I was able to find info for student loan forgiveness that added hundreds of billions to the federal deficit/debt but not on the payment hiatus.

I could understand the need to pause payments during the pandemic lockdowns since so many people were not able to work. But honestly there should have been more requirements to qualify because a lot of people like me did not miss a paycheck but they still had their loans paused.

This issue has a lot to it; the cost of higher education, why some people borrow so much when there are actual, real options to do it for less. But just wiping out loans for some people based on arbitrary decisions by just the executive branch seemed wrong just as a lot of the BS going on now is wrong. We are rapidly losing our government and legal, due processes by virtue of apathy from the opposing branches of government. I’m not sure what the answers are anymore.

Debating whether or not student loans should be forgiven doesn’t address the core issue.

College tuition is too damn expensive.

I’ve said it for years: If student loans ceased to be handed out tomorrow, college tuition would drop significantly.

My kids went to a small, liberal arts college. Their org chart was so top heavy with staff departments that had no clear mission, could be eliminated, or merged with other departments.

No, this would just mean that a lot of the smaller public colleges would end up closing and the rest would be bought out by private equity firms offering even more predatory loans.

The first thing the private equity folks will do is gut those staff departments I wrote about. I have enough experience in the higher education industry to know there are too damned many people who think their only job is to think grand thoughts and leave it to someone else to implement. Of course, no one takes it on and is quickly forgotten. Rinse. Repeat.

I know it was a loooong time ago, but I was able to go full time while working full time summer jobs and part time during the semester. Graduated with zero debt.

Very true. Inefficiency and bloat. Healthcare, same thing. Ctrl+alt+del

Not long after I graduated my small college started construction on an equestrian center. I wonder what kind of impact that had on tuition…

Enabled by…cheap loans for everyone! This is a messed up cycle we’re in…