I haven’t quite come up with a way to refer to this trade/tariff business that’s felt quite right, mostly because I don’t know how it’ll end. Maybe it’ll disrupt everything for good, or maybe it’ll disrupt everything for ill. Maybe both! Whatever the outcome, it’s going to disrupt everything, so I think I’m going to just call it “tariff madness” here at The Morning Dump for the foreseeable future. How is tariff madness impacting the world? It’s impacting it a lot.

Let’s start with the weirdness that is the future of gasoline. The major OEM parts supplier, American Axle, suspects it’s going to have a grand old time in this new paradigm, as engines that use gas or diesel look to be sticking around for a little bit longer. Are investors pouring more money into oil stocks? Nope, quite the opposite. Wait, what? If things are going well at American Axle, they’re not as terrible as predicted at Detroit Axle, which supplies parts to individuals and not to car companies. How did the company survive tariff madness? Some of it is just being the last supplier standing.

Last week, I mentioned that the President took a big swing at the new CEO of Jaguar Land Rover, and now the CEO is swinging back in a most peculiar and, I think, effective way.

Being An American-Based Parts Supplier Has Its Advantages

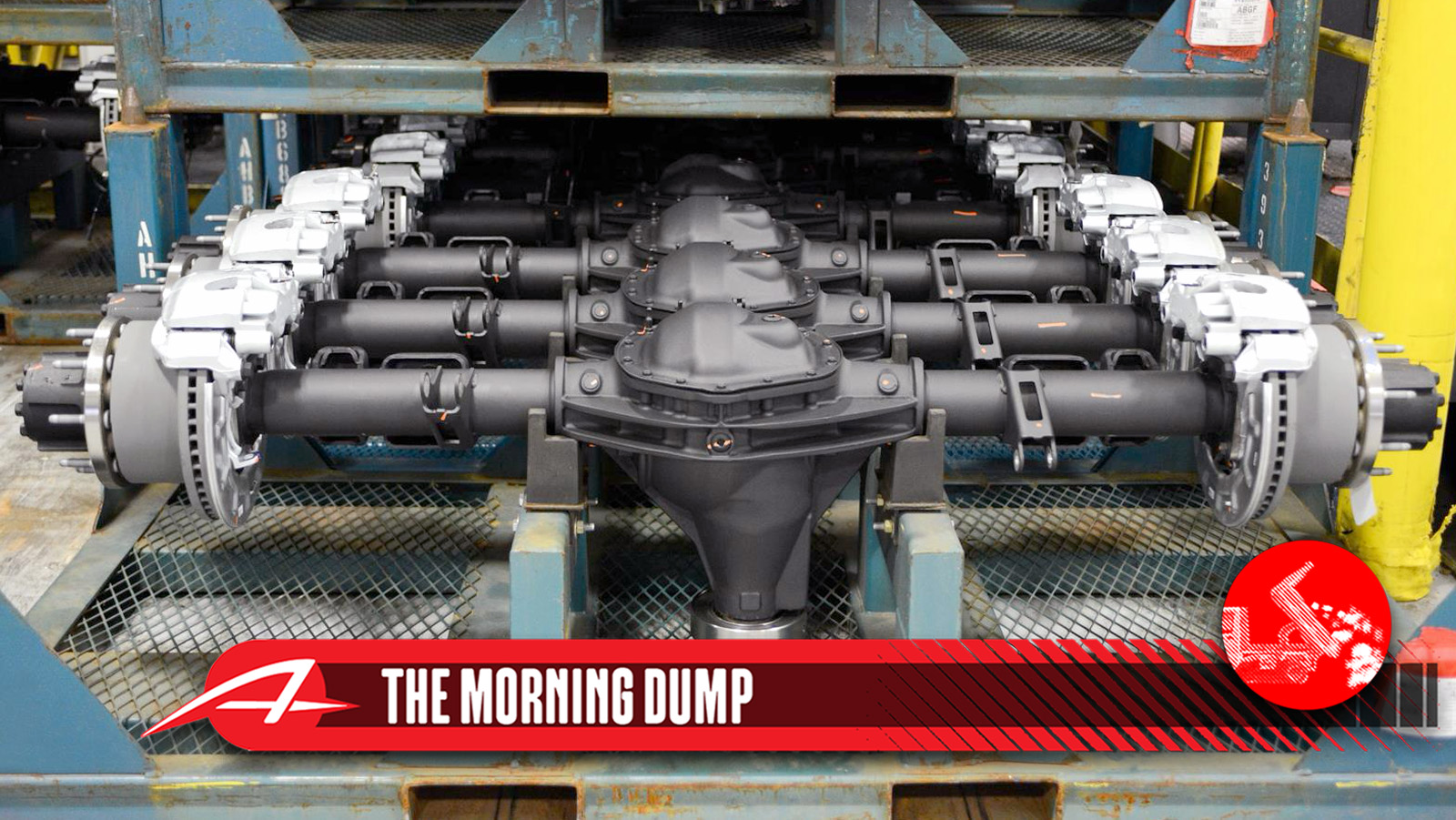

I’m going to talk about two Axle companies today, and it’s important to understand that they’re both way bigger than just axles. Up first, American Axle. This is a Detroit-based company that produces all sorts of forged metal parts for automakers [Ed Note: They developed much of the KL Jeep Cherokee Trailhawk’s 4wd system. -DT]

While the tariff madness is causing problems for a lot of companies (more on that later), the re-localization of production to the United States and the risk of more tariffs at essentially any moment are good for companies with enough capital to survive the madness and shift or expand production at home. American Axle looks like one of those companies.

From Automotive News, it’s clear that both localization and the longer life of gas engines are going to be helpful to the Tier 1 company, even if it still does some work in the EV space:

“We are receiving several inquiries from many of the global OEMs that are looking to localize production,” American Axle CEO David Dauch said Aug. 8. “Hopefully, we can conquest new business going forward.”

American Axle’s largest customer GM announced in July a $4 billion plan to move production from Mexico to the U.S., including converting Orion Assembly to make gas pickups and Cadillac SUVs rather than EVs. Dauch said the move will force American Axle to shift some of its footprint, as it supplies GM in Mexico, but he expects it to benefit the supplier.

“We need to make the necessary adjustments in concert with them, and we’ll do that,” he said. “We do expect there will be some content gains … on those programs.”

American Axle took a conservative approach to investing in EV programs compared with some counterparts, which looks like a wise move as EV volumes fail to materialize and the gas engine tail grows longer under rolled back emissions rules and EV incentives. Still, the company is pursuing electrification as the segment is expected to grow, albeit more slowly than expected.

The company raised its guidance for the year based on all of this, which is the opposite of what is happening with most automakers, who are revising their expectations for profits and revenue down this year based on tariff-related impacts. Of course, even American Axle admits that this requires no changes to the USMCA trade agreement. Will the terms of the USMCA change? It seems quite possible.

Gas-Powered Cars Are Sticking Around, So Are Hedge Funds Starting To Bet Against Oil?

I suppose I should start out by saying that, historically, traditional hedge funds are designed to hedge bets and avoid risk by moving money around in complex ways. One of the tools that a hedge fund can use is a short position, which assumes that at some point in the future a financial product, like a stock, will be worth less than the current value.

With gasoline engines getting a longer life and the slower-than-expected adoption of electric cars outside of China, shouldn’t the safe bet be to go long on oil? Not quite. President Trump’s position has been, essentially, “Drill, Baby, Drill” as he’s hoped to make oil more free-flowing and bring down prices (inflation kills governments). Demand might pick up a little, but that also assumes that consumers have a lot of money and governments are in the mood to spend. This tariff madness, at least, seems to be contributing to some concerns about the expansion of the global economy.

That’s the demand side. On the supply side, bringing down oil to $50 a barrel makes it nearly impossible for manufacturers (especially domestic ones) to make any money. The dirty secret of the Biden Administration is that America became a huge net exporter of energy, and oil producers did really well. Neither the Biden Administration nor oil producers, mostly for image reasons, publicly crowed about this much. Oil producers historically are more aligned with Republicans, though a Republican president might make life much harder. Additionally, OPEC countries seem more intent on protecting market share than making profits, which puts downward pressure on prices.

So what are hedge funds doing? According to an investigation by Bloomberg, reducing short positions on green energy and increasing shorts (i.e. betting against) oil:

The analysis shows that more hedge funds were, on average, net short stocks in the S&P Global Oil Index than net long for seven of the nine months starting October 2024. By contrast, net longs exceeded net shorts in all but eight of the 45 months from January 2021 through September 2024.

The development coincides with a rise in oil supply as some OPEC+ member nations act to preserve their market share. Joe Mares, a portfolio manager at Trium Capital, a hedge fund managing about $3.5 billion, notes that ratcheting up output has “not historically been great” for the oil industry. Evidence of an economic slowdown in the US and China, combined with an expectation that global oil inventories will continue to rise through the rest of 2025, means there’s growing skepticism toward the sector.

Once investors take in “the general slowdown in everything,” the question then becomes, “who’s buying the oil?” said Kerry Goh, Singapore-based chief investment officer at Kamet Capital Partners Pte.

If you’re a consumer, this might be good news for you, as gas prices might go down even as gas engines live a little longer. The other reasoning here seems to be that AI requires a lot of energy, and it’s much faster to stand up renewables like solar and wind than it is to roll out non-renewable energy sources, so swapping those bets could make sense.

How Detroit Axle Is Surviving Tariff Madness

If American Axle is a Detroit-based supplier for car companies, Detroit Axle is a non-Detroit-based (it’s in Ferndale, which, close enough, but it is funny) supplier for individuals. After the company announced it was likely to lay off a large chunk of its staff due to tariff concerns, David wrote about how that might be the end of super-cheap parts from the supplier.

Some of that was true. Parts are getting more expensive, but Detroit Axle has survived for now. How? There’s a great interview in the Detroit Free Press with CEO Mike Musheinesh that sums a lot of it up:

First, his customers accepted his price increases and sales remained stable. Then, his competitors, unable to sustain their own rising costs, either closed shop or reduced their product offerings, allowing Detroit Axle to absorb new customers and sales grew. As of Aug. 5, Musheinesh will not have to lay off any employees or close his Ferndale location.

“I think we’ll be OK,” Musheinesh said. “It’s unfortunate to say, but it’s almost like we’re living off the woes of others.”

Not having to eliminate jobs is a relief, he said, because even though his profits will be down for this year compared with last year, keeping his workforce intact means everything to him and his employees, who he said were extremely happy to hear the news.

There will be winners and losers, and those who have the capital to survive, the flexibility to change course, and the willingness to to try new things might eventually come out on top (this is how I feel about media, btw, in that I think we’ll do well as others fail, but this doesn’t always feel great).

Musheinesh said he was fine switching suppliers from China to India when it looked like India was going to be a better trading partner, but then President Trump increased tariffs on that country. Additionally, the company was using profits from its operations in Mexico to fund the expansion of a remanufacturing facility in Warren, Michigan. With the removal of the de minimis exemption on goods valued at less than $800, that plan suddenly seemed a lot harder:

“That was funding our operation, our remanufacturing facility that we opened up in Warren. That was actually subsidizing us with the machinery we had to buy, the benches, the tools, the equipment and the raw materials,” Musheinesh said. “So when he took the de minimis away and raised the tariffs to 72.5% (out of China), it was just a kick in the gut.”

Everything is in balance or, in this case, out of balance. Gas prices may drop, but keeping your old car running might get more expensive as parts pricing goes up. The story has a great kicker, so I won’t spoil it.

Sometimes, Boring Is The Answer

Last week, I wrote about how, somewhat randomly, President Trump got super mad at Jaguar Land Rover and its new CEO over “wokeness” and the rest. Plenty of people have expressed this view, but most did it nine months ago when the company’s new ad campaign debuted. No one here is implying that President Trump saw a clip of the new CEO on a television segment and then decided to ship off an angry Truth Social post. No one is saying that.

The response from new CEO PB Balaji? Per Bloomberg, it’s just to be boring:

“We have put our plans together, the cars are being revealed, they’re getting exciting response from the customers on the ground,” Balaji said on a call with reporters Friday. “Therefore that’s what the strategy is.”

Asked about Trump’s remarks, Balaji said JLR’s performance in a struggling global car industry proves the company is on the right track. “You need to compare our numbers vis-à-vis how others are delivering,” he said.

No one here is saying that the President has the attention span of a coked-up cocker spaniel, but an approach built on mildly implying that someone should do a financial analysis seems to have some merit.

What I’m Listening To While Writing TMD

It’s Pebble Beach Car Week, and our own version of madness will start soon, so in honor of that let’s have a little KISS. Will we “Rock And Roll All Nite”? Yes, though I still plan to go to bed at a reasonable 9:30 PM… which is after midnight on the East Coast. I’m a wild man!

The Big Question

How much are you paying for gas or, if you have an EV/EREV/PHEV, how much for electricity/both?

Top photo: American Axle

“Will we “Rock And Roll All Nite”?”

See, I only want to Rock and Roll all night and party one weekend a month and two weeks every year. That’s why I joined the Kiss Army Reserve.

I paid 2.89 for 87 in RI the other day. The station next to my job had it for 2.95 as of this morning. It’s hit above 3.00 here and there, but it’s mostly been in the 2.79 – 2.99 range since late 2024.

Daleville, Indiana had a gas war last weekend. $2.61 for 87 octane at 4 stations at the exit.

I pay $0.09 per kWh to charge at home and the Bolt gets about 4 miles per kWh so that is $0.023 per mile. (Assuming I don’t get into work early enough to charge for free)

Regular is currently $3.89 per gallon and the Acura averages 29 mpg. That is $0.134 per mile

Diesel is $4.55 per gallon and the Express gets 15 mpg. That is $0.30 per gallon

Premium is $4.49 per gallon and the BMW R1200RT averages 45 mpg. That is $0.10 per gallon. (but the tires are $600 a set and last 8,000 miles ($0.075 per mile) and a service is $900 every 6,000 miles ($0.15 per mile)

Counterpoint: ‘Merica