I haven’t quite come up with a way to refer to this trade/tariff business that’s felt quite right, mostly because I don’t know how it’ll end. Maybe it’ll disrupt everything for good, or maybe it’ll disrupt everything for ill. Maybe both! Whatever the outcome, it’s going to disrupt everything, so I think I’m going to just call it “tariff madness” here at The Morning Dump for the foreseeable future. How is tariff madness impacting the world? It’s impacting it a lot.

Let’s start with the weirdness that is the future of gasoline. The major OEM parts supplier, American Axle, suspects it’s going to have a grand old time in this new paradigm, as engines that use gas or diesel look to be sticking around for a little bit longer. Are investors pouring more money into oil stocks? Nope, quite the opposite. Wait, what? If things are going well at American Axle, they’re not as terrible as predicted at Detroit Axle, which supplies parts to individuals and not to car companies. How did the company survive tariff madness? Some of it is just being the last supplier standing.

Last week, I mentioned that the President took a big swing at the new CEO of Jaguar Land Rover, and now the CEO is swinging back in a most peculiar and, I think, effective way.

Being An American-Based Parts Supplier Has Its Advantages

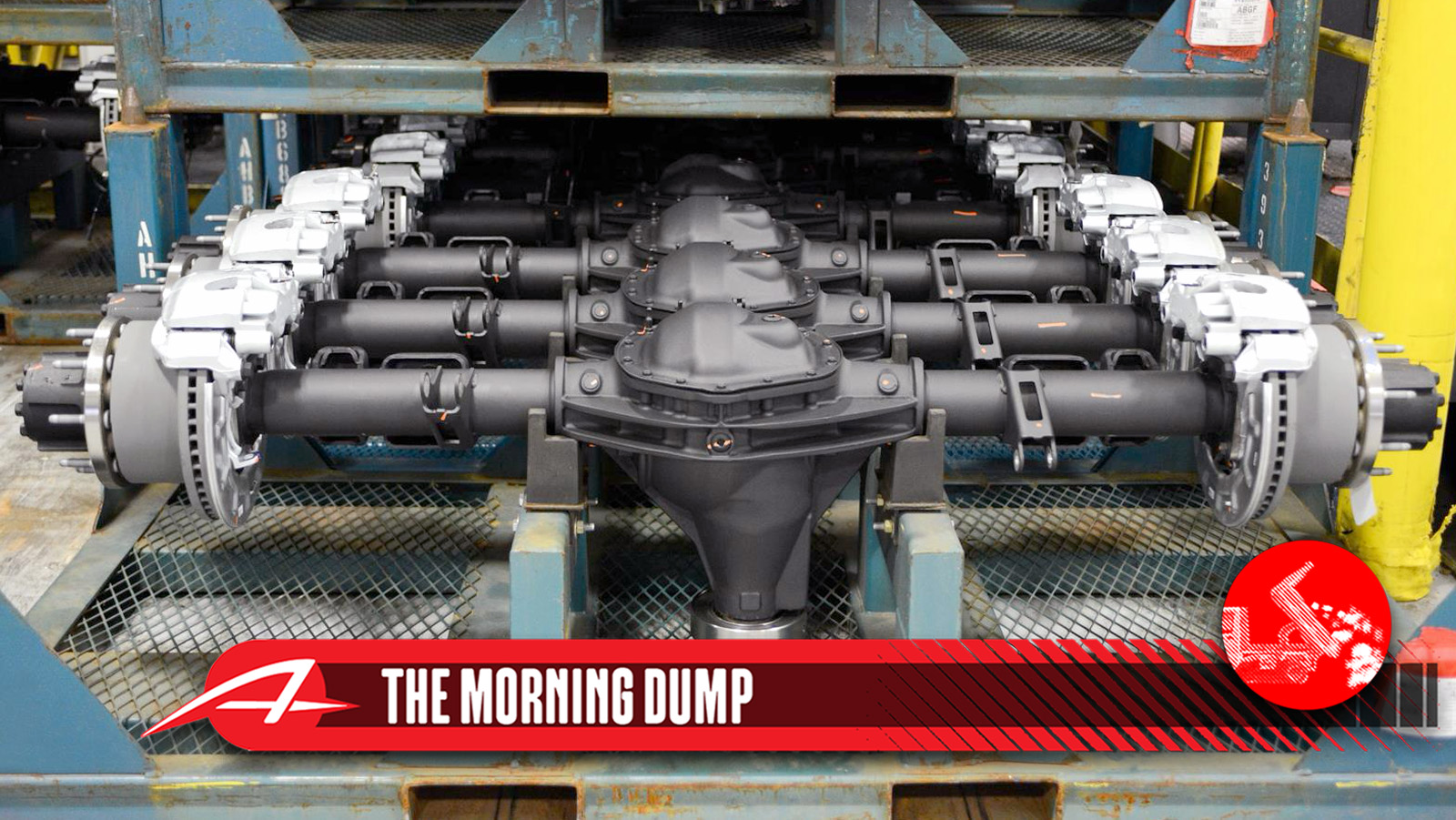

I’m going to talk about two Axle companies today, and it’s important to understand that they’re both way bigger than just axles. Up first, American Axle. This is a Detroit-based company that produces all sorts of forged metal parts for automakers [Ed Note: They developed much of the KL Jeep Cherokee Trailhawk’s 4wd system. -DT]

While the tariff madness is causing problems for a lot of companies (more on that later), the re-localization of production to the United States and the risk of more tariffs at essentially any moment are good for companies with enough capital to survive the madness and shift or expand production at home. American Axle looks like one of those companies.

From Automotive News, it’s clear that both localization and the longer life of gas engines are going to be helpful to the Tier 1 company, even if it still does some work in the EV space:

“We are receiving several inquiries from many of the global OEMs that are looking to localize production,” American Axle CEO David Dauch said Aug. 8. “Hopefully, we can conquest new business going forward.”

American Axle’s largest customer GM announced in July a $4 billion plan to move production from Mexico to the U.S., including converting Orion Assembly to make gas pickups and Cadillac SUVs rather than EVs. Dauch said the move will force American Axle to shift some of its footprint, as it supplies GM in Mexico, but he expects it to benefit the supplier.

“We need to make the necessary adjustments in concert with them, and we’ll do that,” he said. “We do expect there will be some content gains … on those programs.”

American Axle took a conservative approach to investing in EV programs compared with some counterparts, which looks like a wise move as EV volumes fail to materialize and the gas engine tail grows longer under rolled back emissions rules and EV incentives. Still, the company is pursuing electrification as the segment is expected to grow, albeit more slowly than expected.

The company raised its guidance for the year based on all of this, which is the opposite of what is happening with most automakers, who are revising their expectations for profits and revenue down this year based on tariff-related impacts. Of course, even American Axle admits that this requires no changes to the USMCA trade agreement. Will the terms of the USMCA change? It seems quite possible.

Gas-Powered Cars Are Sticking Around, So Are Hedge Funds Starting To Bet Against Oil?

I suppose I should start out by saying that, historically, traditional hedge funds are designed to hedge bets and avoid risk by moving money around in complex ways. One of the tools that a hedge fund can use is a short position, which assumes that at some point in the future a financial product, like a stock, will be worth less than the current value.

With gasoline engines getting a longer life and the slower-than-expected adoption of electric cars outside of China, shouldn’t the safe bet be to go long on oil? Not quite. President Trump’s position has been, essentially, “Drill, Baby, Drill” as he’s hoped to make oil more free-flowing and bring down prices (inflation kills governments). Demand might pick up a little, but that also assumes that consumers have a lot of money and governments are in the mood to spend. This tariff madness, at least, seems to be contributing to some concerns about the expansion of the global economy.

That’s the demand side. On the supply side, bringing down oil to $50 a barrel makes it nearly impossible for manufacturers (especially domestic ones) to make any money. The dirty secret of the Biden Administration is that America became a huge net exporter of energy, and oil producers did really well. Neither the Biden Administration nor oil producers, mostly for image reasons, publicly crowed about this much. Oil producers historically are more aligned with Republicans, though a Republican president might make life much harder. Additionally, OPEC countries seem more intent on protecting market share than making profits, which puts downward pressure on prices.

So what are hedge funds doing? According to an investigation by Bloomberg, reducing short positions on green energy and increasing shorts (i.e. betting against) oil:

The analysis shows that more hedge funds were, on average, net short stocks in the S&P Global Oil Index than net long for seven of the nine months starting October 2024. By contrast, net longs exceeded net shorts in all but eight of the 45 months from January 2021 through September 2024.

The development coincides with a rise in oil supply as some OPEC+ member nations act to preserve their market share. Joe Mares, a portfolio manager at Trium Capital, a hedge fund managing about $3.5 billion, notes that ratcheting up output has “not historically been great” for the oil industry. Evidence of an economic slowdown in the US and China, combined with an expectation that global oil inventories will continue to rise through the rest of 2025, means there’s growing skepticism toward the sector.

Once investors take in “the general slowdown in everything,” the question then becomes, “who’s buying the oil?” said Kerry Goh, Singapore-based chief investment officer at Kamet Capital Partners Pte.

If you’re a consumer, this might be good news for you, as gas prices might go down even as gas engines live a little longer. The other reasoning here seems to be that AI requires a lot of energy, and it’s much faster to stand up renewables like solar and wind than it is to roll out non-renewable energy sources, so swapping those bets could make sense.

How Detroit Axle Is Surviving Tariff Madness

If American Axle is a Detroit-based supplier for car companies, Detroit Axle is a non-Detroit-based (it’s in Ferndale, which, close enough, but it is funny) supplier for individuals. After the company announced it was likely to lay off a large chunk of its staff due to tariff concerns, David wrote about how that might be the end of super-cheap parts from the supplier.

Some of that was true. Parts are getting more expensive, but Detroit Axle has survived for now. How? There’s a great interview in the Detroit Free Press with CEO Mike Musheinesh that sums a lot of it up:

First, his customers accepted his price increases and sales remained stable. Then, his competitors, unable to sustain their own rising costs, either closed shop or reduced their product offerings, allowing Detroit Axle to absorb new customers and sales grew. As of Aug. 5, Musheinesh will not have to lay off any employees or close his Ferndale location.

“I think we’ll be OK,” Musheinesh said. “It’s unfortunate to say, but it’s almost like we’re living off the woes of others.”

Not having to eliminate jobs is a relief, he said, because even though his profits will be down for this year compared with last year, keeping his workforce intact means everything to him and his employees, who he said were extremely happy to hear the news.

There will be winners and losers, and those who have the capital to survive, the flexibility to change course, and the willingness to to try new things might eventually come out on top (this is how I feel about media, btw, in that I think we’ll do well as others fail, but this doesn’t always feel great).

Musheinesh said he was fine switching suppliers from China to India when it looked like India was going to be a better trading partner, but then President Trump increased tariffs on that country. Additionally, the company was using profits from its operations in Mexico to fund the expansion of a remanufacturing facility in Warren, Michigan. With the removal of the de minimis exemption on goods valued at less than $800, that plan suddenly seemed a lot harder:

“That was funding our operation, our remanufacturing facility that we opened up in Warren. That was actually subsidizing us with the machinery we had to buy, the benches, the tools, the equipment and the raw materials,” Musheinesh said. “So when he took the de minimis away and raised the tariffs to 72.5% (out of China), it was just a kick in the gut.”

Everything is in balance or, in this case, out of balance. Gas prices may drop, but keeping your old car running might get more expensive as parts pricing goes up. The story has a great kicker, so I won’t spoil it.

Sometimes, Boring Is The Answer

Last week, I wrote about how, somewhat randomly, President Trump got super mad at Jaguar Land Rover and its new CEO over “wokeness” and the rest. Plenty of people have expressed this view, but most did it nine months ago when the company’s new ad campaign debuted. No one here is implying that President Trump saw a clip of the new CEO on a television segment and then decided to ship off an angry Truth Social post. No one is saying that.

The response from new CEO PB Balaji? Per Bloomberg, it’s just to be boring:

“We have put our plans together, the cars are being revealed, they’re getting exciting response from the customers on the ground,” Balaji said on a call with reporters Friday. “Therefore that’s what the strategy is.”

Asked about Trump’s remarks, Balaji said JLR’s performance in a struggling global car industry proves the company is on the right track. “You need to compare our numbers vis-à-vis how others are delivering,” he said.

No one here is saying that the President has the attention span of a coked-up cocker spaniel, but an approach built on mildly implying that someone should do a financial analysis seems to have some merit.

What I’m Listening To While Writing TMD

It’s Pebble Beach Car Week, and our own version of madness will start soon, so in honor of that let’s have a little KISS. Will we “Rock And Roll All Nite”? Yes, though I still plan to go to bed at a reasonable 9:30 PM… which is after midnight on the East Coast. I’m a wild man!

The Big Question

How much are you paying for gas or, if you have an EV/EREV/PHEV, how much for electricity/both?

Top photo: American Axle

Western CT

Gas: ~$2.89-$3.09 for regular (I’ve given up on premium except for my tractor)

Electricity: ~$0.27/kWh. This is down from $0.30/kWh this month for some reason.

My home consumes between 1600kW to 2200kW throughout the year. I have no choice, except to perhaps lease solar, or buy a system outright and install myself.

I just filled up the Pickup yesterday for the first time in a while. Was weird using a gas pump. Even though my EV cost is about 2/3 that of my gassers, I’m still leaning towards EV for the future. Trying to purge the fleet of all gas cars at this point in my life. I want one gas car, and I think it will be a Miata. But, time will tell. The BMW is gonna go up for sale once I get it back on the road. That should allow me to buy a used EV outright.

I’m very much looking forward to all the prices for everything to go up. I love paying more for stuff. Taxes too, they are awesome. Gotta pay more taxes to bring down the federal debt. Wait, I’ll be getting them back in the form of a “dividend” at some point, right? So…. why are we doing any of this????

Gas is around $3.10 for regular in the Central Ohio area. Depending on the brand/area, premium is $1 – $1.50 additional. I filled up on Ethanol Free for about $4.10 this weekend since I needed gas for the mower. I haven’t been driving since the end of June thanks to an injury (torn bicep tendon), and I don’t expect that to change through the month (much to my wife’s chagrin!).

About $4/gal for regular. Southern California Edison’s electric “rate” is $.42/kwh, but there are fees, distribution charges, etc that are billed per kWh as well. Actual rate with all the taxes and fees is about $.50/kWh – which has got to be the highest in the country? (Or the developed world?) Seems like my monthly bill has gone up 30% every year for the past 5 years.

So $50 to charge a 100kWh battery from 0-100? Sheesh.

Using my PPA solar rate, I’m at 84 cents for 24 miles of range.

Hugely disingenuous to quote peak pricing of the worst plan you can find. Prime TOU is 24 cents/KWh, reduced to 22 cents through the California Climate Credit. Should have gotten solar if that still too much, I’ve got a PPA for 13 cents KWh.

Not sure why you think I’m disingenuous. That is not the worst plan I could find. That is my plan, and that is the rate I pay. In fact, that “worst” plan minimizes my electric bill vs a TOU plan. I could switch to a Time Of Use plan and pay $.36 / kWh plus fees (lowest rate on the SCE website I am eligible for) when I’m asleep or at work. But then I’d pay $.72/kwh plus fees when I am home using appliances. I have done the math and TOU plans cost me more.

I don’t own / charge an electric car. (Own a hybrid that gets 50 mpg.) And I don’t know what a PPA is.

I did look into a battery so I could switch to a TOU plan (charge at low rates at night and draw the pack down during the day). Tesla battery was going to pay for itself with the rate savings, but then Tesla had a huge install fee that was almost as large as the battery itself and the payback time became decades. So I’m sticking with my non-TOU plan.

Wow! I have no idea how/why you have that rate with So Cal Edison. I live near Riverside and have the “domestic” rate which is not TOU. When I add up the various parts that make up the rate (Tier 1 delivery, wildfire fund, Tier 1 generation, fixed recovery) I get a total of $0.32381 per kW/h. That’s expensive, and the rate would go up if I were to hit the Tier 2 level of consumption, but it’s a far cry from $0.50 per kW/h.

They are basically quoting the Tier 2 rate for people that use a lot of electricity.

Oof. That’s the going rate for public fast charging in TN, residential power is generally less than $0.10/kWh before fees.

That is absolutely BANANAS. I live in Ontario, Canada. Here’s Hydro One’s rates. The most expensive having $0.284/kWh on peak, but that has an overnight rate of $0.028/kWh to balance it out (If I had a powerwall, I’d be on that one.)

Also, that’s Canadian dollars (cents)

I use the TOU plan, which has a peak rate of $0.158/kWh

$3.19.9 before Shell discount for 87. The car averages 35 mpg.

Electric is $125 for a 2/2 condo in summer, higher in winter. We like it warm

Dunedin FL, just north of Clearwater.

You missed the mark today. Should have had Detroit Rock City as the Kiss song to go along with your Detroit/American Axle topic.

Detroit Rock City is also one of the very few Kiss songs that’s actually good

D’oh, are you joking? Rock N Roll Over was the first non-Disney album I ever owned.Without Kiss, there’d be no Crue, no Nirvana, and no Metallica.

Oh I’d never argue that they weren’t influential, but I’ll always argue that they weren’t good, because they weren’t.

While they may seem impossibly cheesy now, a neutral review of their entire catalog (especially the early stuff) while considering the time period they emerged from, plainly shows you’re wrong.

Are they “The Who” or “Rolling Stones” great? No, not really. And of their over 120 songs, the most popular are mostly their least nuanced recordings.

Even so, can you deny the galloping bass line and consistent guitar vamps that roll through the core of “I Was Made For Lovin’ You”? Who else could have gotten an actual rock song played so much at the discotheques of the late 70s? (Hello, earworm!)

I can’t believe I’m the KISS apologist here. I’m not even a fan, but I still respect “Cold Gin” and many other deeper cuts that didn’t make pop radio.

Cold Gin is also one of the few KISS songs that’s actually good!

No idea. I mean, what’s the alternative? Not fuel up your car? I don’t drive heavy miles to/for work – those that do have my sympathies but for me, the price of gas is one of those, “It is what it is,” things I don’t dwell on. I just go to Costco and fill up when needed.

You’re right, but I have noticed one thing, anecdotally. When the light turns green and I take off, the lifted pickups no longer gun it to get ahead of me (well, some do, but it happens way less often than it used to). So I do think some people are starting to try to drive a little more efficiently. At least those with the highest fuel bills.

You reckon part of the reason is that hybrids/EV’s have the gauge for fuel efficiency that gamify driving? I have a couple of friends who have efficiency goals on their regular drives.

I do think that’s part of it. I have definitely found myself trying to hit those numbers once or twice. I would also like to think it just makes a person generally more aware of the effect of their driving habits, but I have seen people on hybrid/EV forums complain that the “eco” mode doesn’t seem more efficient, because it just makes them mash the accelerator harder…so I really don’t know if people not gamifying it know what’s happening when they drive.

It might seem silly, but I always try to max out my Eco Score. It makes a big difference when stopping and starting, although I don’t particularly like the way Toyota coded the fake shift point in to make the car more aggressive in terms of regenerative braking vs coasting.

But that’s part of the fun! I love when the giant lifted pickups feel the need to speed around me, or to pace/pass me on the interstate, etc. I usually try to make them work for it just a little bit. You know? I really want to see that lifted pickup hit 90, knowing that I’m still getting >30mpg, and they’re probably in single-digits. I enjoy thinking about their next $100+ trip to the pump.

It’s a perverse pleasure, but enjoyable none the less.

That’s exactly why I noticed. I am usually on electric, so I get up to speed quickly and they really have to push it. I also take pleasure knowing it costs them to get in front of me. That said, I can’t say I mind the idea of less exhaust in the air when an inversion pushes it all down into the valley. I’ll literally breathe a little easier with people caring a little more about efficiency.

They haven’t stopped near me. And whenever they do that, I just know they’re the types to bitch about the cost of gas and diesel, but are less public about it since their guy got into office. Now it’s patriotic to pay more.

I just spent $3.69/gal but that was on a trip outside of the metro area where gas is typically cheaper and at a Costco. My nearest Costco is $4.05/gal and most stations are significantly more.

For the PHEV $0.13/KWh

This has been how it’s been playing out in other spaces. Basically you have one category killer plus Amazon. Best Buy outlasted Circuit City, Hobby Lobby has outlasted Jo-Ann Fabric and Michael’s, etc.

MMMEEP (Magic Mushrooms + Magic Eightball Economic Policy)

$3/gallon for regular, $4 for premium. $0.19/kWhr off-peak, $0.24/kWhr on.

Sometimes I wonder if you could save money by running a natural gas generator with the water jacket hooked into your home heating system, but electricity is also cheaper in the heating season. And who wants to listen to that?

I’ve always thought that if you wanted to live off-grid, in a place that needed heat, a liquid cooled engine would be the perfect option to essentially get free heat with your electricity.

It would… If you had access to unlimited fuel. Natural gas coming from a pipe is a lot better than propane from a truck, which is better than gasoline from a can.

Honda played around with this idea.

https://global.honda/en/newsroom/news/2011/p110523eng.html

The most efficient would be vapor absorbtion refrigeration system using the waste heat in the summer for cooling. Huge upfront capital expense though.

Paying too much for gas, but drive so little now it doesn’t matter.

You need to start up a meme image for tariffs. Picture Joe Isuzu thumbs up, byline, “Tariffs, I love tariffs!”

Gas around here (Boise, ID) has been about $3.50 for regular for a bit. I don’t use it much, and my electricity is super cheap (if I charge exclusively off-peak, it’s 6.185 cents per kWh, but it goes as high as 24.7398 cents at the highest peak of summer evenings), since we have plenty of hydro. Diesel has been at $3.99 for even longer. Gas prices came up from around $3.30 and the diesel stayed where it was.

have an EV so I haven’t looked at a gas station in over a year.

Time of Use electric rates in Colorado (Xcel Energy)

Off-Peak (7pm – 1pm) = $0.077/kWh

Mid-Peak (1pm – 3pm) = $0.143/kWh

Peak (3pm – 7pm) = $0.209/kWh

Just got off my company wide quarterly earnings call. Feelings are mixed, tariff pain is not insignifficant in one business (raw material costs), others may be somewhat buoyed by the current climate. We did cut our annual earnings expectation, but actual margin is up. We need stability out of Washington.

Hold that thought.

It’s a hope and prayer, no relation to reality.

A WAGNER plan.

Need to reach out to you privately, I’m working on a ’62 Corvair and hit a snag or two….

Last guy to ask for advice on a Corvair. I have a plan to acquire a Corvair project some time in the future. Right now it’s like a thought and a plan in the Orange man’s head.

I’ve read a bunch and have links to all the good suppliers, but have not been in close proximity to any year Corvair since the 70’s.

Sigh, my dad owned a 2 in the ’60s but says he can’t help on wrenching anymore. I suspect I have a carb (2 carb?) issue I need to work through. Bought the bible, need to work through it.

Car ran when I pulled off the valve covers to replace leaking pushrod tube seals with new viton ones. I cold set the valve lash and now it won’t start. I have spark and the fuel pump works. I get a cough or two and no more. I did install a bease Pertronix, but a have verifed spark and timing.

Plugs clean?

Yes, new and hand gapped. I filled the carb bowls with fresh gas and verified flow from pump. Timing light indicates proper time (with dist diaphragm unplugged). I have a spark.

I tore down the carbs and replaced needles/seats gaskets/elastomers with new. They are not varnished.

Valve lash may be a bit tight, but it should still at least start. I’ve quadruple checked distributor and firing order. Timing light indicates a go.

Should I toss the points back in? Verify compression and #1 TDC? It ran when I shut it down.

Nothing should have thrown it out of time. I never touched the timing chain or distributor until trying to restart. The original distributor clamp was fractured, I replaced with NOS.

Don’t take advice from me, I once put lash caps on my valve stems and roller rockers then spent two days figuring out my valves were pinned open all the time. Ended up with longer rocker studs and ugly mr gasket covers instead of the pretty sorta finned aluminum cobra ones. Not my happiest week.

The gas stations closest to me (and right off of a major interstate) have been steady around $3.30, but I go a few miles down the road to Costco and they’ve been $2.89 for what seems like months.

edit to add ~1hr north of Detroit.

That tracks with me locally Pittsburgh area. Costco may be 2.99

Gas here is about 2.90 for 87, +0.20 for premium. No EV, but I think our summer electric rates are around 0.12 a kwh, but if you go with a flexible rate, I think you can get down into the 0.06-0.08 a kwh at night for charging an EV.

Lucky, regular is and has been about $3.39 here. I daily a hybrid so I pay less attention, but PA does have high gas taxes. I often save .30 a gallon filling in Ohio or WV if there.

Where do you live where premium is only 20 cents over regular? If I go to the QuickTrip, they’ve now raised their premium to 60 cents over regular – they usually cost about a nickel more than Costco on average. I’m in NC. Our regular is about the same as yours.

I was wrong, it’s +0.20 for midgrade +0.40 for premium. I don’t have anything that takes premium so I don’t pay that close of attention.

“Hopefully, we can conquest new business going forward.”

I guess “conquest” is a verb now. I would have chosen “conquer”.

Or just con.

I look forward to using ‘conquest’ in different ways.

I am going to conquest this pizza, for example.

Eastern Washington and we pay $4/gal for regular gas. Our electricity has gone up recently, it’s 12c/kwh, just a couple years ago it was like 8c/kwh. My electric bill last month was $182 and I live in a hot climate (Spokane) and have one EV in the garage, I can’t complain that’s all still pretty cheap.

I’ve heard that WA is the best state to get an EV due to our high gas and low electricity, I’d agree.

Unfortunately, that fucks you on electric motorcycles in Washington. Registration is like $180 because electric. Literally impossible for me to ride enough miles to make it cheaper than a gas bike.

$4.05 for 87 at my nearest station in the suburbs of San Diego.

We were expecting prices to shoot up in July due to a new tax but surprisingly prices have remained stable.

Not sure on electricity rates but I bet they’re high enough to make solar not look so appealing.

Gas tax went up 6 cents a gallon in Washington as well and every conservative at work was freaking out about it, but prices remained exactly the same for 3 weeks and then eventually dropped a little.

Also, can we start calling tariffs for what they are?

Call it IMPORT TAX.

I suppose that is more accurate than Big Far Jerk Tax.

Big Fat Jerk Tax is equally accurate, I think.

I’d argue it’s a VAT in all but name.

Volatile As-wpies tax

“How much are you paying for gas or, if you have an EV/EREV/PHEV, how much for electricity/both?”

$3.75 for SFBA regular and $0.31/kWh for PG&E joules. According to my friends at the EPA that makes gasoline a bit cheaper than electricity ’round these parts.

I’m not sure if I buy the assertion that gas is cheaper to run, with those numbers. If your car gets 30 mpg (doubtful, in Bay Area traffic) then your gas cost is $0.125 per mile. If your EV goes 3 miles per kW/h (my wife’s Solterra averages 3.5 in SoCal traffic) then that would be $0.1033 per mile.

That’s why I use the EPA website. They have a handy side by side comparator that shows how much it costs to go 25 miles in up to four vehicles that can run on both electricity and gasoline. Using that comparator and choosing four common PHEVs and EREVs it shows that those vehicles will go those 25 miles a bit cheaper on $3.75/gal gas than $0.31.kWh power.

https://www.fueleconomy.gov/feg/Find.do?action=sbsSelect

It’s not a perfect methodology but it’s the best easy to use apples to apples comparison as I’ve been able to find. I have found their numbers tally overall very well with my own cars.

Just for fun I compared a 57 mpg (city) base HEV Prius to a 145 mpge Tesla Model 3. Even in 100% stop and go traffic the Prius should cost $1.64 for 25 miles and the Tesla $1.80. So gas wins there too, at least as the prices I listed.

The comparator also shows a Solterra winning against a 30 mpg car in stop and go traffic. You’d expect that as stop and go traffic is where electricity does best and ICE the worst.

My local petrol station is charging £1.649 per litre for the 99RON that all my cars need because it’s the only E5 option, and they all need 97RON or higher.

That’s $2.21 per litre.

Which is $8.37 per US gallon.

The cheap stuff is £1.429 per litre, you can do your own maths.

In the US we subsidized oil.

The BTU in a gallon of gas is worth $8.37.

It’s not Drill baby drill it’s

Burn Baby Burn

Gas $2.89 New England

Electricity $99/mo. For next 22 years w Solar

Electricity $383 this month without Solar.

How does that work in winter?

Solar company supplies system. They “lease” your roof for $99/mo. for 25 years.

Panels produce more electricity than consumed.

Power company bill shows up saying

No Payment Required.

Solar company maintains system for free.

I’ve had it for three years and still produce more in winter months than consumed.

So, thanks for asking and now sound effects should be producing a cash register sound.

You’re lucky. I’ve heard more complaints than crows from my neighbors who leased their solar roofs. I don’t know whether they’re systemic issues or specific to those particular subscriptions though and things keep changing.

I was thinking more about how well the panels work when covered in snow. I don’t imagine the solar company comes out and clears off the snow for you.

After snow gets slightly built up on the panel it slides right off. Lower coefficient than the roofing material (shingles, etc.) .

It actually helps remove the snow below the panels. Thanks for your attention to this matter. Lol

Not sure why the lol but you do you.

It’s a DJT reference.

Well that explains that.

Gas is about $3.19 for regular, $4.19 for premium locally.

Oddly, my small/medium town has a persistent gap of some 30 cents between stations on the north side of town and south side, which are less than 10 minutes apart from each other. This has been the case for years, and includes stations owned by the same companies (not just branded the same). So it’s clearly intentional and well thought out – I just don’t understand how the entire population of the town hasn’t figured it out yet and adjusted their behavior.

Same thing in my area. 10 minute drive to the other side of the tracks and gas is consistently 20-30 cents cheaper.

Yes, gas in my neighborhood is a consistant .15 cheaper than 15 minutes out.

Because it’s less convenient.

If you take an average fill-up of 12 gallons, that’s $34.68 at $2.89/gal. That same fill-up at $3.19/gal is $38.28. If you’re talking another 20 minutes to drive (round trip) and less than a $4 difference in total bill… well mentally the total price just isn’t different enough to matter.

This logic is undeniable, but human behavior, especially relating to gas prices, is anything but logical. We all know people who will drive 10 extra miles to save 5 cents a gallon.

Costco can be .05 to .10 cents cheaper than the gas station right off the freeway. But there’s at least a 30 min wait if you go when it’s busy. I will gladly pay the buck or two difference to be able to drive right up to the pump.

Two things to make Costco gas purchases work: Use the Costco credit card and you will get 5% cash back on gas purchases at Costco (4% back on gas elsewhere). Go to a Costco with a BIG gas station. The location near where I work has a really big gas station (24 pumps?) so there is rarely a line. The one near my house has an inadequately small gas station and there is nearly always a long line.

Gas: $2.50/gallon at a Bucc-ee’s last week (where fuel is a loss-leader), but more like $2.80-$2.90 around town.

Eletricity: The last bill was over $400 (yay summer!) and broke down to about 12-13 cents/KWh all inclusive.

Trump: Why does he care what a bit player in the US car market, run by a British-Indian conglomerate, is even doing at all?

Why does he care about shower heads, or bowling ball tests that don’t exist, or …..

I imagine the inside of his head sounds like a drumset consistently falling down a flight of stares.

COTD!

Stares? JFC.

Maybe he has no idea JLR is a bit player.

You had me at “he has no idea…”

That too.

…is that $400 for a month? How the heck is it that expensive? I live in a hot climate, with a large house, and a pregnant wife so we cool the house to 70 so she’s comfortable, and we have an EV, and our bill has never crested $200/mo. And we pay ~12c/kwh

“How the heck is it that expensive”

Kids, probably.

“and a pregnant wife”

So you’ll find out yourself firsthand soon enough.

I was gonna say, holy smokes this guy is consuming a TON of electricity. $400 / $.13/kWh = 3,077kWh per month. He deserves that high of a bill or he doesn’t know what all inclusive means because it’s like 3 or 4 times the US average and that is already high.

I just used 924kWh this past month. One of the hottest months on record. This was for a 100+ year old house with zero insulation (literally the walls are hollow) with central air. And this past month I happened to start a kitchen renovation which has resulted in leaving doors open longer than longer, setting the AC colder than normal so I’m not sweating to death, and it’s ripped down to the studs so I’ve lost a complete “wall” enclosing the stud-bays so it’s the outside sheathing staring back at me.

Even if I had an EV, it would have added ~400kWh to that, which would still have me less than half of that guy. What the hell is this guy doing?

Would it be hard to put some rock wool in those walls?

Rock wool is going in the walls of the room that’s being gutted. But that’s just the external walls of one of the rooms.

Dude is making aluminum from bauxite, probably.

https://en.m.wikipedia.org/wiki/Bayer_process

my guess is a Pool

If so look into variable/dual speed pumps. Last I checked payback on those pumps was pretty quick.

The energy savings on a dual speed pool pump vs a single speed are no joke. Reducing pump speed by 1/2 allows the pump to use only 1/8 as much energy. The display on my pool pump shows wattage while running, and I have seen that relationship on the display!

https://www.energystar.gov/products/pool_pumps

You might want to look into heat pump water heaters too. I ran the numbers on those and compared to a purely electric water heater the payback at my PGE rates and with the rebates available was about a year. That makes replacing even an otherwise functional but energy hogging electric heater with a brand new heat pump with a 12 year warranty a very attractive idea.

I have a pool and a ~3K sq ft house outside Atlanta where summer is quite hot and I am paying half that much. Honestly, I was surprised how little the pool changed my overall bill.

My guess is he thinks he is a taste maker for luxury stuff, which would include Jaguar cars. I know he used to go all over talking about how great is Rolls/Bentley’s were. As always, he has the worst ideas in taste (or in anything really).