I haven’t quite come up with a way to refer to this trade/tariff business that’s felt quite right, mostly because I don’t know how it’ll end. Maybe it’ll disrupt everything for good, or maybe it’ll disrupt everything for ill. Maybe both! Whatever the outcome, it’s going to disrupt everything, so I think I’m going to just call it “tariff madness” here at The Morning Dump for the foreseeable future. How is tariff madness impacting the world? It’s impacting it a lot.

Let’s start with the weirdness that is the future of gasoline. The major OEM parts supplier, American Axle, suspects it’s going to have a grand old time in this new paradigm, as engines that use gas or diesel look to be sticking around for a little bit longer. Are investors pouring more money into oil stocks? Nope, quite the opposite. Wait, what? If things are going well at American Axle, they’re not as terrible as predicted at Detroit Axle, which supplies parts to individuals and not to car companies. How did the company survive tariff madness? Some of it is just being the last supplier standing.

Last week, I mentioned that the President took a big swing at the new CEO of Jaguar Land Rover, and now the CEO is swinging back in a most peculiar and, I think, effective way.

Being An American-Based Parts Supplier Has Its Advantages

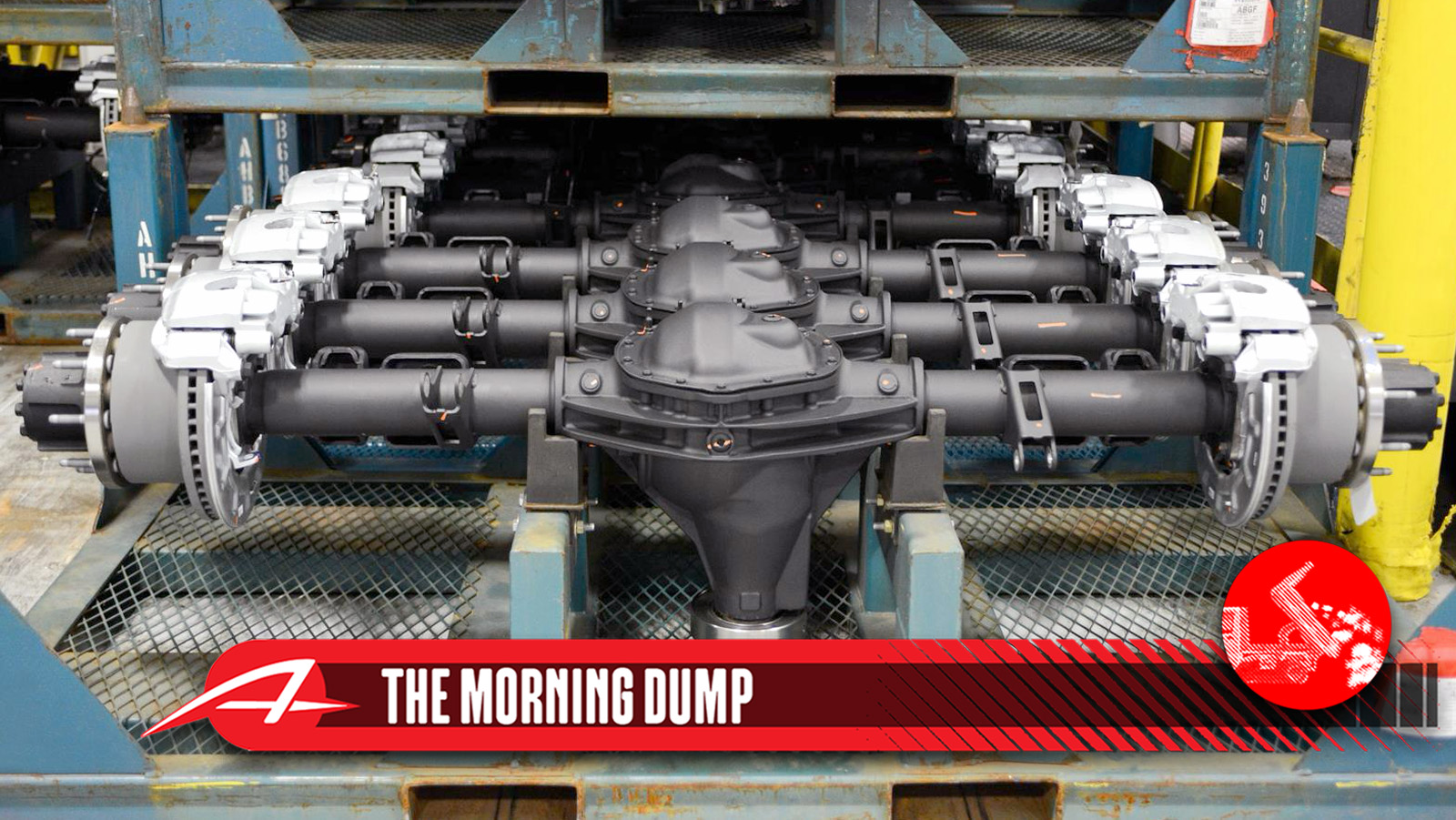

I’m going to talk about two Axle companies today, and it’s important to understand that they’re both way bigger than just axles. Up first, American Axle. This is a Detroit-based company that produces all sorts of forged metal parts for automakers [Ed Note: They developed much of the KL Jeep Cherokee Trailhawk’s 4wd system. -DT]

While the tariff madness is causing problems for a lot of companies (more on that later), the re-localization of production to the United States and the risk of more tariffs at essentially any moment are good for companies with enough capital to survive the madness and shift or expand production at home. American Axle looks like one of those companies.

From Automotive News, it’s clear that both localization and the longer life of gas engines are going to be helpful to the Tier 1 company, even if it still does some work in the EV space:

“We are receiving several inquiries from many of the global OEMs that are looking to localize production,” American Axle CEO David Dauch said Aug. 8. “Hopefully, we can conquest new business going forward.”

American Axle’s largest customer GM announced in July a $4 billion plan to move production from Mexico to the U.S., including converting Orion Assembly to make gas pickups and Cadillac SUVs rather than EVs. Dauch said the move will force American Axle to shift some of its footprint, as it supplies GM in Mexico, but he expects it to benefit the supplier.

“We need to make the necessary adjustments in concert with them, and we’ll do that,” he said. “We do expect there will be some content gains … on those programs.”

American Axle took a conservative approach to investing in EV programs compared with some counterparts, which looks like a wise move as EV volumes fail to materialize and the gas engine tail grows longer under rolled back emissions rules and EV incentives. Still, the company is pursuing electrification as the segment is expected to grow, albeit more slowly than expected.

The company raised its guidance for the year based on all of this, which is the opposite of what is happening with most automakers, who are revising their expectations for profits and revenue down this year based on tariff-related impacts. Of course, even American Axle admits that this requires no changes to the USMCA trade agreement. Will the terms of the USMCA change? It seems quite possible.

Gas-Powered Cars Are Sticking Around, So Are Hedge Funds Starting To Bet Against Oil?

I suppose I should start out by saying that, historically, traditional hedge funds are designed to hedge bets and avoid risk by moving money around in complex ways. One of the tools that a hedge fund can use is a short position, which assumes that at some point in the future a financial product, like a stock, will be worth less than the current value.

With gasoline engines getting a longer life and the slower-than-expected adoption of electric cars outside of China, shouldn’t the safe bet be to go long on oil? Not quite. President Trump’s position has been, essentially, “Drill, Baby, Drill” as he’s hoped to make oil more free-flowing and bring down prices (inflation kills governments). Demand might pick up a little, but that also assumes that consumers have a lot of money and governments are in the mood to spend. This tariff madness, at least, seems to be contributing to some concerns about the expansion of the global economy.

That’s the demand side. On the supply side, bringing down oil to $50 a barrel makes it nearly impossible for manufacturers (especially domestic ones) to make any money. The dirty secret of the Biden Administration is that America became a huge net exporter of energy, and oil producers did really well. Neither the Biden Administration nor oil producers, mostly for image reasons, publicly crowed about this much. Oil producers historically are more aligned with Republicans, though a Republican president might make life much harder. Additionally, OPEC countries seem more intent on protecting market share than making profits, which puts downward pressure on prices.

So what are hedge funds doing? According to an investigation by Bloomberg, reducing short positions on green energy and increasing shorts (i.e. betting against) oil:

The analysis shows that more hedge funds were, on average, net short stocks in the S&P Global Oil Index than net long for seven of the nine months starting October 2024. By contrast, net longs exceeded net shorts in all but eight of the 45 months from January 2021 through September 2024.

The development coincides with a rise in oil supply as some OPEC+ member nations act to preserve their market share. Joe Mares, a portfolio manager at Trium Capital, a hedge fund managing about $3.5 billion, notes that ratcheting up output has “not historically been great” for the oil industry. Evidence of an economic slowdown in the US and China, combined with an expectation that global oil inventories will continue to rise through the rest of 2025, means there’s growing skepticism toward the sector.

Once investors take in “the general slowdown in everything,” the question then becomes, “who’s buying the oil?” said Kerry Goh, Singapore-based chief investment officer at Kamet Capital Partners Pte.

If you’re a consumer, this might be good news for you, as gas prices might go down even as gas engines live a little longer. The other reasoning here seems to be that AI requires a lot of energy, and it’s much faster to stand up renewables like solar and wind than it is to roll out non-renewable energy sources, so swapping those bets could make sense.

How Detroit Axle Is Surviving Tariff Madness

If American Axle is a Detroit-based supplier for car companies, Detroit Axle is a non-Detroit-based (it’s in Ferndale, which, close enough, but it is funny) supplier for individuals. After the company announced it was likely to lay off a large chunk of its staff due to tariff concerns, David wrote about how that might be the end of super-cheap parts from the supplier.

Some of that was true. Parts are getting more expensive, but Detroit Axle has survived for now. How? There’s a great interview in the Detroit Free Press with CEO Mike Musheinesh that sums a lot of it up:

First, his customers accepted his price increases and sales remained stable. Then, his competitors, unable to sustain their own rising costs, either closed shop or reduced their product offerings, allowing Detroit Axle to absorb new customers and sales grew. As of Aug. 5, Musheinesh will not have to lay off any employees or close his Ferndale location.

“I think we’ll be OK,” Musheinesh said. “It’s unfortunate to say, but it’s almost like we’re living off the woes of others.”

Not having to eliminate jobs is a relief, he said, because even though his profits will be down for this year compared with last year, keeping his workforce intact means everything to him and his employees, who he said were extremely happy to hear the news.

There will be winners and losers, and those who have the capital to survive, the flexibility to change course, and the willingness to to try new things might eventually come out on top (this is how I feel about media, btw, in that I think we’ll do well as others fail, but this doesn’t always feel great).

Musheinesh said he was fine switching suppliers from China to India when it looked like India was going to be a better trading partner, but then President Trump increased tariffs on that country. Additionally, the company was using profits from its operations in Mexico to fund the expansion of a remanufacturing facility in Warren, Michigan. With the removal of the de minimis exemption on goods valued at less than $800, that plan suddenly seemed a lot harder:

“That was funding our operation, our remanufacturing facility that we opened up in Warren. That was actually subsidizing us with the machinery we had to buy, the benches, the tools, the equipment and the raw materials,” Musheinesh said. “So when he took the de minimis away and raised the tariffs to 72.5% (out of China), it was just a kick in the gut.”

Everything is in balance or, in this case, out of balance. Gas prices may drop, but keeping your old car running might get more expensive as parts pricing goes up. The story has a great kicker, so I won’t spoil it.

Sometimes, Boring Is The Answer

Last week, I wrote about how, somewhat randomly, President Trump got super mad at Jaguar Land Rover and its new CEO over “wokeness” and the rest. Plenty of people have expressed this view, but most did it nine months ago when the company’s new ad campaign debuted. No one here is implying that President Trump saw a clip of the new CEO on a television segment and then decided to ship off an angry Truth Social post. No one is saying that.

The response from new CEO PB Balaji? Per Bloomberg, it’s just to be boring:

“We have put our plans together, the cars are being revealed, they’re getting exciting response from the customers on the ground,” Balaji said on a call with reporters Friday. “Therefore that’s what the strategy is.”

Asked about Trump’s remarks, Balaji said JLR’s performance in a struggling global car industry proves the company is on the right track. “You need to compare our numbers vis-à-vis how others are delivering,” he said.

No one here is saying that the President has the attention span of a coked-up cocker spaniel, but an approach built on mildly implying that someone should do a financial analysis seems to have some merit.

What I’m Listening To While Writing TMD

It’s Pebble Beach Car Week, and our own version of madness will start soon, so in honor of that let’s have a little KISS. Will we “Rock And Roll All Nite”? Yes, though I still plan to go to bed at a reasonable 9:30 PM… which is after midnight on the East Coast. I’m a wild man!

The Big Question

How much are you paying for gas or, if you have an EV/EREV/PHEV, how much for electricity/both?

Top photo: American Axle

So, Big Oil is taking it the shorts, eh? Couldn’t have happened to a nicer bunch of folks.

I pay about 10 cents per kWh at home (so about $8 for a full battery, which will take me around 300 miles). I do almost all my charging at home, so I’m paying about 3 cents per mile. In the rare occasions when I need to use a public charger (on a road trip, etc.), I pay 35 – 45 cents per kWh or 10 to 12 cents per mile.

When charging at home, my base electricity cost is between $0.087 – $0.093/kWh, depending on month (my local utility publishes the rate chart for the next year in October).

On the rare occasions I use public charging infrastructure, I’m paying around $0.17/kWh for Level 2 charging and $0.40 – $0.50/kWh for fast charging.

So about $8 for a full charge at home, $30 for a 20-80% jolt at a fast charger.

I’m paying about $0.09/kWh (not that that matters, but it’s a 3 year contract) and gas is $2.50-$2.90/gallon, depending on where you go (low end being Walmart or Murphy, high end being Chevron or Exxon Mobil). That’s about the only good thing I can think of about Texas FWIW.

“ The dirty secret of the Biden Administration is that America became a huge net exporter of energy, and oil producers did really well. “

I wouldn’t call that a “dirty secret”. First… there was nothing secret about the US trying to become ‘energy independent’.

Increasing production so you guys don’t have to be dependent on imported oil has been a long term strategy for many US administrations… both Democrat and Pre-MAGA-MORON-Republican.

So if anything, this is actually a huge success.

And if I was a hedge fund manager, I’d be betting against oil long term as well. Why? Because oil is a globally traded commodity.

With the growing number of BEVs GLOBALLY, it’s setting the stage for a glut in oil supply at some point in the future where we will have another temporary drop in the price of oil to a level where nobody is making money.

I watched this happen in the mid-1980s, again in the late 1990s, again in the late 2000s and again during Covid.

Each time it happens, it’s for different reasons, but the root issue is too much supply for the amount of demand. When that happens, the price drops, all the least profitable/marginal oil sources get mothballed and money for keeping up or expanding oil supply dries up.

And if I had to put a timeline on this, I’m gonna guess this is gonna happen at some point in the early to mid 2030s where by which point, the majority of the vehicles sold in markets like China and the EU will be BEVs.

And every BEV sold incrementally reduces demand for oil-related products in the long term.

And that’s gonna happen whether the oil-industry-owned Republicans like it or not.

Note that I’m not anti-oil per se. I know enough about the oil industry to know that we will always need some oil-related products

But there will be a gradual shift where the oil industry’s biggest products won’t be stuff like gasoline. It will be other stuff like lubricants, sealants, coolant, materials like various plastics and other stuff.

“How much are you paying for gas or, if you have an EV/EREV/PHEV, how much for electricity/both?”

I have a C-Max Energi… which is to say it’s a plug-in hybrid with ~20 miles of EV range when I start my day (I charge it using a 220V charger during off-peak times such as every night as well as on weekends).

So over the past year and 30,000km, my combined gasoline and electricity cost works out to about CAD$110/month… which is about 45% less compared to my previous car, a manual 2008 Honda Fit.

Of that $110/month, between $15-$20 is for electricity.

I eventually plan on installing solar on my roof.. probably when I eventually replace my C-Max with what will likely be a BEV.

“except the OPEC guys can always constrain the supply to raise prices. “

Yeah I’m fully aware of that and when they’ve done in the past.

But in recent years, all that happens then is all the non-OPEC guys increase their production and make more money. So the price spike usually doesn’t last much more than a year.

And it has gone in the other direction where earlier in this decade, the Saudis deliberately flooded the market because some non-OPEC guys like Russia didn’t want to voluntarily constrain supply to keep prices at a reasonable level where everybody made money. And then we had the perfect storm of bad news with COVID and oil prices went into the negatives.

Northern UT, gas is $3.20 at my local Costco (the best price around, but it varies by community). Honestly don’t know what electricity rates are since I have an 8.9kW solar array and haven’t had an electricity bill more than double the connection fee in a couple years.

Our local electricity theft group has implemented some rather troubling Rate changes that are often hard to change to fit any changes to your household. most concerning is the 4-8 timeframe during the week which is now 28-35 cents per KWH. Supposedly the overall average is 15 cents per KWH, but it sure does seem like they are trying to get more out those that would plug in the daily truckster while they eat and watch the tube. used to be the higher rates were during the day in the thick of the heat or cold.

We have time of day rates. Off-Peak is $0.09 from 9pm to 7am and all day on weekends, Mid-peak is $0.15 from 7am to 5 pm, and On-peak is $0.44 from 5pm to 9pm. Needless to say my EV is programed to only change from 9pm to 7 am. (I plug in when I get home and it just sits and waits until off-peak)

I’ve also found other electricity use easy to shift. I have an all electric house.

Largest usage by far is the heat pump which is programmed to preheat / cool the house before the rate changes. Today it was 100F and I switched from 75F to 72F from 3pm to 5pm and then to 78F at 5pm. From 5pm to 9pm the house temp drifted up to 76F and the heat pump stayed in fan mode.

Hot water heater is set at 115F On-Peak so in reality it doesn’t run

Dishwasher gets programed to run after 9 pm

Laundry is done on the weekend

We still use the stove and oven of course and lights, TV, computers etc but besides the stove those have very minimal draw. Last month 10% of our usage was on-peak – only 45 kWh.

I charge at work for free so I don’t pay attention much to gas prices even when driving my FJ I don’t pay much attention. When I have or my fiance has to fill up her car though it is crazy how expensive premium can get.

Gas is under 3 per gallon for the low grade stuff, Truck suggests to use midgrade 89 octane, so $3.50 ish depending on the station. I think the No ethanol 91 that I use on most everything else is around $3.80 a gallon

Man, I woulda thunk more CA readers would comment. I’m not even in one of the major three cities and my gas has been pretty consistent ~$4.29 for 87.

I remember when 91 was .20-.40 more than regular but now it’s consistently $1 more.

I really want the factory Bronco tune for the extra warranty-backed power, but the added cost of premium on a 20 gal tank would ruin me.

I try to ride my bicycle.

And, most often, my ride into the office is peaceful.

I wish more people rode their bicycle and freed up space on the roads.

Eh, I agree, fewer part time drivers on the road would be great to me.

I agree! (see username)

Gasoline is about $4.29/gallon with the .50 discount at the local Nob Hill Aisle 1 gas station, ~$4.09/gallon at the nearest Costco [San Francisco, CA Bay Area].

Don’t have an EV yet. No doubt likely will someday, have owned a hybrid [Honda Insight Gen 1] in the past, again, probably will own one again. Rates in my city are $0.13176/kWh for “baseline” and $0.26723/kWh for anything over that (which is a pretty low baseline if you have nearly all electric appliances like us).

What’s wild is I have a CNG (compressed natural gas) Honda Civic GX and the variance in pricing around here is pretty large. $3.69/gallon-of-gas-equivalent by SFO (~15 minutes from work), but $5.69/GGE near Oakland airport (~5 minutes from home). So I tend to fill up once a week by taking the long way home via SFO and over the San Mateo/Hayward Bridge. But it only takes typically 5-6 GGE per fill up, so I occasionally just fill up where it’s most convenient.

Or, you could avoid the $8 San Mateo Bridge toll and loop through San Jose. It’s only an extra 30 miles. Depends on how valuable your time is I guess.

I’m going east on the bridges on the way home (work in San Francisco, live in the East Bay) so that’s the free direction. I did calculate the extra fuel used vs. the lower cost and figured out I’m still ahead.

Oakland-San Jose-San Francisco as the morning leg would be insanity to save $8 I guess. I forgot for a moment that the tolls were one way going towards SF.

Yep, exactly! And come this October, it’s only going to get more insane in the mornings as all those HOV stickers expire (mine included). Not looking forward to it at all.

Southeast Ohio is ~$3-$3.25/gallon range. I pay closer to $3.75 for mid-grade. That depends on where you go though. I have a mild hybrid Ram 1500(lol) so I doubt that counts. I would love an EREV though. If not for me then for my wife who drives upwards of 25,000 miles a year. The two bills I despise paying are my electricity bill and my gas card. I wish I could afford a solar array to cut my electricity bill down. My electricity bill is Mid-$300 a month and I only see that jumping higher now that I have to pay 2cents more per kwh starting in August.

Pacific NW somehow always manages to be one of the worst for gas prices. $3.80 or so at the warehouse club, up to $4.60 or so if you shop at the only gas station for the next 20 miles.

Here in SW Virginia (Roanoke area), unleaded regular (89 octane) runs from $2.63 on the low end (warehouse clubs) to $3.19 on the high end, if the station isn’t really trying to compete on price.

My car takes premium so I try not to look at the price and just pump it in.

Pretty much

Gas around me fluctuates between 2.75/gal to 3.30/gal for regular. That’s a level I could live with probably forever honestly. My electricity bill has doubled in less than 5 years however so I’m in no rush to increase that.

I pay $3.15-$3.35 for gas lately. The funny thing is, it’s cheaper by my house and by my work, but much more expensive in between (thanks to Cook County taxes and “The Barringtons”). So I never buy gas in between.

The two cheapest, regularly, are Woodman’s Megatastic Grocery Store (by my house) and a crappy little Gulf station (by my work). Yup, Gulf, a brand that disappeared from around here for a long time.

Gulf stations are really hard to find down here too, on the Gulf.

Gas is $2.80ish at the warehouse clubs and $3.20 or so everywhere else. Electricity is about $0.18 per kWh. I get a small rebate of the difference between the wholesale and retail cost for letting the utility control when I charge at home. The solar nets out to paying for the house electricity. I’d like to get a heat pump dryer to replace the vented electric one. That would make the solar go further and reduce my total energy cost. But the upfront cost is…..ouch.

Diesel has been $3.40-$3.70 here in raleigh. my wife filled up her own car for the first time in months and said ‘when did diesel get to $3.59??? i don’t remember it above $3.00??’

Filled up at $2.80 for E10 yesterday at a local-ish station that always has the cheapest prices. Most stations in this area are around $3.09 for E10 and $2.85 for E15.

SWVA here. Gas is $2.85 or so per gallon. Our electricity is $.17 per kWh, but with the solar we’ve had for a year I haven’t had a bill in 4 or so months. I got in when the rebates were in effect and I was guaranteed a 1-1 net metering agreement. They won’t pay me for extra electricity I produce, but my balance due has remained very negative for a while.

I want an EV to better take advantage, but I hate Elon and nothing else is compelling at/under $25k.

Start bitcoin mining to use some of your negative bill balance?

There’s a thought! Is that still worthwhile?

If electricity is free, I bet it is.

-deleted comment-

It looks like electricity (for my Volt) is sitting at about $0.1764/kWh off-peak (peak being 3-7PM; I have it programmed to charge off-peak).

Gas (Regular/87) is currently $2.98 (nearest Sam’s Club) to $3.19 at our local Meijer (and we get $0.10/off with the credit card). Diesel is about $3.79 right now at Meijer. Premium (93) is a buck more, so I typically try and fill up at Sam’s Club, especially in the Camaro, as it has a big tank.

I pay on average $0.16 per kWH at home but I charge for free at work that covers my round trip most of the time. I also have solar panels that help a lot to bring the cost down (27 panels). If I am charging at home, I try to charge when the solar production is at peak so the sun charges the car basically.

For gas, the ones that use premium I get it from BJs at $3.90 per gallon (once a month during the summer time) and for my Beetle I use Rec fuel that is the only one around me ethanol free ($4.99 per gallon) but thats like once every two months, I dont drive it much.

$0.125/kWh for electricity (raised recently from $0.10) and whatever Sam’s Club charges for gasoline on a given day. I just know it’s the cheapest place in town so that’s where I usually gas up at.

I’m fairly lucky in that my transportation-related energy costs don’t make much of a dent in my monthly budget anymore. A good thing too with my daughter going off to college next year. Got a taste of those expenses this weekend. $55.00 college application fee. I was presently surprised by that amount. Oh wait, since she was accepted, there was also a $425.00 “acceptance” fee suddenly due shortly after the application fee was paid. :-/

I feel for you. Those fees and things add up. It’s been a lot of years, but I don’t remember an “acceptance fee.” I do remember being careful about applications, though. Only applied to one college because I knew I qualified for their highest scholarship. Still a lot of costs not covered by it, though. Good luck.

Thanks! We’ve been funding a 529 here and there for awhile, so at least the first couple of years are covered. I have to give a lot of credit to my daughter – she decided where to go a couple of years back so this was the only college applied to and she’s already picked up around $10K in scholarships. She also claimed to have penciled out a plan where if she works summers it’s possible to get through everything in four years owing around $6K total in loans once we extinguish the 529. I’ll believe it when I see it, but in the meantime I’m like “That’s awesome and of course I’ll be happy to re-paint your Corvette this winter!”.

Good on her! Always good to have a plan; even if she finds herself pivoting away from it, she has laid some groundwork that’s likely applicable. And her plan sounds reasonable. If she can avoid working much during the school year and just work summers as planned, she’ll probably do well. That was one of my biggest mistakes–too busy and tired to do my best.

Those loans add up quickly, but it sounds like she’s the sort of person who’s going to end up in a good career quickly enough to pay them down fast.

I’m in the same boat (not literally since I can’t afford a boat). Dropping the kid off end of the week for her first term. She has a solid plan and we’ve been funding the 529 since birth, even with some good scholarships it isn’t enough. She’s going to have to work summers…which is fine. I want her to feel some ownership of this education. Seems like 10x what I paid for the same school 30 years ago. Also gas was $0.89/gallon then….

I pay 8¢/kWh to charge my EV

Guessing you are, like me, in the TVA service area, since it seems we have some of the cheapest electricity in the country.

Nope, I’m in Michigan. My utility offers super cheap off peak rates in exchange for slightly higher peak rates.