I feel like I probably spend a lot less on cars per year than the average person. Not because I don’t own any cars, but because the two cars I do own are incredibly cheap, both in their purchase price and their insurance costs. Plus, because I live in New York City, I only drive them once a week (at most). So my gas bill is pretty low.

Still, I wince at my credit card bills every month as I see the toll and gas charges pile up. Though it feels like the costs for owning a car are going ever upwards, one study has found it’s actually cheaper to own a new car in 2025 versus last year.

AAA released its annual Driving Cost Analysis study last week, offering up some valuable insight into just how much money people are spending each month to own and operate a new car. The study looks at six categories—fuel, maintenance, insurance, registration fees, depreciation, and car price—to determine the effective monthly dollar amount for the privilege of having a new vehicle.

This year’s study revealed that, on average, the cost to own a new car over a yearly period was $11,577, or $964.78 per month. That’s about 5.8 percent down versus 2024. In a world where everything feels like it’s getting prohibitively expensive, this is a bit of a surprise. But after looking at a few other numbers, the study starts to make sense.

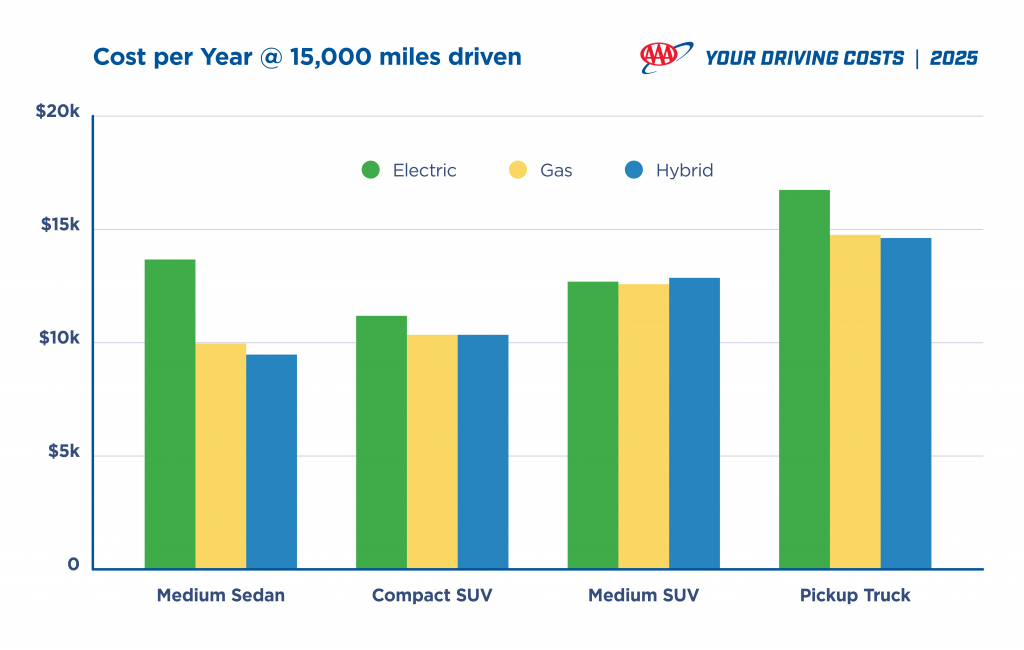

Source: AAA

Firstly, and most importantly, is the cost of new cars themselves. By the end of 2024, the average price for a new vehicle came in at $49,740, according to Cox Automotive. In the nine months since, that number hasn’t really changed. According to Automotive News, the average price for a new car is hovering at $49,889. A small increase, yes, but nothing substantial enough to make a dent in AAA’s study.

What about the interest costs associated with assuming a loan to buy a new car? Well, according to AAA, that number has actually dropped quite a bit—15 percent to be exact. In 2024, buyers paid $1,332 per year on average for finance-related costs related to their new cars. But in 2025, that number has dropped to $1,131 per year.

AAA cites fuel prices as another big reason for the drop. The study says the average cost of fuel dropped to just 13 cents per mile, down 12.8 percent versus last year. Interestingly, the price of electricity for charging EVs actually went up slightly, from 15.9 cents per kilowatt hour to 16.7 cents.

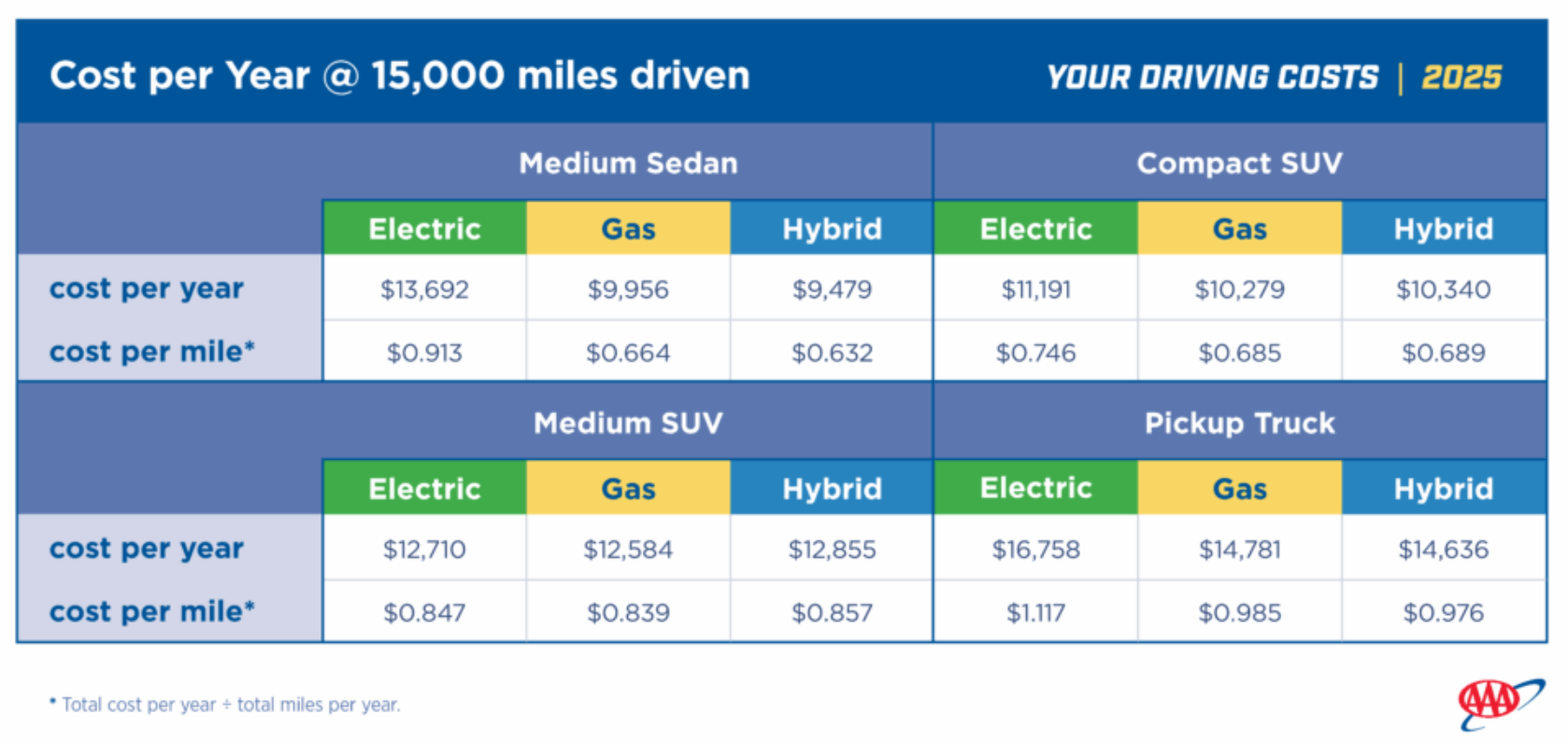

Those factors, plus all of the other reasons why EVs should be leased and not bought, are why it’s still cheaper overall to own a gas-powered car in America. From the study:

The primary factor affecting the cost differences between electric vehicles (EVs) and gas vehicles this year is fuel prices. While EVs remain more expensive in “ownership costs” (depreciation, insurance, fees, and financing), they have lower “operating costs,” particularly in fuel and maintenance. Last year, EV fuel costs were about one-third of gas vehicle costs.

This year, however, gasoline prices have significantly decreased, while electricity prices have slightly increased. Although EVs still offer fuel savings—less than half of gas vehicle costs—this does not sufficiently offset their higher ownership costs. Consequently, EVs are now more expensive overall across all vehicle categories in this study.

Things are a little different with hybrids. AAA discovered hybrids have the lowest average maintenance costs—even less than EVs. For two of the four vehicle categories studied, medium sedans and pickup trucks, hybrids are actually the cheapest powertrain option, undercutting pure ICE power.

I don’t expect the findings from this study to last for long. Tariff-inflicted price increases have already begun to bleed into new vehicle costs, while some automakers are finally starting to increase MSRPs to keep their margins positive. It’s not just transaction prices, either. If something costs more to replace, that means it’ll cost more to insure. That counts for the car and any parts that have to be imported—stuff like bumper covers and quarter panels aren’t immune to tariffs.

So if you think things are expensive now, just wait until next year.

Top graphic image: Toyota

Support our mission of championing car culture by becoming an Official Autopian Member.

I think these numbers are very skewed by the fact that there are very few mainstream EV models and many more “luxury” EVs. This makes the average depreciation numbers far higher for the EVs in each category. It also may not be accounting for the fact that the majority of EVs get a discount from MSRP in form of the tax credit (currently, yes that will go away soon). I notice that I have not read any articles quote this line out of AAA’s report “Therefore, overall results from the EV/Hybrid analysis cannot be directly compared to the overall results from the regular YDC study.” which basically proves out the fact they also think that their data should not be compared between the EVs and gas car because it is misleading (of course I have seen numerous people sharing this study as a reason why no one should buy EVs).

As an anecdote looking at a mainstream EV vs an “equivalent” gas vehicle I purchased a new 2023 Bolt EV for $20K after the $7.5K tax credit and sold the car 2 years and 20K miles later for $19K, meaning my car only depreciated by $1000 in 2 years of ownership when accounting for the tax credit. Had I instead purchased a Chevy Trax for ~$22K I would have been able to sell it for around $15-16K which would have been a depreciation of $6-7K in the same amount of time, not to mention the fact that I saved over $3000 in fuel costs and my insurance costs were in line with my other gasoline powered vehicles. I think all this study proves is that more affordable EVs are needed in the market across categories.

Someday I’ll have something newer (not new) when I have a bit more income. Until then, my 2004 Grand Caravan is doing ok; I think I’ve spent around $600 in parts this year, insurance is about $120 (splitting my normal payment for two cars in half) and gas usually only needs to go in it once a month, given it didn’t get driven a ton.

I did do 3500+ miles on it in the past three months, having just gotten back from a 2500 mile road trip in it yesterday. The clock turned over to 245k miles total.

It’s not beautiful, it doesn’t have the best ride, but it’s got lots of storage space, gets the kids around and is pretty cheap to run at around $200 per month. No idea how I could ever afford near $1000/month for something brand new.

I agree… the idea that people pay, on average, about $1,000. per month to drive a new car is sobering. And in reality, they don’t even own the car, it since they’re still making monthly loan payments on it for years to come.

I’ve had exactly one new car in my life, which I leased through my business, effectively making it cost about a third less (to me, after tax benefits) than it actually did. The $700. monthly lease payment for the Mercedes CLK probably came to close to $1,000. a month after insurance, gas, etc… After the tax write off (because it was my company car, and I had a separate ‘personal’ car) it actually cost me roughly $650. per month, back in 1999-2000. Not chicken feed, but at the time, I could afford it easily, and the idea of spending that much on a car didn’t bother me.

Since that lease, things have been different: I’ve only owned used cars: in 2001, I spent $16,500. on a one-year-old VW Golf TDI that I owned for 23 years, but all the cars I’ve bought after that one have been in the $2,000. to $5,000. range. Since they’re old (ranging in age from 20 to 36 years), and since I’m old too (well, deep into middle age), and since I mostly worked from home before I semi-retired a few years ago, I don’t drive a lot of miles, so insurance is about $100./month for both cars (I actually have three cars plus a small motorcycle, but usually, only two of the cars are registered/insured). Gas is pretty negligable costwise, even though my current ‘daily’ probably gets about 10 MPG: I only drive a few thousand miles a year max, divided among two cars. I do spend some money on maintenance/repairs when necessary, but it’s not that much nor that often: a guesstimated average would be maybe $75. per month over the past few years, though all the cars have something that still needs doing on them.

I DO think about owning a ‘new’ car… to me, ‘new’ means made within the past decade. Mainly because I’d like to daily a car with modern safety features: lots of air-bags, crumple zones that’ve been modeled by powerful computers, and some cameras and sensors, even though I know all of that increases complexity, weight, and cost to own. A six or seven-year-old Mazda CX-5 would probably be ideal, but they’re in the $15-20K range, so it’s hard to bite that bullet when I only drive a couple times a week at most, so I’m not actively shopping and just thinking about it.

I was a kid in the 1970s, so at the time, I was less aware of the cost of living. In addition to the exhorbitant cost to run a new car these days, folks pay for smart phones, data plans for them, internet connections for their homes, all kinds of subscription services (streaming video and audio, etc…), and of course shelter is expensive, be it a mortgage payment and rent. Insurance of various kinds costs a fortune too. I know that plenty of folks make six-figure incomes, and that doesn’t even raise an eyebrow these days, because it costs so much to be alive.

It’s all a bit dystopian to me, to be honest.

It certainly does have a dystopian air to it. I look at other people and comments on the Internet and can’t help but feel very thankful and lucky that we can live the life we do, given the general expense of things these days. But I suppose that it helps that we’re able to live mostly pretty frugally. Our newest, least used car is 13 years old with 130k miles on it, for example.

But we shop at thrift stores for ourselves and for the kids (mostly), all our electronics are bought used or hand-me-downs (we’re currently using my family’s old phones as our new phones) and we’re lucky enough to have enough money to make Costco runs every month and stock up so I can cook the vast majority of our meals at home.

Suppose I’m just bragging right now, but I just can’t imagine always needing that latest car or computer or phone or whatever and constantly going out to eat. No idea how people can afford that, given we already are in debt between our mortgage and credit card and we’re not exactly living extravagantly.

Great job on the frugality! I’m just going to remark on the phones: I’ve had a cellphone for going on 25 years now, and I don’t recall ever paying for one. I keep them a few years and when I need to replace it, there’s usually some kind of deal going on for a free upgrade. My last phone was a Pixel 6 (when they were the current model) that I got for $0 due to a plan change by my carrier. My family members and most people I know do this as well.

Kudos Beardy! 🙂 My daily computer is almost a decade old and still runs totally fine: it’s an Asus ZenBook i5 laptop now running Windows 11. I like it so much, I bought another one of the same vintage off of eBay (maybe $150. a few years ago) just to have a backup that I know will be good. I’m also one of those weirdos without a cellphone, and the only TV I watch is either Youtube or comes from downloads I do myself. Like yourself, I mostly always cook at home: I’ve got lots of practice and am a pretty capable cook (I also enjoy it). As mentioned, all of my cars are old, and I paid off my house a few years ago, so that’s nice.

To be 100% honest, I don’t feel deprived… I feel comfortable w/my chosen living scenario. Yes, I’d like a newer car as a daily driver (and I could afford to buy one today if I chose to) but not having it right now doesn’t irk me much. I wish more people would consider living with a bit more mind towards saving for the future.

Who wants a new car anymore?

So many complaints about lack of buttons, dials or cruddy UIs. No thanks.

Almost any car, decently maintained, can last 150-200+ K miles. And the depreciation rates seem to have accelerated. Maybe look into that.

Don’t get me wrong… insurance rates have certainly gone up. Even on eight-year-old cars like mine. But so have medical costs, which is probably a big contributor to my liability insurance.

I have a ’17 Honda with <70 K miles on it. Bought it with cash outright. I wrestle all the time with whether I want to carry comprehensive on it anymore. It spends most of its time in a garage where most stuff won’t happen to it. And I take an Uber or a Lyft when I might be the liability.

I have an umbrella policy, but to qualify for that, I have to carry certain levels of coverage on my vehicle. I may have to reevaluate all this.

Advice is welcome. Pretty much as always.

This is a tough one, and it is all based on the risk you are willing to take relative to the other costs in your life. I won’t tell you what to do, but can offer some mitigation to the cost of comprehensive.

I can’t really think of anything else.

The average car on the road is 12 years old these days. New cars are more expensive, but your odds are also getting better that you’re going to hit something older should you get in an accident. I’ve never been a fan of looking at “cost of new car” or “cost of financing for new car” – new cars are a luxury. People may need cars in the US transportation system; they do not need *new* cars. Still plenty of used iron out there for sub-10k.

I have two cars; a 1999 4Runner (on which I’ve never carried comprehensive or collision) and a 2015 BMW. If you want to split the baby, just dial up the deductible on your comprehensive/collision. I’ve got a $2500 deductible on mine, which means carrying comprehensive/collision costs me something like… $15 a month?

How much is your comprehensive costing? I’ve looked over family members’ insurance (not in the same state I live in) and I’ll see things like $100/month for comprehensive with a $500 deductible on a car worth $8000 – which means that if you total your car less frequently than every 6 years, you’re probably better off just piling (as the above commenter indicates) the money into a savings account. At an inflection point – usually assuming you total a car less often than 4-8 years – carrying collision is actually net-negative.

This to me is the crux of the matter.

If you have enough assets for an umbrella policy to make sense, the decision to have comp coverage on a car is small potatoes in comparison. Don’t cheap out over a couple hundred biannually if it costs you millions worth of protection. On the other hand, if you don’t really need the umbrella, then you can do a cost/benefit on the specific impact of the comp coverage vs likelihood of making a claim.

Yea this makes sense, round here gas felt like it dropped about 20%.

I remember in January Gasbuddy was predicting mid $4’s during the summer but we never even hit $3.75

In my neck of the woods it’s been slowly but steadily going up. It’s slowed, but beginning of the summer it was 2.80-ish, now it’s 3.05 -3.15, depending on station. It’s more expensive now than any time since late 2024.

Oh definitely slowly going up, summer blend being more expensive will hopefully creep down again in october. But way better than 2022, I didn’t see any $6’s here but it sure got close.

So this year they just want your first born, a kidney, and a leg. However, you can keep your 2nd born and the other kidney and leg. Got it! Good to know. Next year, however…Do you really need that other kidney????

We bought a 2024 Chevrolet Trax LS in January of 2024 for around $24K including dealer fees, taxes, and registration. We wrote a check for it.

If we bought a similar Trax in 2025, it would have cost a few hundred $$ more.

I’m a bit scared about the wet timing chain 3 cylinder turbo. How has yours been? Really nice looking SUV’s BTW. They actually come in colors! Congrats. Hope you get good service out of the Trax.

We got ours in the Blue Glow color, which was a 2024-only, LS/1RS-only color, which makes it stand out, as far as seeing others like it. And it’s not really an SUV. It’s only 3″ taller than the wife’s Cruze. The EPA labels it a wagon on the Monroney label, so that’s what we call it. So far, the little 1.2L Turbo in our wagon has been just fine. I was a bit leery of getting a first-model-year of this 2nd generation Trax, but other than a few minor teething issues it’s been fine.

The Ambient Light Sensor had issues right after we started driving it. Found out there was a Technical Service Bulletin (TSB) for that issue so I brought it back to the stealership and they replaced it in less than an hour under warranty.

Two weeks later, Chevrolet issued a recall for the ECM programming during the stop/start cycle. I never had an issue with it, but had the recall done right away just to be safe.

Earlier this summer, I noticed the A/C was not blowing cold air during a remote start. Looked it up when I got home, and, sure enough, there was a programming TSB for that. So I brought it in and they fixed it in 45 minutes under warranty.

Those are the only issues we’ve had with it in almost two years. As far as the wet timing belt issue, the stealership included a 3rd party lifetime powertrain warranty (WarrantyForever) for free when we bought the Trax. I have to follow their rules pertaining to scheduled service, and in turn, they’ll warranty the entire powertrain from the turbo all the way down to the wheel bearings for life. (or until the book value of the vehicle falls below the cost of the repair/replacement of the powertrain)

They are really nice for what they cost, especially. My friend just bought one for his small business and let me drive it. I liked it a lot. But like you, that wet timing belt 3-banger scares me.

I absolutely love the look of the Trax. I just wish it were AWD; it could be a great Crosstrek competitor.

How’s your real-world mileage been? They seem to be rated pretty low for a small car with a 1.2L.

Pretty much 34 mpg every tank. 87 octane. Mostly highway miles, but some in-town driving. It’s heavier than a small wagon needs to be, at almost 3000 lbs.

We’ve stored it for the winters so far, so no need for AWD. If I really wanted AWD, I would have sprung for an Equinox or maybe even a Blazer. I daily a RWD GMC Canyon, and the wife’s daily driver is a Cruze and we get by just fine in Northern Wisconsin winters.