Objectively, new cars are better than they ever have been. They’re quieter, more powerful, more efficient, more feature-rich, and safer than the cars we grew up in. They’re also quite expensive, which can make one wonder how people are affording them. As with anything in life, “affording” is a relative term, and it sure looks like the average new car payment in July is going to blow past the $740 mark. That’s a bit alarming, yeah?

At the same time, everything appears to be hitting the fan for giant automotive supplier ZF Friedrichshafen; it turns out that knowledge around advanced driver assistance system warning lights may be lacking; and we might be about to have a new American Nürburgring king.

Welcome back to The Morning Dump, our daily round-up of the hors d’oeuvres of automotive news. You know, little bite-sized tidbits you could have a bunch of during cocktail hour before tucking in for a proper meal. Let’s hit it.

JD Power Predicts A New Car Payment Record

If you’re like me, you probably feel like cars have grown incredibly expensive over the past half-decade or so. While it used to be possible to buy a new car with a sticker price of less than $20,000, it just isn’t happening anymore. In an age of $44,000 Subaru Foresters, I can’t help but wonder just how much people are paying month-to-month for their new chariots, so let’s see what’s being reported by Automotive News:

J.D. Power projected July will end with the average new-vehicle loan payment reaching $742, up 1.6 percent from a year earlier and setting a record for the month.

Ah. While average car payment isn’t a perfect metric because the person who finds a leftover unregistered Chrysler 200 in a dealer’s storage lot for peanuts and the person bold enough to finance a McLaren 720S with the bare minimum downpayment both exist on the spectrum, not only do we know that some ultra-luxury shoppers are putting purchases on hold, we also know that truly cheap cars are getting harder and harder to find. Besides, a car payment of $742 a month is like, mid-range-Toyota-Highlander-with-a -trade-in territory. So what’s causing this jump in average car payment at a time of slowly declining new car loan interest rates, at least based on preliminary data?

“July results are … being impacted by lower-than-normal incentive escalation by manufacturers,” [JD Power’s Thomas] King said in another statement. “Instead of discounts rising as they normally would at this time of year, incentive spending has edged down to 6.1% of MSRP in July from 6.3% in January, reflecting the cost pressure that manufacturers are under due to tariffs.”

Ah, yep, if we look at the early data, we’ll see that incentive spending as a percentage of MSRP has fallen 0.1 percent over last July but in raw dollars, things are pointing towards a slightly increased average incentive spend of $3,051, up from $2,999. Cars are just getting more expensive, which really begs the question: How much longer can we sustain this? According to the latest available census data, median household income in America stood at $80,610, and even in a single-vehicle household, spending more than 11 percent of median gross household income simply on a vehicle payment just doesn’t seem feasible for many. Add in the early July data suggesting that the average used car price now stands at $29,514, and I can’t help but get the feeling that we’ll see some dramatic changes in car ownership trends if people keep getting less for their money.

Things Aren’t Great At ZF Right Now

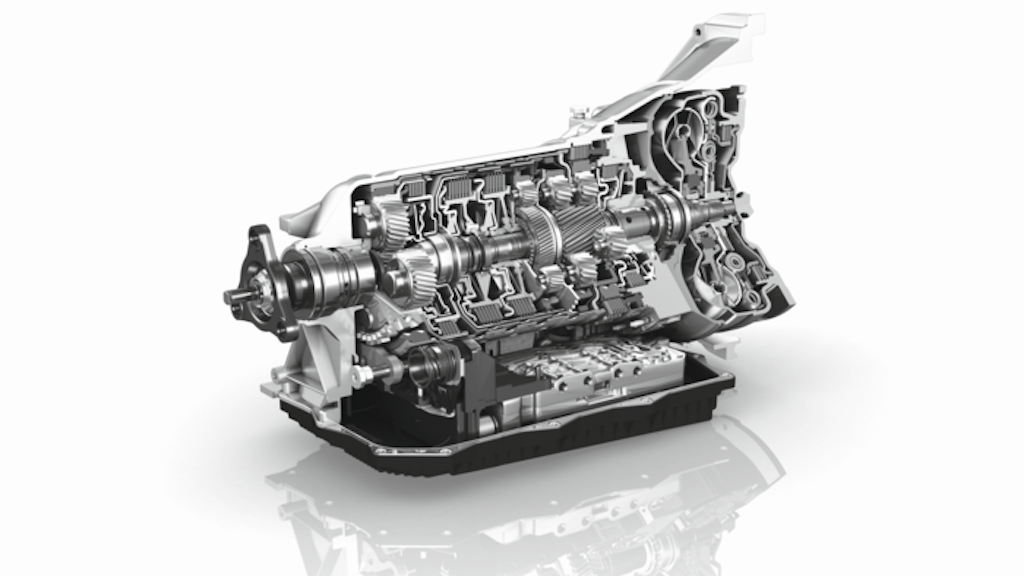

Even if you haven’t heard of major automotive supplier ZF Friedrichshafen, you’ve probably experienced at least one of its transmissions. Variants of the 8HP eight-speed automatic for longitudinal applications are in everything from the BMW 3 Series to the Ram 1500, the 9HP nine-speed automatic for transverse applications is in vehicles like the Honda Ridgeline and Jeep Cherokee, and that’s before we even get into the old stuff and the manual transmissions.

Despite essentially being at the head of the class when it comes to automatic transmissions, ZF has found itself in some trouble. We’re talking billions of Euros in debt among other economic pressures that are all piling up and threatening to tear this industry titan apart at the seams, w ith Manager Magazine reporting (so long as Google Translate doesn’t do me dirty):

Due to horrendous debts of more than €10 billion, high interest rates, and tough times in day-to-day business, the management board closed smaller plants in Gelsenkirchen and Damme and has already verbally sidelined others like Eitorf. Up to 14,000 of the approximately 54,000 ZF jobs in Germany could be lost by 2028. And that’s not all: In order to finally reduce its debt, the management board has been trying for some time to sell off the airbag and belt division (ZF Lifetec). Even the drivetrain units (Division E) and the driver assistance systems business are uncertain at ZF.

If that doesn’t sound especially good, hold your horses, because things could get worse. Per Manager Magazine, among the assets that ZF is considering selling is its driveline business, officially called Division E. In a way, it’s kind of the heart and soul of the company — the highly-respected part responsible for transmissions and electric drive axles. Per the repot, the supervisory board is voting on whether the management board can restructure the profitable Division E, and Works Council members seem understandably unhappy because restructuring often means that leadership mistakes led to this point, and further layoffs probably wouldn’t be off the table. Unhappy enough to protest, even, with Manager Magazine writing:

When the two demonstration marches, armed with placards (“Leadership? No sign of it”), cowbells, and pyrotechnics, arrived at the Forum in Friedrichshafen to continue the works meeting that had been interrupted two weeks earlier, all the dams broke from above. The downpour didn’t stop activists from rolling a poster bearing the slogan “Strategy instead of disaster” from the roof of ZF headquarters.

Well, that’s scathing, but also probably fair. These sorts of financial issues generally start from above, and once in deep enough, there are no easy ways out. For now, I think I’ll row through the gears in my ZF S6-53BZ six-speed manual transmission and think of the people who worked hard to engineer and assemble it. As we say in Canada, keep your stick on the ice, we’re pulling for you.

What Does This Light Mean?

It’s been absolute ages since warning lights first appeared on dashboards, but the mass adaptation of features like lane keep assistance and forward collision warning mean that drivers have more to scan than ever before. How are they responding? Probably not by brushing up on knowledge. British car warranty firm Warrantywise contracted OnePoll to survey 2,000 drivers on dashboard lights related to advanced cruising control and well, things aren’t looking good:

From alerts for lane assist to adaptive cruise control, the symbols now found on many vehicles’ dashboards appear to be causing more confusion than confidence, with four in ten drivers (41 per cent) admitting they don’t recognise or understand a single warning light from a suite of basic cruise control-related warnings. In a world where cars can steer, brake and park themselves, many drivers are left struggling with what should be the most basic line of communication from their car: the dashboard.

According to the study, 41 percent of drivers surveyed could recognize the lane keeping warning light, 33 percent could recognize the cruise control warning light, and just 28 percent could recognize the forward distance warning light.

Perhaps the most shocking thing here is that only a third of drivers knew the cruise control warning light, because it’s not like cruise control is especially new. My 26-year-old summer toy has a cruise control light, and that thing predates the film adaptation of “Requiem for a Dream.” Considering these systems play a significant role in how vehicles operate, are we really ready for the semi-autonomous era if many drivers likely wouldn’t know from the dashboard if something’s malfunctioning?

Rocking The Ring

Ever since the mid-engined Corvette debuted, armchair experts have wanted to know one thing: How fast could it lap the Nürburgring? Never mind that conditions on the famed German circuit can change literally hour-by-hour, and that times from different years aren’t directly comparable due to track improvements, this is one of those metrics that people turn into an absolute measuring match. Admittedly, I do find fast times amusing bits of trivia, but there are caveats behind those headline figures.

Well, good news: We’re about to find out how fast the mid-engined Corvette can really lap the Green Hell. Chevrolet released a teaser yesterday that Nordschleife times for the 670-horsepower Z06, 1,064-horsepower ZR1, and absurd 1,250-horsepower ZR1X will be released on Thursday, which means we’ll have a lot to discuss today. So, buckle up, because with the Ford Mustang GTD holding the American car lap record at 6:52.072, things are about to get spicy.

What I’m Listening To While Writing TMD

The LA Riots remix of “Lowlife” by Scanners is one of those songs where I can’t remember when and under what circumstances I first heard it, but you know what? It still slaps. Upbeat instrumentals, mildly depressing lyrics, hell yeah.

The Big Question:

Do you reckon the Corvette ZR1 will beat the Mustang GTD’s Nürburgring time?

Top graphic image: Lexus

The average age of vehicle ownership keeps going up. That probably coincides with cars from the 90’s and 00’s becoming more reliable. But because of that, I would imagine people are holding on to them longer and putting more money into repairs/maintenance due to new cars getting this expensive. I know I have held onto my 2008 Tacoma even though I really don’t use it that much lately because it’s paid off, reliable and I can do most of the work on it myself.

I don‘t think it’s fair to put the blame on the drivers for dashboard oblivion.

For a couple of decades already even the poorest new car has some sort of screen that could convey written messages, and car industry still rely on cryptic icons and no clue on “what the hell is the issue behind this engine light”.

It’s 2025 but we still live like it’s early 80’s

Payment is largely meaningless without knowing the loan term and interest rate. To pay off my ’11 BMW wagon (which I still own) in the 3.5yrs it took me to do it, was about $1200mo even with a decent down payment. IIRC it was around 6% back then, maybe 5% and a bit. IIRC, the required payment was just under $700 for five years.

I picked that car up in Munich 14 years ago today. 7/31/2011. ~$46K MSRP, after discounts but with taxes and fees I think it was $42K out the door, and I put $6K down. Then I got the $500 BMWCCA new car rebate check in the mail later. Ordered to my spec, drove it around Europe for two weeks with friends, and I still love it like day one 14 years on. Worth every single penny.

I can’t imagine paying that much for a Forester. Very glad nobody makes anything new I want anymore.

But ultimately I have no problem borrowing money, I just hate paying interest to do it. Tossing $1000mo at a car to pay it off doesn’t bother me much, but I like $0/mo better.

This sounds like a dream trip. I have always been fascinated with those “take deliver from the factory” options. Assuming you’re from the states, did you have to get an international drivers license for those 2 weeks? Was that on your dime or included in the sale?

I did get an International license through AAA for some nominal sum. $25 or something. No big deal.

I actually did it twice – first for the ’11 wagon that I still have, and again in 2015 for a ’16 M235i. Took my mother with me for that one, spent a month and visited nine countries. Somehow I didn’t push her off an Alp. I came very close to doing it again for a Porsche Cayman in 2019, but couldn’t quite stomach the price of the thing. Now there isn’t anything I want. Sigh.

the 1500-3000 a year i pour into my Used BMW is still looking pretty good right now.

Even better for my used Toyota that costs maybe $500 in parts/year. That leaves another 1000-2500 for Z3M parts.

AVERAGE IS MEANINGLESS: Give us medians! Better yet, give us the median vs the median household income. If median monthly payments are rising higher than income, that’s probably bad news. If median payments are rising slower than median income, that’s probably good news.

Using the median doesnt make everything magically perfect, but it definitely prevents the massive distortions at the high end of the market. If people are paying more per month, but that debt load is easier to bear, that’s way different than paying more per month but less able to bear it.

Here’s a dumb example: In 2024 GM sold around 14 times more Trax than Hummer. Let’s say every single one was a 2025 bare bones base model (we’re Really trying to bring the average down here) at $20,500, the one Hummer that sold was for $105k.

The average for those 15 vehicles is more than the highest possible Trax msrp.

The median is $20,500.

Extrapolated to the market at large, the breathless reporting of the skyrocketing average sales price could be a capital B capital D Big Deal if super normal buyers are choosing way more expensive options, or a complete nothingburger if it just means already rich people are buying even more expensive options.

What’s more is the article hints at this tension but then doesnt provide an alternative. Without things like medians to counterbalance the hype, the average doesnt give us one iota of useful information.

I would greatly appreciate if the Autopian, as a rule, was going to report on something like an average price/payment/etc, they do the legwork to find medians to contextualize the news. I get it’s more effort and this is a daily news roundup article that takes a huge amount of effort to do (it’s also my fave article of the day), but when the article itself winks at the fact that it’s a low-information statistic and then doesnt ground it with something higher-information it misses the opportunity to educate.

I dunno why I chose this particular article with averages in it to rant… but here it is.

/end rant

Exactly, I need something to walk down the next time I lose a fob! Wait…

200 bonus points!

Also one of those instances where mode makes sense. What’s the most common car payment? The mode.

The bad thing is that they do give the median income, while I’d prefer to see both at least be consistent.

Just did a quick look at a Toyota Corolla SE. (A model up from base)

No cash down, 60 month term, very good credit score (670-689):

$523/mo. estimate from Toyota (7% apr). Probably more when you include taxes and the like. So, let’s call it $550.

For something that should easily go double the loan period. You could go a bit longer and get a lower payment, and I’d not blink. It’s a Corolla, man.

Someone who signs up for this deal isn’t going to be sneered at by me, especially if they’re not automotively inclined.

Being sanctimonious is an excellent way to shut people down. I am glad some here are fortunate enough to never have made a car payment ever, but a lot of people are just trying to make life work. And yeah, had I not been so fortunate, I might have been such a person.

As long as they’re not being ostentatious, or right at the edge of their fiscal limit, someone just trying to make it work day-to-day in their ordinary car can have a car payment. And that’s OK.

I am reminded about how someone here once said that getting someone into a decent new ride was when that person’s life changed for the better. No more broken down car, or hoping a vehicle makes it to work that day.

Let’s not sneer at the guy who’s just trying to make it day-to-day.

Term length doesn’t matter. All that matters is “cost of interest.” Well, that and not spending more than you earn, and ideally saving 15-25% of income.

That is: At the end of the note, what percent did the interest add to the price?

Ideally you want to shoot for 10% or less. No, not 10% APR, but that you pay $1100 or less per $1000 of the total transaction price of the vehicle. That’s an ideal. I think 15-20% is more where people shoot for, but it depends on the lending environment. It’s easier to get the number lower when there’s ultra low APRs broadly available.

i did do a loan recently, and my calculated “cost of interest” should end up at < 0.75%. That is, for every $1000 the car cost, I paid less than $1007.50. That required shopping the loan myself, putting ~80% downs and setting up an accelerated payment schedule to complete a 60-month note in ~18 months.

For me, borrowing was worth it because the cash I could keep on hand stood invested in a boring Treasury MMF, which lowered my cost of borrowing even further (likely closer to $1002.50 per $1000, taking taxes into account), and let me keep an extra chunk of cash on hand in the event life went extremely sideways for some reason.

Real Estate is not a lot different. I have a condo that I bought in late 2011. My interest rate is 4.125% I have an IRA that is making 13+% Do I sell off stocks to pay off my condo? No. The IRA is making more money than I’m losing on interest (which is also tax deductible).

Warning lights should come up as overlays in social media feeds on phones. It’s the only place where most people are looking.

“Talk about a push notification!” – Groucho Marx, with his brothers pushing a broken-down Chrysler into the shop

I get that there’s a lot of anti-financing people here, and that’s great if you’re a person who can make that work. Keep doing your thing! If you can work on your car, or have managed to get your hands on something old but reliable? More power to you. A righteous path for sure.

But there are a lot of people in this country that are simply trying to keep the lights on. Keeping the lights on requires a job. Getting to that job requires a car (for most of the country). For those who are not exactly liquid, there’s a lot of value to be had from a cheap new car with a warranty, versus taking a chance on throwing what might be that persons entire life savings (let’s say, 4k) into a car that… two months later explodes. That sort of event can put said person into just that much more financial despair.

This is why cheap new cars are so important. I’m not advocating for someone making 35k a year to sign up for a 7 year loan on a Grand Cherokee (a major issue these days) but rather, for that person to get their hands on a basic compact sedan that meets their needs. There’s been so much bullshit “well at that price you could get a much better used car” as if the first 3-5 years of warranty covered ownership has absolutely no value to someone with no cash on hand. A reasonably priced new car (Corolla) can provide someone with limited means, cost controlled transportation over the life of a loan and far beyond. It sucks that the options have become more limited lately, but that’s what we get for being so psychotic about not buying anything that might be perceived as “cheap”.

Not to mention the downstream effects for the people who have no cash AND no credit. No cheap new cars means no cheap used cars.

Affordability is an issue for most of us. I’m not anti-loan, just in favor of smart financing. I also tend to hold onto vehicles well past the loan term. At the right time, a lease can make a lot of sense.

I need to replace my old ’05 MDX, it is about worn out in some regards with some rust. It needs 4 tires and major power steering system repairs, plus front struts. I could just put that same money into a newer, nicer vehicle that will go another 10 years or so.

THIS. One top of that, the corporations that now set the bar for used car values are pretending their market is it’s own entity irrespective of new cars. So it’s not uncommon to see a 2020 CRV with 45k miles priced dangerously close to a brand new one, just ‘cuz.

Banks don’t look kindly on big, long term loans for well-worn depreciating assets and rates are already high. It’s a double middle finger of the highest order clearly meant to exclude certain buyers. Don’t even get me started on how insurance companies use this data.

Automakers also keep designing cars that are bigger and heavier enough to wreck a car from just a few years ago in a minor accident. Again, just ‘cuz. The previous gen Accord, a decently sized car, was getting a “poor” on some IIHS tests toward the end of its lifecycle. And we’re already seeing the dreaded red P on new cars as tests adapt to these changes.

Can you imagine taking out a 72 month loan on a “top safety pick” only for it to be deemed unsafe after two years?

Somewhat ironically, I think we are in a golden age of cheap cars in the US. The options may be limited, but some of they are very good. The Civic and Corolla both start around $25k and are legitimately nice cars ($25k is $15k in 2005 dollars; some people hate adjusting for inflation, but that is the only way to make a meaningful comparison). Vehicles like the Mirage, Trax, Versa, and Soul are even cheaper. These may not be as desirable as a Civic or Corolla, but they are far safer and more reliable than sub-$15k vehicles available in 2005.

You have a very good point about the downstream effects, though. While there are great cheap car options available, they don’t sell in big numbers. I don’t think it is a problem if people choose a $40k car with a longer loan term (assuming they understand the risks of a longer loan term) over a $25k car, but that does limit the stock of affordable late-model used cars. I think the high cost of new cars is largely driven by consumer choice, and as such isn’t a major problem. The high cost of late-model used cars might be the real issue, even if it gets less attention.

I haven’t crash tested a Soul, but I rented a 1st gen one in and around Mississauga, Ontario years ago and was almost gleeful at how much fun it was and what fun little fripperies it had to play with. Really one of the most surprising rentals I ever had. Sure, I’ve rented hotter, more comfortable, more opulent cars. But that lime green Soul really over-delivered.

And being in Canada always puts a smile on my face. Except Edmonton. I have never had fun in Edmonton.

This is the correct take. Used car prices are asinine as well. And, you often can’t find more than a pile of parts masquerading as a car for less than 5-10 grand nowadays. The days of a $1,500 “beater with a heater” are over, for the most part.