Objectively, new cars are better than they ever have been. They’re quieter, more powerful, more efficient, more feature-rich, and safer than the cars we grew up in. They’re also quite expensive, which can make one wonder how people are affording them. As with anything in life, “affording” is a relative term, and it sure looks like the average new car payment in July is going to blow past the $740 mark. That’s a bit alarming, yeah?

At the same time, everything appears to be hitting the fan for giant automotive supplier ZF Friedrichshafen; it turns out that knowledge around advanced driver assistance system warning lights may be lacking; and we might be about to have a new American Nürburgring king.

Welcome back to The Morning Dump, our daily round-up of the hors d’oeuvres of automotive news. You know, little bite-sized tidbits you could have a bunch of during cocktail hour before tucking in for a proper meal. Let’s hit it.

JD Power Predicts A New Car Payment Record

If you’re like me, you probably feel like cars have grown incredibly expensive over the past half-decade or so. While it used to be possible to buy a new car with a sticker price of less than $20,000, it just isn’t happening anymore. In an age of $44,000 Subaru Foresters, I can’t help but wonder just how much people are paying month-to-month for their new chariots, so let’s see what’s being reported by Automotive News:

J.D. Power projected July will end with the average new-vehicle loan payment reaching $742, up 1.6 percent from a year earlier and setting a record for the month.

Ah. While average car payment isn’t a perfect metric because the person who finds a leftover unregistered Chrysler 200 in a dealer’s storage lot for peanuts and the person bold enough to finance a McLaren 720S with the bare minimum downpayment both exist on the spectrum, not only do we know that some ultra-luxury shoppers are putting purchases on hold, we also know that truly cheap cars are getting harder and harder to find. Besides, a car payment of $742 a month is like, mid-range-Toyota-Highlander-with-a -trade-in territory. So what’s causing this jump in average car payment at a time of slowly declining new car loan interest rates, at least based on preliminary data?

“July results are … being impacted by lower-than-normal incentive escalation by manufacturers,” [JD Power’s Thomas] King said in another statement. “Instead of discounts rising as they normally would at this time of year, incentive spending has edged down to 6.1% of MSRP in July from 6.3% in January, reflecting the cost pressure that manufacturers are under due to tariffs.”

Ah, yep, if we look at the early data, we’ll see that incentive spending as a percentage of MSRP has fallen 0.1 percent over last July but in raw dollars, things are pointing towards a slightly increased average incentive spend of $3,051, up from $2,999. Cars are just getting more expensive, which really begs the question: How much longer can we sustain this? According to the latest available census data, median household income in America stood at $80,610, and even in a single-vehicle household, spending more than 11 percent of median gross household income simply on a vehicle payment just doesn’t seem feasible for many. Add in the early July data suggesting that the average used car price now stands at $29,514, and I can’t help but get the feeling that we’ll see some dramatic changes in car ownership trends if people keep getting less for their money.

Things Aren’t Great At ZF Right Now

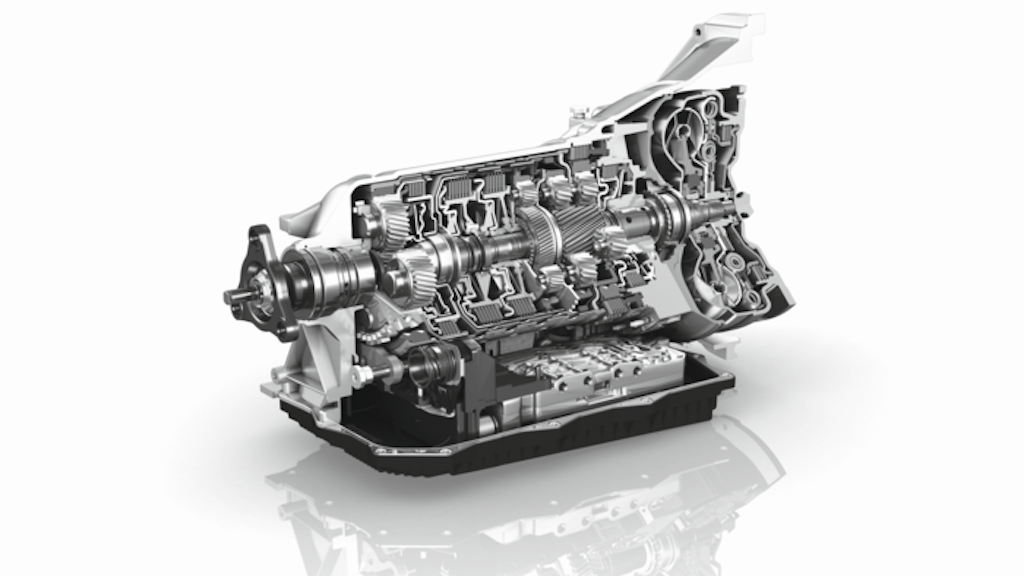

Even if you haven’t heard of major automotive supplier ZF Friedrichshafen, you’ve probably experienced at least one of its transmissions. Variants of the 8HP eight-speed automatic for longitudinal applications are in everything from the BMW 3 Series to the Ram 1500, the 9HP nine-speed automatic for transverse applications is in vehicles like the Honda Ridgeline and Jeep Cherokee, and that’s before we even get into the old stuff and the manual transmissions.

Despite essentially being at the head of the class when it comes to automatic transmissions, ZF has found itself in some trouble. We’re talking billions of Euros in debt among other economic pressures that are all piling up and threatening to tear this industry titan apart at the seams, w ith Manager Magazine reporting (so long as Google Translate doesn’t do me dirty):

Due to horrendous debts of more than €10 billion, high interest rates, and tough times in day-to-day business, the management board closed smaller plants in Gelsenkirchen and Damme and has already verbally sidelined others like Eitorf. Up to 14,000 of the approximately 54,000 ZF jobs in Germany could be lost by 2028. And that’s not all: In order to finally reduce its debt, the management board has been trying for some time to sell off the airbag and belt division (ZF Lifetec). Even the drivetrain units (Division E) and the driver assistance systems business are uncertain at ZF.

If that doesn’t sound especially good, hold your horses, because things could get worse. Per Manager Magazine, among the assets that ZF is considering selling is its driveline business, officially called Division E. In a way, it’s kind of the heart and soul of the company — the highly-respected part responsible for transmissions and electric drive axles. Per the repot, the supervisory board is voting on whether the management board can restructure the profitable Division E, and Works Council members seem understandably unhappy because restructuring often means that leadership mistakes led to this point, and further layoffs probably wouldn’t be off the table. Unhappy enough to protest, even, with Manager Magazine writing:

When the two demonstration marches, armed with placards (“Leadership? No sign of it”), cowbells, and pyrotechnics, arrived at the Forum in Friedrichshafen to continue the works meeting that had been interrupted two weeks earlier, all the dams broke from above. The downpour didn’t stop activists from rolling a poster bearing the slogan “Strategy instead of disaster” from the roof of ZF headquarters.

Well, that’s scathing, but also probably fair. These sorts of financial issues generally start from above, and once in deep enough, there are no easy ways out. For now, I think I’ll row through the gears in my ZF S6-53BZ six-speed manual transmission and think of the people who worked hard to engineer and assemble it. As we say in Canada, keep your stick on the ice, we’re pulling for you.

What Does This Light Mean?

It’s been absolute ages since warning lights first appeared on dashboards, but the mass adaptation of features like lane keep assistance and forward collision warning mean that drivers have more to scan than ever before. How are they responding? Probably not by brushing up on knowledge. British car warranty firm Warrantywise contracted OnePoll to survey 2,000 drivers on dashboard lights related to advanced cruising control and well, things aren’t looking good:

From alerts for lane assist to adaptive cruise control, the symbols now found on many vehicles’ dashboards appear to be causing more confusion than confidence, with four in ten drivers (41 per cent) admitting they don’t recognise or understand a single warning light from a suite of basic cruise control-related warnings. In a world where cars can steer, brake and park themselves, many drivers are left struggling with what should be the most basic line of communication from their car: the dashboard.

According to the study, 41 percent of drivers surveyed could recognize the lane keeping warning light, 33 percent could recognize the cruise control warning light, and just 28 percent could recognize the forward distance warning light.

Perhaps the most shocking thing here is that only a third of drivers knew the cruise control warning light, because it’s not like cruise control is especially new. My 26-year-old summer toy has a cruise control light, and that thing predates the film adaptation of “Requiem for a Dream.” Considering these systems play a significant role in how vehicles operate, are we really ready for the semi-autonomous era if many drivers likely wouldn’t know from the dashboard if something’s malfunctioning?

Rocking The Ring

Ever since the mid-engined Corvette debuted, armchair experts have wanted to know one thing: How fast could it lap the Nürburgring? Never mind that conditions on the famed German circuit can change literally hour-by-hour, and that times from different years aren’t directly comparable due to track improvements, this is one of those metrics that people turn into an absolute measuring match. Admittedly, I do find fast times amusing bits of trivia, but there are caveats behind those headline figures.

Well, good news: We’re about to find out how fast the mid-engined Corvette can really lap the Green Hell. Chevrolet released a teaser yesterday that Nordschleife times for the 670-horsepower Z06, 1,064-horsepower ZR1, and absurd 1,250-horsepower ZR1X will be released on Thursday, which means we’ll have a lot to discuss today. So, buckle up, because with the Ford Mustang GTD holding the American car lap record at 6:52.072, things are about to get spicy.

What I’m Listening To While Writing TMD

The LA Riots remix of “Lowlife” by Scanners is one of those songs where I can’t remember when and under what circumstances I first heard it, but you know what? It still slaps. Upbeat instrumentals, mildly depressing lyrics, hell yeah.

The Big Question:

Do you reckon the Corvette ZR1 will beat the Mustang GTD’s Nürburgring time?

Top graphic image: Lexus

I’m fortunate/frugal/old enough that I haven’t had a car payment in a while, but my mind has anchored on the idea that $350 a month (for 60 months) is the maximum reasonable monthly car payment. That doesn’t get you much these days without a bunch of cash or a valuable trade in.

I was looking at a new Civic Sport hatchback last year. With the interest rate at the time, the payment was going to be over $400/month with $12k down. My payment had been $239/month on a new 1998 Civic with $4k down.

I couldn’t quite swallow that and wasn’t willing to throw more money at the down payment for a Civic, which is still basic transport in my mind.

Honda is out of control. Right now Acura will lease you a TLX at the same monthly payment as a Civic. Guaranteed.

I’m going to take a note from Sea Lab and just stick Bizarro in front of every noun related to the auto industry in casual conversation.

It was when Hyundai was offering cheap EV leases so we got an Ioniq 5.

Don’t you mean a bizarro cheap EV lease?

Maybe. It’s legitimate cheap to me, since I’m only eating like $9k of the depreciation.

It’s bizarro cheap to Hyundai, since they sent me a trade-in letter the other day showing that the thing has already lost like $30k in value.

I’m in your boat, I cannot fathom an $800 a month car note for ONE car.

What if it belonged to, let’s say, Jon Voight?

I don’t think a Jon Voight signature on the K-car plastic wood dash is worth that of a Shelby or Duntov on the appropriate car.

That said – do you want to maintain it? How do you clean it? Sharpie dissolves in rubbing alcohol.

Is his pencil in the glovebox?

I’m exactly in this spot. I have never had a loan before, but am looking at one potentially next spring (family life finally caught up to me and the 2-seater has to go).

I am buying a pre-depreciated car as I could never justify buying new, but with 10-12k down on a 25k car, it’s still around 300/mo for 60 months. Insanity.

I’m doing it because I’m financially able (because no one needs a twin turbo V6 daily driver), but the smart move for anyone that has 10-12k to put down on a car would still be to take that 10-12k and buy an older Accord or something. If you don’t have 10-12k to put down on something, you’re just SOL.

SAME. I can’t get out of the research cycle of what is the best way to spend ~$25k on a car that I won’t cringe paying $300/month for. I seem to land on a Model Y, cringe for other reasons, and then close that browser window.

The other option’s been a ~5 year old IS350, but noncurrent Lexus infotainment feels *old*.

I’m looking at a Stinger GT1 same age as your IS350 (I couldn’t do a Tesla either, don’t blame you). I’ll be pulling the trigger next spring. Right now if I want a 2020-2021 like I want, I would have to settle for grey or black. Bleh. Most likely, if depreciation doesn’t hit, I’ll need to dip into the 2018-2019 models for a red or blue one. Mostly the same but missing some nice tech upgrades.

Good luck with your search!

I know many people will disagree with me, likely younger ones who fancy themselves upwardly mobile, but IMO borrowing (let alone over-borrowing more than is prudent, often at unfavorable terms) to drive a new/fancy car isn’t flexing, it’s just idiocy.

I’ve been high-earning and upwardly mobile when I was younger/professionally ambitious/higher energy, but I never took out a loan to drive a car. And I only leased a new car one time for just a year through my business, so it effectively cost about a third less than the payment, and after such a negative experience with that new late ’90s Mercedes, I was never tempted to do that again.

The fact that real estate is now so much more expensive than it was 20 years ago (even accounting for inflation) makes sinking money into a depreciating asset like a car even more foolish that it used to be. If you see a guy/gal driving a used sensible Japanese sedan that’s old enough to vote, drink, and get drafted, you know he/she has got a good head on their shoulders.

I’ve owned some fun cars in my youth, my current fleet is 3, all at least 11 years old but relaible and clean. I never wanted to be car poor or house poor. I bought the house in July 2010 near rock bottom, then refinanced (at a shorter term) after rates reduced. There is a lot more to life. My daughter pursued a passion for dance. We always took vacations, often for multiple weeks during the long winter break. We have been to Europe/Mediterranian twice. We live comfortably, not extravagantly.

We can do what we want, travel when we want – without bank balances intervening – to a large extent. But there is a tradeoff – new car or overseas vacation for 3 years? Pick one.

overseas vacation for the win

Where are YOUR priorities. I have money to spend – its the allocation.

I have a toy I’m eyeing up. I also know that buying such toy requires sacrifices elsewere.

Buy the toy overseas and bring it back? Win/Win. My priorities are snagging a place to live a few months in said overseas and buy the forbidden fruit and be able to park it. Granted that I am looking a Twingo’s, or a Volvo Amazon, but nevertheless, they are cheaper there, than here.

The toy is in the garage across the street from my parents. A low mile, original, garage kept ’90 ZR1 Corvette. With a 6 speed manual.

THAT is a toy.

Agreed. I like my Del Sol in the turns. And in summer with the top down. Mostly I just want to drive around in Europe for a couple of months a year

Huh. I always read that the Del Sols were not great to drive. So I looked it up and this article almost convinced me otherwise until I got to the comments section.

Whatever, though. Drive what you love!

Read some of the comments. Laughed when someone wrote ‘homage to the 914’.Yes I had a 914. There is a sweet spot about handling and an open top and a low center of gravity that transcends the need for speed for me. Also I like my insurance costs low and I encumbered by speeding tickets.

That’s the choice we have made, but there is a traedoff. No, you don’t get a new car. No, I don’t get a toy project car. No, we are not investing XXXX dollars in new furniture and flooring.

2 things

1) There is a Manager Magazine. So you could be a manager at Manager Magazine, managing managers who manage teams to that produce content that helps managers manage their management?

2) I did not know I had a cruise control warning light.

Part Time Casual Labour Magazine is a lot more interesting. They actually do real work there.

“manager at Manager Magazine, managing managers who manage teams to that produce content that helps managers manage their management”

Swipe left, ladies!

The car market looks pretty bad. Used cars may look like an option for buyers who can’t afford new, but look at how expensive the average price of them has gotten! Production shortages over the years have reduced inventory, people are hanging onto stuff longer, and cars are totaled for relatively minor damage, but there’s another thing that occurs to me that’s likely to be a growing issue going forward: as new cars get more expensive, it’s the more affluent who will buy a greater percentage of them and they will buy a larger mix of premium vehicles, vehicles that cost a lot more money to maintain when used and are totaled even more readily. Even the cars from more reliable brands are often equipped with drivetrains of lower durability and greater cost demand to repair.

100%. The goal of the American corporate state is to kill off the middle class and send that wealth upwards. You do that by essentially outlawing the starter home (through zoning/artificially inflated markets, taxes etc) and killing off the family car.

Automakers are betting big on the affluent. Take GM. The mindset used to be “a car for every stage of your life”. Sell them a Chevy when they’re 21, a Pontiac at 35, a Cadillac at 50, a Buick at 102. This is very attached to the now dead Protestant work ethic amongst decision makers. Now we have a cabal of zero-sum thinkers.

Post-pandemic, the attitude is “why sell four $25k Chevys to four normal men (aka “those loser normies”) when you can just sell a single $100k [insert every brand we offer] to a rich guy” (aka “a winner”). Spoken like a true fail son.

To maintain growth, however, they will need to push for the wealthiest 12% to buy more and more. And that land that was supposed to be affordable “snout houses” will just be a stable of new car garages collecting dust beside a mansion.

It’s worth noting that China is taking the exact opposite approach here.

The rich are also buying the starter houses, colluding to keep rents and their RE asset values high with the goal of essentially turning everyone else into an indentured servant, the same reason health insurance is tied to employment and there are extreme-debt higher education requirements for jobs that have little to nothing to do with what the student actually learned. I think the ultimate goal is a kind of neo feudalism.

Right, the “gently used” 2-3 year old used car is almost the same as a new one, especially if that new one can have some discounts on. it.

Wonder when/if the car market will seize up like the real estate market when the price of admission simply disqualifies so many willing customers.

If you do not have the cash available to pay for a new car out-of-pocket, you go for a used car that you can afford. Do not take out a loan on your car. If anything, take out a loan on some digs in some sane place where no car is required.

I just financed a vehicle at 3.9% interest and my cash is making 4% guaranteed, FDIC insured in the bank. Why would I pull that cash out of the bank instead of taking that loan?

This is the way. Always look for the best move for you. Sometimes, you want the car paid off because the loan costs more than you get for hanging onto the money. Other times, you want to keep the money so that it can gain interest. Always look at the terms of loans, leases, savings, CDs, etc. An informed decision beats a hard rule every time.

Many if not most jobs in this country are completely inaccessible by anything other than a car. I would have to strong arm one of the five property owners within walking distance of my employer to be able to walk or bike to work.

Other than a couple of major cities, this country is simply not designed to be compatible with public transit. Which is a major issue, but an issue the average person is not able to change, sometimes you just need a reliable car to get to work.

I’ve always argued the way to go for the cash strapped is to get your hands on a basic new Corolla. The used market is genuinely awful right now, provides little value, and only exposes people with no liquidity to the risk of repairs.

Why would you move somewhere totally different (and likely more expensive, since convenience comes at a cost) just so you can avoid having a $30k car loan or whatever? That makes no sense.

This is an argument that unfortunately doesn’t work for the sort of person who already can’t afford new cars. Moving closer to work almost always means higher housing costs. Hell in most places in the US, a walkable neighborhood with access to jobs means $$$$$$$$.

There’s a sad irony that to afford a house or rent, most have to live so far away from work that they’re forced to own a car. But that’s not something that’s changing any time soon.

Buy an in-town condo for $980k to avoid a car payment.

Seems entirely safe. There are absolutely no indicators that home values are unsustainably high. We’ve never seen a situation where the housing market is subject to a severe adjustment or anything.

There are limits to thinking of vehicles or housing as an investment, because people need shelter and generally need to get to work to pay for that shelter and other basic needs.

It’s rarely an option for someone to pay cash outright for their vehicle. I’d suspect it’s even less likely that you’d be able to choose between financing a car, paying outright for a car or just picking up expensive housing instead.

This is logic from 100 years ago. If you some how have the cash to pay out of pocket, you can definitely invest it at a higher rate than whatever interest you’d have on a secured auto loan.

Also, most people have monthly budgets and live month to month. Getting a 15 year old car with 100k+ miles on it that might not be mechanically sound isn’t as good of a buy as a new car with a warranty, especially if you need consistent, safe and reliable transportation for you and your family.

Just read the damn owners manual.

The modern version of it is do a google search and watch some talking head on YouTube/Tiktok explain it to you.

I suppose you also want us to move stuff if we can’t find something in the fridge and ask for directions if we’re lost.

My car currently has a light flashing that is not in the manual. Only suggestion on the forum was to tap into some 1980’s era code reading that my car apparently still has and see if it says anything.

I’m currently stuck with a $1,000 monthly total payment on a combination of a new roof for my house and a stock loan I used to buy some shares of the company I work for (a person has to be nominated just to purchase the shares… it’s weird). Anyway, I guess I can afford a new car once those are both paid off. Yay?

Just kidding, that money will get rolled over into rental-property improvements once the time comes. I’m more than happy to keep driving my current combo of classics and fleet-beaters to avoid anymore payments for awhile.

ZR1 for the win… er, lap time… whatever – I just like the ZR1. I was going to say “yes” to the big question anyway, and now I see that is indeed the case! Looking forward to seeing more than a few Corvettes at Road America this weekend and as long as it makes the trip alright, my daughter’s rough-around-the-edges C4 will be sitting right there among them.

JFC

well…at least 0% financing is making a comeback!

That’s gotta be a good sign for the economy right? RIGHT?!?

They need to standardize all this ADAS (Advanced Driver Assistance Systems) stuff like they did for OBD-II and the check engine light. Sadly, even though it was almost 30 years ago, some people are still confused by it.

Do you reckon the Corvette ZR1 will beat the Mustang GTD’s Nürburgring time?

I think it just did.

Setting ever faster Ring times is starting to bump into physics limitations. As you drop further under 7 minutes the cars become too heavy to go much faster. This is mainly due to the huge balls needed for drivers to go that fast around the Ring.

That’s why Sabine Schmidt was so damn quick. Metaphorical balls don’t carry a weight penalty.

She was so great, on track and off. Miss her.

Yep we’re at the point where the following three things matter over all else.

So a Mustang GTD is around 4200lbs with a full tank, and are on aggressive “road legal” slicks. A Mustang GT3 race car is more around 2800lbs, has similar or more aero (and more underbody aero), and faaaaaaaar stickier, soft, slick tires.

I know on many race tracks the difference between a street level track car and the actual GT3 race car version (like a Cup car) can be 2 seconds per minute.

There’s a key piece of information missing? How long is the average loan term? My sense is that if you can’t pay it off in 60 months or less, you’re driving more car than you can afford.

What is the basis of this statement, which I’ve also seen made about “cash”, “24 months”, “36 months” and “48 months”?

Cars last longer than ever; it’s not surprising that loan terms have grown as well. Every car I’ve financed has been for 60 or 72 months, that’s just my sweet spot. If someone else says 36 or 84, and then pays off the loan, who am I to say they can’t afford that car?

The industry has convinced you to view car affordability through the lens of the monthly payment rather than the total cost of the vehicle. If you can’t pay a car off in 60 months, your chances of becoming upside down on your loan increase. This says nothing of the other things in your life that you aren’t affording or putting by the wayside.

If your interest rate is low (~>4%), then your money can do better work for you elsewhere. Taking out a 60-month loan doesn’t mean you “can’t” pay off the car in 5 years. It means you can take that long if you end up choosing to do so over the course of the 5 years.

Avg 72 month car loan rate is approaching 7% these days so your money isn’t doing much good elsewhere with the elevated levels of volatility.

60 month loan seems like the new 36 month loan – it’s those loans that are longer than 5 years that are targeted at buyers who want to be in a car that’s more expensive than they could otherwise afford. I don’t want to hear people with 72+ month loans complain about the cost of housing. Every extra year of payments is $9k that could have gone into a home, an appreciating rather than a depreciating asset.

This is all just vibes.

Why 60 months?

Your chances of being upside increase with every month you have a loan, they vary by the type of vehicle, the down payment/trade-in, etc….there isn’t some magical point where it’s always *ok* as opposed to a point where it isn’t. Not to mention that being upside down only matters if you plan to sell your car. If you’re keeping it for the long haul, who cares? Buy gap insurance if you want to, and live carefree.

If 60 months is how you personally plan out your car buying, fine. Who am I to say otherwise? I would simply not try to make my own experiences universal for everyone.

I think you’re misunderstanding my point. The question isn’t a moral one on how much you should spend on a car. The facts are simple. The increasing consumer preferences towards primarily high-dollar SUVs and trucks is only possible because it has become normal for consumer to take out extremely long loans.

The data show that home ownership, especially for people under 40 is at an all time low. There are many factors at play and deciding to spend limited resources on a $60k 4Runner is one of them. A vehicle is a depreciating asset rather than a house which is typically a appreciating one.

My hang up is entirely with your arbitrary choice of 60 months as the threshold where things go from affordable to not affordable.

People on the internet have been making this argument for literal decades, only the threshold changes. Meanwhile cars last longer, are worth more at the end of a 6 year loan than ever, etc.

My only point is that there shouldn’t be a hard and fast rule. People’s situations vary, their individual tolerances of risk vary, the depreciation curves of the cars they buy vary, the interest rates they qualify for vary, and so on. I already own a home. Why is your anecdote about homeownership vs car payment applicable to my situation whatsoever?

A “one-size-fits-all” bit of advice is to me less helpful than no advice at all.

You have to look at the interest rate for the loan and if you can get a significant decrease for a shorter loan term. As well as looking at interest rates for parking your money in investments, CDs and other vehicles for income later.

Some people like to hold onto cash for other reasons like emergencies or travel since those things are typically paid by credit card at an excessively higher rate.

If there’s no interest rate penalty, I usually take the loan out at a much longer loan term while paying it down at a faster term rate because that gives me flexibility if anything comes up.

Many points here, but blanket statements (made by many people here, not just yours) are not reflective of reality and depending on many factors, are not always the best financial advice.

One should not look at affordability of a car through the lens of the monthly payment – they should consider the total purchase cost. Furthermore, the more past 60 months you go, the closer to upside you get in a car, especially considering that past the 5 year point is when cars start to hit those pricey higher mileage maintenance needs.

Bottom line – for most people a car should not be a constant payment. Everyone complains about the high cost of homes these days and then doesn’t stop to consider that they purchased a car that they couldn’t only afford on a 72 or 84 month loan.

Unless, like Hyundai did for us in 2020: 0% for 7 years. Again a 2019 in 2020. Last year’s model. Hilarity ensues: When we purchased the Ionic (40 to 50 MPG), gasoline on the way home was $1.10/gallon. The Del Sol, summer and fall only, easily gets 35 to 40, the Lexus Campmobile however brings everything crashing down as it consumed premium gallons at 16.7 mpg. The Cabriolet get 30 when running but mostly sits and waits for the total rehab. So 1 payment at 0% (346/) with no down payment. I will wait for the complete fall of used EV prices before I get serious about the Ionic 5 though.

Not only the $742 monthly payment, but there is also outrageously expensive car insurance to consider.

My Geico rate went up 20% this year just because, no accidents, nothing.

Mine went up about 15% and, believe it or not, I have a fairly spotless driving record

Insurance guy here to tell you: it’s not you. It’s everyone else having accidents that cost more to fix.

Mine went down somehow? Shrug. Not by much, a few bucks a month, but I’ll take it.

Most auto parts come from a country that we charge 30% import tax for.

Who knew people downstream end up footing the bill?

I doubt cars will ever be cheaper since buyers are willing to finance increasingly expensive vehicles for increasingly long terms. I could see 120-month loans for $70,000 regular cars becoming common in the not-too-distant future. A lot of people blame manufacturers or CEOs or billionaires or whatever for the high cost of cars, but consumer behavior is driving this. Honestly, I don’t know why companies would bother selling cheap new cars since no one is pushing back on this.

If there is a bright side, it is that cars are lasting long enough that expensive vehicles and long terms may not be disastrous for those willing to keep their vehicles after they are paid off.

the problem comes when some dope hits you and your car is totaled 6 years into that 10 year loan. You still owe 42 grand on a car thats worth 10.

I’m not arguing in favor of 10-year loans – I just think that is likely where we are going. Again, consumer behavior is driving this.

I personally would not consider a loan of over 36 months, even if that limits what I can buy (I tend to buy used unless I am buying something that holds its value far better than average). I don’t mind people taking on long loan terms, assuming they understand the risks associated with long terms and how they can mitigate those risks. Unfortunately, I don’t think most buyers know what they are getting into even with more typical loans.

That’s what GAP insurance is for.

Can’t you finance those RVs that Mercedes documents as being rolling piles of broken plastic for like 20 years or something? I mean how else can an average retiree afford a $250k diesel pusher Class A?

So why not for your $100k Ford F-350 Super Duty King Ranch Dually?

I am thrilled to have not had a car payment in over ten years and three cars with under 80k miles on the clock. The only payments I need to make now are into my high-interest savings accounts that are big enough to pay cash for the difference the next time I want to trade something in. $300 a month is typically plenty.

Same, we haven’t had a car payment in almost 20 years and we’ll never go back. Just one less thing to worry about.

One benefit of where I live is that you only pay sales tax on the difference in value between cars when you trade them in at a dealer. So if we trade a car worth $20k and leave with a car worth $30k, the tax is only on $10k. It is enough to save almost $2k over selling the old car and buying the new one at full price. It typically makes up for getting a bit less in trade than you would selling the old car to a private party.

That’s actually awesome. Texas isn’t like that at all. For years if you bought a used car everyone would report the purchase price as $1 to avoid paying taxes. Some time back Texas got smart and now they go by the KBB value, no matter the condition of the vehicle. If you buy a $300 basket case you’ll pay the taxes based on the value of a fully running vehicle. Having a system like you guys which would involve mathematics just doesn’t seem likely in this state.

It is oddly a thing that helps dealers and consumers.

It’s the same here in MN where I live.

The times were released a couple hours ago.

So yes, I believe the ZR1 will beat the Mustang, but not by as much as I would have expected.

And all behind the Porsche, it appears.

*As we say in Canada, keep your stick on the ice, we’re pulling for you*

And if the women don’t find you handsome, they should at least find you handy.

My favorite Christmas-colored Canuck.

“I’m a man and I can change. if I have to. I guess.”

“And if the women don’t find you handsome, they should at least find you handy.”

Ugh, no thanks. I’ve heard such a guy dismissively called a “dishrag”. He’s a shoulder cry on, to wipe away tears, complain endlessly to, to get an ego boost from and sometimes used to have stuff done but he is always, ALWAYS kept locked circling in a platonic orbit regardless of relationship status.

Welcome to: The Friend Zone.

dude, its from “the red green show”. look it up

So what?

This response leads me to believe that being friends with women isn’t really a risk for you.

I’m not sure what you mean. Are you of the belief I’m not at risk of friendship only relationships with women because I’m much too attractive?

If so you are very perceptive. Kudos.

I think Jamie means it seems like you don’t respect women very much. And therefore they probably don’t want to be friends with you.

Well Jamie is dead wrong. I do respect women overall.

My definition is not something I pulled out of thin air although I did expand it a bit for clarity. It was told to me by a woman about 25 years ago whom made it clear it was a term used among women she knew who had little regard for the men in their lives they were not attracted to but had no qualms about exploiting. “if the women don’t find you handsome, they should at least find you handy” is an invitation to that kind of exploitation. That’s not a healthy relationship. I found it offensive but I didn’t (and still don’t) blame her for sharing it. If Jamie and others want to shoot the messenger well that’s on them.

Okay that’s fair. Didn’t mean to be accusatory. Your comment didn’t come off to me as you being a messenger. More like those guys who hate “bitches” who “friend zoned” them but I’m happy to be wrong.

You should still watch the Red Green show, though.

$746 is $200 more than my wife and I paid a month for our first apartment.

Finance the purchase of a depreciating asset? No thanks.

Same actually. $550 was my first married apartment as well. And the biggest payment I’ve ever had was $432, and it was only that high because it was a 36 month term. I abhor car payments and avoid them as much as possible.

It is $126 more than I paid per month on my first mortgage. Though that was 1997. Jesus.

Take money out of appreciating assets to pay cash for a depreciating asset? No thanks.

I never said to do that!

One of my favorite posts in Audi groups is a photo of the forward collision warning light taken at 85mph with one hand on the wheel captioned “What does this mean? Help.”

Those always produce some enjoyable comments.

“ZF is considering selling is its driveline business,”

That might actually be a good strategic move. Long term, as BEVs take more and more market share, the number of vehicles that need those 8/9 speed automatics will be fewer and fewer.

Also one thing I wonder about… Given their dominant position in the transmission business, how is it they’re not raking in the cash and instead, built up piles of debt? Did they become dominant because they didn’t ask enough money for those 8/9 speed automatics?

“Do you reckon the Corvette ZR1 will beat the Mustang GTD’s Nürburgring time?”

I actually don’t care. I’m with James May when he said that cars tuned for the Nürburgring make for terrible vehicles you’d want to drive on regular roads.

Anybody else notice that people all of a sudden got less excited about ‘Ring times soon after James May made the argument about how not interesting ‘Ring times are?

It seems to me that people care more than they ever have. Manufacturers are building cars specifically to achieve certain times, like the Mustang GTD. I agree it’s the most useless metric of all time.

I dunno, I’ve never given 2 shits about what car wins ring times.

Do people actually buy certain cars because some professional driver ran it around a course 2 seconds faster than some other potential car they might buy? Like the lap times actually factored into their car purchase over things like price, aesthetics, interior livability, engine note, etc, etc?

The chase for ring times and people using it seems like dick measuring that one dick tells some other dick about but no one else actually cares about beyond “that’s interesting”.

Who drives their commute like a race car driver all day where .0001 seconds improvement actually matters?

Man, if only there was something that happened in the last 20 years that showed everyone that encouraging people to recklessly finance things that are outside their budget doesn’t end well for anyone involved. Maybe if that happened corporate greed could be reigned in a smidge and consumers would know better than to get suckered into stretching themselves thin.

…oh. Wait. It did and corporations are greedier than ever and consumers are as clueless as ever. Surely nothing could go wrong this time?

The rapidly increasing wealth gap is always going to result in more people being deeper in debt. Auto loans are just a pathway through which the issue manifests.

That’s how trickle up economics works, baby

…. I’m sorry to point it out, but while the crisis happened 17 years ago, many of those bad decisions were made more than 20 years ago… so no, lots of people doing this crap today have very little memory of the last big financial crisis.

*sighs deeply*

“encouraging people to recklessly finance things that are outside their budget doesn’t end well for anyone involved”

How is getting a massive bailout not a happy ending?

Can’t wait til all the American manufacturers get to sit in front of Congress with their tails between their legs and go “UwU daddy we’re so SOHWWY can we please have a wittle bailout? Pwetty Pwease”?

The subsequent berating done to such executives by lawmakers is but theatre done for the cameras only and behind the scenes the treatment is FAR more cordial.

I suspect it will be pretty darn close between the ZR1 and GTD, and the ZR1X will beat them by a little. That said, I also don’t think it will matter in the slightest.

The GTD buyer wants a Mustang and the ZR1 buyer either wants a Corvette or a mid-engine sports car. I don’t think many buyers are going to switch because one got a little bit better time. Most of the people who might be swayed by one data point are probably going to buy based on horsepower or 0-60, anyway.

What does this matter to me? As far as things in the automotive world to be excited and or concerned about this doesn’t crack the top 1000.

James May nods in approval

Amen. I couldn’t care less about articles featuring 1,000 hp hyper cars and anything that costs over $60k. I’ll never experience it so who cares.

Meanwhile I got Robot Cantina in the background stuffing lawnmower engines in cars trying to get to 55mph in less than 30 seconds.

I thought lap times and other performance measures were interesting in the past when cars were more mechanical. I presume the GTD used every software tweak available to optimize performance on the Nurburgring to set this record. I have a hard time caring about records that were set with laptops instead of mechanic advancements.

It is the same reason I couldn’t care less about performance records achieved with EVs. Performance figures achieved using software and other computer technologies (launch control, advanced traction control systems, etc.) feel like cheating to me.