If you’re an enthusiast with your heart in cars in other countries, you’re almost certainly aware of the barriers America has set between you and your dream car. The most common hurdle is the so-called 25-Year Rule, which dictates that you can’t even import most cars until they’re at least 25 years old. Once your favorite vehicle is old enough, your pain might not be over yet. If your favorite vehicle is a truck, America says you have to cough up 25 percent of your truck’s value at importation time. This is the so-called Chicken Tax, and it’s been the bane of importers and automakers for 61 years, despite technically not having anything to do with trucks.

Back in early 2022, I wrote a story titled “The 25-Year Import Rule’s History Is More Complicated Than You Think” for Jalopnik. The Imported Vehicle Safety Compliance Act of 1988 is one of the most infamous pieces of car law in American history. In that story, I explained how Americans began saving oodles of cash on imported cars by bypassing official dealership sales channels and just importing their desired vehicles directly from their origin nation. Not only were these cars cheaper, but they sometimes had options that were never offered in America.

An often-told story is that the imports of these vehicles, many of which were desired European cars, pissed off the likes of Mercedes-Benz, which lobbied for strict importation rules to protect itself. Yet, the truth was far weirder. As I reported in my story, Mercedes-Benz’s own U.S. dealers were among those bypassing official channels and importing their own gray market vehicles to sell to customers at a discount.

These vehicles also needed to be converted to meet Environmental Protection Agency and Federal Motor Vehicle Safety Standards regulations. As my story reported, some of the importers of those days did shoddy, potentially unsafe conversion work.

I had always planned on following this story up with a story about the Chicken Tax, but that never happened. The Chicken Tax, which is a tariff of 25 percent on imported trucks, is sometimes misunderstood. In some ways, it’s also worse than the 25-Year Rule, and it’s arguably one reason why you cannot buy something like the $13,000 Toyota Hilux Champ here in America. Let’s dig into the madness.

The Chicken War

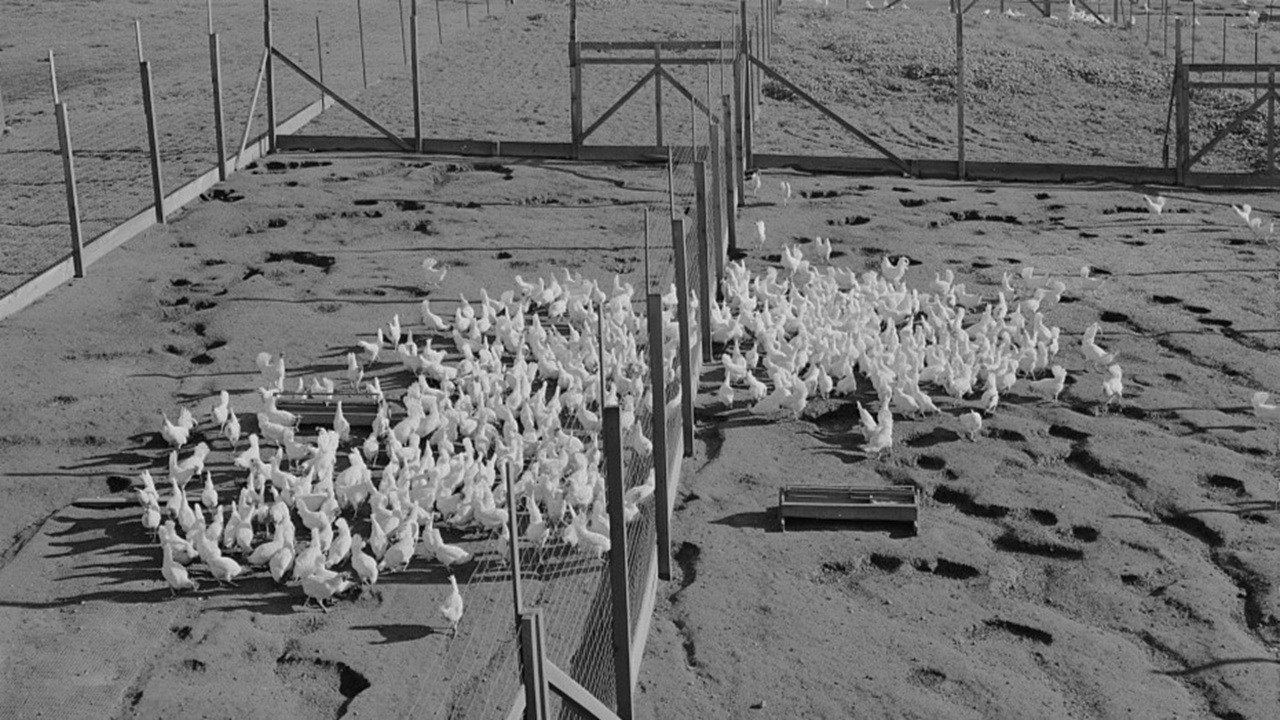

If we flip our calendars back to the early 1960s, we see a very different era of global trade than the one that we’re living in now. As Time magazine reported in November 1962, chicken used to be a delicacy in Europe. While post-World War II America had figured out how to mass-produce chicken products on an incredible scale, Europe hadn’t quite figured that out yet. Time reported that chicken was considered a rich person’s food in Europe, and the only time a poor worker might eat a chicken was when either the worker or the chicken was sick.

America saw a market here. See, America’s chicken farming prowess was so good that, despite the huge numbers of chickens consumed by America, there was still a large surplus. America began sending those chickens over to Europe, and as Time noted, the States were a large reason why chicken became common in Europe:

Much of the credit belongs to U.S. chicken farmers, who have brought down prices from Antwerp to Zurich by delivering frozen broilers to Europe at 30.5¢ a lb. Last year the intake of chicken rose 23% in West Germany alone. Demand for chicken expanded briskly in the rest of Europe, and U.S. farmers, with shipments worth $45 million, grabbed nearly half of the import market.

At first, this seemed like a win for everyone. America got to make money from surplus chickens, and chicken was no longer reserved for just the rich in Europe. Unfortunately, a new problem quickly arose, and it was that chicken farmers in Europe just couldn’t compete with the rock-bottom prices of chicken from America.

Europe began biting back, from Time:

That’s when the great chicken war began. The Dutch accused the U.S. of dumping chickens in Europe at prices below cost of production. In Bavaria and Westphalia, protectionist German farmers’ associations stormed that U.S. chickens are artificially fattened with arsenic and should be banned. The French government did ban U.S. chickens, using the excuse that they are fattened with estrogen. With typical Gallic concern, Frenchmen hinted that such hormones could have catastrophic effects on male virility.

The Common Market is making every effort to shoo away the U.S. chickens. A new rule effective last July fixes minimum prices on poultry entering the market, and each of the six member nations is also permitted to tack on a tax pegged to domestic poultry production costs. The minimum price set for U.S. broilers is 33.3¢ a lb., and the West German supplemental tax adds another 9.7¢. To make matters worse, the Common Market this month imposed an arbitrary surcharge of 2.8¢ on broilers. All this boosts delivery prices of U.S. chickens by as much as 50%. Since August, U.S. exporters have lost 25% of their chicken business in the Common Market.

Time continues that this 50 percent chicken tariff exploded into a full-blown poultry trade war. In one instance, Time wrote, Arkansas Senator J. William Fulbright interrupted a debate over nuclear weapons for NATO to protest Europe’s protectionist policies over chicken. As Time noted, this trade war was far larger than just tariffs on imported chickens:

The great chicken war is only the opening blast in a larger crisis in trade relations between the U.S. and the Common Market. The U.S. sells 10% of its farm produce abroad, and one-third of that total—or $1.1 billion worth —usually goes to Common Market nations. The Common Market has made no secret that it is moving toward broadly higher agricultural tariffs to protect small, inefficient European farmers. Last week a panel of U.S. economists reported to Congress that U.S. farm exports to Europe may shrink as much as 30% by 1970. Heaviest losses are expected to be in rice, wheat, feed grains—and poultry.

Time magazine never described what the six-member nations were, but a separate report in 1964 by the New York Times noted that the countries were Belgium, France, Italy, Luxembourg, the Netherlands, and West Germany.

The New York Times report noted that, at least at first, the tariffs weren’t meant to punish America, but encourage farmers in Europe to amp up their production so that Europe could become more self-sufficient in providing for its people. The tariff was supposed to give those farmers some breathing room before being wiped out by cheap American chicken.

The Broiler Heats Up

Unfortunately, things spun out of control quickly. By mid-1963, America’s chicken exports had fallen by at least 66 percent compared to the 271 million pounds of chicken shipped to Europe in 1962. The nations also couldn’t agree on the economic impact of the tariffs. Europe argued that the tariffs weren’t that big of a deal, and that they amounted to only $19 million in losses to America. Meanwhile, the U.S. government argued that the losses were far higher at $46 million. The American poultry industry reportedly claimed that its losses were even greater than that.

America’s farming industries also found themselves in a tough position. About a quarter of America’s agricultural products were sent to Europe, so reduced exports had the chance to deal major damage.

President John F. Kennedy had spent much of the so-called “Chicken War” trying to bring down the temperature in the room. He had constant contact with then-Chancellor of West Germany, Konrad Adenauer. Among his conversations with European partners, President Kennedy pleaded for reductions in tariffs.

President Kennedy was assassinated on November 22, 1963, leading to Vice President Lyndon B. Johnson being sworn in. President Johnson’s approach would be a bit more aggressive than President Kennedy’s. Europe eventually offered to lower its tariff by 10 percent, but as the New York Times reported, America had deemed that insufficient, perhaps a bit too little, too late.

Further, as the New York Times wrote, America was committed to making back the $46 million it claimed to have lost through retaliatory tariffs. On December 4, 1963, President Johnson made good on America’s word with Proclamation 3564—Proclamation Increasing Rates of Duty on Specified Articles. President Johnson’s proclamation claimed that Europe “maintains unreasonable import restrictions upon imports of poultry from the United States” and that “such unreasonable import restrictions directly and substantially burden United States commerce.”

The Chicken Tax Hits

At the bottom of the proclamation was America’s retaliation, which called for a 2.5¢ per pound duty on potato starch, a $5 per gallon duty on brandy worth more than $9 per gallon, a 3¢ per pound duty on dextrine and soluble or chemically treated starches, and finally, a 25 percent duty on trucks worth $1,000 or more.

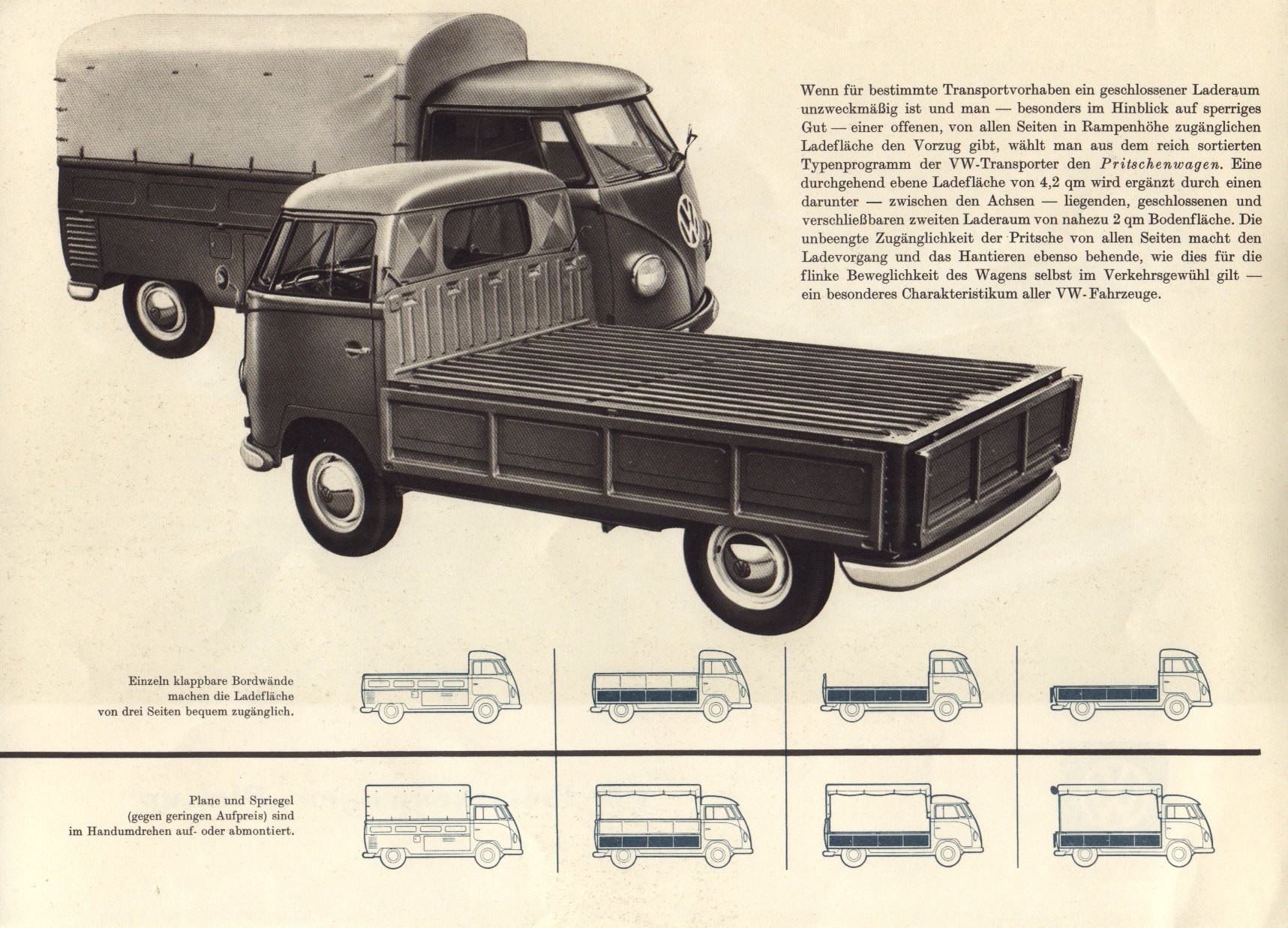

Per the order, the retaliatory tariffs went live on January 7, 1964. The impact of the tariffs, which we call the “Chicken Tax” today, was immediate. The Volkswagen Type 2 van and truck were popular workhorses in America, but now they were subject to the tariff, making them unattractive imports. However, you’ll note that President Johnson’s proclamation did not single out European trucks. Instead, it was a tariff on all import trucks.

The impact of this was destructive to Japanese automakers like Datsun, Isuzu, Mazda, and Toyota, which had spent much of the 1950s and early 1960s exporting several compact work vehicle models to America. Many automakers ceased exporting these vehicles to America as the tariff ensured that these vehicles could no longer compete. In 1964, foreign truck imports plummeted by two-thirds.

But hold on, what do trucks have to do with chickens? A report from 1997 by the New York Times revealed there might have been some politics involved:

The official reason given for choosing light trucks was that American imports of Volkswagen vans from West Germany were close in dollar value to the lost American sales of chickens to Europe. But recently released audio tapes from the Johnson White House suggest that the President may have had another motive. The tapes show that in January 1964, President Johnson was trying to persuade Walter Reuther, the U.A.W.’s president, not to call a strike just before the 1964 election and to support the President’s civil rights agenda. The tapes also show that Mr. Reuther wanted President Johnson to respond to Volkswagen’s growing shipments to the United States, although the labor leader was more concerned with the Beetle than the vans.

Through three rounds of global trade negotiations since then, import fees on virtually every other manufactured good except clothing and textiles have been reduced to 2 percent or 3 percent or have been eliminated. But Detroit has lobbied effectively to protect the light-truck tariff.

So, if you’re charitable and believe the official explanation, then America set tariffs on trucks because of their value relative to chickens. However, there are potential holes in this logic. Again, the tariffs didn’t hit just trucks from Europe, but trucks from anywhere that wasn’t America. Likewise, the tariffs never went away, even six decades after the resolution of the chicken war.

Beating The Tariffs

While many automakers have simply decided against sending their more affordable trucks to America, others have tried to beat the tariffs through different methods. Toyota’s method was to build trucks that it thought Americans would want, first with the 1964 Stout 1900. The Stout was a failure, selling all of four units in its first year. Toyota came back swinging with the Hilux in 1969, but since that truck was still built outside of America, Detroit still had the upper hand.

Ultimately, Toyota learned that the best way to fight domestic trucks was to build its trucks here in America, which meant that they wouldn’t be subject to the truck tariffs.

Not everyone reached the same conclusion. Some automakers engaged in a practice known as “tariff engineering,” or building a vehicle to follow the letter of import law, but not the spirit. The term had been around since at least 1881 thanks to the U.S. Supreme Court case of Merritt v. Welsh. Back in those days, Customs determined grades of sugar based on the Dutch standard of color. Darker sugars were considered to be of lower quality and thus, subject to lower import duties. One importer found a clever hack around this by making high-grade sugar infused with molasses for a darker color. The Supreme Court ruled that while the importer might have cheated, the problem still fell on Congress, as the test for sugar quality was based solely on color rather than composition. So, the importer followed the letter of the law, but not the spirit of it.

The most hilarious example of this happening in the car world is the 1978 Subaru BRAT, which is an acronym for “Bi-drive Recreational All-terrain Transporter,” but that part isn’t important. The most famous part about the BRAT is its pair of jump seats that were welded into its bed. This was tariff engineering at work for all to see. See, by putting real seats in the bed of the BRAT, Subaru’s ute was no longer a truck, but a passenger vehicle.

Of course, it was up to you what to do with the seats after, and many folks cut them out and ditched them. Some of the coolest BRATs still on the road today still have those compliance seats. These seats meant that the BRAT was subject to only the normal 2.5 percent duty rather than the 25 percent Chicken Tax.

Another way to dodge the tax was to ship vehicles to America in an incomplete state. The Isuzu-built Chevrolet LUV rolled off the boat into America as a cab chassis, and the bed was grafted on after the fact. Doing so meant that the LUV was hit with only a four percent duty, and no jumpseat trickery was needed. This loophole closed in 1980.

The 2001 Mercedes-Benz Sprinter arrived in America using another method. The vans were assembled as knock-down kits in Düsseldorf, Germany, and then shipped to South Carolina, where they were put together using some American parts and badged as either Dodges or Freightliners. This satisfied America enough to dodge the 25 percent duty.

The most infamous case of tariff engineering was the Ford Transit Connect, and I’ll just let Automotive News take the wheel here:

Ford Motor will pay $365 million to resolve U.S. allegations it violated a federal tariff law by misclassifying and understating the value of hundreds of thousands of its Transit Connect vehicles. The Justice Department said the settlement resolves allegations that Ford devised a scheme to avoid higher duties by misclassifying cargo vans imported from Turkey from April 2009 to March 2013.

Customs and Border Protection ruled in 2013 that Transit Connects imported as passenger wagons and later converted into cargo vans were subject to the 25 percent duty applicable to cargo vehicles, rather than the 2.5 percent passenger vehicle duty. The Justice Department said Ford imported the vehicles “with sham rear seats and other temporary features to make the vans appear to be passenger vehicles. These temporary rear seats were never intended to be, and never were, used to carry passengers.”

Ford included these seats and features to avoid paying the 25 percent duty rate, the government said. After Customs clearance, the Transit Connect vehicles were immediately stripped of rear seats and returned to its original identity as a two-seat cargo van. “The government will not permit companies to evade duties by adding sham features to their products and then misclassifying them,” said Brian Boynton, head of the DOJ Civil Division.

In case you were curious, Ford allegedly did not ship the seats back to Turkey to be used in other vans heading to America. Instead, the seats were destroyed here in America. Despite the waste, Ford was estimated to have saved $250 million in import duties through its alleged tariff engineering. Reportedly, Ford feared the bill from the investigation was going to be $1.3 billion, but it instead paid out $365 million.

You Still Can’t Have That Tiny New Truck

The impacts of the Chicken Tax are still felt today. Back in 2009, Autobytel reports, India’s Global Vehicles wanted to export Mahindra compact pickup trucks to America. However, doing so was a non-starter due to the tariffs. The publication noted that Thailand had also fought against the Chicken Tax because it, just like India, has a nation full of cheap, compact trucks. However, building a factory to assemble those trucks in America or hitting them with a tariff would take their cost advantage away.

Until recently, the best alternative was the North American Free Trade Agreement (NAFTA), and the United States-Mexico-Canada Agreement (USMCA), which allowed automakers to set up plants in Mexico or Canada and ship trucks to the United States without getting hit by the tariff. However, even USMCA has been under threat with the present trade war.

The efficacy of the Chicken Tax remains hotly debated today, over six decades later. Some believe that it’s part of the reason why Americans cannot enjoy the awesome small trucks that the rest of the world does, while others believe that allowing in imported trucks could erode the Big Three.

Either way, this is the reason why that $500 Honda Acty that you just bought came with a seemingly pointless $125 charge to Uncle Sam. It’s also a major reason why your dreams of driving one of the cute pickups from Asia will have to wait at least 25 years. Your favorite trucks have to stay oceans away because several decades ago, Europe and America got into a chicken fight.

Top photo: Toyota/Depositphotos.com

Turkey and chicken in the same article just makes me hungry. I want some deep fried with mash and gravy

Not just cars and trucks.

US chickens washed in chlorine are still a block to just about all trade talks between EU and the US and even places like South Africa.

US farmers just cannot be bothered to clean out sheds after each batch of chickens and so salmonella builds up and up, and the only way to make chicken safe to eat is to wash in chlorine….

At they same time they are a strong lobby in both the major political parties.

And the truly amazing thing is US chicken eaters just accept chlorine washed chicken.

What sucks is Canada does not have a “chicken tax” but because our market is so much smaller than America’s, no manufacturer bothers to federalize small trucks for us that they can’t also sell in the US.

Canadians would like a small, bare bones work truck like the Toyota Hilux Champ, but we won’t get it unless the American chicken tax is killed, and I’m sure Ford, GM and Stellantis would lobby very hard to keep that from happening.

So much for the invisible hand of the market huh?

Well explained Mercedes, thanks!

Despite (or maybe because of) how it looks, I’d love to have a Hilux Champ. I see regular Hiluxes in LA from time to time (driven over the border from Mexico) but I’ve yet to see a Champ make the journey.

In 1962 readers of TIME magazine wouldn’t need to be told which countries were in the Common Market.

Global Vehicles USA (actual name; or GV-USA for short) was actually a Miami-based importer run by would-be entrepreneur Alex Perez. He started in 1994 as East European Imports, bringing in Aro 24s and Dacia sedans from Romania and fitting them with Ford 2.3-liter 4-cylinder engines, until 1996 after being sued by a private California import.

Perez’s company returned in 2001 as Crosslander International repackaging the Aro 24 as the Crosslander 244. To get around such required safety features as airbags and ABS, Perez somehow convinced the Bush Administration-led USDA to classify the Crosslander as road-legal agricultural vehicle. Then he embarked on a scheme of convincing prospective US and Brazilian dealers of investing $250,000 for exclusive dealerships and showrooms. In 2005, Perez travelled to Romania with the intent to buy Aro from the Romanian government. But something went wrong, and Romania issued an arrest warrant for Perez, as did Brazil.

Crosslander dealers and investors were demanding their cars, or a refund of their money, but Perez managed to keep them at bay with promise after promise until he convinced Mahindra in 2007 to let him sell their product in the US, with an agreement to allow Mahindra’s tractor dealer network sell some vehicles. But Mahindra backed out of the deal in 2009 – not because of tariffs, but because the cars were not yet ready for US legalization. By now, Perez’s dealers and investors were getting anious and angry, and Perez started begging Mahindra to send him some cars, and he would get them certified himself. that prompted Mahindra to talk with Romania, and then they decided to call off their relationship with Perez and go it alone on certifying its own vehicles, Eventully Mahndra realized it would be too expensive to bring its products to meet US safety and emissions standards, so they gave up trying to enter the US market. Meanwhile, Perez sued Mahindra. I haven’t heard much from him since, but I know he’s still wanted in Romania (and much of Europe for that matter), Brazil, and now India.

I actually knew dealers in Bessemer, AL and Meridian, MS that were prospective Crosslander dealers. The Bessemer dealer also sold Aro’s.

We read about the chicken tax – thanks for explaining it in detail!

I suppose if there was still a market for smaller trucks, the domestic manufacturers could make them. The Chevy Colorado has grown in every dimension over the last couple of decades. My husband is on his third one for his work truck. (Before that, they went through a couple of Toyota small trucks, each nicknamed Stripe because of course they had 1970’s stripes.) They went from extended cab to those funny backwards half doors for transporting kids too big for car seats but small enough to fit (or for just putting in stuff for work). The latest one has four doors and a full length bed. He lowered it and put on air bags. It’s still smaller than many trucks on the road.

Two things can be true at once. I believe both!

(but also, as others have pointed out, footprint rules/”light trucks”/etc. also factor in and who knows what the best solution is.)

“finally, a 25 percent duty on trucks worth $1,000 or more”

Would this $1,000 value be adjusted for inflation? In either case, it would seem the $500 Honda Acty would not be subject to the 25% tax as it it’s worth less than $1,000…

It’s only adjusted for inflation if the law says so. Probably not in this case.

One more “feature” of inflation, not a bug. Nearly all limits that activate a tax are fixed, while limits that deactivate are usually tied to inflation for this reason. Eventually you capture the overwhelming majority of the market with a slow enough boil the

peasantscitizens don’t notice.Without these protection laws would the U. S. auto industry have ended up like Australia’s? We may never know.

Nah. 300 million Americans vs 25 million Australians makes for quite a difference in addressable market. Without a bigger local market to sell to, and with labour costs making exports impractical, our auto industry became unviable without tariffs.

I believe that by the 1980s, all the Japanese trucks coming to the US had their bed and the rest of the truck put together after importation. I know Toyota actually manufactured the beds here but I don’t know about the others.

PS – There’s no way that super cheap Toyota would be here anyway, for various reasons.

Yep – that Hilux Champ would not have the required safety technologies or the amenities that buyers in a developed market expect. There’s no way it would make it to America without the Chicken Tax.

The chicken tax didn’t kill small trucks though, we still had our Rangers and S10s and Rampages and such, the footprint rule killed those.

Also not to go a little against the grain here but kei trucks really aren’t as good as an old fashioned mini-truck, barely seat two in a bench seat, anemic power and even less safety, at least in an S10 or Ranger you had some crumple in the front, beefier frame and can get decent power.(58hp Isuzu P’up diesel aside).

Poor sales killed small trucks. Regular cabs don’t sell – so they got cut from the lineups. If you want to blame a regulation I would look more towards seatbelt and car seat laws.

When I was a kid it was perfectly normal for parents to ride in the cab of a truck and the kids jump in the bed. Today everyone has to be an a seatbelt – which means you need a 2nd row to carry 3 people in a compact truck.

A Ford Maverick is shorter than a 2000’s Supercab Ranger that didn’t even have 4 doors. The Maverick trades bed length for a rear rear seat.

The Maverick gets 42mpg in hybrid form, meeting footprint rule requirements. 2011/2012 Ranger sold over 90k trucks, 2021/2022 and then 2023 Maverick sold around 90k units each year. And the 2011/2012 Ranger was selling against the smaller Colorado, the Sport Trac, Dakota so more direct competition than the Maverick faces. So the demand was definitely still there the last couple years of the Ranger.

Between the two of us we have state the following facts:

The Maverick is smaller than a Ranger from the 00’s

The Maverick meets footprint rules for CAFE

Therefore – CAFE footprint rules did not kill small trucks.

Most of the trucks the old Ranger competed against are still around – they just got bigger when 4 doors became the most popular bodystyle for trucks. Tacoma, Canyon, Colorado, Frontier – still around and never stopped production. The Ranger went away for a bit then came back. What happen was the regular cabs got dropped

In 2015 GM stopped making the regular cab Canyon / Colorado

In 2015 Tacoma stopped making the regular cab Tacoma

In 2019 when Ford brought the Ranger back to NA it was not offered in a regular cab.

In 2021 Nissan stopped making the regular cab Frontier

In each one of of these cases the regular cab was dropped at a model redesign because regular cabs do not sell in high enough volume to bother making them anymore. They are still available for full size trucks but only make up 3% of total full size truck sales.

To the point of the Maverick vs Ranger size, the Maverick has a larger wheelbase(121 vs 111 inches base models) and track width(63 vs 59) It is not smaller than the old Ranger, it’s still small but the Ranger was pretty compact, especially in 2WD single cab flareside form. And yes it meets footprint rules.

I guess my main thought is smaller trucks like the Ranger were killed off due to the EPA rules before crew cabs were popular. Also 2008 was not kind to low mpg vehicles, $4 per gallon gas and cash for clunkers.

Maybe I’m remembering wrong but feel like back in 2010, single cab trucks were still pretty popular, even the 2 door Wrangler was still as popular, if not more so, as the Unlimited.

I should clarify. The 2025 Maverick (199.8 inches) is shorter than a 2010 Ford Ranger Supercab (203.6 inches)

The footprint rule didn’t go into effect until model year 2012 so you can’t blame it for anything prior to that.

A 2 door Wrangler is a very different use case than a regular cab truck. A 2 door Wrangler still can carry 4 people – a regular cab compact truck is limited to only 2. They have the same problem as a 2 seat sports car – you can’t carry the family or friends.

The oldest data I can find on cab percentages is 2016 when regular cabs were down to 7% of trucks.

I remember 4 door compact trucks taking off in the 00’s.

Whenever the next administration rolls back all this stupidity, I hope this particularly protectionist shit gets culled as well; though I won’t hold my breath.

IF there is a next administration and not a Fourth Reich.

I’ve heard from exporters that if you are just doing a one time personal informal import under the $2500 limit, customs usually won’t consider the kei trucks as a truck and just charges the 2.5% duty not the 25%.

Fuck the chicken tax. Fuck CFAE. Fuck the different-but-not-better US FMVSS standards.

We should sign on to the UNECE standards, or at least accept both, like Mexico does. That would make the 25-year shit moot.

Also, brown sugar is yummy. Maybe there’s a good way to use it with chicken LOL

There absolutely is.

mmmmmmmmmmmmmmmmmmmmmm

Coke can chicken, now with real cane sugar?

/s

I have said the same about FMVSS and EPA regulations being “out-of-harmony” with the rest of the world many times. The biggest thorn is California with its own CARB standards: many times, EPA and federal government have been trying to force California to harmonise with EPA. Yet, Tenth Amendment “protects” the state rights to create the laws that the Congress hasn’t passed.

If President Trump cares about reducing the government cost and waste: he could simply sign the executive order to eliminate NHTSA and force EPA and FMVSS to harmonise with the de facto international standards. However, he has no love for anything with United Nations…

In the Obama era CARB and EPA did harmonise. Then Trump came in and rolled back federal requirements.

CARB has nothing to do with the 10th amendment. The Clean Air Act specifically grants California the right to write their own emission standards and the other states the option to choose whether to use CARB or EPA standards. Congress could pass a change to the Clean Air Act tomorrow and eliminate CARB – but they don’t have the votes.

In the Medium and Heavy Duty segment CARB and EPA were set to harmonized again with EPA 2027 – and again – Trump is looking to roll that back

Rolling back the emission regulations is probably the wisest move. The vehicles have gotten so clean that further tightening of the regulations would be more counterproductive.

They cause the vehicles to be much more complex and harder as well as more expensive to service if one part fails or the car is damaged in the accident. Thus, many perfectly servicable or repairable vehicles being written off by the insurance carriers. That is not good for the enviroment…

Adding the hybrid system makes the vehicles heavier, leading to higher particle pollution, especially for brakes and tyres. Many components are built as one “unit” so replacing one part means replacing the whole unit. That is also not good for environment…

Yet, Tenth Amendment “protects” the state rights to create the laws that the Congress hasn’t passed.

I explicitly included this statement because California and several other states had been battling President Trump during his first term about eliminating the waiver for California. They filed the lawsuit against Trump Administration as to preserve their “state right” to set the laws or augment the federal laws. EPA’s Andrew Wheeler contended that one state cannot set up the standards for the rest of the country.

I don’t claim that the CARB was granted the right under the Tenth Amednment. I claim that CARB and other states invoke the Tenth Amendment through their lawsuits against the Trump Administration.

Sorry but no – further tightening emission regulations is not counterproductive. Regulations have to continually tighten just to keep up with the increased population and vehicle miles driven in our cities. Air quality is not improving and in some cities it is getting steadily worse.

We still have plenty of poor air quality days when all one has to do is go outside at look at the sky. We should not be able to see the air.

No, hybrids do not increase brake particulate pollution. Hybrids (and EVs) use regeneration for the vast majority of brakings so brakes last many times longer than in a regular ICE car. Both my 2005 and 2009 Prius went more than 10 years without changing pads or brakes. They were both sold with the original pads in place with more than 50% of the service thickness.

A hybrid also doesn’t weight much more than a regular car – the Honda Civic Hybrid Sport is 282 lbs heavier than the Civic Sport and returns 36% better fuel economy (49 mpg / 36 mpg) and makes 50 more HP. Of course that isn’t apples to apples as the Hybrid has extra features like a moonroof, dual zone auto HVAC, and heated seats.

At this point every base vehicle should be a hybrid. It is proven tech that is 25 years old. Pays back in a few years with fuel savings. It is not actually more complicated than turbo DI I4 with the inevitable 8 or 10 speed auto.

One state is not setting standards for the rest of the country. California is setting standards for their own state. Every other state can freely choose whether or not to use CARB or EPA standards.

I until recently, I had a 1993 Civic with manual everything, including steering – a paragon of the ‘light simple analog’ car. I recently had to replace it with a 2012 Prius C Three.

The Prius has climate control, power windows, two more doors, power mirrors with turn signals, rear seats you would actually want to use, a touchscreen, about ten times the number of airbags, and an entire electric drive system with battery – and of course twenty years of engineering and tech bloat have added… 10% more weight compared the 93 Civic.

Anyone sopping crocodile tears about the added particulate pollution of hybrid vehicles without even a side mention of the personal monster trucks most people drive is delusional, dishonest, or some measure of the two.

Here is but one of many… https://cookthestory.com/brown-sugar-chicken/

It is funny that this started as a squabble over small pickups and still exists today despite none of the big three even making anything that could be called small pickups

Remember, anything implemented by the Govt. rarely ever goes away even if the original reason is longer valid.

Not much has changed since 1776.

Grievance 16 – For cutting off our Trade with all parts of the world

Our markets are not open. Free trade is restricted by horrible tariffs. End the Chicken Tax.

The chicken tax is also why SUVs started getting 4 doors after about 1980.

Also, since trucks don’t have to be as safe as cars, or meet the same pollution or mileage standards, the American auto industry has tried with much success to get all the edge case vehicles defined as trucks. The government guaranteeing a 25% margin over foreign competitors on top of that, and it’s no wonder the American auto industry has forgotten how to make anything that isn’t a truck. Oh, and with the Section 179 deduction the government is further subsidizing 6000+ pound “trucks”

I was talking to someone who claimed that by depreciating their SUV 100% in a year, and selling it and buying a new one every year they were actually making a small profit that paid for the gas it used.

A Dodge Dakota 4-door has seatbelt pretensioners and other safety features that the 2-door model doesn’t have due to some designation it gets by being a 4 seater. My ’97 K3500 has a GVWR over a certain limit that makes airbags not required. GM being GM, they were just like ¯\_(ツ)_/¯ and put covers over where every other GMT400 has airbags. Strange things happen when politicians and accountants get involved.

I agree. When a lot of these laws were created, the lines between cars and trucks were much more obvious. Now there are tons of gray areas.

Mazda quit selling 2WD (FWD) variants of their crossovers because the 4WD made them a “utility vehicle” instead of a passenger car and the rules were more lax. There are a thousand examples, but my favorite is when Rolls-Royce intentionally added weight to some models to get them over 6,000 and therefore eligible for section 179 as “trucks”. Hahahaha.

Like the Chrysler PT Cruiser which is considered a truck for CAFE purposes!

Unless it’s a convertible.

Flatbed

It was – but automakers flew too close to the sun and Congress closed that loophole. It was the flat folding seat that made the PT Cruiser a “light truck”. Current rules require a 3rd row of seats to take advantage of the seat folding loophole:

For non-passenger automobiles manufactured in model year 2008 and beyond, for vehicles equipped with at least 3 rows of designated seating positions as standard equipment, permit expanded use of the automobile for cargo-carrying purposes or other nonpassenger-carrying purposes through the removal or stowing of foldable or pivoting seats so as to create a flat, leveled cargo surface extending from the forwardmost point of installation of those seats to the rear of the automobile’s interior.

This finally explains why my IS300 wagon is classified as a light truck / utility vehicle as per the title and registration despite sharing a chassis and drivetrain with a Supra… it does make a flat surface back there just big enough for a twin size air mattress for camping.

Up until about 1990 Customs gave SUVs the benefit of the doubt both ways – they paid the lower car import duty and Japanese ones weren’t counted in the “voluntary” car quotas. The Big 3 and UAW lobbies complained about that and around ’90 they split the difference – 4-door SUVs were cars and 2-doors were trucks.

It was a Pyrrhic victory for the forces of Detroit as by that time the VRA had expired and public demand was trending heavily to 4-door SUVs.

Yeah, I meant to type 1989.

Iphone thumb.

The Chicken tax has nothing to do with the number of doors. Import Tariffs are based on international tariff descriptions which are different than the rules used by NHTSA CAFE. For example an Audi Q8 is a “light truck” for CAFE and a passenger vehicle for the Chicken Tax.

All “Light Duty” vehicles under 8,500 GVWR have the same emission regulations. A F150 has the same emission regulations as a Mitsubishi Mirage.

Safety regulation are also the same for all light duty vehicle – that changed back in in 2000.

Section 179 is still a thing though.

Customs started calling ambiguous truck car things trucks if they had 2 doors, and cars if they had 4.

Cue chicken tax on 2 doors

That happened in 1989, but my fat thumb hit the wrong number on the iPhone and my fat head didn’t notice. Actually my head is of normal girth at 7 1/2 but my eyes have been messed up.

Why did customs change in 1989?

I have no idea

What is it now?

I have no idea.

Sorry for any confusion

I feel like Chicken Tonight – like Chicken Tonight!

*flaps wings*

Thanks, Mercedes! I may have been the impetus for this article, when you replied to a comment I made on another post. When I was researching for that comment, I learned that the sales of Volkswagen light trucks fell off a cliff in the US in 1965, losing something like 80%. The Chicken Tax made them so much more expensive that Americans could buy an Econoline or A100 pickup or cargo van cheaper than any VW.

But as for the Toyota Hilux Champ, even if they could be legally imported and without tariff, I don’t think Toyota would sell them in the US. They’d just cut into sales of the more profitable Tacoma.

You were the inspiration for this! Thank you! 🙂

Admittedly, the Champ was only the most obvious foreign truck that was on my mind, in part because I’m still thinking about those super cheap Hilux campers.

If a squabble over chickens is still significantly affecting global trade 60 years later, it’ll be interesting (demoralizing) to see how the current full on trade war affects future/current generations as time progresses.

I don’t know how many future generations we’ll have…

Turns out the real ‘chicken run’ happened in the ‘60s: Europe raised a tariff on frozen poultry, and LBJ clucked back with a 25% tax on trucks. So every time you see a Ford F‑150 going for six figures—even if it’s just hauling your groceries—you’re really just financing old-school poultry payback.

That’s one helluva way to play chicken.