The Morning Dump today will again be about vehicle affordability, specifically focusing on new data from Edmunds that shows Americans are so underwater on their trade-ins that even James Cameron couldn’t find them.

This is showing up in the failure of subprime lenders, starting with Tricolor Holdings. Did that company crash because of fraud, or was fraud a necessary condition of serving the subprime market?

That’s bleak, so perhaps something a little more positive to round it out? If you wanted a Subaru Outback, but not from Subaru, then Mitsubishi might have the car for you. And if you wanted a GM-built EV in August, but you didn’t want a GM-branded one, you probably got a Honda Prologue.

1-in-4 Trade-Ins Carried Negative Equity Of More Than $10,000 In Debt

If yesterday was about how wealthy buyers and electric cars skewed the average transaction price, today’s theme is that underwater buyers at the other end of the spectrum are drowning.

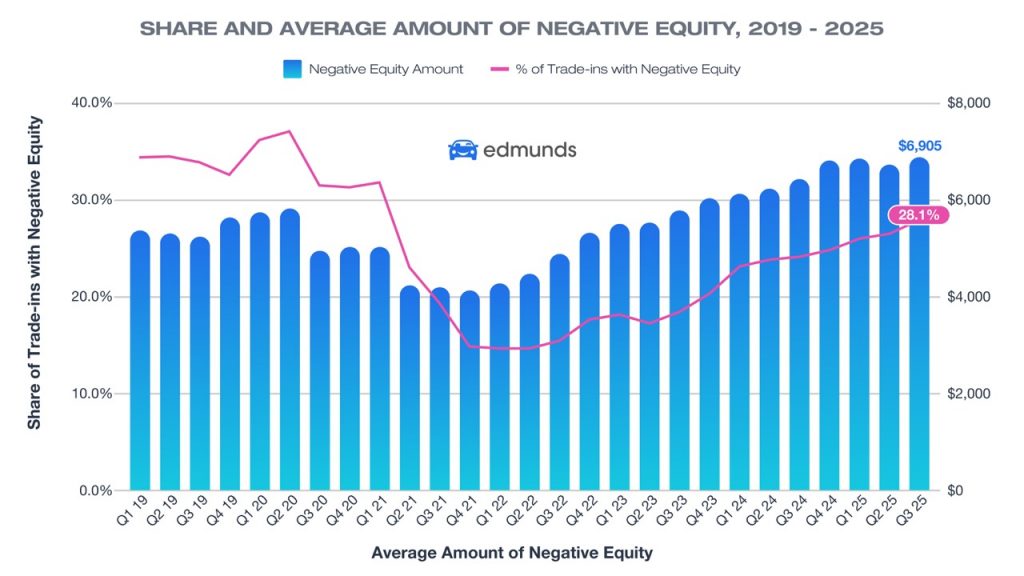

The numbers come via Edmunds, which titles its latest data report “Underwater and Sinking Deeper.” This seems accurate, as Q3 data shows that people trading in cars are extremely upside down on their loans.

About 28.1% of cars traded in last quarter were upside down, with an average amount of $6,905. That’s just the average. About a quarter owed more than $10,000 on their vehicles.

What’s happening? Some of this is the fact that the average trade-in is 3.7 years old, meaning these are the pandemic-era loans I was warning about back in 2023. This is the reaping/sowing moment for those unfortunate buyers. It’s also a sign that people are making even bigger mistakes by trying to buy another car too soon.

“The sheer amount of debt consumers are carrying in their trade-ins should be a wake-up call,” said Ivan Drury, Edmunds’ director of insights. “Nearly one in three upside-down car owners owe between $5,000 and $10,000 — and a growing share owe far more than that. Much of this stems from shoppers trading out of vehicles too quickly, or carrying loans taken out during the pandemic car market frenzy, when prices were at record highs. Those choices are now catching up, making it far harder to buy again without piling on even more debt.”

Americans do not love the idea of downsizing, and it may not always be a reasonable choice for everyone, but it’s probably necessary for many consumers.

“For many car owners, there’s no quick fix for being underwater. It’s about minimizing how much deeper you go,” said Joseph Yoon, Edmunds’ consumer insights analyst. “If you can, wait until you’ve paid down more of your balance before trading in. But if you do need to replace your car, make sure your next purchase fits your budget, not just your needs. The right vehicle choice can prevent a short-term decision from becoming a long-term setback.”

You can imagine a scenario wherein a consumer took out a loan on a vehicle in 2022 for a car that was overpriced. For whatever reason, this consumer now trades in and rolls that debt into a new car, which is now even more underwater. That works so long as people keep staying employed and don’t take any other hits like, say, an increase in healthcare costs due to the expiration of ACA credits.

Of course, if this were happening, there would be warning signs like the failure of subprime lenders.

‘When You See One Cockroach, There Are Probably More’ – Jamie Dimon

JPMorgan & Chase, the New York-based megabank, had to take a $170 million charge-off on the third quarter related to its exposure to Tricolor Holdings, a subprime auto lender.

According to Bloomberg, the quote above comes from JPMorgan boss Jamie Dimon, who added that “Everyone should be forewarned on this one.”

What does that mean? It sounds ominous.

A little background is required here, as Tricolor had both a very specific client profile as well as allegations of shenanigans. The company is said to have focused on people with low or no credit, including undocumented immigrants. That seems like a questionable area to be loaning to right now, given the shakiness of the job market.

There’s probably more to this than merely loaning to people at the lower end of the market. From another Bloomberg report:

Bankrupt subprime auto lender Tricolor Holdings appears to have been a “pervasive fraud” of “extraordinary proportion,” a lawyer helping oversee its liquidation said in court Friday, underscoring the scale of the company’s alleged misconduct even as investigators continue to unravel its finances.

Initial reports “indicate potentially systemic levels of fraud,” according to a presentation made in court by Charles R. Gibbs, who is representing the court-appointed trustee.

While Gibbs didn’t elaborate on the nature of the fraud, a preliminary examination of Tricolor’s records shows that at least 29,000 loans pledged to creditors were tied to vehicles already securing other debts, Bloomberg reported earlier Friday.

This kind of fraud shouldn’t be that easy to pull off, right? Also, what was the exit strategy here? It sounds like it’s being alleged that the company borrowed money multiple times from creditors for the same vehicle.

The subprime market is already a powder keg, so why not toss a few matches in and just see what happens…

There’s Gonna Be A Mitsubishi Outback-Like Thing

Mitsubishi makes reasonably nice cars at a reasonably nice price for, presumably, reasonably nice people. The brand recently added a Trail Edition trim to the Outlander, which Thomas had some opinions about.

Essentially, it’s a decent deal; it just made some of the best features optional. Perhaps the company is going to fix that? From a press release:

MMNA recently debuted a Trail Edition package on Outlander, and this new model will build upon the graphic features on that vehicle by adding off-road-specific bodywork, off-road-focused drive modes and performance upgrades, and unique interior styling with specific materials. This vehicle will take the company’s legendary Super-All Wheel Control (S-AWC) all-wheel drive system3, honed from Mitsubishi Motors’ 12 wins on the legendary Dakar Rally and on the muddy tracks of the World Rally Championship, to the next level, allowing families to explore further beyond where the pavement ends.

More details, including naming, imagery, technical specifications, pricing and on-sale timing will be the subject of future announcements.

So, it’s another Outlander, just more Outback-y maybe?

Honda Really Needs A Cheap EV Here

The tax credit-fueled boom of Q3 had a fun outcome: according to registration data put together by S&P Global Mobility and shared with Automotive News, the third best-selling EV in August was a Honda:

The Honda Prologue was among August’s biggest winners as registrations jumped 81 percent to 9,005 vehicles. The Prologue was the No. 3 most-popular EV for the month after the Tesla Model Y crossover and Model 3 sedan, S&P Global Mobility said.

Registration data serve as a proxy for sales because some EV makers don’t separate U.S. results or report sales by model. Many automakers also don’t report sales monthly.

The Prologue came with incentives of $12,704 per vehicle in August, compared with $5,813 a year earlier, Motor Intelligence said. In contrast, Honda’s gasoline-powered CR-V crossover had $2,016 in August incentives, the data provider said.

Obviously, the Prologue is a GM Ultium vehicle underneath. This goes to show that there are plenty of Honda buyers out there for a Honda EV crossover at the right price (which is much lower than the MSRP). Or is this a sign that people would buy an Equinox EV if it had CarPlay?

What I’m Listening To While Writing TMD

The sad news yesterday was that legendary soul and R&B singer D’Angelo passed away due to complications from pancreatic cancer. I was tempted to do “Untitled (How Does It Feel)” this morning, but I love his cover of Smokey Robinson’s “Cruisin.'” RIP.

The Big Question

What happens next?

Top photo: Edmunds, Dodge

I was in my mid-40s when I first paid more than 10k for a car. Because at that point in time I could afford it. Everybody sets their own priorities, I guess.

Many people are upside-down due to bad circumstances or decisions, but one thing that doesn’t help are the terrible trade-in values provided by dealers. Sure, you don’t have to trade in your vehicle to them, but many incentives on new car prices are typically tied to trading in. This only compounds the “upside-downness” of the transaction and continues to increase the negative equity acquired.

Trade in values have been a lot stronger the past few years than they have in the past. You can thank Carvana for that as they forced dealers to get more competitive with their trade values.

Very true. First thing I tell anyone looking at trading in a vehicle is to get quotes from Carmax and Carvana before they start. Maybe take a little less than those if the tax difference makes it up, but don’t take a hit when they make it so easy to sell your car to them.

True, but if they were making more money on the trade, the incentives would exist. The advantage to trading in where I am is that you only pay sales tax on the difference in value. At 6.75% that means buying a new car and trading in a car worth $30k saves over $2k in sales tax.

We just sold a vehicle to Carvana for almost $9K more than any dealership would offer. I know the dealerships need to make a profit, and Carvana’s high prices are part of its growth strategy, but DAMN. One of the offers was $12K less than Carvana. And I’m not talking about a six-figure vehicle. This is a truck we sold for about $28K.

can confirm. Twice in the past 3 months.

Americans are bad at managing money. In other news, water is wet! Details at 6!

Seriously, I used to frequent the Personal Finance subreddit and the amount of just terrible financial decisions out there is astounding. And I say this as someone who has made more than a few bad ones. The keeping up with the Jones’ is a real problem for a large percentage of the country and the chickens are coming home to roost.

Considering our entire economy depends on people spending money they don’t have, I believe this is by design.

I spent an entire year in high school taking geometry, yet not one day was spent in interest rates or any type of personal finance. They want us financially illiterate.

I also think it’s less “keeping up with the Jones'”, and more “everything is fucked anyway, I might as well have a nice car for my hour each way commute to the job I hate”.

Marketing people are entirely aware that higher-level trims are the profit centers largely because they enable clout chasers to justify spending large sums on options that are significantly overpriced. “I wanted the ventilated seats and they only came on the Platinum level trim, which costs $15k more.” If you asked anyone what the individual options are worth it would be a fraction of what they spend. But the trim level badge is really what is being purchased.

I have worked in banking for 20+ years. Each new generation of tellers seems to know less about money and finance in general than the generation before them.

In my local area, the only high school students who are getting any financial literacy education at all are the ones who take the “dumb kids math” rather than advancing from algebra to geometry to trigonometry and so on. It’s not a surprise that the only young adults who seem to have an even rudimentary grasp of interest rates, budgeting, etc. are the ones who had someone work with them individually to teach them how to be a financially responsible adult.

On a slightly related note, I just watched a video of a person in Moscow crying because when Putin shut down the internet for “reasons,” they were 100% unable to navigate where they were going. They had been driving around for 2 hours and ended up right where they started. Sounds like fun when gas is becoming quite rare.

The internet has replaced big chunks of people’s brains.

And it’s only getting worse.

pedantic point: water is not wet

*ducks as StillPlays throws a brick in my direction

Far too many people care about what type of car they drive. It is truly the largest way people spend money they don’t have. The results of a car-centric culture and terrible planning create a situation where most people are forced to own a car to complete basic tasks. People then use the car as an extension of their feeling of self-worth, which makes them very susceptible to being manipulated by marketing. People are quite bad at separating what they need from what they want.

Rather than buying new, people should find a decent certified pre-owned vehicle and save 20-30%. Having a warranty can be beneficial as it reduces the financial shock of repairs, which can otherwise lead to a cycle of credit card debt and other financial stresses. Since certified pre-owned vehicles avoid the biggest depreciation hit, it makes it easier to avoid getting underwater while still providing access to a good interest rate. Don’t be picky about color, and most definitely don’t spend an extra dime on higher trim levels unless you have money to burn.

Gotta love us some late stage capitalism. We are seeing it play out in accelerated time because Americans are dumb enough to think the country should be ran like a corrupt business. I feel no sadness for people who voted for orange Mussolini and now are suffering.

Zero sympathy at all. They asked for this! And still somehow stick up for it. Indoctrination at its finest.

Soybeans anyone?

I call it stage 4 Capitalism. and no, chemotherapy will not help. And the idiocy of car buyers lessees is epic. Her is your 24 month lease for only 179/month. 10000 miles with just $4,800 duet signing. Well dumbfucks, that means you are losing the future value of your $4,800 and your lease costs $379 per month. JFC, simple arithmetic, but that monthly published cost in the ad takes the prize.

I hate to be overdramatic but I literally think reckless car purchasing is an existential threat to our country, and I’ve said as much many times. There’s so much about the numbers presented here and in the article yesterday that are simply staggering.

The average new car transaction is now over $50,000. A little over a quarter of cars are being traded in with negative equity that averages nearly $7,000 after LESS THAN 4 YEARS. The median household income in the US in 2024 was $83,730. Do these numbers make sense to you? They shouldn’t, because they’re insane.

This is the culture we’ve created in end stage capitalism. The vast majority of the population is made up of robotic consumers that place all of their self-worth in money and assorted toys. The majority of new ICE vehicles are quite reliable these days and can easily hit six figure mileage with routine maintenance. But we’re turning them in 3.7 years because we have to keep up with the Joneses and feed the Truck Industrial Complex.

The average new car price isn’t that far off from the median household income after taxes, especially if you live in an urban area. None of this is sustainable and it’s absolute lunacy to have that much money tied up in a depreciating asset. Like everyone here, I love cars! I’m also fortunate in that I could go out and get a $60-$70,000 car if I really wanted one.

But WHY IN THE NAME OF GOD AND ALL THAT IS HOLY would I do that right now? It’s pissing money away for a status symbol and manufacturers are going to keep charging more and more until they can’t anymore. Unfortunately people with 0 financial literacy have proven unequivocally that they will simply keep paying more and more so long as the finance guy can show them a palatable monthly payment…and that’s how so many people are underwater.

There’s no easy way out of this and it’s 2008 all over again but with different assets. It’s all going to come crashing down soon. I kind of go back and forth on who’s to blame. The capitalists who believe they love rugged individualism claim people do this to themselves and that if they were less dumb with their money this wouldn’t be a concern.

I do think that’s a portion of it and unfortunately actions have consequences…not to mention a shocking portion of the population doesn’t believe anything bad can or will happen to them until it does. Then they go “woe is me” in all sorts of viral clips and my first instinct is “well you fucked around and you found out, hopefully you learned something and don’t do it again”.

But also, the lack of basic financial education in this country is astounding, and other, more civilized nations have layers upon layers of laws that protect the average buyer from such unapologetically predatory practices. I absolutely think there are good, smart people who wind up being conned into this stuff or find themselves in bad situations due to circumstances that are outside their control, and I think there should be more guardrails in place for those folks.

I don’t really care that much that Kyle who has a bachelor’s degree and makes $60,000 at a desk job is in a precarious financial position for his F350 Big Pee Pee edition or whatever that’s never towed or hauled anything. But I do feel bad for the working class family whose car got totaled by someone who was uninsured and needs a car that seats 5 right now or their livelihoods will be in jeopardy, because they’re vulnerable and dealerships know exactly how to exploit them.

Anyway, I’ve rambled enough. Shit is fucked yo, but in the grand scheme of everything that’s completely fucked or on its way to being completely fucked in the US this is just part of the equation. And many of the people in this situation enthusiastically vote for “anal soldering iron that’s NOT woke” over “person who thinks the world can be a better place” over and over again, so what can you do?

Anyway don’t trade your car in or sell it until you have the title in hand unless you absolutely have to. And even then I’d say hold onto what you’ve got as long as you can, because eventually this shit is going to go south and the deals will be plentiful. But I really feel for anyone who absolutely needs a car right now.

“I think we should improve society somewhat.”

(popping out of well) “And yet you participate in society! Curious. I am very intelligent.”

Mostly agree, but I don’t think this is about financial literacy. For 80 years jobs have been moving out of urban centers and are now almost entirely in urbanized/sububran rings around metropolitan areas. This has been fueled by massive investment in the highway/interstate system, which has also coincided with massive reductions to public transit.

The result is that while people living in poverty tend to spend around 30-40% of their annual income on housing (more or less inline with middle class spending) but spend 40-50% of their income on transportation.

What will cause the dominoes to fall isn’t someone making 90k a year with a $1200 84 month note on a lux suv, it’s these subprime companies who are servicing the people who have no other choice. The rest will be collateral damage.

If they taught you in school how taxes worked, what they went to, and how your $10 an hour job doesn’t mean you get $10 per hour takehome, people would be outraged.

Instead they drip feed it to you and perpetuate bullshit

(like your hourly wage is X before various taxes automatically taken out of your paycheck, then at the end of the year you have to pay more taxes on it, and by the way Social Security at it’s current rate of spending will run out of funds before you’re eligible to receive it, and even if you receive it the return on “investment” you get on it is much much much worse than the worst performing general funds).

Just think about how much you would be able to afford if your yearly pay was your takehome pay. It’s death by a billion different taxes on everything.

Just think about how much you would be able to afford if

your yearly pay was your takehome pay.your taxes were spent on universal healthcare and post secondary education for all instead of aircraft carriers and farm subsidies.How’s that going for Canada and the UK RN?

MAiD, and they’ve recently been arguing to expand it to kids without parental permission.

Ask anyone in the UK about the state of the NHS right now. It’s not too great.

Frankly we could have a public option for medical services in the US based off the model the US military has for doctors:

We get you a medical degree, in exchange you work for us for X amount of years where we provide you housing, food, and a relatively low wage in exchange for no debt and a free medical degree.

I’m all for reducing the military, though I think getting rid of our bases in foreign countries first makes more sense than getting rid of aircraft carriers first. We wouldn’t have so many people trying to commit terrorist attacks against us if we weren’t in those countries fucking with their countries in the first place.

The military alone is $892.6B. a year in 2025.

assuming the cost is distributed amongst the working individuals equally, that’s $5306 a year per person.

that’s enough to cover costs for transportation for a year.

Well we’re not going to get rid of the military entirely, but we can make a ton of cuts, and make the national guard do more useful shit.

“But at least we’re going to be RICH from the tariffs! Daddy said so! …and he KNOWs how to run a ~con ring~ business! Those dumb foreigners are going to pay all the tariffs for us!!11!”

The point is, I’m the victim here.

I’ve been shouting into the clouds that people need to STOP buying cars because of the fucking infotainment systems and SCREENS. Then people get all pissed and say mean things. So, again, STOP treating your cars like phones! You don’t need a new phone, and you surely don’t need a new car because your poor whittle scween isn’t as big as the new ones. Idiots.

Need to shout louder. The clouds cannot hear you!

Do note that most new cars are terribly boring to drive. Shit, some do it for you. Whaddayagonnado? Stare out at the clouds, yell some more? Remember the route you took so it is etched into your brain so you don’t have to use the map… oh wait, the car knows what to do. Time to get some rest and watch Blue Planet… zzzz

I feel like this bubble will be sustained for exactly 36 more months via shell game techniques and obfuscation, at which point it won’t be as much of a bubble but one of those once in a lifetime zits you get that get 10 million views on YouTube when your brave friend decides to touch it and it pops all over their face, and then hey puke all over you, and we are left with the pie eating scene from Stand By Me.

Hmmm – what happens in about 36 months? ‘Tis a mystery.

The few people who haven’t yet realized they live in a fascist dictatorship get their last opportunity to wake up? Of course, it will be far too late to do anything at that point, but that is already true, so it won’t matter much.

JD Vance will win by like 12 votes over a Democratic ticket consisting of two of the least popular human beings of all time.

In hindsight, I wonder if maybe voting for Hillary would have been a better choice….sigh. They could have ran almost anyone else…

It’ll take more that 36mo either way to get back on track.

-End of Political comment.

There is no way it makes it 36 months. The writing is already on the wall.

That was distressingly visceral imagery. Flashbacks to Osmosis Jones.

Great reference, great movie!

“AssMatt” of course you would like it

(j/k 🙂 )

Ha! I like cartoons and I like Bill Murray, especially when he’s palpably enjoying being schlubby as hell. I think Osmosis Jones, like a few of the Farrelly Brothers’ other films, suffered due to poor marketing–nobody knew what to make of that movie! I tend to think they’re underrated filmmakers (although I haven’t actually seen Something About Mary).

I give it shit because it’s nausea fuel for me, not because it’s a bad movie! I appreciate it for being live action and 2d/computer assisted animation, especially since the rise of fully 3d animation and especially with the rise of generative-AI slop. :/

Some weird financial guy, eventually played by Christian Bale, will ask some idiots to create (because they don’t exist) a Swap on the ABS Market, the Asset being sub-prime Car Loans, and they will, because they think HE’s the idiot.

For which Bale collects a multi million dollar check before driving off in his 2003 Toyota pickup.

I rented an Outlander for a few days last spring. It was comfortable and spacious, and got surprisingly good gas mileage. Seems like a decent option if you want a crossover.

You might be the only person who didn’t comment on the upcoming CARPOCALYPSE. How refreshing!

Sure you might be underwater on your loan, but have you considered a new car? If you simply go with a 10 year finance term we can finance the new car and your debt at an amount that fits your monthly budget. Of course this means you only qualify for an apr of 20% but did I mention, New Car!!

“Yeah, but I’m saying that TruCoat. You don’t get it, you get oxidation problems. It’ll cost you a heck of a lot more than $500”

I’ve relatives that have rolled car loans into their mortgages.

If you think a 10-year term, paying off your car, is bad – just think of what it’d cost to invisibly attempt to pay it off over 25 years.

That used to be a big thing and was a reason that a lot of people lost their homes. I remember specifically looking at a foreclosure listing, the loan history and the historical Google Street Views. They had bought the house right and well before the big increase in prices. However once the house value started to sky rocket so did the refinancing. Rather than do a nice safe 80% loan they were 80/20ing it every year or two. Meanwhile the street view showed the Camcord or other sensible car being replaced by a Mercedes, the drive way getting widened, a fancy motorhome and then boat filling that extra space. The old truck getting replaced by a new lifted high trim one and of course that Mercedes getting replaced by a newer one.

I have looked through the public records on some foreclosure homes and they are sometimes amazing. People who bought at a good time / price managed to get themselves into the same situation as people buying at the market peak on interest only loans.

There would be a new refinance every year (or less, in some cases). A normal home may have a dozen records or so over an owner’s time with it. These had pages and pages even before getting to municipal liens and foreclosure.

One of our friends did this. Refi, paying off the cars/student loans.

Not long after, lost job and had to relocate.

Had to rent out the old house for several years until the housing market improved enough for them to sell and break even.

Well, at least he was able to rent it and hold on to it until he was able to get out w/o getting foreclosed or selling at a loss.

They still lost money monthly, since rent didnt fully cover the mortgage, but yes, they were lucky enough to be able to bridge the gap. They both have decent paying professional level jobs, so one job loss was painful, but not fatal.

I don’t get it. How can you be so stupid as to trade in a car that is massively upside-down in value? I can see getting screwed because you totalled the car and it was upside-down, or even needing to get out of a loan because of a job-loss (BTDT, got the t-shirt), but to presumably *voluntarily* trade a car and roll that negative equity into a new loan just seems completely and utterly assinine to me. If you are underwater, suck it up and drive the damned thing until you AREN’T underwater.

And let’s face it, while *occasionally* people get a different car because their needs legitimately change, most often it is boredom with the current car.

After that painful lesson learned 25 years ago, I refuse to be upside-down on a car loan period, even if in theory at this stage in my life it could be financially beneficial to be at times. Nope, not ever again.

Lizard brain is distracted by shiny object.

You know it.

I have long suffered from automotive ADHD, but at least I admit it and try to keep the associated financial stupidity to a level I can easily afford. Only once have I been upside-down on a car I HAD to get rid of. And that lesson HURT. And thankfully was on the first new car I ever bought, so the lesson was learned early. I went a dozen years before I bought a new car again.

I could just let my freak flag fly and own more/newer/fancier cars than I do. My conservative engineer brain won’t let me live above my means though.

Hah! My “means” covers anything up to about a new 911 at this point – but my Inner Yankee Cheapskate sez “no way, Josiah”. I know I would love it and hate it in equal measure, and the money is offensive, so nope.

The only way I can see it making any sense is if you are going downmarket enough that you will pay less per month because you can’t afford what you are paying now. Still a poor long term financial move but if your expensive vehicle is at risk of repossession it might be the better option.

However, I suspect that not very many of these trade-ins fit that scenario.

Same, the one and only time I did this was because my car literally went underwater (up to the mirrors!) while at the dealership. I was young and stupidly agreed to let them “fix it” which they did not. Within a year the seats wouldn’t move, the radio didn’t work, the driver-side door handle rusted internally, the transmission started to fail, and the CEL kept coming on. Of course the original dealership took absolutely no responsibility for any of this so I had to do what I could. I traded it in for a base model Tacoma and rolled in that negative equity. At least I rolled it into a car that was a reliable as the sun coming up and I drove that Taco for the next 13 years paying off its loan and the previous and I kept driving that while I paid off all my other loans and then saved up cash to buy something else. Never again.

If they’re still upside-down after 3.7 years of ownership, then they’re just continuing down their established path by rolling it into a larger debt.

One of the reasons I read this site (and numerous other car sites) is I enjoy reading about cars, other’s driving and purchase experiences, history, tech, etc. My car fantasies are all experienced vicariously- I’ve separated the thrill and interest from actually owning a lot of the cars I like. I’ve usually bought cars within my means, don’t care what people think about me, and assign no social status to what a person drives- since many of them are deeply in debt. This has been a good thing, but probably not easy for most people.

One of the main reasons I love this site and pay for it are the comments. Well I love me some Jason and Mercedes too, but the comments are priceless. 50K average for a new car? (head spins a 360). 50K for the privilege of recalls, Large annoying touchscreens, enough engineering that is sure to self destruct once the accountants replace the long life component with plastic to save 5 cents per car, vegan leather?, etc etc. I was in the cell phone lot at the airport a week ago in my 1999 300RX. A new Escalade backed in next to me and literally blocked the sun. Of course it was driven by a 5’2 blond Karen. Bizzaro world was a superman comic book in the 60’s, now it is on full display in real life. PS that 50K is a very chunky down payment on a nice condo on the ocean in Belize

“What happens next?”

Nothing. Consumers don’t learn from their own mistakes or the mistakes of others. I don’t see any incentive for companies to stop offering these loans. They may lose money on a small percentage of these loans, but that is more than offset by the interest they are paid. Some subprime lenders may be shady, but others are just good at math. As long as the numbers keep working, there is no incentive to change.

Predatory lending could be stopped, but it would take legislation. I’m generally not a fan of government regulation of markets, but in this case it may be appropriate. It isn’t going to happen any time soon, though.

Right on. And it’s not just subprime. All lenders make it painfully easy to roll negative equity. And of course they do- it’s how manufacturers, dealers and lenders all make money. Until someone cuts the credit card in half, it will continue.

Financial literacy is painfully low in our country, and that isn’t helping things.

There’s one born every… something something.

Yeah, low financial literacy is a big problem. Of people that have underwater car loans, I wonder how many of them even understand the concept of negative equity? I presume most of these buyers are focused only on what their payment is.

I can see situations where rolling negative equity into a new loan might be reasonable, but if you don’t understand basic financial concepts, how can you possibly make an informed decision?

Unfortunately, I don’t see financial literacy improving anytime soon.

> Unfortunately, I don’t see financial literacy improving anytime soon.

Or *any* literacy. It’s more difficult to divide and conquer an educated population, and they can’t have anything standing in their way of that.

We have hundreds of thousands of federal employees not being paid thanks to the ruling party insisting on cutting health insurance subsidies for millions of people while wanting cover from the opposition. There are tariffs increasing the cost of everything also implemented by the ruling party. There are also mass deportations happening of anyone with brown skin and/or speaking Spanish, also at the behest of the ruling political party. Let’s not forget deploying federal troops into major cities.

What happens next IMO is car sales falling off a cliff. Political unrest is bad for business.

Consumer confidence will continue to tank, and take what’s left of the economy with it. Great time to buy if you’ve got the resources. To quote George Bailey…

“Can’t you understand what’s happening here? Don’t you see what’s happening? Potter isn’t selling. Potter’s buying! And why? Because we’re panicky and he’s not. That’s why. He’s pickin’ up some bargains”

The rich will get richer… we common folk are screwed.

People are gonna be FUCKED when the bubble bursts

Thiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiis

I wonder how these figures would look if you isolated cars, pickups and SUVs. My feeling is that people who buy cars aren’t so upside down, but people who buy really expensive $70,000 F-150s with minimal options are probably losing their ass the worst.

One of the biggest economic indicators of an impending recession, I feel, is the reintroduction of the Jeep Grand Wagoneer. It’s like our era’s Ford Excursion. A big dumb overpriced short-bus.

I dunno what the US market is like, but in the Canadian market, trucks hold their value the best. So unless they’re rolling it within the first 2 years and absolutely pounded the miles to them, they’re probably doing ok.

Hell, I unloaded my 2018 F150 for 12k more than I owed to get out of debt (in hindsight, looking at current prices, I should’ve just paid the truck off).

> unless they’re rolling it within the first 2 years and absolutely pounded the miles to them

That’s exactly what they’re doing. People beat the absolute piss out of everything anymore. Zero sympathy.

Yeah but trucks are massively overpriced so I just assume that cost just trickles down to re-sale price.

Man, a modern Ford Excursion would be so cool.

I believe the word you’re looking for is “expensive”, not “cool”.

There’s one at a consignment dealership about 15 miles from me that stare longingly at every time I drive by. Eight bolt wheels; body still looks great despite Midwest winter salt… Oh how I want to upgrade from the F-150.

I want to stop and ask about it, but the wife insists we need a pickup to pull the camper, and a “suburban” just won’t do. 🙁

As the kids say, FAFO.

Who knew fucking around international trade rules with other industrial powers would be bad for the economy?

This bubble predates this by a massive amount, the 2008 bailout of the banks just delayed the inevitable and made it much much worse.

Oh, he knew. He did it anyway because it couldn’t possibly affect him or his corrupt-ass family in any way. They’ve made over 5 billion since the start of this administration. He’s trying to build a literal royal family. It’s incredibly obvious. When you already have more money than God, what else could you possibly want to obtain? Power and status. Unfettered power and unquestioned royalty. And people are not only OK with that, they are cheering it on! America is on the verge of death, and the self-proclaimed “patriots” are the ones killing it.

“Is said to have?” I mean, the “Tricolor” in the name references the three colors of the Mexican flag, which is what the company’s own marketing indicates. Moreover, something like 2/3 of their market were illegal immigrants; they explicitly indicated in their 2022 marketing documents that their customer demographic was individuals without FICO scores or social security numbers.

I’m not going to cry any tears for JP Morgan Chase’s losses here, but it’s not just “The company is said to have,” but the company itself said it.

Secondly, I’m always troubled by these stories of underwater trade-ins, but not because I feel particularly bad for the borrowers. The average age of car on the road in the US is 12 years (https://www.bts.gov/content/average-age-automobiles-and-trucks-operation-united-states). While in the US it is difficult to get around without a car outside of some urban markets, there is expressly no need to get a new car.

We as a country do a miserable job at teaching fundamental economics to students who really should be equipped to learn that keeping car debt is not normal, and our media does an equally bad job at amping the perceived danger of older vehicles which (inadvertently, I suspect) generates demand for new vehicles among those least equipped to afford them.

“… and our media does an equally bad job at amping the perceived danger of older vehicles …”

I don’t know if it’s media parroting this or if it’s just old habits, or things they thought they learned from their parents. I know a lot of people that are simply not comfortable with a car having over 100,000 miles, this despite the evidence (12-year average age) that vehicles now last longer than ever.

There’s a pretty large portion of the market that are buying simply because they are bored with the old car and like new things. Personally, the existence of one year old used cars simply baffles me.

My dad was this guy. Financially very smart, he simply refused to believe that a domestic would last beyond 100k miles, so even though his 2010 Explorer was doing just fine, at that mark, he simply had to get a new vehicle. His excuse was “it’s taking them forever to get [some replacement part].” When I asked who the they was, exactly, the answer was “the dealership.” He couldn’t even conceive that there are plenty of aftermarket parts available.

People also get scared when said older vehicle has an expensive unexpected repair bill. I have a buddy that paid to put a new transmission in his 125k mile Silverado, then immediately sold it and got a new (used) one.

There are also a lot of people, who need reliable transportation and if they do not have it then they may lose job, not get to medical appointments, cannot afford large repair bills and cannnot do the repairs themselves.

A 100,000 mile Yaris is pretty much the pinnacle of transportation reliability, and are available for 6-8k.

If you’re on the ragged edge of fiscal solvency where you cannot even take a day off of work, then the answer is not “new car and payments” – it’s the legendary beige Corolla (or equivalent), which will allow you to save money.

Put another way, a $40,000 car (which is less than the average price of a new car) you trade in with $6000 negative equity (also the average) is going to cost you at least $46,000 because you did not pay ahead of depreciation; a Corolla you pay $7,000 for is certainly not going to cost you $39,000 in repairs and lost productivity over its lifetime.

IOW, “reliability” is, for the most part, a false economy.

That is why we need new $20K cars. There are exactly 0 yaris near me for sale. your posting a worse case. There are people who cannot do car repair that need to know they will not be hit with $10k in repairs on their used cars. I had over $18K in repairs just this year and all by $1200 were covered under warranty.

There are 429 Yaris for sale nationwide in the US; if we’re talking basic Toyota products (Corolla, Avalon, Yaris, Echo) for sale under $10,000, there’s 1,056 to choose from. Autotrader being as it is, that’s also overlooking all the local classifieds that have vehicles for sale.

Most cars are not going to have 18k in repairs. I agree we need cheaper new cars, but the used market is plentiful and reliable.

Was down a Facebook rabbit hole and some guy with a beard was talking about the 6 best used cars to buy. #1 was 2000 to 2005 Buick Le Sabre. I thought about that and said to myself: Yes that satisfies the brief. Cheap to buy, gets me places, cheap to repair, probably comfortable seats, and they are available in the 5 to 7K range. Since it makes great sense I am sure no-one will listen to him and buy one.

I don’t want to be that guy, but if you can’t get students excited to learn things like history, science with explosions (chemistry), and things like that, how are you going to get them to learn ::economics::

Our kids had personal finance classes, but, like most teenagers, info only stays in their brain long enough to ace the test, then push out to make room for something else more interesting like tik tak nonsense.

I *mostly* agree – but I’m going to posit a counterpoint to this. Done correctly, there is a LOT to be said for treating a car as a utility bill. And by that I mean get the absolute cheapest lease on the cheapest car you can stand to be in. Get a new one every 2-3 years. With the cost of repairs for even the cheapest cars being astronomical today, if you are on a tight budget this can really work out well if you can lease it cheaply enough. For example, my bestie was in nursing school AND working full-time. She had not much cash available, and zero time or energy to deal with car dilemmas, and no ability to DIY. So she ended up leasing a succession of base VW Jettas for something like $250/mo. Didn’t have to do anything but put gas in them and change the oil once a year (and I think the dealer did that for free on the first one). Easy to budget for, no surprises, no repairs, didn’t even have to put new tires on them. But IMHO this only works for *cheap* cars, and of course if you can stay within the mileage limits. It makes no sense to serially lease luxobarges. It’s not the cheapest way to own a car, but over time, it’s not really THAT far off as long as the car is cheap. And most people have champagne tastes on tap water budgets these day.

If leasing rates had been reasonable when I bought my mother her Soul three years ago, I would have loved to do the same – but we had the money to just buy the thing. Which is a privilege most do not share. The interest rate was low enough that we did actually finance half of it, leaving the other half to make money.

Mileage limits are the thing that I know got co-workers in trouble and have kept me from leasing because of being a single car household most my adult life. About 2010 coming out of the great recession I had a coworker dealing with both his RSX and his wife’s suv (MDX?) being thousands of dollars underwater and risking repossession because they rolled thousands of miles over into new low-milage leases and didn’t want to slum it in an Accord or CR-V for 5-6 to get out from under it. His first thought was whether he could get his wife into a newer car to reset the lease.

You have to be realistic about what you are going to do with it. In the case of my friend she actually bought too many. She did 10K/yr leases and only put about 7K a year on each car.

My question is why people would feel like they need a new car so soon, that they would make such a terrible financial decision. Especially if these were new cars, why trade them in so soon? I mean, *I* do that, but I pay off the cars first. I would never do it if I owed on them.

I traded in the 2023 Miata RF I had (as I mentioned on here before) because the transmission lost its 3rd gear syncro with a whole whopping ~8k miles on the car luckily what I traded it in for was worth less and the trade in value was only about 1.5k less then I paid for it so I decreased my monthly payments. To me they is really the only time I can see trading in a new(er) car so quickly if you just do not think you can rely on it because of issues it may be having. I do not get trading in a car that is perfectly reliable but then rolling over 10k+ into s new loan doesn’t make sense I guess unless you just really hate the car.

If someone hates a car so badly that they’re willing to turn negative equity into more negative equity, then that tells me they’re terrible at car shopping.

I had to do this with my 2022 Civic Si. In the 13 months I owned it, 2 of them were spent out of service for warranty work without a loaner car. I was on the lucky side that I could drive my track car Miata, which wasn’t fun for the 150mi commute I had. The final straw was when the sticky steering issues started to plague the car, but by then i was past the 3/36k warranty. Honda wanted to charge me for a new steering rack, and I simply punted the car to the highest bidder. Ended up only losing $1500 from the purchase price, and the loan amount was way less than that.

I also had a ’22 Si, but I only had it for 10 months before someone crashed into me. Funnily enough, I also had the sticky steering recall on the ’23 Integra I replaced it with (because it’s basically the same car). It shouldn’t have been a warranty issue for you; that is/was an official recall. Felt great to get it fixed!

I was one of the first cars to experience it. It started for me in October 2022; dealer was unable to recreate and no loaners for unapproved warranty work. I knew it was eventually going to be a recall but it was infuriating to live with on my 150mi round trip commute. Plus with all of my other issues I had (blown turbo, broken seat frame, bad door lock actuators, bad window regulator, bad infotainment unit, obscene creaky trim rattles, and cruise control that would fail randomly) I was over it.

Obviously, I didn’t learn from it because i now have a 2018 Civic Type R and we just bought my wife a 2025 Pilot Trailsport.

It was a very annoying steering issue. I was very happy when I found out it was a recall; I thought I’d just have to live with it. I had better luck than you otherwise (though I agree about the creaky, rattly trim.) Or maybe I just didn’t have the car long enough for it to become the villain.

Only time we traded a new vehicle back in less than 2yrs was 99 Suzuki Grand Vitara we bought brand new (this was also the last new car we ever bought).

-1st reason was wife had a 2nd kid and her rear facing car seat would not fit in back seat without one of the front seats shove all the way forward. Tough when we all rode together.

-2nd reason was the manual transmission would occasionally jam/not let you downshift into 1st/2nd when coming off the interstate ramp. Took it to dealer several times, but always ‘no problem found’ and would then suggest that it was possibly my wife not knowing how to drive a stick. I’m really surprised the Service Advisor lived. She’s been driving a stick since she was 16 and quite adept at it.

Any modest modern car will run likely more than 100k with minimal maintenance. Cars are no longer worn out at 5 years old. Spark plugs and other items considerd consumable decades ago last 120k nowdays. I’m an engineer and the newest car in my fleet is 11 years old, the one with the lowest milage has 135k. They are not the same car.

I’d rather spend the money on other stuff.

George Carlin comes to mind:

Think of how stupid the average person is, and realize half of them are stupider than that.

I’ve never liked that quote, because I feel like Carlin knew that’s not how averages work.

He knew that at least half the population was too stupid to know what the median is.

Carlin’s material is still applicable today!

Hilarious

Image what he could do with all of today’s nonsense!

RIP

Capitalism is inherently inflationary, so as things continuously get more expensive the debt grows. We will likely never see car debt go down.

You just need to pull yourself up by

your own bootstrapstariffs.“2008 here. Just checking in to see how everyone is doing!”

We learned nothing as a whole. Thanks for asking.

Earmuffs

2008? That’s so long ago that I bet they did not even have cars.

LALALALALALA! I CANT HEAR YOU!

Everyone shaddap! This is a golden opportunity.

Here. Write this down, write this down.

Okay. First, there’s this gorilla at the Cincinnati Zoo — are you writing this down it’s really important

What happens next is likely a whole bunch of loans going into default because the borrowers can’t repay them. This was the inevitable outcome of ever-increasing prices and stagnant wages for most consumers. If you can’t afford both your car payment and something essential to continue living, such as medicine or heat, you’ll skip the car payment first.

I’m not judging anyone who happens to be multiple thousands upside-down on a car because crap happens and I get it, but I’ll never understand how someone can be so stupid that they trade in a car they’re upside-down on for something even more expensive. Like yes, we do need to teach basic financial literacy but there’s also a point where common sense should kick in.

How much you are or aren’t upside down doesn’t have to do with the next car’s value per se. Usually people are doing this because the more expensive car can float their disequity and they can’t finance a cheaper car to get out of their old car they’re upside down in. So they double down on a more expensive car. The feeling is, ‘I’m already upside down, may as well drive something that I like.’

Worst advice I regularly hear is Dave Ramsey telling people to take out loans to pay car disequity and sell their cars, so then they’re left with no car and a car payment. Worst advice… Unless you’re in NYC.

Shocked to hear that Dave Ramsey is giving out bad advice.

Being unknowledgeable on this topic, I guess I’m surprised banks will loan more than the new vehicle is worth to cover this ‘disequity’?

I haven’t financed a car in over 20 yrs…also haven’t bought a brand new car in over 20 yrs, and my kids are now in their 20s…this might all be related.

Most banks (Synchrony, among others) will do LTV of 125%.

So if the car is $10,000, then they’ll loan up to $12,500, thus permitting you to bring $2,500 of negative equity into the purchase.

Which doesn’t make it a good idea on either end of the equation – the people who do such things are the most likely to default, and the banks are, of course, heavily exposed.

So buying the $50k car lets you cover that $10k underwater?? Wow. Guess we’ll bail them out if losses are too high like last time.

Banks know how to balance their risks well: Keep all of profits on high rate loans, but beg to Govt if they experience a loss later.

which they cover by charging 29% interest on revolving credit card debt.

I’ve been expecting the bottom to drop for almost 10 years now. So clearly things will continue on the current trajectory for another 10 as the universe continues to spite me.

Gee, who knew that those 84-month loans on vehicles that people couldn’t afford would come back to bite the market. Total shocker.

It’s also caused by leasing getting so much less attractive than it used to be. People who used to have lower car payments and leased and re-leased are now going to financing because most leases (especially on luxury cars) suck these days. So they finance for 84 or even 96 months so their payment is like their 24 or 36 month lease payment they got used to over the years.

I am LingOL on our 84 month lease on the commuter Ionic from 2019. 0% interest, 0 Down Payment and they gave us $1,000 cause it was bought in 2020. Regularly gets 45 mpg and it can be a bit of fun, but fuckall it needed a rear wiper.

We’ll happily roll your balance into a new 96-month lease on a new Ram – Stellantis, probably.

What bubble pops first?

A sub-prime auto lender managed exclusively by AI?

Venture capital bros could be throwing millions at you right now for this idea but instead this comment has likely been scraped by an AI bot and some tech sociopath is probably gathering seed funding for a new startup already.

CarvanAI

We could have had Saturn Skynet, yet here we are.

Could be AI. All the hype, and none of the actual benefits.

That’s because you don’t own the AI. Those five people see the benefit, and that it does not benefit you.

But how else are you going to see a picture of Gandalf with huge naturals?

The way the Furry community does it, by apparently all being incredibly rich and commissioning it. (I have a lot of friends who are animators, the Furry commission gig is…lucrative, apparently.)

“Gay Furry Pride” isn’t just a slogan found on VMS signs in construction zones my friend.

I feel like AI is coming and hard. I just hope it doesn’t have crazy ripple effects on the rest of the economy.

Narrator: It had crazy ripple effects on the rest of the economy.

Given OpenAI’s most recent announcement, you’re right on AI coming hard. (Don’t search it on a work computer).

I’ll put some money on the big boy, commercial real estate.

With the bailout Argentina, then Argentina turning right around lowering their soybean tariffs screwing US soybean farmers even more, and China not buying US soybeans due to tariff retaliation. And all the other ways all farmers are getting stomped on right now. I’d say a crash in agricultural land value, then only to be scooped up by private equity at a discount, and Vance’s connection to Acretrader to facilitate that scoop up. I have family who are cattle ranchers, I’ll do my best to help them out in any way if it were to come to that.

I don’t think people realize how dire things are. Vance is ruining a LOT of rural lives, and those people not only have no clue he’s screwing them in their own state, they actively cheer him on. It’s unreal. We’re living in a 2025 remake of Idiocracy. Vance would be the one shutting off their water supply and forcing them to pay for Brawndo, which of course plants crave. I jest, but not really…

I post this comment. By the time someone reads it, I have no idea.

To quote Ruth Langmore on what I contend to be one of the best one-liners in TV show history:

“I don’t know shit about fuck.”