The Morning Dump today will again be about vehicle affordability, specifically focusing on new data from Edmunds that shows Americans are so underwater on their trade-ins that even James Cameron couldn’t find them.

This is showing up in the failure of subprime lenders, starting with Tricolor Holdings. Did that company crash because of fraud, or was fraud a necessary condition of serving the subprime market?

That’s bleak, so perhaps something a little more positive to round it out? If you wanted a Subaru Outback, but not from Subaru, then Mitsubishi might have the car for you. And if you wanted a GM-built EV in August, but you didn’t want a GM-branded one, you probably got a Honda Prologue.

1-in-4 Trade-Ins Carried Negative Equity Of More Than $10,000 In Debt

If yesterday was about how wealthy buyers and electric cars skewed the average transaction price, today’s theme is that underwater buyers at the other end of the spectrum are drowning.

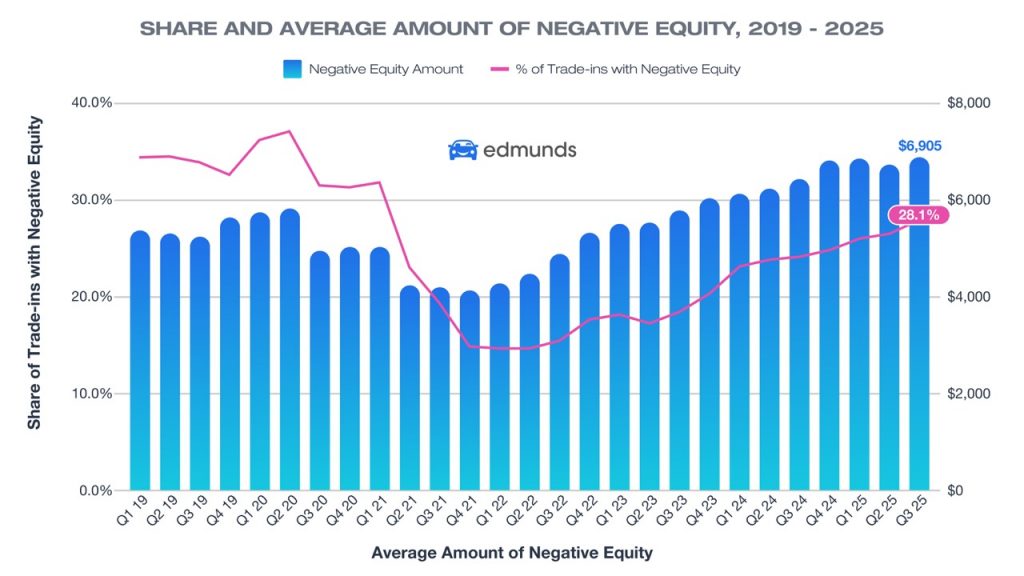

The numbers come via Edmunds, which titles its latest data report “Underwater and Sinking Deeper.” This seems accurate, as Q3 data shows that people trading in cars are extremely upside down on their loans.

About 28.1% of cars traded in last quarter were upside down, with an average amount of $6,905. That’s just the average. About a quarter owed more than $10,000 on their vehicles.

What’s happening? Some of this is the fact that the average trade-in is 3.7 years old, meaning these are the pandemic-era loans I was warning about back in 2023. This is the reaping/sowing moment for those unfortunate buyers. It’s also a sign that people are making even bigger mistakes by trying to buy another car too soon.

“The sheer amount of debt consumers are carrying in their trade-ins should be a wake-up call,” said Ivan Drury, Edmunds’ director of insights. “Nearly one in three upside-down car owners owe between $5,000 and $10,000 — and a growing share owe far more than that. Much of this stems from shoppers trading out of vehicles too quickly, or carrying loans taken out during the pandemic car market frenzy, when prices were at record highs. Those choices are now catching up, making it far harder to buy again without piling on even more debt.”

Americans do not love the idea of downsizing, and it may not always be a reasonable choice for everyone, but it’s probably necessary for many consumers.

“For many car owners, there’s no quick fix for being underwater. It’s about minimizing how much deeper you go,” said Joseph Yoon, Edmunds’ consumer insights analyst. “If you can, wait until you’ve paid down more of your balance before trading in. But if you do need to replace your car, make sure your next purchase fits your budget, not just your needs. The right vehicle choice can prevent a short-term decision from becoming a long-term setback.”

You can imagine a scenario wherein a consumer took out a loan on a vehicle in 2022 for a car that was overpriced. For whatever reason, this consumer now trades in and rolls that debt into a new car, which is now even more underwater. That works so long as people keep staying employed and don’t take any other hits like, say, an increase in healthcare costs due to the expiration of ACA credits.

Of course, if this were happening, there would be warning signs like the failure of subprime lenders.

‘When You See One Cockroach, There Are Probably More’ – Jamie Dimon

JPMorgan & Chase, the New York-based megabank, had to take a $170 million charge-off on the third quarter related to its exposure to Tricolor Holdings, a subprime auto lender.

According to Bloomberg, the quote above comes from JPMorgan boss Jamie Dimon, who added that “Everyone should be forewarned on this one.”

What does that mean? It sounds ominous.

A little background is required here, as Tricolor had both a very specific client profile as well as allegations of shenanigans. The company is said to have focused on people with low or no credit, including undocumented immigrants. That seems like a questionable area to be loaning to right now, given the shakiness of the job market.

There’s probably more to this than merely loaning to people at the lower end of the market. From another Bloomberg report:

Bankrupt subprime auto lender Tricolor Holdings appears to have been a “pervasive fraud” of “extraordinary proportion,” a lawyer helping oversee its liquidation said in court Friday, underscoring the scale of the company’s alleged misconduct even as investigators continue to unravel its finances.

Initial reports “indicate potentially systemic levels of fraud,” according to a presentation made in court by Charles R. Gibbs, who is representing the court-appointed trustee.

While Gibbs didn’t elaborate on the nature of the fraud, a preliminary examination of Tricolor’s records shows that at least 29,000 loans pledged to creditors were tied to vehicles already securing other debts, Bloomberg reported earlier Friday.

This kind of fraud shouldn’t be that easy to pull off, right? Also, what was the exit strategy here? It sounds like it’s being alleged that the company borrowed money multiple times from creditors for the same vehicle.

The subprime market is already a powder keg, so why not toss a few matches in and just see what happens…

There’s Gonna Be A Mitsubishi Outback-Like Thing

Mitsubishi makes reasonably nice cars at a reasonably nice price for, presumably, reasonably nice people. The brand recently added a Trail Edition trim to the Outlander, which Thomas had some opinions about.

Essentially, it’s a decent deal; it just made some of the best features optional. Perhaps the company is going to fix that? From a press release:

MMNA recently debuted a Trail Edition package on Outlander, and this new model will build upon the graphic features on that vehicle by adding off-road-specific bodywork, off-road-focused drive modes and performance upgrades, and unique interior styling with specific materials. This vehicle will take the company’s legendary Super-All Wheel Control (S-AWC) all-wheel drive system3, honed from Mitsubishi Motors’ 12 wins on the legendary Dakar Rally and on the muddy tracks of the World Rally Championship, to the next level, allowing families to explore further beyond where the pavement ends.

More details, including naming, imagery, technical specifications, pricing and on-sale timing will be the subject of future announcements.

So, it’s another Outlander, just more Outback-y maybe?

Honda Really Needs A Cheap EV Here

The tax credit-fueled boom of Q3 had a fun outcome: according to registration data put together by S&P Global Mobility and shared with Automotive News, the third best-selling EV in August was a Honda:

The Honda Prologue was among August’s biggest winners as registrations jumped 81 percent to 9,005 vehicles. The Prologue was the No. 3 most-popular EV for the month after the Tesla Model Y crossover and Model 3 sedan, S&P Global Mobility said.

Registration data serve as a proxy for sales because some EV makers don’t separate U.S. results or report sales by model. Many automakers also don’t report sales monthly.

The Prologue came with incentives of $12,704 per vehicle in August, compared with $5,813 a year earlier, Motor Intelligence said. In contrast, Honda’s gasoline-powered CR-V crossover had $2,016 in August incentives, the data provider said.

Obviously, the Prologue is a GM Ultium vehicle underneath. This goes to show that there are plenty of Honda buyers out there for a Honda EV crossover at the right price (which is much lower than the MSRP). Or is this a sign that people would buy an Equinox EV if it had CarPlay?

What I’m Listening To While Writing TMD

The sad news yesterday was that legendary soul and R&B singer D’Angelo passed away due to complications from pancreatic cancer. I was tempted to do “Untitled (How Does It Feel)” this morning, but I love his cover of Smokey Robinson’s “Cruisin.'” RIP.

The Big Question

What happens next?

Top photo: Edmunds, Dodge

And I thought panic buying toilet paper was foolish enough during the pandemic. Panic buying cars is beyond next level.

Matt, the shenanigans that go on in the sub-prime auto market stagger the mind. I’m not even talking about the lending fraud, I’m talking about the insurance fraud. I once caught a single lender who generated literally hundreds of false claims along with very professional looking Property Damage Assessments on GAP insurance. Like, it’s not a bug, it’s a feature. I’d estimate that roughly 15% of the entire sub-prime auto economy is pure fraud. Then I’d say another 10% is pure graft, but technically legal. I’m talking about all the fees and charges that get foisted on the borrowers. Like, every single VIN is a coupon to steal a little and there is an entire industry is built to do the stealing. Some of the conversations I’ve heard by small groups (of always white men) would really curdle your milk.

Feeling good about paying off the van a week ago.

I’ve spent my whole life scratching my neck like Tyrone Bigguns thinking about buying new cars. If I could buy a new car every 2 weeks I probably would. I fucking love new cars.

While I may be crazy, I’m not stupid. Or at least not that stupid.

I don’t want 2008 back. I really don’t. Coming out of college right into the worst of the recession was absolutely fucking brutal. It took me many years to crawl out of the piles of debt and sadness that were required to muscle through those years. To say nothing of the fuckery that the federal government is pulling right now, and all the other inequality bullshit we all deal with, but when the fuck are Americans going to prioritize their needs over payments on massively expensive monster trucks and SUVs? For the love of God people, if you don’t have the money, buy a fucking Corolla or something. Believe it or not, it will get you to where you need to go.

My big prediction is lots of shocked looking faces showing up as thumbnails in the YouTube Finfluencer category. The backgrounds will show some AI combo of fire, dollar bills, expensive vehicles, and jagged arrows heading downwards.

Sounds like a job for Captain Hindsight. I mean when people were paying 15 grand over asking for a Kia Telluride the consequences should have been pretty obvious.

hahaha honestly yes, this is a significant part of the issue.

Or when lockdown happened, people were like “this seems like the PERFECT opportunity to overpay on all the pickup trucks on 96 month loans!”

Captain Hindsight and his trusty sidekick, ObviousBoi! Maybe Netflix could turn this into an Anime series about financial literacy in an effort to reach the next generation of consumers before they reach the age of making truly stupid monetary decisions.

What happens next may look like the housing crisis of 15 years ago. What may happen next is that lower middle class to poor people will never be able to buy a new car and only the rich will and the poor will only ever own used cars that will get ever more expensive to maintain.

The reason that the rich were so rich, Vimes reasoned, was because they managed to spend less money.

Take boots, for example. He earned thirty-eight dollars a month plus allowances. A really good pair of leather boots cost fifty dollars. But an affordable pair of boots, which were sort of OK for a season or two and then leaked like hell when the cardboard gave out, cost about ten dollars. Those were the kind of boots Vimes always bought, and wore until the soles were so thin that he could tell where he was in Ankh-Morpork on a foggy night by the feel of the cobbles.

But the thing was that good boots lasted for years and years. A man who could afford fifty dollars had a pair of boots that’d still be keeping his feet dry in ten years’ time, while the poor man who could only afford cheap boots would have spent a hundred dollars on boots in the same time and would still have wet feet.

A story as old as time. That’s why they say being poor is so expensive.

My experience is now the boots are $300+, and still might fail in a couple years, with warranty denied. The dilemma is whether to buy the cheap boots (and everything else), expecting them to be cheap and non-durable, or buy the expensive boots, and hope that they actually last, and don’t fail just as quickly as the cheap stuff. Or, what I’m doing more and more, is to just keep using/fixing the old stuff to the point of complete destruction, and avoid anything new if at all possible, expecting anything new these days to fail quickly, even if it is more expensive.

Ding ding ding. That old story doesn’t apply to the present like it once did.

I disagree a bit.

There is still quality out there in most things, one just has to pay for it.

Or, as you are doing, the more expensive stuff is actually fixable.

I specifically went to a Cobbler shop in my town (so glad there is still one). They can re-sole shoes and boots, as long as the materials and stitching are quality to begin with.

Donut media on YouTube, usually pretty sensational/simplistic, but they had a “review” of old tools versus new with a good message. [I don’t remember the numbers, the point stands.]

Old wrench: $18 (50 years ago, $90 in 2025 money)

Well, do you compare that to an $18 wrench now, or a $90 wrench now?

The modern $18 wrench is minimally useful and disposable, but the modern $90 wrench was actually at least as good as the 50 year old one.

Their conclusion was great. “They DO make them like they used to, you just have to pay for it.”

This held up across other tools too. Paying an amount now that is equivalent to the old tool with inflation (similar value), and the quality is very similar. There’s just more low end choices now.

I know this doesn’t hold for all things, but I don’t think it’s that bad.

“My experience is now the boots are $300+, and still might fail in a couple years, with warranty denied.”

+1

The extra money spent these days often does not get you better quality… it just gets you something that looks more fancy. And sometimes it even gets you WORSE quality.

In the case of boots, if you want something that lasts, you’re better off going to some army surplus store and get the boots there.

But they won’t look fancy. Nor will they have a brand name with ‘status’.

I’ve quoted this in the comments here too. It’s very useful.

I have a thing for Mid Century Modern. I bought Saarinen chairs (used) and reconditioned them. They are 40+years old. Knew they cost $2,500 or more each. I repeat they are over 40 years old. 2500/40=62.5. They last because they are built well. Ikea chairs are cheap and you will throw them out in about 2 years, because they will be broken. There is a truth in buying good stuff, as in Toyota, over time you save money for fun stuff like an old used VW Cabriolet to restore and waste money on.

I think a smart way to avoid debt, assuming one is financially well off( there isn’t one answer to this), would be to buy used.

It is not always the best option, but if you are in need of a car and don’t have the money to buy new, that may be the only option.

For example, a new Yukon costs 60k+ or 70k+. One can avoid spending money by buying a well maintained used example (say a 2017 or 18 model). And even if you do decide to upgrade it, with off road tires with Braids or Method wheels, king shocks, motorola antenna , a small lift, offroad bullbar+ winch, the cost should still be less than what a brand new stock Yukon would be.

And, interest in general is a sin, especially for us (I will add it is prohibited in Islam and for some castes in Hinduism as well, probably Christianity and other religions too). So, buying with cash is best (if it exists at hand, otherwise wait until a later period where one has obtained sufficient cash).

As I have heard from a Kenyan person, a person who buys a Corolla even though he can afford a Mercedes Benz is one that has good financial literacy (although anyways an MB will cost thousands more in maintenance and will be not as reliable or durable as a Corolla will be).

Used to work with a guy would say, “I make my car payments before I buy the car.” It was a real revelation to me.

I had only known about the usury prohibitions in Islam and Christianity, glad to know it’s more universal (as it should be!)

“We buy

thingscars we don’t need with money we don’t have to impress people we don’t like”I am Jack’s simmering resentment.

The canary in the coal mine is that JP Morgan Chase is one of the world’s largest and most financially sophisticated banks, yet still took a loss of $170mil where the signs were there. The CFO calls the loss immaterial, which it is to this beast of a bank, but Jamie Damon is a pretty smart guy and so knows there are many more of these to come. A few hundred million here, there, and everywhere, pretty soon the total becomes material.

First Brands group just declared bankruptcy (bought up many auto part brands), turns out they may have been factoring the same invoices multiple times, was financed through private equity and banks. Now well over a billion dollars “has gone missing”. The consensus here is that there are many companies now financed in the same manner, so the is concern about contagion risk.

And finally, the corporations bought back their already overpriced stock in the years between 2008 and covid, by taking on stupendous debt loads loans from the banks due to the interest rate being so artificially low within this period. Stock prices inflated more, the execs, board, and big funds sold large chunks of their holdings, leaving many so called blue chip corps holding the bag to pay back the loans or constantly refinance them at ever higher interest rates.

Buy cans of beans. And a good can opener.

I had a dollar to buy a can of beans but even that is now $1.79 CAD

And you’ll only get 20¢ back from your Toonie because they got rid of pennies.

When you owe the bank $100k you have a problem. When you owe the bank $170 million then they have the problem.

Not if you have greased the palms of enough polit…err, I mean are too big to fail.

predatory loans. can be regulated but the poor gets poorer. period.

I recall that after the 2008 crisis some analyst saying that the banks and private equity just raided the wealth that middle America had in their houses, and that cars would be next. I guess this is what that looks like.

I understand that for the foreseeable future, there are a lot of federal workers that won’t actually be needing a car. Many potential customers are also being locked up/deported. Perhaps lack of demand will bring prices down.

I don’t often see this mentioned in articles, but the Prologue is a frigging HUGE vehicle. I’ve seen a few up close lately and they are way bigger than they look in photos. I’ve got an Ioniq 5 that does a similar thing from paper to reality, but I think the Prologue must be like 2′ longer.

Indeed. It has a strangely long wheelbase; the proportions are all weird.

We’re in an everything bubble.

And we all talk about the everything bubble, and a watched bubble doesn’t burst.

Something else will probably happen that will cause most/all the bubbles to burst, and it’s likely to be eeeeeeexxtra shitty this time.

I’m really concerned about everything, because if and when it happens, almost no one alive has seen anything like it.

If we had decent public transportation and more companies let workers who could be remote be remote this would be all less of an issue.

I like your comments, but you are off on this one by a lot

Your points are correct…but that’s not why there are loan issues.

Last year, I traded in a fully-owned car for $3000, which was above what the NADA guide said. Three days later, it was listed on the dealer’s website for $7999. People are upside down by so much because dealers are greedy.

That’s not how this works at all. Dealers have to make money, so of course they did what you said.

Oooh. I hope the new Outlander has more chrome on its face.

Maybe they can call it ‘rugged chrome’ and put it on the fenders too. Then they can come up with some chrome whiskers and call them ‘boulder feelers.’

>What happens next?

I had lunch with the son (older than me) of one of the original “auto mile” founders.

They are doing a large number of loan modifications. They are trying to keep their recovery rate — or percentage of successful repossessions of delinquencies — deliberately down, as they don’t want the cars coming back. They’d rather them stay out there, still get paid eventually, and not have the cars back on the lot to deal with.

His assertion is that’s not just him. If anything, it’s far worse elsewhere.

We discussed how the pandemic stimulus packages functionally made some customers appear to be better borrowers, given the cash stimulus and student loan deferment.. They had more to spend, couldn’t get into trouble as quickly, so were given loans that without that stimulus, they likely wouldn’t have ever been offered.

That extra cash got spent. Student loans you must pay again. Rent and other core expenses are up. There’s less overtime available. There’s fewer job openings. So it’s all increasingly coming to a head. Not just on auto loans, but BNPL, credit cards, student loans and mortgages.

We fundamentally have a sub-prime lending crisis that’s not fully surfaced. It won’t blow up like 2008, but a reason for the federal lending rates being lowered is to get ahead of a potential liquidity crunch that could take down a few regional banks.

I’ve been saying it for years and will say it again.

If you have to use someone else’s money to buy something you cannot afford said something.

Now using someone else’s money to buy things for yourself is the standard, and as the economy worsens and people have no hope for saving their money to buy things like a car, a house, etc. suddenly what little income you make becomes disposable, because there is no hope that you can save to buy something, which will further worsen the the state of the economy while a select few rake in the profits catering to this Doomer economy.

There will be a breaking point, and if we know what’s good for us we’ll let the banks fail and what comes after will be things priced at prices people can afford.

But considering how the 08 Crash went the banks will probably get bailed out again, delaying the inevitable yet again, till we get into a crash we can’t recover from.

Absolutely the banks will get bailed out. There’s plenty of socialism for the businesses that cause the problems in the first place, while the rest of us can pull ourselves up by our bootstraps.

but but but I don’t have boots or straps

That’s okay, it’s an impossible task anyway.

Originally it was a “let them eat cake” type statement.

Smart businesses and smart people realize that there is a lot of value in a sensible amount of debt. Your Dave Ramsey-ing would prevent almost the entire populace from ever owning a decent vehicle or a home.

Define “decent”

Look, I understand the sentiment that people should do all they can to live within their means, but the idea that anyone is going to save up enough cash to buy a house with cash, even if the market crashed, is basically a pile of nonsense.

I’ve never had enough cash on hand to buy even the most decrepit, falling down structure in my very, very affordable by comparison to most places, town in the Northeast. I mean, it’s great if you or someone had a decent start and a pile of cash at some point. But I could live in a basement for a decade hoarding cash and living on ramen without coming up with that sort of money.

I was lucky enough to buy my shitty, shitty house in 2019 and I only owe 120k on it today, which apparently means I’m in a pretty decent position compared to most. If I refused to do anything but buy shit with cash, I would still today, be renting, and I would be looking at the same house being double the price, the market increasing faster than I could ever possibly raise the funding.

Financing things with a real strategy is totally fine.

Tiny homes are not that expensive, and a small plot of land to place said tiny home on is not that expensive either (much more expensive than the tiny home itself).

What seemingly you and others fail to understand is the purpose of things like a home or a car. What is in your home that you use?

A toilet, shower, sink, a bed, and storage.

If you were building the cheapest house you could, with the above listed things, how cheap do you think you could make it for provided you had the tools and expertise?

Does that mean said home would be a dream home?

No. It would be a roof over your head you own.

Would everyone choose to buy that home instead of renting? No.

Would people still buy them? Yes, and they do so.

To apply this to cars look at the Toyota Hilux Champ

Is it the safest new car? No

Is it the most fuel efficient new car? No

Is is the most capable new pickup? No

Would people happily buy one for $10K if it were sold in the US? Hell yes they would!

I’m not advocating for the banning of loans, however we have gotten to this place in the economy because of loans. Costs lose their relevancy when you stop having to pay them up front, you stop seeing the actual cost and just see the monthly payment, so the actual costs balloon till they get so expensive that noone can afford them anymore, however all the money that is still owed is still owned, and all the unsold product still cost money to make, and still costs money to store, so someone will eat the costs.

I totally would love to have more modest and affordable choices and not only have “luxury homes” and “luxury cars” on the market. Trust me. We’re on the same page with wanting the option to buy truly basic vehicles. And I totally agree that a number of people have managed to find a way to finance literally everything to the point of distorting the market. And living modestly is great! But like, let’s not pretend that the answer is for 80% of us to retreat to some sort of non-permanent shanty village. And a tiny home and land (there is not a single available parcel of land in my entire community) isn’t necessarily something that’s either available or even allowed to most Americans that need to commute to work.

There’s a middle ground that should be a totally reasonable, and attainable thing. And it probably involves a significant, but not ridiculous amount of financing.

Time to move. Mobility is the one asset most of us can obtain this day in age and I’d argue it’s a necessity. No longer are businesses even slightly loyal to their employees. Getting fired is a regular thing nowadays, and when everything is rented, leased, etc. you need consistent income. Mobility is not a guarantee for consistent income, but it greatly increases the probability of it.

In another life I’d be a welder living on jobsites in a little camper trailer and move from jobsite to jobsite.

There is a middle ground, however it requires the cheap options. Look at the prices of modern pickups in the US, they’re almost always obscenely high. Why? Because of the chicken tax and the footprint rule killing off all the small more fuel efficient pickups, then Ford decides to come out with a pickup the size of an Escape and everyone and their mother goes to buy one, except the “standard” hybrid drivetrain makes up only 20% of production yet 80% of orders. Same for the base (XL) trim, 20% of production 80% of orders. It has improved slightly since initial production, but the overwhelming majority of orders are for the XL trims and Hybrids and neither have been anywhere close to being met even after several years of production, not due to a lack of components, but because it’s hard to upsell someone on a F-150 that gets less than half the MPG, some of them with less payload for more money…

Oligopolies are a massive reason behind why shit is so expensive in the US, including but not limited to automobiles, insurance, healthcare, housing, etc. and PARTICULAR LAWS are a massive reason behind their existence.

The cheapest options are rarely the best option, but they need to exist to provide an alternate, because if there are no cheap options the lowest priced option now becomes the cheapest option, even if said lowest price is massively inflated due to an oligopoly.

When it comes to stuff like housing, which I believe falls under the category of shelter, and shelter being more essential to survival than water or food (initially) there must be a cheap option for it or prices will remain obscenely high. Getting rid of square footage minimums would be a great start, banning corporations from owning homes for the purpose of renting (they’re welcome to build apartment complexes) would be another great start.

When it comes to automobiles I want to get rid of the Chicken Tax and the Footprint Rule.

When it comes to the general market I want to get rid of all tariffs on foreign goods except for food, because having domestic food production is of the utmost importance, and except for goods other foreign countries have tariffs against us (excluding food). Whether it be cars, computers, planes, trains, back scratchers, I could give a shit, fair is fair. China has a 100% tariff on foreign made automobiles, so the US should have a 100% tariff on Chinese automobiles, until China gets rid of their 100% tariff on our automobiles.

I agree with most of this (I hate the zoning laws that make it nearly impossible in many towns to build anything but McMansions for instance), except for the transient lifestyle concept.

I have kids and an entire support system locally that has tremendous value that cannot be replaced by me job-hopping. Decent public schools that we are very involved and connected to. That all shifts into me becoming the support system for some of the elderly in my family. Also, we like our friends and family, lol.

Obviously for someone who doesn’t have those ties and can find opportunities to build a life somewhere else for far greater pay, sure, that’s fine. But trust me, there’s no freaking way that moving my family to a tiny house in the middle of nowhere is going to improve my family’s life, or make us wealthier. That would be an insane risk for hardly any chance of reward. Also, pretty sure my family would hate me for it, and I’d deserve it.

I’d much rather have a mortgage.

And that will be one of the repercussions of this shit, just one more reason people won’t have kids.

I agree that you shouldn’t have to move around, if you see how houses are built, then realize the average houses people buy have 25+ year old plumbing and wiring, which if either fails it can easily destroy for home, you know housing prices are massively inflated.

I’m not blaming you for the situation you find yourself in, just saying this day in age the system is built more for being a tumble weed than setting down roots, likely to the detriment of the country.

One in four Americans has less than $1000 in cash, and almost half of us don’t have $5000. Let’s not pretend that we need to nitpick over the definition of “decent vehicle.”

And if you want to talk about the purchase of a home with case, it’s likely less than 1% of Americans could afford the shittiest shithole without financing.

The reason Americans have so little cash is because of the cost of living, which is massively inflated due to factors outside the control of your average American, but many of those same factors are due to Government intervention whether it be taxes, tariffs (another form of tax), overregulation resulting in higher costs of compliance (which effectively is a tax), as well as allowing Corporations like Blackrock to buy up all the single family homes.

You misunderstand my point.

I’m not saying that the amount of money your average American has in savings is enough, or even that it’s their fault.

I’m saying that the issue is cost, and “cheap” debt only worsens the issue.

When you can no longer afford to buy things the price of said things does not matter to you, what matters is the payment cost and frequency of payments, with duration of payments mattering less so.

So as we have seen prices have inflated massively, but the monthly payments have stayed mostly the same, just for much longer durations.

However when you lose your source of income you either have to pay out of your savings (what little you have as you rightly pointed out), you go further into debt to make payments on the debt you already owe, or you stop paying entirely.

The money is still owed, but you now lack the means to pay it back. Whereas if you owned X product, the only costs of ownership are the ones inherent to the product.

Idk how much money you make yearly, but imagine your stated annual wage was your takehome pay.

How much more would you make yearly?

Frankly the issue isn’t how much people are paid in the US, the issue is the cost of everything, which inflation, shit regulation, and taxes play a massive part in.

I find it incredible and telling that modern expectations for shareholder returns were not factored into this analysis.

Define modern. This dates back to Ford and the Dodge Brothers’ stake in Ford as Large Shareholders of the company.

Dude. Goodbye. This is so disingenuous.

Just saying, it is an issue, one you rightly pointed out, but as I pointed out it has existed since the early 1900s, yet the problems we have today did not exist then.

Welcome to the problems of the K- Shaped Economy!

Ultimately, to make the top of the K go up, the bottom has to go down. And realistically, the lower class in America is tapped. There’s just nothing left to extract. So, naturally it’s the middle classes turn to face extraction of their resources. Think, inflation is a primary mechanism of wealth redistribution. This continuous cycle of consumerism drives debt, which beholden the formally fairly mobile middle class to the powers that be. What comes next? Presumably the unknowing bottom.

I’m sure this’ll turn out just fine for Stellantis, Kia, and Nissan who have a history of happily

preyingcapitalizing on that specific market segment.Stellantis might have quite a successful play to run a RAM commercial to prospective buyers showing how they can afford a new 1500 with a HEMI, despite all the financial warning signs flashing.

Why do I have a sneaking suspicion that tomorrow’s TMD will see Hardigree listening to Bigod 20’s cover of “Like a Prayer” (Madonna). It’s a great song to listen to while trying to start your old beater.

Tri Color wasn’t a sub-prime lender, they were a glorified BHPH lot that targeted individuals that they knew weren’t even on the scale, in other words being sub-prime would be a massive step up for their customers. So I don’t see how this in anyway indicates anything other than a bad business model that was only kept going this long through fraud, that would eventually catch up to them regardless of the state of the economy.

The growth in underwater trade ins and the increasing depth of those scuba diving buyers is concerning, but not at all surprising. The age of those trade ins mean that yes they were bought in the era where they were over paying $5-10k so completely unsurprising that they are now $5-10k underwater. The fact that such large numbers of buyers are still able to buy and roll means this isn’t going to have a significant impact in the short term.

First paragraph is super spot on.

Agree. If these underwater explorers were feeling (as) broke (as they are), I would think more of them would hold onto the “old” car rather than rolling all that into a replacement, barring the odd situation where they require something different or the car that should have plenty of life left in it doesn’t (like a Hyundai/KIA about to go out of warranty with its 2nd engine starting to consume oil). They might be stupid, but seeing the new monthly payment would surely give even the most pathetic of Jones’-pacing consumers pause, right? Shit.

I’ve been through two massive market corrections and right now feels like it’s about to be a third. When Warren Buffett owns more treasuries than the US Government, you know something is coming. Batten down the hatches, because it’s going to be ugly.

yep. Circle the wagons and all of the other metaphors. Alllll of the metaphors.

Of course, I thought the market was going to take a dump two years back, so shows what I know

The K economy is 80% of the populace getting the soiled end of the stick, and has been going on for far longer than most acknowledge, but current sickening madness of pulling the rug (any sort of safety net, along with consumer protections) out from under will likely have dire consequences.

But not for the ones doing the pulling. They’ll be just fine.