I saw this graph earlier this year at a New York Auto Show marketing conference and it’s been haunting me ever since. I think it explains why the labor showdown isn’t getting resolved soon. I think it explains why automakers are losing their minds. I think it shows why everything in the automotive world feels so unsettled.

Also, I should note that I wasn’t invited to this conference (I don’t think) and definitely crashed it. The people who hosted it couldn’t have been more gracious and even fed me a sandwich, a cookie, and a Sprite. These are good people. I don’t remember much else about what was said at the conference, but this one graphic, from global intelligence firm S&P Mobility, has stuck with me.

I’m going to do a The Morning Dump wherein I just have one big story and a bunch of little ones sort of supporting it.

Term Of The Month: Peak Model Complexity

I’m grateful that the folks over at S&P have posted a related version of the graphic for us, in this story about Peak Model Complexity (PMC) and how it impacts marketing. They saw fit to make it an acronym and I agree. PMC! PMC! PMC! Get a tattoo of it on your left butt cheek now, thank me later.

I’m grateful that the folks over at S&P have posted a related version of the graphic for us, in this story about Peak Model Complexity (PMC) and how it impacts marketing. They saw fit to make it an acronym and I agree. PMC! PMC! PMC! Get a tattoo of it on your left butt cheek now, thank me later.

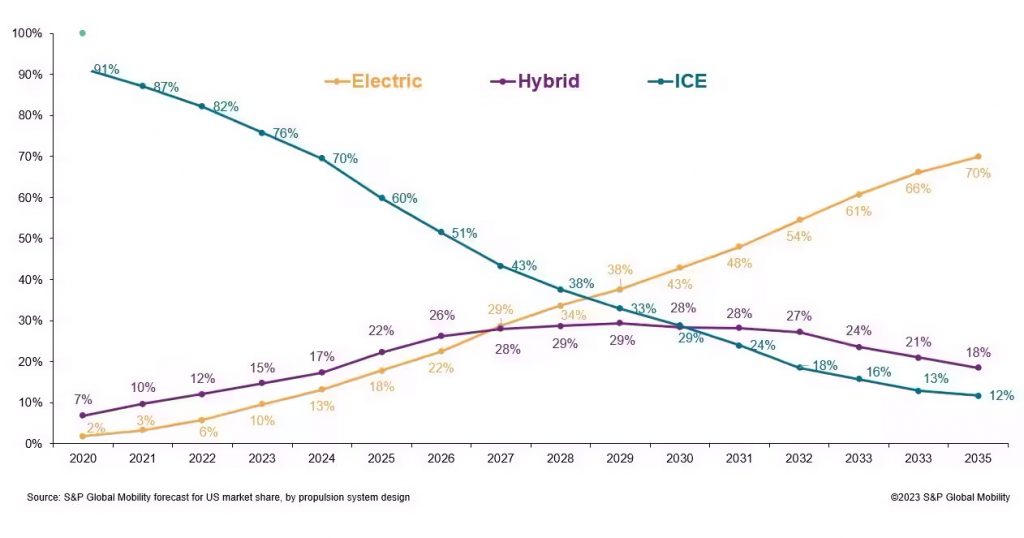

What the graph at the top of the post shows is that, right now, people in the United States have about 450 nameplates to consider when shopping for a car (this assumes Kia Niro PHEV, Kia Niro ICE, and Kia Niro EV are different models, but trim levels are the same). As car companies still sell their old gas model ranges and start incorporating EVs and PHEVs, there will be a crossover period where there are a lot of cars for sale. Somewhere in the 2027-2028 range, by S&P’s estimate, that number will rise to 650 nameplates.

In the graphic shown here, you get that not as total numbers of models, but as a percentage of the total market. If you look at the difference between the number of EV models and the actual percentage of vehicles that’ll actually be EVs you can start to see the issue. The number of gas models and pure BEV models reach parity around 2026, but they only crossover in terms of percentage of the market in 2028/2029.

Here’s S&P on what that all means, especially for marketing:

The increased model count will cause a drop in sales-per-nameplate figures: In 2018, the average sales volume per nameplate in the US market was 49,000 units. That is expected to dip to 36,000 by 2027. This requires some new thinking by OEMs, which for decades have stated that a nameplate must sell between 40,000 and 60,000 units to be profitable.

But this tectonic shift is happening already — impacting production cycles, sales forecasting, supplier relationships and marketing budget allocation.

The impact to profit margins, platform economics, operating expenses, product lifecycles and go-to-market timing will cut across all aspects of the auto business — from new and used car sales, to vehicle acquisition, parts and service. Retailers and their marketers will need to do more with less, and sooner than later.

Every marketing campaign and initiative will face this decision: Which message or offer should we serve to which customer — EV, hybrid, or ICE?

Marketing is definitely a key part of this and indicative of the larger problem, but the bolded parts are what I want to focus on. Just as I don’t think that automakers were particularly ready for the UAW strike, I question whether automakers (the ones that aren’t just pure EV automakers at least) are ready for all of this. The fact that automakers might be peeling back their EV ambitions in the face of slackening demand is yet another worrying factor because that’ll just lead to more model complexity.

This isn’t to say that automakers are blind to this. They aren’t. If you’re curious why the domestic automakers basically killed all of their cars, this is a big reason. They can only make so many cars and they’re already clearly going to be making so many cars.

Also, this assumes car sales are strong in 2027 and 2028. If the economy falters and car sales drop overall, the number of cars sold per unique model would be even lower than the 36,000 in 2027. Automakers need to make a lot of vehicles with big production numbers in order to be profitable, given the huge economies of scale that come with selling a million pickups as opposed to 30,000 small EV crossovers.

EVs, The Detroit 3, And The UAW

Electric vehicles have to be cheaper to make. Tesla’s huge advantage is only going to get bigger if Tesla, and other EV automakers, don’t have to worry about unionized labor, and don’t have to worry about dealers, and don’t have to worry about supporting millions of gas-powered cars at the same time.

Electric vehicles have to be cheaper to make. Tesla’s huge advantage is only going to get bigger if Tesla, and other EV automakers, don’t have to worry about unionized labor, and don’t have to worry about dealers, and don’t have to worry about supporting millions of gas-powered cars at the same time.

Automotive News has a piece that’s worth reading today about why the Detroit automakers (Ford, GM, Stellantis) rightly view the UAW strike as an existential issue, even if labor itself is only a small portion of the current costs associated with being an automaker:

“This is a defining period for Detroit and the future of the auto industry as we firmly believe that if GM, Ford, Stellantis accept anything close to the deal on the table the future will be very bleak for the U.S. auto industry,” Dan Ives, managing director at Wedbush Securities, said Wednesday in a research note to clients.

That’s a pretty bold statement, but here’s the thinking behind it:

If the Detroit 3 meet the UAW’s demands, labor costs would soar to $136 per employee, costing the companies up to $8 billion each, according to an analysis by Colin Langan with Wells Fargo. Taking a deal as it stands now would drive up the price of an EV by $3,000-$5,000, Wedbush estimates, at a time when new cars are already unaffordable to many and as automakers struggle to make money on EVs.

“This is … an almost impossible decision that could change the future of the Detroit automakers in our view,” Ives said. “Let’s be clear: This is a growing nightmare situation.”

Also, if you’re wondering why the current and former President decided it yuck it up with auto workers, this is why. Just three of the most important states to domestic automotive manufacturing (Michigan, Indiana, Ohio) are key to winning the White House.

This Is Why Ford And GM Are Hitting Back At The UAW

New strong statement from $GM CEO Mary Barra, echoing some remarks of here crosstown rival Farley: “We need the UAW leadership at the bargaining table with the clear intent of reaching an agreement now. For them to do otherwise is putting our collective future at stake.” pic.twitter.com/JCQZkxciFD

— Michael Wayland (@MikeWayland) September 29, 2023

The UAW strike is an ever-evolving situation and, frankly, as confused as automakers seem, I can’t promise that reporters are any smarter. The UAW is clearly, to me at least, using the media as much as they are using the automakers to tilt the negotiations towards themselves. It’s their right to do so, but it’s not a professional obligation for journalists to always fall for it (it’s possible that the UAW gave one outlet a fake strike plant list, for instance).

It has, at times, seemed like Ford and GM have done better than Stellantis, but it’s worth asking: Who wants us to think that? Is it the UAW? Is it the automakers?

Today, those two automakers and the UAW both pretty much agree that the other side is being unreasonable. Let’s start with GM CEO Mary Barra, whose statement is above, but here’s the key thing to me:

It is clear Shawn Fain wants to make history for himself, but it can’t be to the detriment of our represented team members in the industry. Serious bargaining happens at the table, not in public, with two parties who are willing to roll up their sleeves to get a deal done. The UAW is pitting the companies against one another, but it’s a strategy that only helps the non-union competition.

And, even harder from Ford CEO Jim Farley, via The Detroit Free Press:

“What’s really frustrating is that I believe we would’ve reached a compromise on pay and benefits but so far the UAW is holding the deal hostage over battery plants,” Farley said in extended remarks following a Facebook Live in which Fain announced the UAW’s next targets.

“Keep in mind, these battery plants don’t exist yet. They’re mostly joint ventures. They’ve not been organized by the UAW yet because workers haven’t been hired and won’t be for many years to come,” Farley said. “The UAW is scaring our workers by repeating something that is factually not true. None of our workers today are going to lose their jobs due to our battery plants during this contract period or even beyond this contract. In fact, for the foreseeable future, we will have to hire more workers as some workers retire, in order to keep up with the demand of our incredible new vehicles.”

He’s not entirely wrong. Those joint venture battery plants haven’t been built, they haven’t been organized, and Ford’s plans, in particular, are super in flux due to other serious issues. It’s not clear that Ford wants to, or can afford to, make all of those battery plants union plants. It’s interesting that Ford says he thinks the UAW has come to terms on benefits and pay (which explains the positivity last week) and, yet, can’t get past the battery thing.

It makes sense for the UAW to do what it can to sort of pre-organize the plants by guaranteeing higher wages for battery workers, but it also makes sense for automakers to point out that no one has even been hired for those plants!

Stellantis Suddenly Spared Strikes

Here’s a fun one. Stellantis has been mostly combative with the UAW, and vice versa, and yet Stellantis was spared another round of strikes. What’s going on here?

Here’s a fun one. Stellantis has been mostly combative with the UAW, and vice versa, and yet Stellantis was spared another round of strikes. What’s going on here?

Fain said Chrysler parent Stellantis was spared from additional strikes because of recent progress in negotiations with that company.

“Moments before this broadcast, Stellantis made significant progress on the 2009 cost-of-living allowance, the right not to cross a picket line, as well as the right to strike over product commitments and plant closures and outsourcing moratoriums,” said Fain, who was delayed nearly 30 minutes in making the online announcement. “We are excited about this momentum at Stellantis and hope it continues.”

As far as PMC is concerned, Stellantis is actually probably in better shape than Ford or GM. They’ve slowly starved their model lineups, with Chrysler basically becoming a brand of one and Dodge just barely offering cars themselves. People tend to point out the lack of products as a downside for Stellantis, and it currently is, but it opens up Stellantis to more opportunities and less PMC in the near term.

Also, curiously, it could make strike negotiations easier, because the company’s EV plans are a little fuzzier.

The Big Question

How big of a deal is PMC? What are other ways it can mess with the car market? Is it good for consumers or bad for consumers?

Those charts are naturally showing a transition in revenues. What it doesn’t show is where the revenue is being earned. There’s no guarantee that as ICE revenues drop for the Big 3 that BEV revenues will increase. It’s entirely feasible that the domestic market loses any advantage it has in the ICE market when transitioning to BEV because it and the workers aren’t giving enough credit to the manufacturers outside of the domestic market. I have a feeling that’s why the Big 3 are using the language they’re using right now.

As was pointed out, there are a LOT of variables that can and will affect that chart. For example: Currently, gas is over $6/gallon in Southern California. The reasons for that don’t really matter, but I’ll bet a large percentage of the population will be looking at some kind of EV or hybrid for their next ride.

Will the gas prices come down here? Sure they will. Can I trust them to not be volatile from now on? Ha…what do YOU think?!

PMCs… keep the existing nameplates rather than create new ones. Eg Yeah the Mondeo is now powered by an electric motor (yes dead nameplate but still)

“How big of a deal is PMC? “

It’s not a big deal at all and it’s mostly a self-inflicted problem… with Mercedes-Benz being the worst offender with their 25 or so ‘classes’ of vehicle.

Making things even more stressful for automakers is the fact that this chart was pulled out of a consultant’s ass. They would love to have this much predictability. Look at the complaints about the UK backtracking on ICE bans. I think the transition will be slower than predicted, with hybrids being dominant, unless there are revolutions in batteries, power generation (are we still five years from fusion?), and, often ignored, power transmission (e.g., California telling people not to charge their cars to avoid brownouts).

The UAW is out of its mind and will force chapter 11s unless it backs off. I want Shawn Fain to disclose his TSLA holdings. The Ford CEO got $21 million last year. Probably too much and CEO compensation is broken because of board nepotism. But make that $1 million and what does the other $20 million get you across Ford’s 57,000 UAW employees? $350.88 a year. Not a 40% wage increase, not one less work day a week, and definitely not the smoke too much at lunch request to go back to defined benefit pensions.

Any of that will come from higher prices to consumers that are already tapped out, unless they go with Toyotas and Teslas instead.

> make that $1 million and what does the other $20 million get you across Ford’s 57,000 UAW employees? $350.88 a year.

That’s not the point. Anti union people always bring that up as if it was.

The point is that a CEO making $24M vs an assembly worker making 60k means he earns 400 times what a worker does.

Four hundred times. *That’s* the point.

If that was the point then the UAW could fix that by fighting to cut his pay to $1,000,000 and get everyone a $350.88 raise. Instead the UAW is fighting for packages that will bankrupt the big-3 within a year or two even after they are forced to significantly increase already high prices.

I think it’s most telling that even this likely optimistic chart is showing that in 2030 EVs still make up less than half of nameplates, and even by 2035 more than 1 in every 10 vehicles will still be plain vanilla ICE. As an advocate for PHEVs, I also strongly suspect the mix between hybrid and pure EV will be closer to 50:50 than they’re predicting, but we’ll see.

And again, this is a prediction based on the idea that EV adoption is going to be a steady up-and-to-the-right proposition, which I think anyone who has spent more than 5 minutes thinking about this would say is a fantasy.

Here is a more sober-minded projection, from the EIA.

The reference case is less than 20% EVs (including PHEV!) sold in 2050, and a virtual plateau after about 2030.

https://www.eia.gov/todayinenergy/detail.php?id=56480

I’m not sure if even I am this pessimistic, but the idea that a switch is going to be flipped and EVs will go to the majority in any short period of time is pretty foolish to me.

Oh wow, and that’s _including_ PHEVs. It sounds like they’re basically predicting that once the early adopters all have them people won’t be willing to pony up for the added cost of an EV, and they’re predicting that costs will basically be steady as efficiency of scale is offset by increasing material costs. I would have a hard time arguing with any of their points.

I would guess this does not factor in Fuel prices over time. Most of this will likely be contingent upon increased high speed DC charging systems and reduced higher speed gasoline pumps and at a price per mile that makes the extra wait time for the electrons to make sense.

Right now, the US BEV and PHEV marketshares are around 7.5% and 1.8% respectively. In the EU, BEV and PHEV marketshare are 15% and 7% respectively.

So the EIA’s estimates are on the pessimistic side, but not unreasonably so. There are 15 states with LEV regulation (steadily escalating GHG limits on cars, like CAFE but with actual teeth), and that’s where the majority of EV sales are expected. Those states account for–not coincidentally–20.6% of US auto sales.

Wow. Just wow. You definitely won’t see anything like that on a US Government website. With the status quo in policy, technology, and materials cost, that seems about right to me. However, I think everyone is betting on at least one of those to change dramatically in that time.

That IS a US government website.

At some point a democratic administration will dramatically increase gas taxes to turn the screws on holdouts that refuse to switch to EVs.

Counter-prediction: The first administration that tries to significantly increase the gas tax gets voted out so hard in the next election that it retroactively cancels all of the legislation they passed in the previous cycle. That’s why they’re using incentives to drive EV adoption instead of raising the gas tax today.

As the current manufacturers try to make multiple power-source models on a single platform, it makes all their products sub-optimal from both a cost and packaging perspective.

For example, maybe they want to try gigacasting to save manufacturing costs. It is unlikely the same casting will work for all the different drivetrains so they are stuck with less efficient designs while EV-only companies continue to innovate and lower their product costs. When the EV sales crossover happens, the old line manufacturers will be at a serious cost disadvantage.

The PMC chart is interesting. I do feel (pure gut instinct) that consolidating similar vehicle lines would be a good idea. Choice paralysis often leads to me simply not buying something (especially if it’s not a need).

I’ve seen commenters here say (for example) that the Ford Escape’s sales are being cannibalized by the Bronco Sport, which makes sense to me.

In a quasi-related fashion, ask r/Prius what vehicle replaces the Prius v (discontinued after 2017 MY) and watch the sparks fly. The page for the v on Toyota’s website mentions the RAV4 Hybrid, yet many say the Venza is closer in profile and functionality (and I’m inclined to agree).

Nonetheless–even looking at Ford’s or Toyota’s SUV lists, how many of these models are really similar in size? Might it vastly simplify manufacturing, R&D, etc. to consolidate?

I haven’t shopped in person so I don’t intuitively know (for example) the size differences between a Corolla Cross and a RAV4, or what differentiates a Highlander and a Grand Highlander (….or either Highlander sized vs. a Sequoia or 4runner). You’re telling me none of those models could be cut out without hurting the bottom line?

More choice is not always good. In 1996 BMW made 5 cars, 2 or 3 of which I would have heavily considered. In 2023 BMW makes by my count 17 cars, none of which I would remotely consider.

It boggles my mind that Toyota in particular has so many different SUVs and CUVs. Absolutely agree, they could stand to drop a few of those in favor of more diversified options.

Anyone wondering about the quality of workmanship in the plants that are not striking presently? Seems like the UAW has done a great job creating disgruntled workers, will that play out in the product?

We’ll I have seen a lot more damaged packages after the UPS & Teamsters deal was done.

Indiana is most definitely not a swing state. There aren’t enough collective brain cells here to even think about middle ground positions, and platforms, and what might be in an individual’s actual own best interest. Status quo, and reacting to fear, is so much easier.

/Indiana native and lifelong resident.

Not that long ago, Indiana had quite a few Democrats in state govt, and even governors and senators. Then one day they ran off to Illinois and gridlocked the state legislature via unable to have a quorum. That was a death blow for the Dems, the citizens never forgave that ploy by Pat Bauer. Even having Golden Boy Evan Bayh coming back from his Wash DC lobbying job was not enough to get them back in power.

Voting red over that is truly cutting off your nose to spite your face.

PMC is a large reason why I’ve been saying the volume OEMs should just get together and divide engineering on a shared platform that can be scaled up/down for 3 or 4 sizes of lower end Common Universal Vehicles—about the only things people buy/they want to sell. With the savings, they could even (not that they would) make sure the engineering is actually solid and they won’t have as many warranty issues. As for the customers, who would notice or GAF that their boring-as-shit eunuchmobile is a shared platform when it’s not like they don’t already all look and drive alike, anyway. Virtually none of the buyers care about dynamics, so while that’s a way to still separate them in terms of feel, it’s not going to require a lot of resources to do so. Basically, it would be a kind of throwback to old GM, when badge engineering still made for a lot of difference between brands in terms of style, interior, and character with even some dimensional variance (as opposed to later when they were all much closer to being the same thing with some different trim). Of course, who would be assigned the engineering roles? That’s where egos become an impenetrable shield.

Sergio Marchionne had lobbied the auto industry for years to collaborate on engines, and they all slammed the door in his face. His reasoning: Does every car company really need to have its own version of [for example] a bog-standard 2.4l four-cylinder engine? He saw it as redundant and ultimately wasteful.

To that end, I agree with you (and him, I guess) in that I am surprised that there is not more collaboration in the industry in terms of engineering. It’s not unheard-of, but it’s rare in an industry that claims to be worried about controlling costs.

Yeah, I remember that I thought he had a good point. Like, everyone has a 2.0T, too, and they all have about the same specs. Just stamp a different plastic finishing cover for the top and who’d notice or care? Just don’t let Ford be the ones who build it (I know from experience). Especially on low end cars, the people who buy them do not care, they just want something they can afford that does what they need, is reliable, and maybe doesn’t look too embarrassing. I’m not recommending this for the higher end, but the prices make up for the lower volumes, anyway.

> Sergio Marchionne had lobbied the auto industry for years to collaborate on engines, and they all slammed the door in his face

Maybe they would have taken the idea seriously if it hadn’t come from Fiat.

I design engines for OEMs.

Once you have a plant set up to churn out hundreds of thousands of engines you hit the law of diminishing returns on the cost savings from common parts. If your piston supplier needs multiple tools to make one piston they can make two different ones for the same cost. Use those two pistons in a common block with two different machining ops and you have two engine variants to the price of one.

As long as you have enough volume with each variant you are beyond getting gains from sharing engines, and instead you’d risk costs from quality issues beyond your control. And you also lose control of making well timed upgrades as tooling wears.

I’ve had to change the design of parts to suit existing tooling on a line as it was much cheaper to introduce a new local variant than replace tooling.

There are benefits of having competing engines in the same class. You get competition to increase power (car enthusiasts like this) reduce emissions (the planet likes this) and increase durability (everyone likes this).

We’re already very focused on efficient production. Having someone else decide all 2.0 turbos should be the GM C20LET wouldn’t be more efficient, and we’d be stuck with that lump of iron for ever.

Like any forecast (economic or weather) this model has LOTS of assumptions built in.

Just one thread gets pulled and the entire model collapses. Who yanks in it could be anyone. For example, US political leaders, global politics (new wars), environmental (new pandemics), new technological breakthrough in energy production or storage, etc.

Ask me again in 3 years what this is.

Everybody knows this, of course. Automobile companies can and will “pivot” to the most profitable production in an instant (yes, even in the long-term production cycles of car building). The era of 5 year plans are dead.

The fact that Toyota doesn’t have a viable EV means we’re not ready yet. Toyota makes the best cars, and it’s clear that they can’t make an EV with the reliability people expect from Toyota.

Why doesn’t the UAW ask for a works council? Where labor actually has a seat at the table, making up half the executive board.

Demand the maximum pay be no more than 50x the lowest paid employee or temp.Limit the use of temps, and enforce the limit. Make them hire the temp after a year max.

Toyota makes appliance cars with ho-hum driving dynamics and mediocre-to-poor interiors. They’ve been coasting for decades on a reputation of reliability, but the top 5 makes are within a rounding error of each other. Toyota’s US sales numbers rely solely on the fact that our consumers are creatures of habit. I wouldn’t look to Toyota as some kind of wise automotive oracle.

Why doesn’t UAW ask for a works council? Demand a 50x pay spread between the lowest & highest salaries?

Because the UAW knows that Wall Street would rip the lungs out of any company that met those demands, and their boards & C-suites (who also know that) would be toast. Unions can ask for more money, shorter days, better benefits, etc., that’s just a matter of degree over what workers get now. The people who own the companies (primarily financial institutions like banks, venture capitalists, mutual funds, the hundred or thousand shares you own yourself don’t mean squat in that context) would feel threatened by those ideas. Why, what if Chase ended up having to accept such policies in their organization?

Wow that thing about PMC is actually super interesting. I generally thinkg marketing is mostly a waste of company resources, but it’s pretty clear marketing is of growing importance when consumers have THAT many products to consider.

I will be hear with my ICE vehicles until they die, I die, or I can find a decent used EV.

30 years from now you will look at SMOG maps and wonder why the Mid-Atlantic region of the USA has one large CO2 emission…that will likely be me.

I tell anyone who will listen: find the gas car you like now and take really good care of it. Maybe 10 yrs from now the picture will be clearer.

I have a BMW Z3 that I will use until the day I can no longer get parts for it. Even if it is my weekend fun car.

PMC will come along just as automakers fully realize their dreams of knowing everything about us through their non-CarPlay infotainment systems.

They will become data centers that make cars, like airlines are banks or IT companies that fly airplanes.

Balance will be restored.

Automakers are going to accelerate phase-out of ICE nameplates with no direct replacement to make room in the range and also to steer customers towards EVs by removing the option a few years earlier than they’d be required to anyway.

Every single development project I have been on in my 20+ years as an engineer has taken 2X the time than what was planned. I expect this transition to be identical. We will want to stop selling ICE vehicles in 2035, but in reality, it’s probably 2045. It’s just going to take much longer to implement these changes than we think.

With that said, your PMC chart is fascinating, and something I had not yet thought of. There will be TONS of required selling models to build and support. I agree the suggestion that the only way to make this happen is to decrease options within said models, thus decreasing the total options offered by the brand.

I’d go as far to suggest that 2027 will be when this pain STARTS, but the pain will last at least 10 years, with the first 5 being catastrophic to industry and our world economy. I predict that the world will be back to “pre-pandemic” levels in 2045. It’s going to take one whole generation to whack-that-mole.

That doesn’t match my 25 years of engineering experience at all. What kind of abysmally managed environments have you been working in?

Mech Eng of tools and instruments. Development projects calling on every discipline known to man take years. And that first pass schedule is always at least half the total time it takes in the end. Nobody is ever honest with themselves during that planning phase.

I have seen recently actually 2014 or so Tesla with just about 100K on the clock with leaking and ruined rear drive units, batteries causing 50 mile range and or limp mode on the dash. and in both instances the repairs were 10-20K if you could find someone to do the work. Potential lack of secondary market and residual loan costs on many of the full EV vehicles is what is really scaring a lot of potential new adopters.

Tesla is famous for their poor quality control, though. They rank near the bottom even in China.

I only skimmed the PMC part because I saw marketing, got bored, and it sounds like not my problem.

Thanks for your insights

PMC isn’t an issue as all the automakers are moving to shared platforms. Many models built on the same platform, most of the costs of development are spread across, manufacturer may only have 2-4 platforms. Some platforms are even designed to work with ICE, Hybrid, and EV. The only difference is the body. PMC seems like a made up problem needed to justify some peoples worth.

“Only” the body is a pretty massive difference, though. Different sheet metal, different interiors… and every metal stamping or plastic part needs tooling or molds to create. Each one of those can cost thousands of dollars apiece. And if you can’t spread that cost over a larger number of products, then the price of the component goes up. Way up.

I’m proposing something similar, but shared more industry-wide. I don’t think it needs to extend to a completely shared BiW, so brands could still be differentiated, but it could as a lot of visual differentiation can be covered with just changes to plastic parts and maybe bolt on sheetmetal. Is the average CUV buyer going to care? They already look very much alike and are almost all visually unappealing, so how much would it even matter to the average buyer if the BiW is the same and what difference would that make if it did when that’s the only available option? They’re not going to go out and buy Morgans instead (though I might).

It’s less and less common to see platform sharing between ICE and EV, and when it is done it generally brings a lot of bad compromises for both sides. And that’s the problem – the automakers are trying to consolidate platforms to reduce development costs, but they’re getting slapped with basically a 2x increase because of the transition to EV. It’s most likely wiping out all of the benefits of their cost reduction efforts for the past decade. That’s a big deal.

Labor costs don’t intrinsically directly translate to a corresponding increase in product price. It’s the unwillingness of companies to accept labor as a necessary sunk cost to continue as profitable entities that does this. They tend to behave as though they’re financial wealth generators, like banks, when in reality labor is required to sell the widgets that generates their profits, thus ensuring their continued existence.

A lesson that’s stuck with me for years came from when I was in evening MBA classes with a bunch of other professionals. One of my electives was a class on sales, and was taught by a guy from industry, not a professor. The very first thing he did to introduce himself to the class was to go around the room and have everyone give their name, occupation, and then asked whether your job contributed to your company’s profits. So, I’d say “V10omous, engineer, and yeah of course what I do contributes to profits”. Every person in the class said something similar, and we were from all walks of corporate life. Managers, engineers, accountants, designers, manufacturing, etc.

After everyone had spoken, he said “You’re all wrong. The only thing that contributes to profits is sales, the only job that generates sales is a salesperson, and literally everything else goes into expenses. Engineering, manufacturing, etc are necessary, but they are expenses nonetheless, and *your company will always see it that way*. Only sales puts money on the other side of the ledger”.

The point of the lesson was obviously to hype us about sales, since that was the class topic, but the bolded point has always been something I’ve considered in my career.

That’s interesting, thanks for sharing. While it’s hard for me to accept that labor is simply a line item expense, since it’s not as though said widgets appear out of the ether, the bolded point makes “sense” from their perspective. That said, I tend to believe that investing in labor is generally a good idea. In our industry, it’s considered a sure thing and one of our biggest expenses, strictly out of necessity (retention).

I think it more highlights how leadership at these large companies thinks. Labor is very much a necessity but because it is an expense line item it is easy to think that you can simply reduce the amount of that expense and through extremely superior leadership abilities not actually see a reduction in output.

“I can inspire the remaining 75% of my workforce and find efficiency in the end-to-end process to maintain previous output and I’ll be a business genius.”

Sure, it’s necessary to make the product so sales has something to sell, but it’s still an expense.

That’s a pretty narrow viewpoint, but not uncommon for an industry salesperson. Any revenue generator contributes to profits. It could be licensing revenue, investment revenue, real estate, revenue from lawsuits. It’s not uncommon for salespeople to think the corporate world revolves around them.

Then, when profits are down due to a dip in sales they are first to blame someone else. Engineering isn’t giving us good products, product is behind, PR is killing us because of all the lawsuits. Profits are their fault, until sales drops, then it’s everyone else’s fault.

I agree the analysis is simplistic and biased toward sales (not surprising given the class topic of course), but I had never considered myself a corporate expense before that day, and have never not considered myself one since.

In that sense it was very enlightening.

yeah, it can be a bitter pill. But having been in charge (in part) of P&L I guess I just always knew that’s how it was.

If it makes anyone feel better all C-level people are also 100% an expense.

Interesting thought for products to sell.

I’ve spent most of my life in the other half of economy (services).

Sales force doesn’t work quite the same in Medicine with providers earning “profits” with billable procedures. Same I suppose for lawyers with billable hours, plumbers with billable jobs, construction workers, child care workers etc.

In these cases, “labor” is what they’re selling.

UAW and WGA strikes may be trying to make a stand for labor in general, or maybe not.

They can both be true. The reason we have bonuses and equity comp that directly correlates with the performance of the company is because our work impacts the performance of the company. Of course sales is the only department that goes out there and sells services or products. But (1) they’ve got nothing to sell without the rest of the company, and (2) their comp is a line item just like ours.

I’ve heard that before. And I’m even more of a loss to the company than that: I work in maintenance and operations. We never make the company a dime, but if we screw up, we can cost the company millions. And that attitude can keep everything about one rough day away from crashing if a company doesn’t want to invest in proper maintenance and timely repairs.

But they’ll only ever see us as a necessary expense, if even that.

As a Finance/Credit person. My counterpoint is “All sales are a gift until paid for.” Sales makes revenue, but not profit.

Of course he’s not wrong about how companies see it, as they’re mostly run by Marketeers.

One of my startup partners was a great salesman. He taught me, “Nothing happens until somebody sells something.” And that is true.

Sales guys like to say they’re the most important part of any organization.

This pile of BS always reminds me of the old story of the person who’s looking for their car keys under a street light. Someone comes to help them, and starts asking questions about how and when they lost the keys, and the person says “well, I dropped them over there, but the light’s better over here.”

Sales are the ones standing closest when the sale actually happens, so it’s easy to attribute the revenue to that salesperson. The engineer who argued for a design that ultimately is what caused more people to choose that particular product is much more indirect and hard to measure, so the assumption is that they’re not related. But a product with no salespeople (self-serve or automated) is going to bring in a lot more revenue than a bunch of salespeople with no product.

I’m not sure how crazy that PMC stuff is when a lot of the EVs will be the same platform/drivetrain/batteries, with different bodies. Like VWs MEB, GMs Ultium. GM was already kind of doing it with the Bolt and Bolt EUV, different bodies but identical batteries/motors.

Think the issue is their current gameplan is to make trucks/suvs until the EVs catch on, and keep making just trucks/suvs as EVs. Think slowly competition(China) will find ways to sell small EV cars, that despite tariffs will be more affordable options, and could really shake up the market.

Super fascinating article. I hope it gets good traction so there’s incentive to do more like it. I don’t have anything to contribute other than ++good would read more

Some of it, as you have mentioned, is that some of those nameplates are counted as 2-3 different models, and I think we might not see that as a bad thing. If I can get some combination of a PHEV, an EV, a range-extended EV, a hybrid, and a gasser, that’s a good choice, and a lot of interchangeable parts should keep prices from skyrocketing.

But, as V10omous already mentioned, I think we’re going to start seeing even fewer options within trim levels. You’ll get one of three or four trim levels, and the options in those will be mostly locked down (except, of course, dealer-installed options, which will continue to be a moneymaker). That’s not going to be fun for buyers.

I like the idea of one chassis/nameplate being all the options. If we can take something like the Rav4, which already has the plug-in-hybrid and the ICE, add an EV (compliance car style) and even offer a REX EV the total development costs would be better. Instead everyone is throwing as many batteries as possible on a skateboard and naming it the same as the ICE.

Valid point on the skateboards, but that is also reducing costs in its way, since they use the same skateboard to underpin several models. But I’m with you that they should try to get more use out of the same platforms. It wouldn’t surprise me if you started seeing skateboard platforms modified to be PHEVs, at least, if companies start to realize the demand is there.

Only one of those is a swing state. Obama narrowly winning Indiana in 2008 feels like it took place a century ago.

I’m skeptical of some of the numbers (70% EV nameplates barely a decade from now? Not without major technological breakthroughs), but I think it’s a given that complexity within model lines will decrease to compensate for increased complexity in full ranges. So fewer options, more packages, fewer colors, fewer manual transmissions and other rare options, etc. Basically a laundry list of stuff people here love to complain about. In this case, I’ll join in the chorus.

I thought the same thing about the numbers. I think the shape and timeline are exactly the one the U.S. government is selling. But I’m not fully convinced that reality is going to keep pace with that. Too many variable we discuss all the time around here.

But I do think that a longer transition will have the potential to draw out the pain and complexity of the transition for these companies. The longer they have to play in both worlds at a high level, the longer they have to deal with that 36K volume per model instead of 49K volume per model. And who knows how long the little guys like Subaru and Mazda can afford to play that game.

The 2035 numbers seem like they were a predetermined based off state legislation timelines. My bet is most states will have delayed implementation at that point because we will likely only be around 50% EV at best. PHEV are gaining too much steam right now, and I see quite a few manufacturers holding onto them in their line up for a while to come.

Can’t wait to see how Porsche handles this with their endless options list. It’s been a part of their brand ID, though I guess they are at the end of the economic spectrum that will be able to keep it if they want to.