Car owners in Arizona will soon find it harder to keep their cars on the road for affordable prices after an unfortunate court ruling. RockAuto, the popular car parts retailer based in Wisconsin, is being told to pay the state of Arizona $11 million in retroactive sales taxes in addition to paying the state’s already convoluted sales tax scheme. As a result, the founder of RockAuto says, it will have to stop selling car parts in the state. Let’s get into it.

Since 1999, Jim Taylor’s RockAuto.com has offered a refuge for car owners wanting to escape dealership prices. But more than that, RockAuto is famous for stocking parts for cars that have either lost manufacturer support, or have been built by manufacturers that have not existed for decades. The retailer’s motto is “All The Parts Your Car Will Ever Need,” and in my experience, it’s not even really an exaggeration. RockAuto’s influence spreads far and wide, from the countless Gambler 500 builds rocking RockAuto parts to my neighbor’s garage door, which sports dozens of the sweet collector magnets that you get in RockAuto shipments.

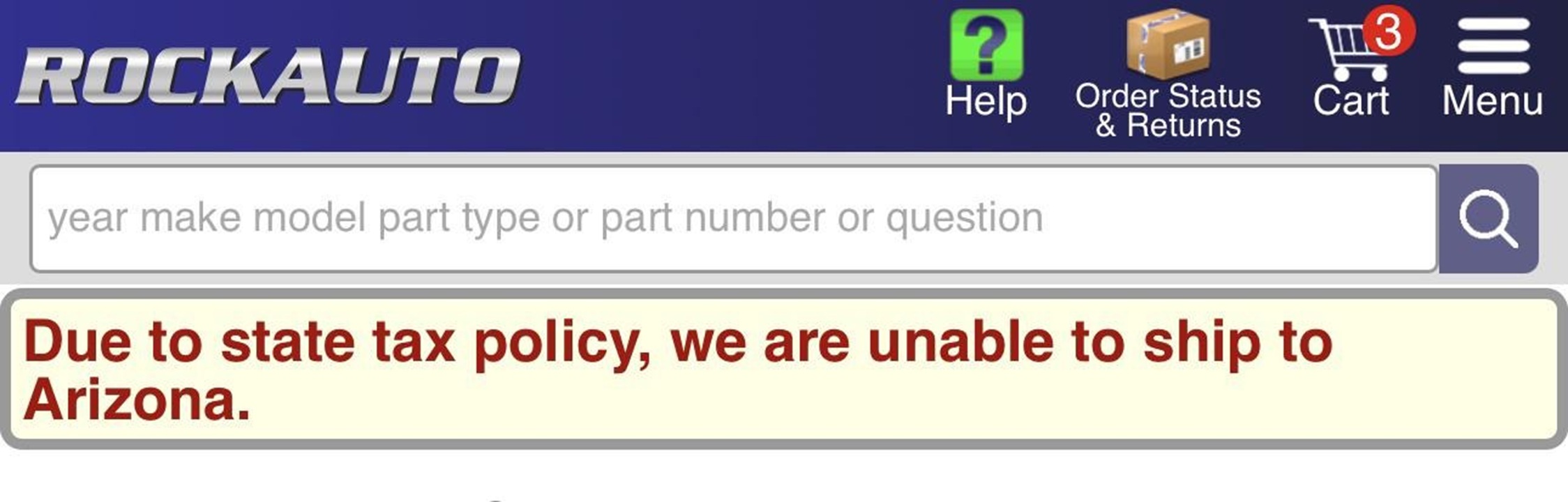

Sadly, if you own a car in Arizona and want to buy parts from RockAuto, time is running out. Due to how Arizona has chosen to impose sales taxes, the company says it’s now unsustainable to continue selling parts to customers in the state. But why is this happening?

Economic Nexus

In 2019, then Arizona Governor Doug Ducey signed House Bill (H.B.) 2757 into law. From the Arizona Department of Revenue:

This legislation requires remote sellers and marketplace facilitators—to begin filing and paying transaction privilege tax (TPT) in Arizona starting October 1, 2019. The legislation is the result of a 2018 ruling by the U.S. Supreme Court in the South Dakota v. Wayfair case. The decision allows states to require out-of-state businesses without a physical presence to collect and remit tax on sales from transactions in their state.

In 2018, the U.S. Supreme Court decision in South Dakota v. Wayfair, Inc. overturned the 1992 decision of Quill Corp. v. North Dakota. In Quill, the Court held that the Dormant Commerce Clause doctrine prevented states from collecting sales tax from retailers unless those retailers had a physical presence in the state.

In the decades since the Quill decision, an entire e-commerce industry has sprouted up and flourished. The states saw this as a bad thing because, thanks to that case, businesses were selling products all around America, and the states were missing out on hundreds of millions in potential sales tax money. States have also seen it as a negative for local businesses, as someone buying a product from a local business would have to pay sales tax, but that person could potentially buy the same product from an out-of-state seller and not pay tax.

In 2016, South Dakota passed Senate Bill 106. This bill was designed to attack Quill, and three large retailers refused to comply: Wayfair, Overstock.com, and Newegg. The state took the issue to court, and the law was shot down by the Sixth Judicial Circuit Court of South Dakota and the South Dakota Supreme Court. This set the stage for the state to take it to the U.S. Supreme Court. The Supreme Court decision is 40 pages long, but it can be summarized in a single sentence. The South Dakota v. Wayfair decision overruled Quill‘s physical presence rule, which Arizona claims gives it the power to tax out-of-state businesses that purposefully avail themselves of the market in that state.

RockAuto’s Alleged Taxes

RockAuto has complied with Arizona’s Transaction Privilege Tax since the revision went live in 2019. But then, something odd happened. The Arizona Department of Revenue (ADOR) ran an audit on RockAuto’s sales in the period between April 1, 2013, and April 30, 2019. ADOR had concluded that RockAuto actually did have a physical presence in Arizona and, as such, should have been paying sales tax in Arizona before 2019. How much did ADOR want? $11 million, which covers the taxes and penalties that the state says it missed out on.

RockAuto challenged this notion that it has a physical presence in Arizona, and in early June 2020, the parts retailer filed a complaint in the Arizona Tax Court. In April 2023, the Superior Court of the State of Arizona, in the Arizona Tax Court, ruled in favor of RockAuto. In that case, ADOR argues why it thinks RockAuto has a presence in the state:

The Department contends that “RockAuto’s extensive use of its [at least six] in-state Affiliates (which it calls suppliers) to fulfill orders in-state, and other in-state actions . . . show that the necessary physical presence exists.” […] The Department “see[s] no reason to treat [RockAuto] differently for tax purposes merely because it employed agents to do in Arizona what it could have done itself.”

The Court then states some interesting facts about RockAuto’s parts business in relation to Arizona:

While it is undisputed that RockAuto spent $132,964 in advertising allocated to Arizona during the audit period, and it provided magnets, goodie bags, or other promotional items to more than 500 events in Arizona during the audit period, RockAuto is indisputably an online retailer located in Madison, Wisconsin. […] Its provision of those items to Arizona—the latter items upon request of the event organizers—does not make that Arizona-based activity.

It is also undisputed that roughly “89% of orders RockAuto placed with Arizona suppliers shipped to customers outside of Arizona,” while “83% of RockAuto’s sales to Arizona customers came from suppliers outside Arizona.” […] (While the Department did not dispute these statements of material fact, it lodged relevance, foundation, and hearsay objections to them. The Court overrules each of those as unfounded.)

The Department rests its analysis on “the important fact [] that the in-state activity is effective in creating and maintaining the in-state market,” but fails to countenance those material facts that RockAuto’s Arizona suppliers do not generally or significantly direct their activities for RockAuto at establishing or maintaining an Arizona market.

However, the Court claimed that RockAuto’s suppliers in Arizona do not exist to help RockAuto establish a market in Arizona, as ADOR insisted. Instead, the Court claimed, whether a customer gets a part from a supplier in Arizona or not is entirely up to them. RockAuto can be configured to get parts to you based on your desired cost, speed, or efficiency. Because of this, only 11 percent of orders placed in Arizona are fulfilled by suppliers in Arizona, and the Arizona suppliers ship most packages to other states.

The Court ruled that RockAuto did not have the requisite physical presence for the state to try to collect taxes from RockAuto. The Court then ordered ADOR to pay RockAuto $892.95 in costs and $136,875 in attorney fees.

ADOR Appeals

ADOR wasn’t willing to let it go and appealed the case to the Arizona Court of Appeals, which reversed the decision and the fees ordered by the lower court a year later. What was different this time? The Arizona Court of Appeals agreed that, sure, only 11 percent of RockAuto’s sales in Arizona were fulfilled by suppliers in Arizona, but the volume didn’t matter. For that Court, what mattered was the function of the suppliers. From the case:

During the audit period, RockAuto contracted with distributors, six of whom were in Arizona, that supplied inventory, shipped orders, and processed returns for RockAuto. About 11% of orders placed with Arizona distributors shipped to Arizona customers, and slightly more than 80% of orders placed by Arizona customers shipped from outside Arizona. RockAuto did not maintain its own inventory. Instead, RockAuto required its distributors to send RockAuto daily inventory lists, and RockAuto listed the distributors’ products on its website. Customers placed orders through RockAuto’s website, and RockAuto forwarded the orders to its distributors.

RockAuto’s contracts required the distributors to comply with RockAuto’s shipping and return policies. The distributors had to use RockAuto’s software, which printed shipping labels listing RockAuto’s name with the distributor’s address. RockAuto also required its distributors to package RockAuto’s orders using RockAuto’s branded tape, include a RockAuto promotional magnet, and ship the orders directly to customers by mail or common carrier. RockAuto paid for the tape, magnets, and packing boxes. RockAuto suffered the loss if in-transit packages were lost or stolen. If customers returned products, RockAuto provided return labels that had RockAuto’s name with the distributor’s address.

RockAuto chose which distributor and location fulfilled customers’ orders. RockAuto considered multiple factors but prioritized “getting the customer his part quickly, getting him a reasonable shipping cost, [and] having it be the right part.” If a customer’s online cart contained multiple items, the customer could see if the products would ship from different warehouses. But RockAuto did not disclose the warehouse’s location or that it used distributors to fulfill orders. RockAuto’s website also allowed customers to select different brands of the same part and then click “Choose for Me to Minimize Cost,” and RockAuto’s system selected the brand that would ship with the other products for the “lowest total cost.

The Arizona Court of Appeals disagreed with the Tax Court, saying that the customer actually doesn’t have the choice of where they get their part from. Apparently, the Tax Court confused RockAuto’s option to have more than one part of your order to ship from the same place as meaning that you get to choose to get the part from an in-state supplier. The Arizona Court of Appeals continued:

Customers were responsible for all shipping costs, and customers complained if shipping was expensive or took too long. RockAuto advertised that its prices were lower than its competitors’ prices, and having distributors ship directly to customers was less expensive than reshipping orders from Wisconsin. RockAuto’s president said RockAuto chose distributors based on inventory and “whether [it had] a facility that is suitable for e-commerce” and that location was not a factor. But he also said shipping times were lower when Arizona distributors shipped orders to Arizona customers and that shipping costs were “related to the distance.”

RockAuto did not want to compete with its distributors;so,its contracts prevented the distributors from selling products directly to consumers through the distributor’s website, a website the distributor controlled, or a third-party’s website. RockAuto helped its distributors resolve ongoing issues with inventory, orders, and RockAuto’s software. During the audit period, RockAuto employees made four one-to two-day business trips to Arizona to meet with distributors.

RockAuto Takes A Hit

In the end, the Arizona Court of Appeals ruled that RockAuto does have a presence in Arizona, since it has its Arizona suppliers ship to Arizona customers, use RockAuto’s systems, and handle RockAuto’s returns. The Court supports its conclusion by pointing out that RockAuto’s employees also visited the suppliers in Arizona and that RockAuto sends promotional materials to customers in the state. The Arizona Court of Appeals ruling also seems to imply that the Arizona Tax Court might have been applying Quill‘s nexus test in a post-Quill world. Either way, this spells bad news for RockAuto.

Jim Taylor made his voice heard, explaining how absurd he thought the whole situation was, from the Arizona Capitol Times:

Somehow, every Arizona factory and wholesaler selling parts to us became our branch office when we asked them to ship directly to our customers. Address labels became stores, refrigerator magnets became salespeople and, magically, RockAuto was in Arizona.

No previous court case (including ours in the Arizona Tax Court) found a retailer “physically present” without employees or assets or someone making in-state contact with customers. ADoR’s own publications say “drop-shipping” from Arizona suppliers does not create tax liability. But ADoR persists in demanding six years of taxes (which we didn’t collect from customers) plus interest and penalties — far more money than we earned in 20 years selling auto parts to Arizonans!

RockAuto said that, due to Arizona’s tax rules, it might have to stop selling parts to customers in the state. That was back in 2024. Since then, the news has been quiet. That was until August 2025, when a TikToker posted a video claiming that RockAuto had ceased selling parts to customers in Arizona.

Bad News For Arizona Car Owners

There has been a bit of a panic among fans of RockAuto since then, but information has been thin on the ground. Some people report not being able to order parts to an Arizona address, while most people have reported no issues. What gives? I reached out to Jim Taylor for an explanation, and he sent me this:

RockAuto is selling to most Arizona customers right now. Below is an explanation of what happened in August, which we posted on Facebook in response to what I suspect is the same video you saw on TikTok.

However, the current situation is not sustainable so we plan to stop sales to Arizona in early November. We’re working on an announcement now to customers who have gift certificates or store credits they may want to use for Arizona shipments. Additional facts may help you understand this situation:

1. It’s true we had a long, costly and ultimately unsuccessful battle over Arizona’s retroactive “magnets are salespeople” theory. But the message you saw refers to a new policy: blocking automated access (due to “cyber security protocols set by AZ Homeland Security”) to the website we used to find tax jurisdictions and rates since 2019 (when Arizona began requiring retailers to collect tax regardless of “physical presence”).

2. Automated access to jurisdiction and rate data is essential for us because, while in-state retailers pay tax based on the location of their stores (even if they ship to customers in other parts of the state), Arizona requires out-of-state retailers to pay whichever combination of approximately 100 local taxes applies to each customer’s home or business. We stopped accepting orders because we can’t sell without collecting tax and we had no way to know what tax to collect.

3. After a few days of panic, we found another way to obtain location and rate data so we are accepting Arizona orders again. Some customers still may see a “can’t ship to this address” message because the “work around” does not work for all addresses.

4. We’re not sure how long we can continue such a fragile approach to something as important as taxes. Arizona tax rates are much higher than our profit margin so it’s less costly to miss a sale than to fail to collect the right tax. And we learned in our court case that, unlike other states, Arizona does not impose a sales tax on consumers which businesses are expected to help collect. Arizona has a Transaction Privilege Tax making retailers solely responsible for knowing what taxes to collect and pay. Those who can’t figure it out must forego the privilege of selling to Arizonans.

5. This situation is unique to Arizona. Even if we are unable to take new orders from Arizona, we’ll honor warranties and accept returns for past customers as always. And we’ll happily ship parts anywhere outside Arizona, for as long as there are cars and people who need to fix them!

In short, Taylor says it will cost RockAuto less money to lose all sales in Arizona than it would cost to accidentally pay the wrong tax. So, RockAuto making the decision to stop sales to Arizona customers this November. RockAuto already stopped buying parts from Arizona suppliers in late 2024. Jim Taylor also worries that RockAuto will only be the start, as his business cannot be the only one that has no offices in Arizona, but has suppliers and customers in the state.

Sadly, it’s unclear how you can help. Thousands of car enthusiasts have already sent letters to the office of Governor Katie Hobbs, urging the state to change direction. However, the state has thus far remained steadfast.

Sadly, this is a five-year battle that, at least for now, ADOR has won. But in reality, it seems like everyone loses, as ADOR loses a stream of money, car owners in Arizona will lose a parts resource, and RockAuto will not be able to serve customers in Arizona.

(Correction: We accidentally took Taylor’s quote out of context, and that has been corrected. We regret the error.)

Top photo: RockAuto

Just here to say that 2 stroke Vespa (or clone) in the background is awesome. Had a 75 Vespa for several years and despite owning a dozen motorcycles it was my favorite for running errands.

there are a few different theories about the purpose of business, i believe that #4 guides this situation.

the purpose of business is to:

1- maximize shareholder profit;

2- maximize stakeholder interests/benefits;

3- screw the salesman out of his commission;

4- minimize tax liability.

that said, it seems to me that ADOR is over-reaching…

So, Rock Auto is actually just one IT guy, sitting in an office building in Sun Prairie or Middleton, and that’s it? Everything else is “suppliers”?

Damn, what a racket. Reminds me of when Kim Cattrall explains what Tom Hanks does for a living in Bonfire of the Vanities.

It baffles me that people aren’t aware of this.

Lots and lots of online businesses are just middlemen/drop shippers run out of their home office…don’t actually have a real warehouse, never actually handle the product or anything.

See also: Almost every seller on Amazon.

As long as the prices are reasonable, the parts get to me on time, and they provide some modicum of customer service from said office building, I don’t really care.

No, you’re supposed to get mad because someone is making some money for their work helping you get a part for a reasonable price. You overpaying for parts or not getting your car fixed is supposedly fine as a worthy trade-off.

/s

I mean, isn’t that what many “retailers” are turning into? Walmart is rife with this on their online sales, and Amazon has is a giant shipping supplier (although they do have their own brands for many items).

Yeah… That’s how so many online retailers are able to have such quick order processing/shipping times.

In this case, everyone benefits from economy of scale. Retailers have reduced operating cost and inventory liability, customers get quick delivery and cheaper shipping/handling prices (and usually a better return policy)

How do you think drop shipping works?

If I sell something with your name on it under contract, do you now own my business?

In Arizona, you can only order from Crock Auto, because the whole Arizona tax scheme is a giant crock of donkey dung.

Arizona is the new Chicago. Their political system is trash and their entire government is currupt as hell. Rock Auto might be a ehh store for some people, but I will enjoy watching the people of Arizona get what they wanted here.

The fuck we are.

The right wing wants to turn us into Florida, while the older centrist Republicans/Mormons are quietly trying to hold back the white trash contingent along with the democrats.

The latter of which I might add, currently own nearly every high office in the state except Maricopa County Sheriff (Jerry Sheridan, a former lacky of Arpaio’s), State Education Superintendent (Tom Horne, a walking corpse who’s dead set on bankrupting us by giving free money to rich people in the name of “school choice”) and the MCC Attorney’s office (Rachel Mitchell, a do nothing dunce).

We’re a great state with smart people running the show behind the scenes and planning our progress well, but we have mouth breathers like Justin Heap and Kari Lake who insist on turning us into a hellscape. Thank god she fucked off, a shame her trash family still lives here by the Biltmore.

Rant like a deranged and hateful person all you want. I stand by what I said.

Who’s ranting? Tell me which part I said was wrong or fuck off.

Btw, it’s spelled “corrupt” dumbass.

I’ve always found it funny that Chicago & Illinois are supposedly the pinnacle of corruption for imprisoning their corrupt governors, while other states who are instead re-electing their corrupt governors are a model of integrity (see Sarah Huckabee Sanders/Arkansas as an example).

I think it was because of how long it took to imprison them maybe! I’m in the north east and in school were learned about Rhode Island, who had a mayor in one of their cities who was much loved, even after his jail term. He was re-elected right after he got out!

If you think there’s any level of government anywhere that’s corruption-free, then you’re incredibly naive (I think Vlad the Impaler got close in the 15th century, but I don’t see rows of impaled thieves lining the roads coming back any time soon).

Doesn’t change my original point. I don’t have any love for any government anywhere, I don’t get why you guys keep bringing up other places. Or talking about other things.

If we are talking about failed political systems, and massive corruption at every level of goverment, nowhere in the US comes close to Florida and Texas.

Az politics have been bigly corrupt for many, many decades.

Actually goes back to far before it became a state.

No surprises here.

Counterpoint: Rock Auto is complete trash.

I personally love repeatedly getting incorrect parts that are quite heavy that I have to pay return shipping on, especially when there’s no way to contact the company about it

It’s been a couple years, so perhaps they have fixed this?

No way to contact the company ever.

Bullshit.

service@rockauto.com

Oh, yeah, that works like gangbusters. They’ll be “Rock Starship” by the time you get a reply.

I’ve typically gotten a response within a day. That’s about on par with most companies’ customer service.

I’ve not had any issues, TBH

Sure about that? Like the others, every time I’ve used it, they’ve responded within a day and the problem’s been resolved.

Really?

Then Rock Auto can suck a big one before I will spend a dime with them.

OTOH I see contact info posted below…

Thanks GirchyGirchy!

I’ve been ordering from them for several years. Only once did I get the incorrect part. I went on the website, filled out the form to return the order, they sent me a return label, I shipped it back, within a week I had a refund. I will say though, I have never tried to actually call anyone. That may be a can of worms.

Two cracks at a compressor for my beater Pathfinder, both incorrect (wrong lines on both, where to connect to the A/C system) and unable to return either. They are super heavy, and the cost to ship back was bananas. Zero help from RA. They know what they’re doing.

I’ve ordered from them for well over a decade for several cars. I’ve received wrong parts, broken parts, parts that won’t fit, needed warranty service, etc.; their automated system has worked all but once. That one was going to force me to pay for return shipping of a part damaged in transit. A simple email to them fixed that quickly and all was well.

These days, trying to call anyone at most any company is an empty can of worms.

Shit you are right about that.

When I need to call the Doctor’s office for anything it’s usually a 3 or 4 step crap shoot on their menu system to try and get it done.

But the best is trying to deal with the CVS Pharmacy which is located in the local Target near me. It’s not possible to get a human on the phone, but if you can get their damn menu shit to work right you may be able to leave a message. And good luck getting a response in 24 hours or less.

Being someone with Parkinson’s disease let me tell you how frustrating it is to try and type stuff into my phone or laptop on a tough day. I have tried using the speak to text app on my phone many times. It is also less than ideal at times.

Arizona sounds more and more like Florida everyday. America! What a fucked up mess…

I have had nothing but good luck with them. Heck half the time I would have no idea that GM made two different “parts” for the same vehicle. Particularly, or recently, this was the case on a 2006 Silverado 5.3 alternator. but yeah, I have saved so many headaches being able to identify this type of stuff from that site and then checking the vehicle and photos.

My experience with Rock Auto has always been solid, I received an incorrect part exactly one time, but it was because they shipped the wrong part, in that case I requested a return authorization and they told me to keep the wrong shock and they would send out the correct model.

The only other issue was that they and a number of other suppliers were shipping the wrong size CV boot clamps for non-S Boxsters. I pointed it out after ordering from FCP Euro, Rockauto, and I think Pelican Parts. Only FCPEuro offered any relief, but it was only a few dollars so I wasn’t really that mad.

Yeah, the return policy is not always sunshine and rainbows. I ordered a mirror glass for my Vehicross, but it was not the correct shape. Rockauto justified not paying the return shipping because according to their vendor/distributor it’s the correct part, but they were still willing to refund the cost of the part as long as I shipped it back.

I did get the mirror the distributor thinks will fit a Vehicross, but they’re sorely mistaken thinking a Rodeo mirror glass fits a Vehicross and there was really no way to make RA aware of this. Fortunately I got lucky and their backend had a bit of a glitch and gave me a free shipping label.

Your comment reminded me of PTSD from when I was trying to buy stuff for my Amigo. Similar stories to my Pathy.

I’m kind of with the state on this one. If you have warehouses in a state that are shipping your product for you, even if you don’t OWN them, then you have a presence in that state, as they are your agents. No different than if you are using Amazon or Walmart to fulfill your sales through the services they offer in that regard. But I agree with Rockauto that going back six years is ridiculous. There should have been some sort of slap on the wrist settlement and life goes on for everybody. I also don’t see how stopping selling in the state gets them out of paying however much money that six years of taxes is. I assume that it’s enough that Arizona will continue to go after them, though I suppose with no assets in the state it probably will be hard to collect. But at what point does it become a criminal indictment of company for tax fraud of some kind?

And I feel like collecting taxes, even in states with wildly varying local tax rates, is very much a solved problem at this point. The point of sale software I installed and supported 20 years ago had no problem doing it for charge accounts based on the account holder’s zip code, never mind Amazon and every other major e-tailer in the country. There are LOTS of states that have local option sales taxes that vary all over the state, including my own state of Florida. Some states have state, county, AND city sales taxes where the county and city taxes can vary all over the place. And everybody manages to collect and pay the taxes. And I have a friend whose almost entire job was paying the sales tax nationwide for a smaller e-tailer that sells goofy heath care products. It’s a LOT of work, because you do end up doing sales tax returns for all those individual jurisdictions with differing rates. But it’s just a cost of doing business nationwide, no different than if you had stores in every state.

it’s basically a slippery slope arugmnet. if you use a third party carrier say DHL and they are based in Arizona well now DHL is your agent and now you have a presense in Arizona and now you have to pay up.

There doesn’t seem to be a specific legal definition for what defines a “presense” in the state. so Arizona is using all of these external factors to build a case. The purpose of a law is to not be vague it should specifically state what constitutes a presence in the state and what does not. Arizona is taking advantage of the vagueness of the law to get broad powers to collect tax. A judge should throw out the case and say “sorry the law doesn’t say that 3rd party agents constitute as having a physical presence therefore you can’t claim that it does 10 years after the fact. Get congress to rewrite the law if that was your intent. ”

lawmakers do this all the time they make the law as vague as possible to give the government as broad a power to do as they see fit and then leave it up to the courts to interpret the meaning of the English word salad they put on paper that it takes dozens of people with PHDs in law to duke it out and in the end nobody can agree and it’s up to one judge to make a ruling. don’t like that ruling? well as soon as that judge leaves his seat you can try it again, roll the dice and hope you get your favorable outcome the second time! Don’t like the ruling just spend more money and appeal it to a higher court using taxpayer dollars!

My state had this ‘presence’ battle many years ago with Amazon. The sales tax rule was originally intended for a ‘retail’ presence, aka physical storefronts, since ‘mail order’ was not significant previously, but got redefined to include the online only warehouses physically in the state since their volume was huge and disrupting the market. The brick & mortar stores (Target, Best Buy, etc) were having to charge sales tax for their online sales, but Amazon didn’t. Amazon lost, and now they charge sales tax and they still dominate.

Amazon is just tough to beat. Literally anything you can imagine, direct to your door in a day or two. Even if it costs a little more, the convenience is unreal. And most of the stuff I get from them would be a multi-hour drive to get brick and mortar, if I could even get it at all. And I don’t exactly live in the middle of nowhere.

But I think it is absolutely fair that online retailers should collect and pay sales tax too – should have been that way from day 1. Level playing field – they have enough advantages as it is.

While I try to minimize my tax liability when I can, I don’t begrudge paying taxes. It’s the price we pay for a civilized society. As I like to say – the taxes in Somalia are probably rather low, but I don’t want to live that way.

They aren’t just using a shipping company ala DHL and UPS. They are literally using third-party warehouses to receive, ship, and store the goods, then fulfill their orders in their name. Those 3rd party warehouses are used by ALL the online parts vendors, BTW, which is why your order from Eeuroparts or FCP or whomever can come from all over creation, not just some central warehouse that they own. It’s a FAR more efficient way to do business. And I very much side with the state that it constitutes “presence” whether that is defined as a black and white thing or not. Somehow, none of the other various online car parts companies are whining about this and taking their toys and going home. The law applies equally, and RockAuto was trying to do an end run around it IMHO.

And yes, laws are generally written fairly vaguely. That allows flexibility as times change. Interpretation is literally the court system’s job. States do in fact have VERY broad powers to collect taxes.

That’s interesting about FCP. I don’t think I’ve ever received anything that didn’t come from CT, which is convenient because it’s often next day even with regular UPS.

I used to love it when I lived in Maine, same deal, everything from them was next day regular ground. Florida, not-so-much.

They have been using 3rd party more and more. For the order I placed on Sunday, most of it is coming from their warehouse in CT via UPS, but one part is coming from elsewhere via USPS. It only makes sense – warehousing is EXPENSIVE, and by leveraging these 3rd parties you save having millions in slow-moving inventory sitting around collecting dust until somebody needs it. What they used to do is basically order it from their supplier when you bought it, then it would be delivered to them, then they would send it to you. Adding a bunch of delay and added expense. Makes waay more sense for the supplier to just ship it directly to you. And of course, this is how FCP has gone from being really just a Volvo/Saab supply house to one that can sell parts for most of the major European brands. They expanded their own warehousing operation considerably, but not THAT much!

eEuroparts is REALLY into the 3rd party game. But unlike Rockauto, when you order a bunch of stuff and it comes from all over, they don’t screw you on the shipping (though their “free shipping” must be by by pony express it takes so long). I rarely order from Rockauto for that reason, and also because their “customer service” is on par with the worst DMV offices if anything goes wrong with your order. My supplier of last resort, and it has to be a LOT cheaper or just not available elsewhere before I can be bothered. I was actually surprised that FCP was slightly cheaper than eEuro overall for the stuff I ordered this time.

the whole point of “does X or Y count as having a presence” is up for debate is the whole problem with the law. The law should be more clearly defined what qualifies and what is exempt. Also going back ten+ years and applying late fees and penalties is just asinine.

I don’t disagree with this. It should have been “if you sell it here you collect the tax” from Day 1. And I also agree that going back years was ridiculous. But so is RockAuto’s reaction to all of this going forward. Two wrongs just make more wrongs, and as I said, I don’t see how they are getting out of paying whether they take their toys and go home or not.

That’s what got me too. WTF is the deal trying to go back in time to squeeze blood from a rock? Seriously. Bullshit here.

If I was Rock Auto I would also tell Arizona to eat shit and just not play their game.

At the very least, you’d think the supplier who’s in state and actually selling the product should have to pay tax.

But they aren’t the ones selling it – Rockauto is. They are just a warehousing and fulfillment company who gets paid by Rockauto. It’s Rockauto’s responsibility to take care of the paperwork.

Of course, Rockauto could go one step further up the fullfillment chain and sell through a company that DOES take care of all that nasty paperwork – but that costs a lot more. But it’s easy, which is why so many companies sell through Amazon or Walmart or Newegg type “platforms”. They take a big bite out of the profits though.

Good thing we don’t have those ridiculous state, county, city, and whatmacallit taxes in Germany. The sales tax (MwSt.) is 19% everywhere for most of items and services. Some certain items and services are taxed at 7%.

Individual European countries are on par with individual US states in many ways. Europeans tend to not understand that the US is literally a federation of individual states, and many things vary WIDELY between states. Taxes are no more consistent across Europe as a whole than they are across the US states. Most states only have one or two sales tax rates, some have hundreds. It is what it is, and it’s ultimately a “locally controlled” thing. A number of US states have no sales tax at all. New Hampshire and Alaska have both no sales tax and no income tax. My state has no income tax and a fairly average 7% sales tax rate (technically 6.5% + .5% county). I save about $15K a year in taxes vs. the state I lived in previously. Also, commonly only goods are taxed, not services. Though of course that varies widely and wildly too.

I’m quite sure all the EU countries have a much more uniform tax policy than US states. All EU members just have VAT (although the rates are different, but not a hodge-podge of different taxes like in the US).

Not all of Europe is in the EU. That most, if not all European countries have settled on some form or another of VAT is neither here nor there. Neither approach is “better”, it’s just different ways to get to the same end – collecting money to fund civilization.

And I would argue that in many ways the US method is actually simpler, because generally only the final link in the chain needs to deal with taxes on goods and services as a rule. All of the hands that the good passes through on the way to the end user can mostly ignore sales taxes on it. If I am buying or making something for resale to another business, I don’t have to worry about sales taxes at all. Obviously, tariffs are a whole different thing entirely.

In the modern, computerized world this really isn’t that hard to deal with (BTDT). At whatever time is necessary, your point of sale system is going to spit out a report that says you need to send $X that you have collected in tax to taxing entities A-Z, and you do it. God-forbid that you have to PAY someone to take care of that work (while reaping the benefits of NOT having to have direct employees in every place you do business).

I would argue that whatever you’re used to might feel ‘simpler’, but it might not be if you look at it more objectively.

When I buy a car or bike here in the states, I have to take into account what county & township the dealership is in, and also what county & township I live in (and another different set if the vehicle ends up parked somewhere else, like let’s say a track car or a motorcycle that gets ridden only in the summer) just to figure out how much I’m gonna end up paying, with taxes; and that’s just ‘local’, before we talk about ‘state’. Nobody in Europe (EU or not) has ever had to deal with this BS. Ever.

Also while we’re talking about taxes, you can go ask anyone in Europe if they’ve ever had to file taxes as a private person (not a business). Not yearly, not every decade, not when you die, not ever.

When my bewildered friends in Europe ask me “how can people consistently vote against having universal healthcare and free education??” I just have to shrug and tell them they don’t understand how people on the other side of the pond think about things..

No you don’t. You just pay the amount that the store tells you to. They do all the work, you just swipe your card, hand over the cash, or write a check (yes I know checks cause Europeans heads to explode).

Our income tax preparation system exists for a very simple reason. A WHOLE lot of people make their living off of it. I used to myself as a paid tax preparer before I got into IT (I have an accounting degree). Sure, we could automate the vast majority of it, just like the Europeans largely have. But then what are all those people going to do for a living? Sometimes, there is necessity in inefficiency. And when the inefficiency is tiny compared to the ultimate cost, that is perfectly fine with me. And ultimately, if your tax situation is simple, you can just do it yourself online for free anyway. Takes all of ten minutes a year for the typical low-paid wage slave.

Again, might be ‘simple’ for you, but to me it just seems dumb; throughout history there have been entire economic sectors that have been obsoleted out of existence, time and time again. (the buggy-whip makers story comes to mind)

Should we just keep burning coal just so the mines stay open? (actually that’s kind of rhetorical now, since the US DOE had just come out with a proposal to subsidize coal mining to the tune of $600mil right after shutting down clean energy projects that have been almost completed and paid for)

For all those tax accountants, if they’re out of a job and can’t/don’t want to get re-trained in doing something else, we could just pay them the same salary until retirement, and it would cost a fraction of what we’re now paying for tax preparation each year, which includes all those sweet profits for the likes of Intuit and HR Block, and their exec’ bonuses for their daily necessities, like yacht-buying.

It’s also very funny to me, as a kid who grew up in communism, that the big capitalist US just wants everyone to pay for some people to have a job doing something completely irrelevant and unnecessary, which is straight out of the communist playbook (except for that small detail about most of the taxpayer money going to some private entity’s profits and some billionaires’ families)

You are entitled to your opinion, however wrong or misguided it may be. <shrug>

We already have major issues with kids finding decent jobs and you want to make that WORSE? Unlike the coal industry, there is no real harm being done by having some paid tax preparers in the mix other than a tiny increase in the effective amount of tax people pay. If I would pay to have my fairly complex taxes done professionally (I own multiple rental properties), it would cost me a few hundred bucks. My income tax liability last year was on the order of $40K. Utterly rounding error. And there is some savings on the government side, theoretically. Not remotely comparable to coal mining downsides. Nobody is getting black lung doing taxes, nor is the world burning because of their CO2 emissions.

Interestingly, I have lived in Hungary right after the fall of communism and have spent quite a lot of time there since. And the UK. And I still infinitely prefer living in the US, warts and all. Nowhere is perfect. At least nowhere I can afford to live in the style to which I have become accustomed. If I was filthy with it there are all sorts of places I would love to move to.

Seems a bit entitled and out of touch to waive away any issue you personally would just throw some money at, but it also sort-of tracks (the owner of multiple rental properties couldn’t care less about the wasted time and money of people who have to work more than one job to be able to survive, especially when those are also the people who just pay their taxes in full, rather than use one of the countless loopholes for the well-to-do to dodge them)

Oh grow the fuck up already.

As I said, if you are a typical taxpayer, you can do your taxes online completely for free. Takes some minimal amount of effort to do so. You can even do it via a phone app these days. if you can’t be arsed with that minimal amount of effort, then pay somebody to do it for you.

So why DON’T you still live in Europe, exactly?

“Go back from where you came from!!”

is the MAGA way of thinking, so I guess that clears some things for me 🙂

So just because I wasn’t born here means I can’t wish for any kind of improvement in my current home country (in which I’ve lived longer than anywhere else)? Maybe I should pay less taxes if I don’t have the right to complain about anything LOL

And just to address your ‘you can do your taxes for free’, 1. it’s capped to about $60k/year (depends a bit by state) and 2. even if you would qualify for the income cap, it still takes time, so not really ‘free’ (unless your time is worthless)

I make multiples of that, have a far more complex return than the average bear, and it takes me about 45 minutes a year to do my taxes using cheap software (and I don’t even need that, I could just use the free paper forms). It’s a complete and utter non-issue. And I very much doubt that someone in my situation, aka one who owns effectively multiple businesses in addition to multiple homes and has a high paying job would just get a notice in the mail in ANY European country, even if it does work that way for the average wage slave.

I am the least MAGA person you will ever meet. But I don’t have a whole lot of time or patience for people who whine about where they live when they obviously have alternatives. If where you live doesn’t suit you – MOVE. No different than the wankers who whine about how they will never be able to afford a house near the beach in SoCal. Boo. Fucking. Hoo. No, the US is not perfect, far from it – but evidently it’s good enough that you choose to live here when you have an easy alternative. But ultimately it is what it is and some things just aren’t going to change, ever. Like how we do personal income and small business taxes in this country. There are far more serious issues to spend energy on.

there are some places like Florida that has ZERO sales taxes on retail sales. they levy taxes in other ways.

This all sounds like Uber, Lyft, etc trying to claim their employees aren’t employees.

Very much agreed.

The point of sale software I installed and supported 20 years ago had no problem doing it for charge accounts based on the account holder’s zip code

So what do you do when the tax boundaries don’t comply with zip codes? Some depend on county boundaries, improvement district boundaries, stadium subsidy boundaries, or other entirely arbitrary boundaries like which side of the street you’re on.

Ultimately, for online sales, zip code and street address pretty much has to be “good enough” because what other information does, for example, Amazon have to go on? All they have is your shipping address. It’s really not that big of a deal. The whole POS system I supported was EXTREMELY flexible – there were stores in places where the tax rate not only varied by where the store was, and where the account holder lived, but also by what item they were buying and whether they were buying for personal, internal business use, or resale. Sales taxes in the US can obviously be VERY complex – but that is just the sort of task computers are good at sorting out. Not much fun setting the tax table up during an install and making sure the item database was properly coded as to rates, but that was why I was paid the medium-size bucks to do it.

As I said – this is a long solved problem. Rockauto just doesn’t want to bother to do the work and spend the money to properly update their system. And/or they are just cutting off their nose to spite their face to give two middle fingers to the state of AZ. Or they don’t do enough business in Arizona to make it worth their while to bother, which is a valid business decision. But AZ certainly isn’t the only state with a bazillion different tax rates by location.

ZIP plus 4 is more precise, but boundaries such as those are a challenge.

Glad I don’t live in AZ but have a car guy friend that does and maintains quite a fleet of old stuff. Not being able to source parts from RA would put a serious dent in my car habit. There are well over 200 magnets on my toolboxes and lift. Figure 200 orders at $100/pop, and saving 50% over buying local even including shipping, that’s $20k I didn’t have to spend on parts.

This is what freedom looks like.

Aren’t taxes like the opposite of freedom? Like taking your money is limiting your opportunity to do stuff.

For poor people, that is, rich people have enough extra to not have to worry about sales taxes much.

I think that was sarcasm. At least, I hope that was sarcasm.

Yes, that is a lot of sarcasm

It’s a lot of sarcasm. I have family that lives in Arizona. I’ve seen it up close.

Taxes don’t limit opportunities, they increase them. Wanna try living in a place were the basic necessities of civilization are privatized? Pay a toll to leave your driveway. Pay 100 grand when your house catches fire. Pay your toilet every time you take a dump.

That’s the libertarian dream!!

Taxes are how we pay for civilized society. I bet the taxes in Somalia are quite low, and you would probably have a lot of “freedom” there too.

Here’s an idea: If you want to see what happens when libertarians take over, look no further than Grafton, New Hampshire.

Roads got worse, crime went up, the town government’s legal fees skyrocketed, a bunch of registered sex offenders moved in, the only police officer couldn’t do his job because the town couldn’t afford to fix the squad car.

Oh, and then the bears moved in and started attacking people.

https://newrepublic.com/article/159662/libertarian-walks-into-bear-book-review-free-town-project

https://www.vox.com/policy-and-politics/21534416/free-state-project-new-hampshire-libertarians-matthew-hongoltz-hetling

Not sure what New Hampshire Libertarians have anything to do with Arizona Republicans but if you do you. Yes I saw that article back when it came out couldn’t really be much more of apples than oranges.

To be fair, I think I misread/misinterpreted your original comment

That’s OK. I wouldn’t move to Florida either.

Glad I don’t live in Arizona (which almost happened). Dealer wanted $132 for NGK iridium plugs for my car, Amazon was $72, eBay was $80, and RockAuto was $62. Said plugs showed up today and that’s this weekend’s project. Most of the mechanical parts for mine are dirt cheap there. New belt? $7. New valve cover gasket? $21 for the good one.

I have found some parts cheaper on Amazon or eBay (like some of the R1 Concepts brakes) but it’s been the best place for me to find parts for the car.

Same experience for me. The dealership quoted almost $300 to replace the NGK iridium plugs in my 4 banger Mazda. I got the plugs and new boots off RockAuto for about $80. Obviously much of the dealer’s cost came from labor, but they were going to charge $42 per plug.

I didn’t ask how much the dealer wanted to do the work for me, just how much parts were. It’s maybe a half hour job for me and I have all the tools.

$42 a plug sounds like robbery, even compared to the $33 several local parts departments quoted me for what I imagine is the same plug I need for my Mazda.

Yeah as long as you have a torque wrench, the right socket, and long nose pliers (the plugs are pretty deep in the engine) you’re good to go.

I picked up an $8 set of magnetic spark plug sockets from Amazon. 14mm and 16mm. Used my middle extension and didn’t have a problem.

The sockets in question:

https://a.co/d/baXyB0I

The magnets are strong enough I had to try to pull the plugs out, or off the plugs when the new ones were installed. Pretty happy with them.

Rock Auto is only good for a parts look-up reference. Their return process/policy is so freaking awful that I’ll never order from them again. Look it up there, order it on Amazon.

That is what I was about to post. It’s usually cheaper now too.

Dunno, I’ve always had good experiences with RockAuto including their returns/exchanges/refunds whereas I’ve so rarely had good experiences with Amazon that I simply avoid Amazon altogether (not to mention the inherent problems of Amazon itself.) Likewise for my kid and all our friends who wrench on their own cars, they all much prefer RockAuto (& eBay) over Amazon for parts besides what they get from specialist websites.

Guessing it might depend on where you live and the luck of the draw depending on whoever happened to receive your complaints and the way you might have conducted yourself? Just that I’ve used RockAuto *frequently* for well over 12 years now (so much of my old refrigerator’s main door was covered with their magnets, lol) and have yet to have any problems with them…

Rockauto is a pain to return to only because I don’t own a printer, they seems to do a much better job than Amazon of making it easy. Yeah I had to drive to a Walgreens to drop it off, but…….. You still have to do that with Amazon.

And there aren’t any counterfeit Chinese parts on rockauto. I don’t think there’s a whole lot on Amazon either, but eBay is bad.

In my experience, Amazon is a mess of counterfeits and substandard parts, although not as bad as eBay. It may depend on what brand you’re buying for.

Amazon parts are made with much Chinesium and rock auto parts tend to be the same quality you find at autozone

Do yourself a favor and pick up the cheapest Brother laser printer

https://www.amazon.com/Brother-HL-L2405W-Monochrome-Subscription-Replenishment/dp/B0CPL7HRQN/?th=1

I bought one like.. 12ish years ago. I think I’ve replaced the toner once maybe 8 years ago. I print things once or twice a year and it always just works.

I second this. I actually first got a Brother printer based on an online recommendation, but it was one of those rare instances where you CAN believe what you read online.

Cheap and reliable. We’ve been very happy with ours.

Same with Brother printer! We use it infrequently, but it’s always ready to go since it uses toner instead of that expensive ink that clogs up if you don’t use it regularly. We’re on our 2nd toner cartridge in 6 years.

Agreed! Brother laser printers are the epitome of “a printing appliance.” The only time I need to pay attention to my printer to figure out why the $@&! it’s not printing is when I run it out of paper.

Still trying to convert my parents from inkjet printing, but apparently there are sewing/crafting techniques that only work with ink, so mom gets a veto..

I’ve had Rock Auto send me the wrong parts and Amazon send me the wrong parts. It happens. Never had an issue with returns. It’s just the PITA of printing, boxing, and shipping. Been using Rock Auto since we got rid of Prime. Only use Ebay if I can’t find it anywhere else.

It seems like the moral of the story is don’t let the dokotas near the supreme Court. These guys get into office and think I’m going to generate revenue they never think of the repercussions. The 19 cent Colorado transport fee has to be costing the industries more in compliance then the state actually generates. I can only imagine it has to be worse for something variable like Arizona has. Delaware and new Hampshire need to figure out how to circumvent this and cash in.

Wayfar has had an enormous effect on internet commerce. We currently spend five digits a year to comply, as we have to figure out the correct sales tax down to the rooftop level in 40+ states. We also get hit with credit card transaction fees on the tax we collect, but of course we don’t get that back.

To me, this reads like two problems. First, the court battle to define if they had nexus previously. Secondly, RA is trying to get by with some cut-rate tax calculation software which is why they’ve cut off AZ. AZ is not the only state that has complex sales tax calculations, most jurisdictions have multiple levels but RA’s software can’t deal with AZs. RA has decided on this course of action to bring attention to the AZ nexus decision, but they’re really struggling with their tax calculations.

I’m going to take a look and see how/if this affects us, but thank goodness we don’t drop-ship from any AZ suppliers…

I was going to say, this case makes me quote Sterling Archer: Little of column A, little of column B.

On one hand, if RockAuto still ships to my home state of Alabama? Certainly they have the brain power, whether human or digital, to calculate complicated sales taxes. Throw five darts at a state map, and you will hit five different sales tax rates, thanks to their international embarrassment of a state constitution, the longest constitution of any government on Earth and getting longer every year, which is a whole other discussion in itself.

On the other hand: this is exactly how overzealous regulation and taxation strangles business for no other reason than pure greed, and a prime example of why I believe in limited government. This is yet another example of a gubmint entity wanting to kill a golden goose for its eggs while telegraphing its intentions to the goose, forgetting that the goose could choose to simply fly away instead.

Yes, RockAuto could probably figure out how to properly calculate taxes in Arizona. Yes, Arizona seeking such a ridiculous judgment in court is a very “CCP is asshoe” thing for a government to do. So who is more in the wrong here?

My moral code requires me to reject all such naked cash grabs from all such creative government bookkeeping. I stand with RockAuto. Down with The Man.

My current county is wanting to raise the sales tax rate 0.5% so it will be the same as all the surrounding counties (9.75%) (max allowed).

That’s a good reason, right?? /s

So, they had parts that were in Arizona, and they sold those parts to people in Arizona, and they didn’t think that anybody should have to pay Arizona sales tax on that transaction?

If only simple were that simple

no they had third party partners in Arizona who exclusively sold parts to rock auto who would ship their parts directly from their facility in Arizona to customers in Arizona (and other states around the country) using rock auto package tape and rock auto return address.

customer in Arizona buys product off of rockauto.com Rock auto purchases part from third party supplier that happens to be located in arizona and then gives the shipping label to third party supplier. third party supplier in arizona packages product in rock auto branded packaging and puts rock auto shipping label on package and it is sent out. 89% of those packages were sent to other states and 11% of those packages were sent to Arizona residents.

after years of no action by the state 12 years later the state of Arizona decides that hey actually for those 11 percent of packages you actually did owe sales taxes and we just made up a number and are hoping you pay up.

What matters is the actual number of 11%.

They didn’t have any parts in Arizona though. Ever. Rockauto doesn’t own any parts that aren’t in their Wisconsin warehouse.

I guess the Needles, California post office is about to be a busy place.

Bingo. That’s how dish and laundry detergent became top-selling items at Costco in Coeur d’Alene, Idaho: because of people driving over from Spokane, Washington to buy it and take it home, after Spokane banned phosphates from detergents, effectively banning clean dishes from the city. People would rather break the law and have clean dishes than “save the environment.”

Some of my favorite forms of civil disobedience are the low stakes, silent majority kind like this. Few people shout “Down with The Man” at the top of their lungs, but millions mutter it under their breath exactly like this every day.

https://www.nbcnews.com/news/amp/wbna29918496

The Supreme Court decision came in 2018, like you said. That should’ve been enough time to find a way to collect the taxes.

Of course, Arizona can always simplify their tax code and make it easier to collect the sales tax.

Doesn’t Colorado have a similar issue with local taxes? Ohio and NY also have local taxes. Arizona can make their tax structure similar to theirs. PA has one sales tax rate for mot of the state, with a slightly higher rate for Philly and Pittsburgh.

So, what Arizona should do is have one sales tax rate for most of the state, with maybe a special additional tax for Phoenix and Tucson.

Lots of states have a state wide sales tax rate and authorize county and/or other local gov’ts to impose their own taxes. That is the way it is in my state, the state tax is 6.5% and depending on jurisdiction the city, county or public benefit district will tack on their own taxes.

That means I can drive 10 mi south to the Costco/Home Depot ect there and pay 9.2% sales tax or drive 11 mi north to that Costco/Home Depot ect and pay 10.3% sales tax. You can guess where we do most of our shopping.

It’s not that easy. If memory serves there’s an amendment in the State Constitution that makes establishing any new taxes at the State level have to be put on the ballot and pass a statewide referendum.

Add in the fact that since we had this stupid school voucher scam shoved down our throats we rank last in the nation on just about every education metric and I doubt anythings going to change any time soon.

We are well and truly on our way to passing Mississippi as the poster child of the American Third World.

when a huge portion of your state population is a bunch of retired septuagenarians baaaad decisions get made.

You’ll have to get a new “poster child” even if it’s not Arizona. Mississippi now does a better job teaching kids to read than most states:

https://www.theargumentmag.com/p/illiteracy-is-a-policy-choice

I’m pretty sure any random people can establish some special district anywhere (if the local council people don’t pay attention and/or get bribed enough) and start collecting local taxes, without any kind of amendment anywhere.

In Alabama Ecomerce sales taxes is a seperate rate than the local rate. the state takes most of it and the local city/county get crumbs. If you buy somehting local it is the other way around the local city and county get the majority and the state gets a much smaller percentage.

Heart of Dixie native here. I implied in a previous comment that “the state takes most of it and the local city/county get crumbs” has been standard operating procedure in Montgomery for over a century now, thanks to that abomination of a 1901 constitution.

Texas also has a baffling layering of sales taxes because Income Taxes are Communism, but what it apparently doesn’t do is block whatever tax software’s API from grabbing the appropriate tax.

It may suck for AZ car part buyers and for Rock Auto but Federal Contract Law has a form the SS-8 I believe that has a dozen questions about the business relationship and whether the business relationship is an independent contractor or an employee. The fact that Rock Auto controls so much of the relationship makes it an employee employer relationship not a business to business relationship. Another interesting fact will come out if Rock Auto tries to force the IC business pay a partial amount of the cost the business could use Rock Auto for wages, taxes on wages any expenses would need reimbursement benefits cost would need to be reimbursed. FedEx played this screw the IO treat them like an employee but don’t cover employee expenses and had a judgement of over a billion dollars against them

Rock Auto isn’t the suppliers’ only customer.

Most of the warehouses RA uses are Parts Authority, Auto Value/Bumper to Bumper, or Factory Motor Parts. These same warehouses supply independent parts stores throughout the country.

What you’re saying with the SS-8 would really only apply if RA was their only customer. Also, the warehouses pay their employees like W2 employees of the supplier they work with. The IRS doesn’t care who pays the payroll taxes, as long as someone pays them.

Fedex Ground and Fedex Express are actually separate companies. Fedex Ground uses contractors for drivers. After the judgment, Fedex Ground only contracts with companies that make their drivers W2 employees (of that contractor), taking care of the tax issue.

I’m with Dogisbadob on that one. Just because they dictate the terms doesn’t seem like they are the employer. If I have a contractor (or five) in China make a widget for me with my specs and drop ship it out around the world in my box, with my tape and my magnet, does that make me a Chinese company? I don’t think so. I’m the middle man. I’m in Anytown USA. I go to China twice a year to see the factory and make sure they are up to snuff with quality , etc. I understand the other points of view but I don’t see it that way. I don’t own the factory. They make widgets for 100 other people. I don’t pay their employees, etc

I agree with you and I’m against most tax dodging.

As long as contractually the partners are allowed to have customers other than Rock Auto then I’d say Rock Auto has no presence here. Hopefully they take it to the State Supreme Court, not that I’m at all confident those corrupt clowns will do the right thing.

Arizona made the law purposely vague so they will have broad power to interpret as they see fit. this whole case should be thrown out. The law should specify what conditions constitute having a presence in the state. They are just using various loose arguments to say “see this is why we consider them having a presence in the state” and its gone to court three times and they have gotten three different rulings.

That’s gubmint for you – always moving the goal posts in order to run up the score.

It doesn’t help that the legislative process is so painfully slow (by design) that we frequently end up with laws that were written for life as it was decades ago.

yeah legislators get paid to do absolutely nothing all day. so they fill their time with golf trips and meeting lobbyists. so the only laws that get passed are the ones that are drafted by the lobbyists that donate the most to their campaign fund.

Yep. By the time you’re taking the Bill Clinton route and saying stuff like “it depends on what the meaning of ‘in Arizona’ is,” that’s where I reject any government’s claims out of hand.

Either a business has a physical presence in a state, or it does not. RockAuto does not. I’m sure there are lots of restaurants that use Idaho suppliers for their potatoes, that do not do business in Idaho. Just because their potatoes grew in Idaho dirt does not mean that Idaho gets to get creative with taxation and tell them they now have to pay Idaho taxes for things they are not doing under their own name in Idaho.

that only applies for a private citizen. a whole business can’t be an employee. the partners are whole warehouse distribution companies not just a dude selling parts to rock auto out of their garage.

Good for Rock Auto. This whole thing sounds like the work of some bureaucrat trying to make a name for themselves. I wonder, though – is RA saying they’ve had $11m in sales in AZ, or $11m in profits?

Exactly like what it sounds. Hey, aren’t red states supposed to be ‘pro-business’ and no taxes?

Yeah. Pro business and no sales tax .

Hasn’t Arizona been more of a purple state this decade?

They voted Nazi party in both 2016 and 2024. They showed some reasoning ability in the 2020 election.

It sounds like AZ is saying they failed to remit $11M in sales taxes, so if the rate was 10% (I don’t know what it really is), that would indicate $110M in sales for which taxes weren’t paid.

They’re saying they have less than $11m in profits from AZ, because $11m is the tax+penalties amount from 2013-2019.

What RA is really saying is if the tax rate is 10% (or whatever the rax rate ends up being on average in AZ), they have less than 10% margins on sales to AZ.

sales tax is calculated at the register based on sale price not on the profit generated. corporate tax or corporate income tax is calculated based on profit.

I am aware of that. What I was saying is RockAuto’s quote was that the $11m in tax an penalties is more than their profit from that time period. So you can deduce from that statement the profits. I have no idea what the actual tax rate is in AZ, and according to the article and RockAuto, it actually varies based on the exact address the item is sent to. I used an example tax rate (a guesstimate average) to illustrate. You had previously asked about what RockAuto was saying, and I’m saying that they’re saying whatever the tax rate is, it’s higher than their margins.

Since they didn’t collect sales tax during the time period they believed they didn’t need to (under Quill), to now retroactively pay it for all those sales would more than wipe out their profit, because the tax rate is higher than the profit margin. It’s not like they’re going to back to customers from 2013 and say “um, actually plus tax your order equalled $X, please pay the tax now”.

Arizona says they owe 11 million so if sales tax was 10 percent that would be 110 million dollars in auto part sales whish is seriously doubtful they sold that much only in the state of Arizona.

That’s not the only money we’re talking about here though. There are also compliance costs.

Rock Auto stopped shipping to my COUNTY maybe 5, 6 years back over some similar city/county-specific sales tax collection nonsense that RA didn’t want to bother with – had to get parts shipped to one of my coworkers in the next county.

I have since moved to the next county over, so my magnet supply is unhindered again.

The Wayfair case decision was a pain in the ass for my company too, but thankfully we only have true nexus in four states.

Seems like ADOR is pushing more on the fact that they have distributors in the state than they’re pushing magnets = nexus.

Yeah, the ‘Magnet’ focus feels like spin. I think RA toed the line of what counted as a nexus and got burned (having third-party fulfillment warehouses which you have exclusivity contracts with and who use your software is… looking like an obvious attempt to use a loophole.)

I believe the warehouses could work with other partners they just couldn’t sell direct themselves.

I could be wrong on that and I’m not going to go look the case up and read through the pleadings to find out.

Mercedes did a fantastic job boiling this down but non lawyers often miss, glance over, or just don’t understand how important a lot of the minutiae is.

Yeah, but their use of RockAuto’s software indicates a closer business relationship than mere drop-shipping.

Manner and means is pretty ironclad.

I abhor the use of the word “loophole” when it comes to tax law. The burden of proof should always be on any government as to why they deserve one thin dime of anyone’s money, whether a business or a citizen. Calling lawful avoidance of paying taxes a “loophole” implies the assumption that this money was the government’s to begin with, and you are trying to avoid giving them something that belongs to them, rather than compelling the government to prove its case why it deserves the money in the first place.

That’s why I’ve said for years: the most effective price control on earth is a free man with his wallet in his hand and a skeptical look on his face, saying, “Yeah, but how much is this REALLY going to cost me? Nope, not at these prices.”

Right but the law is “if you do business in this state, you owe us taxes collected on the economic activity in this state” — there was a court case about this, which RockAuto lost! The burden of proof was on the government and the government proved it.

And many people, myself included, think the government’s case was bullshit.

Like I said elsewhere, killing the golden goose for its eggs is never a smart move, especially if the goose knows your plans. The goose can simply fly away.

I *think* but am not certain their (RA’s) focus on the magnets bit is that ADOR’s comments about “marketing specifically to AZ in AZ” = magnets, and AR is scoffing at that. Which, sure I’m ok with calling that silly…but it also kinda ignores a lot of the rest of it.

arizona doesn’t have a clause in the law that “defines” what constitutes having a presence. so when they took RA to court arizona had to pull at all the threads they could “see they got magnets and shipping tape and employees visit here sometimes even!!” the whole court case should be thrown out because the law fails to define what even IS a physical presence in the state and is thus unenforceable.

“L’etat c’est moi” bullshit. “The law is whatever we think will put power and money in our hands, and if you say otherwise, you’re a bad citizen, if not a criminal.”

I mean, the article mentions ADOR’s own guidelines DO say drop shipper does not equal physical presence. So it does have a definition. But their argument (including the magnets and tape and visits) is that this particular drop shipping arrangement is a physical presence.

So ADOR failed to define what a physical presence is.

They did define what a physical presence isn’t.

And now they’re arguing that the thing that isn’t a physical presence becomes one with tape+magnets+visits.

I’m not siding with ADOR here. I was replying to someone who thought it was odd that RA kept complaining “magnets=salespeople” and my interpretation of why they said that.

This is a good argument, I think ADOR is trying to draw a distinction that they should have clarified in their guidelines — that someone drop shipping from Arizona without any other activity in the state is exempt. Basically “if the only thing you do here is drop shipping, you’re fine.”

But uh… RockAuto showed up and sponsored things and marketed physically which changes things

And of course it *is* actual marketing! “We didn’t market, we just distributed promotional material to hundreds of people repeatedly” is not exactly a winning argument.

Well, there’s an ironic acronym.

Hodor?

Hahahah that seems about right

Classic tail wagging the dog situation of arguably poorly conceived (and poorly implemented – Homeland Security?) policy having perverse effects.

Freedom yo

Doesn’t look like a huge market for them in the first place.

I suppose AZ customers could do what I do to get cases of that wine I like, rent a mail drop just over the state border and send the packages there (I used to use one of my employer’s offices, until they decided to get rid of all their leases in said state). Though, that would be quite a drive for anyone in the middle of the state

Most of the population is either in Phoenix Metro or Tucson, both of which are closer to Mexico than to a state border. I think it would be harder to get stuff across the national border? Regardless, a six hour round trip to save on parts is probably not on the table.

el racoto

racoto.com.mx shipped by FedMex LOL

AZ person gets mail drop in CA for RockAuto Parts.

AZ person sets up mail drop in AZ for non-CARB legal performance parts.

AZ person drives to CA and ships non-CARB parts to CA and then picks up RockAuto parts.

Step 4: Profit, at least until they get busted.

Set up 2 offices 1 on each side of the border

Easier to just use Vegas/Nevada 😛

Well I neat trick is rent the box and put in a forwarding address.

That’s what I was thinking.

I have been giving my RA magnets to my grandson for his toolbox and he was excited when I got a big box (A/C hard line for my Ram) but when I opened it, there was no magnet, but instead a roll of “Aspen & Arlo” artisan wrapping paper featuring kittens wearing Santa hats.

https://aspenandarlo.com/products/maine-coon-santa

He was so bummed.

Uh, I don’t see the problem? Lol.

You might or might not realize that that was a rather negative comment to post on a website where one of the co-founders, David, has *several* cats he adopted after their mother gave birth to them in one of his Jeeps and another one of the co-founders, Jason, has a cat named Tomato.

Yeah, you and your grandson might gain some appreciation for the cat-themed wrapping paper after reading the multiple articles the aforementioned co-founders have posted about their cats, they’re a bit of a hoot to read 🙂

That’s a bit of a reach to turn my comment into a negative cat post. He wanted a car magnet and didnt get one. You might realize that that was a rather negative comment to post on a car website.

Heh. I sold shoes for years, and like many vendors, shoe companies send out little thank-you gifts at Christmas, usually some sort of sweet treat. Dansko, the nurse/chef clog company, used to send out a small box of chocolates shaped like their shoes, that were made by a really tasty artisan candy maker, and it was always one of the deliveries we looked forward to the most around the holidays. Somewhere circa 2008, Dansko decided that in lieu of candy, they would mail all their customers a box of environmental virtue signaling instead: a four-pack of CFL lightbulbs. Even the very crunchiest hippies at my company, which was based in Portland even, were incensed.

Not only that, but half of them were broken when they arrived. So basically, in the name of environmental awareness, Dansko shipped tiny boxes of biohazards to all its customers in North America.

The chocolates were far less harmful by every conceivable standard.

(PS: before you ask, yes, I once scored four touchdowns for Polk High, and to paraphrase Beetlejuice, IT KEEPS GETTIN’ FUNNIER EVERY SINGLE TIME I HEAR IT.)