Car owners in Arizona will soon find it harder to keep their cars on the road for affordable prices after an unfortunate court ruling. RockAuto, the popular car parts retailer based in Wisconsin, is being told to pay the state of Arizona $11 million in retroactive sales taxes in addition to paying the state’s already convoluted sales tax scheme. As a result, the founder of RockAuto says, it will have to stop selling car parts in the state. Let’s get into it.

Since 1999, Jim Taylor’s RockAuto.com has offered a refuge for car owners wanting to escape dealership prices. But more than that, RockAuto is famous for stocking parts for cars that have either lost manufacturer support, or have been built by manufacturers that have not existed for decades. The retailer’s motto is “All The Parts Your Car Will Ever Need,” and in my experience, it’s not even really an exaggeration. RockAuto’s influence spreads far and wide, from the countless Gambler 500 builds rocking RockAuto parts to my neighbor’s garage door, which sports dozens of the sweet collector magnets that you get in RockAuto shipments.

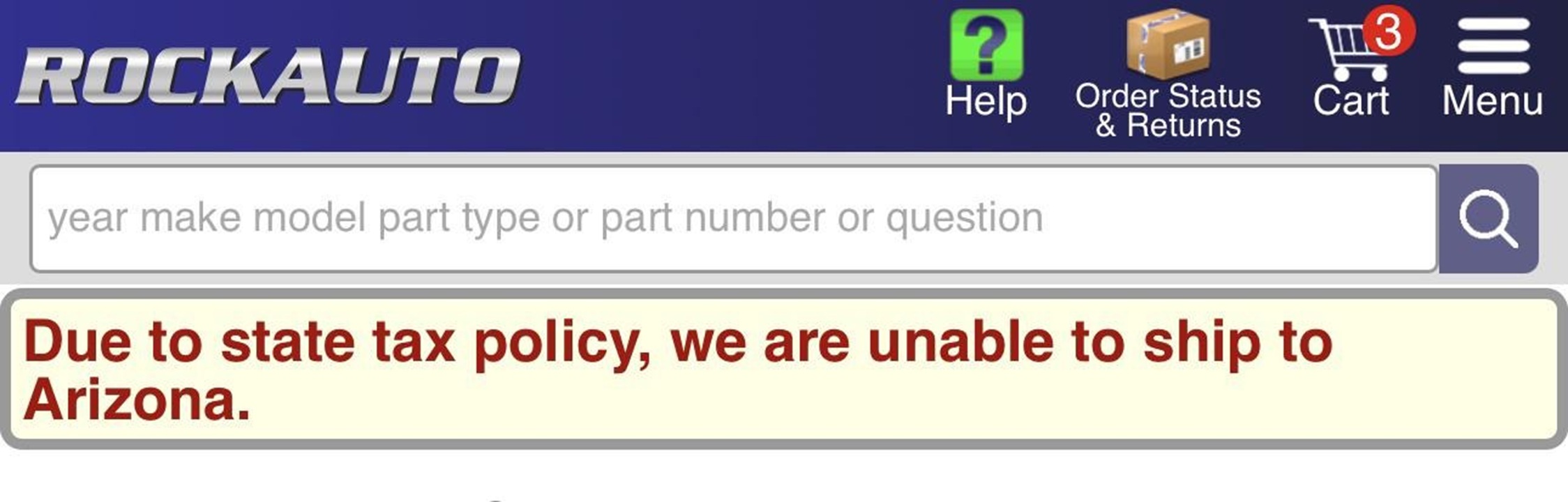

Sadly, if you own a car in Arizona and want to buy parts from RockAuto, time is running out. Due to how Arizona has chosen to impose sales taxes, the company says it’s now unsustainable to continue selling parts to customers in the state. But why is this happening?

Economic Nexus

In 2019, then Arizona Governor Doug Ducey signed House Bill (H.B.) 2757 into law. From the Arizona Department of Revenue:

This legislation requires remote sellers and marketplace facilitators—to begin filing and paying transaction privilege tax (TPT) in Arizona starting October 1, 2019. The legislation is the result of a 2018 ruling by the U.S. Supreme Court in the South Dakota v. Wayfair case. The decision allows states to require out-of-state businesses without a physical presence to collect and remit tax on sales from transactions in their state.

In 2018, the U.S. Supreme Court decision in South Dakota v. Wayfair, Inc. overturned the 1992 decision of Quill Corp. v. North Dakota. In Quill, the Court held that the Dormant Commerce Clause doctrine prevented states from collecting sales tax from retailers unless those retailers had a physical presence in the state.

In the decades since the Quill decision, an entire e-commerce industry has sprouted up and flourished. The states saw this as a bad thing because, thanks to that case, businesses were selling products all around America, and the states were missing out on hundreds of millions in potential sales tax money. States have also seen it as a negative for local businesses, as someone buying a product from a local business would have to pay sales tax, but that person could potentially buy the same product from an out-of-state seller and not pay tax.

In 2016, South Dakota passed Senate Bill 106. This bill was designed to attack Quill, and three large retailers refused to comply: Wayfair, Overstock.com, and Newegg. The state took the issue to court, and the law was shot down by the Sixth Judicial Circuit Court of South Dakota and the South Dakota Supreme Court. This set the stage for the state to take it to the U.S. Supreme Court. The Supreme Court decision is 40 pages long, but it can be summarized in a single sentence. The South Dakota v. Wayfair decision overruled Quill‘s physical presence rule, which Arizona claims gives it the power to tax out-of-state businesses that purposefully avail themselves of the market in that state.

RockAuto’s Alleged Taxes

RockAuto has complied with Arizona’s Transaction Privilege Tax since the revision went live in 2019. But then, something odd happened. The Arizona Department of Revenue (ADOR) ran an audit on RockAuto’s sales in the period between April 1, 2013, and April 30, 2019. ADOR had concluded that RockAuto actually did have a physical presence in Arizona and, as such, should have been paying sales tax in Arizona before 2019. How much did ADOR want? $11 million, which covers the taxes and penalties that the state says it missed out on.

RockAuto challenged this notion that it has a physical presence in Arizona, and in early June 2020, the parts retailer filed a complaint in the Arizona Tax Court. In April 2023, the Superior Court of the State of Arizona, in the Arizona Tax Court, ruled in favor of RockAuto. In that case, ADOR argues why it thinks RockAuto has a presence in the state:

The Department contends that “RockAuto’s extensive use of its [at least six] in-state Affiliates (which it calls suppliers) to fulfill orders in-state, and other in-state actions . . . show that the necessary physical presence exists.” […] The Department “see[s] no reason to treat [RockAuto] differently for tax purposes merely because it employed agents to do in Arizona what it could have done itself.”

The Court then states some interesting facts about RockAuto’s parts business in relation to Arizona:

While it is undisputed that RockAuto spent $132,964 in advertising allocated to Arizona during the audit period, and it provided magnets, goodie bags, or other promotional items to more than 500 events in Arizona during the audit period, RockAuto is indisputably an online retailer located in Madison, Wisconsin. […] Its provision of those items to Arizona—the latter items upon request of the event organizers—does not make that Arizona-based activity.

It is also undisputed that roughly “89% of orders RockAuto placed with Arizona suppliers shipped to customers outside of Arizona,” while “83% of RockAuto’s sales to Arizona customers came from suppliers outside Arizona.” […] (While the Department did not dispute these statements of material fact, it lodged relevance, foundation, and hearsay objections to them. The Court overrules each of those as unfounded.)

The Department rests its analysis on “the important fact [] that the in-state activity is effective in creating and maintaining the in-state market,” but fails to countenance those material facts that RockAuto’s Arizona suppliers do not generally or significantly direct their activities for RockAuto at establishing or maintaining an Arizona market.

However, the Court claimed that RockAuto’s suppliers in Arizona do not exist to help RockAuto establish a market in Arizona, as ADOR insisted. Instead, the Court claimed, whether a customer gets a part from a supplier in Arizona or not is entirely up to them. RockAuto can be configured to get parts to you based on your desired cost, speed, or efficiency. Because of this, only 11 percent of orders placed in Arizona are fulfilled by suppliers in Arizona, and the Arizona suppliers ship most packages to other states.

The Court ruled that RockAuto did not have the requisite physical presence for the state to try to collect taxes from RockAuto. The Court then ordered ADOR to pay RockAuto $892.95 in costs and $136,875 in attorney fees.

ADOR Appeals

ADOR wasn’t willing to let it go and appealed the case to the Arizona Court of Appeals, which reversed the decision and the fees ordered by the lower court a year later. What was different this time? The Arizona Court of Appeals agreed that, sure, only 11 percent of RockAuto’s sales in Arizona were fulfilled by suppliers in Arizona, but the volume didn’t matter. For that Court, what mattered was the function of the suppliers. From the case:

During the audit period, RockAuto contracted with distributors, six of whom were in Arizona, that supplied inventory, shipped orders, and processed returns for RockAuto. About 11% of orders placed with Arizona distributors shipped to Arizona customers, and slightly more than 80% of orders placed by Arizona customers shipped from outside Arizona. RockAuto did not maintain its own inventory. Instead, RockAuto required its distributors to send RockAuto daily inventory lists, and RockAuto listed the distributors’ products on its website. Customers placed orders through RockAuto’s website, and RockAuto forwarded the orders to its distributors.

RockAuto’s contracts required the distributors to comply with RockAuto’s shipping and return policies. The distributors had to use RockAuto’s software, which printed shipping labels listing RockAuto’s name with the distributor’s address. RockAuto also required its distributors to package RockAuto’s orders using RockAuto’s branded tape, include a RockAuto promotional magnet, and ship the orders directly to customers by mail or common carrier. RockAuto paid for the tape, magnets, and packing boxes. RockAuto suffered the loss if in-transit packages were lost or stolen. If customers returned products, RockAuto provided return labels that had RockAuto’s name with the distributor’s address.

RockAuto chose which distributor and location fulfilled customers’ orders. RockAuto considered multiple factors but prioritized “getting the customer his part quickly, getting him a reasonable shipping cost, [and] having it be the right part.” If a customer’s online cart contained multiple items, the customer could see if the products would ship from different warehouses. But RockAuto did not disclose the warehouse’s location or that it used distributors to fulfill orders. RockAuto’s website also allowed customers to select different brands of the same part and then click “Choose for Me to Minimize Cost,” and RockAuto’s system selected the brand that would ship with the other products for the “lowest total cost.

The Arizona Court of Appeals disagreed with the Tax Court, saying that the customer actually doesn’t have the choice of where they get their part from. Apparently, the Tax Court confused RockAuto’s option to have more than one part of your order to ship from the same place as meaning that you get to choose to get the part from an in-state supplier. The Arizona Court of Appeals continued:

Customers were responsible for all shipping costs, and customers complained if shipping was expensive or took too long. RockAuto advertised that its prices were lower than its competitors’ prices, and having distributors ship directly to customers was less expensive than reshipping orders from Wisconsin. RockAuto’s president said RockAuto chose distributors based on inventory and “whether [it had] a facility that is suitable for e-commerce” and that location was not a factor. But he also said shipping times were lower when Arizona distributors shipped orders to Arizona customers and that shipping costs were “related to the distance.”

RockAuto did not want to compete with its distributors;so,its contracts prevented the distributors from selling products directly to consumers through the distributor’s website, a website the distributor controlled, or a third-party’s website. RockAuto helped its distributors resolve ongoing issues with inventory, orders, and RockAuto’s software. During the audit period, RockAuto employees made four one-to two-day business trips to Arizona to meet with distributors.

RockAuto Takes A Hit

In the end, the Arizona Court of Appeals ruled that RockAuto does have a presence in Arizona, since it has its Arizona suppliers ship to Arizona customers, use RockAuto’s systems, and handle RockAuto’s returns. The Court supports its conclusion by pointing out that RockAuto’s employees also visited the suppliers in Arizona and that RockAuto sends promotional materials to customers in the state. The Arizona Court of Appeals ruling also seems to imply that the Arizona Tax Court might have been applying Quill‘s nexus test in a post-Quill world. Either way, this spells bad news for RockAuto.

Jim Taylor made his voice heard, explaining how absurd he thought the whole situation was, from the Arizona Capitol Times:

Somehow, every Arizona factory and wholesaler selling parts to us became our branch office when we asked them to ship directly to our customers. Address labels became stores, refrigerator magnets became salespeople and, magically, RockAuto was in Arizona.

No previous court case (including ours in the Arizona Tax Court) found a retailer “physically present” without employees or assets or someone making in-state contact with customers. ADoR’s own publications say “drop-shipping” from Arizona suppliers does not create tax liability. But ADoR persists in demanding six years of taxes (which we didn’t collect from customers) plus interest and penalties — far more money than we earned in 20 years selling auto parts to Arizonans!

RockAuto said that, due to Arizona’s tax rules, it might have to stop selling parts to customers in the state. That was back in 2024. Since then, the news has been quiet. That was until August 2025, when a TikToker posted a video claiming that RockAuto had ceased selling parts to customers in Arizona.

Bad News For Arizona Car Owners

There has been a bit of a panic among fans of RockAuto since then, but information has been thin on the ground. Some people report not being able to order parts to an Arizona address, while most people have reported no issues. What gives? I reached out to Jim Taylor for an explanation, and he sent me this:

RockAuto is selling to most Arizona customers right now. Below is an explanation of what happened in August, which we posted on Facebook in response to what I suspect is the same video you saw on TikTok.

However, the current situation is not sustainable so we plan to stop sales to Arizona in early November. We’re working on an announcement now to customers who have gift certificates or store credits they may want to use for Arizona shipments. Additional facts may help you understand this situation:

1. It’s true we had a long, costly and ultimately unsuccessful battle over Arizona’s retroactive “magnets are salespeople” theory. But the message you saw refers to a new policy: blocking automated access (due to “cyber security protocols set by AZ Homeland Security”) to the website we used to find tax jurisdictions and rates since 2019 (when Arizona began requiring retailers to collect tax regardless of “physical presence”).

2. Automated access to jurisdiction and rate data is essential for us because, while in-state retailers pay tax based on the location of their stores (even if they ship to customers in other parts of the state), Arizona requires out-of-state retailers to pay whichever combination of approximately 100 local taxes applies to each customer’s home or business. We stopped accepting orders because we can’t sell without collecting tax and we had no way to know what tax to collect.

3. After a few days of panic, we found another way to obtain location and rate data so we are accepting Arizona orders again. Some customers still may see a “can’t ship to this address” message because the “work around” does not work for all addresses.

4. We’re not sure how long we can continue such a fragile approach to something as important as taxes. Arizona tax rates are much higher than our profit margin so it’s less costly to miss a sale than to fail to collect the right tax. And we learned in our court case that, unlike other states, Arizona does not impose a sales tax on consumers which businesses are expected to help collect. Arizona has a Transaction Privilege Tax making retailers solely responsible for knowing what taxes to collect and pay. Those who can’t figure it out must forego the privilege of selling to Arizonans.

5. This situation is unique to Arizona. Even if we are unable to take new orders from Arizona, we’ll honor warranties and accept returns for past customers as always. And we’ll happily ship parts anywhere outside Arizona, for as long as there are cars and people who need to fix them!

In short, Taylor says it will cost RockAuto less money to lose all sales in Arizona than it would cost to accidentally pay the wrong tax. So, RockAuto making the decision to stop sales to Arizona customers this November. RockAuto already stopped buying parts from Arizona suppliers in late 2024. Jim Taylor also worries that RockAuto will only be the start, as his business cannot be the only one that has no offices in Arizona, but has suppliers and customers in the state.

Sadly, it’s unclear how you can help. Thousands of car enthusiasts have already sent letters to the office of Governor Katie Hobbs, urging the state to change direction. However, the state has thus far remained steadfast.

Sadly, this is a five-year battle that, at least for now, ADOR has won. But in reality, it seems like everyone loses, as ADOR loses a stream of money, car owners in Arizona will lose a parts resource, and RockAuto will not be able to serve customers in Arizona.

(Correction: We accidentally took Taylor’s quote out of context, and that has been corrected. We regret the error.)

Top photo: RockAuto

American tax code at it’s finest.

Arizona proving once again it’s the worst state to live in

I have been buying rockauto parts here in AZ for years, I have never gotten something shipped from in-state. I will miss the magnets, hopefully things change in the future. Also, don’t sleep on the rockauto t-shirts. Decent t-shirts for 8 bucks.

RockAuto wasn’t able to ship to a lot of Colorado, but it appears that they fixed it now. I was kind of tired of going to Wyoming to pick up my parts.

I’d love to see this proof. As far as I know, rock auto does not own the warehouses nor the parts. They are a website only.

The article covers this reasonably well – they exert enough control over the process and the distributors that it counts as being in-state. Which makes sense – otherwise companies would just play games with shell companies to avoid taxes entirely.

This really is absurd…made me think of this though:

“I’ve got some…oceanfront property in Arizona”

I thought maybe AZ outlawed little flexible fridge magnets

Various states and smaller countries have been trying to claw back tax revenue by imposing these taxes on non-intra-state businesses. The problem is by making these laws and putting them into effect they’re killing the small and mid-size online business that support the economies of multiple states, as only the giants who had the money to do dodge the taxes in the first place will end up paying any.

In other words, the only websites that will be able to hack it will be places like Amazon, Digikey, and Newegg.

This screws over brick and mortar businesses too, because they can’t move stuff as quickly as an online businesses with commerce transit and distribution hubs can. Those online giants will absorb even more of the overall transactions which will give them even more resources and leverage to strangle the physical stores.

I just don’t know what the hell fear we Americans have of a unified tax instead of carving out a dozen different caveats. Most other countries have VATs because it gets rid of this tangled web of taxes based on region and sales type.

this is a good point. a lot of the E-Commerce giants started out as brick and mortor stores and then expanded. having to hire accountants 10s of thousands a month and book keeping software to track all these taxes is a huge barrier for entry for smaller businesses.

i wonder if we will get to a point where a shipping company becomes a middle man. you tell DHL you want to buy X from rock auto and shipped to your house. DHL buys X from rock auto. Sells it to you for a tiny bit of markup and then ships it to your house. DHL does the transaction in rock auto’s home state or a no sales tax state like florida and then delivers it to your house.

Don’t e-commerce sales tax platforms like Avalara and TaxJar handle most of these sales tax complexities? I mean, even eBay uses something like that on their side to handle sales tax calculation and payments for sellers.

Yes, a unified VAT would make things much easier, and Arizona basically saying “if you have a warehouse here, you have a physical presence here” is kinda bullshit given the way fulfillment works these days, but it occurs to me that the technology to clear these hurdles is readily available.

As far as I know they expect a certain level of diligence from their customers to report the proper earnings for the tax to be deducted. But a lot of these recent laws make that difficult because the rules are different for each state, and some like the ones in Arizona are obscured unless you go through a specific channel. Thus defeating the purpose of the tax agents you hired in the first place.

I operate multiple online businesses. Managing tax liability is the single biggest headache our company deals with. I’m sure that’s no news to many Autopian readers.

One of our online stores may stop selling to customers in California. We’ve got our California sales tax situation pretty well sorted out and running smoothly. That’s not the problem.

But California seems to think we should be paying state income tax. We have no physical presence in California and never have. But the state is taking the position that selling products to people who live in California means our company is liable for state income tax.

Unless we can beat this we will stop selling to customers in California. And since that’s where most of our sales happen it will be very difficult to justify keeping that online store open. And California will have succeeded in closing a business run by two people, part time, from their home in another state.

It’s getting harder and harder to be an online retailer. We don’t even ship outside the US any more, it’s too much expense, trouble, and most of all risk of whether the package will even get there. And thanks to the Supreme Court, states where we have no presence or representation are requiring us to collect taxes for them? I don’t get paid to collect and disburse sales taxes for 50 states.

AZ resident and person-with-too-much-exposure-to-tax-law here. Mercedes did a nice job of summarizing the arguments in both cases, as well as indicating that the Ducey TPT law is poorly written.

However, the real tax law issue here is that Rock Auto has both a physical nexus and an economic nexus in the state, so they clearly owe sales taxes in AZ, just like Amazon and eBay and any other online retailer.

Rock Auto is choosing to not do business in AZ, and the fact pattern seems to be that their choice is based upon the fact that they calculated a tax amount owed that was different from what the AZ tax authorities calculated. One or both of them may have executed their calculations with imprecision or inaccuracy, who knows. But Rock Auto is not being forced to stop selling in AZ, they are making that choice so that they don’t have to pay that difference.

In the end, this is a failure of leadership at Rock Auto to engage their government relations organization with the AZ tax authorities to work out what the sources were of difference in the amount owed, and to agree on a number to pay. Taking their ball and going home is not a mature or executive decision.

If I understand Taylor’s comment at the end, they are choosing to stop selling in Arizona because Arizona won’t give them access to the tax details they need to collect tax correctly from customers. See this excerpt from his message:

But the message you saw refers to a new policy: blocking automated access (due to “cyber security protocols set by AZ Homeland Security”) to the website we used to find tax jurisdictions and rates since 2019 (when Arizona began requiring retailers to collect tax regardless of “physical presence”).

They didn’t take their ball and go home because Arizona required them to collect tax, they did it because Arizona insisted that they collect tax and then wouldn’t tell them how much to collect. Since getting that wrong would cost them more than they’re making on Arizona sales, they chose to not do business there.

Lol our government being run by old farts who don’t understand that increasingly, digital infrastructure is also the infrastructure is governance, is why these tech companies have so much power.

You are correct that this is what Taylor stated, and he is correct that the TPT is sort of unique in how it defines the tax collection calculations for state / local / municipality.

But his statement elides the fact that you don’t hear about OTHER online retailers failing to overcome administrative hurdles to obtain the rate data. Instead, other online retailers have taken the time to work through the access to the data available through the state website.

The Ducey administration sponsored several poorly-worded laws, and the current Republican state legislation leadership has further impaired the processes necessary for doing business in AZ, including the dip-stickery that is “AZ Homeland Security”. But the professionals in the state tax administration deal with online retailers who have a tax nexus in AZ all the time, and they regularly solve basic tax rate data access issues with other companies, and they regularly come to agreements on back sales tax with other companies as well.

Mercedes’ article paints a picture that suggests Taylor might be an unreliable narrator of the situation, given the unique situation in which Rock Auto has found itself. Which is unpleasant for me, since I buy stuff from them.

That’s fair. I definitely have some questions for both sides (like why does DHS care about “protecting” tax information that is presumably supposed to be public information anyway?). Maybe we’ll get a followup article at some point that airs out all the dirty laundry. 🙂

The protection is probably about closing down open access to creaky systems that the state originally built to serve internal needs. Wouldn’t surprise me at all to learn that the state security people determined that several open apis were Swiss cheese.

Those who say that Republicans are pro-business are rather inaccurate. They seem to favor big businesses, by removing environmental protections, lowering taxes and providing subsidies, but do not know how to put the words together to write laws that actually benefit businesses and consumers, such as the customers of Rock Auto.

“ the company says it’s now unsustainable to continue selling parts to customers in the state.”

That’s a lie.

What it really means is they now have to compete on an even footing with parts suppliers based in Arizona. And with a bit of programming, they most certainly can charge sales tax for customers with Arizona delivery addresses.

That same thing is already done elsewhere… like in Canada. Live in Ontario? Pay the Ontario sales tax. In Quebec? Then pay the QST.

Why should Rock Auto be allowed to get away with not charging sales tax?

They shouldn’t.

I’m on Arizona’s side on this.

Sorry, but did you read the full article? Rock Auto has been collecting taxes for years in Arizona and in the quote from Jim Taylor he’s saying that they no longer have a way to know what taxes Arizona is charging in each area due to new “cyber security protocols”. So he’s saying they won’t sell in Arizona anymore because they don’t know how to figure out what taxes to charge. Additionally, they disagree with the notion that they have a physical presence in AZ and as such should not have to backpay taxes from 2013-2019, which is the court case that has bounced around.

“ because they don’t know how to figure out what taxes to charge. “

I still think that’s a lie. I don’t believe it for a second. How is it that other businesses can figure this out and not Rock Auto? Nah… that’s bullshit.

“Additionally, they disagree with the notion that they have a physical presence in AZ and as such should not have to backpay taxes from 2013-2019, which is the court case that has bounced around.”

In my view, if they are selling to AZ people while they are physically on AZ land, then they have enough presence to pay the taxes… including the back taxes.

And you’ve provided further evidence you didn’t read the article.

Rockauto has no physical presence in Arizona, they don’t have a single building that says “Rockauto”, they don’t have a single employee stationed in the state. They place orders with INDEPENDANT suppliers that are in the state of AZ to send parts all over the country, some of which end up in AZ.

You just provided evidence that you didn’t read/comprehend what I said. Let me repeat and clarify it…

“In my view, if they are selling to AZ people while they (THE PEOPLE DOING THE PURCHASING) are physically on AZ land, then they have enough presence to pay the taxes… including the back taxes.”

Just because your customer is in AZ doesn’t mean your company has a physical presence in AZ.

A physical presence in AZ would be a building registered to the company, an employee with an AZ address for their tax filing, etc. “Someone went on the internet and bought something” is not the same.

And they were paying taxes, they’re objecting to AZ attempting to rug pull them by retroactively applying taxes because they’ve suddenly changed their interpretation of their own tax law.

The point I’m making is that why should a company outside of AZ get a free ride on taxes compared to local AZ companies?

If you’re selling product to AZ people, then you’re doing business in AZ.

The physical ‘bricks and mortar’ presence idea is out of date.

In the past, various governments simply let it slide because the dollar amounts involved in e-commerce was small and not worth the time.

However these days, buying stuff online is the way most do it now. So it’s not small potatoes anymore. And on top of that, it’s driving local companies out of business in some cases.

That’s why governments are becoming sticklers about this.

And as I said in an earlier comment… if other companies can figure this out, why can’t Rock Auto?

And if the interpretation of tax law truly changed, why isn’t this affecting a bunch of other online sellers?

Does an AZ company selling and shipping to AZ residents who are in a different tax jurisdiction need to comply with the tax in the delivery jurisdiction?

Yeah, so I read what you’re saying and regardless as to how byzantine the tax code is, how do jamesmaypointsateverything.gif retailers manage to make it work? ECS Tuning, for example, they’re in Ohio, why are they special and or geniuses?

I’m never going to give Doug Doucey credit for anything* I’m sure he’d be perfectly happy signing a crap tax code into law, but that was long enough ago someone else would have pitched a fit. This sounds more like sour grapes.

.

.

*OK one thing I’ll give him credit for; he sent trump’s phone call to voicemail when he was certifying Bidens win in 2020. I mean I’m sure trump was calling to make sure he certified Biden winning Arizona… I’m sure.

They’re not trying to skip out on taxes, Arizona is making it not worth RockAuto’s time and money to figure out what RockAuto needs to charge their cusomers. In all likelihood, other companies are having the same issue and are simply flying under the radar (which I know from personal experience) or have margins high enough that a tax error can simply be paid without taking a loss.

Should rockauto be paying taxes? Absolutely. Should the state of Arizona be intentionally obtuse when providing the information to make that practical for a company? Absolutely not if they want their business, which it doesn’t seem that they do.

If physical presence were the issue, then maybe Rock Auto would have an excuse as you describe.

Unfortunately for them, sales tax nexus is easy to identify, and they clearly have achieved nexus if they owe $11 million.

The generally accepted limit that provides evidence of nexus is $100,000 in sales or more than 200 transactions.

What is Nexus? | Sales Tax Institute

It seems to me that the issue is, AZ does not have “a state sales tax”. That would be easy to deal with. AZ has hundreds of different sales taxes and no way to determine what particular combination applies to any particular sale. And the fact that AZ businesses shipping to addresses inside AZ (or selling to an individual who doesn’t live in the business’s jurisdiction) don’t have to comply with that is just frosting on the cake.

Not saying it isn’t complicated. I’m only saying that given other online retailers are able to figure this out, there’s no excuse for Rock Auto figure it out as well.

They don’t seem to be getting a free ride, they are and have been paying the taxes required since the 2019 law went into effect. There seems to be some confusion on how to continue to do that, but the main issue seems to be the taxes AZ is demanding from prior to the current law going into effect. The attempt by the state to grab some disputed past due taxes seems to have now cost them the future revenue stream that would exist if the business continued to operate there. All I see is losers in this one, no winners. Glad I can still order stuff and get those sweet magnets where I live!

No, Rock Auto is stating that the $11 million in back taxes and penalties that Arizona is claiming it is owed is more than they have profited from all sales in AZ in the last 20 years, and rather than pay the $11M in Arizona to continue sales there, they are choosing not to continue sales to the state because the state is attempting to screw them over, and its not economically viable to sell there when you factor in an $11M penalty. They could revise their tax collection and still compete, they have since 2019 until now, in compliance with the tax law that was passed for 2019 onward.

The objection is Arizona is trying to extort money from Rockauto by changing the definition after the fact, so Rockauto is choosing to no longer do business in the state.

“No, Rock Auto is stating that the $11 million in back taxes and penalties that Arizona is claiming it is owed is more than they have profited from all sales in AZ in the last 20 years, ”

But that’s an apples-to-oranges thing. Rock Auto fucked up and didn’t collect enough tax at the point of sale. That’s on them. The taxes themselves should not affect their profitability… IF THEY ARE COLLECTING THEM PROPERLY.

But given some of my past experiences with stupid shit Rock Auto does like greatly jacking up shipping fees just because what I ordered didn’t all come from the same warehouse, I’m not surprised that they don’t have a taxation specialist on their staff who would do the homework so the company would avoid problems like this.

The only time this would truly be unfair is if it was a different standard being applied to Rock Auto compared to everyone else.

And I don’t think that’s the case here.

Rock Auto’s management is just pissed they lost the case and is throwing a hissy fit and is merely sending an ‘FU’ message to the state of AZ.

What is stupid about that? Now they have to pay for multiple shipments instead of just one.

It’s stupid because they’ll have a very similar product in the same warehouse… but that very similar product will slightly more expensive.

And I’m not talking about a small increase. I’m talking about me picking different things then getting to the point where I’m about to pay and the cost of the parts/supplies was around $100 and the cost of shipping was over $100.

Essentially instead of having a proper warehouse and distribution system, it seems they just have a bunch of ad hoc locations they ship from and try to make the consumer pay for the end result of that.

So your complaint is that the parts are too cheap…….

Maybe try and cross shop those parts at your local auto parts store and see what it adds up to…….

No… my complaint is their shipping/supply chain is convoluted which makes their ‘cheap’ pricing misleading.

And the parts, with individual shipping each from a different warehouse, are still going to end up cheaper than getting the part at your local Autozone.

For example, an Alternator for a 1987 Civic

Auto Zone, Duralast 14757, including core charge and not including tax, $159.99

Rockauto, AC Delco 3341716, including core charge AND delivery, AND TAX, delivered to my door, $97.00

You’re getting hung up on the fact that your shipping charge was the same as your parts charge, and not the fact that buying those parts locally would have cost you more.

I find it in a lot of cases, the pricing is a wash or only slightly more expensive when ordering from a local store and selecting the ‘pick up at store’ option.

Now one unique thing about me is I’m in Canada… so because a border crossing is involved, the shipping from Rockauto is a lot more expensive for me.

And since last year, I’ve stopped buying from them and have been buying stuff from local suppliers.

Interesting that AZ is such a stickler considering I (not an AZ resident) remember walking into a jewelry store with my father (an AZ resident) in Phoenix in the early 90s and walked out without paying sales tax on some jewelry he bought for my step mother because I showed my NC ID and thus it was written up as being sold to an out-of-state resident.

Great article!

As an AZ resident, I will sure miss my Rockauto magnets. What a bummer.

I have dozens of them. I have been thinking of putting the collection up for sale on Ebay.

If your contractor can only do business with you and represents themselves as your company when interacting with the public then in many cases they are going to consider you one and the same for regulations. It’s not the same as typical drop shipping, they are an agent of your company.

Ding ding ding! This is exactly what I was getting. It’s like the test to see if someone is being improperly classified as a contractor instead of an employee. If the description is accurate, these locations were under the complete control of RA.

And honestly, while I appreciate the simplicity of the late 90s web interface, they don’t have magical inventory of NLA parts as alluded to at the start of the article, and in my experience, I can usually find the parts for less money elsewhere.

This isn’t quite what Taylor said. He said it would cost less to lose all sales in Arizona than it would cost to pay the state’s taxes if they were collected incorrectly. Which he clearly thinks is a likely event. There is nearly zero cost to RockAuto paying state taxes if they collect them correctly, because they charge the customer for them and only have to pay admin to get that money to the state. But with a convoluted system in place, they are unable to guarantee they will collect enough taxes, making it likely they will lose money.

It seems like they could go another route, though its super customer friendly either. Determine the highest % of tax you might have to collect, then charge the tax amount you think you need, and charge the difference to the customer as an Admin fee or some such, which goes in to an account to pay off any additional taxes levied. Yes, that would be taxable income, but it should provide enough funds to pay for that too, since sometimes, they will be charging the correct amount and not need the additional for taxes.

Thank you for pointing this out. I screwed up there. It has been corrected.

“only have to pay admin to get that money to the state.”

0.9% of all taxes collected are going to be owed to the credit card company as a transaction fee

True. Most would never think of this. So there is a cost (although a small one).

There is also a significant cost involved in paying for the calculation software and filing returns in every state where you have nexus. Significant.

And the credit card fees are going to be 2-3% at minimum. Hear that? It’s the sound of margins eroding.

Surely they already have software and filing costs for the other forty nine states.

Apparently they are using janky software. I know from personal experience that there are some…entry level…options that seem to offer great savings but are a real problem to actually deal with. If the “website” they’re using to calculate taxes is actually being blocked by AZ, it’s not one of the more professional ones out there.

I just received an order from them last week, I was shocked as I thought they’d already cut us off. It’s beyond infuriating as it seems like they are cherry picking on them when most other online retailers would be in the same boat, so I guess we’ll see what happens.

They cut off our PornHub access as well, the right wing is trying to turn us into Texas (although it took a mass shooting for them to get open carry, which we’ve had since our inception).