The day has come. The day I’ve long expected and, in some ways, feared. The average transaction price for a new car finally eclipsed $50,000. This isn’t a surprise, and it isn’t purely a sign of cars getting more expensive. It’s more a reflection of who is actually buying cars and the realities of the modern economy.

The Morning Dump today is going to focus on the world we live in now, versus the world automakers wished we lived in. I’ll start with the big $50,000 number, which does have a little to do with electric vehicle sales. It’s not like those sales are making people money, as GM is going to take a huge hit due to the loss of EV momentum.

While everyone dreams of alternative fuel sources, Brazil is one of the few places where that’s actually happening. It’s one of the reasons why BYD is expanding in the country. And while we’re talking about the boys from Brazil… Mercedes has a new vision for its brand.

Is It The Car Or The Buyer?

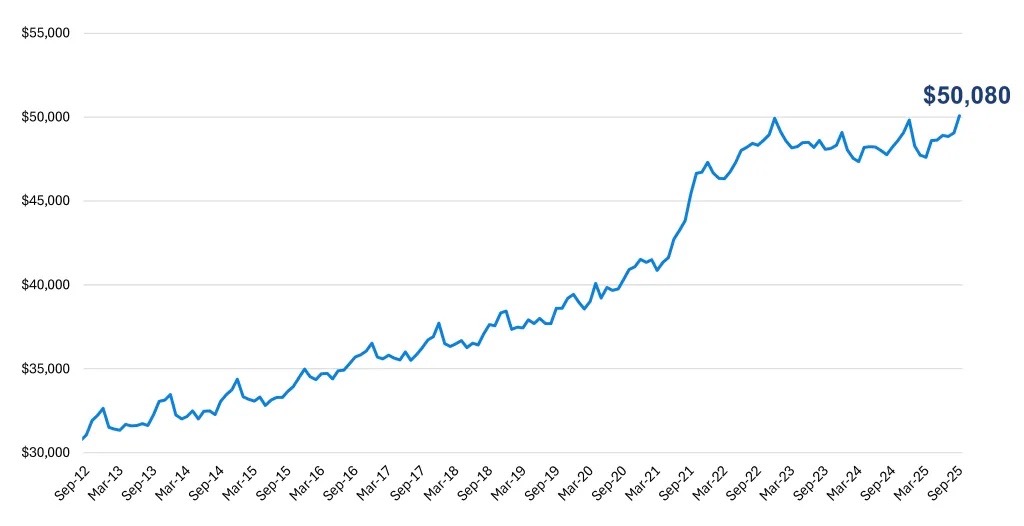

The Average Transaction Price (ATP) chart from KBB/Cox Automotive has almost hit the $50,000 mark twice before. The first time was back in 2022 at the height of pandemic supply shortages. The second time was about a year ago. Finally, for the first time ever, the number eclipsed the $50,000 mark in September.

The number has been hovering close enough to the $50,000 mark that it’s not particularly important that we’ve crossed it. What’s the difference between $50,080 and $49,760 to the average car buyer? ATP essentially takes the total revenue of cars sold in a given period and divides it by the number of vehicles sold, giving you a price that’s more accurate than the average MSRP because it takes into account what the vehicle transacted for after all of the various offsets.

What’s interesting to me here is that this is not merely a reflection of the lack of affordable cars. That’s a part of it, sure, as are perhaps the first impacts of tariffs. A major reason why the average car was more expensive is that a record number of EVs were sold in the United States, and EVs are more expensive (the average ATP of an EV was $58,124 last month). This means that it’s possible there’s a drop in ATP next month.

I’m more interested in what this means about the average buyer. Car sales are still robust even as cars get more expensive. This means that people buying cars are either stretching their budgets (that’s happening) or are merely rich enough to afford a new car.

“It is important to remember that the new-vehicle market is inflationary. Prices go up over time, and today’s market is certainly reminding us of that. While there are many affordable options out there, many price-conscious buyers are choosing to stay on the sidelines or cruising in the used-vehicle market,” explains Erin Keating, Executive Analyst at Cox Automotive. “Today’s auto market is being driven by wealthier households who have access to capital, good loan rates and are propping up the higher end of the market. Tariffs have introduced new cost pressure to the business, but the pricing story in September was mostly driven by the healthy mix of EVs and higher-end vehicles pushing the new-vehicle ATP into uncharted territory.”

I think I’ve referenced this before, but it does remind me of the debate between two jazz musicians (played perfectly by Wesley Snipes and Denzel Washington) in Mo’ Better Blues. Does the audience not come because they don’t care, or do they not care because you’re not playing what they like?

To put it in automotive terms: Are only wealthy buyers entering the market because they’re the only ones with money, or are carmakers not building the kind of affordable cars people want? It’s probably some of both.

The modern economy provides great income growth for some people and for stockholders. The best way to have money is to have money, because the new increases in wealth will be coming from efficiency gains due to AI. If that’s the case, where does the average worker end up?

Some call this “jobless growth” or, the “K-Shaped economy.” From CNBC:

Consumers in the top 10% of the income distribution accounted for 49.2% of consumer spending in the second quarter, marking the highest level since data started being compiled in 1989, according to Mark Zandi at Moody’s Analytics.

The so-called “K-shaped economy” has performed well so far, at least according to broad economic measures such as GDP and consumption. Yet the growing dependence on a small sliver of consumers at the top carries risks.

Zandi said a deep and prolonged decline in the stock market, which is driving almost all of the wealth gains at the top, could send wider ripples through the economy.

“The economy is being powered in big part by the spending of the extraordinarily well-to-do, who are cheered by the surging value of their stock portfolios,” he said. “If the richly (over) valued stock market were to stumble, for whatever reason, and the well-to-do see more red on their stock tickers than green, they will quickly turn more cautious in their spending, posing a serious threat to the already fragile economy.”

The economy depends on AI adoption to continue at an increasing pace, and for wealthier individuals with stocks to keep spending money. How long will that last?

GM Takes $1.8 Billion On EV Production

I’d argue that General Motors is the best-positioned EV company in North America that isn’t Tesla, but that doesn’t mean that all the churn in the electric car market isn’t taking its toll on the automaker.

A recent filing, reported on by the Detroit Free Press, shows that GM plans to take a $1.6 billion writedown from EVs split between $1.2 billion for unused equipment and $400 million for supplier cancellation fees:

“General Motors Company made significant investments and contractual commitments in the development of electric vehicles to help the company’s vehicle fleet comply with emissions and fuel economy regulations that were scheduled to become increasingly stringent,” read the filing. “Following recent U.S. government policy changes, including the termination of certain consumer tax incentives for EV purchases and the reduction in the stringency of emissions regulations, we expect the adoption rate of EVs to slow,” the filing continued. “Our strategic realignment of EV capacity does not impact today’s retail portfolio of Chevrolet, GMC and Cadillac EVs currently in production, and we expect these models to remain available to consumers.”

This equipment will probably be used eventually, but not at the pace initially expected, so GM has to adjust its books.

BYD Launches Ethanol Plug-In Hybrid In Brazil

Brazil made the use of sugar-based ethanol a major part of its path towards energy independence after the gas shocks of the 1970s. The country’s vehicles use a mix of gasoline, bio-diesel, and ethanol to power their vehicles.

Now it looks like the world is getting its first flex-fuel engine-powered PHEV in the form of the BYD Song PRO. From a press release:

BYD founder and CEO Wang Chuanfu said: “After two years of effort by more than 100 Chinese and Brazilian engineers, today our 14 millionth vehicle rolls off the production line equipped with the world’s first plug-in hybrid engine dedicated to biofuel. This is not just a technological breakthrough – it is a green and sustainable solution tailor-made for Brazil.”

He added: “Two years ago, on a visit to Brazil, I realised the potential of ethanol. We then decided that we would bring our plug-in hybrid technology, but with a flex engine developed by and for this country. The car we are delivering today to President Lula is proof that BYD not only invests in Brazil but also co-creates with Brazil unique solutions for the world.”

Brazil is a great place for BYD to expand, as it is arms-length enough with the American government to not be concerned with the fallout from having a BYD plant in the country. Additionally, a flex-fuel vehicle like the Song isn’t going to be sold here anytime soon.

Look At This New Mercedes… Thing

No one buys electric coupes yet, so the fact that every automaker has to show a big EV coupe now is amusing to me. Whatever, this Mercedes-Benz Vision Iconic does look cool.

It’s very Art Deco, with that big throwback grille. This is an EV, so it doesn’t necessarily need a big radiator, but it’s pleasingly dramatic and contrasts well with the deep black paint.

Does it have some crazy concept crap? Yes, it does, which is good!

Mercedes-Benz is researching innovative solar modules that could be seamlessly applied to the bodywork of electric vehicles, similar to a wafer-thin paste. The photovoltaic-active surface could be adaptable to various substrates. When applied to the entire vehicle surface of the Iconic Vision, additional range could be harnessed from the sun, depending on geographical location and local conditions. As an example, an area of 11 square metres (equivalent to the surface of a mid-size SUV) could produce energy for up to 12,000 kilometres a year under ideal conditions. The coating does not contain any rare earths or silicon and can be easily recycled. The solar cells have a high efficiency of 20 percent and generate energy continuously – even when the vehicle is switched off.

Solar paint! I dig it.

What I’m Listening To While Writing TMD

I had to do it. No regrets. Here’s Denzel and Wesley doing “Mo’ Better Blues.”

The Big Question

Is it the buyers or the carmakers?

Top photo: KBB, Rivian, GM

I’ve always a car that looked like the animated series Batmobile, so I will look at that, thanks.

Third option: it’s the regulatory environment, coupled with consumer preferences.

It is much, much, much harder to design a decent car for cheap now than it was 40 years ago. There are so many more safety and environmental regulations to meet, and all of that engineering costs a lot of money. I don’t think it’s a bad thing that cars are much safer and cleaner than in our parent’s generation, but it has to be acknowledged that improvement comes at a cost.

The end result is that new, cheap cars are hateful penalty boxes. I had a 2025 base-spec Corolla the other day as a rental, and Jesus Christ aside from the tiny screen bolted onto the center console that displayed the backup cam and (thank God) handled Android Auto/Carplay duties you could have told me it was a 1995 model, and I would have believed it. The interior was cheap and tacky, with terrible touch surfaces, and the NVH characteristics were painfully bad. If you took the same $22k and change to the used market, you could get a 2015ish Lexus GX in good condition and be vastly more comfortable.

Bottom line- there’s little good reason to get a new, cheap car these days. As a result, only the high-end is making money for automakers, which drives up the average prices.

I like to watch dashcam videos. You’ll see some idiot run a red light, roll their SUV a few times and slam into a light pole. Then they climb out look a little dazed. Cars are substantially safer.

This really needs to be emphasized. Today’s vehicles are dramatically safer than those from a generation ago, and those improvements cost money. On the upside, today’s cars last a great deal longer than their older, less safe cousins.

The used market is the other side of the coin. When cars can regularly last 300k miles or more with basic maintenance, why buy a new penalty box when you can buy a depreciated car from one or two ranges up and drive it for multiple years?

Truth. And doubly-truth for EVs.

I’m eyeing the used Ioniq5 market and I’m seeing a LOT of options <$30K with 15 or 20,000 miles on them.

Not to mention the lower insurance premiums.

I would have very much appreciated getting an older Lexus as a rental instead of the new Toyota. I get that it was a fleet special (in white, even), but goddamn was it grim.

Warranty and safety features come to mind.

Doesn’t this negate your point a bit, though? A base Corolla in 1995 was ~13k, which is equivalent to about 27k now. The new base Corolla is only 24k, and that’s despite it having all the safety/emissions/regulatory requirements (including a backup cam, which is why it has a screen that could mirror phones at all).

So for the same money you can still get a hateful penalty box like we had in 1995, but now it’s far safer, efficient, cleaner, and more reliable.

But most consumers today don’t want that so they spend more to get leather, bigger screens, etc, which costs more.

Looking at it on a % basis rather than straight dollars helps. ATP in 1995 was almost $18k in 1995 dollars, so 38% more. A new Geo Metro in 1995 was about $7k in 1995 dollars, so nearly half the cost. Ain’t nothing for sale at $12-13k new (half the cost of a new Corolla) today.

The top end has grown much faster, while the bottom end has disappeared.

A base 2 door Metro in 1995 had an MSRP of $8,395, or ~$17,850 today. That’s basically in line with what the Mirage MSRP was, and it met all the regulations.

Since there haven’t been any super cheap 2 door cars on the market for years, the better comparison is the Metro sedan, which started at $9,395, or just shy of $20k today. The Versa starting price is ~$18k, and its recently departed sub-20 cohorts like the Accent, Soul, Rio, etc, were all in the same range. All of those cars met the regulations and were still essentially the same price as the 1995 penalty boxes (while being better than a 4-door metro in every conceivable way).

Carmakers didn’t stop selling those cars because regulations made them too expensive, they stopped selling them because no one bought them.

Well, your last sentence is what I’m getting at- penalty boxes are no longer necessary if you are willing to put in the tiniest bit of effort to shop used. I brought up the used Lexus because the Corolla was pissing me off so much during a coffee break I checked what was available nearby on the used market for the same money and found a very handsome midnight blue GX with 80k miles, looked in great condition. If you are a shopper on a budget today, it’s a no-brainer decision, which is why cheap new cars aren’t selling.

Well said. We can vote/legislate ourselves into a situation where we get all these nice benefits from the government but kick the can down the road on paying for them, but that doesn’t work at the (slightly) smaller scale of automakers: if more stuff is to be provided, more stuff must be paid for.

You can probably directly blame the IIHS for making base models more expensive by requiring them to have the same active safety equipment as higher higher trims to get the important Top Safety Pick awards. While the cost of mmWave radars for BLIS and AEB and cameras and chips for lane keep assist should keep decreasing, it’s still easily a few hundred dollars excluding development costs.

I don’t want to “blame” them, because I don’t think it’s a bad thing at all. Frankly I am appalled at the level of apathy we as a species have towards one of the single highest causes of premature death in pretty much every country on the globe, and we just brush it off as normal. But I do think it needs to be acknowledged that all of those improvements cost a lot of money, so cars will get more expensive in relative as well as absolute terms.

It’s the base spec of what is supposed to be an economy car. What are you expecting? A presidential limo?

I’ll bet though if you were to put that 2025 Corolla on your driveway along with a stored in a bubble example of its 1995 predecessor you’d find the newer car much nicer. I imagine it’d compare more closely to somewhere between a 4 and 6 cylinder Camry of that era rather than a Corolla but still beating the older car overall.

The newer Corolla also gets 32/41 mpg vs the older Corolla’s 23/31 rating. That’s quite an improvement. And as many others have noted you would be much better off in the newer Corolla in a crash.

No, I was expecting a basic economy car that didn’t rattle my tooth fillings and require the stereo cranked up to just under the hearing-damage threshold to drown out the road noise. Yes, it has improved economy and safety, but the user experience is 30 years old (or more), which seems a bit silly. Maybe I’m getting into grouchy old man territory, but I expect my cars to be somewhat pleasant places to be these days.

Well I wasn’t there so your review stands. It is however one data point, perhaps another modern economy car will fare better in your eyes. If modern base Civics/Mazda3s/Jettas/Versas/Elantras/Imprezas do not satisfy you vs their 30 yo ancestors then your point is made or you are indeed a grouchy old man.

I never saw Mo’ Better Blues, but man, does that little ditty hit just the right spot for me this morning. Thanks Matt.

It’s a really good movie, and will have you running out to buy a blue dress for your wife and/or girlfriend afterwards. (Assuming, of course, that you comply with the typical demographic profile of a reader here.)

Wait, bedeviling in a blue dress? I DID see that Denzel movie, and it didn’t work out for anybody involved (except Don Cheadle, whom, to it, admittedly owes his career).

I look forward to more Spike joints. Targeting the AppleTVPlus…

I think that the Mercedes concept is absolutely stunning. This is a marvelous styling exercise – and it’s one of the few cars that captures the styling detail and real design ethos of a big 20-30s deco car, but interprets it in a thoroughly contemporary way that doesn’t just look like a cartoonized version of a car from Big-O. Interior is whatever, but that exterior design looks absolutely phenomenal. This isn’t an auto-brutalist shock factor car, it’s truly elegant and massively imposing.

bonus points for mentioning Big-O

All it needs is a wolf in a suit.

Can I get some of that solar paint for my house, too?

Though it’s insane and overdone, which is normal for a concept car, I do like the giant retro grill on that Mercedes EV coupe, though it looked better the first time around:

https://hdwallsbox.com/wallpapers/l/1920×1080/89/mercedes-benz-cars-grilles-lights-old-car-1920×1080-88644.jpg

Just because it’s a big, round number, the average-new-car price topping $50K is depressing, if no surprise at all. 🙁

A base Camry or Maverick is almost $30K these days, so in the low-to-mid $40Ks after tax, title, and registration, and even more if financed. Though cars like these offer much more tech and safety than they did 20-30 years ago, it still makes me blue.

Finally: not that it’s real (as in, you won’t be able to buy it anytime soon) but Mercedes’ solar paint will presumably still require different materials to be applied in specfic, well-defined layers, if only to separate the electrodes. Any scratch that penetrates below the top (clearcoat) layer and into the strata below is going to wreak havoc. Maybe they’ll divide the surface into many individual ‘cells’ so as to isolate and deactivate any that get borked when the idiot in the 20-year-old Dodge dings your door in the parking lot?

Edited later to attach a photo of myself at last weekend’s JCCS in Long Beach, CA, standing in front of a giant inflatible early Honda. By coincidence (I assume) there was an identical car in the parking lot for sale for $10K. Same color, wheels, lights, everything. 🙂

https://imgur.com/a/YbPicmt

I wouldn’t bet on them taking repairability into account. From pulling bumper covers to remove the headlight to replace a bulb to dropping the transmission to get at something on the back of an engine is absurd.

Think about the Rivian that got into a small fender bender that ballooned into a $40k repair. Car companies want to move the metal and most people aren’t thinking about maintenance issues when they drive off the lot.

IME, repairability is almost never taken into account, since (as you say) it doesn’t help sell new cars. Some of mine have been easier to work on than others: my current daily, a Volvo 240 wagon, seems like it won’t be too bad to wrench on (lots of room underhood, the dash looks easy to get off, etc…) whereas my daily two cars ago, a ’00 VW Golf, was a royal PITA every time something needed attention, which was often.

I want to put a stock cam back into my 240 to replace the wild/wonky one that someone installed before it was mine. I haven’t started looking into it yet… I’ve never swapped a cam, though I have done solid lifter shims once, many years ago. I’m procrastinating (’tis my nature) by planning to first install some 8′ long flourescent lights I salvaged in my carport before I do any underhood work on the Volvo.

I don’t think there’s a way out of this problem with the car market.

Automakers don’t want to spend a billion or a few billion dollars developing the next generation of boring, affordable, low margin, small cars. Because if they miss they lose big. If they win and buyers love it? They barely make any margin or profit on these cars and the prices are so low the numbers are equally tiny.

But when they take that same capital spending and swing for a luxury barge customer spending 100k??? Well if they miss, same loss. If they win??? They win big. It’s like everyone saw Porsche’s margins circa 2012-2022 and went “oh wait that was an option all along?!”

And it’s every car maker. Even tiny Subaru is ditching their most affordable models, and they’ve been on a decade long quest to make their smallest cars so nice that you will oy $35,000 for a crosstrek.

“And finally, monsieur, a wafer thin mint”

https://youtu.be/GxRnenQYG7I?si=rmO_HKOrR7gPkQXl

If one just needs transportation and isn’t trying to fill some niche needs or get a hobby or lifestyle car, one can still find a very nice car for mid-twenties. The Elantra and K2 are very nicely equipped and efficient for that price.

Unfortunately, even at that price, the note on a 25K vehicle can still be too much for a lot of people.

The options are disappearing RIP Kia Soul.

It’s a K-shaped economy, except without any K cars.

Gotta drive your K-car through this K-economy while in your K-hole.

No more nice reliant automobiles…

I’m outta here then, heading back to K-Pax.

The economy works just about as reliably as a K car, too.

In Brazil and BYD cars are already everywhere. I’ve riden in a few as Ubers, and they look pretty nice.

It’s the automakers. Along with the financial institutions, the advertising agencies, etc. We are all a lot more susceptible to advertising than we think. Even a person who manages to avoid overt ads finds themselves constantly inundated with product placement and accidental advertising by the people around them.

Combine that with planned obsolescence, warranties, and packaging/computers making cars harder to work on, along with general rising prices (never mind loans helping raise credit scores) and you’ll see that people are pushed to be model consumers on every front.

Do we know what the median price is? Cars have obviously gotten substantially more expensive and the “starter” new car market barely exists, but averages can be skewed by outliers and luxury cars, SUV’s, and trucks have gotten absurdly expensive.

You ask a good question, and the internet doesn’t seem to share your interest in data.

Closest I can find with a quick search while at work is a sales weighted average from MoneyGeek. It’s from last month, but it shows the simple average at $48,841 vs sales-weighted of $47,800. They also find that, adjusted for inflation, the price is actually down a little, but because inflation has hit so many things, the median household still ends up spending 7 months of salary on the car and other expenses have increased.

Hard to find. Last time I did is was about $10K less and that was about a decade ago.

Seems like a sort of repeat of the personal luxury car craze of the 70s.

Cheap cars are out there, but the profit margins are so small they need to sell higher volume than they are. Instead, automakers are focusing more on upmarket models and trims because those who can afford it are the only ones buying in enough numbers to care about.

Anecdotally, the trends you describe are represented in my life. I’m 32, and apart from one guy who bought a new Kia, I don’t personally know anyone in my age group who has bought a brand new car. Ever. All of us are pretty solidly middle class, but new cars seem just a bit out of reach for most of my peers. They’re more worried about trying to afford a home or kids, not in having a new car. Don’t know anyone my age with an EV either, now I think about it. Admittedly my social circle is pretty small.

My folks, on the other hand, are in their early 60s and well off. In the last few years they’ve purchased three new cars and one used car. They fit the new car buyer demographic perfectly. The only other people I’ve heard about buying new cars are people within my parents social circle and my dad’s work. But again, no one my age.

Your generation (mine mostly) sits around for the crumbs of their parent’s inheritance. It’s the only way we will ever be able to have a roof over our heads to live in that we can call our own. Our offspring, if we choose to have them, are going to be indentured workers living under a Neo-feudal system.

The only reason I (and some of my peers) even own a home is because our parents helped with the down payment. That’s the killer. It’s damn near impossible to save enough money to have a down payment when you’re paying exorbitant rent prices and houses keep getting more expensive. We’re looking to sell our starter home and upgrade soon, because lord knows what the market is gonna look like in a couple years.

That was the only way I (I am currently 32) was able to qualify for my first home (23 at the time) is I had to have my dad cosign with me on the loan and help with the 5% down no way I could afford it that young with all the student loans. I sold that home 6 years ago now and used that money to pay said student loans (which actually got mostly refunded due to DeVry lying to students) so I still needed my dads help for the 5% down and the cosign and when I got that refund most of that went to getting rid of my PMI and my failed attempt at moving to Virginia from Indiana.

So yeah without some luck and help from your parents it seems our generation is SoL if they went to college and are renting if they ever want to get a home.

I suspect the “in CA” in your name has something to do with that. Check out the “rust belt” – I bet you can afford to buy a home there.

I point this out to young engineers I work with who complain they will never be able to afford a home here on the west coast. I point out job postings in our company in places where they could make 90% of the salary and buy a house for 1/3 of the local prices. I generally get. “But then I would have to live in X city”

My wife and I purposely spent our first 15 years together in low cost areas where we could live for less, get out of debt, and own a home and build equity. I had opportunities to go to expenses places right out of college but we looked at the cost of living and said “No way we could live the life we want there”. It wasn’t until 10 years ago we moved west. Best place we have ever lived – but expensive. Most definitely not a place to get started

That “together” was important too. Way easier to afford life with 2 paychecks. I know far to many people that are waiting to get married until all their loans are paid off or they hit some sort of financial goal. Being married helps hit those goals quicker.

I think automakers love this trend. It lets them both focus on more expensive models and not care as much about longevity of their products – if you buy a used car you basically get none of the warranty that it may have had when new.

I am older but We bought new cars 13 and 6 years ago and could not afford that now even with bigger incomes because everything else has gotten crazy.

I’m 39. Bought my first home at 27 with no “free money” help. Bought my first (of 3 sequential) new cars a year later, on my own. We’re out there.

Same, I’m 31 and bought a home at 26. I suspect location and career choice factor in.

Now do wages. Have wages or the tax burden on the middle class kept up with everything from car prices to groceries to CEO pay.

I was listening to an episode of the Freakonomics podcast about taxation in the US. From an overall perspective, the middle class is undertaxed in this country. That doesn’t mean there is nothing that needs to change, just that at a high level look through other countries in the world, the US middle class pays less than most others.

Yes, this is a good thing. It often surprises Europeans to learn that proportionally, the rich in the US pay more of their income compared to the poor and middle class than they do in Europe (ie. European income taxes are “flatter” than American income taxes).

Historically, the American tax burden fell disproportionately on the wealthy, and I think that’s something to return to.

I would tend to agree to a point, though I won’t hold my breath that a change like that is coming.

Quietly, one big change already happened. The SALT deduction cap, while raised again after being deleted, phases out at $500k, and is limited to $40k write-off. The SALT deduction cap (or even better, elimination), is ironically the single most progressive piece of tax law passed in the last century or so, as it almost exclusively impacts the top 0.1%. It’s also probably the only thing in the universe that Trump and AOC both support.

Yeah, but in other countries you get something for your taxes. As near as I can tell, mine are just going to an overinflated military and all social services are being cut. At least I see where my local taxes are going and I see my local infrastructure in decent repair and local library still chugging along despite the book-banners making noise.

I think if you add in health care costs to taxes, you’ll find that total burden for Americans is more than Europeans are paying in taxes which include health care.

Now add in higher education costs!

Great point! So yeah, even better elsewhere.

Like the new tariffs, a direct tax on the middle class consumers. Sorry, I don’t buy it every time I see someone say that the middle class pays less taxes than everyone else.

You can listen to the episode or read the transcript yourself: https://podcasts.apple.com/us/podcast/freakonomics-radio/id354668519?i=1000699094163

The whole picture is definitely not painted by my simplified recollection of the episode. However it’s something that absolutely should be noted if you’re going to have an honest discussion on the topic.

You have to be careful when looking at tax burdens by income.

Most of the time the conversation is only about federal income taxes. Those are very progressive with the rich paying progressively more (until you get to the top 1% or 0.5% and then the effective rates plummet because those people don’t make W2 wages they make their money on investments that are taxes at much lower rates than “earned” income.

Many low and middle class households pay no federal income tax. However they pay a lot of payroll taxes which is 15.3% on every dollar earned up to $176K – where it stops. So payroll taxes are flat and then turn very regressive the more you make.

Then we get into state taxes – which tend to be regressive in most states because they lean heavy on sales tax and fees – which are also regressive.

TL / DR: The whole tax picture by income level is complicated

We get less back. Now compare what the US middle class pays for healthcare compared to other countries. And education. And childcare. And food not pumped full of antibiotics that is recalled constantly but usually at least six months after being sold (and almost certainly consumed). Etc.

Health care and education costs eat up that delta handily.

Car makers are in their own focus group hell. So they add more features that aren’t wanted, and prices grow too much. So yeah, car makers.

Homer Simpson designs a car: https://youtu.be/WPc-VEqBPHI?si=3IF2KU4UV1jXgWQ_

Costs are up.

Of something made of steel & aluminum.

Hmmm.

Is it the buyers or the carmakers?

I blame the financial institutions.

I blame the current regime suddenly and quickly makes things a lot worse. Never seen before. Completely avoidable and unnecessary.

This pot has been boiling a lot longer than the current regime has been in power. Have tariffs helped? No. But they’re not entirely, much less solely, responsible for this development.

Prices stayed high the entire Biden admin. Their fault too?

Yes. The Biden administration did not do enough to roll back a lot of pre-existing bad policy. The pandemic put a lot on the back burner that wouldn’t have been in better times.

I mean, Chrysler could pull a copy of that and slip an upright grill on the 2 and 4 door chargers and call it the 300, or Even pull out the Imperial name. I bet that could be brought to market faster than Mercedes, and hopefully faster than the time it takes Hyundai to make a copy.

When I first glanced at the Mercedes concept, I thought it was a Mazda. That grill and the lights give me strong Mazda feels, so I think that’s why my brain pieced that together.

Yes, and. I think it’s a bit of both. The K-Shaped economy is seriously gaining steam, and with a surging stock market that top 10% feels comfortable spending larger sums on vehicles. At the same time, interest rates have dipped slightly in the past few months, and with the end of EV credits, anyone interested in a 40, 50, 60k EV moved purchases up, which likely floated ATP slightly.

The other thing that is much harder to quantify is the general rampant consumerism going on right now. Ever since Covid, there seems to be endless anecdotes of people financing a nice car at high rates and long terms because “I deserve it” or “I need to enjoy life more.” The carmakers won’t ever acknowledge this, but they see it and it plays a huge role on their product portfolios.

All of that completely ignores the orange elephant in the room and Tariffs, which regardless of incentives, has and will continue to push up MSRP and by proxy ATP. Manufacturers are being forced to pursue \higher margin, larger cars in order to keep some gross margin while smoothing out the pain of tariff price hikes. Also for what it’s worth, a 40k car in 2019 would be just shy of 51k in 2025 dollars, so inflation also has a very large part to play in us getting here so quickly. So not only do both consumers feel entitled to nice vehicles while automakers gleefully supply them, but the US reckless leadership has destined us for an ever looming default and repossession crisis.

There is also the fact that up until a few months ago the job market was more in favor of the worker, but that has flipped a bit. so a lot of employees that had jobs had plenty of adjustments for inflation. 15 dollar an hour jobs are now in the low to mid 20’s. so on paper they are making a lot more money, but after buying a 50K car, they are the people complaining about the 6 dollar a gallon Milk jug and 15 dollar lunches from Mickey D’s

How many people earning $22/hr and actually buying $50K cars?

More than there should be.

My dad retired this year at 75.5, from a factory, working on the floor. He made $22/hr (plus did overtime), but had been there a long time, so I think new hires start at $17 or $18/hr. Whenever I’d see him, he’d tell me about some new hire going out and buying a new high-trim truck.

So not $50K, closer to $70K out the door. Before some horrible loan.

”Oh, but maybe their spouse works as well!”

They do. At the same factory, same job, making the same wage.

In my area there are a lot of 1950’s-60’s smallish ranch houses along the main roads, owned by the kind of old-timer rural families that have been in the area for many generations. They always have 3-5 full size pickup trucks in the driveway because there are 3 generations living in the house, each owning a truck that’s worth almost as much as the house is.

This sounds like where I grew up. I had a big realization at my nephews h.s. graduation. All his male friends had not-too-old dualie or lifted quad-cab pickups, usually with diesels. Granted, its an ag area, and some people have legit uses for such rigs, but my peers had used former-family-duty decade old PLC’s, used Chevettes, Escorts, etc. and maybe a basic power-nothing 3-on-the-tree pickup.

Farm Trucks are a write off, or at least were for a long time. Also those 75 year old houses are often fully paid off or perhaps still in the interest and sell price range of say 20 years ago, so the monthly payment has only increased based upon what the local gov’t has decided to up the value on so they can get a higher vig without advertising raising taxes.

Your dad was making $22/hr after working “a long time” in a factory?? You can start at $18/hr at our local McDonalds and I live in a small town in the US.

where is that?

His choice, not mine.

Well, that and his aspirations always being squelched by mom.

It’s what it is. Although they didn’t invest a penny of it (sigh…) they did at least put aside a very sizable chunk of cash to supplement his Social Security, even if it’s all in 0.03% savings.

Welcome to why I’m the exact financial opposite of my parents.

That’s a bummer, sorry. My mom compulsively shopped her way into bankruptcy when I was a kid, so I get wanting to be the financial opposite of your parents!

The real crime is that a 75+ year old man was working a factory floor for only $22 an hour.

Non-working mom swatted down all his aspirations all his life.

Hence he never tried to do anything better.

Now that he’s retired, he does nothing, as he’s not “allowed.”

They did at least save a reasonable chunk of money, but as I mentioned in another comment, none of it was ever invested, just “money in a mattress” that at least is in a bank instead of an actual mattress.

He could’ve easily hung it up far earlier if Mom was at least willing to read the Boglehead book I bought them 20+ years earlier.

I hope his body is still functional and not worn out from all that labor.

My grandfather was a contractor specialising in masonry and tile, and though he didn’t complain about anything, it was clear his body was a wreck in his early 60s.

Yes / No. $22 per hour is low but I don’t get automatic pay raises just based on seniority.

I worked for a Japanese company that make transmissions about 20 years ago and they paid based on the job for their lineworkers. If you worked the same station you got paid the same whether you had 6 months or 20 years on the job. If you wanted to earn more you had to certify on more jobs and move to more complicated tasks. That tapped out pretty quick and to move up again you needed to become a team lead, supervisor, or go into skilled trades.

Today I work for an automaker with union production workers There is always a lot of friction between young guys and old guys because EVERYTHING is based on seniority. Not only do the old guys get paid a lot more per hour based on years of service but jobs are also bid based on seniority. So the old guys get the easiest jobs and the new guys get the crap jobs. Overtime is also based on seniority. So the guys that get paid the most per hour also suck up all the overtime hours. Vacation – you guessed it – based on seniority. ….. While you can say it is a way to cut down on favoritism and it is easy to manage it in no way seems fair to me to pay two people wildly different wages to do the same job because one guy has been doing it longer.

I have a guy working for me, he makes just a bit over 22 and hour when he decided to buy a 50K challenger(used). Should he have, no, did he, yes.

Yes both. Carmakers are not putting cheaper cars on the lot because buyers do not buy them because they are not on the lot to buy.

Waiting for all the comments that say “but incomes have kept up with inflation”

Not for everyone.

The majority of people we know have not had increased incomes. The middle class is almost gone and the US is a ****show right now economically, so I can’t imagine any automaker is feeling great about where we are. The US is Tarriffic.

in the comments on a similar article not that long ago another commenter was telling me to get over my dislike of how expensive cars have gotten since they, adjusted for inflation, are often cheaper than past model years and our incomes have kept up. cars still feel expensive.

It’s not worth the fight today.

The data is the data, the anecdotes are the anecdotes, and people are going to feel about it how they choose to.

I feel most sorry for the people that stuck it out when the job market was tougher for employers. they were seemingly paying new hires much more than seasoned employees. they were in most cases maxing out merit increases, but rarely bringing existing workers up much more if at all.

I think this is an underappreciated part of it.

I got a ~25% raise switching jobs at the beginning of 2022 and solid raises since then. My story is not unique by any means.

For someone who stuck it out at their old place and kept getting 2-3%, it probably does feel differently.

True. And good luck trying changing to jobs now.

Y’all are getting raises?!

Every year for 25 years. Although as with V10omous the largest gain have come from changing companies.

That’s me! I stayed at my current employer through that time; I kick myself for it now. Though at the time, a few of my coworkers had moved on to other jobs and then were miserable.

It is definitely a gamble. I see plenty of trucking companies really sticking it tot he guys that switched over during the shortage. basically yeah they are seeing 30 plus dollars an hour, but also first to be furloughed and or stuck with the suckiest loads.

I have never seen any data supporting this but it is something I’ve always wondered;

How much of people feeling as though wages are stagnant or haven’t kept up with inflation is due to complacency? Looking for a new job sucks. Learning everything you have to learn at a new job blows. But having a certain amount of professional mobility and switching jobs and changing career direction is the best way to improve your income situation.

It’s not just that you can get a pay increase by moving to a new company.

I had a conversation with one of the high-level leaders at a fortune-100 company I worked for a while back about this. He told me that in the rare occasions they hire outside the company they don’t really consider anyone that has stayed at one company for a decade or longer because they are viewed as not constantly evolving. They will consider someone who has changed positions often within a company if they think that company has the reach to have truly offered different perspectives across the breadth of job offerings but would mostly consider people that move around a lot.

It was eye-opening and also ironic since most of the leadership at the company had been there 20-30 years but whatever.

I chose to take a voluntary buyout at one of their ever-constant reorg/layoffs. It took way too long for me to find my next landing spot but I finally did, making almost 40% more. Go figure.

Hahahahaha! “Not evolving!” People who stay at one company are probably performing 2-3 jobs that are not in their original job description.

Good luck finding a new hire with the familiarity to do that!!!

I make no judgement one way or the other. I just found it interesting how the upper leaders viewed the info. I do think there is a lot of value in trying to find a new job every few years for both the pay bump and the increase in experience you get from that, even if it is uncomfortable.

But that is especially true for people being abused like you mention. There are other jobs. The process of finding them is difficult, painful and sometimes demoralizing. But we should all be doing what we can to improve our personal situation as much as we can since there is only so much control we truly have.

You do identify that it is the upper leadership who is out of touch with who actually produces things within the company.

That is the standard narrative but not what has been my experience through my career. Certainly this can be the case but most of the time (again, in my experience) leadership does have some level of knowledge of the process.

Just because I don’t always agree with the decisions doesn’t mean they are making them due to lack of experience. There’s a lot that goes into it.

I think reading the room as it were would be the x factor here. While the market was unusually off kilter due to pandemic recovery and super low unemployment while also experiencing a strong economic uptick, the thing people should have considered at that point was to use the workers job market in there favor. Problem is it is a big leap of faith for some to make the jump. it is almost always scary and you have to figure out how to best fit in while not getting taken advantage of in the new job. But yeah, it was definitely the time to jump around a bit a few years back.

Oddly perhaps, but I am the opposite. I rarely let a person with a laundry list of 12-24 month stints at multiple companies make it to my interviews.

I am not often in a “hiring manager” type of situation but I am on rare occasions. In my positions it is almost always a panel interview where I am either the primary decision maker or a contributor but I always attempt to push the idea that we should focus on the skills, knowledge and personality fit and really ignore the number of roles or time in roles unless it shows that the person has literally never been in one place longer than 6 months or something.

For instance, in my example above I would find that a short–sighted view since you might miss out on someone with in–depth knowledge. The issue with that viewpoint is more an issue of the interviewer not being enough of a subject expert to dig deeper and ask the right questions.

The job market is just a lot different now. I try not to fault someone for finding their way in today’s world. But I live in a world I never thought I’d end up. I’m someone who lives in the details (and gets lost in them on occasion) while everyone I work with/for wants to avoid details and just get the bullet points.

We also use a panel in the end, but certainly when you are sifting through a large pile of resume’s short term work history is one of the things that drives a person down in my pile. Just like too many years at one job seems to be the reasoning for doing this for others. I see short term employment as either lack of commitment. But also it is usually about the amount of time someone with inadequate skills starts feeling the heat for not performing well enough and they then try to move on to avoid being fired.

You can certainly see in a job overview, that someone with long years of experience normally has a lot more than just the base type job listed. Most Companies seem to add hats to strong performers over the years which is either good or bad depending on your perspective I suppose.

The number I’ve heard quoted is it takes at least a year to understand the system well-enough to be good at your new job. With that in mind, anyone staying less than three years is taking more from the company than they are giving back.

But that is just my point of view. I stay where I am because I like having reliable health insurance.

That is certainly part of it. It has been my personal experience and the experience of pretty much everyone I know that large pay raises only come when changing jobs. You also have to be open to moving to follow opportunities. My wife an I have moved 5 times and started or marriage by getting married and moving to the other side of the country in a 3 week span.

My college roommate has lived / worked in 3 different countries. My brother has worked in 7 countries. That is on the extreme end but pretty much everyone I know has moved states several times following opportunities.

Inflation adjusted income for the lower and middle classes increased an average of around 20% since 1979 here in the US. Over the same period, housing prices have increased 86%. Cost of living as measured by the consumer price index (includes housing) has risen by about 200% over the same period. So, have wages increased? Sure, but they haven’t kept up with all the costs, by a long shot.

https://www.visualcapitalist.com/growth-in-real-wages-over-time-by-income-group-usa-1979-2023/

https://inflationdata.com/articles/inflation-adjusted-prices/inflation-adjusted-housing-prices/

https://www.usinflationcalculator.com/inflation/consumer-price-index-and-annual-percent-changes-from-1913-to-2008/

Productivity has also skyrocketed during the same time that wages ever so slowly crept up.

I recently saw a meme of a graph with the starting point “Ronald Reagan”, with a line labeled “bad things” going sharply up, and a line labeled “good things” going sharply down.

Seems accurate.

thank you!

The real wages that increased 20% over the last 45 years are gains in income after factoring in the 200% increase in CPI. The Visual Capitalist link shows that as of 2023 every income bracket is doing better today than in 1979 in real terms.

What I find most interesting in the visual capitalist chart is the timing. The top 20% have been above those 1979 wages pretty much the entire time. The bottom 80% had a varying degrees but in general really bad 80’s and 90’s. The bottom 10% haven’t seen really gains until the last decade

Also it is interesting that the gains since the pandemic are reverse of the trend before. The lowest paid workers saw the biggest real increase in wages (12%) while the top 10% the lowest (0.9%). Which is great. It is the low wage workers that really need that boost.

I’ve seen data that leans both ways, and without deep expertise, I haven’t found anyone I trusted well enough to explain why some of the data is skewed and some is correct. But the one thing I never see is the one data point I believe is the most accurate representation of cost vs income. Labor hours to purchase. For any given cohort, how many hours at their average income would it take to purchase a vehicle at ATP? If that number increases, then pay HAS NOT kept up with costs. Period. There isn’t a great way to argue around that unless you argue the averages used are wrong. If number of hours to pay goes down, then pay has grown faster than costs.

But I have not ever seen any financial analysis based on that data point, despite it being the single most conclusive way of viewing the data I can think of.

Like for like new cars are a deal today.

A base 1995 Toyota Corolla cost $13,782 MSRP. In 1995 the median household made $34,080 a year. A base Corolla cost 21 weeks of income.

A base 2024 Toyota Corolla cost $22,050. Median household income was $83,730. A base 2024 Corolla costs the median household 14 weeks of income.

The average household in the USA is get one heck of a deal on a 2025 Corolla. Not only is it a luxury car compared to a Corolla from 30 years ago but it cost them 1/3 fewer hours of work.

(Same is true for a RAV4. 1996 RAV4 cost 26 weeks of income. Today it is 18 weeks.)

The average transaction price for a new car is mostly increasing in the USA because of a shift in the type of vehicle that average buyer is purchasing. In 1996 Toyota sold 57K RAV4s in the USA. Last year they sold 475K

Buyers are steady shifting away from cheaper cars to more expensive crossovers. Both because as this article noted new car buyers are rather wealthy. Buyers on a budget would rather buy an off-lease CPO CR-V than a new Civic for the same price.

I feel like I get a pay cut every year.

Little of column A, little of column B.

Average new car buyer in 2025 is 55 years old. These people are at or are still close to peak earnings, their “accumulation phase” of their life is over, kids are moving out if they had them, and their savings has had plenty of time to compound.

Home market is the same — the median (not average) home buyer in 2025 is 56!

Then you just have a rather bi-furcated economy at the moment. There are folks who are pinching every penny and buying ANY new car would hopefully seem foolish, and then you have folks doing well, are comfy, and are willing to spend. Supposedly the top 10% of US earners are responsible for 49.2% of consumer spending right now. They will further skew numbers towards the right, as again, they’ve more to spend.

Manufacturers in general are catering towards higher earners, and that’s been a trend since 2005. Heck, Citibank even did a report about it back then, suggesting companies do so, that I’m sure they wish could be erased from the internet.

The “Premiumization Strategy.” Perceived higher value products that yield higher profit margins, even at lower volume. I say “perceived” because many of the same brands purusing this strategy are also trying to ride on prior brand perceptions, while simultaneously trying to strip out costs, which will eventually damage the brand’s value. See: Private equity.

I still think China, or India, or (crazy) Vietnam are going to disrupt the US market, sooner or later, with lower priced vehicles at higher volumes.