One of the dirtiest words in the car import community lately is “tariff.” This year has been a rollercoaster for people importing cars, as the situation around import tariffs is always changing, and the impact has often been about as clear as mud. If changing reciprocal tariffs weren’t puzzling enough, enthusiasts have found a new tariff headache. Some enthusiasts have imported Kei cars only to be told by their brokers that their vehicles are now subject to an additional 50 percent steel tariff. But is this tariff real? If so, what does it mean for your imported dream car?

Back in the spring, President Trump sent the American car import community into a panic when he announced 25 percent tariffs on car imports and imported car parts. These tariffs, in combination with the government’s global reciprocal tariffs, had enthusiasts worried that their dream cars would become 10 to 25 percent more expensive almost overnight. Thankfully, 25-year-old and older classic car imports are exempt from the car tariff. Instead, imported cars were first subject to the 10 percent global reciprocal tariffs, and then became subject to country-specific reciprocal tariffs. Now, another wrench is gumming up the works.

Here’s how it worked in practice. In the past, a car that you purchased was subject to a 2.5 percent duty if you imported a passenger car, or 25 percent if you imported a truck. Of course, that latter number is due to the infamous Chicken Tax. When the American government began applying the global reciprocal tariff, it added to normal duties. This meant that a passenger car import was subjected to a 12.5 percent duty while trucks were hit with 35 percent duty.

The Tariffs Were Already Confusing

On August 1 and August 7, the American government finally began implementing the higher country-specific tariffs that it had been threatening for months. Initially, imports from Japan were supposed to be hit with a 24 percent (and then later, 25 percent) duty, but Japan and the United States worked out a deal to reduce that number to 15 percent.

Since these tariffs are now country-specific, it means that the duty you pay varies based on where the car comes from. A German car gets hit with a 15 percent duty, but one from the United Kingdom would be hit by a 10 percent duty. If you get a car from Switzerland, be prepared to open your wallet to the tune of a whopping 39 percent. That’s on top of your normal duty, which means a Swiss truck is subject to an incredible 64 percent duty. Breaking news out of China suggests that America and China are working out a deal where the average tariff on Chinese goods will be about 47 percent.

These tariffs alone sent the import community into a spin, and a lot of it was because the American government was awful at communicating these changes. Enthusiasts and even Customs brokers were initially unsure if used cars were going to be hit by the car tariff or the reciprocal tariff. I’m a member of a few import car communities, and the confusion was epic, with some brokers swearing that cars were subject to the 25 percent car tariff, while some said that you’d be hit by only the reciprocal tariff, and some said that you shouldn’t be hit by tariffs at all.

I got to watch this confusion play out in real time, from my previous coverage:

In May, I explained that my 1997 Honda Life had been hit by the 10 percent reciprocal tariff upon entry, leading me to pay a total duty of 12.5 percent. The problem was that nobody could give a definitive answer on whether getting hit by the reciprocal tariff was proper or not.

My Honda rode to America aboard the MOL Clover Ace roll-on roll-off ship in May, or after the tariff grace period had been expired for over a month. Here’s the wild twist: My importer contacts had hundreds of cars on the same ship and some of them even unloaded their cars at the same port on the same day. My little Honda basically kept their cars company during the long voyage.

Yet, some of these importers paid the reciprocal tariff and some did not. This was no help in solving the confusion. My Customs broker, All Ways International Shipping (AWIS), charged me a Customs duty of $32.25, or 12.5 percent of my car’s $258 purchase price. I expected to pay $6.45, or 2.5 percent. AWIS charged me the 12.5 percent based on its reading of the tariffs. It was a difference of just $25, so I didn’t really care in the end. But I still wondered: “Was that right?” For much of May and June, the advice in the importing world was to choose a Harmonized Tariff Schedule code in your import paperwork that would correspond with you paying only 2.5 percent, not 12.5 percent.

This madness happened again when my 1998 MGF rode aboard the Höegh Seoul. Once again, I paid the reciprocal tariff, but others with cars on the same boat reported paying only 2.5 percent. What this means is that months after these tariffs were announced and then implemented, people still didn’t know what tariffs their cars were subject to.

The Reciprocal Tariffs Were Legitimate

Thankfully, I was able to find a solid source about tariffs. Easy ISF, a company specializing in helping importers fill and file their documents with Customs, reached out to Customs’ Automotive & Aerospace Center of Excellence and Expertise. Judy Staudt, Acting Center Director, Automotive & Aerospace Center of Excellence and Expertise, sent Easy ISF a saddening message:

According to EasyISF, which has direct contact with U.S Customs and Border Protection, cars that are older than 25 years old are indeed exempt from the car tariff. However, cars are subject to reciprocal tariffs. So, you may ask, then, what is going to happen to all of those people who paid only 2.5 percent when they should have been paying 12.5 percent or more? EasyISF has bad news:

We have received direct confirmation from the acting director in charge of all auto imports at CBP that these duties are required. Despite this, we have also seen many cars clearing customs only the 2.5% duty, and we have lost a significant number of importers to brokers who are not charging the tariff.

The thing to keep in mind is that the initial release is generally just to make sure the vehicle doesn’t have contraband or anything inadmissible. The actual, full entry review by CBP can take up to 314 days. Some people might get away with not having paid the duty, but many won’t. I guarantee we will see a lot of angry posts in the next few months of people getting hit with the missed duty.

Sadly, EasyISF is right on the money. The Autopian is aware of at least two enthusiasts who have been hit with bills from Customs months after clearing their cars at only 2.5 percent. Customs demanded that these enthusiasts pay for the duties that Customs say the enthusiasts skipped out on.

It’s unclear if Customs will catch everyone who cleared a car at 2.5 percent. What is clear is that, regardless of how you interpret the law, the U.S. government interprets it as you needing to pay up more than usual.

Unfortunately, this has already had an impact of pricing some enthusiasts out of the market. Now, having to pay 15 percent on a Kei car is basically nothing. Remember, I paid just $258 for my Honda Life. At 15 percent, the duty is just $38.70. Buy a Kei truck for $1,000? Alright, now you’re looking at a duty of 40 percent, or $400. That sucks, but it’s not the end of the world. Thankfully, duties no longer stack, so you’re not paying 2.5 percent plus the 15 percent.

The math changes a lot for big and dreamy cars. Say you score a sweet Honda NSX for $50,000. Well, now you’re paying $8,750 in just tariffs alone before you even put it on a boat. To put that into perspective, you can import at least two whole basic Kei cars for the price that you’re paying in tariffs alone.

But at the very least, enthusiasts who do have the cash know how much they’re going to have to give to the government on their next Kei car, right? Right?

Here We Go Again

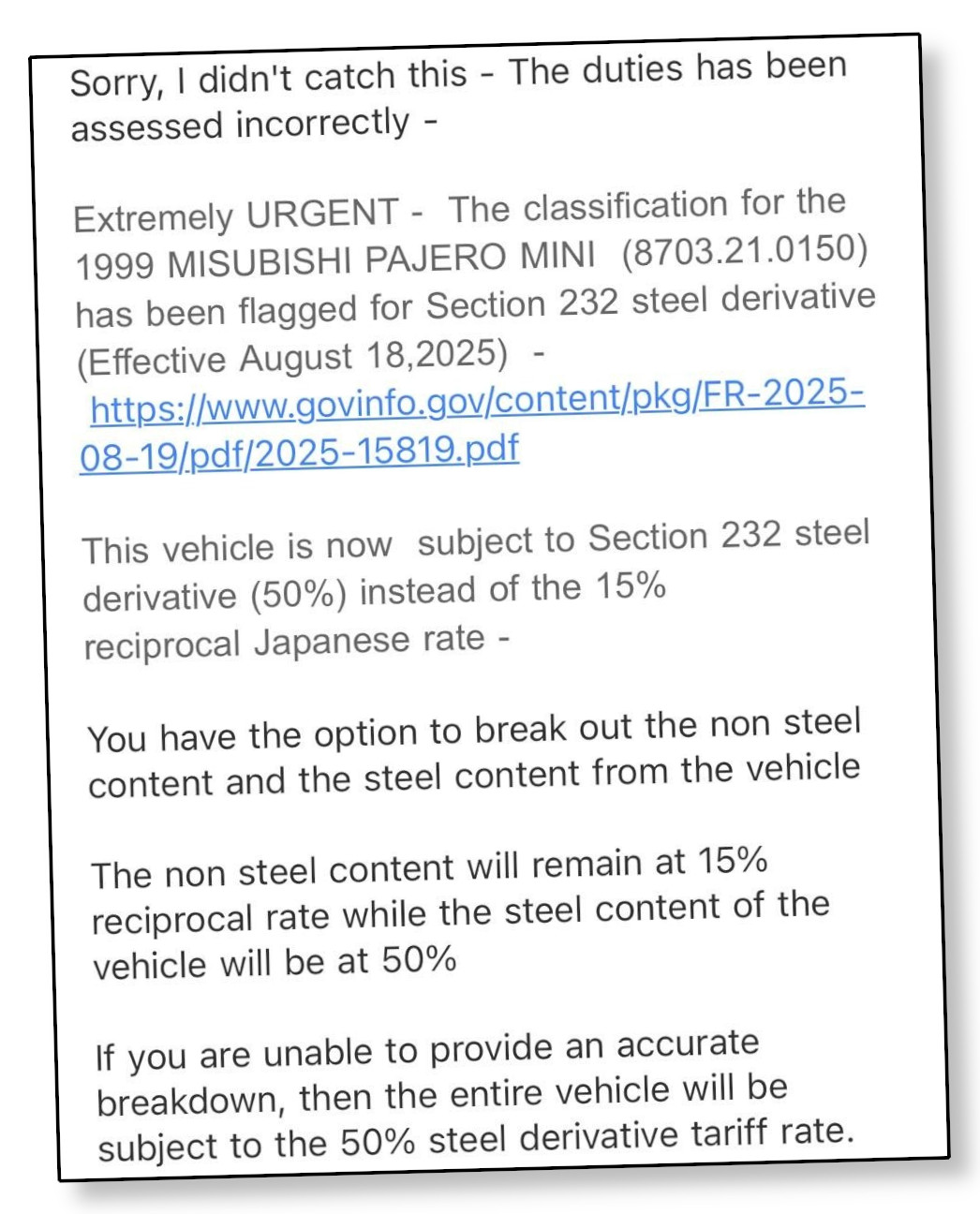

Earlier in October, enthusiasts began reporting that, when they attempted to import sub-1000cc vehicles, they didn’t just get hit by the reciprocal tariff, but also by steel derivative tariffs. Here is the letter one enthusiast got from their Customs broker.

This started the bickering all over again. Importers and Customs brokers began arguing with each other in the comments about who is right and who is wrong. Sadly, these discussions didn’t stay civil, and some people began throwing mud entirely unnecessarily. But who is right? Some brokers say that classic car imports are exempt from the steel tariff, and some say that classic car imports are definitely subject to the tariff. Here we go again.

First, let’s talk about the steel tariff everyone is worried about. From CBP:

On February 10, 2025, the President issued Proclamation 10896, “Adjusting Imports of Steel into the United States,” under Section 232 of the Trade Expansion Act of 1962, as amended (19 U.S.C. 1862). This proclamation imposes a 25 percent ad valorem tariff on certain imports of steel articles and derivative steel articles from all countries, effective June 23, 2025. See 90 FR 11249 (March 5, 2025).

In Proclamation 10896, the President authorized and directed the Secretary of Commerce to publish modifications to the HTSUS to reflect the amendments and effective dates in the proclamation.

Effective August 18, 2025, in accordance with “Adoption and Procedures of the Section 232 Steel and Aluminum Tariff Inclusions Process” the Commerce Department will be adding additional steel derivative products to Annex I of the HTSUS to be subject to Section 232 duties. Further, Annex II makes technical corrections to the Harmonized Tariff Schedule of the United States.

If you wish to bore yourself with the legalese, click here to head on over to the Federal Register. Otherwise, our friends at EasyISF break it down:

This is 100% correct.

There is absolutely no question that the Section 232 steel tariff apply to all passenger vehicles over 25 years of age and under 1000cc — specifically those classified under HTS 8703.21.0150.Keep in mind “passenger”: this does not apply to Kei Trucks or Kei Vans without rear seatbelts or any vehicle with a displacement over 1000CC.

In all honesty, my guess is that the inclusion of 8703.21.0150 was a mistake. The broader 8703.21 section that got hit mainly covers ATVs and UTVs, which were likely the intended targets of these tariffs. But because the changes are being implemented so quickly, things like this slip through — and while it may be an oversight, it doesn’t change the fact that the tariff currently applies.

The list of HTS codes that fall under the 50% Section 232 steel duties can be found here. [Click Here.]

If you review the attached sheet you will see that all classifications beginning with 8703.21, including these vehicles, are covered and must report steel content.

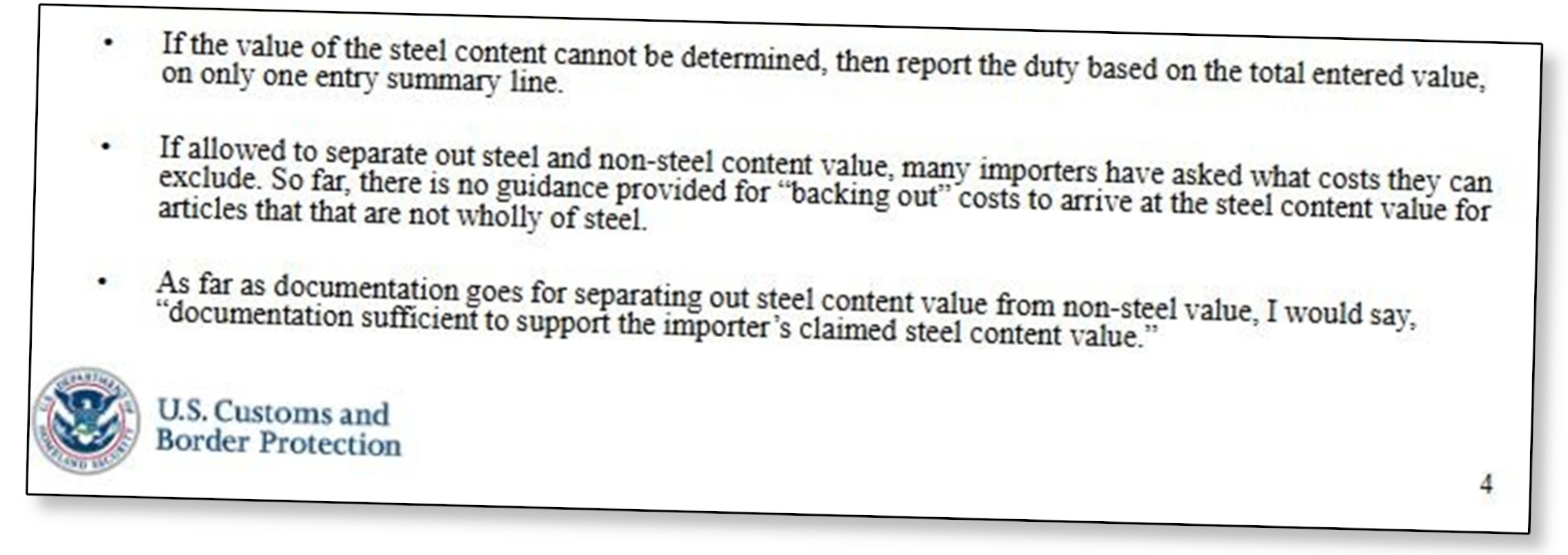

The real problem isn’t the steel duty — it’s that CBP still hasn’t provided clear instructions on how to calculate or break out the value of the steel content. The FAQ only says:

“The value of the steel/aluminum content should be determined in accordance with the principles of the Customs Valuation Agreement, as implemented in 19 U.S.C. 1401a.”

In a presentation last month, CBP shared the attached slide on this topic, but nothing more concrete. We have importers importing millions of dollars a week in steel products, and even they aren’t sure if they’re doing it correctly. Their attorneys aren’t sure, their consultants aren’t sure, we aren’t sure, and it’s very likely because CBP themselves don’t know how to apply it. At this point, the question isn’t whether these tariffs apply to these vehicles — they clearly do — but how exactly they should be applied.

In other words, regardless of how you read the rules, the U.S. government thinks that you need to pay 50 percent on the steel content of your next Kei car. That’s in addition to the regular 2.5 percent duty and the reciprocal duty for whatever country you got the car from. Of course, the cruel twist is that if you cannot provide a calculation for how much steel is in your car, the whole thing will be subject to a 50 percent tariff.

But don’t worry, because the government is not done twisting the knife yet. This went into effect back in mid-August, yet Customs still has absolutely no guidance on how importers and brokers are even supposed to accurately report steel content. Basically, we only just figured out the reciprocal tariffs, just in time to be thrown another curveball.

A Glimmer Of Good News

Thankfully, I do have good news, sort of. As EasyISF says above, the new tariff impacts vehicles under 1,000cc. So, those of you importing bigger, faster cars should be safe for now. Still, it’s unfortunate that, depending on the exact situation, any Kei car you buy may automatically be 50 percent more expensive. Just spent $20,000 on a mint Autozam AZ-1? Well, if you cannot prove the steel content, it’s going to cost you $30,000, and you haven’t even paid for anything else yet.

I fear that, at some point, enthusiast cars in other countries will simply become unattainable for the average enthusiast. The upsetting part is that there doesn’t seem to be any good reason for this. Most people who buy over 25-year-old imported cars end up supporting American business, from the importers who find the cars and the brokers to handle the paperwork, to the truckers who deliver the cars and the shops that fix them. If you buy your car from Duncan Imports or The Import Guys, you’re pumping money into local American businesses.

Our saving grace, for now, at least, is that most Kei vehicles are dirt cheap, so even a 50 percent tariff may hurt, but is still within reach. So, if you live in a pro-Kei state and want to get a Kei vehicle, I would still go for it. Just be sure to calculate your final cost before you send your money off to Japan.

Otherwise, I will continue monitoring this situation. With luck, car enthusiasts might adapt and triumph. Your dream car might have gotten more expensive, but it doesn’t have to be the end!

(Update: Corrected the tariff percentages.)

Hey Mercedes,

Licensed Customs Broker here

There is a “pecking order” in how we are to report the tariffs. The 25% auto parts tariffs supersede the Steel/Aluminum/Copper.

Please see US CBP Cargo Systems Messaging Service CSMS # 64916414:

The Executive Order (EO), “Addressing Certain Tariffs on Imported Articles,” signed on April 29, 2025, sets out the procedure for determining which of multiple tariffs will apply to an article when that article is subject to more than one of the tariff actions listed in the EO. Specifically, the EO pertains to the application of tariffs imposed by the following presidential actions:

a) Proclamation 10908 of March 26, 2025 (Adjusting Imports of Automobiles and Automobile Parts Into the United States);

b) Executive Order 14193 of February 1, 2025 (Imposing Duties To Address the Flow of Illicit Drugs Across Our Northern Border), as amended,

c) Executive Order 14194 of February 1, 2025 (Imposing Duties To Address the Situation at Our Southern Border), as amended;

d) Proclamation 9704 of March 8, 2018 (Adjusting Imports of Aluminum

Into the United States), as amended; and

e) Proclamation 9705 of March 8, 2018 (Adjusting Imports of Steel Into the United States), as amended.

Either way if the steel is from Japan or UK it would pay 25% due to those agreements.

Thanks!

David

Thank you for the insight! Sadly, I suppose you have provided even more evidence that there’s so much confusion out there, even among brokers.

I have played it safe thus far and paid the tariffs. I’m not in a rush to piss off the feds. 🙂

Yup there definitely still is, and I definitely ask my coworker even when I’m sure, just to be safe.

Don’t worry about that if you underpay, Uncle Sam will come a knocking. If you overpay, well you might not hear from them.

So far we have not had any issues applying those rules above.

Definitely a pecking order, but the CSMS you mentioned (64916414) is from May 5th. CSMS #65236574 from June 3rd provides the updated stacking guidance.

Since these vehicles are over 25 years old, they qualify for a 0% rate under 9903.94.04 for the auto-related Section 232 tariffs.

Because they are not subject to the Auto 232 duties, the steel and aluminum Section 232 duties are applicable.

I’m looking to export myself, personally. But that doesn’t promise to be any cheaper.

I went through this sh*tshow back in August importing some Citroen 2CV parts. This was while deminimis was still in place, but customs took two orders that were about $300 each and added them together, and also included about $200 shipping, which put the total (including shipping) just over $800. I spent about two weeks working through all the documents they wanted me to fill out, including percent steel/aluminum/stainless steel for every part (including individual bolts!). I gave them a few different calculations for the steel/aluminum content (including calculating the value based on the weight of each part and the cost/kg of steel or aluminum on the spot market), since none of us could figure out what the heck they wanted. In the end I think I convinced them that the total value was well below the $800 deminimis, because they released my shipment without any duties.

I guess those are now the “good old days”: the largest 2CV parts vendor in the EU has shut down shipments to the US until the tariffs are sorted out. Luckily there are still some vendors in the US, but who knows what will happen when their stocks run out.

Probably an unpopular opinion here, but as a resident of Japan it kind of sucks to see their cool cars hoarded by foreign markets. Japanese people are seriously struggling with the cost of living and the weak yen. Many can’t afford to travel overseas anymore.

Buying up their cars at rock bottom prices just adds to the misery for local enthusiasts.

Aren’t there some rules in place that make owning older cars stupidly expensive there? If yes, those should probably be dealt with first.

No, there are loads of folks with old/collector cars. There is an inspection routine, but that applies to all cars over a certain age.

The export market has both reduced the number of cars available and driven the cost of remaining cars through the roof.

I see. I have wondered about this before, how cars there are so relatively cheap. I won’t take any cars from you, though!

It’s a new political philosophy: Confusionism.

I had no idea when I bought my Crown Majesta last October how lucky my timing was, it arrived just days before “liberation day.” It’s also an amazing ride.

Still dreaming of a second home in one of those 1 Euro wrecks, as long as it has a driveway of some sort to park my unobtanium in ‘murica’ toys.

It sounds like the value of keis that are already here will be on the rise.

So on the downside, my dream of Importing an Alfa Brera just got way more expensive.

On the upside, I still have long enough to wait that things might change by then.

I’m so glad we made America great again!

Our long national nightmare of peace and prosperity is finally over.

Are we tired of winning yet??

How have I never seen a Suzuki Cervo before? Two door hatch? Plaid seats? In blue for crissakes? Round sealed-beam headlights and fender mounted mirrors? I don’t care if it’s only half as entertaining as it looks, because it looks so nice!

I guess it’s a good thing I don’t think I’ve got the emotional energy to expend on importing an interesting little car like the Cervo, since I can’t really get my head around what it might actually cost, even after reading Mercedes’ excellent article.

My favorite Cervo derivative is the “Mighty Boy”

https://en.wikipedia.org/wiki/Suzuki_Mighty_Boy

It’s adorable, but that soft top in the back scares me. 😉

So because the car is made of steel they are charging a steel tariff ? Guess my S8 would get the aluminum one