One of the dirtiest words in the car import community lately is “tariff.” This year has been a rollercoaster for people importing cars, as the situation around import tariffs is always changing, and the impact has often been about as clear as mud. If changing reciprocal tariffs weren’t puzzling enough, enthusiasts have found a new tariff headache. Some enthusiasts have imported Kei cars only to be told by their brokers that their vehicles are now subject to an additional 50 percent steel tariff. But is this tariff real? If so, what does it mean for your imported dream car?

Back in the spring, President Trump sent the American car import community into a panic when he announced 25 percent tariffs on car imports and imported car parts. These tariffs, in combination with the government’s global reciprocal tariffs, had enthusiasts worried that their dream cars would become 10 to 25 percent more expensive almost overnight. Thankfully, 25-year-old and older classic car imports are exempt from the car tariff. Instead, imported cars were first subject to the 10 percent global reciprocal tariffs, and then became subject to country-specific reciprocal tariffs. Now, another wrench is gumming up the works.

Here’s how it worked in practice. In the past, a car that you purchased was subject to a 2.5 percent duty if you imported a passenger car, or 25 percent if you imported a truck. Of course, that latter number is due to the infamous Chicken Tax. When the American government began applying the global reciprocal tariff, it added to normal duties. This meant that a passenger car import was subjected to a 12.5 percent duty while trucks were hit with 35 percent duty.

The Tariffs Were Already Confusing

On August 1 and August 7, the American government finally began implementing the higher country-specific tariffs that it had been threatening for months. Initially, imports from Japan were supposed to be hit with a 24 percent (and then later, 25 percent) duty, but Japan and the United States worked out a deal to reduce that number to 15 percent.

Since these tariffs are now country-specific, it means that the duty you pay varies based on where the car comes from. A German car gets hit with a 15 percent duty, but one from the United Kingdom would be hit by a 10 percent duty. If you get a car from Switzerland, be prepared to open your wallet to the tune of a whopping 39 percent. That’s on top of your normal duty, which means a Swiss truck is subject to an incredible 64 percent duty. Breaking news out of China suggests that America and China are working out a deal where the average tariff on Chinese goods will be about 47 percent.

These tariffs alone sent the import community into a spin, and a lot of it was because the American government was awful at communicating these changes. Enthusiasts and even Customs brokers were initially unsure if used cars were going to be hit by the car tariff or the reciprocal tariff. I’m a member of a few import car communities, and the confusion was epic, with some brokers swearing that cars were subject to the 25 percent car tariff, while some said that you’d be hit by only the reciprocal tariff, and some said that you shouldn’t be hit by tariffs at all.

I got to watch this confusion play out in real time, from my previous coverage:

In May, I explained that my 1997 Honda Life had been hit by the 10 percent reciprocal tariff upon entry, leading me to pay a total duty of 12.5 percent. The problem was that nobody could give a definitive answer on whether getting hit by the reciprocal tariff was proper or not.

My Honda rode to America aboard the MOL Clover Ace roll-on roll-off ship in May, or after the tariff grace period had been expired for over a month. Here’s the wild twist: My importer contacts had hundreds of cars on the same ship and some of them even unloaded their cars at the same port on the same day. My little Honda basically kept their cars company during the long voyage.

Yet, some of these importers paid the reciprocal tariff and some did not. This was no help in solving the confusion. My Customs broker, All Ways International Shipping (AWIS), charged me a Customs duty of $32.25, or 12.5 percent of my car’s $258 purchase price. I expected to pay $6.45, or 2.5 percent. AWIS charged me the 12.5 percent based on its reading of the tariffs. It was a difference of just $25, so I didn’t really care in the end. But I still wondered: “Was that right?” For much of May and June, the advice in the importing world was to choose a Harmonized Tariff Schedule code in your import paperwork that would correspond with you paying only 2.5 percent, not 12.5 percent.

This madness happened again when my 1998 MGF rode aboard the Höegh Seoul. Once again, I paid the reciprocal tariff, but others with cars on the same boat reported paying only 2.5 percent. What this means is that months after these tariffs were announced and then implemented, people still didn’t know what tariffs their cars were subject to.

The Reciprocal Tariffs Were Legitimate

Thankfully, I was able to find a solid source about tariffs. Easy ISF, a company specializing in helping importers fill and file their documents with Customs, reached out to Customs’ Automotive & Aerospace Center of Excellence and Expertise. Judy Staudt, Acting Center Director, Automotive & Aerospace Center of Excellence and Expertise, sent Easy ISF a saddening message:

According to EasyISF, which has direct contact with U.S Customs and Border Protection, cars that are older than 25 years old are indeed exempt from the car tariff. However, cars are subject to reciprocal tariffs. So, you may ask, then, what is going to happen to all of those people who paid only 2.5 percent when they should have been paying 12.5 percent or more? EasyISF has bad news:

We have received direct confirmation from the acting director in charge of all auto imports at CBP that these duties are required. Despite this, we have also seen many cars clearing customs only the 2.5% duty, and we have lost a significant number of importers to brokers who are not charging the tariff.

The thing to keep in mind is that the initial release is generally just to make sure the vehicle doesn’t have contraband or anything inadmissible. The actual, full entry review by CBP can take up to 314 days. Some people might get away with not having paid the duty, but many won’t. I guarantee we will see a lot of angry posts in the next few months of people getting hit with the missed duty.

Sadly, EasyISF is right on the money. The Autopian is aware of at least two enthusiasts who have been hit with bills from Customs months after clearing their cars at only 2.5 percent. Customs demanded that these enthusiasts pay for the duties that Customs say the enthusiasts skipped out on.

It’s unclear if Customs will catch everyone who cleared a car at 2.5 percent. What is clear is that, regardless of how you interpret the law, the U.S. government interprets it as you needing to pay up more than usual.

Unfortunately, this has already had an impact of pricing some enthusiasts out of the market. Now, having to pay 15 percent on a Kei car is basically nothing. Remember, I paid just $258 for my Honda Life. At 15 percent, the duty is just $38.70. Buy a Kei truck for $1,000? Alright, now you’re looking at a duty of 40 percent, or $400. That sucks, but it’s not the end of the world. Thankfully, duties no longer stack, so you’re not paying 2.5 percent plus the 15 percent.

The math changes a lot for big and dreamy cars. Say you score a sweet Honda NSX for $50,000. Well, now you’re paying $8,750 in just tariffs alone before you even put it on a boat. To put that into perspective, you can import at least two whole basic Kei cars for the price that you’re paying in tariffs alone.

But at the very least, enthusiasts who do have the cash know how much they’re going to have to give to the government on their next Kei car, right? Right?

Here We Go Again

Earlier in October, enthusiasts began reporting that, when they attempted to import sub-1000cc vehicles, they didn’t just get hit by the reciprocal tariff, but also by steel derivative tariffs. Here is the letter one enthusiast got from their Customs broker.

This started the bickering all over again. Importers and Customs brokers began arguing with each other in the comments about who is right and who is wrong. Sadly, these discussions didn’t stay civil, and some people began throwing mud entirely unnecessarily. But who is right? Some brokers say that classic car imports are exempt from the steel tariff, and some say that classic car imports are definitely subject to the tariff. Here we go again.

First, let’s talk about the steel tariff everyone is worried about. From CBP:

On February 10, 2025, the President issued Proclamation 10896, “Adjusting Imports of Steel into the United States,” under Section 232 of the Trade Expansion Act of 1962, as amended (19 U.S.C. 1862). This proclamation imposes a 25 percent ad valorem tariff on certain imports of steel articles and derivative steel articles from all countries, effective June 23, 2025. See 90 FR 11249 (March 5, 2025).

In Proclamation 10896, the President authorized and directed the Secretary of Commerce to publish modifications to the HTSUS to reflect the amendments and effective dates in the proclamation.

Effective August 18, 2025, in accordance with “Adoption and Procedures of the Section 232 Steel and Aluminum Tariff Inclusions Process” the Commerce Department will be adding additional steel derivative products to Annex I of the HTSUS to be subject to Section 232 duties. Further, Annex II makes technical corrections to the Harmonized Tariff Schedule of the United States.

If you wish to bore yourself with the legalese, click here to head on over to the Federal Register. Otherwise, our friends at EasyISF break it down:

This is 100% correct.

There is absolutely no question that the Section 232 steel tariff apply to all passenger vehicles over 25 years of age and under 1000cc — specifically those classified under HTS 8703.21.0150.Keep in mind “passenger”: this does not apply to Kei Trucks or Kei Vans without rear seatbelts or any vehicle with a displacement over 1000CC.

In all honesty, my guess is that the inclusion of 8703.21.0150 was a mistake. The broader 8703.21 section that got hit mainly covers ATVs and UTVs, which were likely the intended targets of these tariffs. But because the changes are being implemented so quickly, things like this slip through — and while it may be an oversight, it doesn’t change the fact that the tariff currently applies.

The list of HTS codes that fall under the 50% Section 232 steel duties can be found here. [Click Here.]

If you review the attached sheet you will see that all classifications beginning with 8703.21, including these vehicles, are covered and must report steel content.

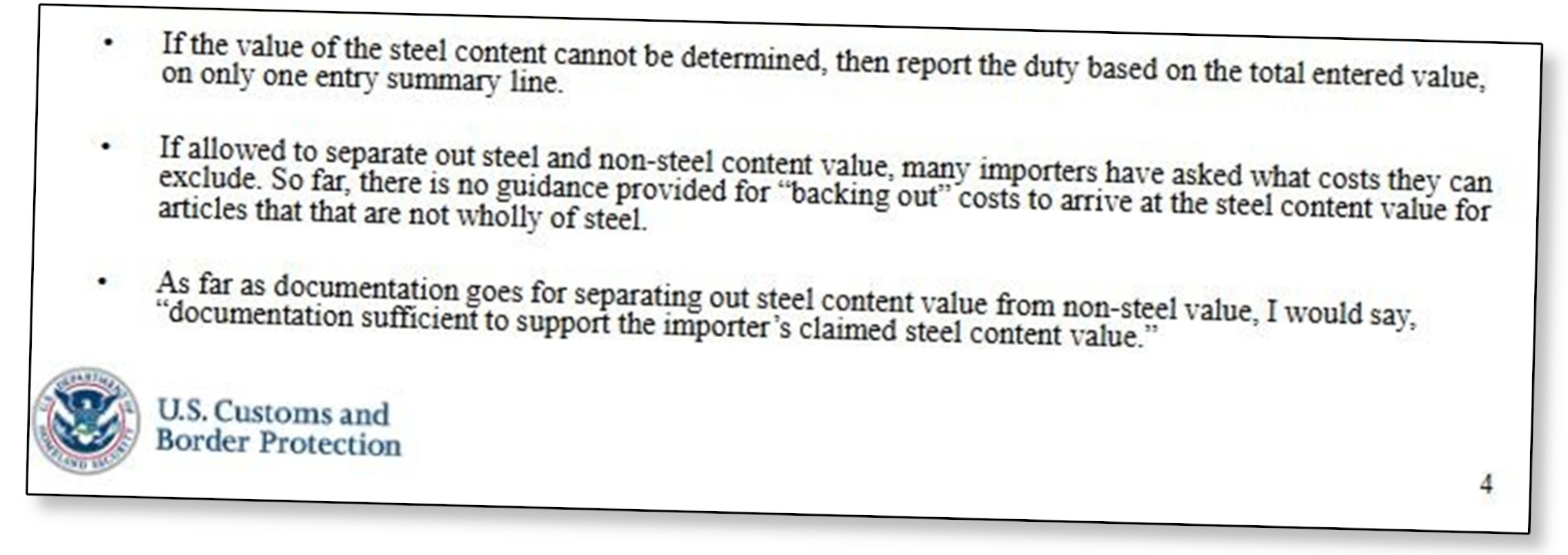

The real problem isn’t the steel duty — it’s that CBP still hasn’t provided clear instructions on how to calculate or break out the value of the steel content. The FAQ only says:

“The value of the steel/aluminum content should be determined in accordance with the principles of the Customs Valuation Agreement, as implemented in 19 U.S.C. 1401a.”

In a presentation last month, CBP shared the attached slide on this topic, but nothing more concrete. We have importers importing millions of dollars a week in steel products, and even they aren’t sure if they’re doing it correctly. Their attorneys aren’t sure, their consultants aren’t sure, we aren’t sure, and it’s very likely because CBP themselves don’t know how to apply it. At this point, the question isn’t whether these tariffs apply to these vehicles — they clearly do — but how exactly they should be applied.

In other words, regardless of how you read the rules, the U.S. government thinks that you need to pay 50 percent on the steel content of your next Kei car. That’s in addition to the regular 2.5 percent duty and the reciprocal duty for whatever country you got the car from. Of course, the cruel twist is that if you cannot provide a calculation for how much steel is in your car, the whole thing will be subject to a 50 percent tariff.

But don’t worry, because the government is not done twisting the knife yet. This went into effect back in mid-August, yet Customs still has absolutely no guidance on how importers and brokers are even supposed to accurately report steel content. Basically, we only just figured out the reciprocal tariffs, just in time to be thrown another curveball.

A Glimmer Of Good News

Thankfully, I do have good news, sort of. As EasyISF says above, the new tariff impacts vehicles under 1,000cc. So, those of you importing bigger, faster cars should be safe for now. Still, it’s unfortunate that, depending on the exact situation, any Kei car you buy may automatically be 50 percent more expensive. Just spent $20,000 on a mint Autozam AZ-1? Well, if you cannot prove the steel content, it’s going to cost you $30,000, and you haven’t even paid for anything else yet.

I fear that, at some point, enthusiast cars in other countries will simply become unattainable for the average enthusiast. The upsetting part is that there doesn’t seem to be any good reason for this. Most people who buy over 25-year-old imported cars end up supporting American business, from the importers who find the cars and the brokers to handle the paperwork, to the truckers who deliver the cars and the shops that fix them. If you buy your car from Duncan Imports or The Import Guys, you’re pumping money into local American businesses.

Our saving grace, for now, at least, is that most Kei vehicles are dirt cheap, so even a 50 percent tariff may hurt, but is still within reach. So, if you live in a pro-Kei state and want to get a Kei vehicle, I would still go for it. Just be sure to calculate your final cost before you send your money off to Japan.

Otherwise, I will continue monitoring this situation. With luck, car enthusiasts might adapt and triumph. Your dream car might have gotten more expensive, but it doesn’t have to be the end!

(Update: Corrected the tariff percentages.)

Hey Mercedes,

Licensed Customs Broker here

There is a “pecking order” in how we are to report the tariffs. The 25% auto parts tariffs supersede the Steel/Aluminum/Copper.

Please see US CBP Cargo Systems Messaging Service CSMS # 64916414:

The Executive Order (EO), “Addressing Certain Tariffs on Imported Articles,” signed on April 29, 2025, sets out the procedure for determining which of multiple tariffs will apply to an article when that article is subject to more than one of the tariff actions listed in the EO. Specifically, the EO pertains to the application of tariffs imposed by the following presidential actions:

a) Proclamation 10908 of March 26, 2025 (Adjusting Imports of Automobiles and Automobile Parts Into the United States);

b) Executive Order 14193 of February 1, 2025 (Imposing Duties To Address the Flow of Illicit Drugs Across Our Northern Border), as amended,

c) Executive Order 14194 of February 1, 2025 (Imposing Duties To Address the Situation at Our Southern Border), as amended;

d) Proclamation 9704 of March 8, 2018 (Adjusting Imports of Aluminum

Into the United States), as amended; and

e) Proclamation 9705 of March 8, 2018 (Adjusting Imports of Steel Into the United States), as amended.

Either way if the steel is from Japan or UK it would pay 25% due to those agreements.

Thanks!

David

Thank you for the insight! Sadly, I suppose you have provided even more evidence that there’s so much confusion out there, even among brokers.

I have played it safe thus far and paid the tariffs. I’m not in a rush to piss off the feds. 🙂

Yup there definitely still is, and I definitely ask my coworker even when I’m sure, just to be safe.

Don’t worry about that if you underpay, Uncle Sam will come a knocking. If you overpay, well you might not hear from them.

So far we have not had any issues applying those rules above.

Definitely a pecking order, but the CSMS you mentioned (64916414) is from May 5th. CSMS #65236574 from June 3rd provides the updated stacking guidance.

Since these vehicles are over 25 years old, they qualify for a 0% rate under 9903.94.04 for the auto-related Section 232 tariffs.

Because they are not subject to the Auto 232 duties, the steel and aluminum Section 232 duties are applicable.

The constant TACOing, back and forth, flip-flopping, etc. is definitely have an affect on it all.

The company I work for (with thousands of U.S. manufacturing jobs) has spent practically the entire year trying to figure out how the tariffs work, and in the meantime has been trying to hold prices steady.

As stuff like this becomes more clear (especially the steel content stuff, since we import a ton of raw steel and also steel-containing products), the response is basically “holy shit we need to charge a lot more for this stuff.”

That isn’t going particularly well, if you can believe it.

I got a tariff bill on a shipment that was USMCA compliant. I emailed FedEx to dispute. It took them a whole month just to say we have received your request. Two months later and still no clue how that’s going.

We have a rather high tech item (US manufactured, here for repairs) stuck in limbo. This administration really added some burdensome regulations to what was previously a seamless and smooth procedure Everything was fine before January.

Yup. Needed a drive from Siemens in a hurry and it was stuck in limbo because even though they had plenty in the warehouse they were on hold as customs was grilling them on the metals content and couldn’t release the order until it was resolved.

Screw anyone who supported these fascist fucks. I am so over this timeline. It is just one idiotic thing after another. The economy can’t crash soon enough. That seems to be the only thing the evil bastards care about besides disappearing people and fetuses.

It would be easier to move to Mexico or Portugal or Ireland or Canada or …. and import any JDM car you want with minimal tariffs.

As a Canadian, this is my exact plan this winter.

this is the loop many third world countries have been using for a long time. it created a whole industry around it

I recently went through the hassle of importing a heater core from England. Off of Ebay. UK sellers jack up shipping prices, because they don’t want to deal with Americans ordering a part and not paying duties and returning the parts, so I paid an absurd shipping fee and duties for what should have been a cheap hunk of aluminum. When replacing a heater core results in swearing at economic policies more than being huddled upside down crunched under a dashboard, well, that says something.

All of this…completely avoidable and unnecessary. We warned you, you didn’t listen.

Trump himself told everyone countless times that he wanted to instate tariffs. Tariff is his favorite word! Big, beautiful tariffs! He loves tariffs! He instated them last time he was president, too, but there were at least more people in the government who were willing to and had the power to push back.

Everyone should have known better, and no one should be surprised that Mr. Tariff is doing…tariffs.

50% is such a ripoff. Don’t they realize a steep % like this may completely stop a lot of people from importing?

They might even lose money in the end because imports will just stop.

This also explains why Jimny prices are up all of a sudden.

“They” don’t care.

For every steel PRODUCING job in the United States there are 80 steel CONSUMING jobs. In order to “create” a handful of jobs at steel plants there are a lot more welders, fabricators, machinists, and manufacturers that will lose their jobs.

Stopping people from importing is the goal of tariffs. The now byzantine tariff system is a further feature to push people to buy American goods, rather than deal with the uncertainty of whether you paid the correct amount.

That’s all well and good. Rah rah American manufacturing! But there are a lot of products that simply can’t or won’t be manufactured in the USA for so many reasons.

The machinery/tooling is too high of a burden to start a new business

The supply chain of raw materials does not exist

With tariffs, outsourcing is still slightly better than domestic manufacturing

and the most important one, NO ONE can manufacture a 25 year old car!

Applying the steel tariff to these cars one of the dumbest things I’ve heard lately. Yah government.

No, not generic government, specifically the Trump administration. Get the facts right so you can warn your children as to who created the problems.

Everyone remember how smoothly things ran before Trump? I do.

This is what we get when we elect to government the candidates who say they’re going to “drain the swamp”. Turns out that “swamp” was a formerly generally thriving wetland and they’ve messed up the ecology something fierce. Now it’s a buggy, stinking mud pit. But what else should we have expected from a casino-bankrupting developer and cronies?

The first time around it was “casino-bankrupting developer and cronies”. This time “casino-bankrupting developer” is one of the cronies. A crony for a bunch of wealthy and powerful people who helped him get elected to stay out of jail, and now get to destabilize whatever market they want on a whim to maximize their return on investments.

So how is the steel content valued?

If you have a guitar with steel strings, is it based on the value of the guitar, the value of the strings, or the value of of a couple ounces of steel?

If you have two cars that are identical except one has had the interior eaten by raccoons ( it happens) , and is only 1% the value of the other but the steel content and condition is the same, is the steel tariff the same?

Is an imported cast iron engine block free of the steel tariff?

It should be, but…

Don’t forget the screws!

Oh, “they” are definitely not forgetting to screw everyone “they” can.

The tariff applies to pounds of steel. So the commodity value of 1018 steel (or whatever grade) x however many pounds x the tariff percentage.

As a percentage of the value of the car (or guitar) that changes, but it’s not part of the calculation. Just value of steel by weight.

I don’t know how granular they are getting with this (and it seems like that’s part of the issue- it’s all a bit vague) but at my last job when we were dealing with tariffs we had to figure out the breakdown of materials for each assembly (x pounds of galvanized sheet steal, y pounds of piano wire, z pounds of zinc, etc) so we could track how to apply surcharges. Truly a blast.

If it helps at all: I live in the UK, specifically England, and my wife just sent a birthday present to her grandma via post. Her grandma also lives in the UK, specifically Northern Ireland.

She had to fill out a customs form, because Brexit. We now have an internal border.

You have to fill out customs forms within the UK now?! Is that just to Northern Ireland because it’s going off island, or would that be the case going to like Scotland too?

Pretty sure just UK Ireland – they are trying to keep the border between it and EU Ireland as open as possible so anything heading over there has to get documentation. Until Scotland and/or Wales inevitably bag out of the whole mess, no documentation for stuff headed there.

That does make some sort of sense, so you’re not paying duties to send stuff to N. Ireland, but just have to document it?

I’m assuming so, but who knows what screw ups may await the unsuspecting birthday gift…

It’s because of the open border between the Republic of Ireland (in the EU) and Northern Ireland (out of the EU). To keep that border open they’ve effectively moved it between NI and Britain.

So no customs borders between Wales, Scotland or England.

Yeah I guess that does make some sort of sense. This world is weird.

There may as well be one here, too. A birthday card was mailed to me on about September 2 to make sure I got it for my birthday a week later. I just got it today.

Stupid Brexit stopped my move to France plans- now I am stuck with the UK or Norway for retirement

Brexit set the UK back a generation economically. Tell me, is it true mostly rural inhabitants came out for the vote, and urban/sub-urban dwellers were so convinced that it could not possibly pass, that many decided not to vote on it?

Beats me, I’ve not met anyone willing to admit they voted for this mess.

Whatever reasons they had to vote for it have almost certainly not been satisfied by the colossal mess that we’ve ended up with.

Yikes, that’s awful as well.

You see the problem here is that you need to purchase a Kei car that’s manufactured in the USA, since these tariffs are designed to protect the beleagured US Kei car manufacturing industry.

Someone has been watching Goldfinger.

That Suzuki pic looks like a mini 1979 AMC Matador and also, surprisingly it’s not Hardigree posting a tariff article- congrats!

The Cervo has been a dream of mine since I was like five years old. It was also exported (with a whopping 1-liter engine rather than the 539cc two-stroke unit used in Japan) as the Suzuki SC100 GX, except in the UK where it was marketed as the Whizzkid! Did I mention that it was originally a Giugiaro design and that it is rear-engined?

Whizzkid is such a charming name.

(Smart child or child who pees the bed) haha!

The current incarnation of the gawps will get what they have coming to them, politically, in the long run. Effective tariffs require a scalpel but all the government seems to possess is a chainsaw.

the real question is how much resources does the gov have to trace all these tariffs. you could declare you bought the car for $500 or maybe even $2500. maybe the importer charges a $7000 ‘document fee’ but you only pay the tariff on the $500.

I don’t know if that would work, do you have to pay duties on the cost of shipping?

When I ship stuff to the EU, if the buyer pays duties and shipping it costs about half what it would cost if they sent me the money and I paid. I’m shipping books which aren’t taxed but they have to pay duties on the shipping.

The duties I paid when I bought my Peugeot from the UK was just on the cost paid to purchase the car, but not sure that’s right.

That is a good question. I can say that there are enough resources that people are now getting letters for not paying enough money to Customs. So the number is greater than zero, but who knows how close it is to 100 percent.

Mercedes, you bring such depth and detail–with great clarity–to special interest topics not necessarily of direct interest to me and about which I’d otherwise surely remain ignorant. I read these excellent and enlightening reporting and reviews of yours and always feel grateful for you and The Autopian.

Everybody, please join up with a paid membership!

Agree. I would never bother reading about tariffs anywhere else, but here – and by Mercedes – somehow I can’t resist.

Hear, hear. This is a great breakdown of what’s happening with imports.

Licensed Customs Broker here.

I only know what the customer sends me, so See no evil, etc. etc.

You don’t pay duties on freight or insurance, just what the commodity is worth.

So fucking stupid, but at least it’s helping our economy, right? …right?

I just bought some eggs (yes, I’m wealthy) and the price has dropped 6 cents. So it’s allllllll worth it!

The desired effect is working. The rich got richer, and certain people of a different skin tone are getting stepped on.

This is what happens when you elect an absolute fucking clown as president. I mean he’s not coming up with these rules because he’s too stupid and lazy. But as the executive, you make sure that your people are doing the right things. Obviously the executive of the United States is doing it on a much larger scale than I do on a daily basis with only 130 employees. but I can tell you we have meetings, I have all of my Ts crossed and Is dotted and we seldom run into problems. When we do, we solve them quickly and efficiently. This administration is a joke.

Also, Mercedes has been crushing it with her articles recently. Always enjoyable to read.

Please become a member of this great sight and support these great writers as they bring us these enjoyable articles.

Site not sight….

A site for sore eyes.

ummmm

I am so extremely glad my Marea slid in mere weeks before inauguration and the start of this massive shit show. Sure, it was as cheap as a kei, but the stress alone probably would have given me an aneurism

Is this winning?

I’m tired of winning.

As I live in one of the no-fun-allowed states that makes it pretty much impossible to register non-USDM vehicles and emissions tests everything back to model year 1968, this doesnt change anything for me, but I definitely sympathize for folks in states where cool JDM cars had been a possibility

Emissions tests everything back to model year 1968?

What state does that?

Delaware. It’s the main reason I’m right across the state line in Maryland.

Bingo

It definitely limits options for imported vehicles, considering how many countries didn’t require catalytic converters until the 1980s or even 1990s

So that means your Kei car has a Maryland flag sticker in the shape of a crab on it and an Old Bay-scented air freshener?

No one I know of. Even keep it as clean as possible California only goes to 1976.

Smog test exemption for 1975 and older cars in CA. BUT when you import a car, it’s a totally different story. 1968-1975 cars still need to be smog compliant to be imported into California. Technically there is a <= 50 cubic inch displacement exemption which should be available for Kei cars, but in practice it’s kind of murky.

Delaware requires either annual or semi-annual (if you pay up front for a two year registration) emissions testing for all cars 1968 and newer. 1968-1974 models get a curb idle test, 1975-1995 models get both a curb idle test and a visual check to ensure factory-spec catalytic converter(s) are in place, and 1996 and up just get an OBD scan to check for any emissions-related codes. The only exception is for the 5 most recent model years, which aren’t required to do anything, so currently 2022-present are exempted, as we are into the 2026 MY

This steel content is almost as stupid as the CPSC wanting to ban kid size dirt bikes because the batteries contained lead.

Actually, the reason is those bikes don’t conform to current pollution standards. They are effectively gross polluters. But distributors and dealers are making it about some battery nonsense. If the issue were really batteries, then cars and other vehicles would be affected…you know, that 12 volt battery in there has lead.

This was over 20 years ago, and they were emissions compliant at the time. Nowadays it’s a California Prop 65 violation or something, but all the young tearaways are on Lithium Ion powered non-compliant e-bikes

I’m breathing a sigh of relief, because I’m working towards getting an imported CR-V. They’re already disturbingly high (a 40-50,000 mile 2000 crv goes for $10-12k minimum) and if they go much higher I think I’m probably just going to buy a used Mach-E or Tesla and put a RHd pedal kit in it.

But the thought was always in the back of my head to pick up a Kei van to sling mail out of. This probably takes that idea completely out of the running.

Friend of mine recently got a throttle body for their CT125, which has to be imported from Thailand. It was flagged at customs because they didnt include the steel content.